Three new ways to earn more with USDC.e

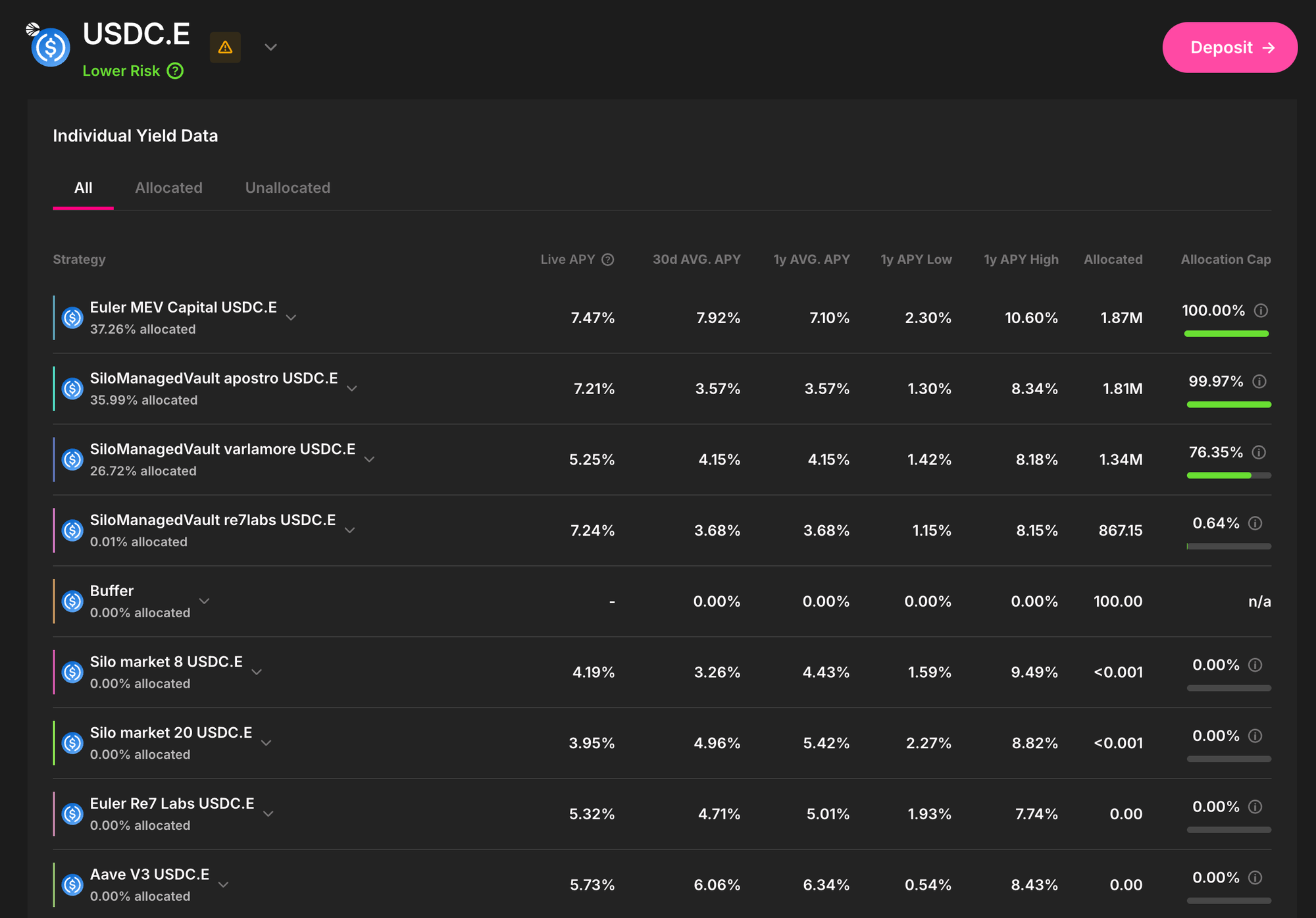

Apostro, Varlamore, and Re7labs join Lazy Summer’s Sonic Vault

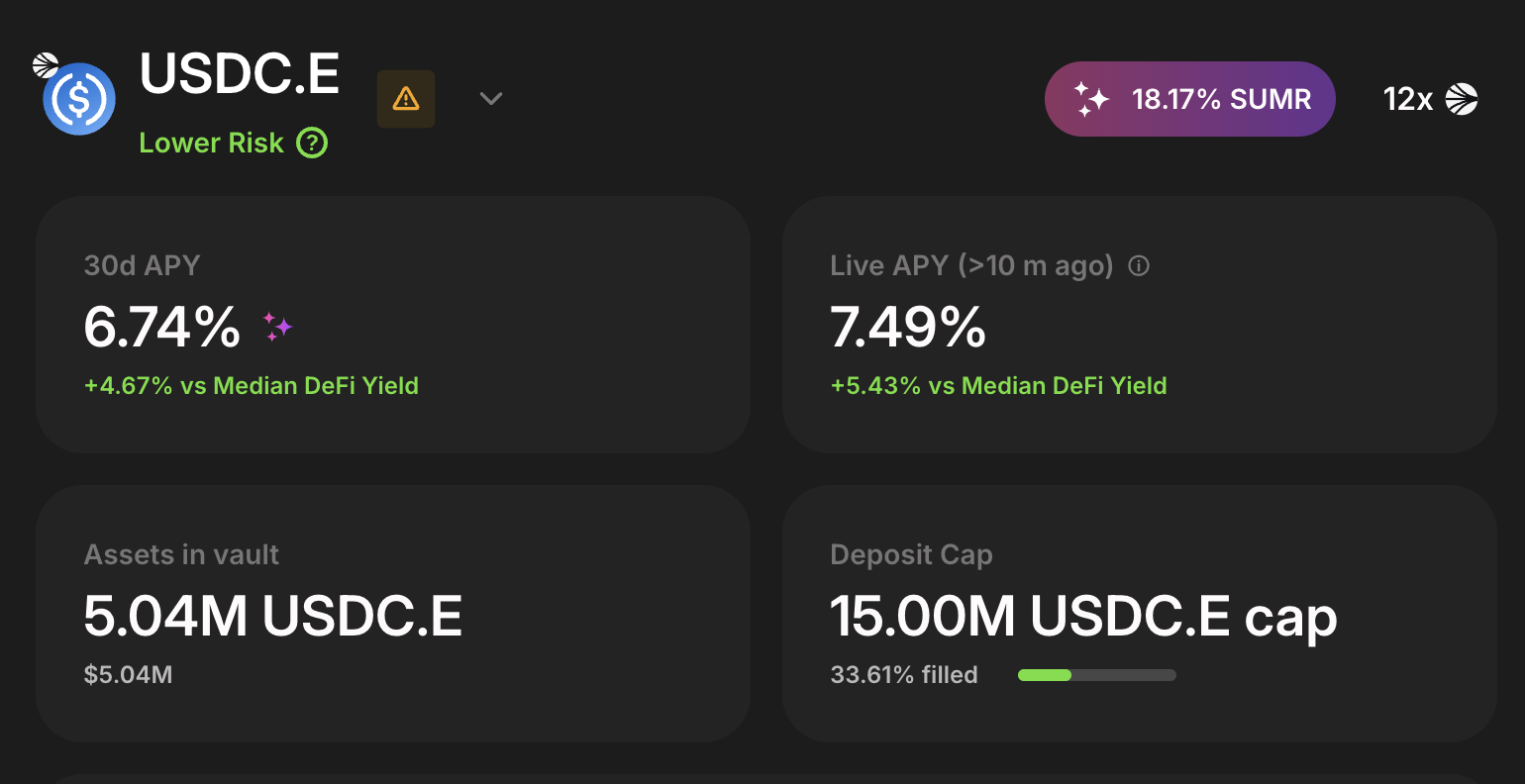

