How Lazy Summer makes it easy to earn from Morpho’s top vaults

What is Morpho Earn?

Morpho Earn turns on-chain lending into curated, risk-managed vaults. You deposit once; a curator allocates across liquid, blue-chip collateral markets.

Why Morpho Markets are so powerful

Curators on Morpho consolidate utilization, liquidity depth, and collateral quality into simple, composable yield primitives that are ****capital efficient and transparent. As a depositor, you get exposure to yield generated from clear, documented criteria for borrowers and markets.

Asset curation, a powerful innovation

Curation on Morpho makes explicit, documented choices about what markets to allow, how much to allocate, and when to rebalance, balancing borrower needs (competitive rates, assured liquidity) with depositor needs (risk mitigation, competitive APYs, continuous monitoring, transparency).

A truly free market

On Morpho, new yield opportunities pop up daily ****from new and existing curators. That vibrancy is great for DeFi… and brutal for depositors. Even power users can’t check every listing, cap change, and relative APY move across new and older vaults.

14 pages of Morpho Vaults

How do you keep up? You shouldn’t have to.

You shouldn’t live in dashboards or miss better opportunities because you’re parked in yesterday’s vault.

If you want exposure to Morpho’s best risk-adjusted markets when they’re best, without spreadsheets, the Lazy Summer Protocol is for you.

Lazy Summer Protocol × Morpho: all the best Morpho Vaults, all the time, with just one deposit

How Lazy Summer makes Morpho shine:

