The Hidden Cost of Manual DeFi Yield Chasing

For as long as DeFi has existed, there’s been a game of musical chairs: users constantly moving funds from one protocol to another, chasing the “highest APY.” On the surface, it feels like a rational strategy.

But what most people don’t account for are the hidden costs. Beyond the gas fees, manual yield chasing entails significant trade-offs in terms of time, stress, security, and performance.

This is where automation fundamentally changes the equation. The Lazy Summer Protocol eliminates inefficiencies, mitigates risks, and captures yield sustainably without requiring constant user oversight.

In this article, Summer.fi will break down the hidden costs of manual yield chasing and show how Lazy Summer Protocol turns a stressful cycle into a streamlined, user-first experience.

The Hidden Costs of Manual Yield Chasing

1. Time Drain: DeFi Becomes a Job

Chasing yield manually requires constant attention:

- Checking multiple dashboards across different chains.

- Tracking APYs that fluctuate hourly.

- Researching new protocols and assessing their risks.

- Executing deposits, withdrawals, and swaps repeatedly.

What starts as a “few clicks” often becomes hours of work each week. For professional investors, time is money. For retail users, it becomes mental fatigue. Either way, yield chasing transforms DeFi from a passive opportunity into an unpaid job.

2. Gas and Transaction Fees: The Silent Killer

Every move costs gas. On the Ethereum mainnet, a single deposit and withdrawal cycle can eat $20–$100 in fees during peak times. Even on L2s, frequent switching adds up.

If you move funds weekly or even daily, those fees quietly chip away at your returns. Many users end up in situations where they’ve “chased” a higher APY but actually net less due to cumulative transaction costs.

3. Mistimed Moves: Always a Step Behind

APY spikes rarely last. By the time a user spots an attractive yield, deposits flood in and dilute the rate. Incentives decay quickly, leaving latecomers underperforming.

Manual chasing means you’re almost always one step behind. Worse, funds often sit idle while you wait to identify the “next best thing,” creating opportunity costs that drag down performance.

4. Security Risks: More Protocols, More Exposure

Each time you move to a new protocol, you expose funds to a new smart contract system. Without deep due diligence, you may unknowingly interact with contracts carrying vulnerabilities, admin risks, or poor governance.

Spreading assets across multiple new strategies multiplies exposure. Over time, the risk-adjusted yield can look far worse than the headline APYs suggested.

5. The Mental Toll: FOMO and Burnout

Yield chasing isn’t just technical — it’s psychological.

- The constant fear of missing out.

- The stress of monitoring multiple chains and incentives.

- The frustration of seeing opportunities vanish before you can act.

Instead of DeFi working for you, you end up working for DeFi. Burnout is real, and it often leads to rushed decisions, skipped due diligence, or simply dropping out of the game.

The Smarter Alternative: Lazy Summer Protocol

Lazy Summer Protocol was designed to solve exactly these inefficiencies. Instead of putting the burden on users to track, manage, and rebalance, it automates yield allocation from end to end while keeping transparency, security, and user control at the forefront.

Here’s how it works:

Fleet Architecture: Yield Bundled for You

Lazy Summer organizes yield strategies into Fleets, also known as Lazy Vaults. Each Fleet:

- Accepts a base deposit asset (e.g., DAI, USDC, ETH).

- Distributes that capital into modular ARKs (yield strategies like lending, staking, or liquidity provision).

- Issues Fleet Shares to depositors, representing their ownership and entitlement to yield.

The Fleet Commander smart contract manages allocations, ensuring funds are deployed according to rules set by governance and risk frameworks.

This means users only deposit once, while the system handles ongoing optimization.

AI-Powered Rebalancing: Agents That Never Sleep

AI-powered Keeper Agents are at the center of Lazy Summer. These agents keep an eye on how well certain ARKs are performing and initiate rebalances as necessary.

- Move capital from underperforming ARKs to higher-performing ones.

- Harvest rewards and reallocate them efficiently.

