The Lazy Summer Promise: Do Less

How to earn the highest quality DeFi yields, and dual token rewards all on Summer.fi

DeFi yield isn’t just accelerating; it’s maturing.

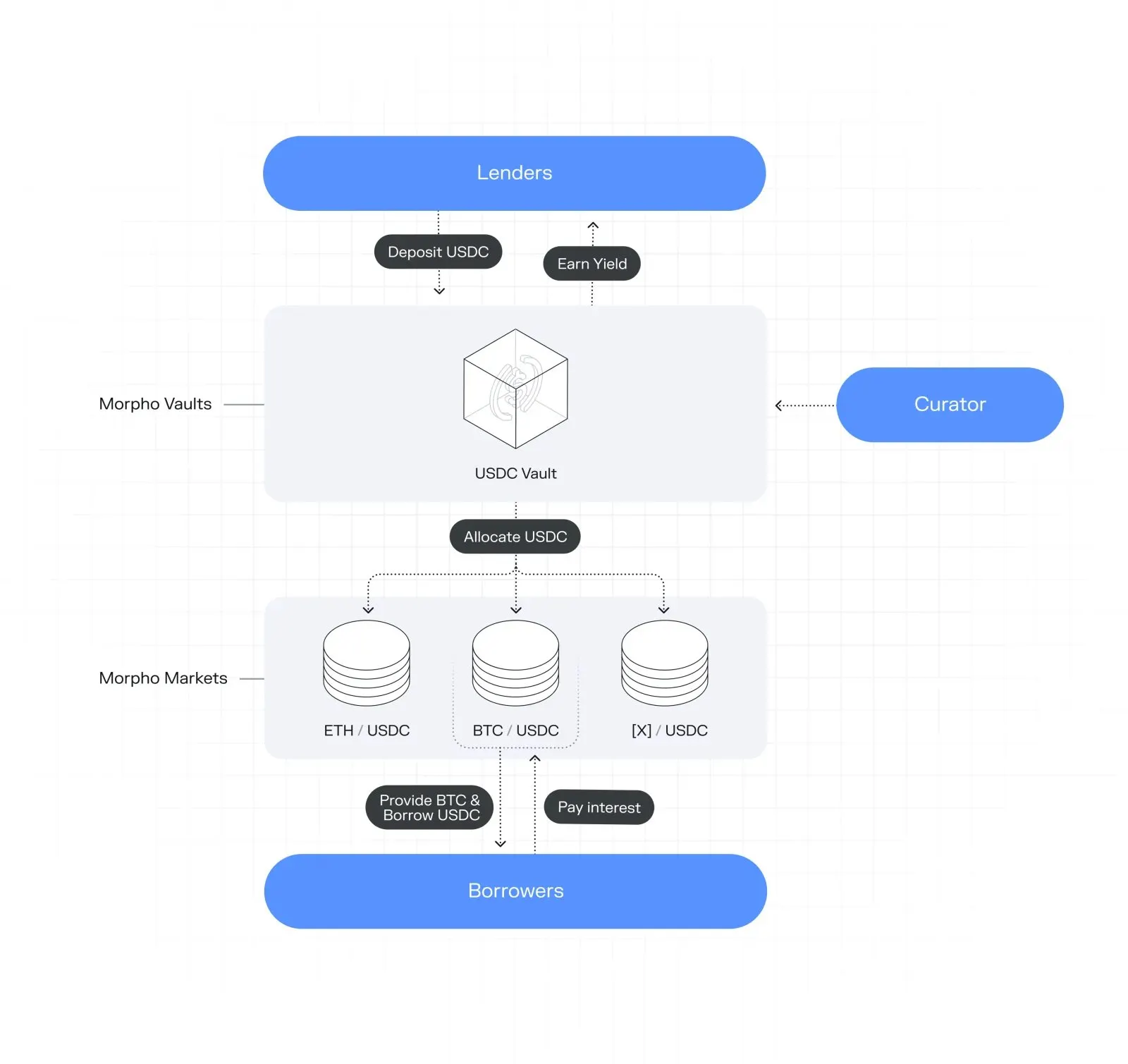

What started as a simple “deposit and earn” mechanic has evolved into a full onchain yield stack: lending markets, curated vaults, fixed-rate primitives, institutional onchain credit, and more. The opportunity set is bigger, more liquid, and professionalizing fast.

The market is waking up to this. Everyone from Bankless, to Bitwise, to Blockworks is posting about onchain vaults.

But growth brings growing pains: fragmentation, complexity, and the headache of constant risk management.

The catch is that earning the best risk-adjusted yield now requires constant work:

- tracking which markets are leading this month,

- monitoring risk limits and liquidity,

- rotating deposits without getting sloppy about risk,

- and doing it again… and again.

