2025: The Fragmentation of Yield

2025 was the year onchain yield grew up (and got more complicated).

If 2024 was about the resurgence of DeFi, 2025 was defined by yield source diversity.

The "risk-free" baseline of ETH staking and Aave V3 deposits remains, but the landscape has fractured into a complex ecosystem of onchain credit, curator-managed vaults, restaking layers, and managed looping products.

The paradox of 2025: Onchain yield got so much better that it actually got worse for the manual allocator. The sheer volume of choice created a "paradox of choice" that penalized those without the time or tools to monitor it.

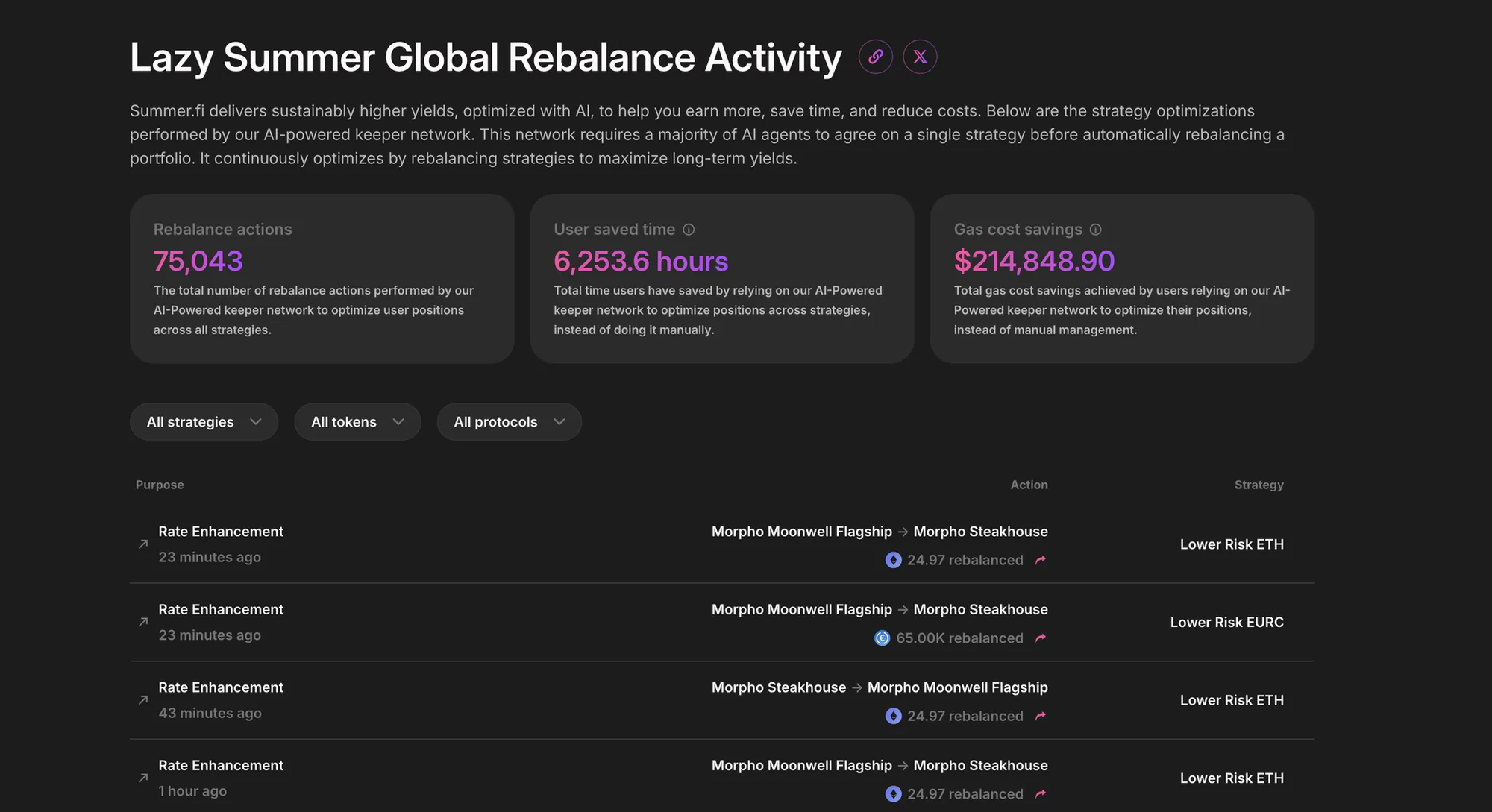

Lazy Summer Protocol was built for exactly this moment. Below, we look at the 75,021 automated rebalance actions that defined the year, and what they reveals about the new state of DeFi.

https://summer.fi/earn/rebalance-activity

2025 DeFi Yield: An evolving landscape

In previous years, onchain yield was often treated as a monolith. Deploy into AAVE or Compound, capture the DAI savings rate and call it a day. In 2025, the market matured into three distinct, non-correlated pillars. The data shows clear fragmented, volatile and competitive behavior across each:

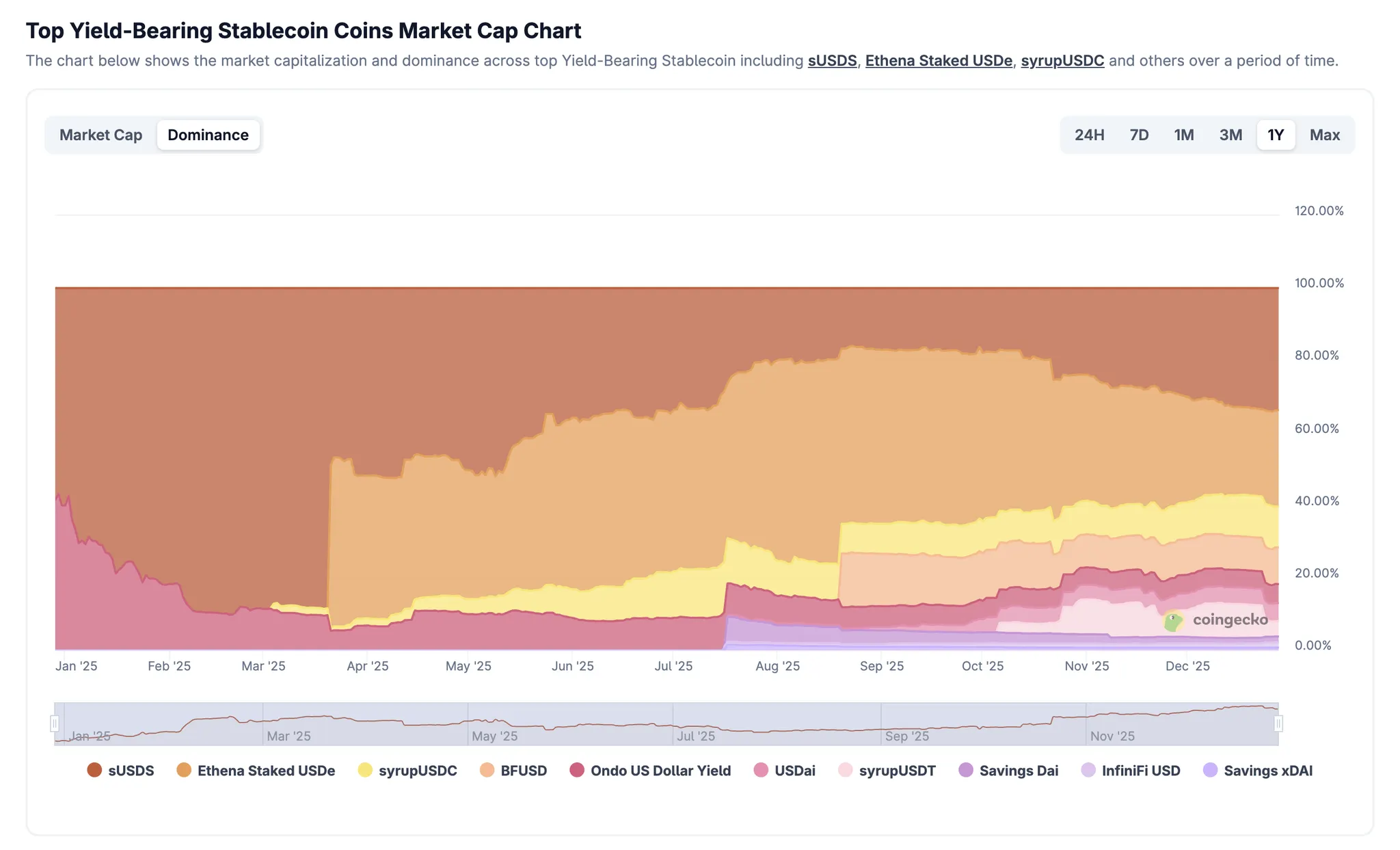

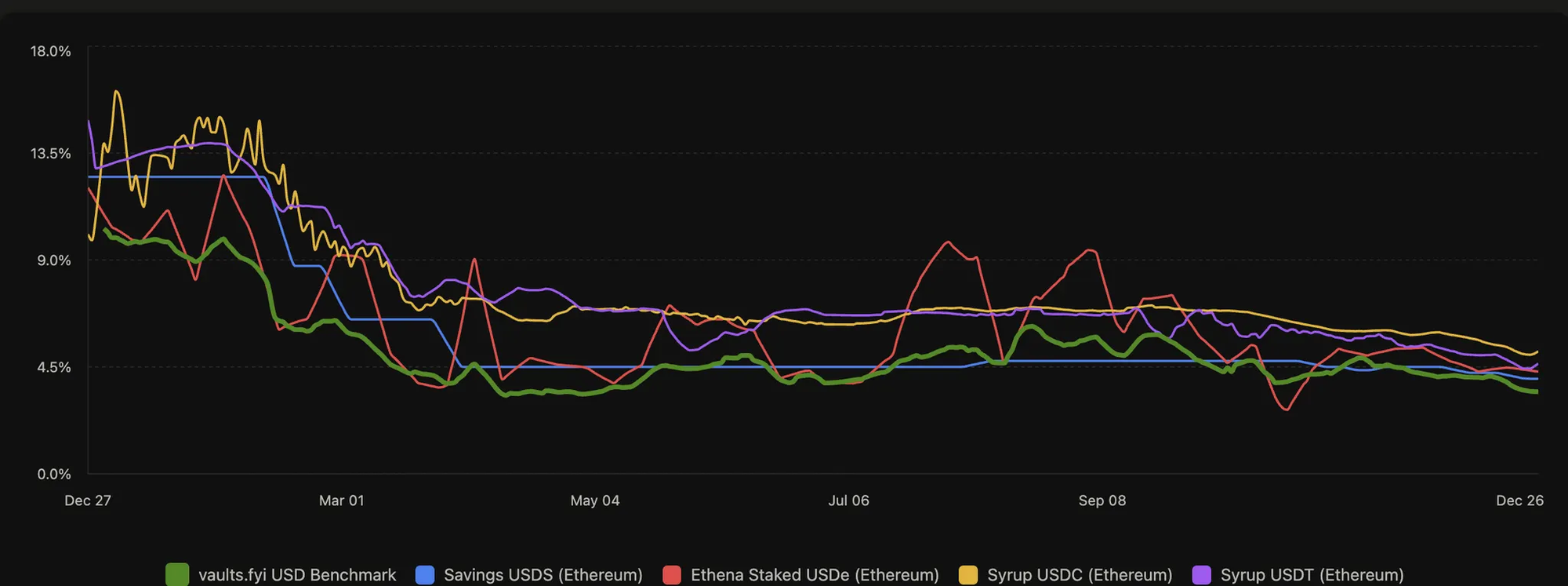

1. The yield bearing stablecoin flight to quality 2025 was a stress test for yield-bearing stables. We saw a decisive "flight to quality"

https://www.coingecko.com/en/categories/yield-bearing-stablecoins#key-stats

2025 was a stress test for yield bearing stables, as the market saw a distinct flight to quality as the year progressed:

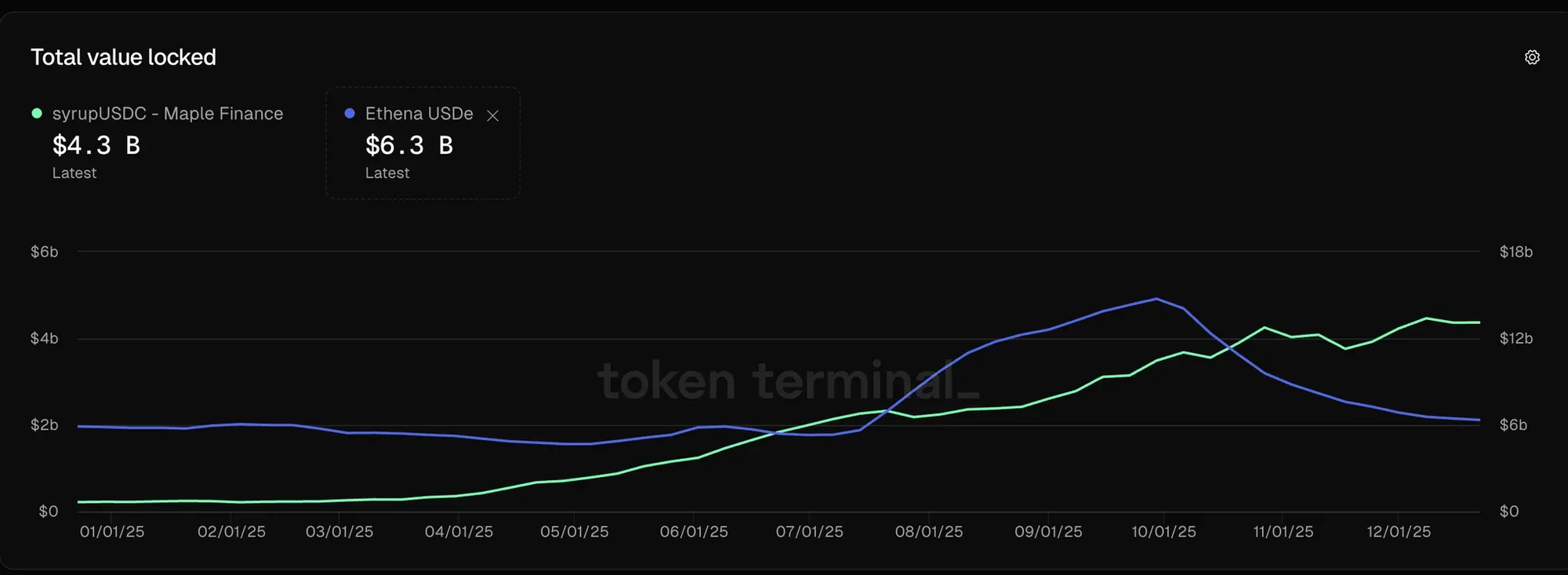

- The Stress Test: The years early leaders like staked USDe saw significant outflows as volatility exposed the protocols weaknesses during period of prolonged latent leverage demand.

Source: Token terminal

- The new game in town: Maple’s Syrup (USDC/USDT) captured the new wave of demand, proving that transparent, institutional crypto credit is a form of lending that DeFi values.

Source: Token terminal

- The benchmark: Conservative capital consolidated into sUSDS (Sky Ecosystem), reaffirming that "Lindy" status is the ultimate premium.

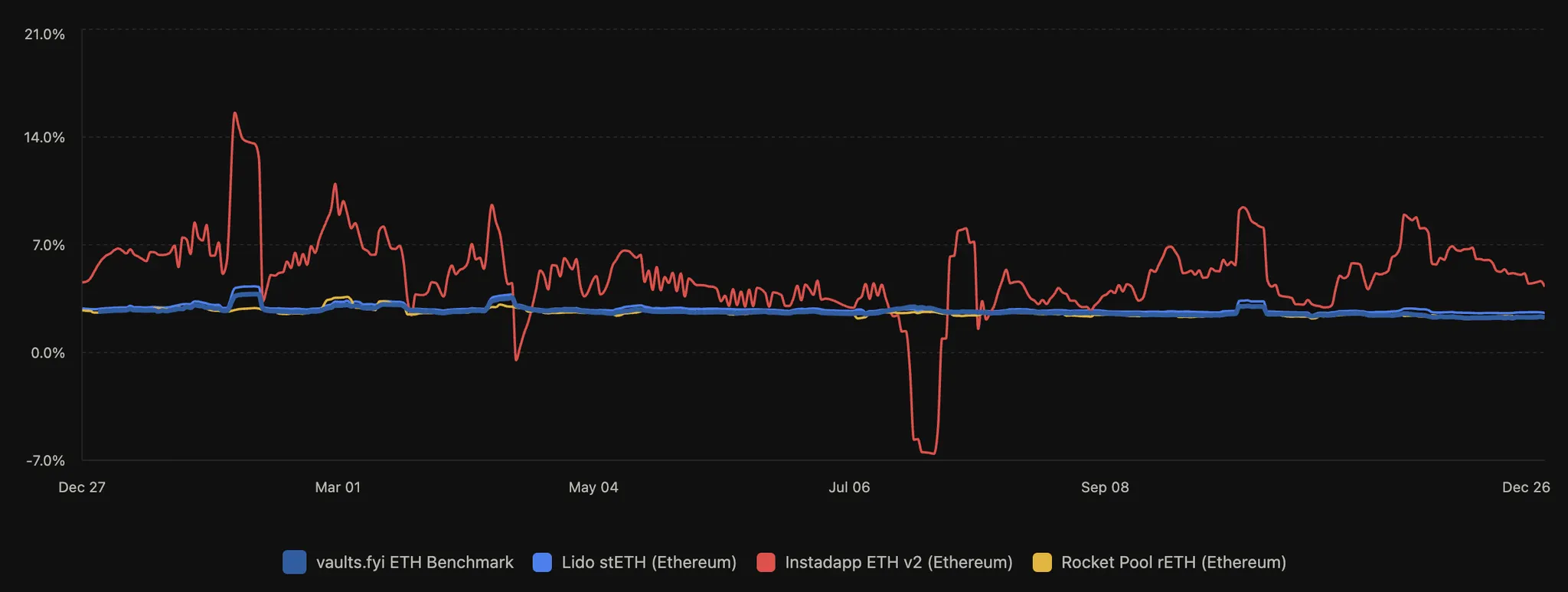

- The ETH Staking benchmark

ETH yield remained the "risk-free" rate of DeFi, though how users achieved grew ever more diverse. Native staking provided the floor, 2025 was defined by the aggressive layering of Restaking, Liquid Restaking and more advanced passive Liquid Staking strategies Origin ETH and FluidLite.

