The only way to stop missing DeFi yield opportunities

Why DeFi users may miss yield opportunities

High-quality, sustainable yield sources remain one of the most effective ways to earn in DeFi, yet even experienced users often fail to capture the full potential of their capital.

It’s not a matter of finding strategies but of responding to changing conditions. Yields shift quickly. Strategies become outdated. And staying in the wrong place for too long can mean missed returns, added risk, or unnecessary effort.

This article explores why even sophisticated DeFi participants fall behind and highlights the tools built to help them stay ahead.

The complexity of optimizing yield and common traps users fall prey to

In DeFi, earning the best yield involves more than selecting a vault and maintaining static positions. Markets shift rapidly, and different yield strategies become more or less profitable based on factors like utilization rates, token farming events, and liquidity dynamics. As a result, most users do one of two things.

- Sit idle: DeFi users just sit in yield strategies that are earning less than they could. It's safe and it's easy… but it is certainly not optimal.

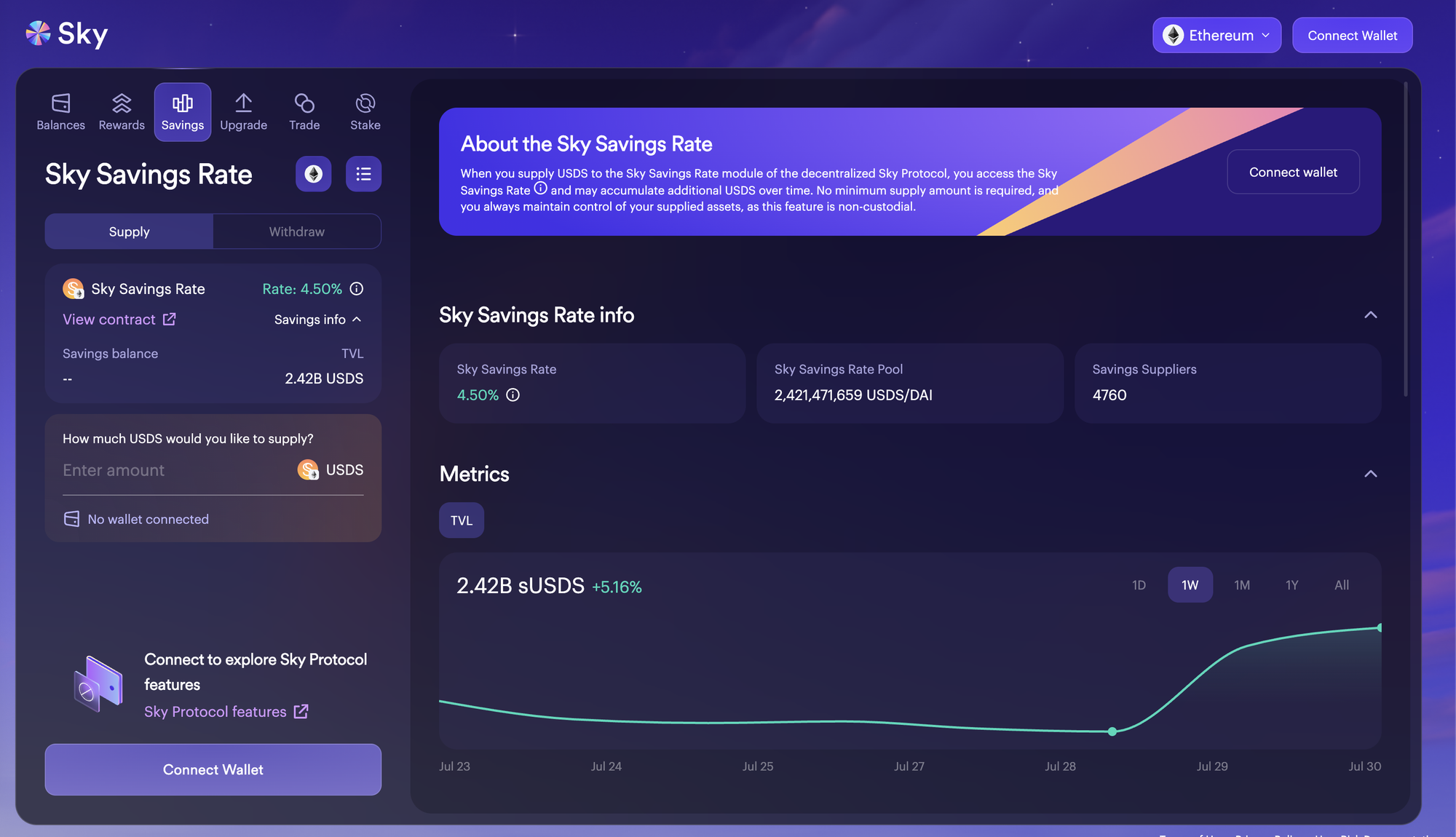

Over $2B in capital sits in the Sky Savings rate, earning yield far below many Morpho vaults.