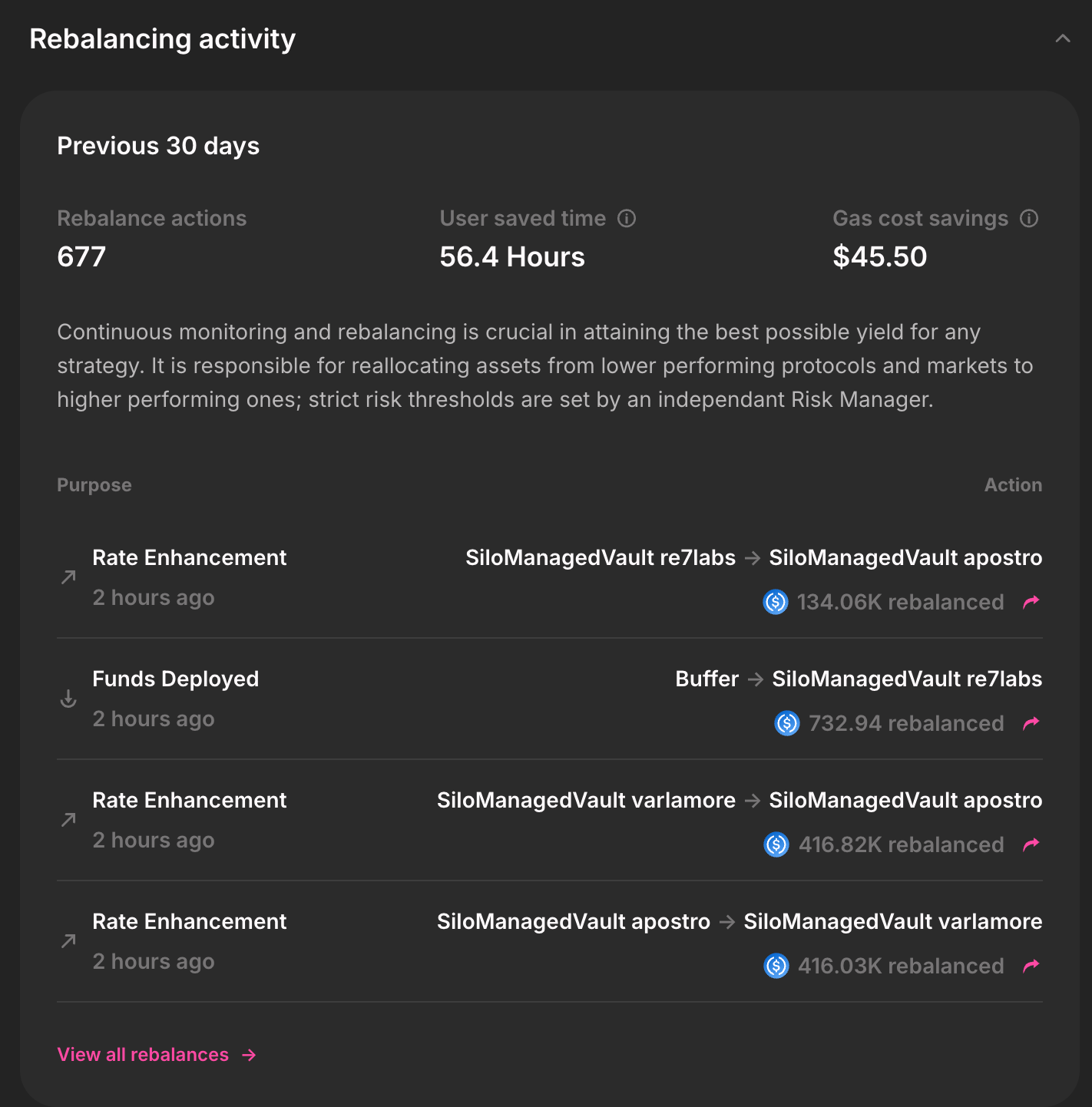

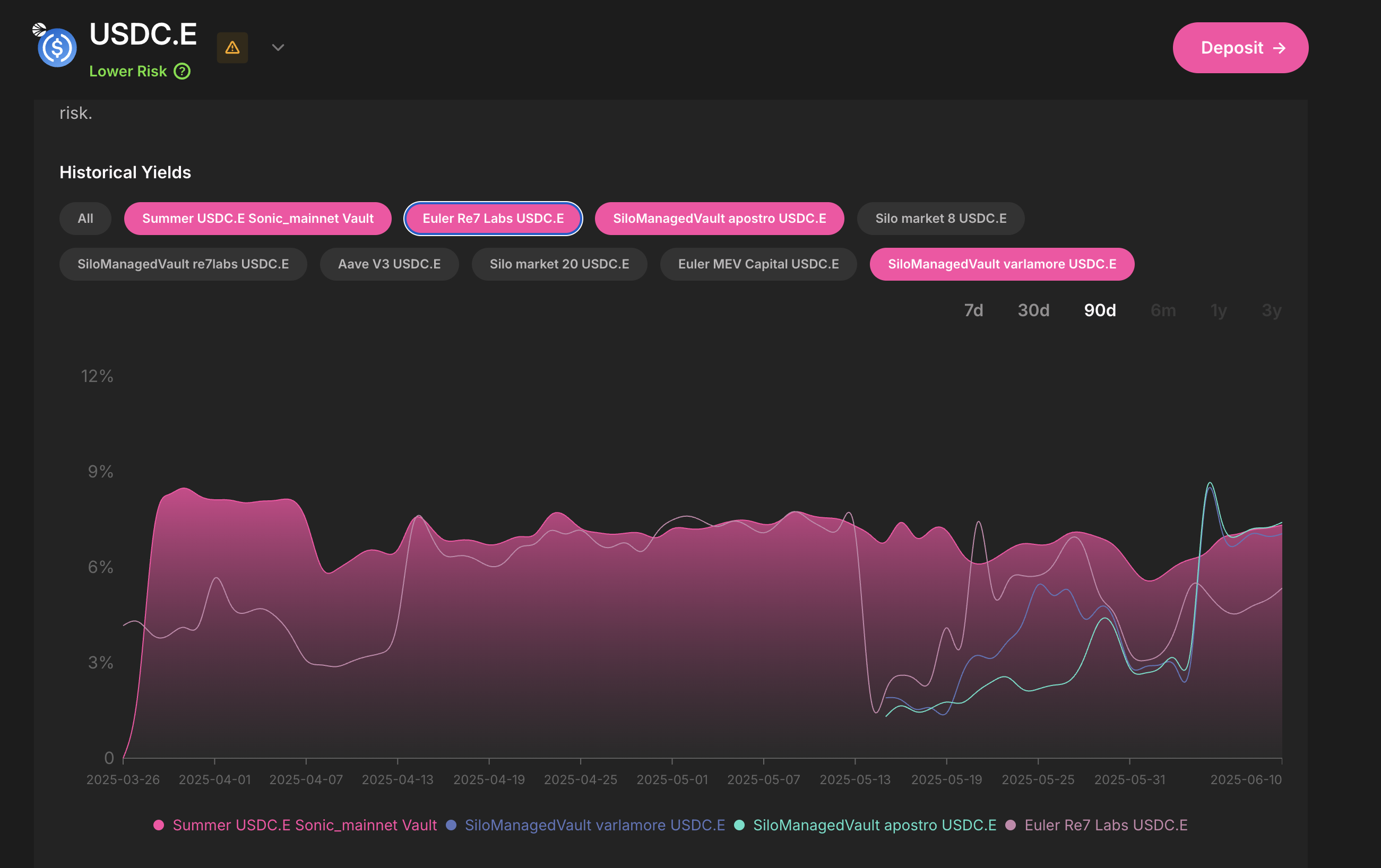

The USDC.e Sonic Vault is built to help you earn more stablecoin yield by automatically rebalancing across top-performing DeFi lending markets, without needing to manage positions yourself.

Today, the vault gets an upgrade with three new high-yield USDC.e strategies from the Silo ecosystem:

- Apostro

- Varlamore

- Re7labs

Automated Exposure to Silo’s top USDC.e markets

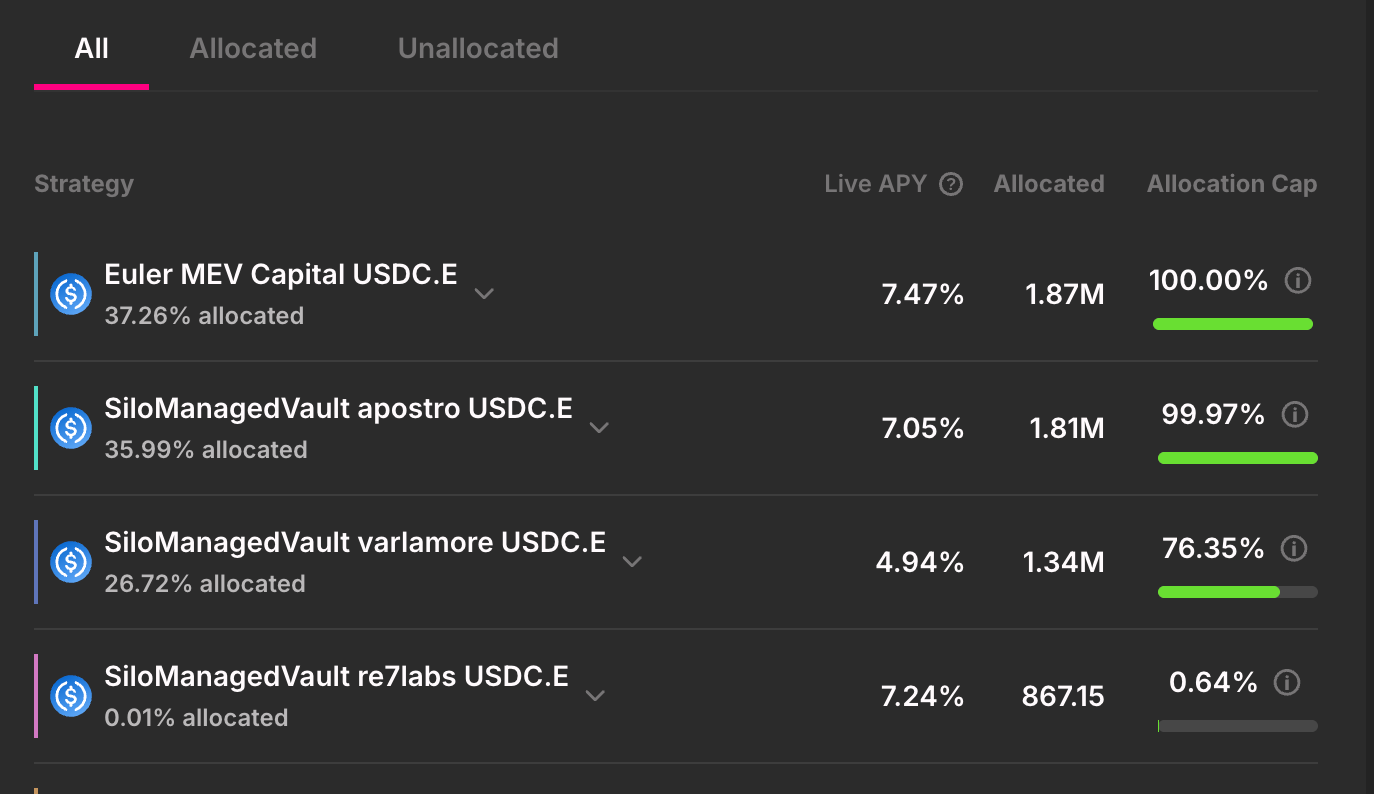

Apostro USDC.e: High yield lending with proven borrowers

The Apostro vault deploys capital into isolated lending markets within the Silo protocol, curated for safety and capital efficiency.

The Lazy Summer Advantage:

With over 35% of the vault already allocated to Apostro, Lazy Summer’s AI Keepers detect high utilization and strong APRs, routing user deposits to where yield is strongest. But even if yield dips, rest assured your capital will always find its way to the best risk adjusted strategies.

Varlamore USDC.e: Stable High-Yield Lending

Varlamore offers another curated Silo vault designed for stable lending income. It focuses on sound collateral and predictable demand.

The Lazy Summer Advantage:

Varlamore offers yield consistency without sacrificing risk-adjusted returns. Lazy Summer rebalances into it automatically when the reward-to-risk ratio outperforms other USDCe strategies.

Re7labs USDC.e: A New Yield Frontier

Re7labs brings a novel market into the Sonic vault ecosystem. While still early in allocation, this vault offers exposure to emerging collateral opportunities with upside potential.

The Lazy Summer Advantage:

As this strategy scales, Lazy Summer’s automated system will increase allocation when it offers a better yield-to-risk tradeoff, letting users benefit early from new opportunities.

Stablecoin yield, optimized with zero management

With Apostro, Varlamore, and Re7labs now live in the USDC.e Sonic Vault, you get:

- Higher stablecoin yields than lending on Aave or Euler

- Diversified exposure across isolated Silo markets

- Automated rebalancing, monitored and optimized 24/7… no more chasing yield!