Even yield as simple vanilla ETH staking has become ever more complex.

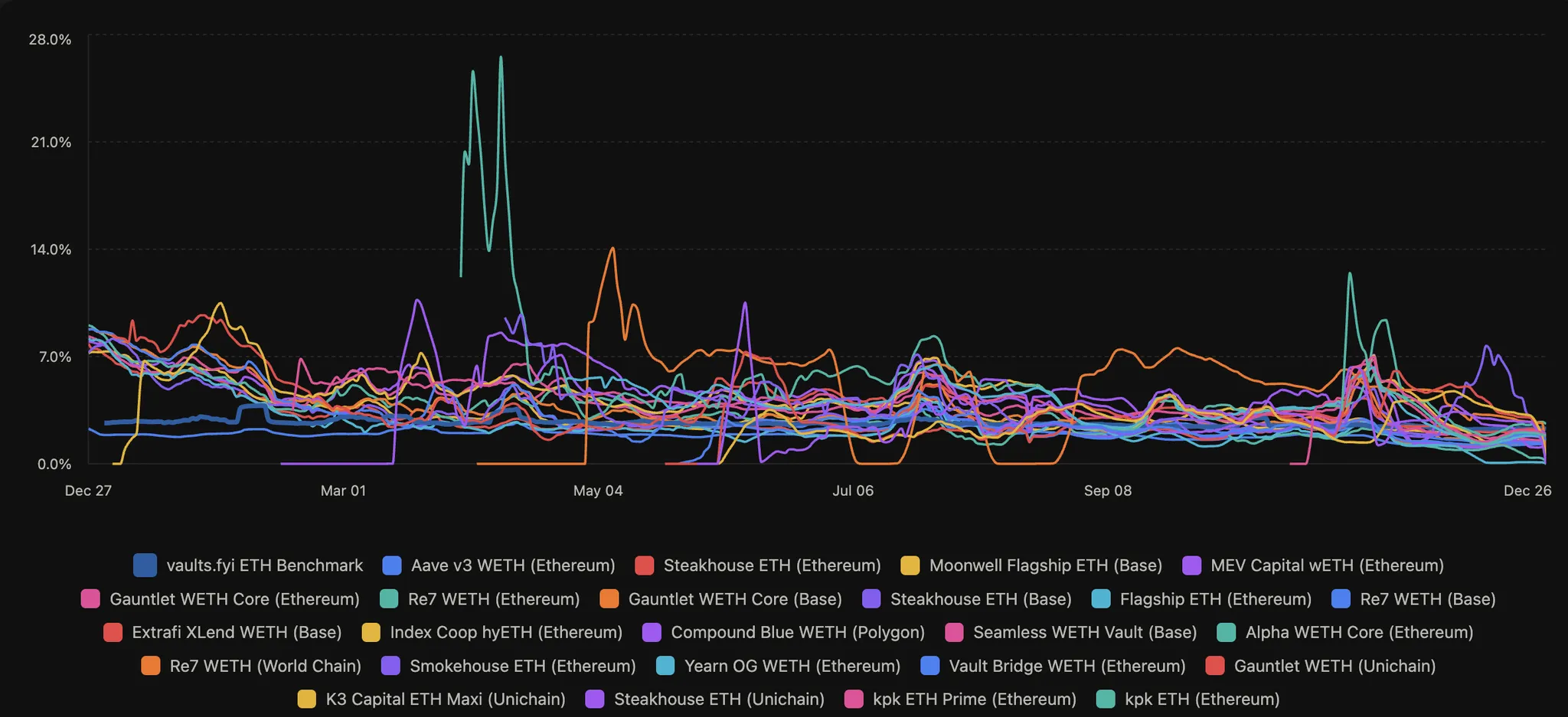

- Peer-to-Pool (The Aave Model): Remained the massive, conservative benchmark for deep liquidity and benchmark stablecoin yield.

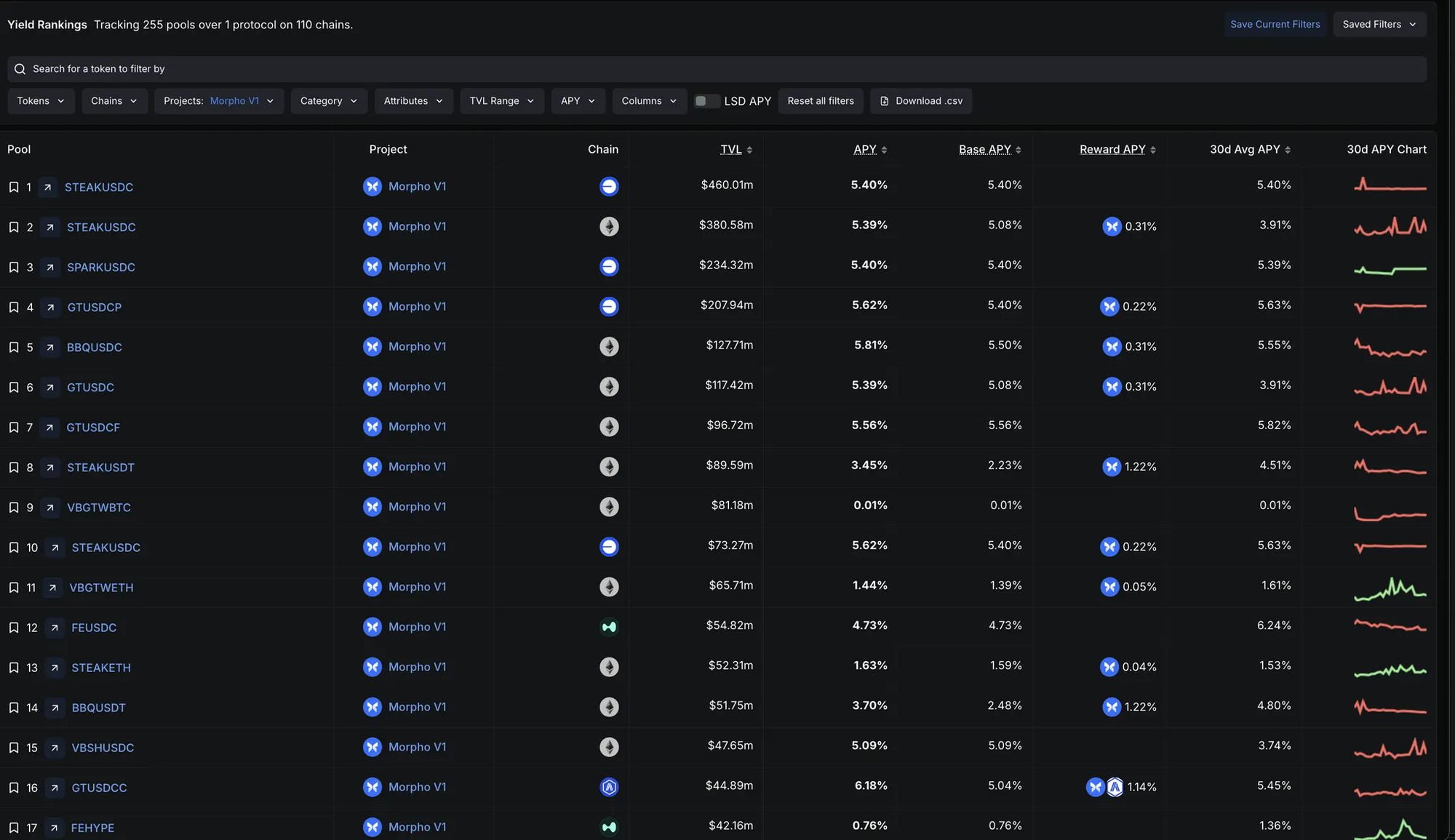

- Curator Vaults (The Morpho/Euler Model): Exploded in volume by offering capital efficiency. However, this shifted the burden of risk to the user. Instead of trusting a protocol, users now had to trust specific Curators to manage parameters. On Morpho v1, a simple search on DeFi Llama results in 255 choices for a user.

The fork in lending markets Perhaps the biggest structural shift occurred in lending, where the market split into two dominant models:

With Lazy Summer Protocol, you didn’t have to chase yield in 2025

Lazy Summer was built on the thesis that manual optimization doesn't scale. In 2025, the protocol turned market volatility into better performance.