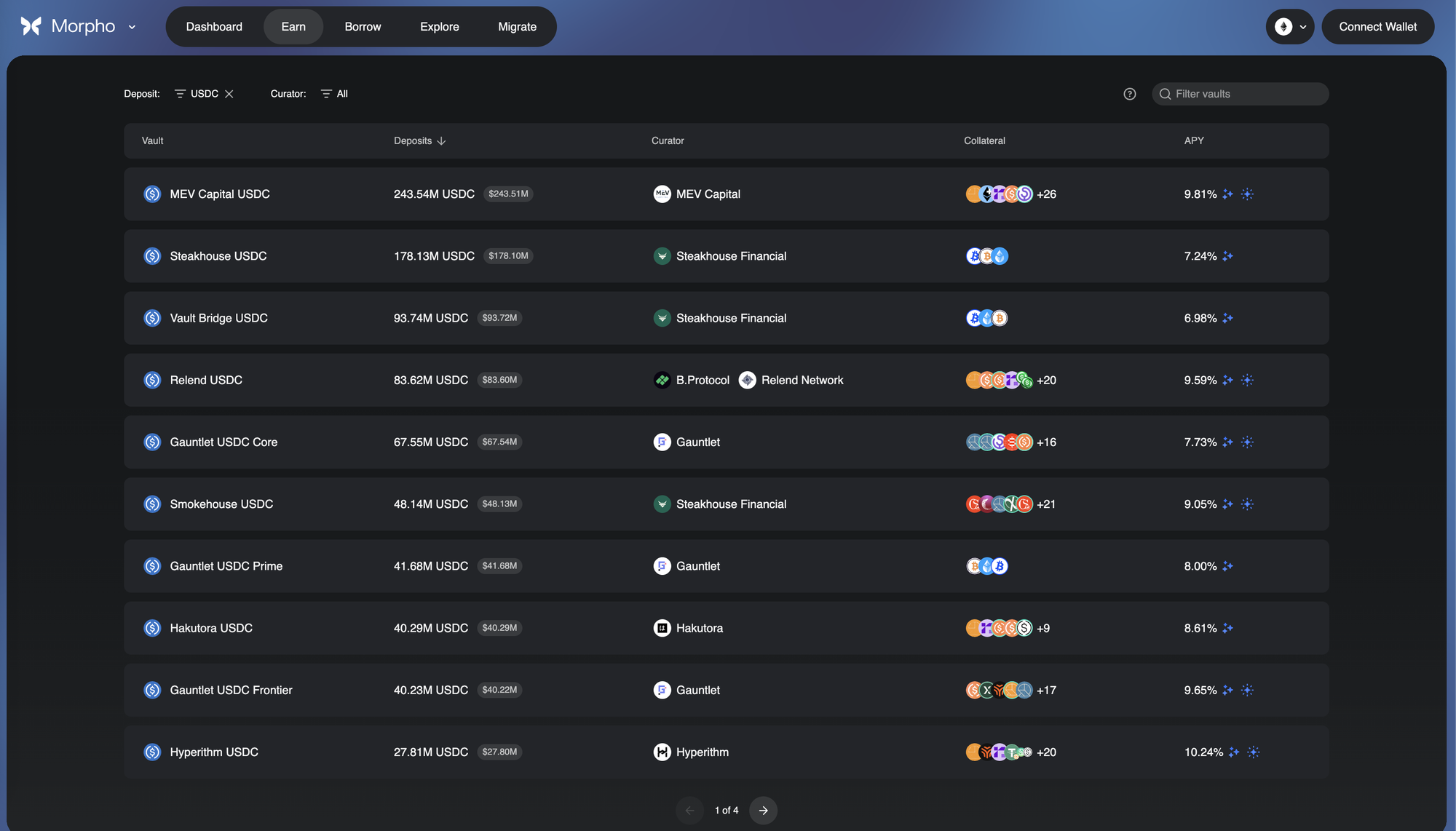

- Chase yields: DeFi users chase yields, even within the same protocol. For example, yield markets within Morpho are constantly shifting. This results in users wasting time chasing yields, which they are usually too slow to capture.

Users on Morpho must constantly choose between over 40 markets to earn on, just for USDC on Ethereum! All this results in a terrible experience for users who want the best yields in DeFi while doing less work.

