The framework for high-risk/reward vaults in DeFi

Risk/reward is the whole game

Risk/reward is the name of the game in DeFi, and in finance more broadly. Right now most DeFi users are forced to pick one of those sides with their capital.

On one end, you have conservative capital, generally deployed into battle tested lending pools, earning steady but modest yields. These are the safe, predictable and boring yield sources that play a critical role as the backbone of DeFi yield.

On the other end, you have the new new high risk of DeFi. Though the days of vegetable ponzi's are gone, there is a new, more considered cohort high APYs across dozens of protocols. These strategies are generally more exciting, lucrative, but they are also extremely time intensive, and require attention, the ability to assess risk.

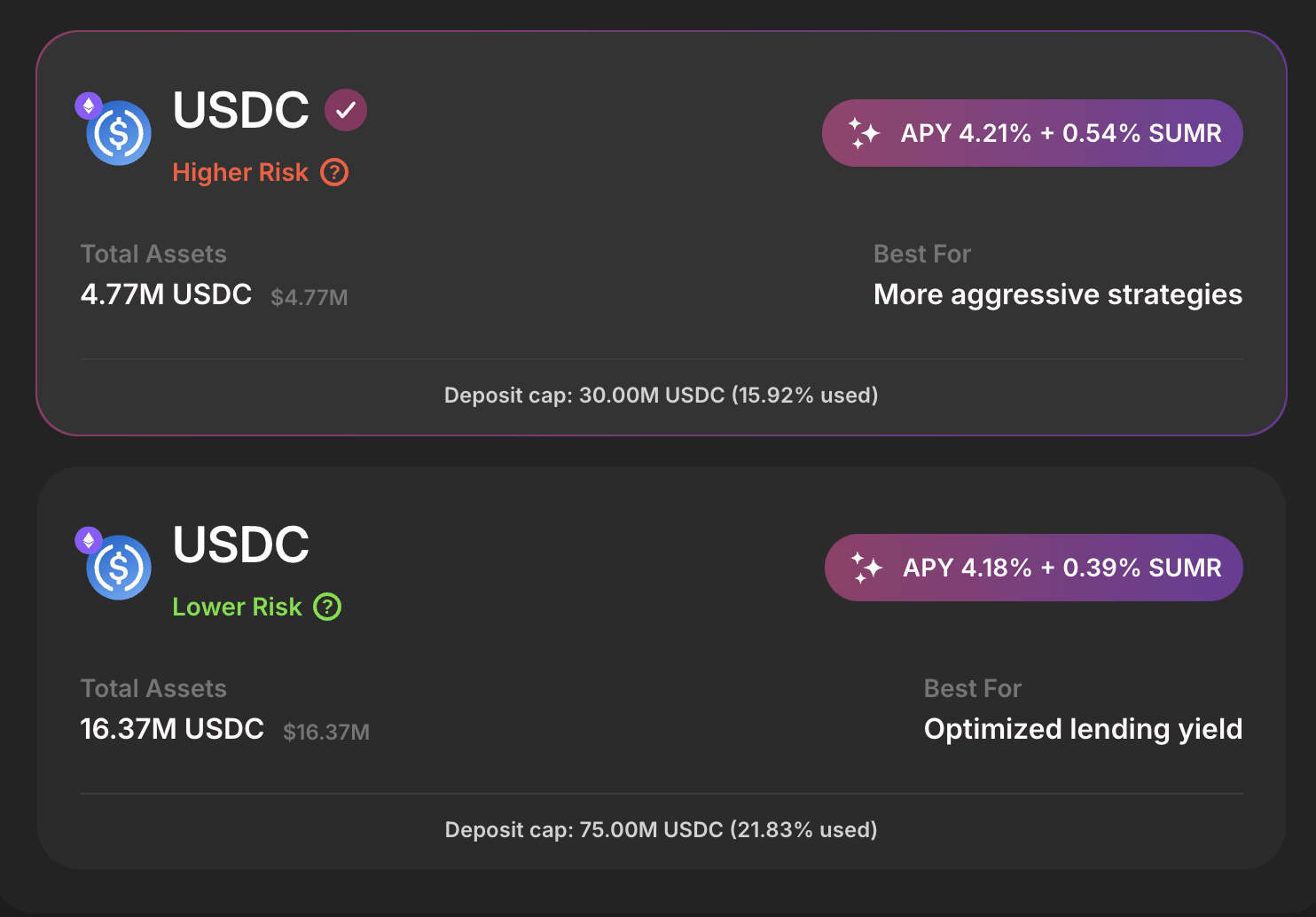

Lazy Summer protocol to date has been focused on low risk DeFi, with a hint of more risk on strategies. Though, the Lazy Summers foray into higher risk strategies has been, admittedly, half hearted. Often times Lower Risk vaults outperforming higher risk vaults, due to strict risk management oversight.

