Why you want to earn SUMR Before TGE (and how to get ready)

The Lazy Summer promise: Do Less

At its core, Lazy Summer makes a simple but profound promise: Do Less.

The protocol handles the complexity so you can automatically access the highest-quality yields from the top protocols across DeFi.

Regardless of market conditions, the protocols number one priority is solving the intense fragmentation across protocols, chains, and yield sources.

Irrespective of a liquid token, the number one priority of the Lazy Summer Protocol is solving the intense yield source fragmentation across protocols, yield sources, and networks.

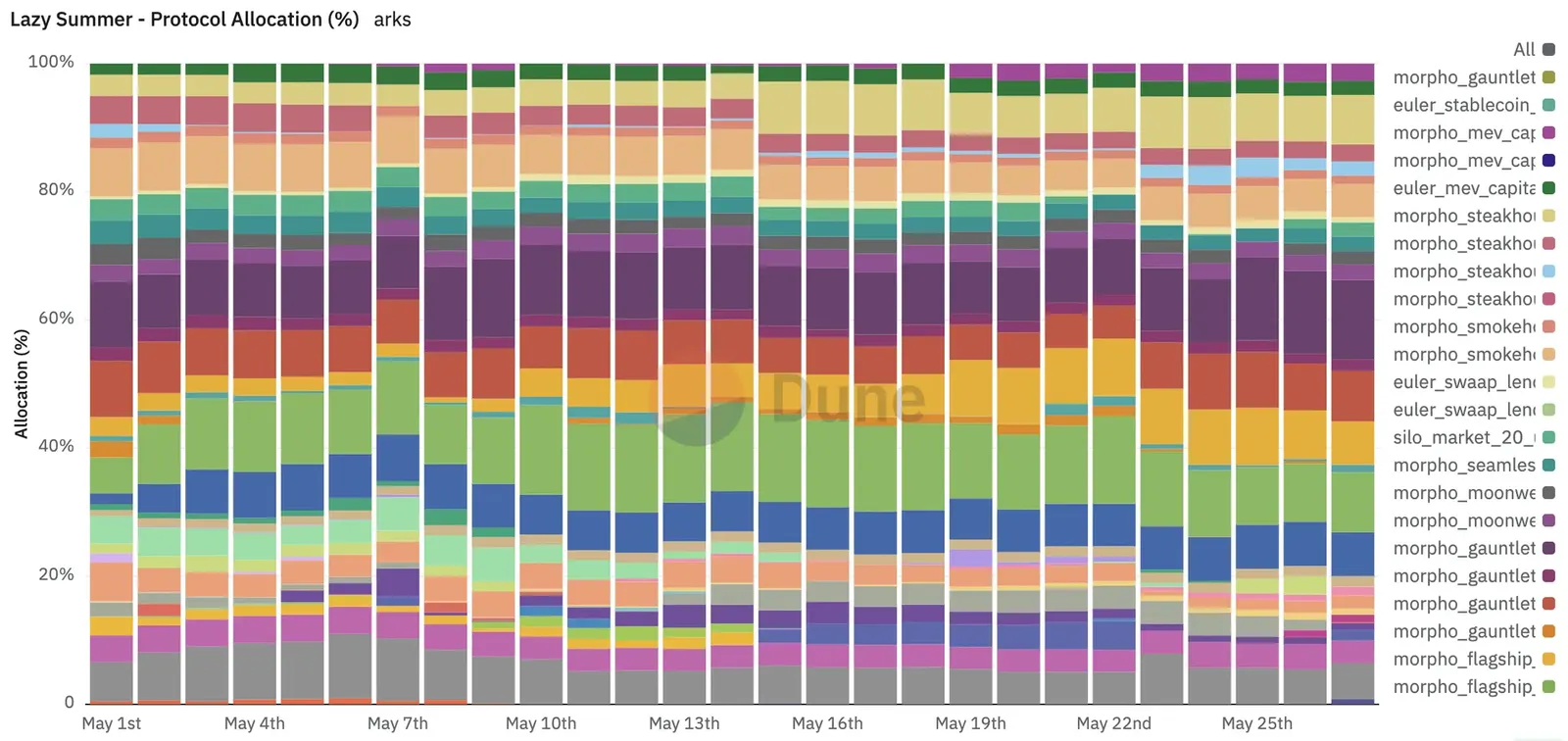