No more second-best yields, the power of automated rebalancing

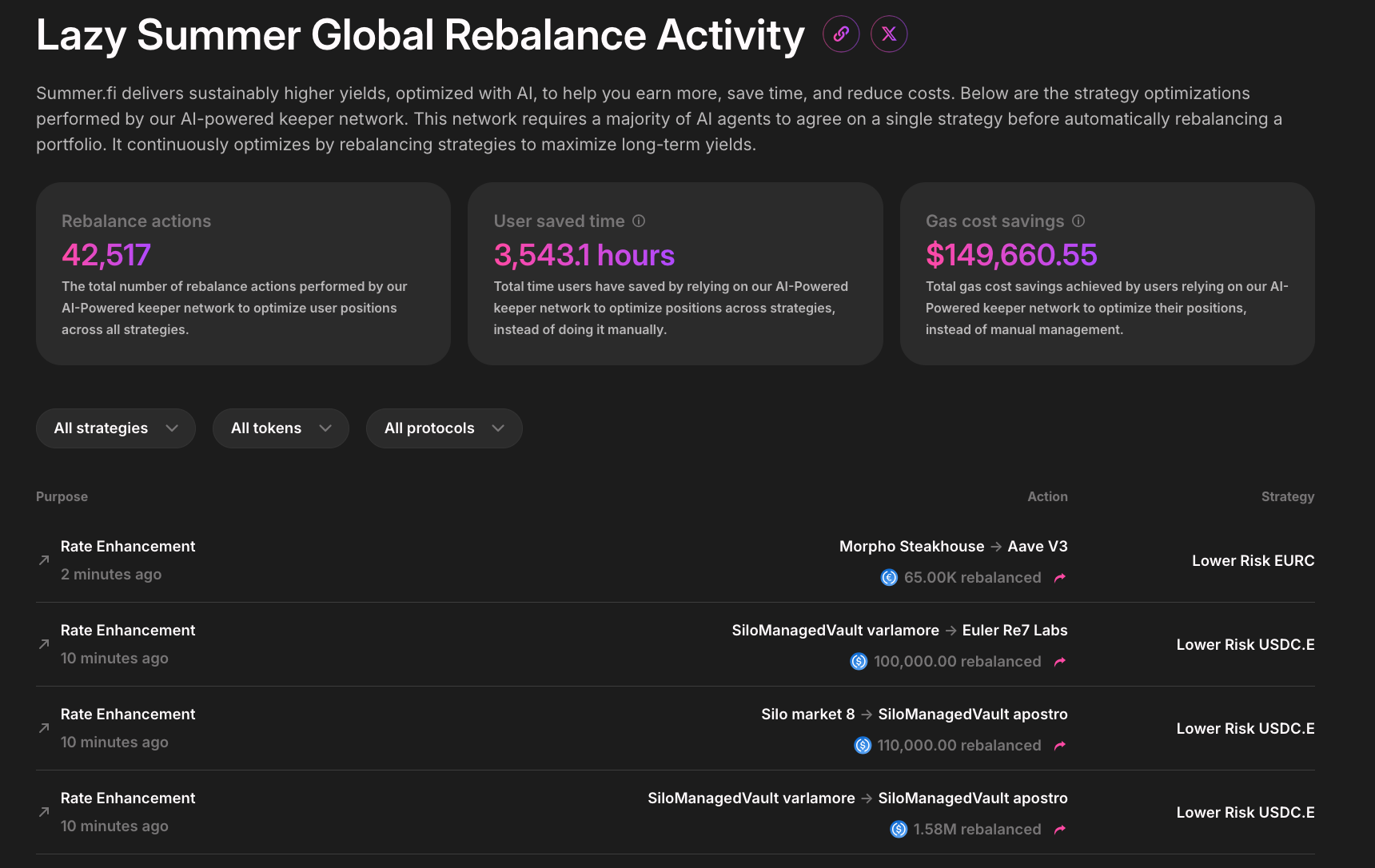

Thankfully, the Lazy Summer Protocol helps users stay ahead and always earn the best of the highest quality yields. How? Automated rebalancing. Once a user selects the right vault for them on Lazy Summer, the protocol uses an AI-powered keeper network that monitors strategy performance and automatically rebalances when a majority of agents agree.

This occurs fully on-chain and without user input, ensuring vaults remain aligned with market conditions. To make this protocol activity visible, Summer.fi provides a Rebalance Activity page where users can view aggregated data on how the Lazy Summer Protocol has adjusted vault strategies over time.

Current Protocol Activity (historical data, not predictive):

- Rebalance Actions: 42,517 automated optimizations performed.

- User Time Saved: 3,543.1 hours of manual monitoring.

- Gas Cost Savings: $149,660.55 in transaction cost optimization.

Check out how much time and money have been saved by the Lazy Summer AI-Powered Agents keeping the protocol optimized! https://summer.fi/earn/rebalance-activity