For DeFi natives, that’s time and attention.

For institutions, it’s operational burden, governance overhead, and constant risk assessment.

Lazy Summer exists to remove that burden.

A brief history of onchain yield

Onchain yield began with simple, foundational primitives:

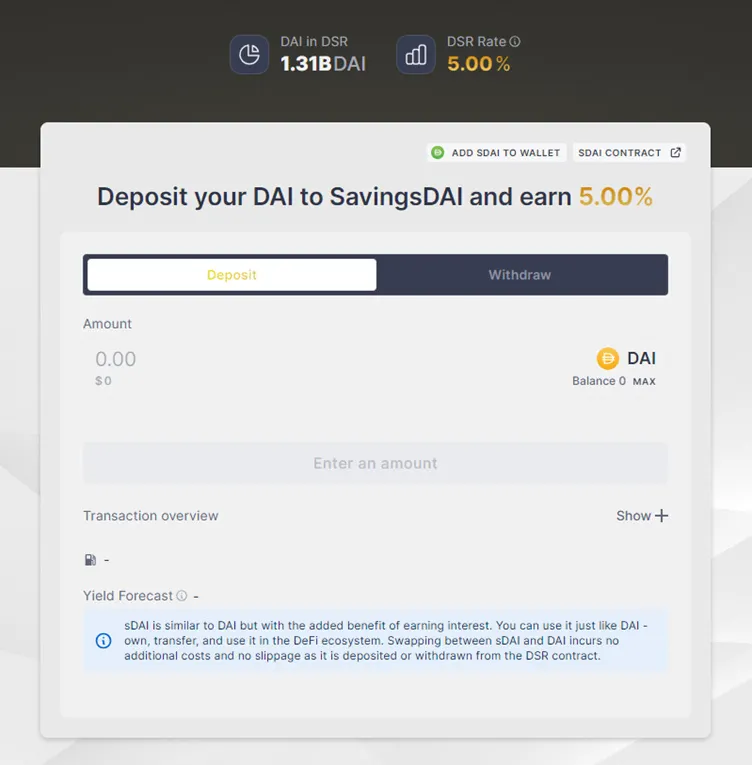

- Maker’s DSR showed the world that “savings” could be native to a protocol. (a primitive that our Ex Maker team knows well)

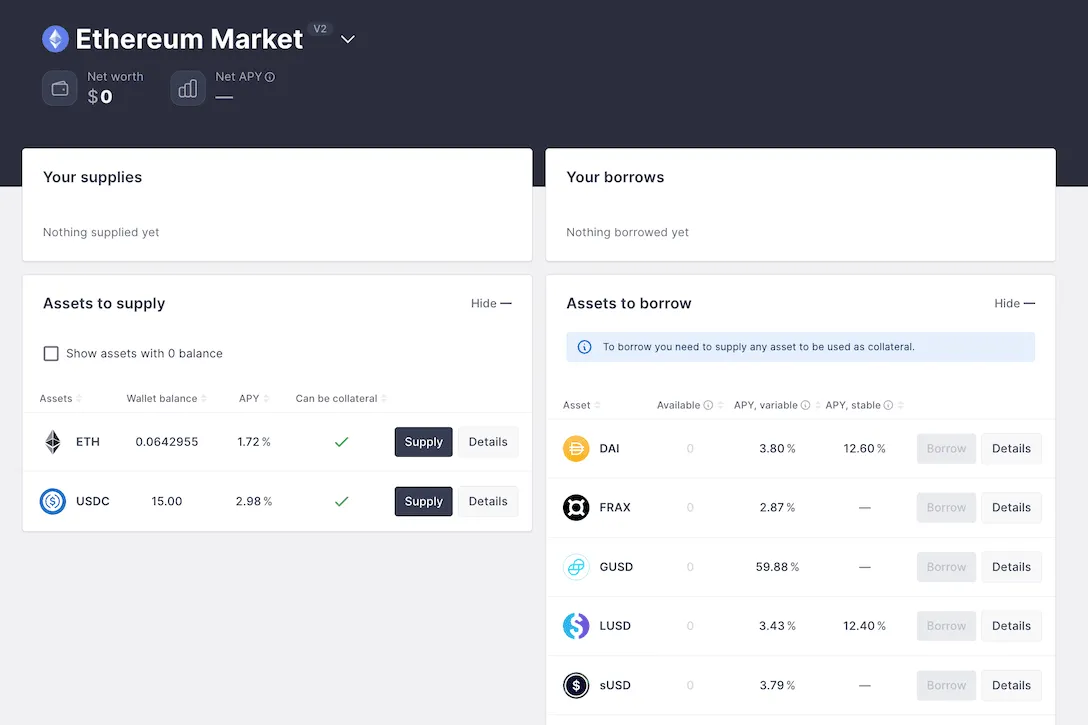

- Aave and Compound scaled lending into standardized, onchain money markets.