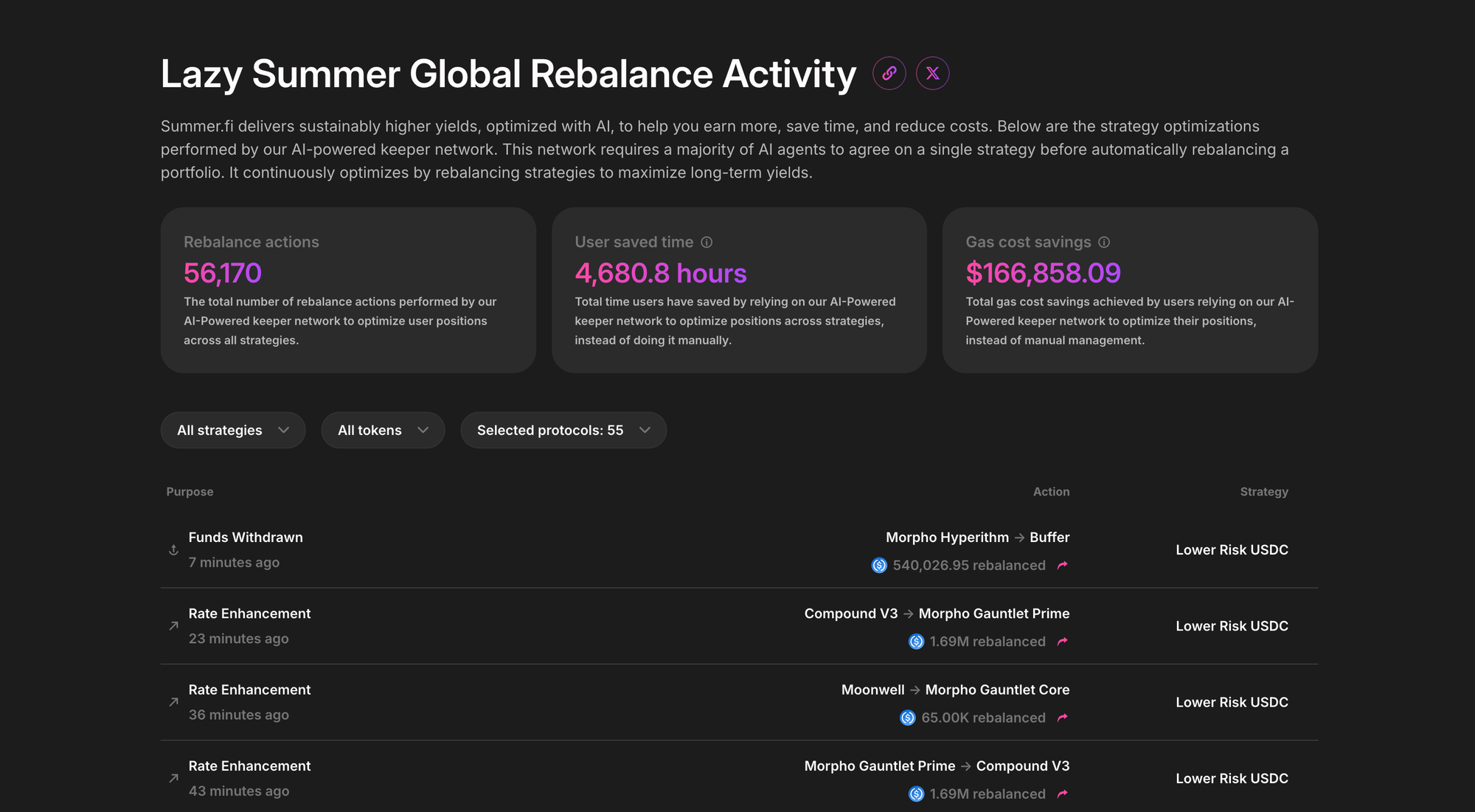

- Autopilot rebalancing. The protocol rotates between Morpho markets as relative yield, liquidity, and risk evolve, so you ride leaders, not laggards.

- Independent guardrails. Collateral tiers, caps, liquidity/venue checks, and concentration limits keep exposure diversified by Block Analitica.

- Cross-protocol context. When Morpho leads on risk-adjusted return, the protocol leans in. If another venue briefly outperforms, the protocol adapts, then returns when Morpho reclaims the edge.

- Less chasing, more compounding. Fewer manual tx’s. More time in the right vaults.

