Yield Source Update: Pre SUMR TGE

The Lazy Summer Protocol promise

Finding the best yields in DeFi shouldn't feel like a full-time job. Between monitoring multiple protocols, assessing risks, and rebalancing positions, chasing yield is exhausting. That's where Lazy Summer comes in.

Lazy Summer Protocol provides automatic exposure to DeFi's highest quality yield sources through a single, simple interface. No constant monitoring. No manual rebalancing. Just set it and forget it while your capital works across the most promising opportunities in DeFi.

A year of Doing Less (and earning more)

As the Lazy Summer Protocol's token, $SUMR, approaches its TGE, we're showcasing the underlying value the protocol has delivered since launch, and the value $SUMR is positioned to capture.

Since launching in February 2025, Lazy Summer users gained automated access to DeFi's highest quality yield sources. They were able to Do Less. But what does that mean in practice? If you've been sitting in a single protocol like Morpho or sUSDs, truly understanding the breadth of additional exposure is profound.

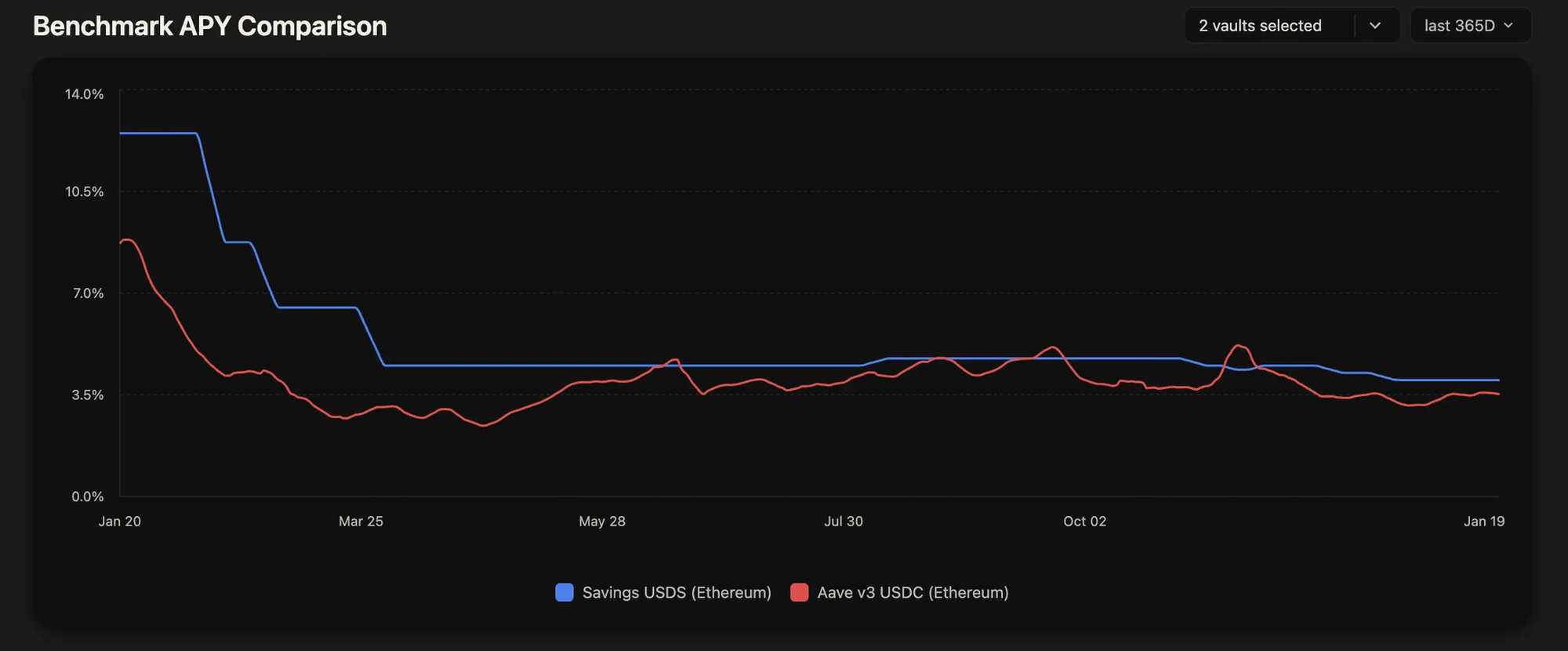

DeFi risk/return is dynamic, so to, should your yield strategy

DeFi risk/return profiles are dynamic, your yield strategy should be too. Not all yield sources offer equal opportunities, and what's optimal changes constantly. October 10 ≠ July 20, for example… when it comes to the best risk/reward protocol or yield source.

