Trade Size Matters: Price Impacts on Ethereum, Optimism and Arbitrum

Most people think centralised exchanges have better liquidity than On chain venues; we put that theory to the test. The results might surprise you. Let’s dive in!

Ethereum's mainnet may not be the best fit for you anymore. With Arbitrum and Optimism, you can trade at lower costs and enjoy more liquidity. But beware, if your trade surpasses the million-dollar threshold, you might find Optimism and Arbitrum not yet the most cost-effective due to substantial price impacts.

Introduction

As Ethereum's layer two solutions like Optimism and Arbitrum grow more advanced, we've reached a pivotal moment to compare their liquidity against Ethereum for the most traded pairs. Optimism and Arbitrum boast lower network fees than Ethereum's mainnet. However, larger traders, lenders, and borrowers must consider whether the lower fixed costs are negated by the potential price impact due to lower liquidity.

Methodology

In this piece, we dig into the liquidity of several highly-traded pairs across Ethereum Mainnet, Optimism, and Arbitrum. Our methodology employs DefiLlama’s swap aggregator, providing the cheapest routes for trading these pairs:

- USDC/ETH

- DAI/ETH

- USDC/wstETH

We scrutinize trades ranging from $1,000 to $100 million, escalating the trade size tenfold at each check, with extra spot checks at $2 million, $5 million, and $20 million. Using the price obtained at the $1,000 route as a reference, we compare larger trades to calculate the price impact.

