The Return of ETH: What Institutional Allocators Should Know About On-chain Yield

Ethereum is back at the center of institutional conversations. After a year where Bitcoin ETFs dominated headlines, ETH has reasserted itself as the programmable reserve asset of DeFi. Staking flows, derivatives, and layered strategies are all creating an environment where ETH exposure is no longer binary, it’s about which risk tier you select and how efficiently you capture yield.

For institutions, the challenge is clear: navigating ETH’s resurgence without adding operational drag. That’s exactly what Summer.fi’s risk-tiered ETH vaults are designed for.

ETH in 2025: Outperformance & Staking Flows

- ETH staking flows are at record levels. More ETH is being locked into liquid staking derivatives (LSTs) like stETH and rETH than ever before. These assets now underpin much of DeFi collateral.

- ETH has outperformed broader crypto benchmarks in multiple recent cycles, supported by fee burns, staking yield, and growing demand for blockspace.

- Institutions are seeking ETH “yield plus.” Plain staking may generate ~3–4% annually, but lending spreads, looping, and cross-venue arbitrage often layer additional returns.

Key point: The opportunity is no longer just “hold vs. stake.” It’s about how to combine ETH as productive collateral with risk-managed, diversified yield strategies.

Tiered ETH Exposure with Summer.fi Vaults

Lower-Risk ETH Vault (on Base)

- Targets conservative ETH holders seeking stable yield with minimized complexity.

- Allocates to tier-one lending markets on Base, curated and supervised by Block Analitica to manage concentration and counterparty risks.

- Automates rebalancing across venues, ensuring capital continuously aligns with risk mandates.

- Transparent and auditable: allocations, rebalances, and performance visible on-chain.

👉 Example: ETH deposited into Aave and Compound markets on Base, monitored for liquidity and collateral safety.

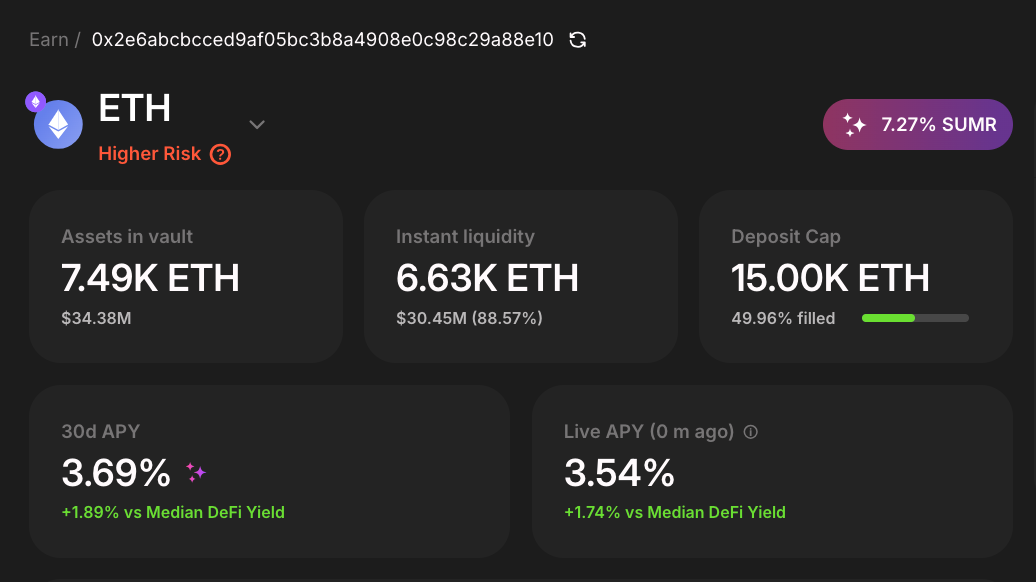

Higher-Risk ETH Vault

- Built for allocators comfortable with more volatility.

- Strategy scope goes beyond basic lending to include looping/leveraged LST strategies and structured ETH yield plays.