There is a gap here that we need to fill, the gap between automated lower-risk vaults and highly time-consuming yield chasing for DeFi's higher-risk yields.

What if Lazy Summer could bring the promise of doing less, to truly high risk/high reward strategies with automated rebalancing and a rules based risk framework?

Why now: a year of lessons and a clear need

A year ago, we launched the first risk-adjusted vaults on Lazy Summer. The growth has been remarkable at times, at one point hovering close to $200M in protocol TVL.

Although, after observing how users interact with Lazy Summer protocol and other protocols, it's clear we've been solving for only one type of user and one type of use case. The risk averse depositor who wants modest above benchmark yield, best in class risk management, and diversified exposure.

The original Lazy Summer promise was and is bigger than that. Giving users automated access to DeFi's highest quality yield does not mean restricting access to only conservative yield sources. High risk does not mean low quality.

DAO Risk-Managed vaults are Lazy Summer extending their reach out the risk curve, giving users who want higher returns an automated, risk managed, and transparent way to get them without having to constantly chase and manage yields.

The risk framework: built to outperform

DAO risk-managed vaults don't just deploy capital to the highest APY and hope for the best, they deploy capital based on a purpose-built risk framework, developed in partnership with Block Analitica, the same team that has been curating risk for Lazy Summer since day one.

The framework, which you can read in full on the Summer.fi governance forum, governs how yield sources (ARKs) are evaluated, categorized, and constrained within the vault.

At its core, the framework answers two questions for every yield source: should we be in it, and how much should we put in it. Those sound simple, but the machinery underneath is what separates calculated risk taking from gambling.

Step 1: Hard filters - getting through the gate

Before any yield source is even considered for inclusion, it must pass a set of binary hard filters. Fail any single one and you're automatically excluded. These filters are designed to be onchain-verifiable wherever possible, keeping the process transparent and objective.

The hard filters include:

- The protocol must have been deployed on mainnet for at least 180 days, eliminating unproven contracts with no live track record.

- Must have at least one completed audit by a recognized security firm within the last 12 months.

- At least 60% of its backing must not be locked or subject to long vesting periods, guaranteeing a realistic unwind path under stress. B

- Backing itself must be transparently verifiable, either fully onchain, via continuous cryptographic proof like zk-proof of reserves, or through monthly attestations from at least two independent auditors.

There's also a dynamic TVL/APY screen that ensures adding any yield source actually moves the needle for vault performance. A yield source must demonstrate that depositing into it at scale would raise the fleet's overall APY by at least 5%.

If a yield source can't meaningfully improve the vault's returns relative to the risk and complexity it adds, it doesn't get in, no matter how interesting the strategy looks on paper.

These filters are deliberately strict, and deliberately quantitative. The framework is designed so that the DAO can verify inclusion decisions without needing deep protocol-specific expertise. If a yield source passes the hard filters, it has earned the right to be evaluated further. If it doesn't, it is automatically excluded.

Step 2: Risk categorization - A, B, or C

Yield sources that pass the hard filters get assigned to one of three risk categories. This is where the framework determines how much capital the vault is allowed to allocate to each yield source, and it's the core mechanism that prevents the vault from degenerating into reckless yield chasing.

Category A: High Confidence

These are the battle-tested yield sources:

- The protocol has been live for at least a year, with no governance attacks or exploits in the last 365 days.

- No leverage, no looping, no delta neutral strategies, and no cross-chain backing.

- If a curated vault is involved (like a Morpho or Euler vault), the curator must have at least a year of track record.

In return for this conservatism, Category A sources get the most generous allocation parameters: up to 70% of the source's own liquidity as a deposit cap, and up to 100% of the fleet's TVL as an allocation ceiling.

