Why Institutional DeFi Integrations Are Broken (And How to Fix Them)

For years, DeFi has promised institutional investors a transparent, borderless, and permissionless environment to access yield opportunities. But in practice, tapping into that potential yield at scale has been less about innovation and more about fighting a never-ending integration battle.

From conversations with banks, hedge funds, centralized exchanges, and DAO treasuries, the same themes keep surfacing:

- Every protocol lives in isolation

- Rotating capital between yield markets is inefficient, sometimes warranting a 2-3 leg trade (withdraw, bridge, deposit).

- Maintenance costs climb with every additional connection.

The result? Institutions are stuck with partial market exposure, high operational overhead, and capital that often misses the best opportunities.

The Fragmentation of DeFi Protocols

Each DeFi protocol is its own silo with its own governance rules, supported chains, collateral parameters, interest rate curves, and liquidity dynamics.

This exposes institutions to borrow/lend rates on individual protocols and markets, posing several critical challenges, like:

- Limited market exposure – Allocating to a single protocol's USDC market exposes you only to that specific market's rates, missing out on potentially higher-performing equivalents elsewhere, and your capital is fully exposed to the risks of a single protocol.

- Duplicated risk analysis – Every protocol integration triggers a new cycle of smart contract risk review, governance analysis, and liquidity stress testing.

- Latency in opportunity capture – By the time a protocol passes risk committee review, the optimal market conditions may have shifted.

Example: A Crypto Custodian wants to provide its institutional clients access to DeFi lending yields, but wants to diversify their exposure across 3 protocols.

The fragmentation forces institutions to manage individual protocol rate exposures rather than operating at a portfolio level, making it difficult to assess aggregate risk or optimize across opportunities.

The Integration Nightmare

Once a protocol passes due diligence, integration is rarely "plug and play." Every protocol requires an integration, creating a time-consuming development cycle due to the comprehensive due diligence required for analyzing individual protocols.

- Different SDKs and APIs – Each protocol offers its own set of developer tools, often with unique function calls, response formats, and implementation patterns.

- Divergent data models – Rates, collateral factors, and liquidity data are reported differently across protocols, requiring custom translation layers.

- Ongoing breaking changes – Protocol upgrades can alter endpoints or contract methods, forcing rewrites of existing integrations.

For an institutional engineering team, this creates parallel integration pipelines, each with its own documentation, testing environments, and deployment processes.

Due Diligence Multiplication: The most resource-intensive aspect isn't the initial technical integration, it's the comprehensive analysis required before implementation. Institutions must evaluate:

- Smart contract security audits and code reviews

- Protocol governance structures and upgrade mechanisms

- Tokenomics and incentive alignment models

- Historical performance and stress testing results

- Oracle dependencies and price feed reliability

- Liquidation mechanisms and slippage characteristics

High Dev Resource Cost of Maintaining Protocol Integrations

Integration isn't a "one-and-done" task; it's an ongoing operational commitment that consumes substantial development resources.

- Version churn – Protocols upgrade contracts, alter risk parameters, or migrate to new chains, potentially breaking existing integrations.

- Security monitoring – Each protocol requires continuous assessment for exploits, governance changes, or liquidity shifts.

- Specialist resource drain – Senior engineers end up maintaining existing integrations rather than building client-facing products or expanding strategy coverage.

This creates a scaling paradox: the more protocols you integrate, the more time your team spends maintaining access rather than expanding opportunity.

Breaking Changes and Maintenance Cycles: Protocol upgrades frequently introduce changes requiring immediate attention. Managing multiple protocol integrations means facing regular urgent updates, each requiring development resources to test, validate, and deploy.

Operational Complexity Scaling: Each protocol requires separate monitoring dashboards, alerting systems, and operational procedures. Teams managing multi-protocol exposure need expertise across multiple interfaces, increasing training requirements and operational risk.

The maintenance burden scales with protocol count, eventually consuming development budgets that could be focused on strategy optimization and client service.

The Solution: Summer.fi Institutional “Single Integration” Model

Summer.fi Institutional is a yield access layer built specifically to solve these institutional pain points through the Lazy Summer Protocol's AI-optimized infrastructure.