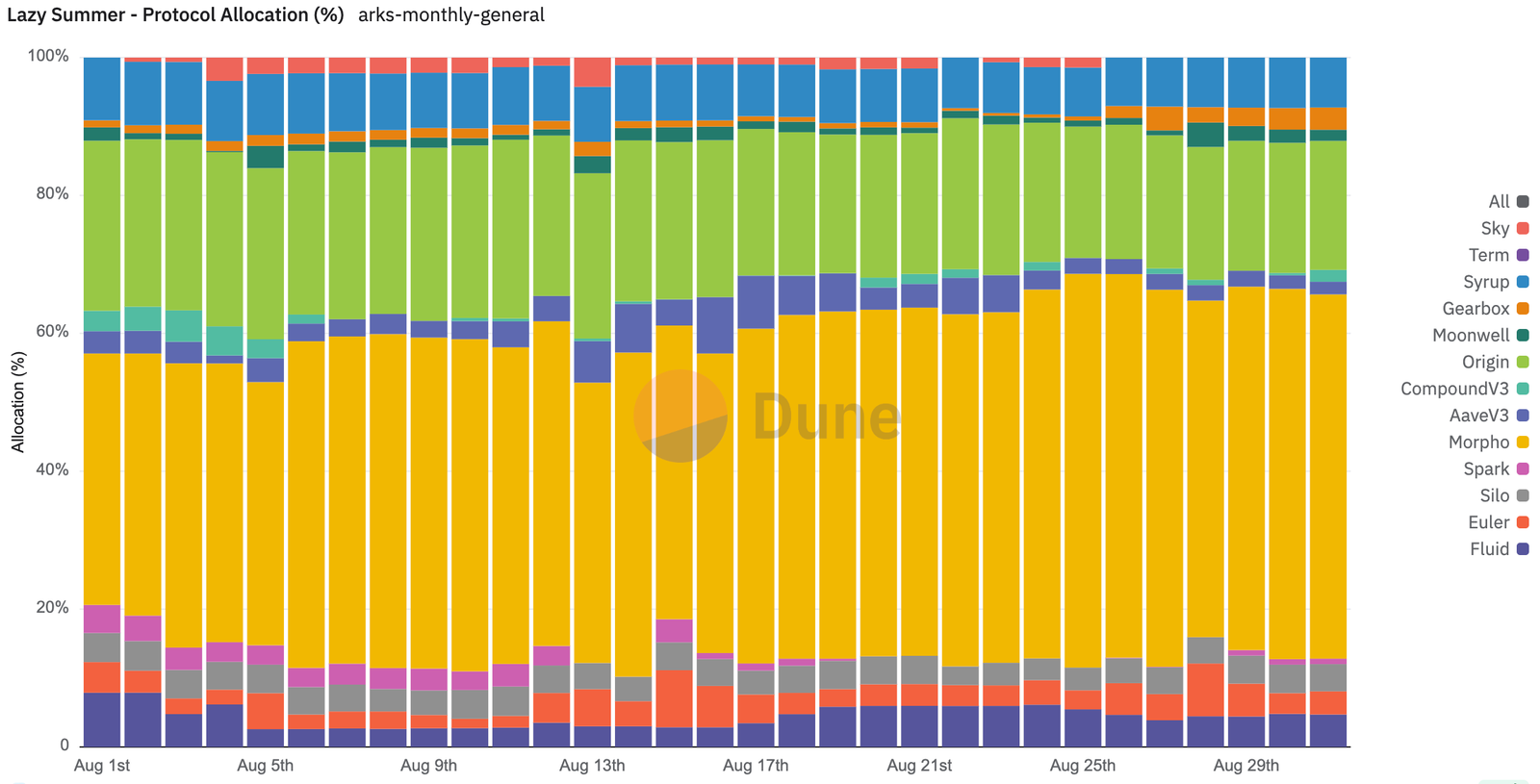

In fact, just last month, Morpho accounted for the majority of yield source generation for the Lazy Summer protocol. Specifically, by the end of August, Morpho accounted for 41% of Lazy Summer’s TVL yield generation across 40 different Morpho Vaults.

This is truly a match made in heaven and shows the power of DeFi composability, as no one depositor could ever achieve this on their own.

All of this while also giving users access to other yield strategies in the same league as Morpho like Origin, Euler, Silo, Fluid, Maple, AAVE, Sky and Spark.