Adapting to any market condition

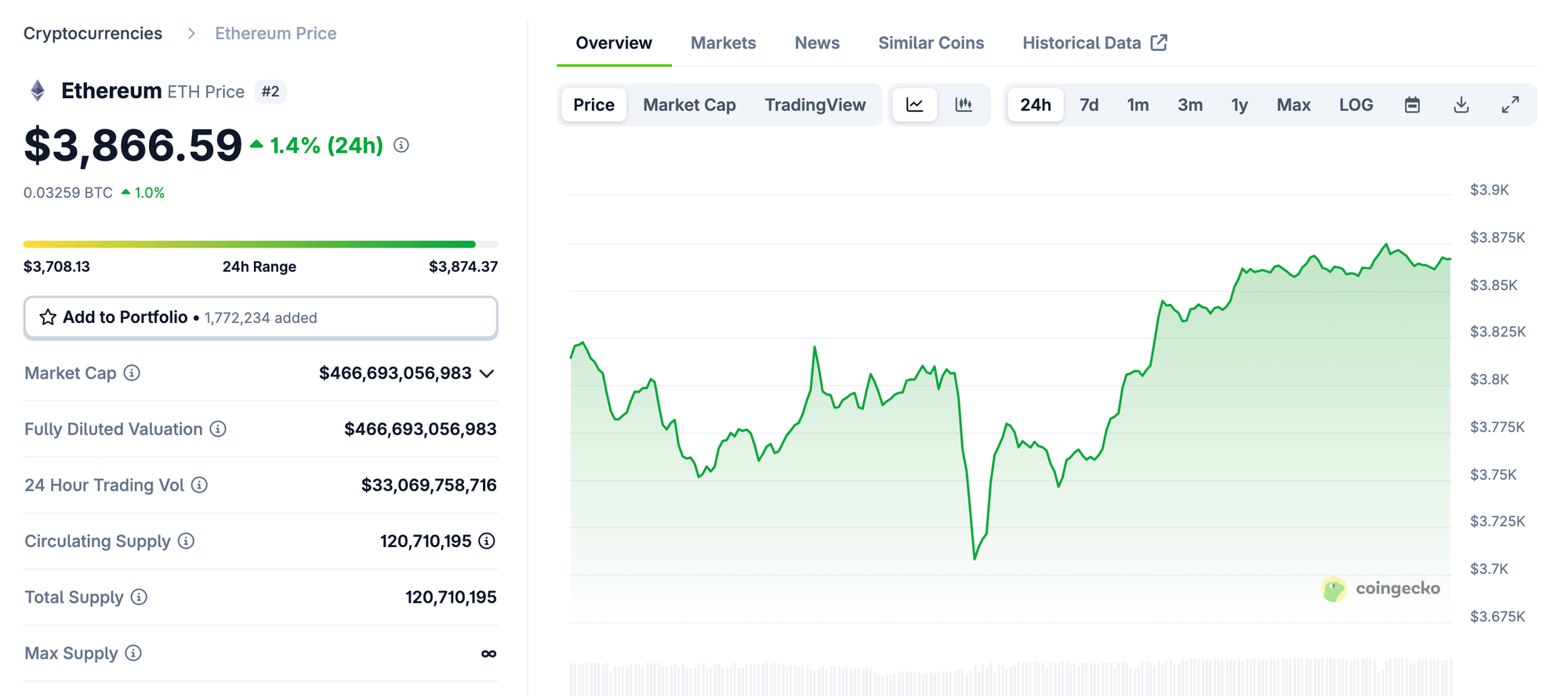

As mentioned, things can change rapidly in the DeFi yield ecosystem but also in the crypto market as a whole. For example, recently the price of ETH has exploded higher.

- What if you are earning in stablecoins?

- What if you are earning in ETH and want to take some profits?

