Tokenization & OnChain Debt: Why Credit Markets Will Define the Next Cycle

Source: Galaxy Digital Asset Management, The Investable Universe 2.0 (2025)

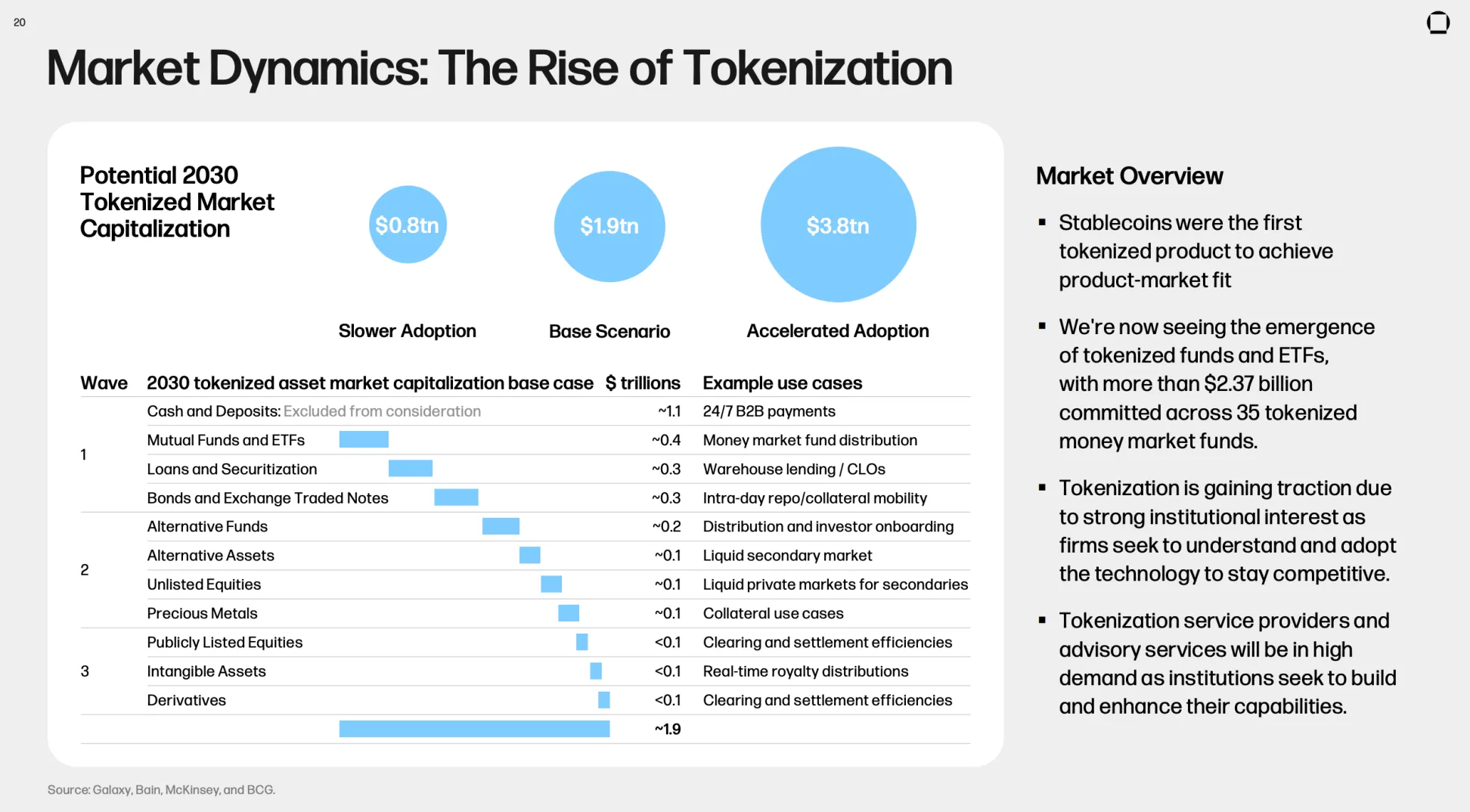

Galaxy projects the tokenized asset market to reach $1.9 trillion by 2030, with the most immediate acceleration coming from onchain credit and debt markets.

The expansion of tokenized U.S. Treasuries, money-market funds, and private-credit pools marks the return of fixed-income infrastructure this time rebuilt on transparent, programmable rails.

The new fixed income stack

Credit, not speculation, is becoming DeFi’s next cycle. Galaxy highlights that “private credit tokenization is growing four times faster than onchain equities,” driven by institutional demand for yield with compliance. This is where protocols like Maple, Centrifuge, and Spark intersect with DeFi-native systems like Lazy Summer Protocol.

The Lazy Summer Protocol integrates these lending primitives via its AI Rebalancer, automatically routing deposits into curated, risk-adjusted credit strategies. This turns tokenized credit into something accessible, diversified, and continuously optimized.

Why tokenization matters for DeFi

Tokenization is not about putting every asset onchain, it’s about creating programmable yield instruments that can move, settle, and rebalance automatically. The real innovation lies in transparency: every position, every borrower, and every yield stream is visible in real time.