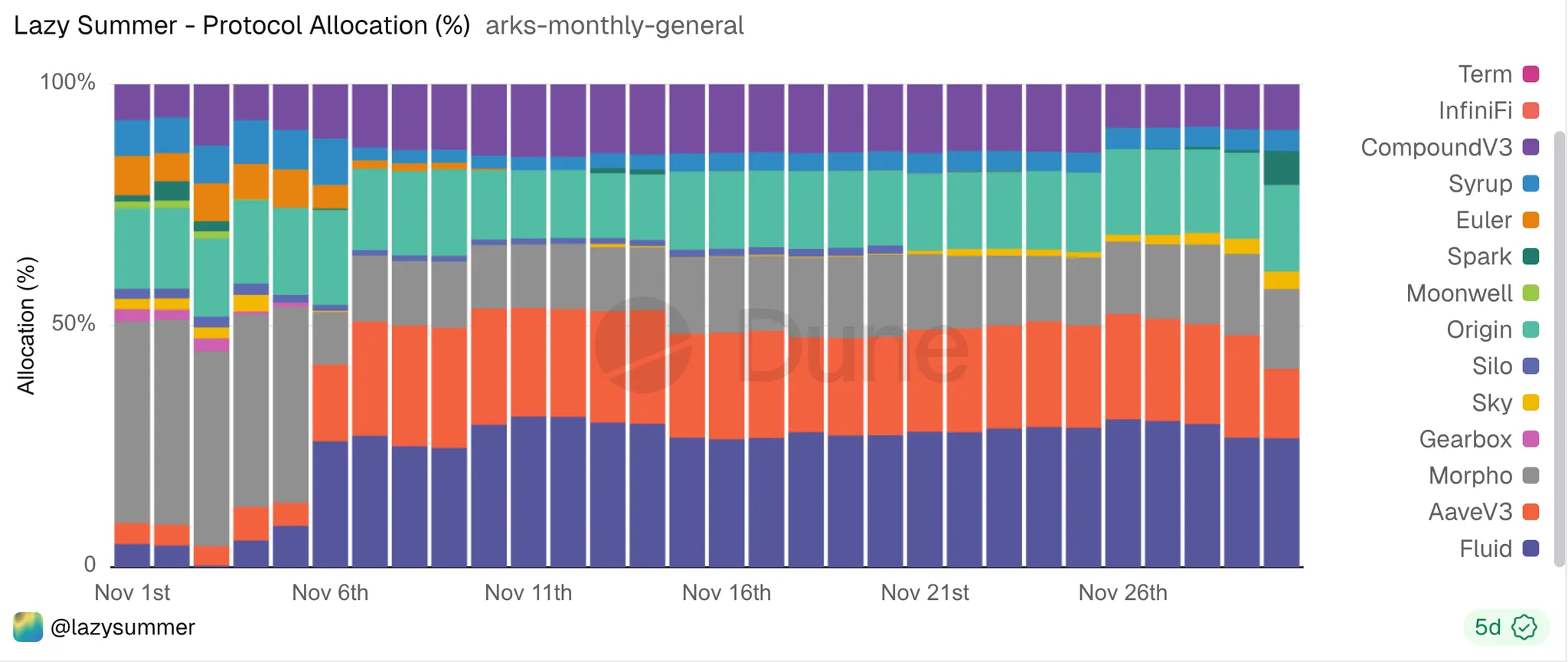

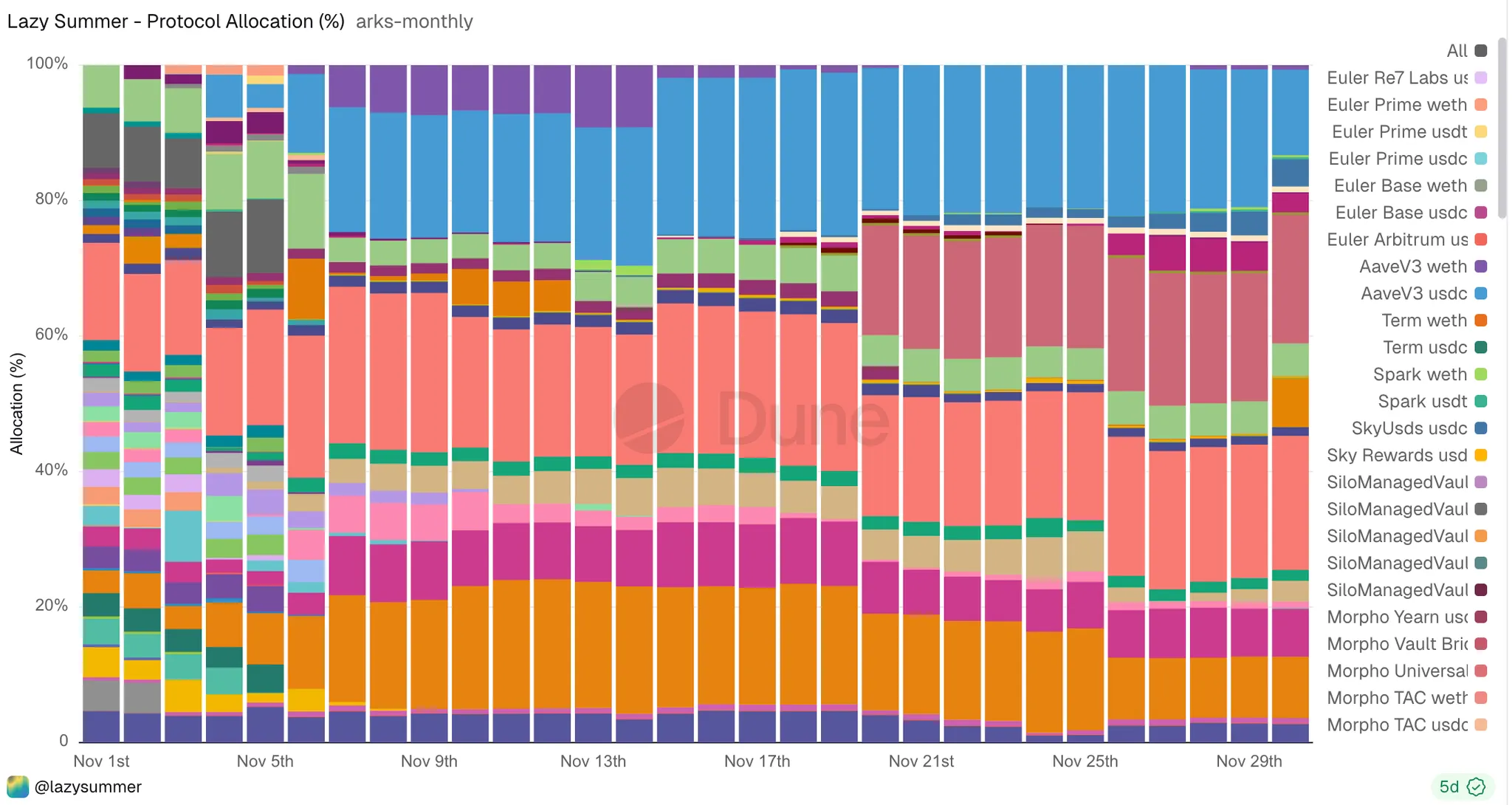

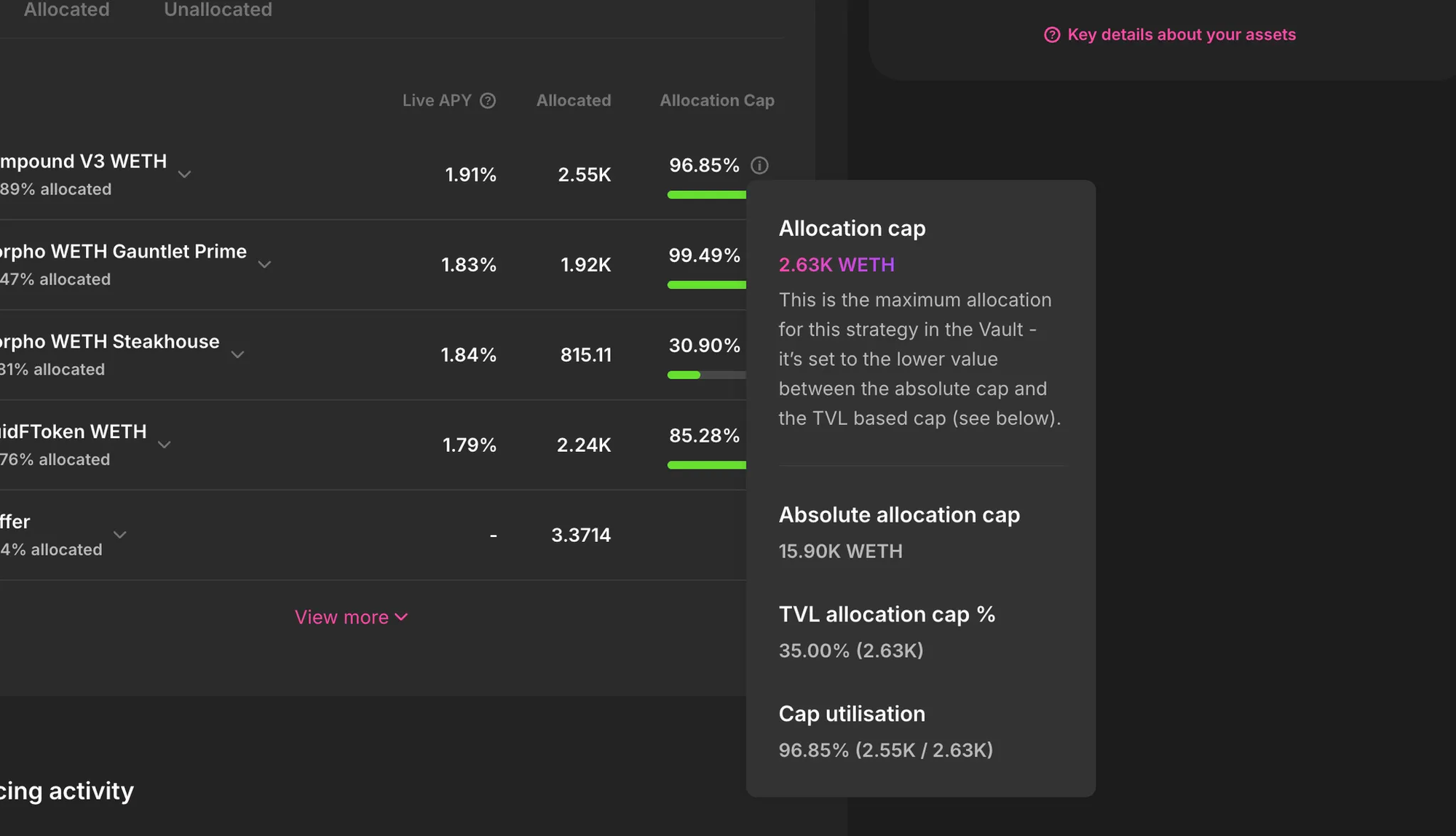

An example of Lazy Summer Protocol Yield Source Diversification

Practically, this means Lazy Summer users can always expect:

- Above-Benchmark Yields: diversified exposure that consistently beats static deposits

- Risk Curation: access to new yield sources inside a strict, governed framework

- No Yield Chasing: Automation, governance and risk experts handle capital rotation discipline including both new yield sources updated constantly, and fluctuating APYs / Risk profiles of established yield sources.