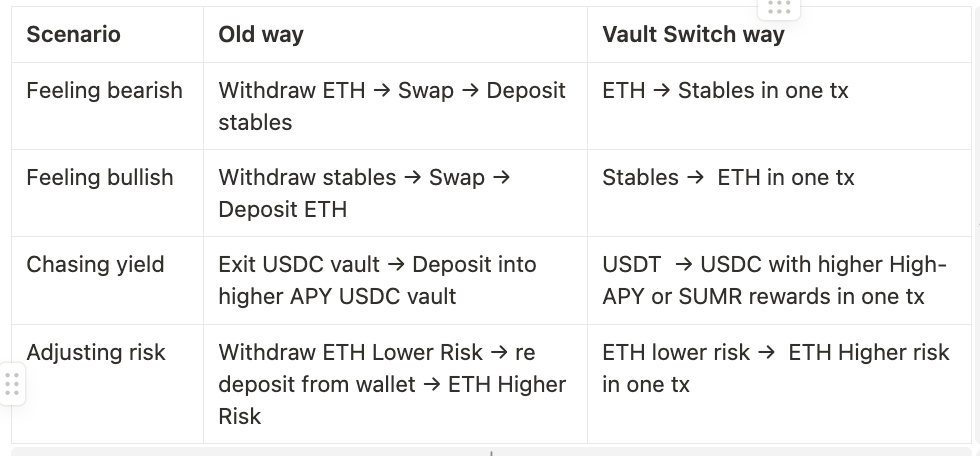

There are many scenarios like this in DeFi and crypto that users will no doubt face when earning yield on assets. Many DeFi users stay in underperforming vaults simply because switching is tedious. Traditional yield strategies require users to manually withdraw and reallocate capital, often across chains or protocols.