Capital shouldn't sit in a single yield source while conditions shift around it. This is exactly what Lazy Summer handles automatically. Here's how that played out over the past year.

The Foundation: Origin and Morpho dominate

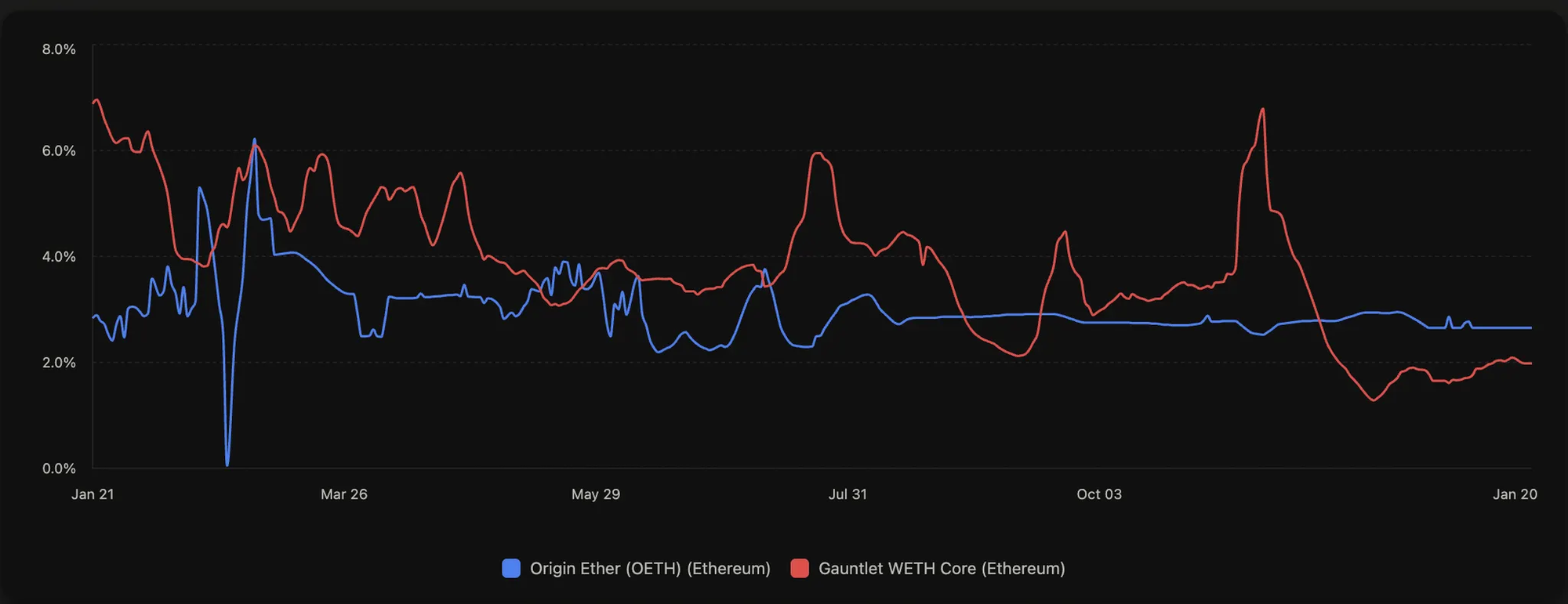

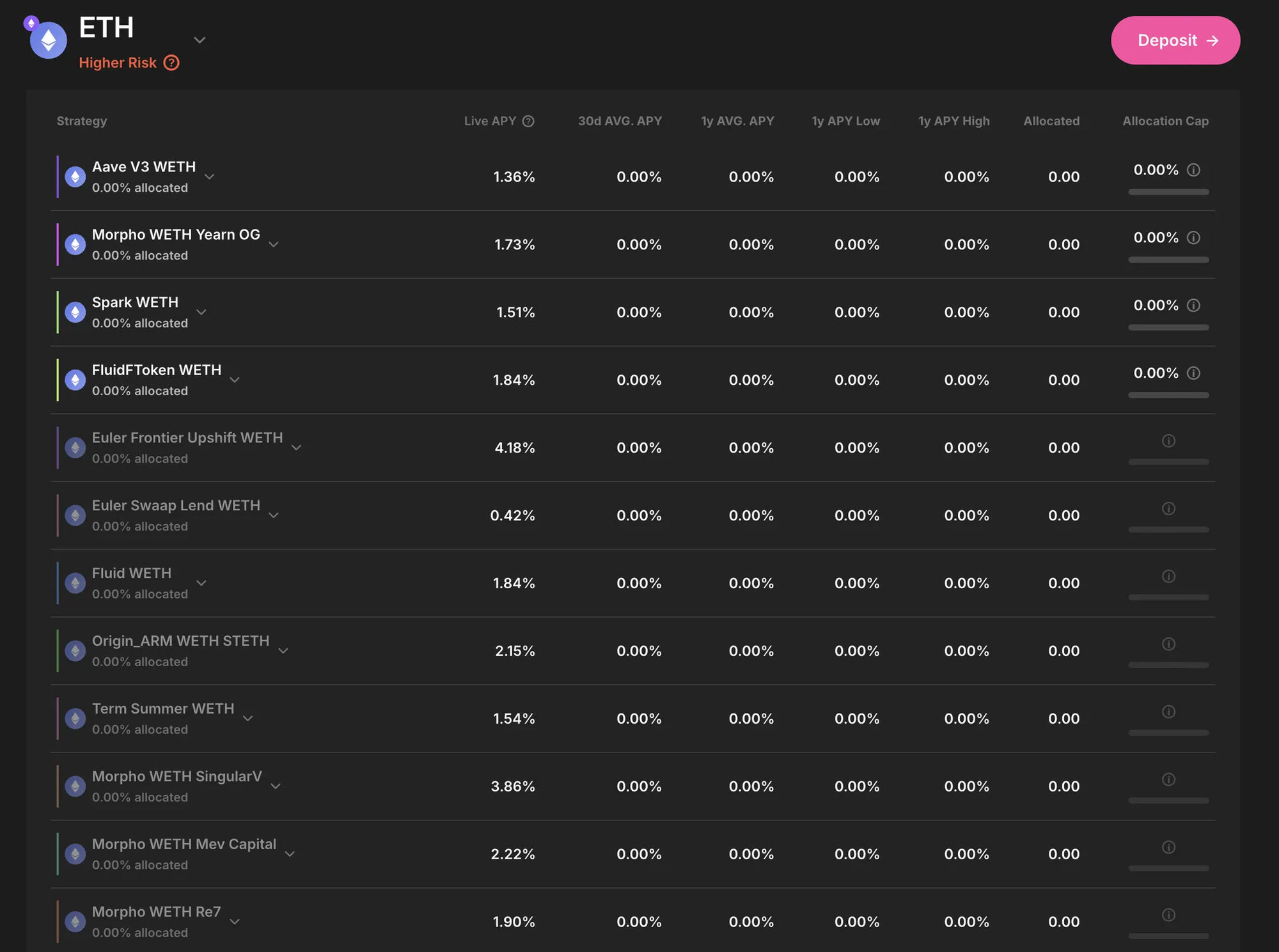

Lazy Summer's yield sources were primarily anchored by Origin and Morpho, specifically their WETH strategies.

Origin WETH emerged as the undisputed heavyweight, securing the highest average share of protocol TVL at 10.53% and peaking at 32.6% in late July. Once it took the lead, it held firmly, remaining the single largest allocation for 134 days, dominating from June through December.

Morpho Gauntlet WETH played the reliable backbone. With a 9.22% average share, it was the "consistency king," remaining in the top-3 allocations for 240 days (approximately 8 months), significantly outlasting Origin in sheer presence.

