The End of Yield Chasing: How Automation Is Rewriting DeFi

If you’ve ever chased a headline APY only to watch it vanish a week later, this is for you. DeFi yields move. Incentives rotate. Liquidity migrates. And every manual hop you make costs gas, time, and too often performance.

Lazy Summer Protocol flips that script. You deposit once; AI-assisted keepers continuously rebalance your funds across top markets to target the best risk-adjusted yield, all on-chain and transparently observable. No tabs. No juggling vaults. No spreadsheet gymnastics. Just compounding signal over noise.

TL;DR (for the busy allocator)

- Stop hopping: Automation reallocates capital for you when market conditions change onchain and permissionlessly.

- Best-in-class venues: Coverage spans curated blue-chip protocols (Aave, Morpho, Maple, Fluid and more), with live performance visible in open dashboards.

- See it, verify it: TVL, flows, and rebalance activity are public on Dune; live APY and supported integrations are visible on the Earn page.

Why Yield Chasing Fails

Yield chasing is fragile. You’re always late to the next farm, you pay in gas and slippage, and you’re exposed to venue-specific shocks (utilization spikes, incentive cliffs, liquidity exits). The costs are invisible until they’re not: missed days in market, idle balances, and the human tendency to rebalance too slowly.

Automation’s edge is simple: it monitors markets continuously and executes when thresholds are met, not when your calendar frees up. That’s the delta between reactive yield and compounded, risk-aware optimization.

What Actually Runs Under the Hood

1) Lazy Vaults (“Fleets”): the user-facing engine

When you choose an asset vault (e.g., ETH Lower-Risk, ETH Higher-Risk, USDC on Base), you’re entering a Fleet a coordinated set of contracts that allocate across underlying strategies. Fleet Commander logic and a network of Keepers coordinate rebalances based on rules baked into the vault.

2) AI-assisted Keepers: always-on execution

Keepers watch markets and trigger on-chain moves when relative yields, risk constraints, or venue health metrics change. That means faster rotation out of deteriorating opportunities and tighter tracking of the best venues without you lifting a finger.

3) Curation & Risk Filters: quality in, noise out

Summer.fi doesn’t “spray and pray.” The team curates protocols and strategies so depositors don’t have to trawl CT for the next shiny farm. That curation process documented in public posts prioritizes battle-tested venues and clear risk disclosures vs. opaque APY generators.

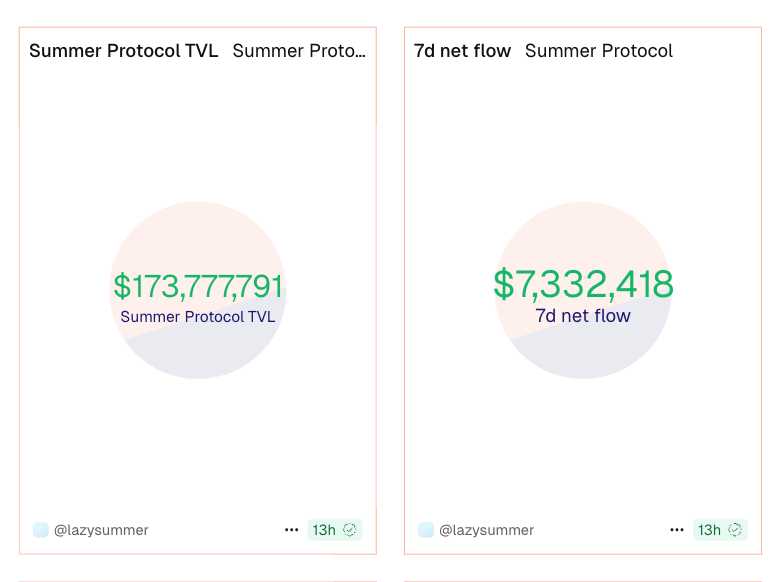

How Rebalancing Shows Up in Real Data

You don’t need to trust a screenshot. Dune dashboards expose Lazy Summer’s TVL flows, inflows/outflows by chain and asset, governance activity, and more. Watch capital rotate as incentives or utilization change; correlate that with the Live APY on Summer.fi Earn.

- Protocol Overview: TVL trends, fresh inflow, and chain/asset breakdowns. dune.com

- DAO/Governance: Delegate distribution and voting history see how parameters evolve in the open.

- Product Surface: Earn shows Live APY updating ~every 10 minutes and the list of supported venues.

Example: ETH Exposure Without the Headaches

Suppose you want ETH yield on Base. Historically, you’d watch Aave/Morpho/other pools, move your position as rates change, and hope you timed it right. With ETH vaults on Lazy Summer, the protocol automatically tilts across staking‐adjacent and lending markets (risk-tiered vaults exist so you pick your comfort level). As strategies are added (e.g., Fluid Lite, Morpho Smokehouse to the Higher-Risk vault), you benefit automatically no manual migration, no new approvals.

That’s the opposite of yield chasing: deposit once, let automation iterate.

What “Risk-Adjusted” Means Here

- Venue quality over gimmicks. The curated set leans into deep-liquidity, widely-used protocols with clear risk surfaces.

- Transparent parameters. Allocation logic and governance are open; changes and proposals are surfaced on the forum and dashboards.

- Operational discipline. Execution is handled by keepers with defined triggers; there’s no late-night human scramble to rotate positions.

For the architecture-curious, the Litepaper/Walkthrough pieces explain the components, execution model, and roadmap in plain English.

Why Smart Users Don’t Chase

Smart users know the best yield isn’t always the highest; it’s the one that lasts.

They don’t waste time reacting to rates; they position themselves to benefit from how markets evolve. Summer.fi makes that possible: an open, transparent, and automated way to access DeFi’s top-tier opportunities without the friction of constant management.

It’s not about chasing the next APY.

It’s about letting automation work so you don’t have to.

Why This Matters Now

In quiet markets, alpha is mostly operational: minimizing idle time, reducing churn, and staying in the best positions consistently. Automation compounds those edges while you work on anything else. That’s why allocators and integrators (wallets, custody platforms, and fintech apps) are wiring Lazy Summer protocol under the hood to turn deposits into yield immediately and keep it optimized thereafter.

How to Start (and How to Verify)

- Go to Earn → pick your asset/network vault → deposit. You’ll see Live APY, supported venues, and your position in one place.

- Connect wallet, select vault, deposit, and that’s it. No manual venue-hopping; just let the protocol run.

- Verify performance via Dune (TVL, inflows, flow timing) and follow monthly rebalance recaps on the blog.

Final Word

DeFi doesn’t lack yield. It lacks time, discipline, and clean execution. Automation puts those advantages back in your corner, compounding the unsexy edges that matter most.

Start earning in minutes on Summer.fi → summer.fi/earn

Join us

Discord | Telegram | X/Twitter | Linktree

Disclaimer: Oazo Apps Limited functions solely as a front-end interface (Summer.fi) provider and it does not act on behalf of any user. Oazo Apps Limited did not launch nor does it operate or control the Lazy Summer Protocol. The Lazy Summer Protocol is accessed through Summer.fi. The information provided herein is provided on behalf of the Lazy Summer Foundation which launched the Protocol for informational purposes only and it does not constitute investment advice. Oazo Apps Limited and the Lazy Summer Foundation are not soliciting or recommending any transaction or guaranteeing any specific returns. Users interact with the Protocol at their own risk. T&C for the use of Summer.fi apply.