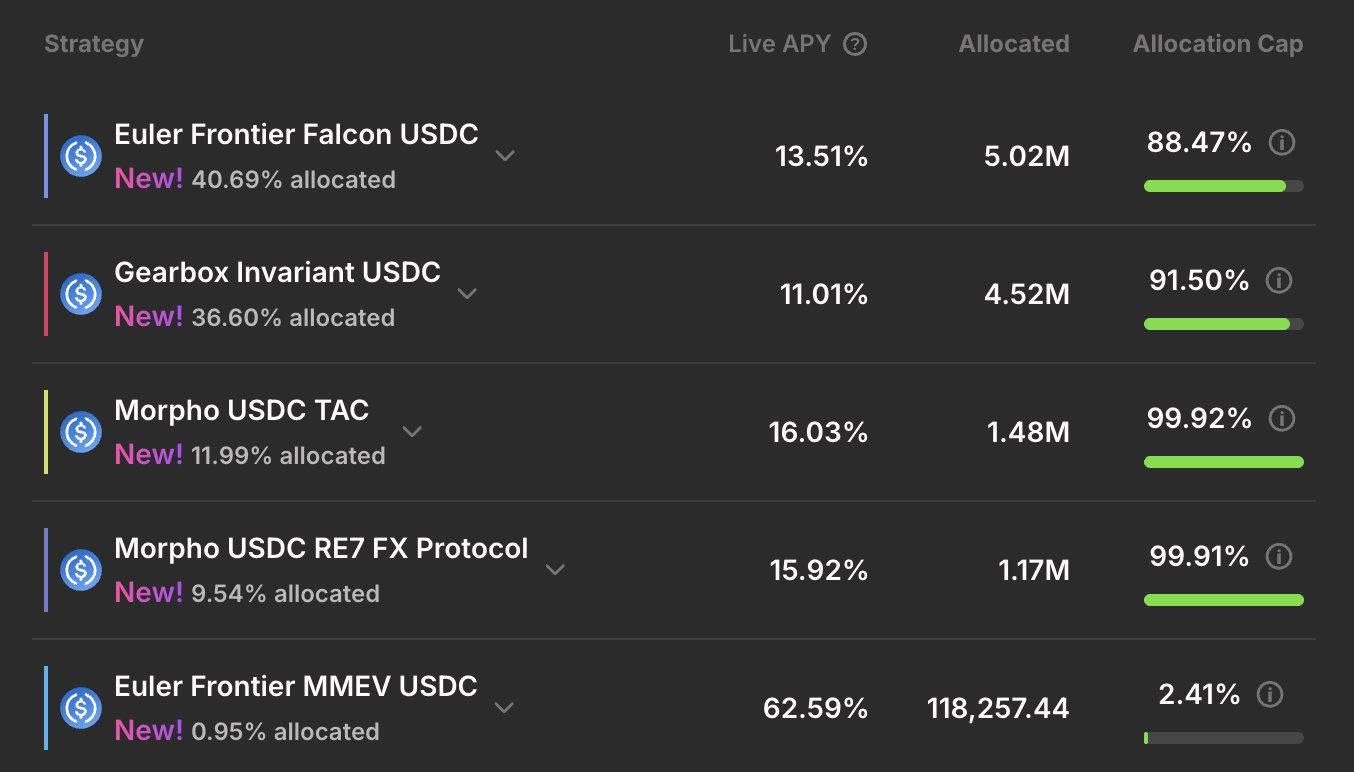

Meet the new Morpho yield sources

Recently, Lazy Summer added 15 new Morpho Vaults for USDC and ETH, bringing the Morpho Vaults total to 55 different Morpho yield sources on Lazy Summer. All of which can be accessed automatically with one single deposit. No manual management whatsoever.

New Morpho USDC Yield Sources

Morpho USDC Gauntlet Prime

Curated vault optimized for risk-adjusted yield across large, liquid collateral markets.

Morpho USDC Gauntlet Core

Higher-risk Core vault, whitelisting liquid markets and optimizing across them.

Morpho USDC TAC

TAC-managed vault allocating across liquid assets for optimized yield.

Morpho USDC Steakhouse InfiniFi

Steakhouse-curated vault lending against InfiniFi ecosystem collateral.

Morpho USDC RE7 FX Protocol

Partners with Aladdin DAO; lends against assets in the f(x) ecosystem.

Morpho USDC Avantgarde Core

Dynamic allocation across liquid collateral markets for risk-adjusted yields.

Morpho USDC ExtraFi XLend

Curated vault targeting high-demand collateral markets on Base.

Morpho USDC Vault Bridge

Bridge vault optimizing USDC yield while lending against curated collateral.

New Morpho ETH Yield Sources

Morpho WETH ExtraFi XLend

Curated WETH vault for high-demand collateral markets on Base.

Morpho WETH Yearn OG

Yearn-curated WETH vault across moderate-risk markets, algorithmically optimized.

Morpho WETH SingularV

Vault is designed for maximized return with careful collateral/oracle risk checks.

Morpho WETH Avantgarde Core

Dynamic WETH allocation across liquid markets for risk-adjusted yield.

Morpho WETH Alpha Core

Blue-chip DeFi strategy with proven earnings; prioritizes safety and long-term value.

Morpho WETH TAC

TAC-managed vault allocating WETH across liquid assets.

Morpho WETH Indexcoop HyETH

High-yield ETH index curated by Gauntlet; allocates across diverse lending opportunities above staking yield.