Morpho's ecosystem depth

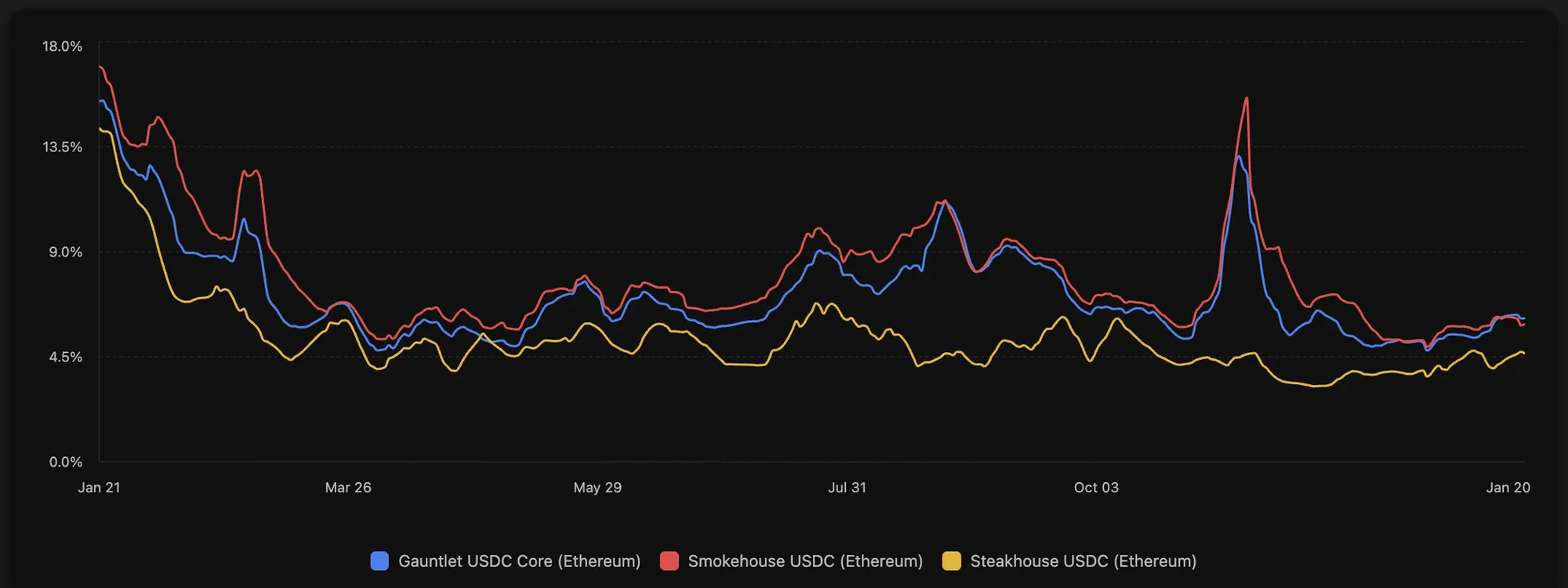

Beyond WETH, the Morpho ecosystem showed impressive breadth across multiple risk tiers and assets:

- Morpho Gauntlet USDC held a strong 5.9% average share

- Morpho Smokehouse USDC and Morpho Steakhouse WETH contributed another ~9% combined average share.

Collectively, these vaults ensured Morpho remained ubiquitous in the top yield ranks throughout the year.

