Lazy but Legendary: How the Lazy Summer Protocol Is Quietly Beating DeFi Benchmarks

While DeFi degen’s are glued to dashboards, tweaking vaults, and stress-refreshing yield dashboards, there’s a new archetype in town: the lazy legend.

They aren’t losing sleep over liquidation risks. They aren’t manually optimizing yields. Hell, they might not even remember the last time they connected a wallet, to a DeFi app.

Image of the lazy legend

And yet somehow they're outperforming the “Degen’s” … the people “in the trenches”.

Welcome to the world of the Lazy Summer Protocol, where less effort leads to more alpha.

The DeFi Grind Is Real (And Overrated)

Let’s be real. Most of DeFi is still a full-time job disguised as “passive rewards.” Managing positions, reacting to market volatility, tweaking automation parameters —all while hoping the next yield strategy doesn’t rug.

DeFi pros treat it like a game of high-frequency optimization. The problem? Even the most dialed-in users still miss entries, mistime exits, or forget to react to subtle market shifts in the yield ecosystem.

Summer.fi’s Lazy Summer Protocol flips this hustle on its head. Instead of chasing every basis point, it builds long-term resilience through automation powered by AI agents.

Set It and (Actually) Forget It

Lazy Summer isn’t just another passive yield farm.

At its core is a set of automated strategies—built on top of the Lazy Summer Protocol—that monitor yields, execute risk-adjusted decisions, and adapt to market conditions. Think of it like having a 24/7 DeFi co-pilot that doesn’t panic, doesn’t sleep, and definitely doesn’t chase yields in a hap hazard way.

You set you deposit, and the protocol handles the rest.

The Lazy Advantage

What’s wild is how consistently the Lazy Summer approach holds up. In backtests and live usage, Lazy Summer strategies often outperform manual setups. Why?

Because humans are inconsistent. We get emotional. We miss signals. But well-designed automation doesn’t.

- Risk management? Curated by DeFi’s best, Block Analitica.

- Rebalancing? Automated.

- Yield sources? Transparent and high quality.