Why Park Your USDC Here?

- AI-Optimized Yield – Our keepers rebalance 24/7 to the best risk-adjusted return; you just watch the points stack.

- Triple Rewards – One deposit earns 12× Sonic points, up to 2 Silo points per dollar per day, and $SUMR—automatically.

- Lower Fees, Fewer Clicks – Deposit once; Lazy Summer handles every rebalance. Save gas, save time, earn more.

- Block Analitica Oversight – Institutional-grade risk frameworks update in real-time as markets move, so you can sleep easy.

How to deposit & get exposure to Apostro, Varlamore, and Re7labs via Silo

- Connect your wallet at Summer.fi

- Deposit USDC.e into the Sonic Vault

- Sit back—Lazy Summer handles the rest

- Claim or compound your SUMR rewards

- Already in? Use Vault Switch to migrate capital instantly

Start earning more with your USDC.e

- SUMR rewards are live

- get 12x Sonic points

- New Silo markets (Apostro, Varlamore, Re7labs) integrated

- Yield optimized automatically—no position management needed

👉 Deposit into USDC.e Sonic Vault now

Join us

Discord | Telegram | X/Twitter | Linktree

Disclaimer: Oazo Apps Limited functions solely as a front-end interface (Summer.fi) provider and it does not act on behalf of any user. Oazo Apps Limited did not launch nor does it operate or control the Lazy Summer Protocol. The Lazy Summer Protocol is accessed through Summer.fi. The information provided herein is provided on behalf of the Lazy Summer Foundation which launched the Protocol for informational purposes only and it does not constitute investment advice. Oazo Apps Limited and the Lazy Summer Foundation are not soliciting or recommending any transaction or guaranteeing any specific returns. Users interact with the Protocol at their own risk. T&C for the use of Summer.fi apply.