Results

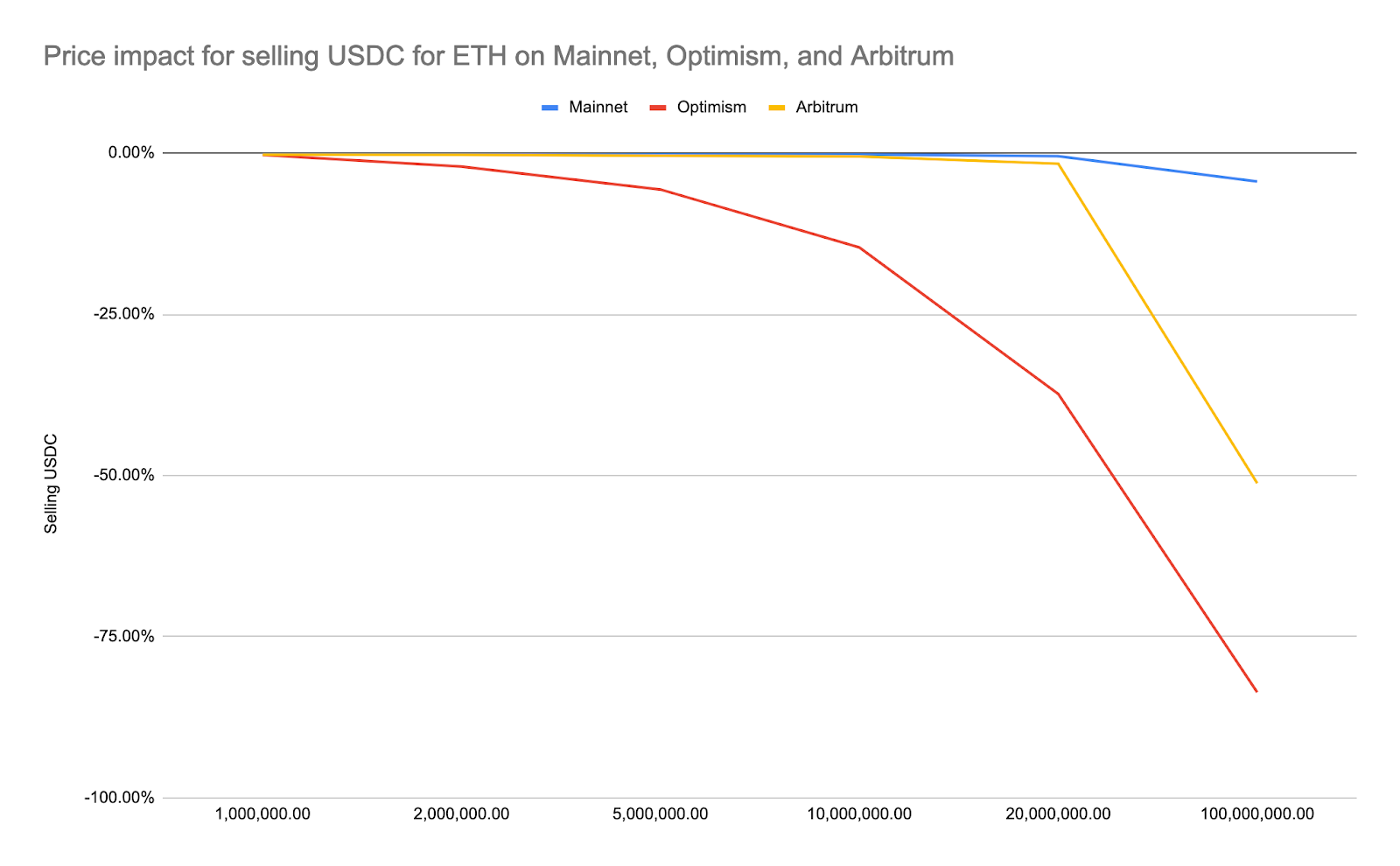

USDC - ETH

When trading USDC - ETH, the price impact across all three networks—Mainnet, Optimism, and Arbitrum is below 0.15% for trades up to $100,000. If you factor in gas costs, conducting these transactions on the Layer 2 networks becomes more economical, despite the slightly elevated gas expenditure. As we escalate the trade size, the picture changes.

From $2 million onwards, the price impact on Optimism spikes to about 2%, and this number only grows as the trade size surges to $100 million. Conversely, on Arbitrum, a trade worth $10 million will leave you with just a 0.5% price impact. However, be wary when exceeding the $20 million mark as there's a sharp increase in price impact at this point.

By better understanding these price impacts across different networks and trade sizes, you can make more informed decisions and optimize your investment choices.