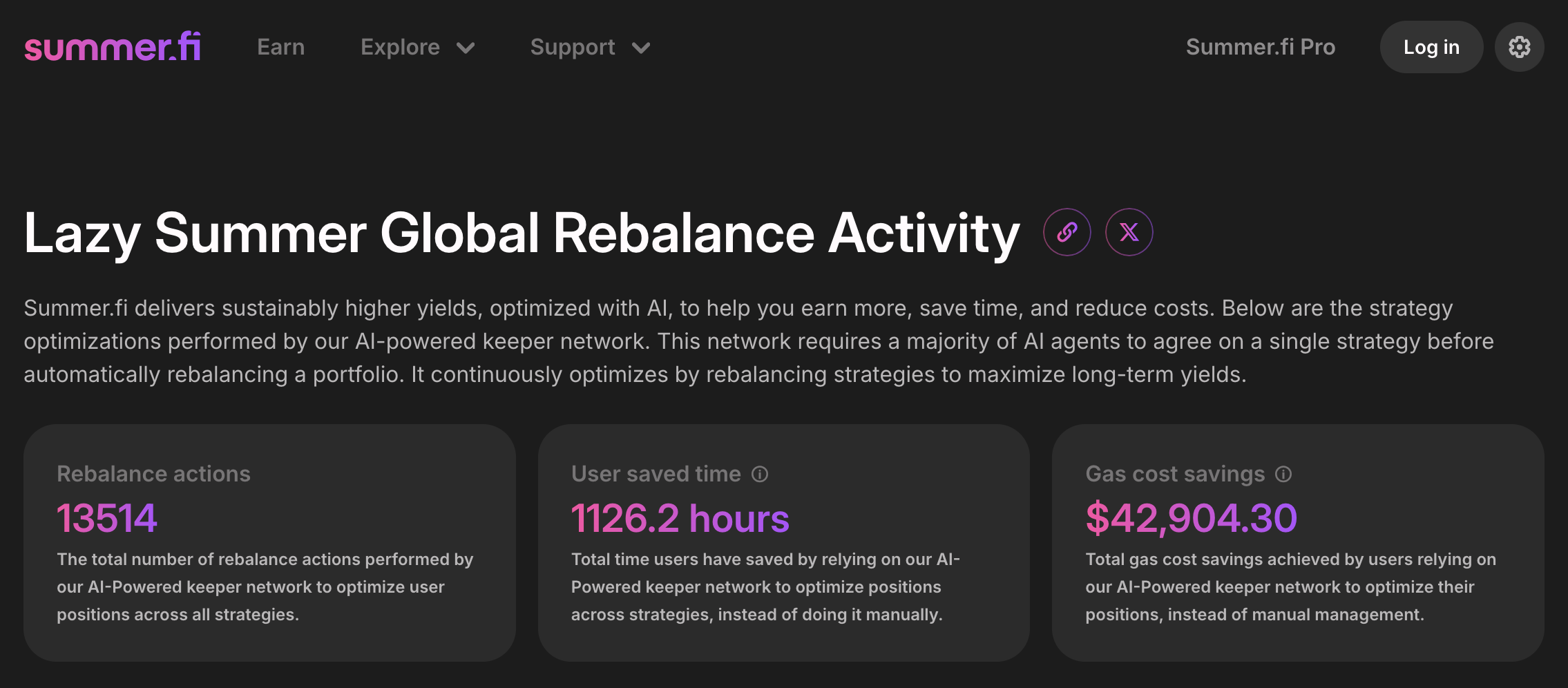

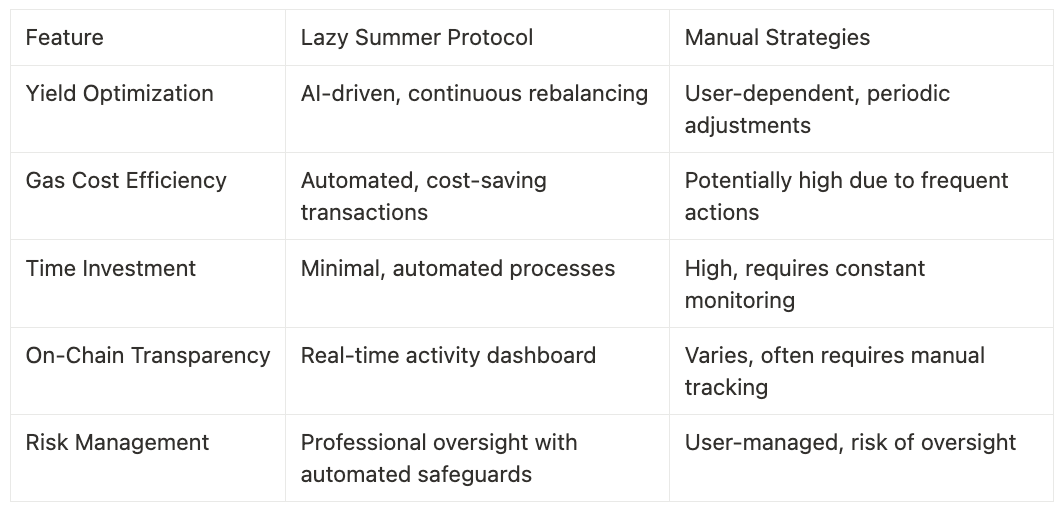

Performance Comparison: Lazy Summer Protocol vs. Manual Strategies

Yield Optimization

- Lazy Summer Protocol: Utilizes AI-powered keepers to continuously reallocate assets across top-performing DeFi protocols, ensuring optimal risk-adjusted yields. (You can read more here : https://blog.summer.fi/how-the-lazy-summer-protocol-goes-after-the-yield/

- Manual Strategies: Require users to monitor markets and manually shift assets, which can lead to missed opportunities and suboptimal returns.

