How Summer.fi curates DeFi’s best protocol’s

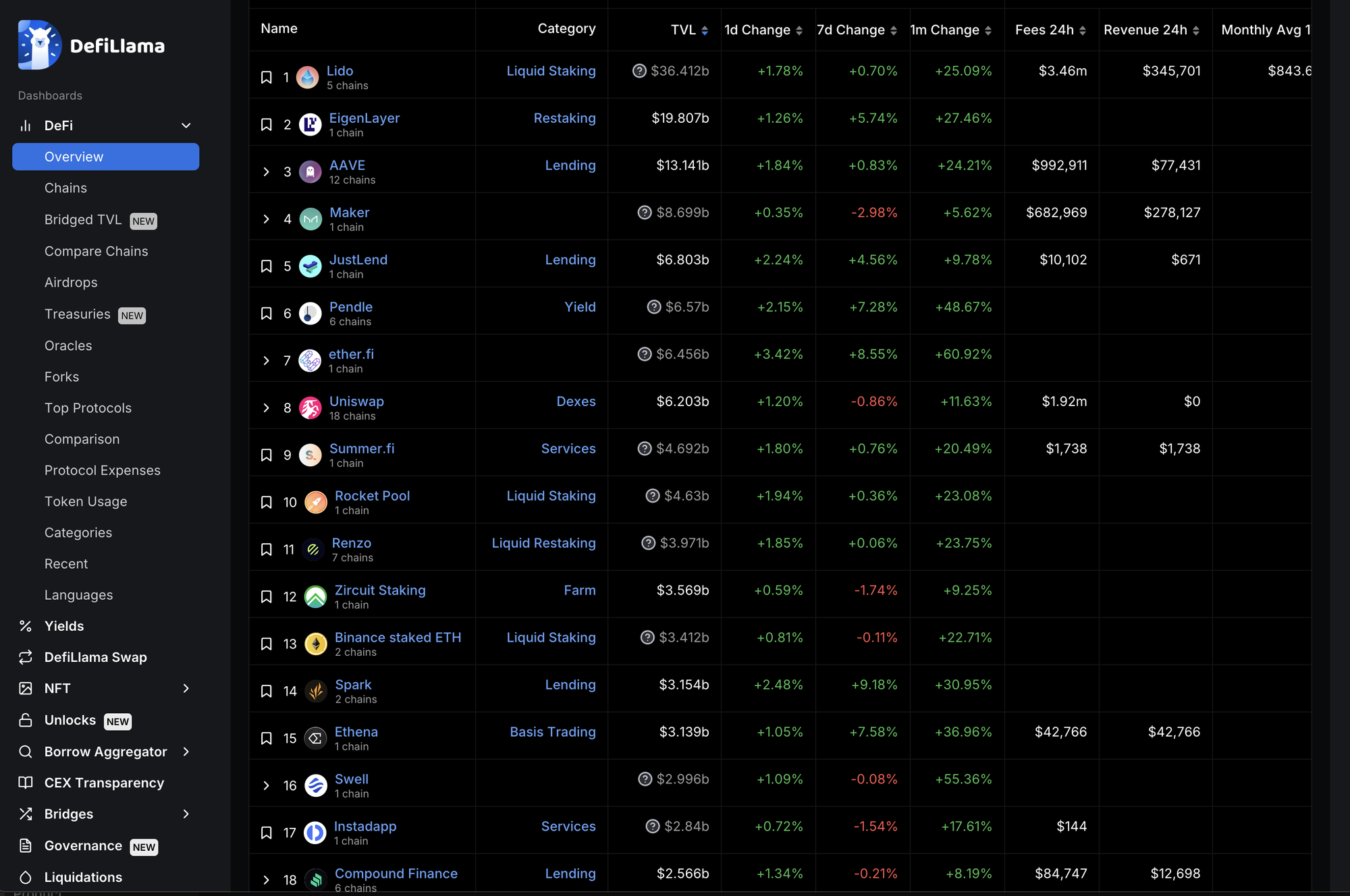

In DeFi, there are ton’s of choices. A simple search on DeFillama.com will yield literally thousands of results… and those are just protocols.

Immediately, you have to start to do lots of due diligence and research to understand simple questions:

- What are the differences between all of these protocols, in the same categories?

- How does this protocol work?

- What can this protocol do for me?