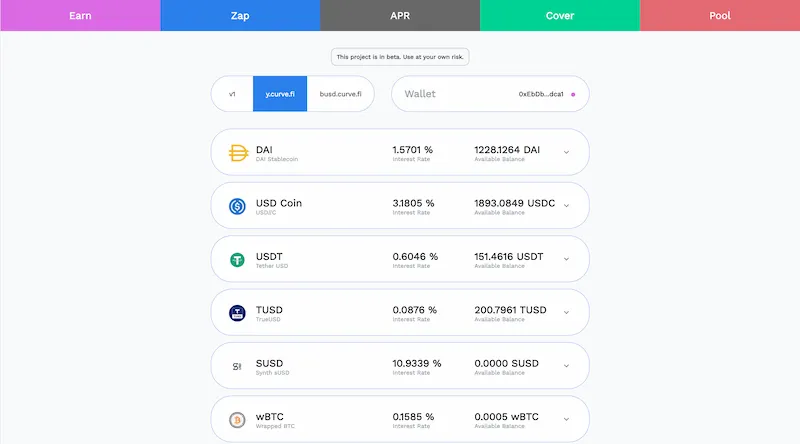

- Yearn made the next leap: yield isn’t confined to one source it’s a moving frontier, and automation wins.

Fast forward to today: the yield landscape is thriving. and the broader market is catching up. More and more “vaults” are becoming the default interface for earning yield onchain.

Source: Merlin

To be clear. this is the moment DeFi matures into a institutional grade category: more opportunity, more choice, more creditability.

Though, that creates a new premium: disciplined reallocation, and disciplined risk management. That premium is what Lazy Summer is built to deliver.

The Lazy Summer promise

Lazy Summer is the simplest way to access a diversified basket of high-quality onchain yields, with a embedded, protocol agnostic risk-curated framework from top risk manager Block Analitica and automated rebalancing.

What you get as a depositor (TL;DR)

Above-Benchmark Yield: diversified exposure that consistently beats static deposits

Risk Curation: access to new yield sources inside a strict, governed framework

No Yield Chasing: governance + risk experts handle rotation discipline so users don’t have t

Or, more simply:

Do Less.

…and still benefit from the continued growth of onchain vaults.

How “Do Less” works in practice

Earning on Lazy Summer is designed to be boring — in the best way.

Don't want to read, watch the video!