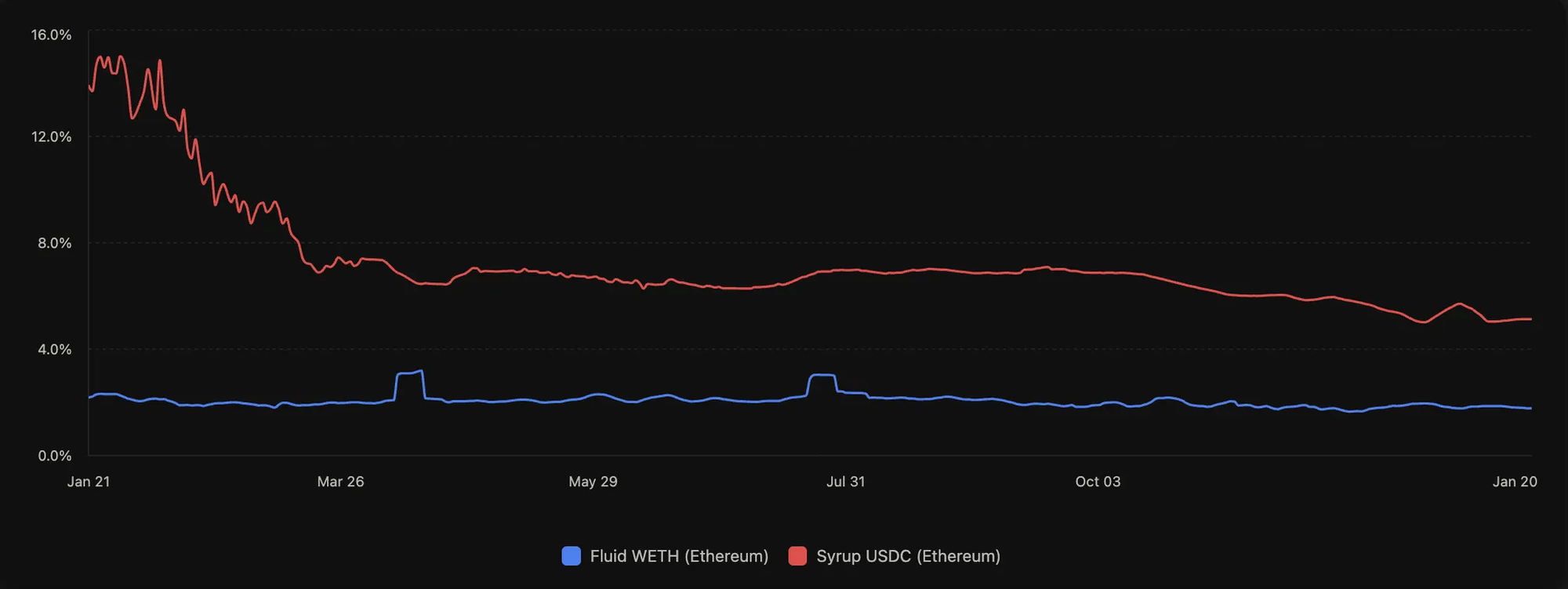

Q4's flight to safety: Fluid and Syrup rise

The fourth quarter saw the rapid ascent of Fluid and Syrup as blue-chip strategies:

Fluid's Q4 rally: The Fluid ecosystem surged in November and December. Fluid WETH peaked at 25.4% of TVL in mid-November, while FluidLite WETH and Fluid USDC both hit all-time highs in mid-December.

Syrup's strong finish: Syrup USDC spent 102 days in the top 3, peaking at 11.3% on December 18, cementing itself as a key stablecoin strategy alongside Morpho vaults.

Tactical rotations: the opportunistic edge

Unlike the steady giants that held baseline allocations, certain yield sources functioned as tactical plays dormant for stretches, then surging when conditions made sense.

The bluechip stablecoin strategy rotation story

2025's tactical stablecoin allocations featured two massive, mirror image rotations:

The year opener - SkyUsds: February began with a rush into SkyUsds, peaking at 18.86% of TVL on February 23. This captured liquidity right out of the gate before other strategies awakened, driven by exuberance around the new administration's crypto-friendly stance.

The year closer - AaveV3 USDC: Capital rotated violently into AaveV3 USDC in Q4, surging to 19.24% of TVL in late November. This represented a flight to safety post Stream Finance, with depositors accepting lower yields for greater security.

Fluid as the momentum play

If Origin and Morpho were the "value" plays of 2025, Fluid was the "growth" play, a high-conviction bet that accelerated throughout the year.

Fluid WETH peaked at an enormous 25.37% in mid-November, functioning as a liquidity magnet during Q4. FluidLite WETH reinforced this, rallying to 19.19% in December, confirming peak appetite for Fluid exposure at year-end.

Concentration vs. diversification: Lazy Summer has the ability to adapt to market conditions

One critical aspect of Lazy Summer protocol is its ability to adapt between concentration and diversification based on market conditions. This continuum of risk/reward tells a fascinating story.

Launch (February 15): The protocol began conservatively with just 12 active yield sources while testing the rebalancing mechanism.

The great expansion (Q2): By June 26, the protocol reached peak diversification. On June 25, the single largest yield source accounted for less than 8% of TVL, risk was nearly perfectly distributed while still producing above benchmark returns.