- Operate under strict constraints (frequency, limits) to avoid reckless churn.

This creates emotion-free, data-driven portfolio management — the opposite of human FOMO-driven chasing.

Risk Oversight: Independent and Systematic

Unlike manual chasing, where users must self-assess risk, Lazy Summer integrates independent oversight via Block Analitica, a specialist risk team.

- Simulates adverse scenarios.

- Prevents overexposure to risky strategies.

- Sets parameters for each vault to ensure sustainable, risk-adjusted yield.

This ensures users earn yield within a safer, professionally curated framework.

Automated Compounding: The RAFT Module

Rewards earned across ARKs are harvested by the Reward and Fee Treasury (RAFT). Instead of leaving rewards idle, the RAFT:

- Converts them back into the base deposit token.

- Reinvests them into the Fleet automatically.

The result? Continuous compounding without the user needing to lift a finger.

User-First Experience

Lazy Summer is designed to make DeFi yield accessible to everyone, not just power users:

- Simple onboarding – social login or passkey, no wallet setup required.

- Gas-sponsorship – first 10 transactions on Base or Arbitrum are free.

- Fiat onramps – deposit directly with fiat, no bridging needed.

- No lockups – withdraw anytime, with no queues or exit penalties.

This strips out the friction that keeps many users from participating in DeFi yield.

Governance: $SUMR in the Driver’s Seat

Lazy Summer Protocol isn’t a black box. With the $SUMR token, users govern the protocol:

- Decide which ARKs (strategies) get included in Fleets.

- Vote on parameters for risk management and rewards.

- Influence protocol upgrades and treasury use.

By holding $SUMR, you’re not just earning yield — you’re shaping the future of how yield in DeFi is managed.