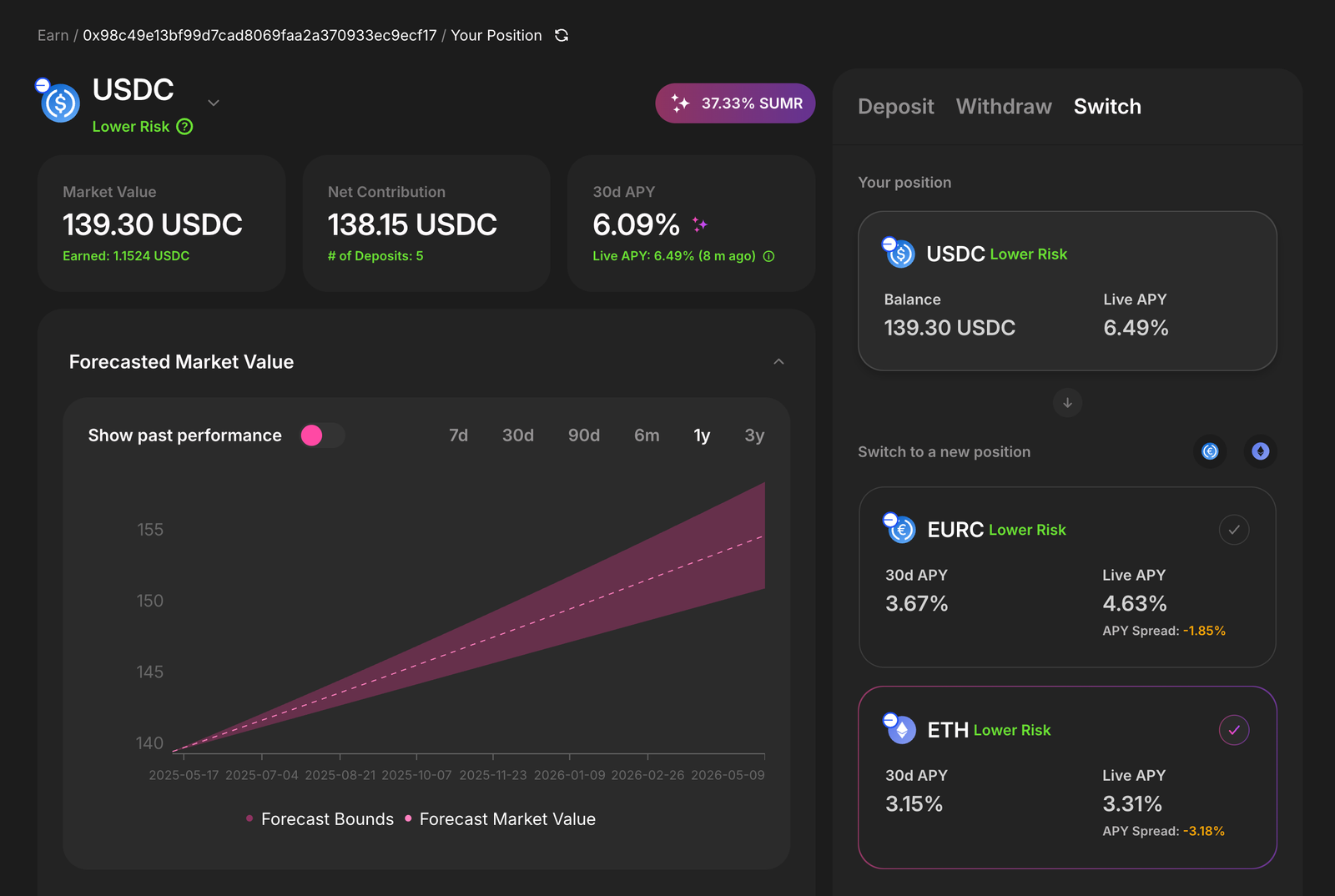

With the Lazy Summer Protocol, even fast-changing market conditions don't matter. The Lazy Summer Protocol enables seamless transitions between vaults through Vault Switch, an on-chain feature that lets users move positions across Lazy Summer vaults in a single transaction. Summer.fi provides the interface to access and view Vault Switch, making it easier for users to interact with this functionality. The protocol handles the logic; the front end makes it accessible.

If market conditions shift, Vault Switch helps users adapt without needing to manage everything manually. And once positioned, the protocol continues optimizing performance through automated portfolio rebalancing, powered by a network of AI agents. That way, users stay optimized both at the point of entry and long after.

When you’ll want to switch

Watch the full video on how vault switch works: https://youtu.be/izn5-tQ1FCY?si=9noQiEB7xFJH_qV_

Final Thoughts

DeFi is complex and favours automated strategies with smart logic over manual attempts at optimization. Don’t miss out on the best of DeFi… Save time and earn more with Lazy Summer.

Get started at summer.fi.

Join us

Discord | Telegram | X/Twitter | Linktree

Disclaimer: Oazo Apps Limited functions solely as a front-end interface (Summer.fi) provider and it does not act on behalf of any user. Oazo Apps Limited did not launch nor does it operate or control the Lazy Summer Protocol. The Lazy Summer Protocol is accessed through Summer.fi. The information provided herein is provided on behalf of the Lazy Summer Foundation which launched the Protocol for informational purposes only and it does not constitute investment advice. Oazo Apps Limited and the Lazy Summer Foundation are not soliciting or recommending any transaction or guaranteeing any specific returns. Users interact with the Protocol at their own risk. T&C for the use of Summer.fi apply.