The New DeFi Stack for Institutions: Composability Without Complexity

“Modular DeFi” isn’t just a buzzword anymore. For institutions, the stack is finally snapping into clear layers front-ends, vault infrastructure, risk engines, and automation—so you can compose the pieces you need without inheriting a tangle of protocol integrations. Summer.fi slots into this stack as the yield layer, as a single integration into Summer.fi opens up the entire DeFi ecosystem, with policy controls and automated execution over curated markets.

The emerging modular DeFi stack

Front-ends (access & UX). Institutions don’t want to glue together SDKs and UIs. They want a clean gateway that is non-custodial, integrates with common custody setups, and keeps the line between interface and protocol explicit. Summer.fi is positioned as focused on compliance, with audits and security partners referenced across the institutional pages.

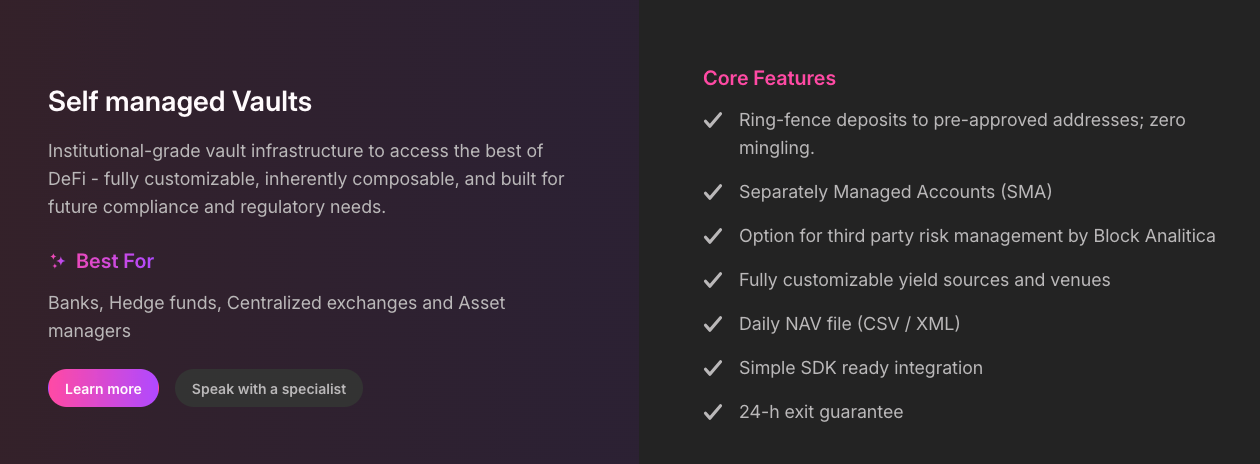

Vault infrastructure (public & self-managed). This is the layer that actually holds strategy logic. You can choose public access vaults (curated, automated, open) or self-managed/closed access vaults (ring-fenced, permissioned, custom mandates). Both routes are built to aggregate on-chain yield in one place across EVM chains.

Automation (AI keepers). A keeper network monitors strategies and rebalances within constraints you define so you get continuous implementation of policy without running a war room every time markets move.

Risk engine (independent curation). The protocol’s public vaults implement risk parameters maintained by Block Analitica; institutions using self-managed vaults can either define parameters themselves or appoint a third-party curator. This is how “frameworks on paper” become enforceable limits in code.

Compliance, reporting, and auditability. The institutional pages emphasize closed access controls, role-based permissions, daily NAV files (CSV/XML), and audit-ready logs—so back-office and auditors get what they need without custom data jobs.

Security partners. References to ChainSecurity and other specialists are listed in the institutional security section, reinforcing that audits and operational discipline are first-class concerns.

Where Summer.fi fits: the yield layer you compose around

Summer.fi provides the institutional yield layer on top of the Lazy Summer Protocol:

- Curated markets, continuously optimized. Public vault pages describe “DeFi’s highest-quality strategies continuously optimised,” with AI-powered automation reallocating deposits across vetted, tier-one venues. (Institutional readers: treat this as automation of policy, not a promise of outperformance.)

- Risk handled like a system, not a spreadsheet. Block Analitica serves as Risk Curator for public vaults; for self-managed vaults, institutions can encode their own limits (caps, diversification rules, reallocation logic) or delegate to a third party.

- Permissioned control & reporting. Closed access to approved addresses, role-based permissions, daily NAV exports, and immutable logs give you segregation of duties and an audit trail without building internal plumbing.

- Non-custodial by design. Assets remain in your control; institutional pages reference compatibility with reputable custody providers.

One integration → many venues. Self-managed vaults expose “one integration for all of crypto’s on-chain yield,” covering public and private markets (lending, DEX LPs, RWAs, looping, and more) across EVM chains. Build the exact portfolio you want; don’t bolt on a dozen SDKs.

How to visualize it with your uploaded images:

- Place “DeFi’s highest-quality strategies continuously optimised” beneath this section to illustrate curated, automated venue rotation.

- Add the “Institutional-grade automation” benefits card (automation, non-custodial, transparency, independent risk management) as a sidebar callout.

- Include the Block Analitica panel where you discuss risk curation.

How this stack enables scalable institutional DeFi access

Cuts the integration tax. Instead of building/maintaining connectors to every protocol, teams integrate once and declare a mandate (assets, chains, eligible venues, caps, reallocation rules). The vault enforces it; the keepers execute it. Result: fewer bespoke pipelines and faster time to coverage.

Turns policy into code. Frameworks become guardrails: exposure caps, allow-lists, and diversification limits live in the vault, and the automation keeps positions within bounds, not just at quarter-end reviews.

Improves operational resilience. When yields move—or a venue’s risk profile changes—the system can rebalance under set thresholds rather than relying on dashboards and manual, multi-step unwinds. That’s the difference between “we noticed” and “we acted.”

Keeps governance and auditors happy. Closed access, role-based permissions, NAV files, and audit logs mean you can prove who did what, when, and under which policy with exports your back office can actually ingest.

Fits your custody and security posture. The institutional pages emphasize a security-first approach and name audit partners; the front-end role of Summer.fi is also clearly stated, which matters for how you document responsibilities.

TL;DR for investment committees

- Modular stack = access UI + vault layer + automation + risk engine + reporting.

- Summer.fi = yield layer that composes with your custody, provides one integration across EVM, and encodes policy into vault logic.

- Scale without headcount creep: Continuous, policy-constrained rebalancing and ready-made reporting replace spreadsheet ops.

Interested in integrating?

Getting access to on-chain yield no longer needs to be complicated. If you’re interested to discover how Summer.fi Institutional would work for you and your clients, get in touch with a member of the team.

🌐 Website: https://summer.fi/institutions

📅 Book a call: https://calendly.com/summer-fi/summer-institutional

Join us

Discord | Telegram | X/Twitter | Linktree

Disclaimer: Oazo Apps Limited functions solely as a front-end interface (Summer.fi) provider and it does not act on behalf of any user. Oazo Apps Limited did not launch nor does it operate or control the Lazy Summer Protocol. The Lazy Summer Protocol is accessed through Summer.fi. The information provided herein is provided on behalf of the Lazy Summer Foundation which launched the Protocol for informational purposes only and it does not constitute investment advice. Oazo Apps Limited and the Lazy Summer Foundation are not soliciting or recommending any transaction or guaranteeing any specific returns. Users interact with the Protocol at their own risk. T&C for the use of Summer.fi apply.