Results That Speak for Themselves

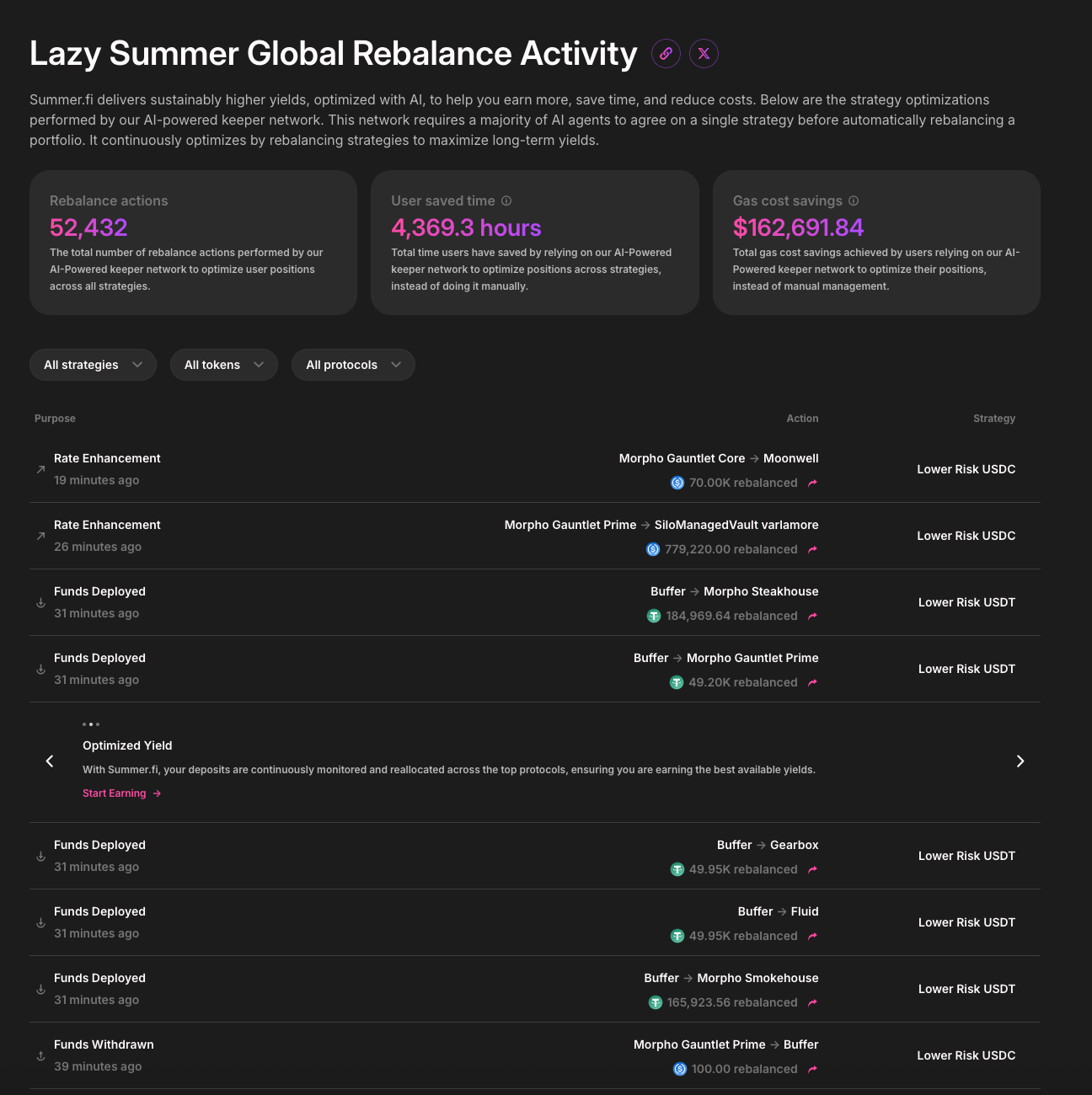

Real numbers speak louder than promises. Thanks to Summer.fi’s transparent Rebalance Activity dashboard, here’s how Lazy Summer Protocol is making a difference:

- Automated Rebalance Actions: An impressive 52,432 strategy optimizations performed—without users lifting a finger, this action is performed by the Lazy Summer protocol AI-Powered keeper network to optimize user positions across all strategies.

- Time Savings: The protocol has reclaimed 4,369.3 hours of user time, eliminating the need for stress-inducing dashboard refreshes and manual redeployments.

- Gas Cost Efficiency: Users have collectively saved $162,691.84 in transaction fees, thanks to batched, AI-powered keeper transactions.

And because strategies are constantly rebalanced by agents, performance consistently outpaces manual chasing all without requiring stress, guesswork, or constant monitoring.

Conclusion

Manual yield chasing promises freedom but delivers stress, fees, and underperformance. Each “better” APY comes with hidden costs: your time, your security, your peace of mind.

Lazy Summer Protocol flips the script. Automating rebalancing, compounding, and risk management gives you a sustainable, optimized yield with none of the hidden costs. Deposit once, stay diversified, and let AI-powered automation do the work, all while keeping governance in the hands of users through $SUMR.

With Summer.fi, DeFi yield finally becomes what it should have been all along: simple, transparent, and truly passive.

→ Explore Vaults on Summer.fi

→ Learn about Summer.fi Institutional

→ Schedule a 15-minute call with a specialist https://calendly.com/summer-fi/summer-institutional

Join us

Discord | Telegram | X/Twitter | Linktree

Disclaimer: Oazo Apps Limited functions solely as a front-end interface (Summer.fi) provider and it does not act on behalf of any user. Oazo Apps Limited did not launch nor does it operate or control the Lazy Summer Protocol. The Lazy Summer Protocol is accessed through Summer.fi. The information provided herein is provided on behalf of the Lazy Summer Foundation which launched the Protocol for informational purposes only and it does not constitute investment advice. Oazo Apps Limited and the Lazy Summer Foundation are not soliciting or recommending any transaction or guaranteeing any specific returns. Users interact with the Protocol at their own risk. T&C for the use of Summer.fi apply.