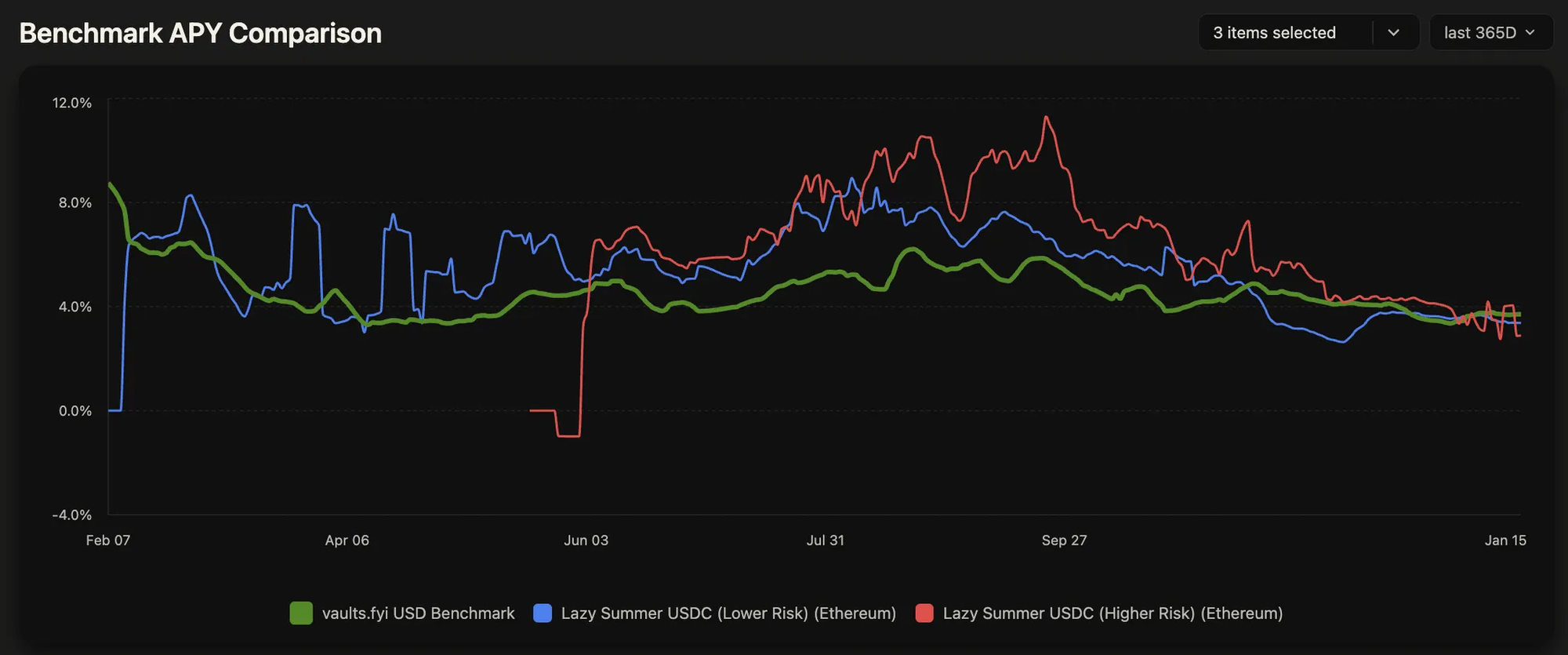

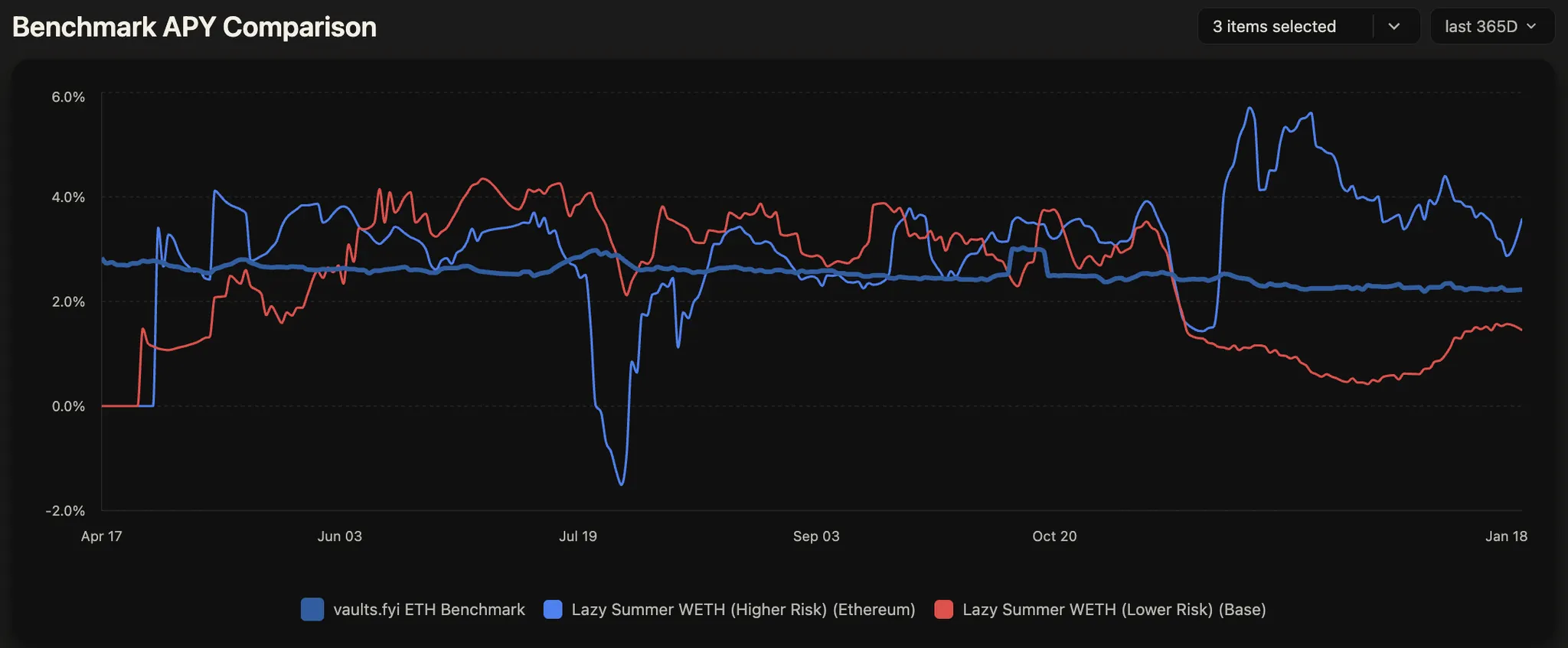

To date, Lazy Summer has executed on this promise well. Specifically, Lazy Summer has produced above benchmark returns on the vast majority of all available vaults.

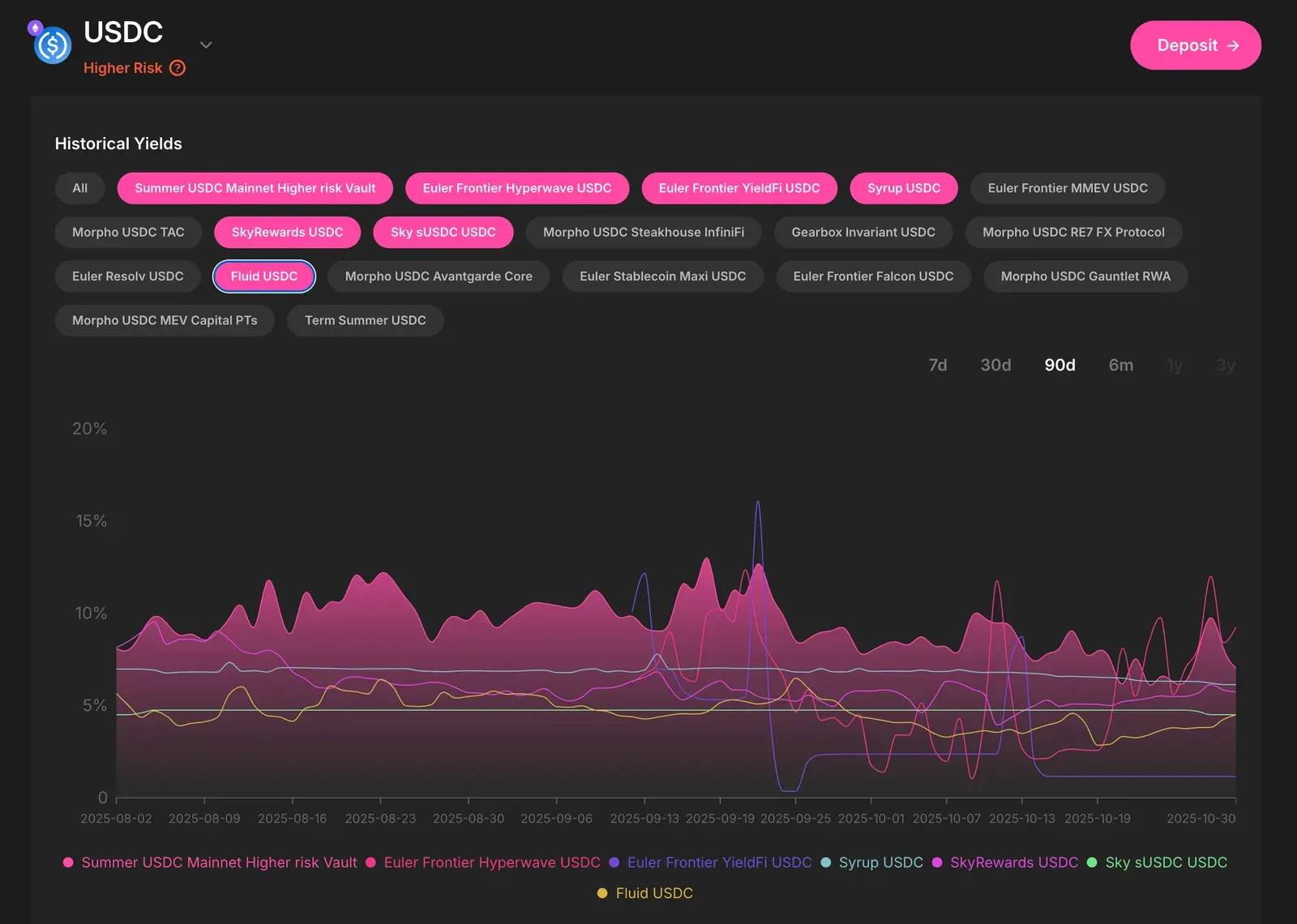

Understanding Lazy Summer returns vs benchmarks

Consistent alpha over benchmark yields

The profound advantage for depositors that Lazy Summer enables is for your capital to be opportunistic.

- USDC and ETH vaults have beaten static deposit rates in almost all available vaults on Summer.fi

- During favorable markets: significantly above-benchmark APYs through opportunistic positioning in higher yielding strategies.