Get the best of Morpho now on Lazy Summer

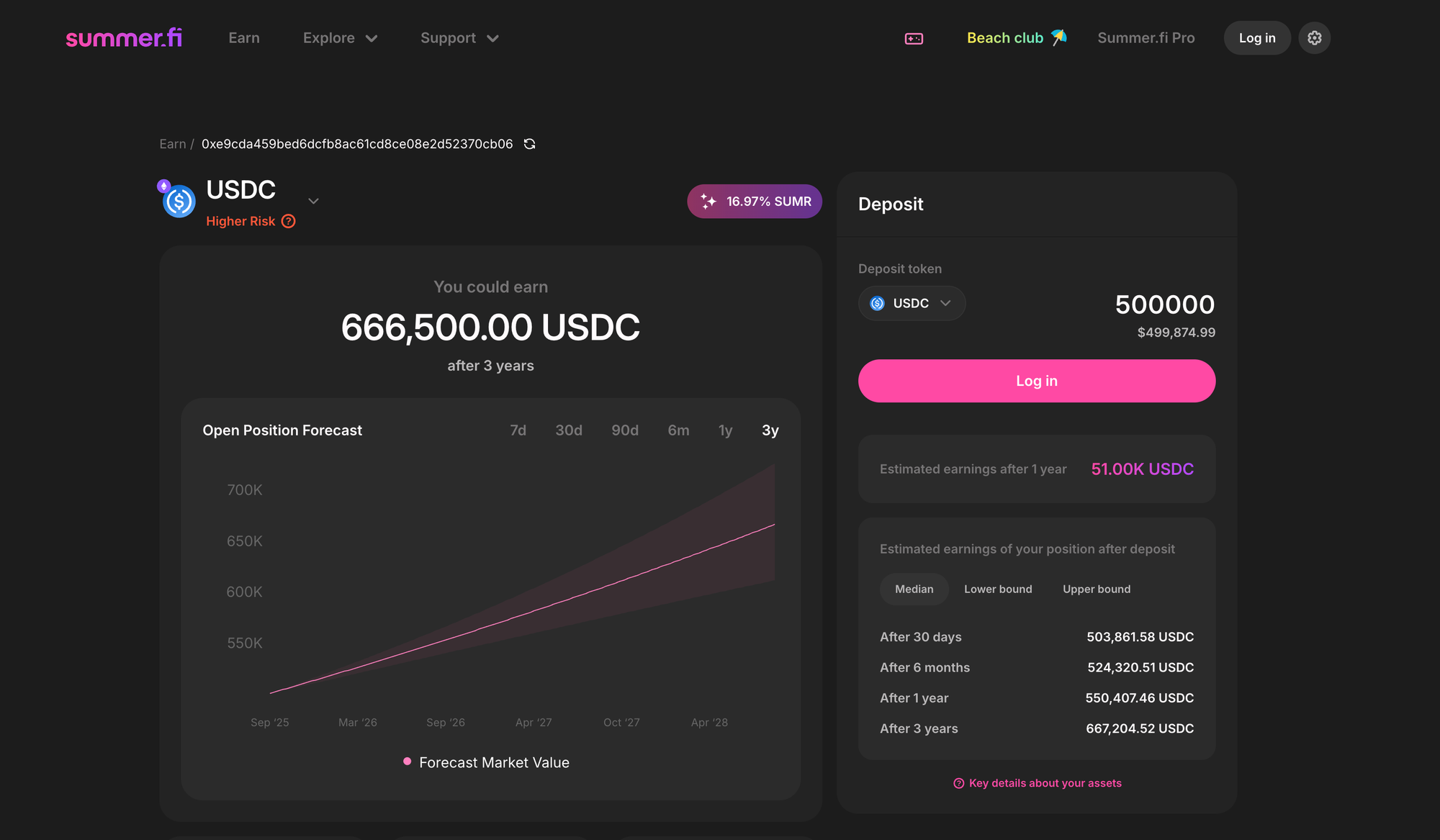

Deposit → Start earning Morpho’s best, automatically.