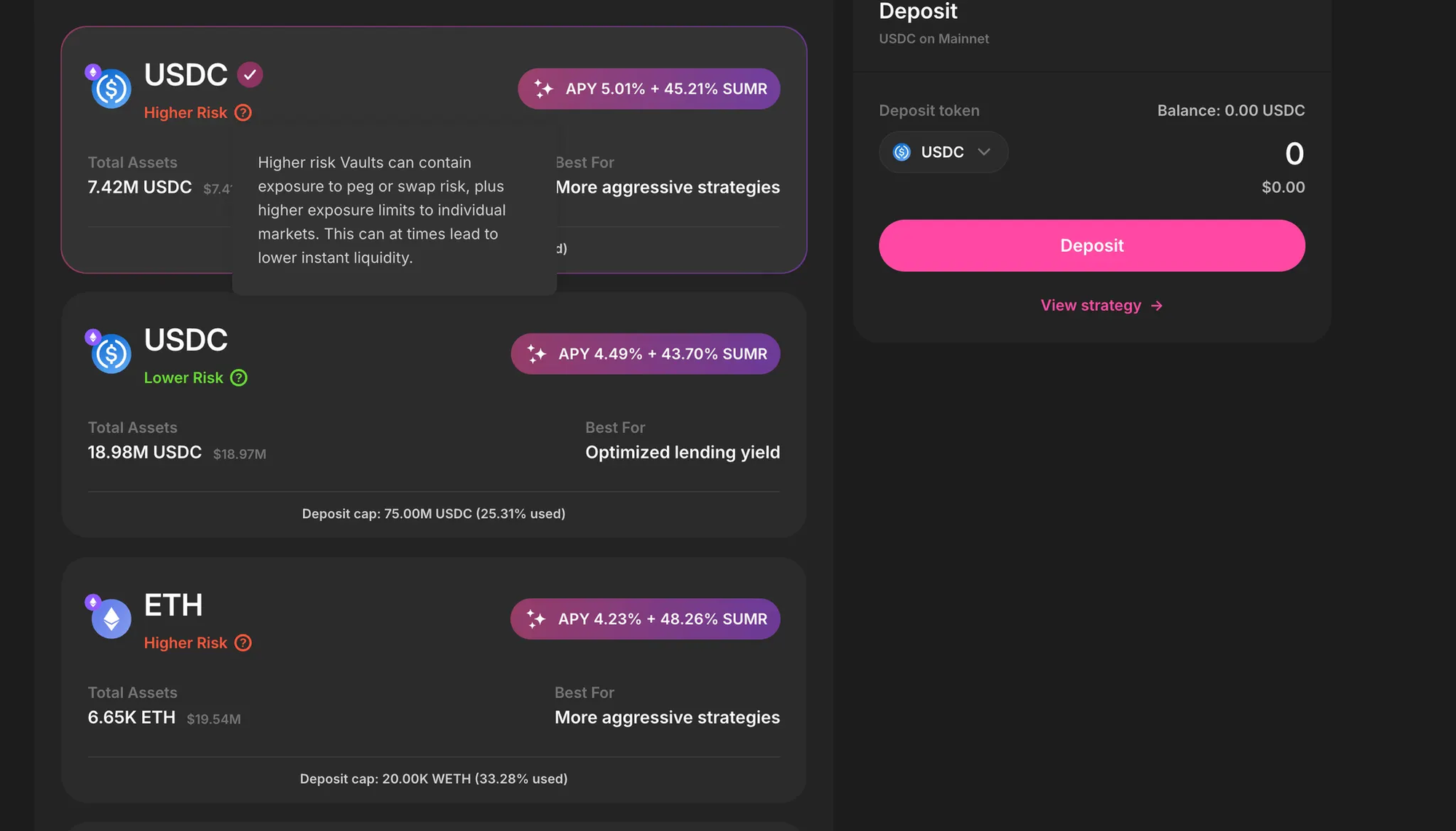

1) Choose your network

Lazy Summer is live on:

- Ethereum Mainnet

- Arbitrum

- Base

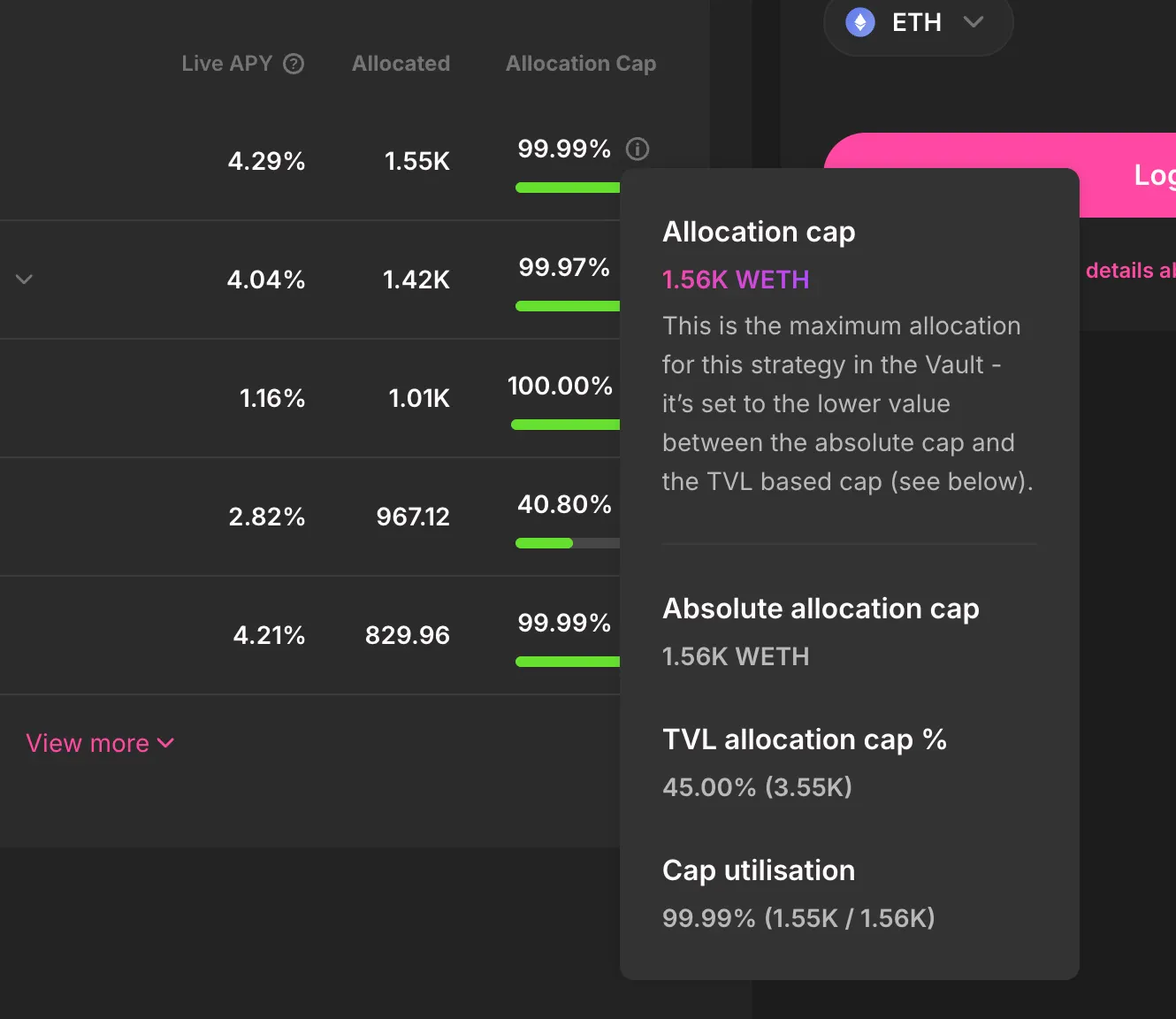

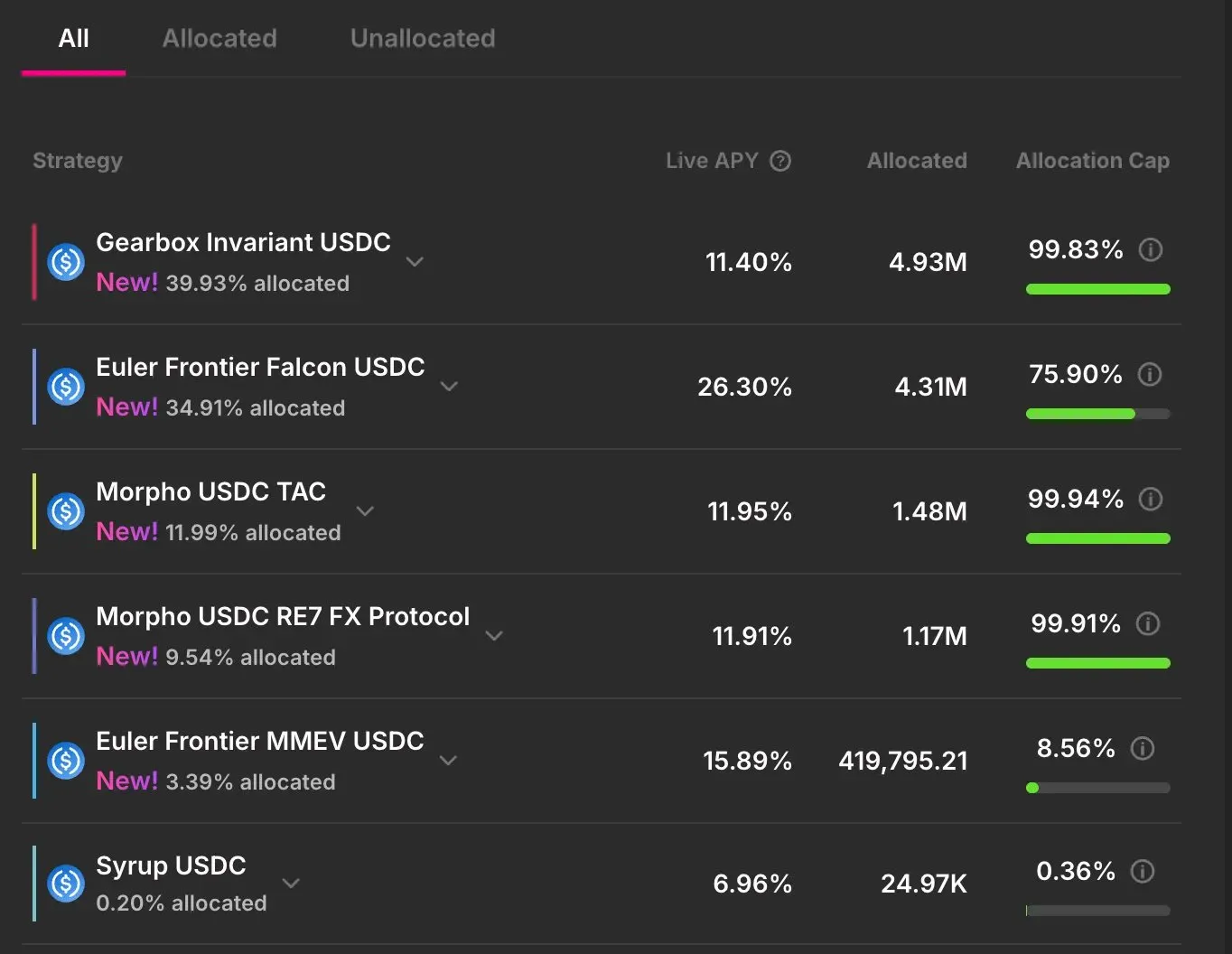

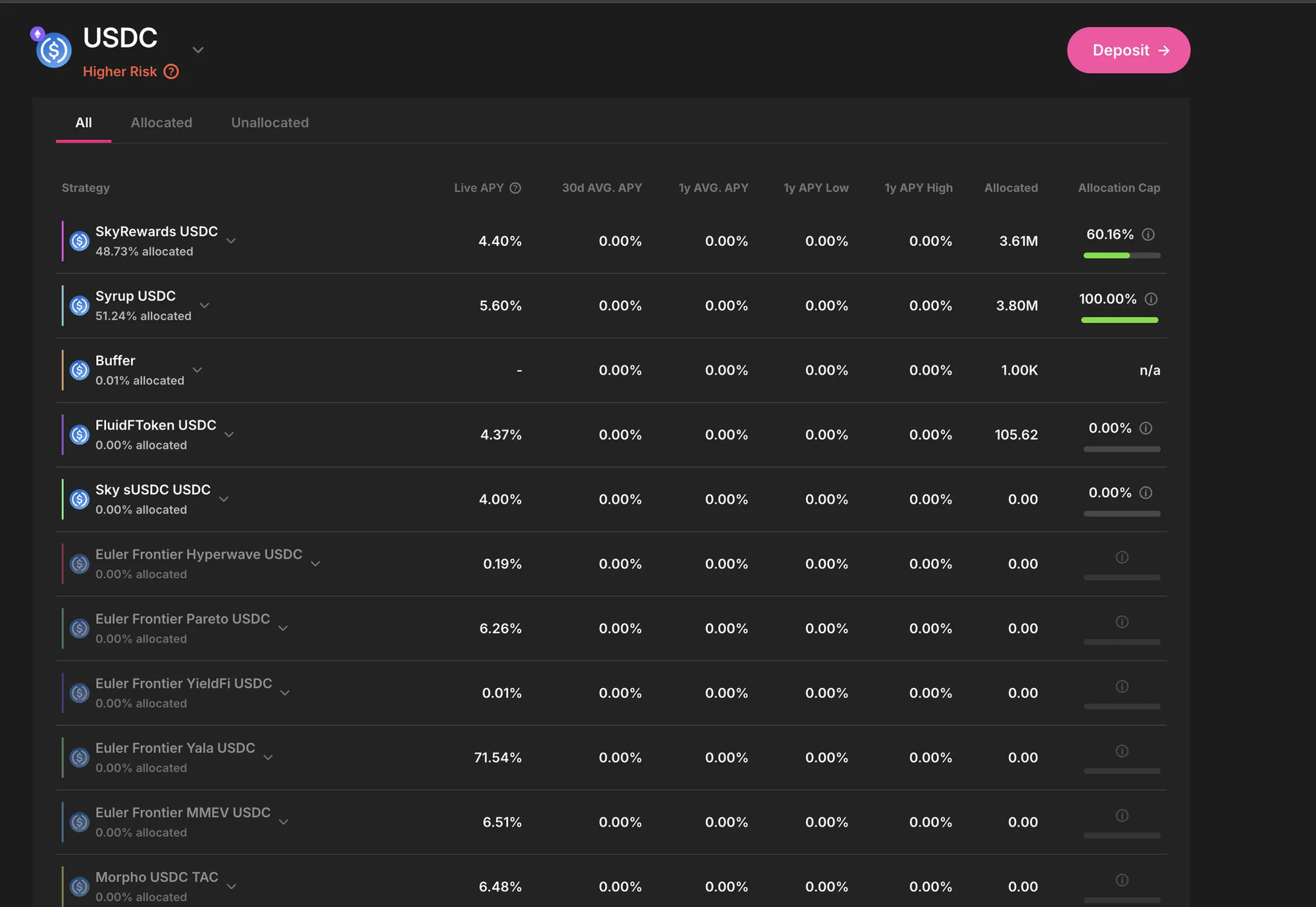

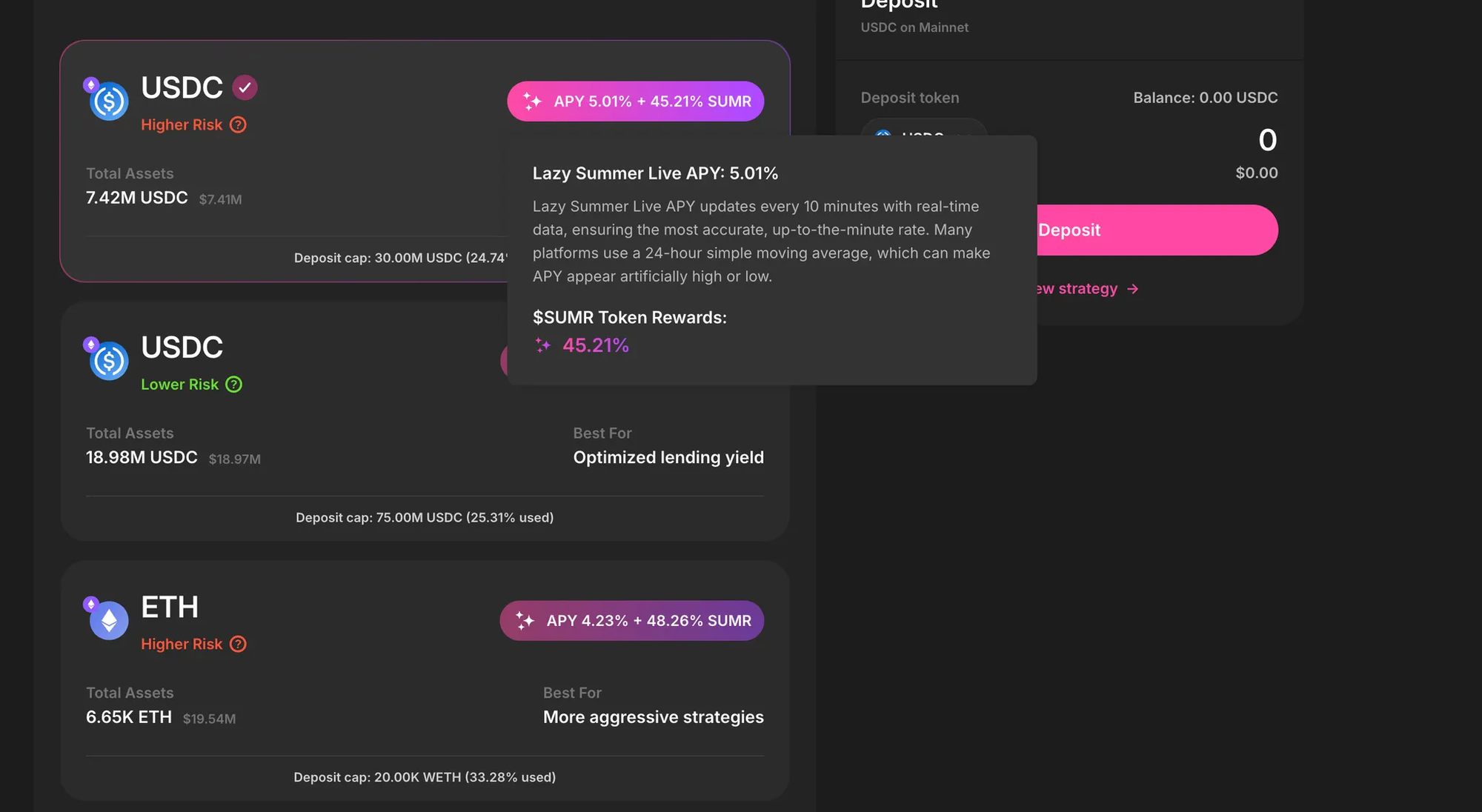

2) Choose your risk profile: Lower Risk or Higher Risk

Lower Risk is designed for stricter constraints:

- no intentional peg/swap exposure,

- more conservative caps,

- broader diversification across underlying yield sources,

- typically smoother liquidity expectations.

Higher Risk expands the opportunity set:

- may include controlled forms of peg/swap exposure,

- higher exposure limits to specific markets,

- can be less instantly liquid at times depending on underlying conditions.

Pro tip: click into the strategy details and look at the underlying yield sources rebalancing activity

3) If all else is equal, prefer better SUMR rewards

Each strategy has a base yield (from its underlying markets) and may also include SUMR rewards on top.

SUMR rewards: the cherry on top

If you just want yield: deposit and earn.

If you want additional upside: claim SUMR rewards and optionally stake them.