- During market stress: automatic rotation to bluechip safety, maintaining at-minimum benchmark yields

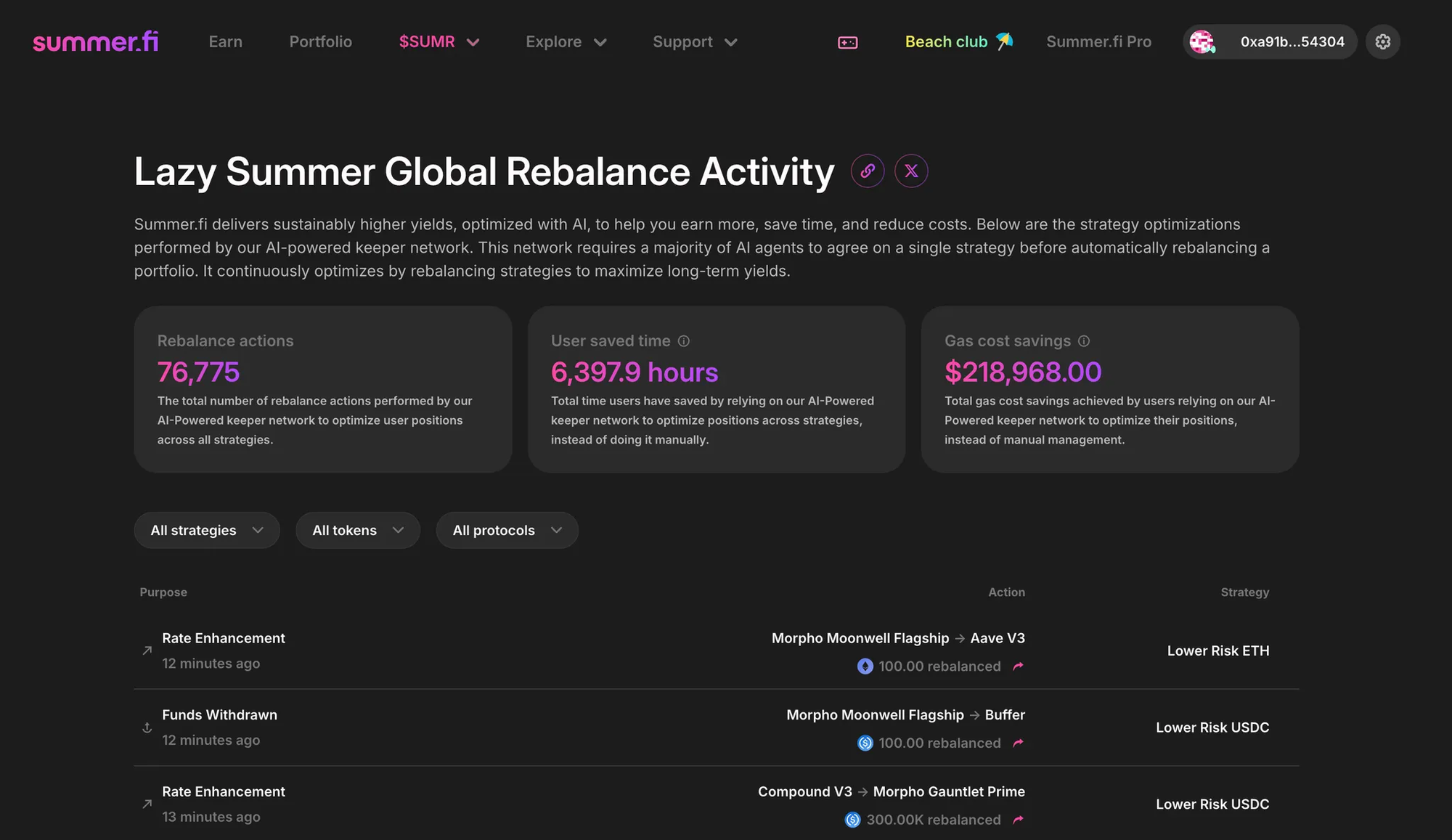

- Over 75,000 automated rebalancing actions in the past year, each one optimizing your position

This is "Set and Forget" DeFi in its truest form, but why does this happen? The answer is threefold.

Why Lazy Summer vaults outperform: Three structural advantages

The answer to that is three fold.

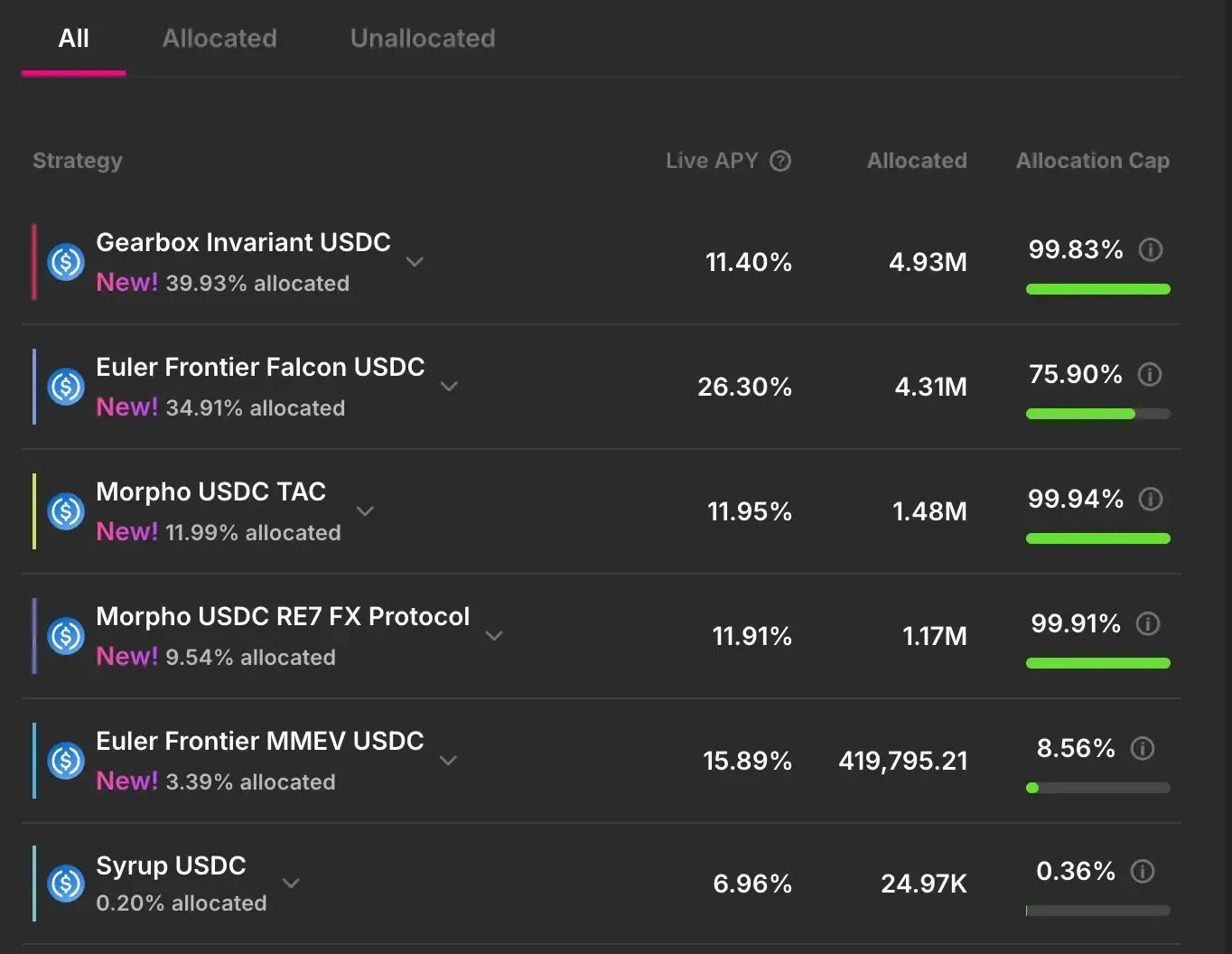

1. Yield source depth and diversity

Lazy Summer can onboard new yield sources in days, not months. Today the protocol supports:

- ~70 yield sources

- Across 5 networks

- Across ETH, USDC, and USDT

- From 16+ major protocols

- Including Morpho, Euler, Aave, Spark, Fluid, Maple, Gearbox, Origin, Sky, Silo, Midas, and more

In November 2025 alone, Lazy Summer provided automated exposure to 98 distinct yield sources. And it doesn’t stop there, each week more yield sources are proposed to Lazy Summer governance to be onboarded into the protocol.