All of these new ways of earning yield in DeFi meant more opportunity to earn great yields, but also much more volatility and fragmentation.

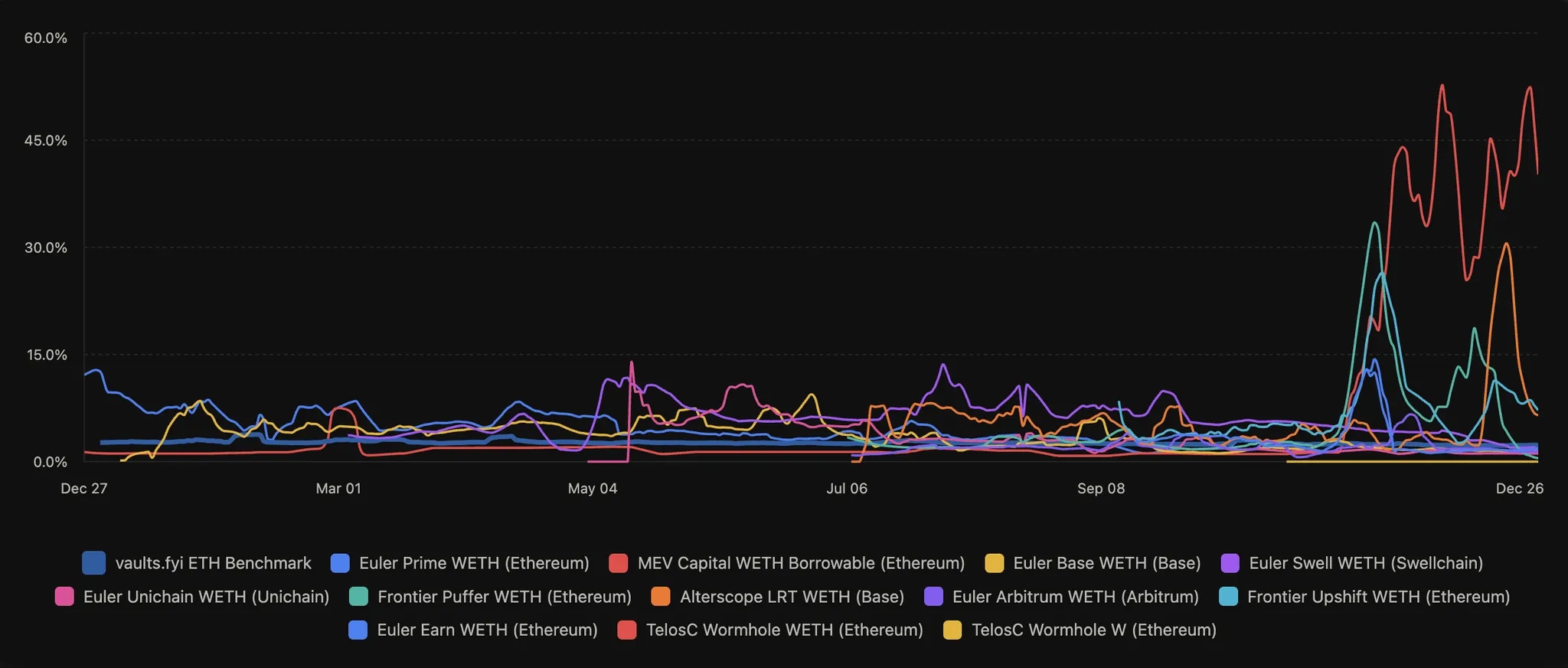

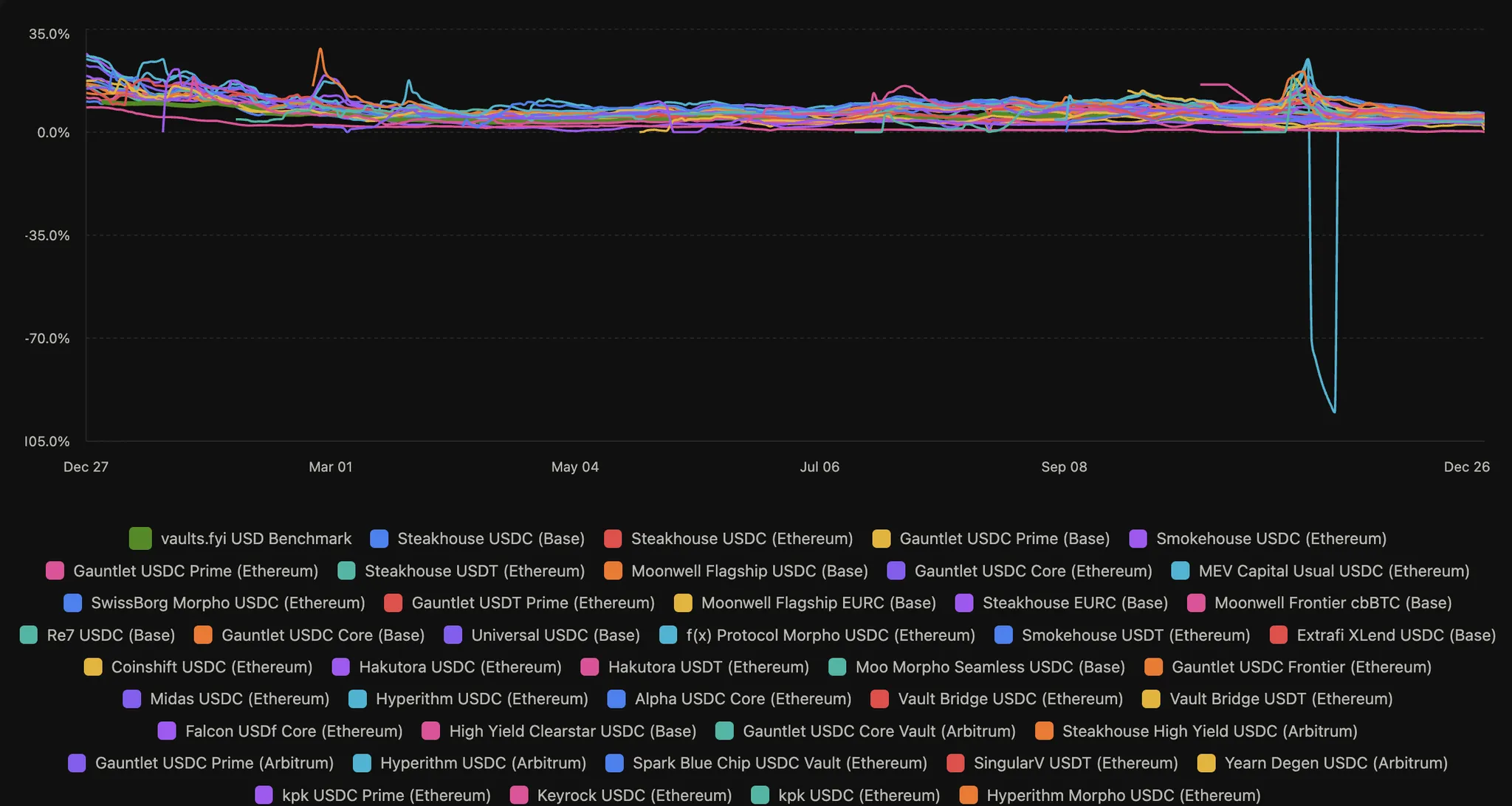

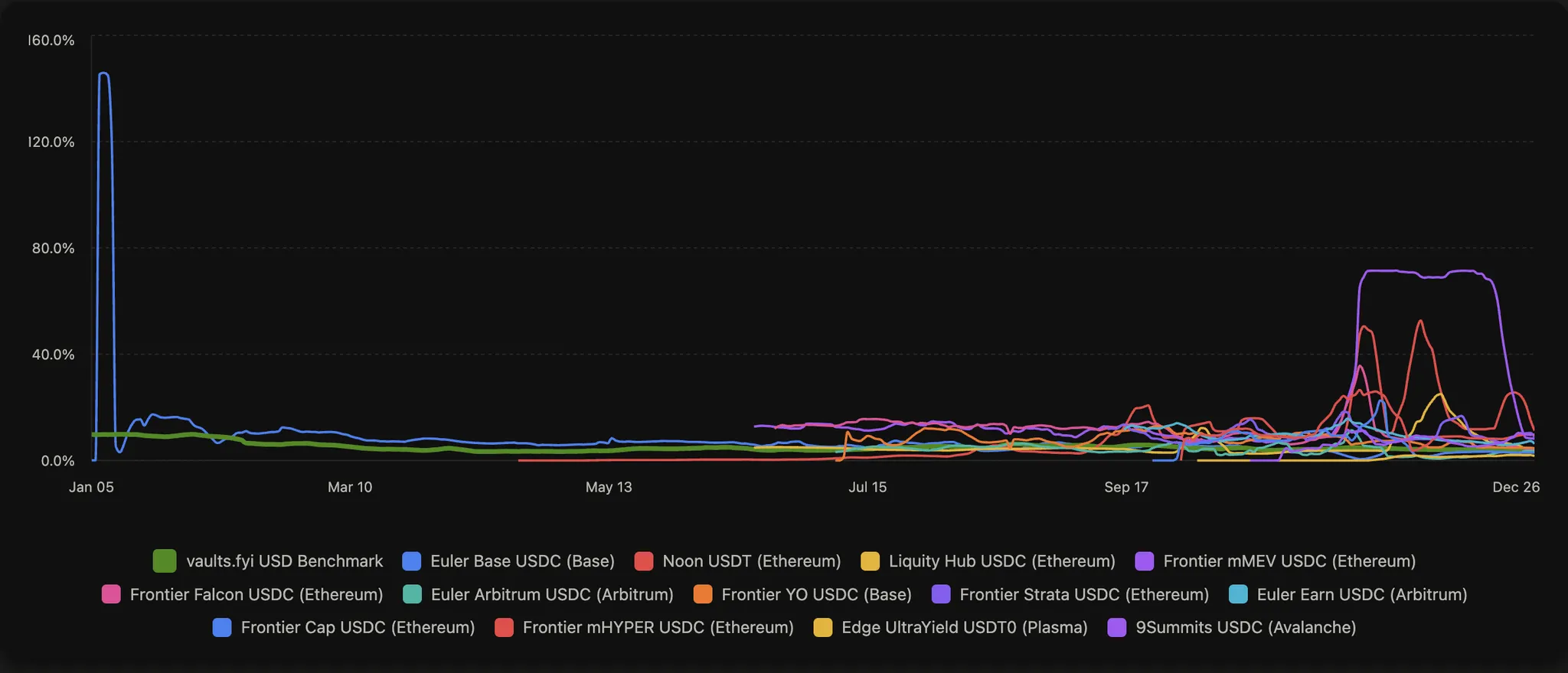

Here is what that looked like in 2025:

Comparing yield bearing stables

Comparing ETH Staking

Comparing lending / borrowing strategies (ETH) - Morpho

Comparing lending / borrowing strategies (ETH) - Euler

Comparing lending / borrowing strategies (Stablecoins) - Morpho