Return of conviction (July 27): The protocol made its boldest single bet, allocating 32.6% to Origin WETH as clear risk/reward outliers emerged.

Maximum access (September 26): The protocol hit peak breadth with capital deployed across 40 unique yield sources simultaneously, capturing the full spectrum of market opportunities.

Post crisis consolidation (November 18): Following the Stream Finance incident, the protocol tightened to just 5 yield sources, prioritizing capital protection over yield seeking.

Spotlight: the year's standout yield sources

The anchor: Origin WETH

Origin WETH was 2025's heavyweight champion. Entering meaningfully in late May, it peaked at 32.59% of all capital ($39.9M) by July 27. From mid-June through December, it remained a top-3 allocation for 186 straight days, the permanent portfolio stabilizer that users never had to manage themselves.

What is Origin? Origin Protocol offers liquid staking derivatives and yield-bearing stablecoins. Origin WETH is their Ethereum vault, providing enhanced yields while maintaining liquidity and composability across the ecosystem.

The bluechip core: Morpho Gauntlet WETH

Morpho Gauntlet WETH was the engine that ran all year, maintaining a top-3 presence for 240 days from the protocol's February start.

What is Morpho Gauntlet? Morpho Gauntlet WETH combines Morpho's capital efficiency with Gauntlet's institutional grade risk management, creating a robust lending market for WETH that balances yield optimization with conservative risk parameters.