Category B: Moderate Confidence

This is where things get more interesting. Category B permits leverage, looping, and delta neutral strategies, but only one at a time.

- The protocol must have been live for at least 180 days

- Less than 50% of its backing can be in leveraged positions.

Allocation parameters tighten considerably: max deposit cap drops to 50% of source liquidity, fleet allocation ceiling to 70%, and crucially, the maximum rebalance inflow is capped at 20% of fleet TVL.

If a yield source uses both leverage and delta neutral simultaneously, it's automatically bumped to Category C.

Category C: Lower Confidence

This is where the most high risk, high reward yield sources live.

- Cross-chain backing is permitted.

- Multiple risk strategies can coexist.

And the parameters reflect that added risk: max deposit cap at 25% of source liquidity, fleet allocation ceiling at 30%, and rebalance inflows capped at just 5% of fleet TVL.

Category C yield sources are high risk, high reward and can absolutely be in the vault, the framework is designed to include them, but the vault's exposure is structurally constrained so that no single Category C source can dominate the portfolio or cause outsized damage if something goes wrong.

The key insight here is that each category comes with a complete set of enforceable parameters. Not just how much goes in, but how fast it can flow in and how fast it can flow out. Rebalance outflow limits are generally more permissive than inflows, because the framework is designed to exit risk faster than it enters it. If something breaks, capital comes out aggressively.

Step 3: Dynamic caps and fleet-level controls

The framework doesn't set static deposit caps and walk away. The Max Cap figures are designed as dynamic ceilings that respond to real market conditions. Keepers monitor available liquidity in real time, if a yield source's liquidity drops (say, other depositors withdraw), the vault withdraws proportionally to maintain its share within the cap. If liquidity grows, effective caps increase up to the category ceiling. This reduces the need for manual DAO votes every time market conditions shift.

Think of the risk framework as a speed limit

Think of the framework like a speed limit, it sets the boundary of acceptable behavior. Going slightly over is tolerable; going wildly over is not. The Keeper system continuously monitors positions against these parameters and rebalances when allocations drift outside their acceptable ranges.

Optimized for speed of onboarding

The framework is deliberately designed to evaluate and onboard new yield sources quickly. DeFi's best yields don't last forever, a new lending market might offer elevated rates for weeks before they compress.

Because the hard filters are binary and the category definitions are rules-based, Lazy Summer DAO doesn't need to start from scratch for every new yield source.

A new yield source can be assessed against the hard filters, assigned a category, parameterized according to the category rules, and proposed to governance efficiently. Speed of onboarding is a performance advantage: the vault that can safely access a new yield source in days rather than weeks captures significantly more of the opportunity.

Guardian safety net

Even with all the above, the framework includes an emergency layers, guardians.

Guardians are established in the protocol's governance structure to have narrowly scoped emergency powers including the ability to set any ARK's deposit cap to zero, triggering automated withdrawal of vault funds from that specific yield source.

This allows surgical removal of a failing ARK without pausing the entire vault.

Grown up degen

In one week, the DAO Risk-managed vaults go live on Mainnet and Base for ETH and USDC.

We are not being modest about the ambition: we expect these to be a top performing vaults in DeFi, consistently among the top 5 of yield ranking when TVL is >1m.

This is what we're calling "grown up degen." All the upside of aggressive DeFi yield strategies, with the risk management infrastructure that institutions and serious allocators demand. No more choosing between high returns and responsibility.

To understand the complete risk framework underpinning them, read the full BA Labs Risk Framework on the governance forum.

Join us

Discord | Telegram | X/Twitter | Linktree

Disclaimer: Oazo Apps Limited functions solely as a front-end interface (Summer.fi) provider and it does not act on behalf of any user. Oazo Apps Limited did not launch nor does it operate or control the Lazy Summer Protocol. The Lazy Summer Protocol is accessed through Summer.fi. The information provided herein is provided on behalf of the Lazy Summer Foundation which launched the Protocol for informational purposes only and it does not constitute investment advice. Oazo Apps Limited and the Lazy Summer Foundation are not soliciting or recommending any transaction or guaranteeing any specific returns. Users interact with the Protocol at their own risk. T&C for the use of Summer.fi apply.