Comparing lending / borrowing strategies (Stablecoins) - Morpho

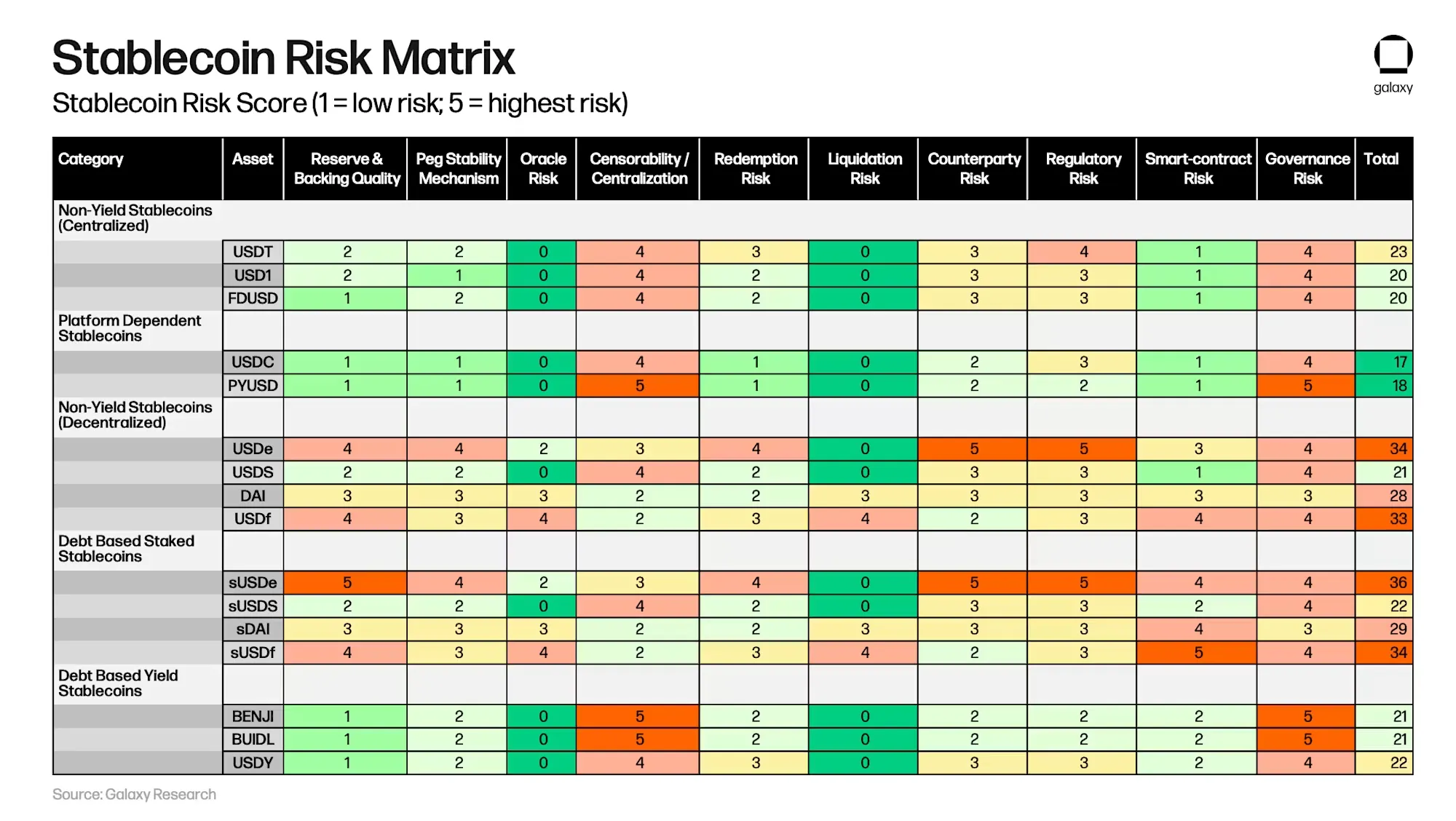

And underlying all of these differing yields are risk decisions users and allocators had to weigh everytime they decided to deposit into something new:

Source: Galaxy Research

While onchain yield fragmented in 2025, Lazy Summer’s automation engine unified the experience and gave users automated exposure to best that the market had to offer.

That meant:

- 75,021 rebalance actions executed

- 65 unique yield sources accessed

- 4 networks covered (Mainnet, Base, Arbitrum, Optimism)