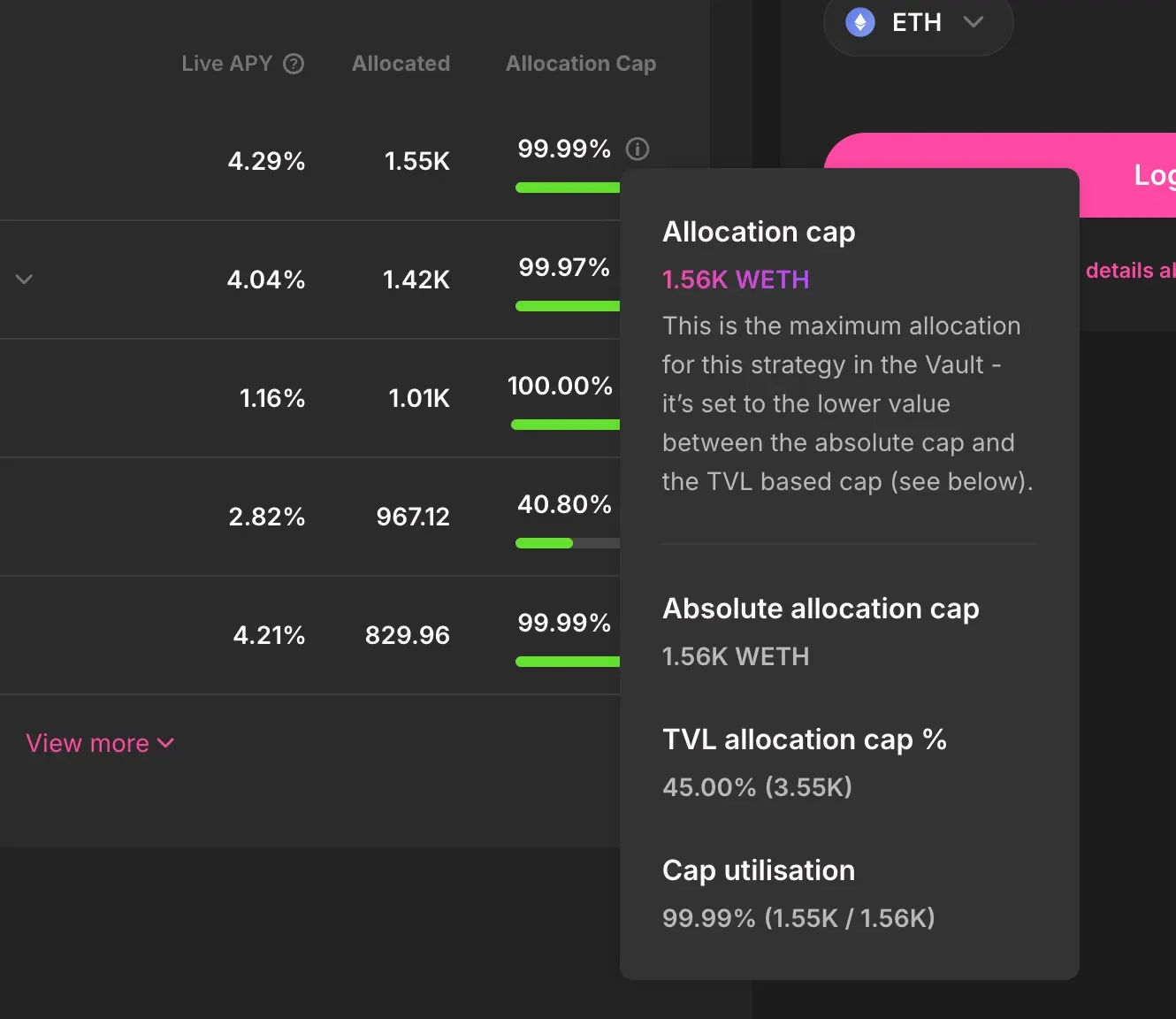

- Best in class risk curation through dynamic risk caps

Every depositor benefits from institutional-grade risk management. Practically, Block Analitica systematically updates:

- Deposit Caps: Managing TVL scaling velocity.

- Allocation Constraints: Ensuring diversification across Arks.

- Liquidity Buffers: guaranteeing withdrawals and rebalances.

- Rebalance Thresholds: Preventing over-trading or lagging reactions.

You can read more about how exactly how Block Analitca manages risk here.

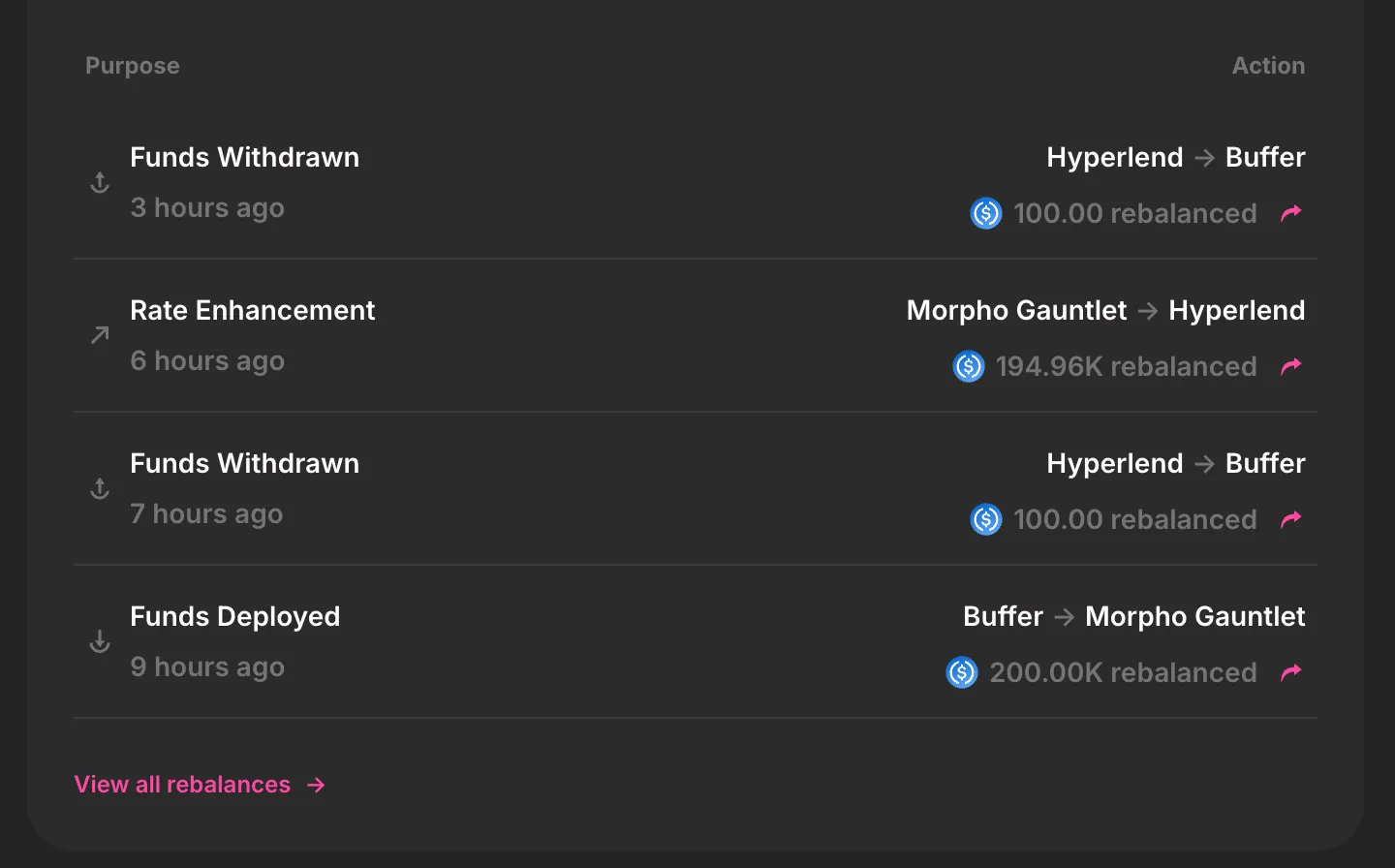

- Automated rebalancing at scale

Lazy Summer is able to give depositors the ability to Do Less and get automated access to all of DeFi most high quality yields because of automated rebalancing. The rebalancer has already executed 75,000+ automated reallocations.

Keepers monitor all yield sources 24/7 and, within governance-approved risk constraints:

- Exit underperforming venues

- Allocate into higher real yield

- Respect liquidity and cooldown rules

- Preserve withdrawal readiness

- Avoid over-trading and tail-risk

All this while onboarding some of DeFi’s best yield sources, giving users diversified exposure to both emerging and extremely well established protocols and strategies.

Why now - The generational setup for SUMR

Fundamentally, Lazy Summer is about access to high-quality onchain yield. Gradually, and then suddenly, DeFi yields have matured into a critical financial primitive not just in DeFi, not just in crypto, but soon also global finance.

We believe 2026 will be the year of the onchain vault. Specifically, this particular evolution of blockchain technology, building on smart contracts and stablecoins, is the onchain financial primitive that makes all other sub-categories accessible to the world, similar to the advent of ETFs in tradfi.

Three massive trends are converging right now to create a once-in-a-decade opportunity:

1. Tokenization Is Eating Finance

Real-world assets are flooding onchain at an unprecedented pace:

- The tokenized RWA market (excluding stablecoins) grew 85% year-over-year to reach $15.2 billion by December 2024

- BlackRock's BUIDL fund attracted over $500 million within months of launch

- Larry Fink called tokenization "the next generation for markets and BlackRock is betting billions on it

2. Yield-bearing stablecoins are exploding

The numbers are tell the story:

- Yield-bearing stablecoin market cap: up 300% year-over-year

- Supply surged 13-fold from $666M (August 2023) to $8.98B (May 2025)

- Total stablecoin market doubled to $250B, projected to hit $2 trillion by 2028

- Dollar-backed stablecoins purchased $40B of US T-bills in 2024, matching the largest government money market funds.