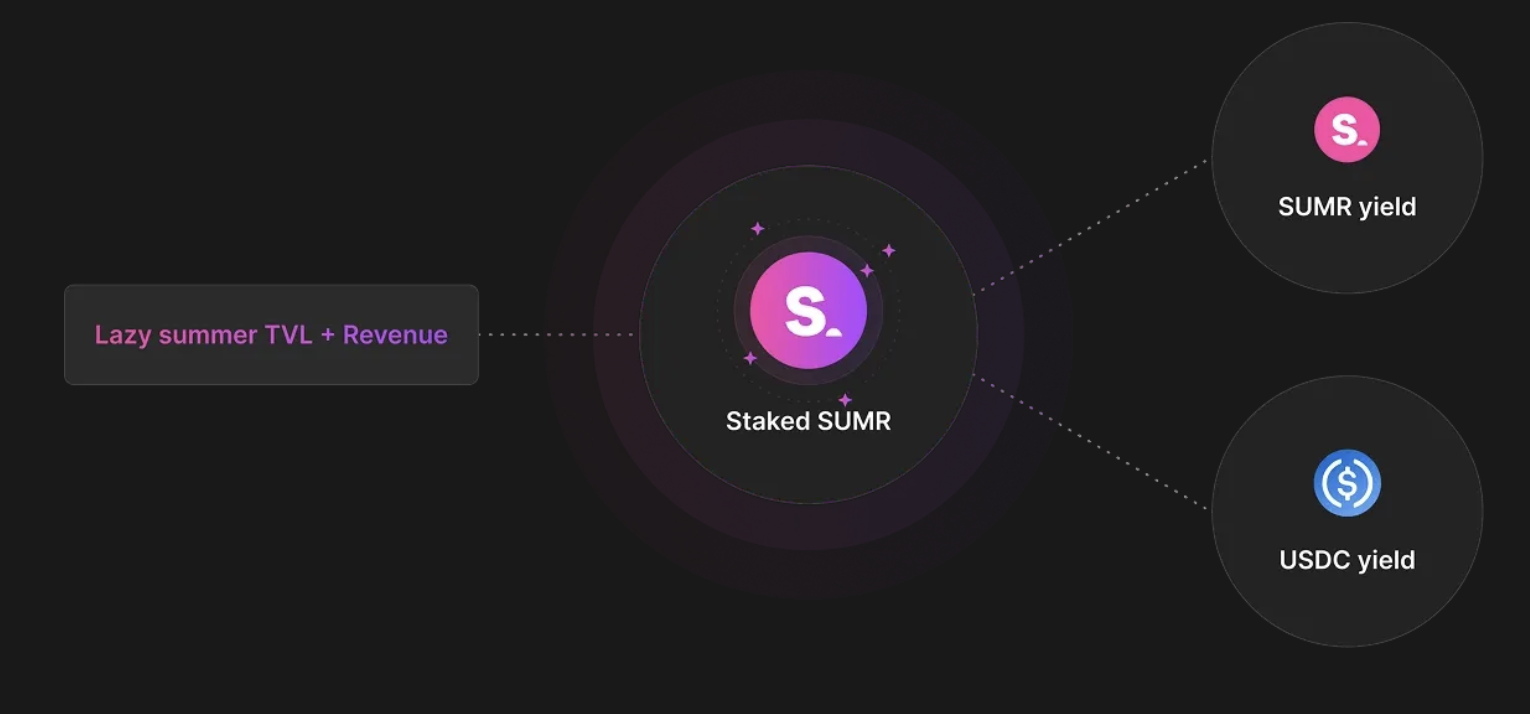

What happens when you claim SUMR

- You earn additional rewards on top of the strategy’s native yield.

- You can then stake SUMR to earn dual-token rewards:

- More SUMR emissions (standard staking incentives), and

- USDC rewards derived from protocol revenue, meaning as usage grows, revenue-funded rewards can scale with it.

This is meant to align long-term users with long-term protocol growth.

Save the date: January 21, 2026

Today, SUMR rewards are not liquid. That changes on January 21, 2026, with the SUMR TGE.

After TGE, the “Do Less” promise stays the same, but with more upside embedded. You’re not only earning yield through curated strategies, but you can also have real economic ownership in the protocol that powers them.

Do Less.

Disclaimer: Oazo Apps Limited functions solely as a front-end interface (Summer.fi) provider and it does not act on behalf of any user. Oazo Apps Limited did not launch nor does it operate or control the Lazy Summer Protocol. The Lazy Summer Protocol is accessed through Summer.fi. The information provided herein is provided on behalf of the Lazy Summer Foundation which launched the Protocol for informational purposes only and it does not constitute investment advice. Oazo Apps Limited and the Lazy Summer Foundation are not soliciting or recommending any transaction or guaranteeing any specific returns. Users interact with the Protocol at their own risk. T&C for the use of Summer.fi apply.