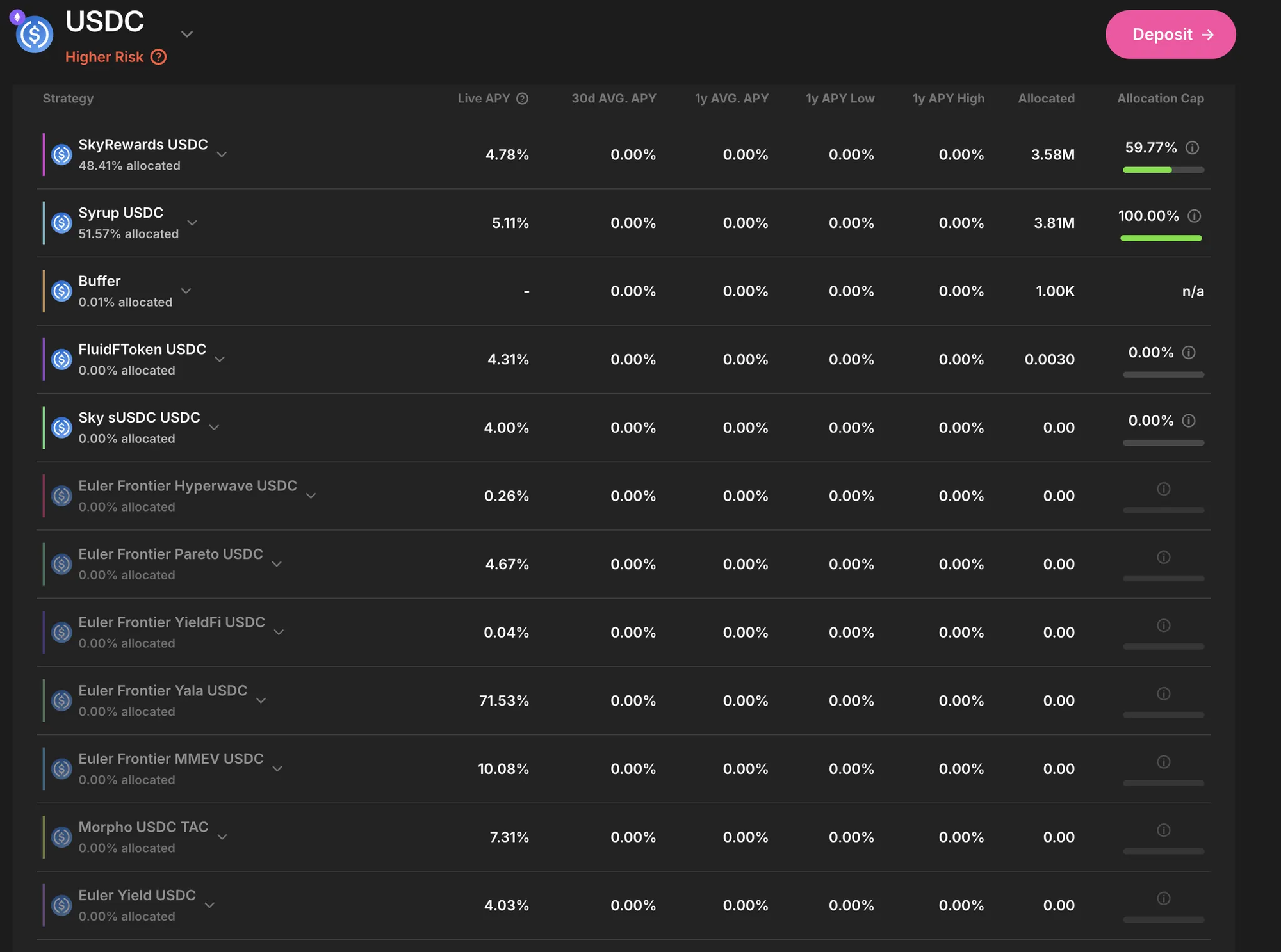

The stablecoin backbones: Morpho Gauntlet USDC & Syrup USDC

Morpho Gauntlet USDC operates on the same principle as its WETH counterpart, Morpho's peer-to-peer lending optimization with Gauntlet's risk curation, but focused on USDC lending markets. It dominated early 2025, frequently ranking #1 between February and April with a peak 19.2% share.

Syrup USDC is Maple Finance's actively managed USDC lending pool, offering institutional-quality credit strategies with professional underwriting. It became the strong closer, emerging as a steady pillar from July onwards and maintaining >10% allocation every day in December.

The only constant is change

Looking back at 2025, it's easy to call Origin WETH and Morpho Gauntlet "obvious" winners. But in January 2025, they weren't obvious at all.

We don't know what the "Origin WETH" of 2026 will be. It might be an existing protocol, or it might not have launched yet. The yield landscape is ephemeral, today's dominant anchor is tomorrow's outdated strategy.

This uncertainty is exactly why Lazy Summer exists. Depositors don't need to predict the next trend or time yield spikes. The protocol does it for them.

New yield sources coming to Lazy Summer

The newest yield sources joining the protocol:

Confirmed:

- Midas Apollo Crypto: A crypto-native yield vault from Midas, Apollo provides institutional-grade exposure to blue-chip crypto assets with active risk management.

- Reserve ETH+: Reserve's yield-bearing ETH token that combines liquid staking rewards with lending market optimization. ETH+ offers diversified exposure across multiple LST protocols with automatic rebalancing for optimal yields.

In Review:

- 40Acres USDC (Base): A USDC lending market on Base L2, curated by 40Acres for optimal risk-adjusted returns in the growing Base ecosystem.

- hgETH (KelpDAO): Kelp's restaking derivative token that provides exposure to restaking rewards while maintaining liquidity and composability across DeFi.