Gas Cost Efficiency

- Manual Strategies: Frequent manual transactions can accumulate significant gas costs, especially during network congestion.

Lazy Summer Protocol: Has executed over 13514 rebalance actions, saving users approximately $42,904 in gas fees. https://summer.fi/earn/rebalance-activity

Time Investment

- Manual Strategies: Demand continuous attention to market conditions, strategy adjustments, and transaction executions.

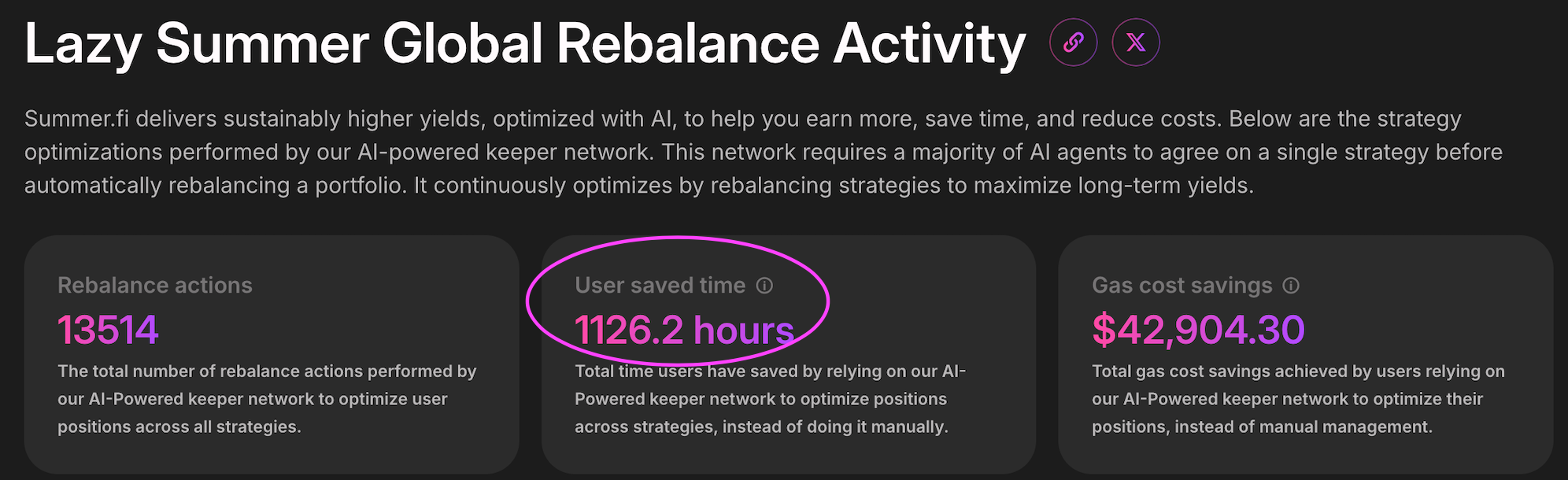

Lazy Summer Protocol: Automated processes have saved users around 1126.2 hours in managing and optimizing their positions. (Source)

On-Chain Proof and Transparency

Lazy Summer Protocol provides transparent on-chain data, showcasing real-time strategy optimizations and asset allocations. Users can view these activities directly through the Rebalance Activity Dashboard.

Risk Management

- Lazy Summer Protocol: Collaborates with risk management firm Block Analitica to set and manage vault parameters, ensuring diversification and protection against overexposure. Read more https://blog.summer.fi/walkthrough-of-the-lazy-summer-protocol/

- Manual Strategies: Users bear the responsibility of assessing and managing risks, which can be challenging without specialized tools or expertise.

In sum

Want to see how chill outperforms grind? Try the Lazy Summer Protocol and let automation prove itself.