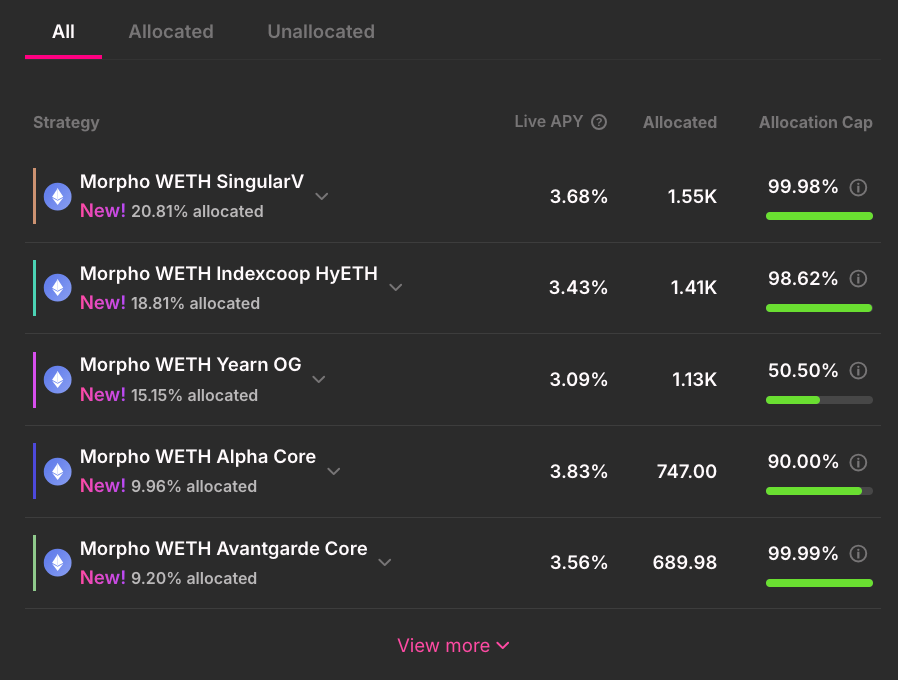

- Current core lineup (from UI) is Morpho-based WETH strategies, e.g. SingularV, Yearn OG, HyETH, Alpha Core, Avantgarde Core.

- Recently announced additions include Fluid Lite (leveraged ETH staking loops) and Morpho Smokehouse (ETH-backed lending diversification) to broaden yield levers.

- AI keeper agents execute dynamic rebalancing across this strategy set, subject to real-time conditions and constraints.

- Policy guardrails remain enforced on-chain — deposit caps, diversification rules, and governance oversight ensure strategy risk stays within mandate.

Risk Spectrum at a Glance

- Lower-Risk ETH Vault: Optimized for capital preservation, consistent yield, and institutional mandates with strict risk controls.

- Higher-Risk ETH Vault: Designed for allocators who can accept drawdowns in exchange for higher expected yield, with ongoing risk curation.

Both vaults:

- Non-custodial by design (your assets, your keys).

- Automated execution through AI keepers.

- Transparent reporting with daily NAV files and on-chain audit logs.

Bridging DeFi Chaos: ETH as a Unified Allocation Layer

The institutional edge is not just yield, but operational efficiency.

- Vault Switch: Rotate between ETH vaults (or into stablecoin vaults) in one transaction, without unwind/redeposit friction.

- Risk Curation: Block Analitica continuously evaluates ETH strategies, adjusting caps and exposures to prevent hidden concentration.

- Dynamic Onboarding: New ETH strategies can be integrated into vaults without institutions building new connectors.

- Unified Reporting: All ETH vaults share the same infrastructure, SDKs, and export formats, making integration with custody and back-office seamless.

What Institutional Allocators Should Watch

- Composition clarity: Understand which venues and strategies are in your ETH vault.

- Volatility management: Define drawdown tolerances and ensure reallocation logic respects them.

- Switchability: Use Vault Switch to dial risk up or down without friction.

- Governance alignment: Monitor how strategy onboarding and parameter changes are governed.

- Transparency: Insist on daily NAVs and immutable logs for compliance.

Explore ETH Vault Strategies

ETH is not just the backbone of DeFi — it’s a yield platform in its own right. Institutions can now choose risk-tiered ETH exposure through Summer.fi’s vaults, balancing outperformance potential with operational discipline.

👉 Explore ETH institutional vault strategies → summer.fi/institutions

Interested in integrating?

Getting access to on-chain yield no longer needs to be complicated. If you’re interested in discovering how Summer.fi Institutional would work for you and your clients, get in touch with a member of the team.

🌐 Website: https://summer.fi/institutions

📅 Book a call: https://calendly.com/summer-fi/summer-institutional

Join us

Discord | Telegram | X/Twitter | Linktree

Disclaimer: Oazo Apps Limited functions solely as a front-end interface (Summer.fi) provider and it does not act on behalf of any user. Oazo Apps Limited did not launch nor does it operate or control the Lazy Summer Protocol. The Lazy Summer Protocol is accessed through Summer.fi. The information provided herein is provided on behalf of the Lazy Summer Foundation which launched the Protocol for informational purposes only and it does not constitute investment advice. Oazo Apps Limited and the Lazy Summer Foundation are not soliciting or recommending any transaction or guaranteeing any specific returns. Users interact with the Protocol at their own risk. T&C for the use of Summer.fi apply.