- 0 time spent by users on research

https://summer.fi/earn/rebalance-activity

2025 Monthly highlights: Capital in motion

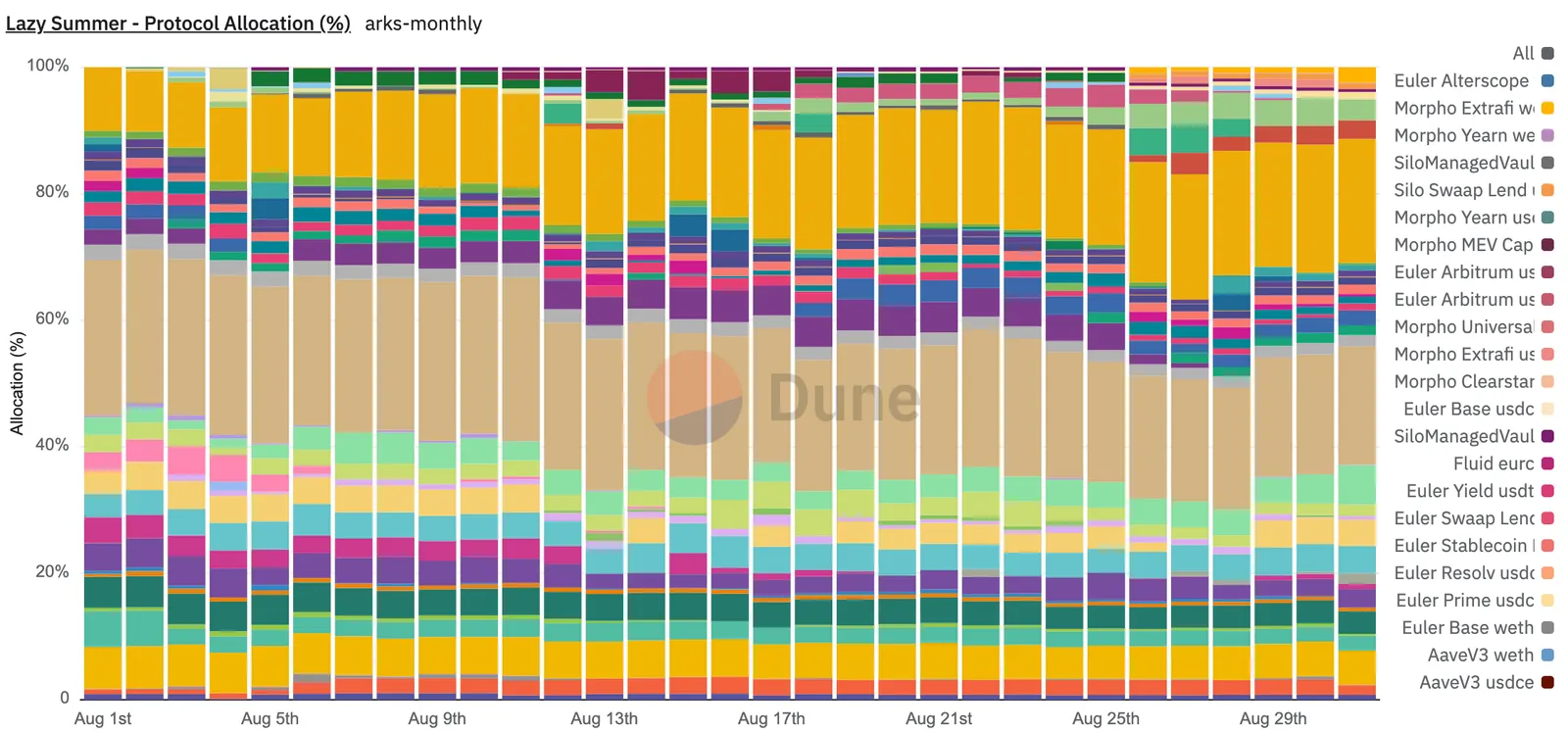

To better illustrate the 75,021 rebalance actions that happened within the Lazy Summer protocol, here are some highlights from some particularly active months in the onchain yield market:

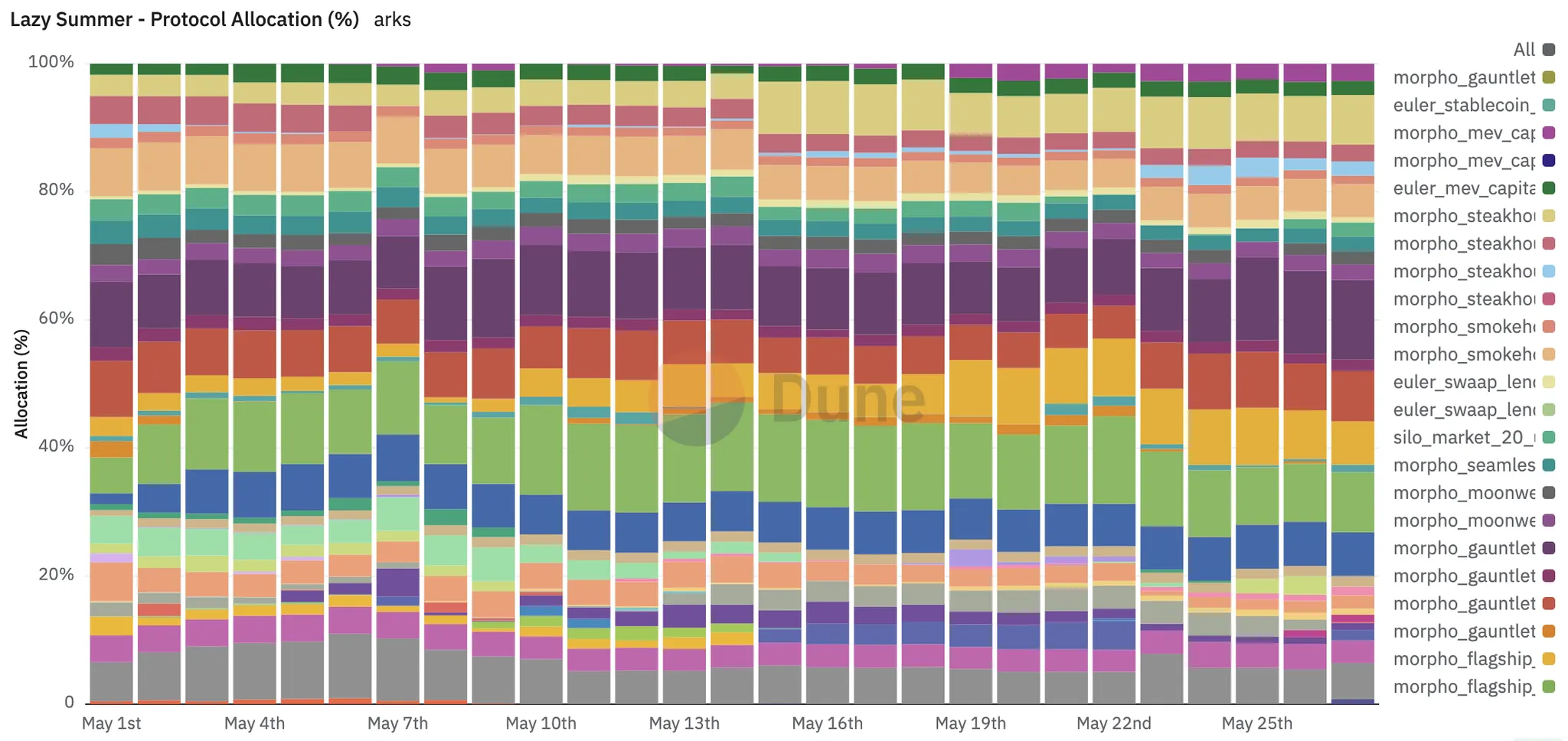

May 2025

May: The ETH Rotation. A decisive shift into ETH-denominated strategies, specifically Morpho Flagship and Euler Prime WETH.

https://blog.summer.fi/lazy-summer-monthly-rebalance-trends-may-2025/

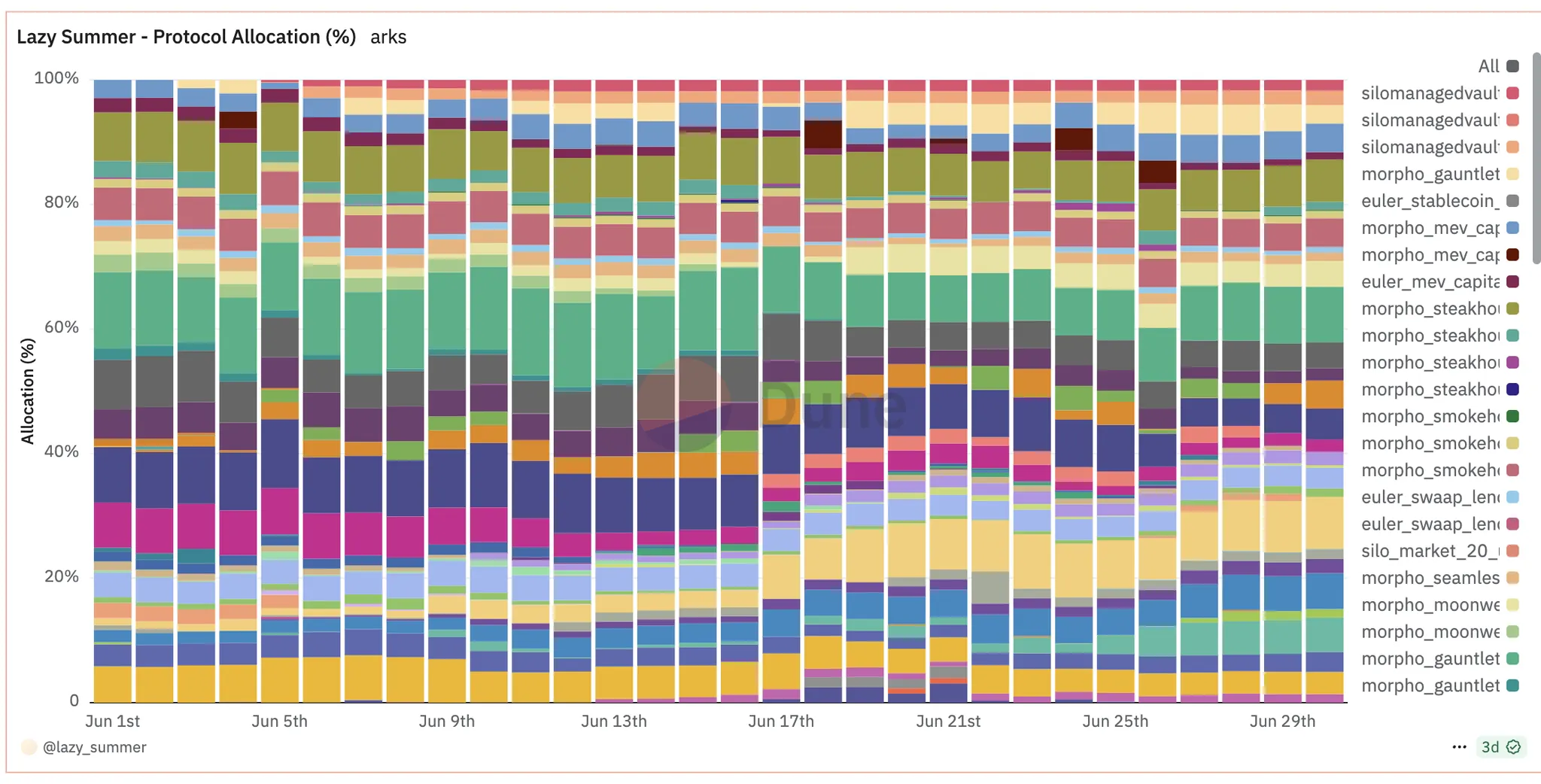

June 2025

June: The Rise of Syrup. While ETH remained strong, Syrup USDC became the "dark horse" of the portfolio, capturing massive institutional credit demand.