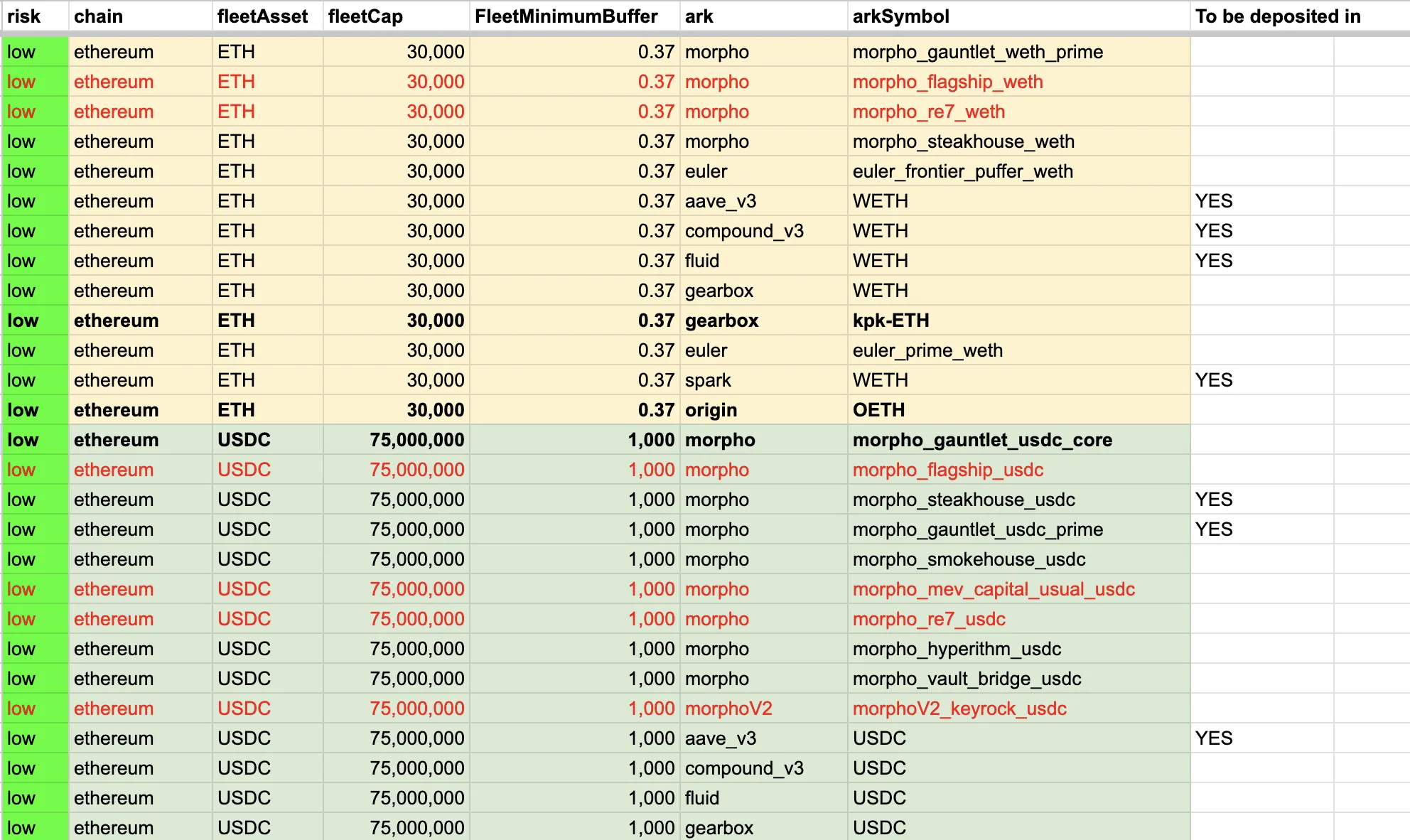

Current risk posture

Block Analitica still sees material risk throughout the DeFi ecosystem and maintains many risk caps at zero.

This conservative stance reflects ongoing uncertainty in the market following the Stream Finance incident and broader concerns about protocol security. While no new caps have been raised yet, increases are expected as market conditions stabilize and protocols demonstrate continued resilience.

This cautious approach prioritizes capital preservation, ensuring Lazy Summer users remain protected during periods of heightened risk.

Get liquid $SUMR + automated yield starting January 21, 2026

The benefits of Doing Less while accessing DeFi's highest quality yields just got better.

On January 21, 2026, Lazy Summer Protocol's token $SUMR goes live. Simply by depositing in the protocol, you'll now earn liquid SUMR tokens across all vaults.

Your next steps:

Deposit into Lazy Summer vaults → Start earning SUMR today

Plan your staking strategy → Stake and consider your dual rewards strategy for post-TGE

Prepare for Aerodrome LP → Capture early liquidity provision rewards

Join us

Discord | Telegram | X/Twitter | Linktree

Disclaimer: Oazo Apps Limited functions solely as a front-end interface (Summer.fi) provider and it does not act on behalf of any user. Oazo Apps Limited did not launch nor does it operate or control the Lazy Summer Protocol. The Lazy Summer Protocol is accessed through Summer.fi. The information provided herein is provided on behalf of the Lazy Summer Foundation which launched the Protocol for informational purposes only and it does not constitute investment advice. Oazo Apps Limited and the Lazy Summer Foundation are not soliciting or recommending any transaction or guaranteeing any specific returns. Users interact with the Protocol at their own risk. T&C for the use of Summer.fi apply.