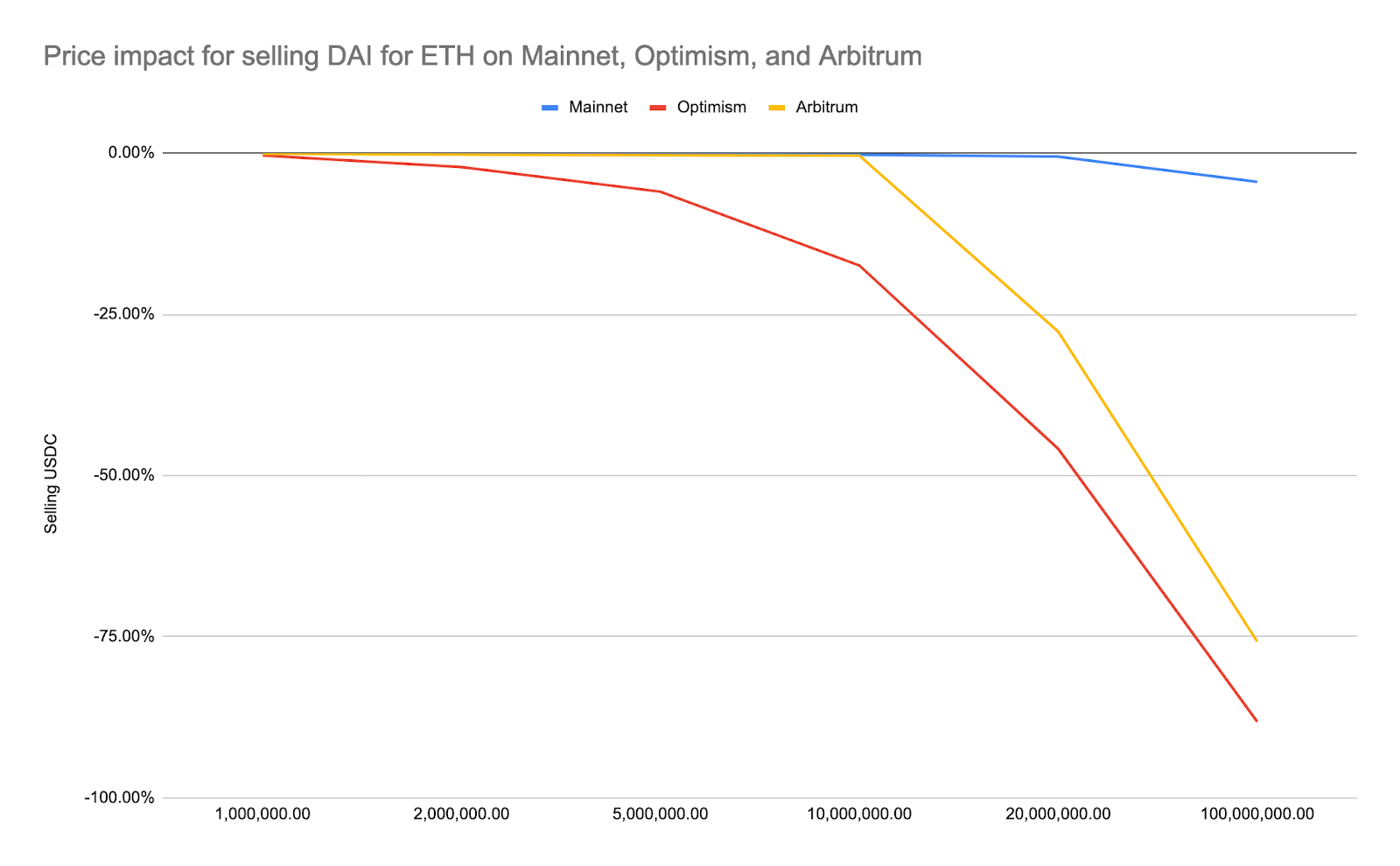

DAI - ETH

When trading the DAI - ETH pair, the liquidity across Mainnet, Optimism, and Arbitrum is relatively consistent. However, a different trend emerges when dealing with larger trade sizes on Arbitrum. Here, you will notice a sharp upsurge in price impact around the $10 million threshold.

If your trades range between $1 million and $10 million, and you're an active trader, choosing USDC - ETH over DAI - ETH might be advisable. This approach can help you optimize your strategy, potentially reducing costs and mitigating price impact.

Knowing liquidity trends and price impacts across networks can be a game-changer for your portfolio, ensuring you make the most informed decisions possible.