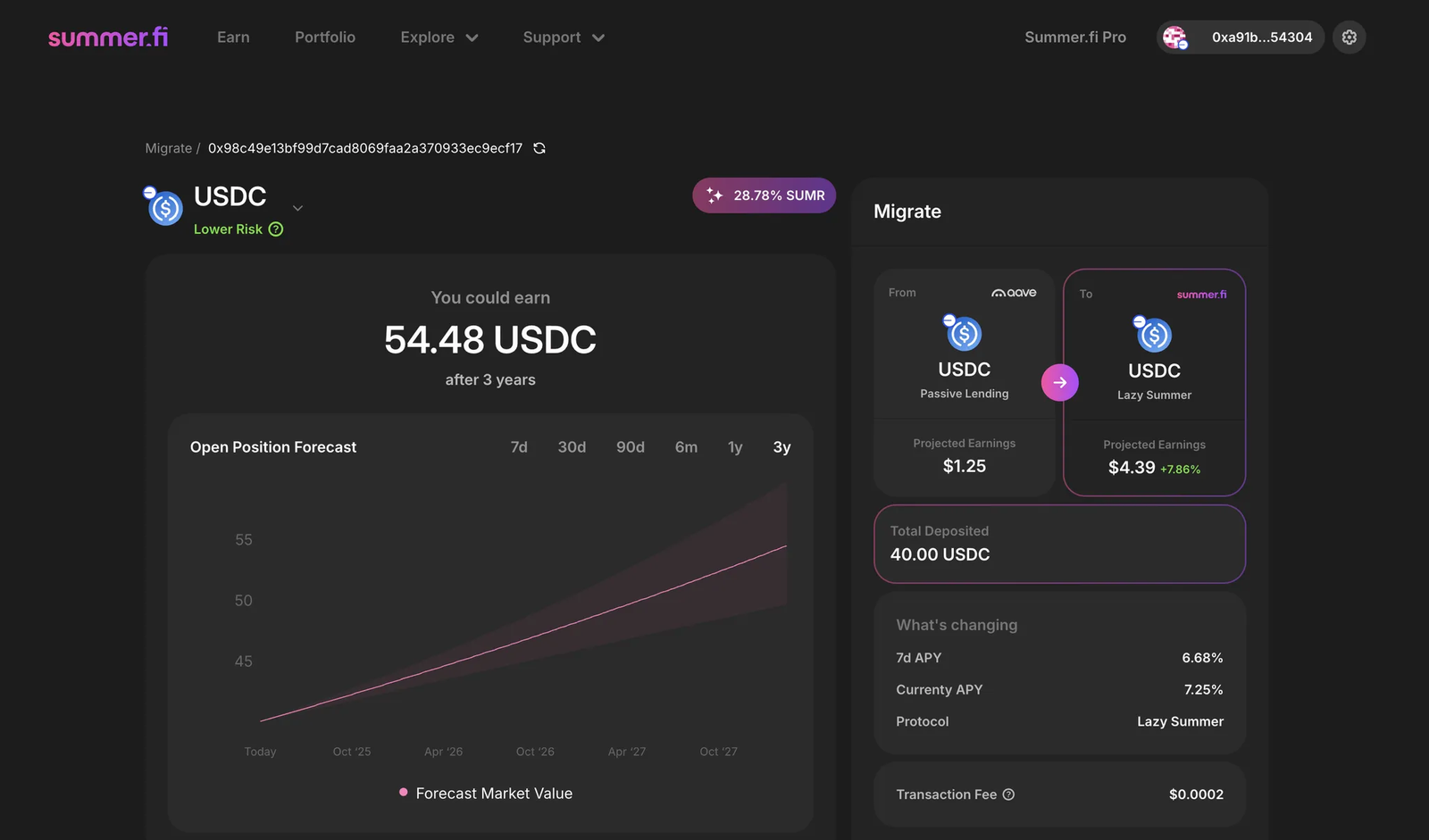

Migrate → Already deposited in Morpho? Migrate in a single transaction and get even more Morpho, Automatically.

Join us

Discord | Telegram | X/Twitter | Linktree

Disclaimer: Oazo Apps Limited functions solely as a front-end interface (Summer.fi) provider and it does not act on behalf of any user. Oazo Apps Limited did not launch nor does it operate or control the Lazy Summer Protocol. The Lazy Summer Protocol is accessed through Summer.fi. The information provided herein is provided on behalf of the Lazy Summer Foundation which launched the Protocol for informational purposes only and it does not constitute investment advice. Oazo Apps Limited and the Lazy Summer Foundation are not soliciting or recommending any transaction or guaranteeing any specific returns. Users interact with the Protocol at their own risk. T&C for the use of Summer.fi apply.