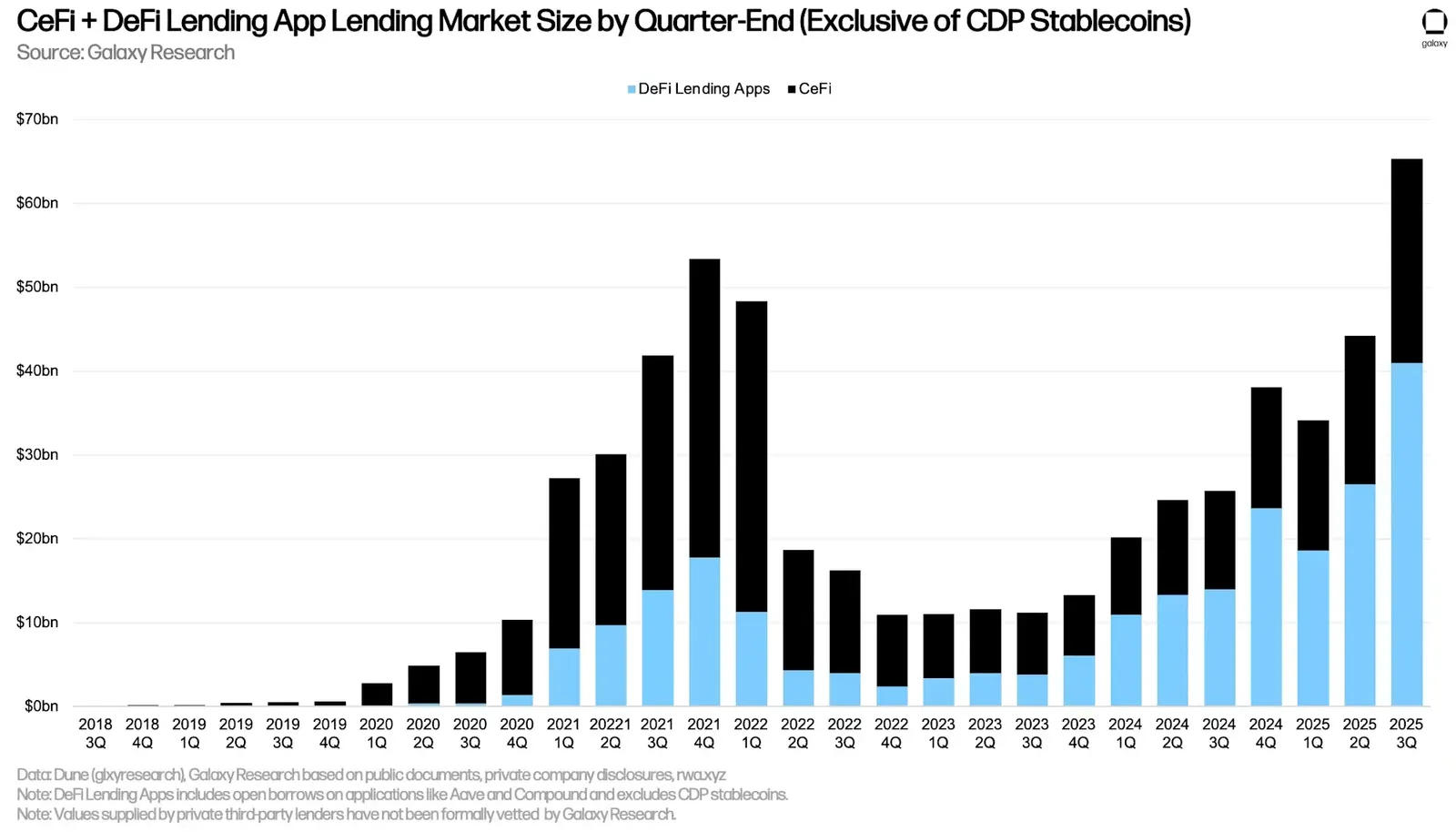

3. DeFi Credit markets have matured

The lending infrastructure is here:

- DeFi lending TVL: $50 billion +

- AAVE alone: $24.4 billion TVL across 13 blockchains

- Total TVL and outstanding loans quietly surpassed 2021-2022 DeFi Summer highs, reaching $65B TVL and $25B in active loans

- Tokenized private credit: $17.5B, up 32% in 2025

Institutions are here. Morpho, Maple, and Euler are building stronger, institutionally aligned venues. This isn't just retail anymore, it's institutional infrastructure.

Source: https://www.galaxy.com/insights/research/the-state-of-onchain-yield

The problem these trends create: Immense fragmentation

As this mega trend of onchain vaults, and key catalysts of tokenization, yield bearing stablecoins and DeFi borrowing / lending accelerate a serious problem is going to accelerate with it…fragmentation.

The explosion in onchain yield creates an explosion in complexity:

- Hundreds of protocols

- Thousands of markets

- Dozens of networks

- Constantly shifting risk/reward profiles

- Zero standardization

Source: Stablewatch , and The Rollup

Rob goes off on why exogenous sources of yield separate NeoFinance from legacy DeFi. https://t.co/LcMvJXGVXj pic.twitter.com/2sGjNxdYv9

— The Rollup (@therollupco) January 13, 2026

For users, this means:

- Paralysis by analysis

- Missed opportunities

- Concentration risk (putting all capital in one protocol because it's too complex to diversify)

- Constant manual monitoring and rebalancing

- Death by a thousand decisions

Source: The Rollup

Big growth creates big problems. Big problems create big opportunities. That opportunity is Lazy Summer.

Why SUMR is the superior asset for capturing onchain yield growth

On January 21, 2026, everything changes. The Lazy Summer protocol's native token, $SUMR, becomes liquid and tradable. SUMR is the introduction of the first revenue-based, dual-reward asset designed to capture the entire growth of the onchain yield ecosystem.

Why SUMR > Individual protocol tokens

1. Protocol agnostic exposure

- Don't bet on Morpho vs. Euler vs. Aave, own exposure to all their growth through SUMR