To say the least, for both people new to DeFi, as well as DeFi OG’s, it can be overwhelming to stay up to date with the latest protocols. Not to mention the latest tokens and strategies.

So, how do you know what protocols to trust? beyond just following influencers on twitter or going with the highest TVL option.

A history of trust in an industry ironically lacking it

Summer.fi’s story starts alongside one of the oldest DeFi projects around today, Maker. Originally known as OasisDex and created for the functional use of the Maker system.

Trust and technical integrity is built into the DNA of Summer.fi because we have chosen to take the same ethos as MakerDAO which has made it the “Leviathan of DeFi” and “The foundation of Ethereum’s financial system”:

Resilient, Secure and Pioneering.

When it comes to building products and features for customers, Summer.fi has taken this ethos and applied it to supporting other protocols that exhibit similar qualities.

Only the highest quality on Summer.fi

Resilient, Secure and Pioneering.

These three words represent what we always seek to offer at Summer.fi to our customers across all facets of the app. That means that when it comes to Protocols, Tokens and Strategies, we only curate the best.

Protocols

When selecting protocols to offer, we consider—building best-in-class financial infrastructure. However the protocols tradeoffs to only offer the best. Allowing you to not have to spend tons of time researching the tradeoffs on your own.

Today, we offer:

Strategies

Protocols, like the ones mentioned above, focus on what they do best—building best-in-class financial infrastructure. However, that leaves understanding how and why to use these tools up to you, the customer.

Summer.fi makes it easy understand and act on the benefits that these protocols packaging them in ways that are much more intuitive and framed around the outcomes that you are actually seeking.

Multiply: Using the highest quality protocols in increase your exposure.

Borrow: Using the highest quality protocols to unlock liquidity.

Earn: Using the highest quality protocols to compound your crypto passively or actively.

Tokens

For us, choosing what tokens to support again makes us focus deeply on you as and end user. When liquidity is low, or we are unclear about the technical integrity of an asset, we will never support it. There is a reason you didn’t see UST or LUNA on Summer.fi.

Curation means, we want you to focus on what matters

Ultimately, Summer.fi spends all this time and effort curating the very best DeFi protocols and strategies so that you no longer have to do all of that work yourself.

We believe that you should be focusing on the execution and that portfolio strategy that you want to use to take advantage of a bull or bear market. Not reading white papers about how a protocol works or doing deep research on how to actually use a protocol in a practical way.

From curation to convenience

Beyond the curation of protocols and strategies, Summer.fi also makes supported protocols much much much easier to use and to manage.

How?

One transaction, much more exposure: Multiplying on summer takes away the need for multiple transactions to increase your exposure. One simple transaction to increase your multiple 2x,3x,4x…

Put an end to second-guessing your profits and your costs, always know how much you’ve made and how much owe:

- Profit/Loss Data: Get a specific breakdown of exactly how much you’ve made or lost denominated in both collateral and USD terms.

- Borrow Costs: See exactly how much you owe, how much you’ve paid and how much you can expect to pay in interest and gas costs.

Never lose another nights sleep: Automated risk management tools protect your positions from liquidation, automatically.

- Stop Loss, your positions with peace of mind: Close your position automatically if the market turns downward, at a price set by you.

- Trailing Stop Loss, capture profits from new highs, automatically: Move your stop loss up, automatically, at a price distance set by you.

- Auto Sell, reduce your risk, automatically: Sell collateral to pay back debt, and reduce risk, automatically.

Go Beyond basic functions: Borrow on summer.fi allows you to go beyond the basics of core protocol functions, making it more intuitive to manage your position.

- Manage: One transaction actions to manage your position seamlessly. Deposit and Payback with any token. Send or swap to anyone or anything right when you borrow.

- Monitor: Best in class position data like Liq. Price and Accrued Borrow Cost.

- Assess: Our position history allows you to analyze your past actions simply.

Set and forget your strategy: Summer.fi automation tools allows you to set your strategy once, and then summer.fi super powers do the work.

- Auto Buy, take advantage of market momentum: Capture market moves and increase exposure, automatically.

- Auto Take Profit, automate your exit strategy: Realize profits to your wallet, at defined price targets, set by you.

Article written by Jordan Jackson

Getting in touch

If you have any questions regarding Summer.fi, contact us at support@summer.fi or our social media.