https://blog.summer.fi/lazy-summer-monthly-rebalance-trends-june-2025/

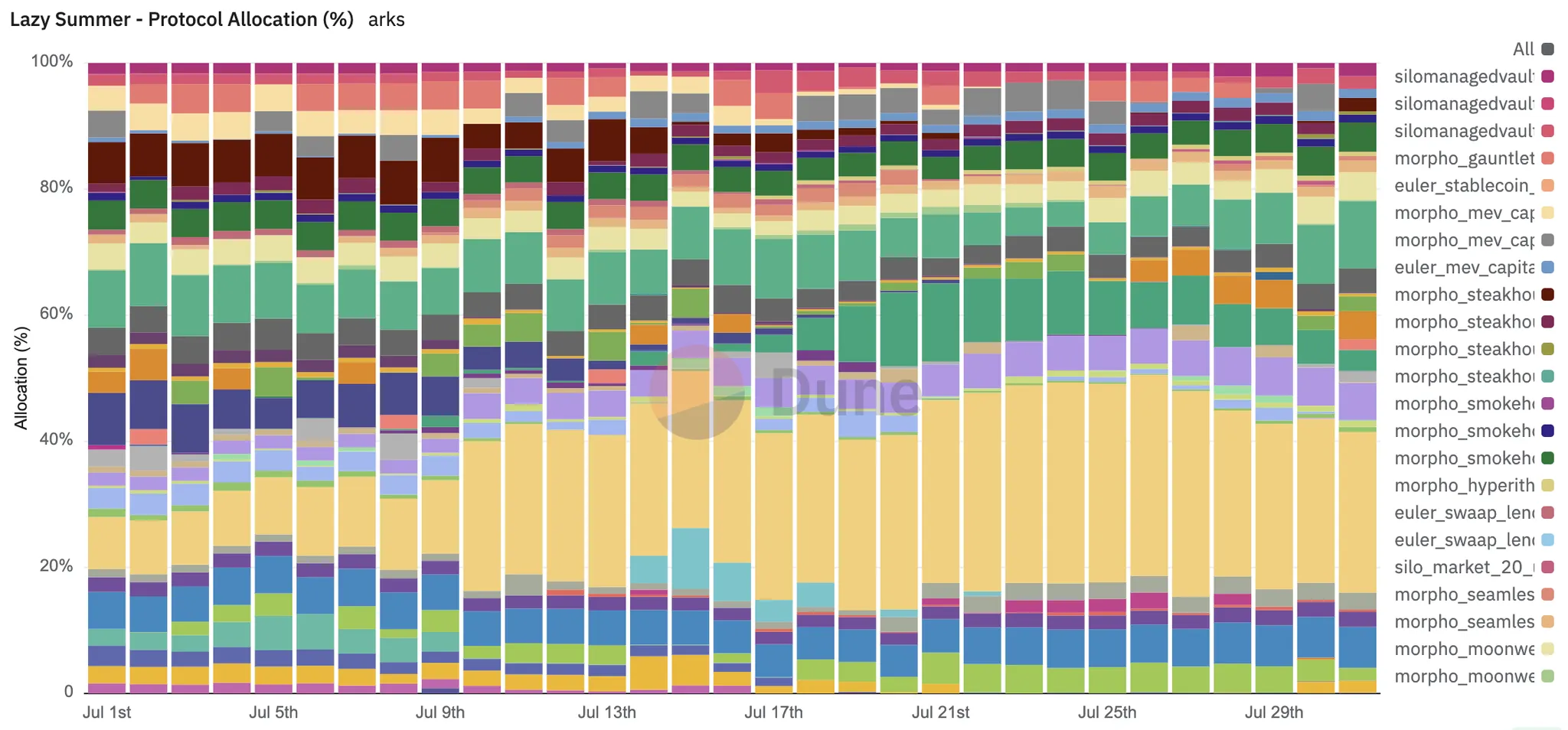

July 2025

July: Morpho Dominance. Capital began consolidating into the Morpho curator ecosystem. By month’s end, Morpho strategies represented ~19.4% of total protocol TVL.

https://blog.summer.fi/lazy-summer-protocol-monthly-rebalance-trends-july-2025/

August 2025

August: The $150M Shift. Over $150M in TVL rotated across Mainnet and L2s. Origin ETH acted as the anchor, while Euler & Gearbox saw tactical inflows to capture spikes in borrow demand.

Why Lazy Summer Won in 2025

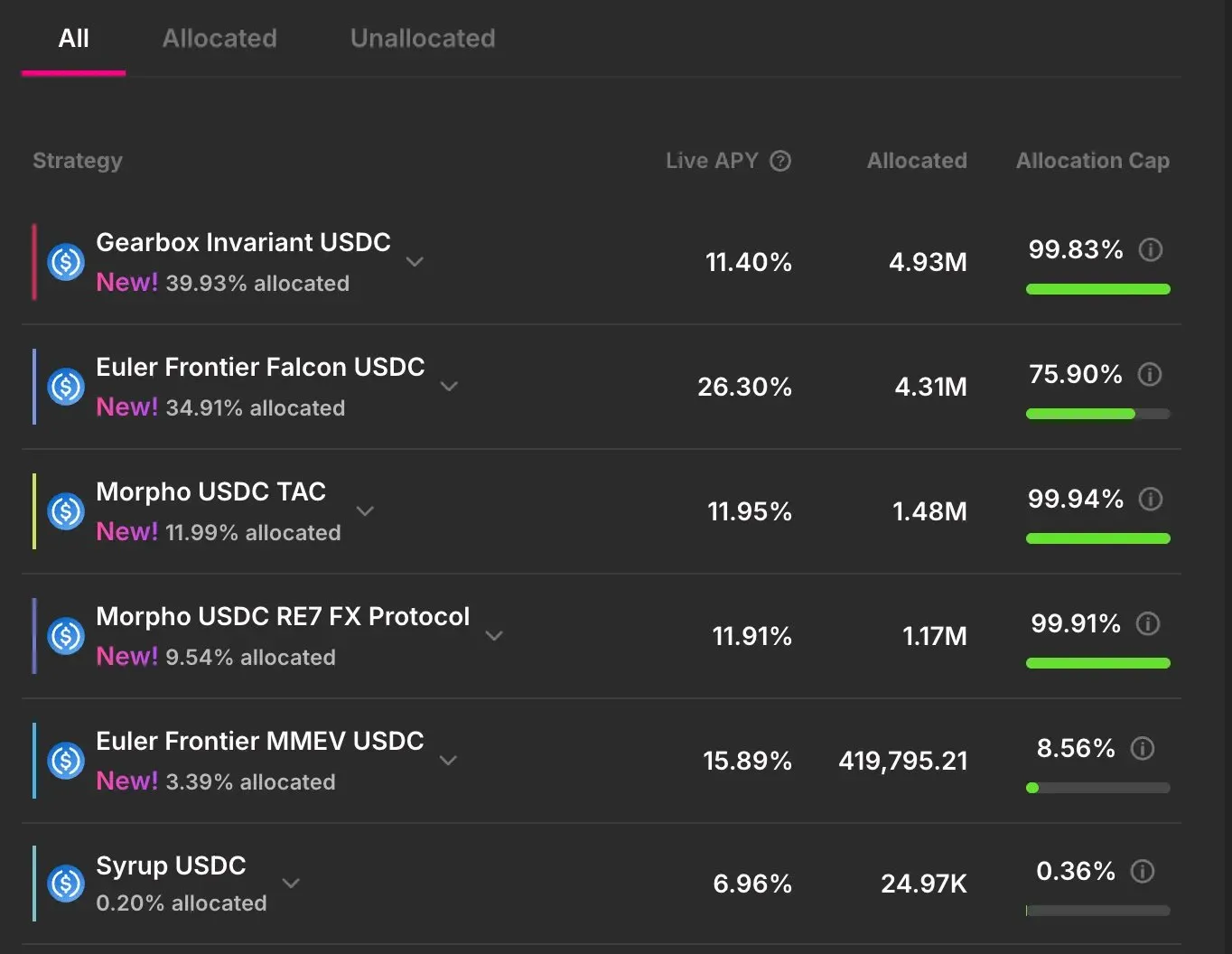

For DeFi Natives, Lazy Summer was an automation engine, capturing yields across 65 yield sources that were too fast, far reaching, or gas-intensive to chase manually.

For institutional allocators, Lazy Summer was the risk-adjusted entry point into DefI Yield. Every rotation was governed by Block Analitica’s independent risk frameworks. You didn't have to vet 255 Morpho vaults or understand which Euler risk curators to avoid, you just had to user Lazy Summer protocol, and that did it for you.