- As new protocols emerge and gain traction, Lazy Summer integrates them

- SUMR captures value from the entire onchain yield market, not a single venue

2. Direct revenue capture

- SUMR is backed by real protocol fees from all deposits

- As onchain vaults explode in 2026, Lazy Summer's revenue scales

- SUMR holders receive direct USDC claims on the protocol treasury

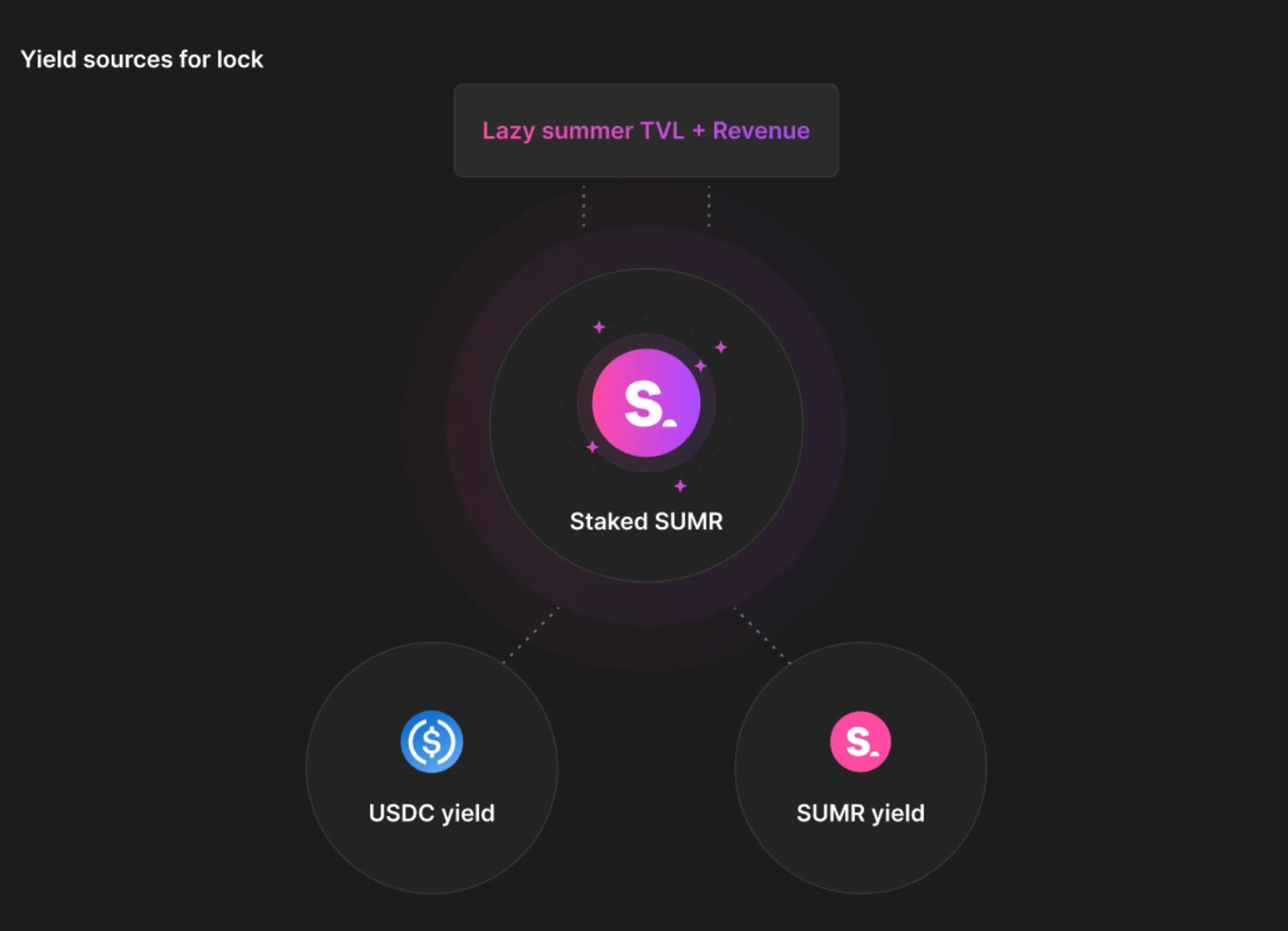

3. The dual staking flywheel Stake SUMR to earn:

- Reward Stream 1: SUMR emissions

- Reward Stream 2: USDC from protocol revenue

This creates a powerful supply shock pressure: the more successful the protocol, the more attractive staking becomes, the more supply gets locked, the more valuable remaining liquid supply becomes.

4. Indexed to market growth, not market timing

- You don't need to predict which protocol wins

- You don't need to rotate between governance tokens

- You own the infrastructure layer that benefits from all onchain yield growth

What this means in practice

If 2026 is indeed "the year of onchain vaults" (as multiple institutional reports suggest), then:

- Tokenization brings trillions in new assets onchain.

- Yield-bearing stablecoins scale to multi-trillion-dollar markets

- DeFi credit continues institutional adoption

Every dollar flowing into this ecosystem creates demand for yield optimization. SUMR is how you capture that value.

How to position yourself before TGE (you have <1 Week)

So, what can you do to earn or acquire SUMR prior to the January 21, 2026 TGE?

Time is running out, so here is what you can do to prepare for launch: Here is your checklist to ensure you are positioned for the launch.