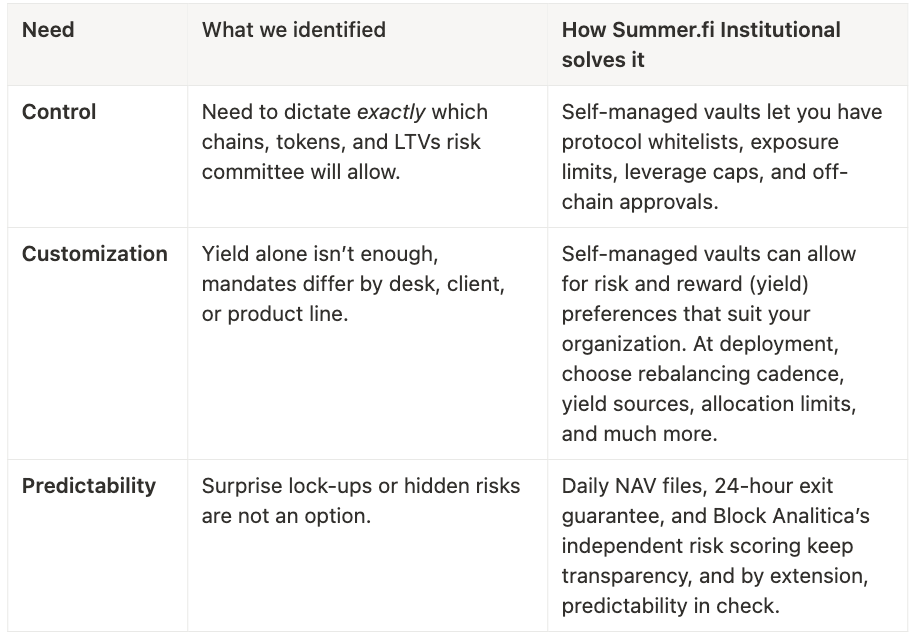

Like all good innovations, Summer.fi Institutional was born of observing painful necessity. Through analysis of banks, hedge funds, centralized exchanges, and DAO treasuries, three core institutional needs emerged:

Fragmentation, integration sprawl, and high maintenance costs represent the hidden operational tax on institutional DeFi adoption.

Summer.fi Institutional “single integration" model eliminates that operational overhead:

- Faster market entry – Access diversified strategies immediately rather than spending months on individual protocol integrations

- Broader market access – Gain exposure to multiple protocols and opportunities through one integration

- Lower operational overhead – Focus development resources on strategy and client service rather than protocol maintenance

- Institutional-grade control – Maintain granular risk management and compliance requirements through sophisticated abstraction layers

Summer.fi Institutional combines access to high-quality DeFi yield strategies with the integration simplicity and institutional controls that professional allocators require.

This single integration model solves the core institutional problem: instead of spending months building and maintaining separate protocol connections, institutions can access diversified DeFi strategies immediately through Summer.fi Institutional.

The Bottom Line

The current DeFi integration model is broken for institutions. Managing exposure to individual protocol rates, building separate integrations for every protocol, and dedicating substantial development resources to maintenance creates an unsustainable operational burden.

Summer.fi Institutional changes this entirely. Instead of building separate connections, institutions can connect once to Summer.fi and gain access to diversified strategies across multiple underlying protocols through the Lazy Summer Protocol.

The result: institutions can focus on what they do best—strategy, risk management, and client service while Summer.fi handles the complexity of multi-protocol DeFi access.

For institutions managing treasuries ≥ $10 million who demand transparent risk and hands-on integration support, this represents crypto's highest-quality yield, finally meeting institutional grade control.

→ Schedule a 15-minute call with a specialist https://calendly.com/summer-fi/summer-institutional

Join us

Discord | Telegram | X/Twitter | Linktree | Summer.fi Institutional

Disclaimer: Oazo Apps Limited functions solely as a front-end interface (Summer.fi) provider and it does not act on behalf of any user. Oazo Apps Limited did not launch nor does it operate or control the Lazy Summer Protocol. The Lazy Summer Protocol is accessed through Summer.fi. The information provided herein is provided on behalf of the Lazy Summer Foundation which launched the Protocol for informational purposes only and it does not constitute investment advice. Oazo Apps Limited and the Lazy Summer Foundation are not soliciting or recommending any transaction or guaranteeing any specific returns. Users interact with the Protocol at their own risk. T&C for the use of Summer.fi apply.