In 2026, it will be more of delivering on those promises for Lazy Summer:

- Above-Benchmark Yield: Diversified exposure that consistently outperformed static deposits.

- Risk Curation: Access to novel yields (like Syrup or Fluid) within a strict, governed framework.

- No Yield Chasing: Governance and risk experts handled the "New Shiny Object" syndrome so users didn't have to.

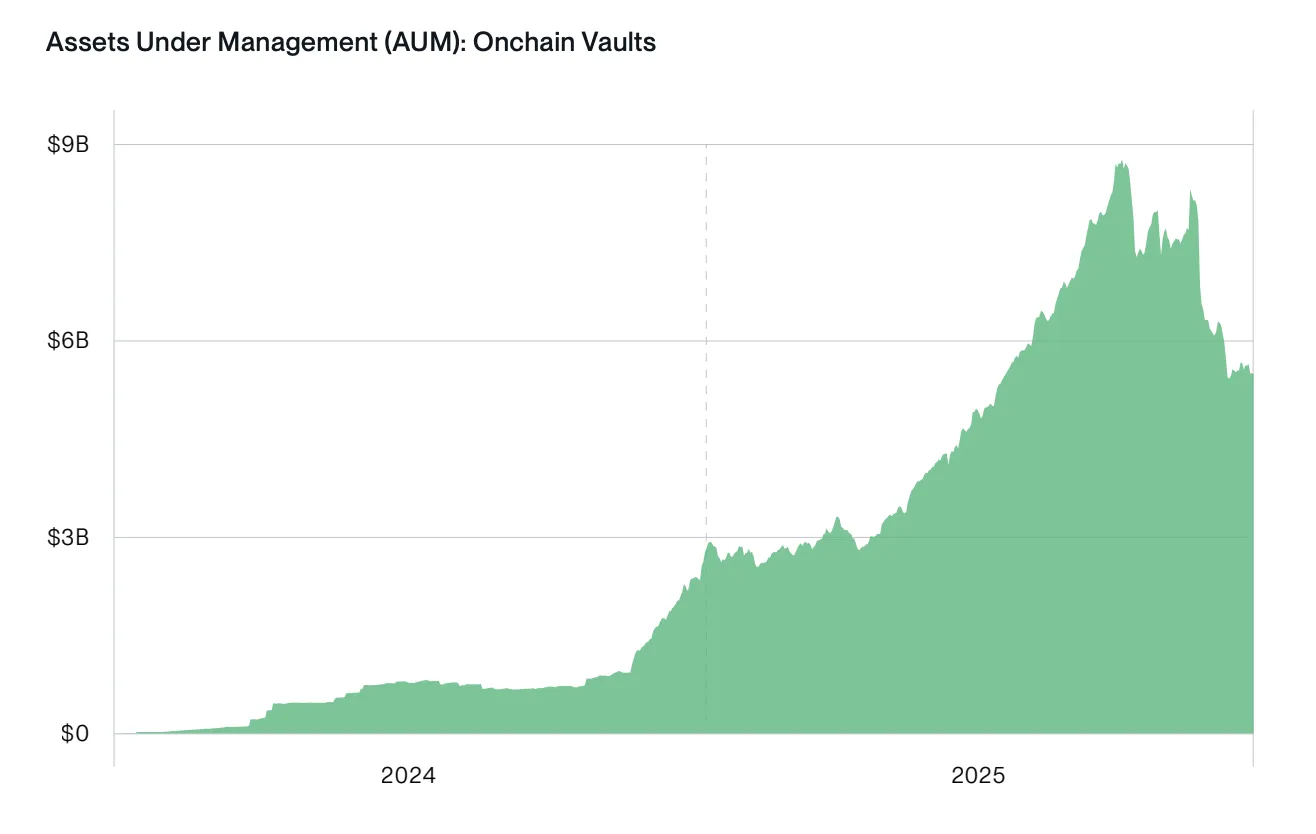

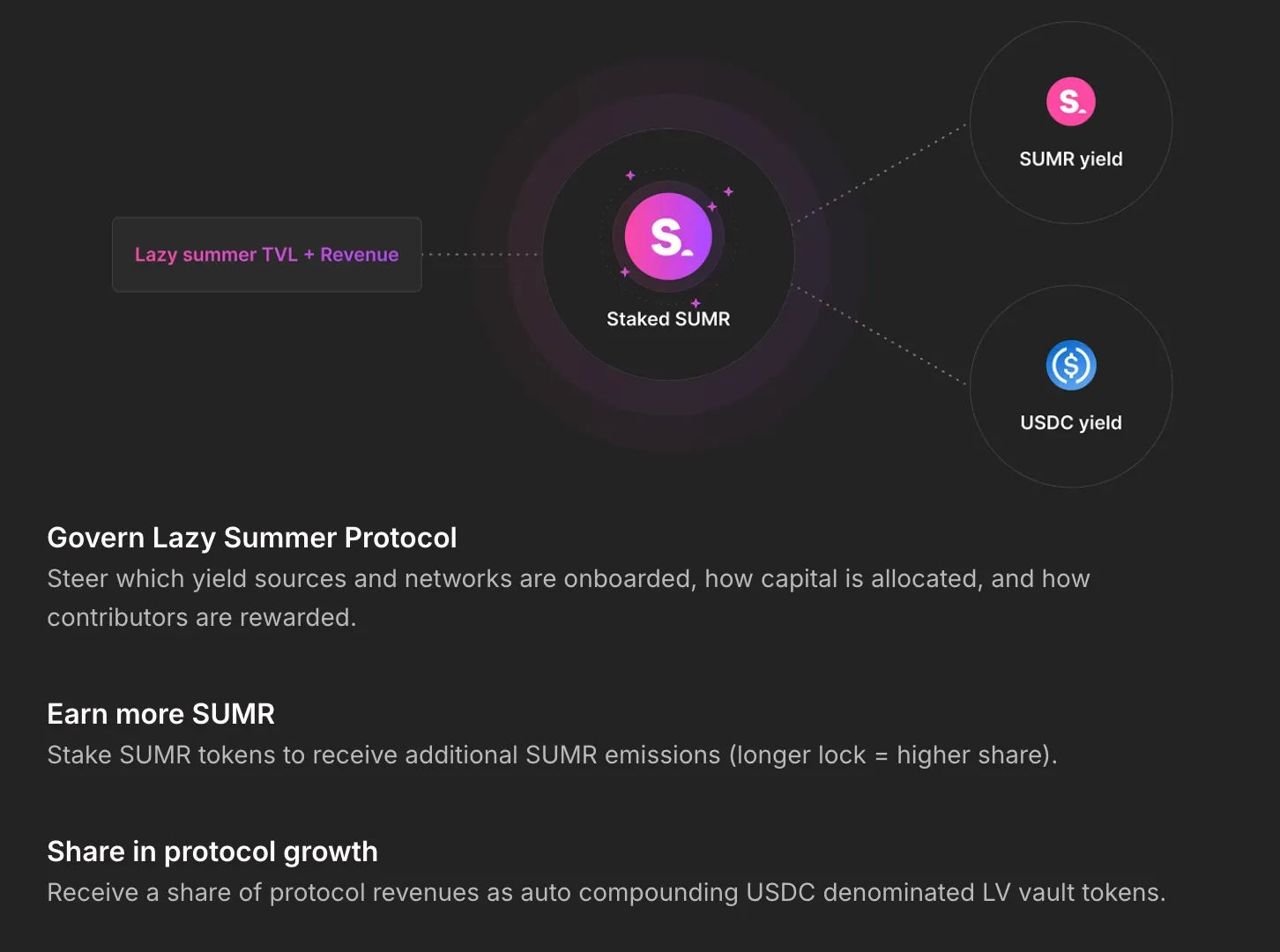

2026: The Year of SUMR

As Bitwise notes, onchain vaults are the "ETFs 2.0." In 2026, we expect these primitives to double in size as the world realizes that "Passive DeFi" is the most efficient way to hold capital.

But one of the most important dates on our calendar is January 21, 2026.

On this day, the SUMR token becomes liquid (TGE). For the users who have used Lazy Summer protocol to navigate the complexities of 2025, this is the moment where protocol participation turns into true protocol ownership.

The best of DeFi yield, automated, risk-managed, and now, rewarded with a liquid stake in the future of the protocol.

Automated exposure to DeFi’s highest quality yield was just the beginning. See you on January 21.

Join us

Discord | Telegram | X/Twitter | Linktree

Disclaimer: Oazo Apps Limited functions solely as a front-end interface (Summer.fi) provider and it does not act on behalf of any user. Oazo Apps Limited did not launch nor does it operate or control the Lazy Summer Protocol. The Lazy Summer Protocol is accessed through Summer.fi. The information provided herein is provided on behalf of the Lazy Summer Foundation which launched the Protocol for informational purposes only and it does not constitute investment advice. Oazo Apps Limited and the Lazy Summer Foundation are not soliciting or recommending any transaction or guaranteeing any specific returns. Users interact with the Protocol at their own risk. T&C for the use of Summer.fi apply.