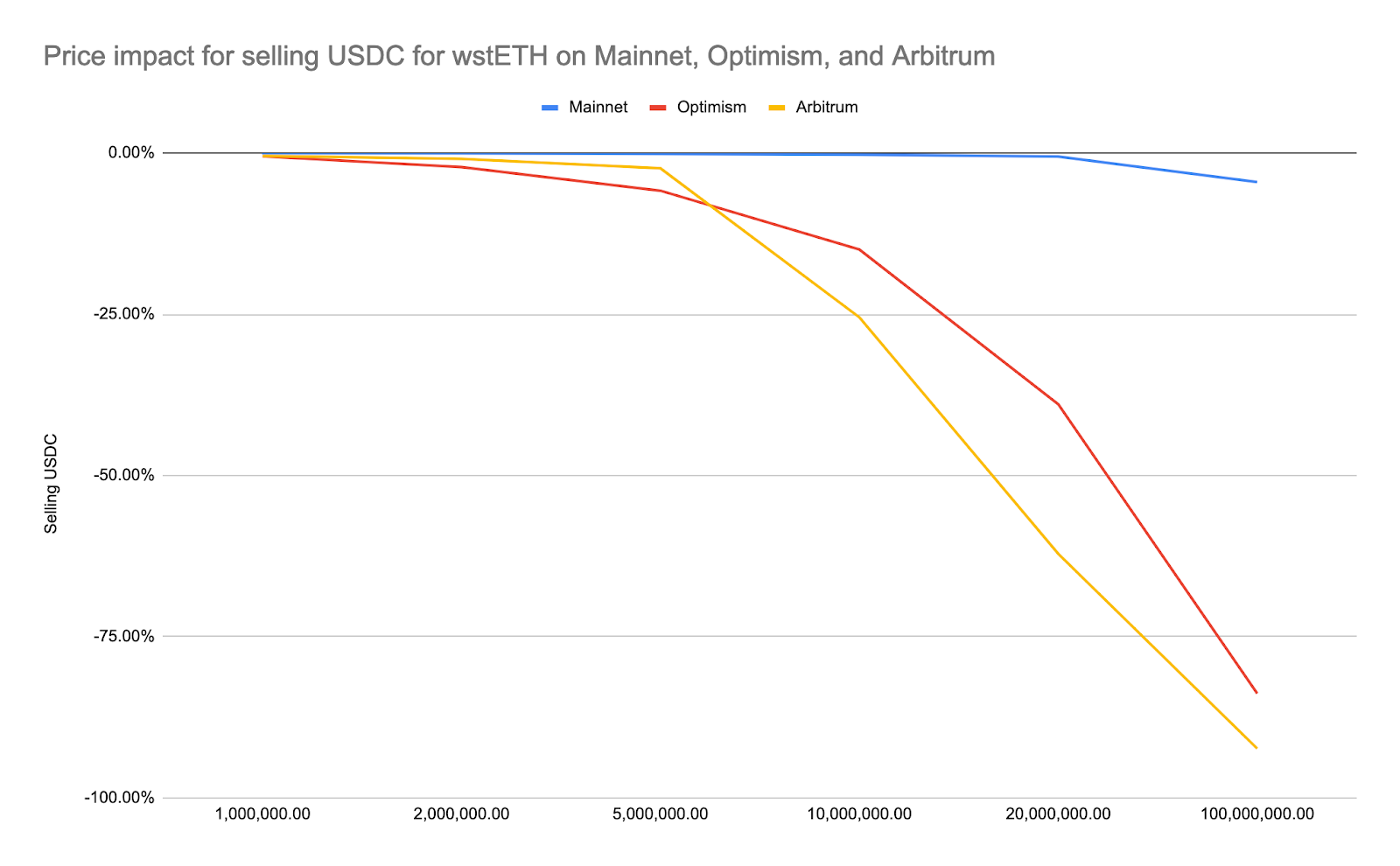

USDC - wstETH

Regarding the USDC - Lido’s wrapped staked ETH pair, the liquidity dips, resulting in a higher price impact. For instance, a $2 million trade will see a price impact of just 0.08% on Mainnet, while on Optimism and Arbitrum, the impacts jump to 2.16% and 0.87%, respectively.

If you're considering going long on wstETH with trades exceeding $2 million at a time, you're likely to see better results on Mainnet.

Conclusion

When it comes to trading size, evaluating the price impact of your trades is crucial to ensure you're not shaving off too much value with every transaction. The advent of Layer 2 networks, such as Optimism and Arbitrum, has diversified liquidity across these networks, making it more challenging to fully gauge before opening positions.

This article examined the various price impacts for trades across Mainnet, Optimism, and Arbitrum. For trades up to $1 million, the price impact across these networks is comparable. However, liquidity can fluctuate beyond that threshold depending on the pair and network. After $2 million, you can see a slight jump in some pairs, which gets steeper and steeper as the trade size grows.

Here's an important note: transactions are significantly cheaper on Layer 2 networks. As a result, you can break down your trades into smaller transactions, achieving more effective price execution even at the same trade size.

Full results:

The full table results, including absolute losses, can be found here.

Getting help

If you have any questions regarding Summer.fi in general, you contact us at support@summer.fi or on our social media.