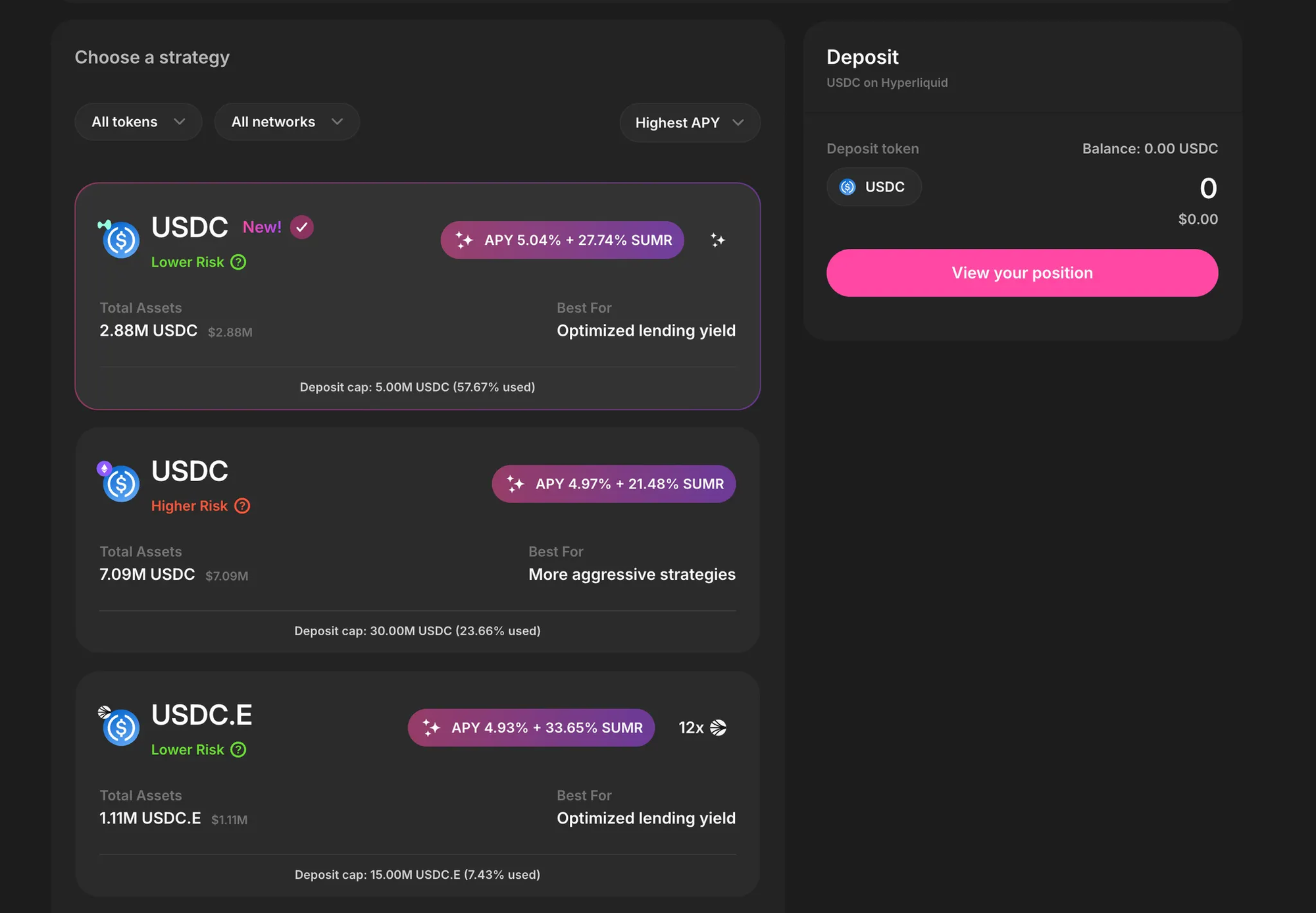

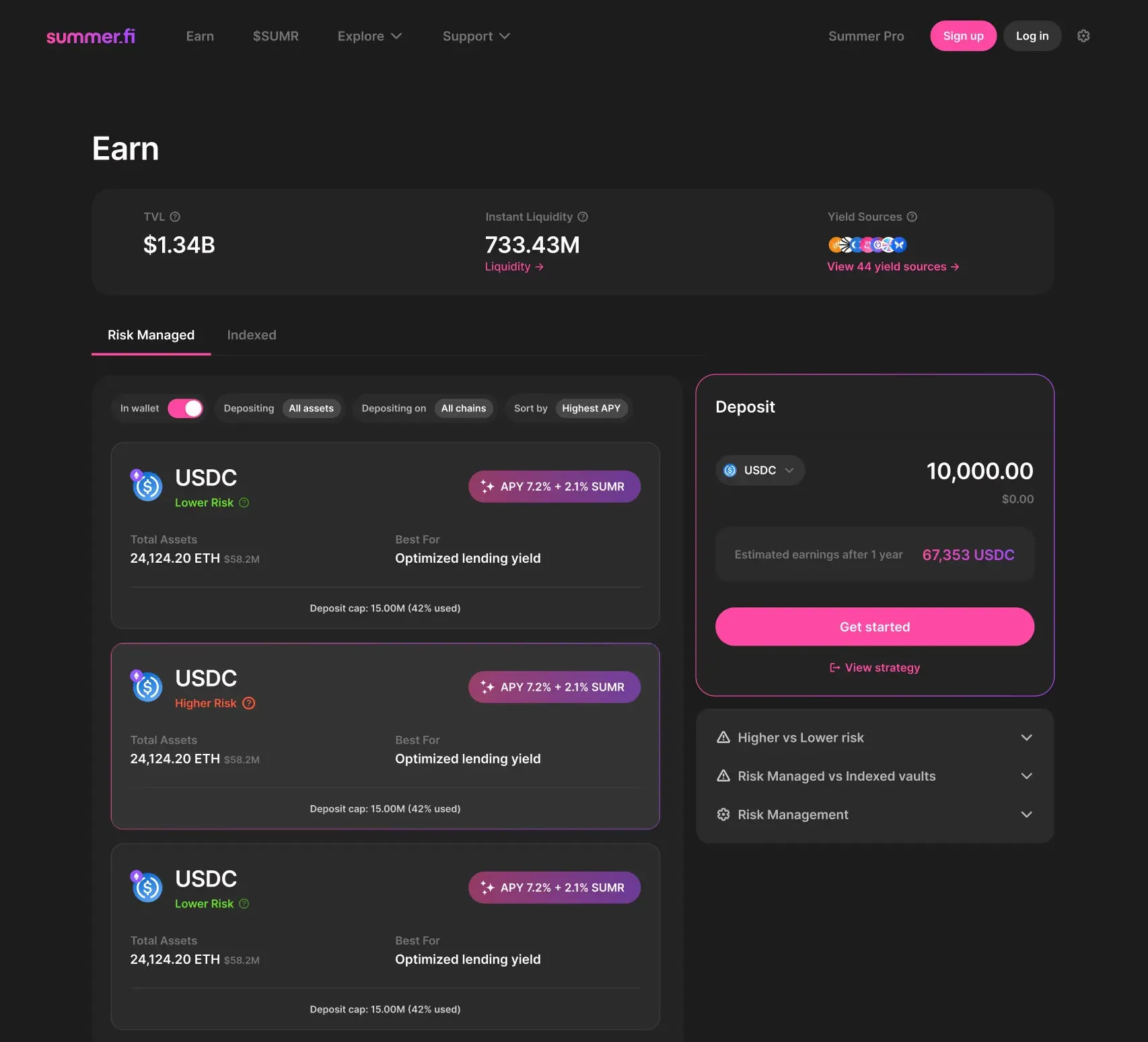

Step 1: Start earning SUMR today

Don't wait for the token to go live, earn SUMR by depositing now.

Your deposit strategy:

- Choose your asset (USDC, ETH, WBTC, etc.)

- Select your network (Ethereum, Base, Arbitrum, Optimism)

- Filter by priority:

- APY → Maximize native yield

- SUMR Rewards → Maximize token accumulation pre-TGE

- TVL → Deposit into the most liquid, battle-tested vaults

Action: Deposit into Lazy Summer vaults immediately. You begin accruing SUMR rewards alongside DeFi yields from day one.

The Edge: Early depositors accumulate SUMR at potentially the lowest cost-basis.

Step 2: Prepare your staking strategy

If you've already accrued SUMR (or plan to acquire at TGE), consider you staking strategy:

- Plan to lock SUMR tokens to activate the dual reward stream (SUMR + USDC)

- Longer lock periods = higher rewards from both emissions and revenue share

- This aligns your incentives with long-term protocol growth

Why this matters: Staking isn't just about rewards, it's about creating the supply dynamics that support price appreciation. Every SUMR staked is SUMR not available for selling.

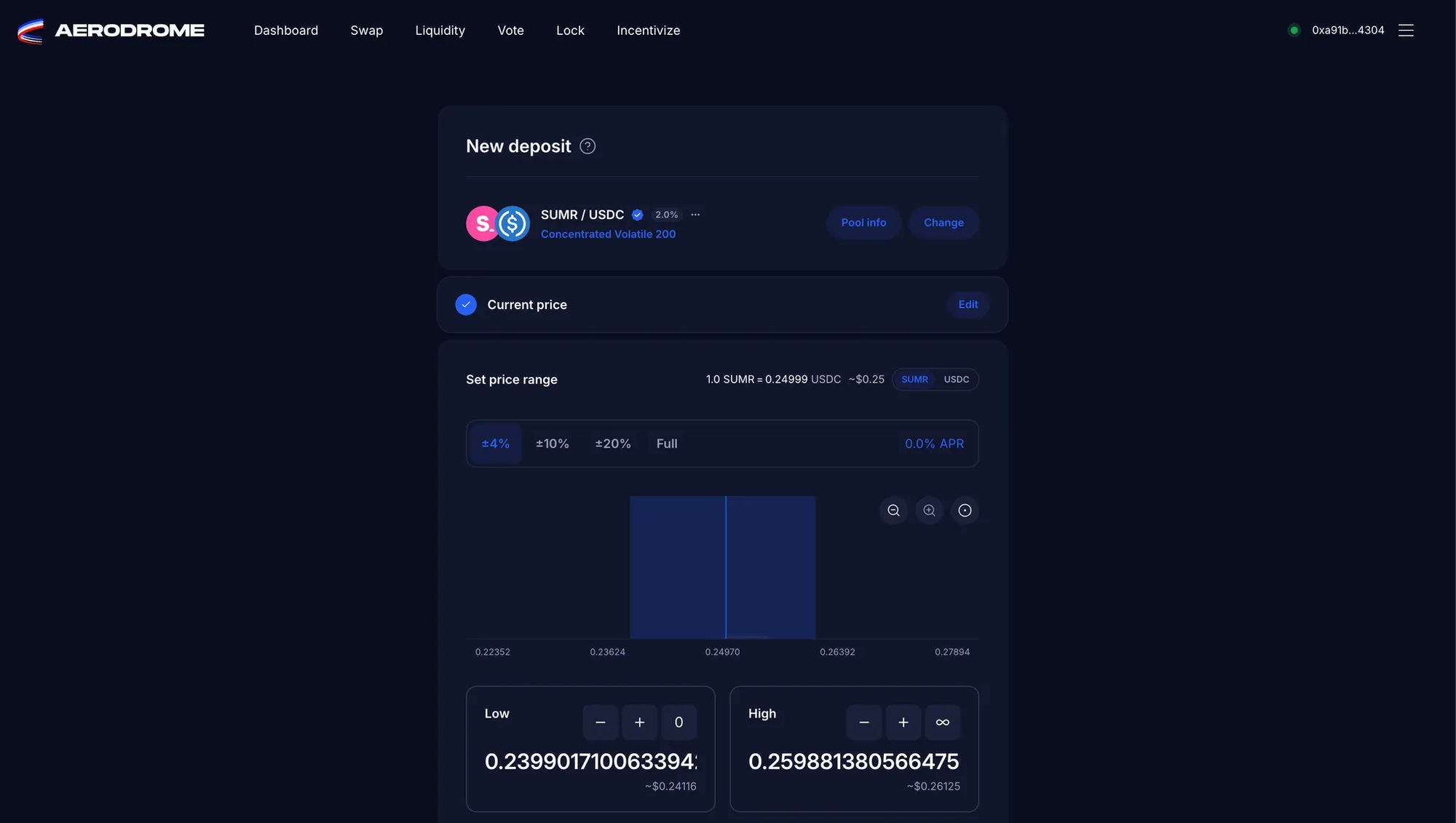

Step 3: Prepare to LP on Aerodrome

For sophisticated DeFi users:

A SUMR/USDC liquidity pool launches on Aerodrome at TGE.

Preparation checklist:

- Ensure you have liquid USDC ready

- Familiarize yourself with Aerodrome's LP interface

- Plan your entry size to deploy immediately at TGE for maximum early APY

- Understand impermanent loss dynamics for a new token launch

The opportunity: Early LPs often capture outsized rewards as the pool bootstraps liquidity.

What happens after TGE: The Lazy Summer roadmap

SUMR TGE is not an end, in fact it is just the beginning. After SUMR TGE, new and existing depositors can expect four major developments to look out for.

Immediate post TGE developments

1. DAO-Managed Vaults Expansion, New vault category being introduced

DAO-Managed vaults aim to:

- Track a broad, competitive set of DeFi yield sources (“top of vaults.fyi” type yields)

- Use a transparent, rules-based framework instead of case‑by‑case expert curation

- Make the risk/return tradeoff extremely clear to users in product copy and UI

https://forum.summer.fi/t/rfc-launch-dao-managed-indexed-vaults-on-the-lazy-summer-protocol/601

2. New Yield Source Integrations Incoming protocols include:

- 40Acres

- ExtraFi

- Midas

- Kelp DAO

- ...and more announced weekly

3. Enhanced SUMR Rewards

- Reward rebalancing across all vaults post-TGE

- Optimization for depositor incentive alignment

- Potentially increased emissions to high-performing strategies

4. Institutional Partnerships

- Major announcements for Lazy Summer's self-managed vault offering

- Enterprise grade infrastructure for institutional capital

- White label solutions for traditional finance integration

If you believe:

- Tokenization will bring trillions in assets onchain

- Yield-bearing stablecoins will become standard financial infrastructure

- DeFi credit markets will continue institutional adoption

Then you should believe in SUMR.

Deposit into Lazy Summer vaults → Start earning SUMR today

Plan your staking strategy → Stake and consider your dual rewards strategy for post-TGE

Prepare for Aerodrome LP → Capture early liquidity provision rewards

Join us

Discord | Telegram | X/Twitter | Linktree

Disclaimer: Oazo Apps Limited functions solely as a front-end interface (Summer.fi) provider and it does not act on behalf of any user. Oazo Apps Limited did not launch nor does it operate or control the Lazy Summer Protocol. The Lazy Summer Protocol is accessed through Summer.fi. The information provided herein is provided on behalf of the Lazy Summer Foundation which launched the Protocol for informational purposes only and it does not constitute investment advice. Oazo Apps Limited and the Lazy Summer Foundation are not soliciting or recommending any transaction or guaranteeing any specific returns. Users interact with the Protocol at their own risk. T&C for the use of Summer.fi apply.