Lazy Summer Protocol builds on that foundation by blending tokenized credit yields with DeFi-native lending returns. The result: portfolios that reflect the same mechanics as institutional credit funds but are available onchain 24/7.

Addressing skepticism

Skeptics point out that onchain credit introduces new risks legal enforceability, counterparty transparency, oracle dependencies. That’s why Lazy Summer’s approach isn’t about chasing any single RWA narrative. Instead, it diversifies exposure across risk tiers, geographies, and collateral types, relying on continuous risk scoring from Block Analitica and external data feeds.

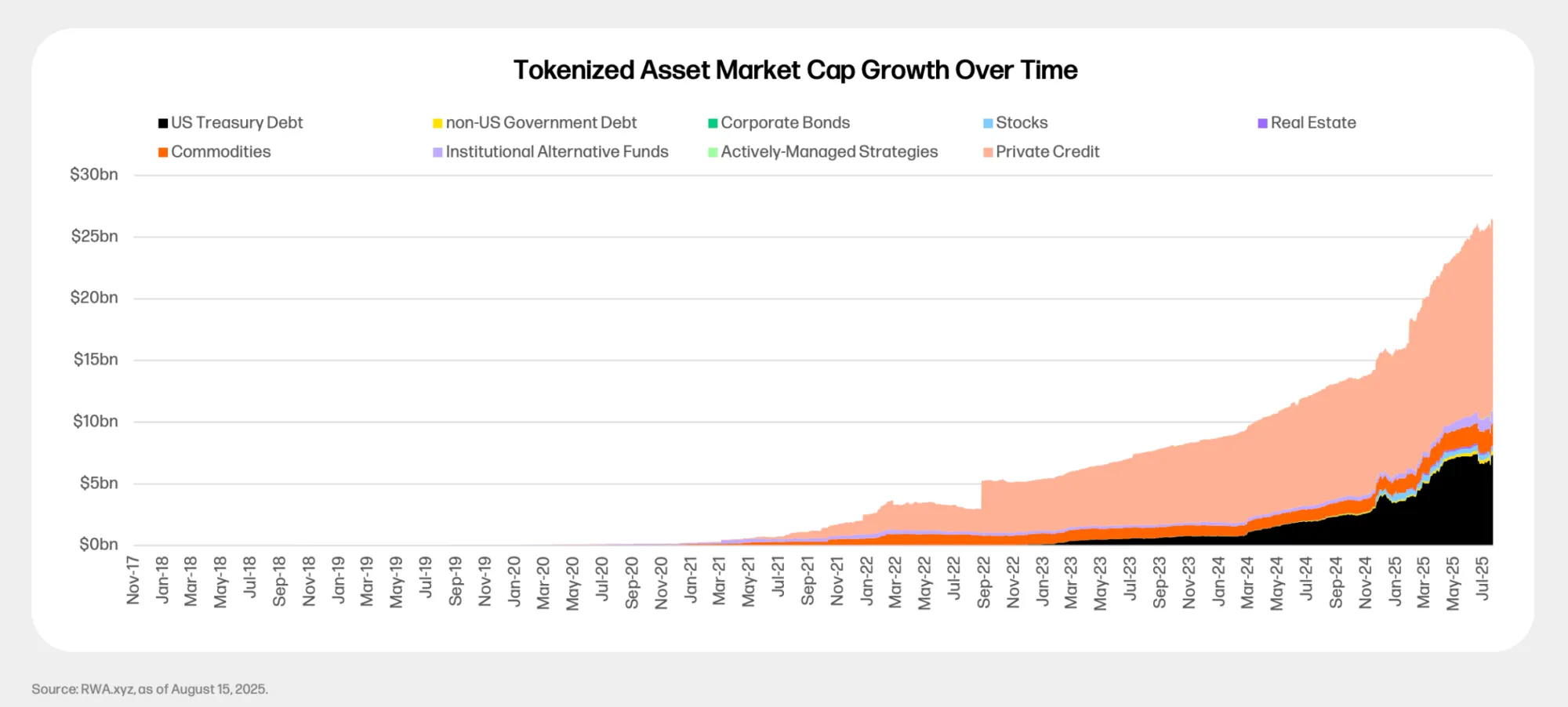

Tokenized assets have grown rapidly to almost $30bn, led by Private Credit and U.S. Treasuries, expanding into Real Estate and alternative strategies. The market has shifted from a single-asset experiment into a diversified, multi-trillion-dollar opportunity in waiting

Galaxy Research, 2025

The takeaway

As traditional fixed income migrates to public ledgers, infrastructure that automates credit allocation and risk balancing will define institutional on-chain access. Tokenization provides the rails. Automation and transparency provide the trust. Together, they form the foundation for the next phase of digital-asset adoption, one where Summer.fi Institutional serves as the bridge between regulated finance and decentralized infrastructure.

Interested in Institutional Integration?

Discover how Summer.fi Institutional enables direct, compliant access to curated on-chain yield markets through customizable, self-managed vaults.

🌐 Explore Summer.fi Institutional: summer.fi/institutions

📅 Book a call: calendly.com/summer-fi/summer-institutional