The DeFi yield strategy you are missing out on

What are some slept on yields?

Crypto prices have become alive once again, and we believe that some projects and strategies have become over looked.

Back in February, 2024, Ethena launched SUSDE, the internet bond.

To date, its probably been one of the best farms and most successful launches of 2024.

- Median SUSDE yield has been above 10% since launch in February.

- Ethena’s token launched fairly and transparently, with a current fully diluted market cap of 7.4b.

- Several points farming seasons with good user token distributions.Shard Campaign (Season 1)Sats Campaign (Season 2)Current Sats Campaign (Season 3)

- Duration: February 19, 2024 to April 1, 2024 (approximately 6 weeks)

- Total tokens distributed: 750 million ENA (5% of total supply)

- Estimated value of distribution: $500 million at the time of airdrop

- Started: April 2, 2024

- Total tokens allocated: 750 million ENA (5% of total supply)

- Estimated value: $260 million (based on ENA price of $0.35)

- Duration: September 2, 2024 to March 23, 2025 (less than 7 months)

Today we think that Ethena, is probably one of the most under appreciated yield strategies for parked stablecoin’s AND crypto Majors like BTC and ETH in users’ portolio’s.

Here’s why:

Above all else, Ethena has a sound design that just makes sense, especially in a bull market.

How? where does the yield come from?

Diagram credit: https://dirtroads.substack.com/p/62-ethenas-odyssey-from-stable-to

A common question users have for all yield bearing assets is where does the yield come from?

Ethena has two main sources of its variable, market driven yield.

Yield source one: Ethereum Staking Yield

The first source of yield for sUSDe holders is Staked ETH yield from the deposited collateral that is deposited in order to mint USDe.

Yield source two: The funding rate from the delta hedging derivatives positions

The second source of yield is derived from perpetual futures funding rates. Its important to note that funding rates can move sharply during times of market volatility. At times being extremely positive when there is lots of demand to be long, and it can also go negative when there is overwhelming demand to be short.

This means that sUSDe, at periods of time can have a very low yield. Ultimately. funding rates usually revert closer to zero or positive and display mean-reverting characteristics.

Three reasons why we feel that Ethena’s SUSDE is slept on right now

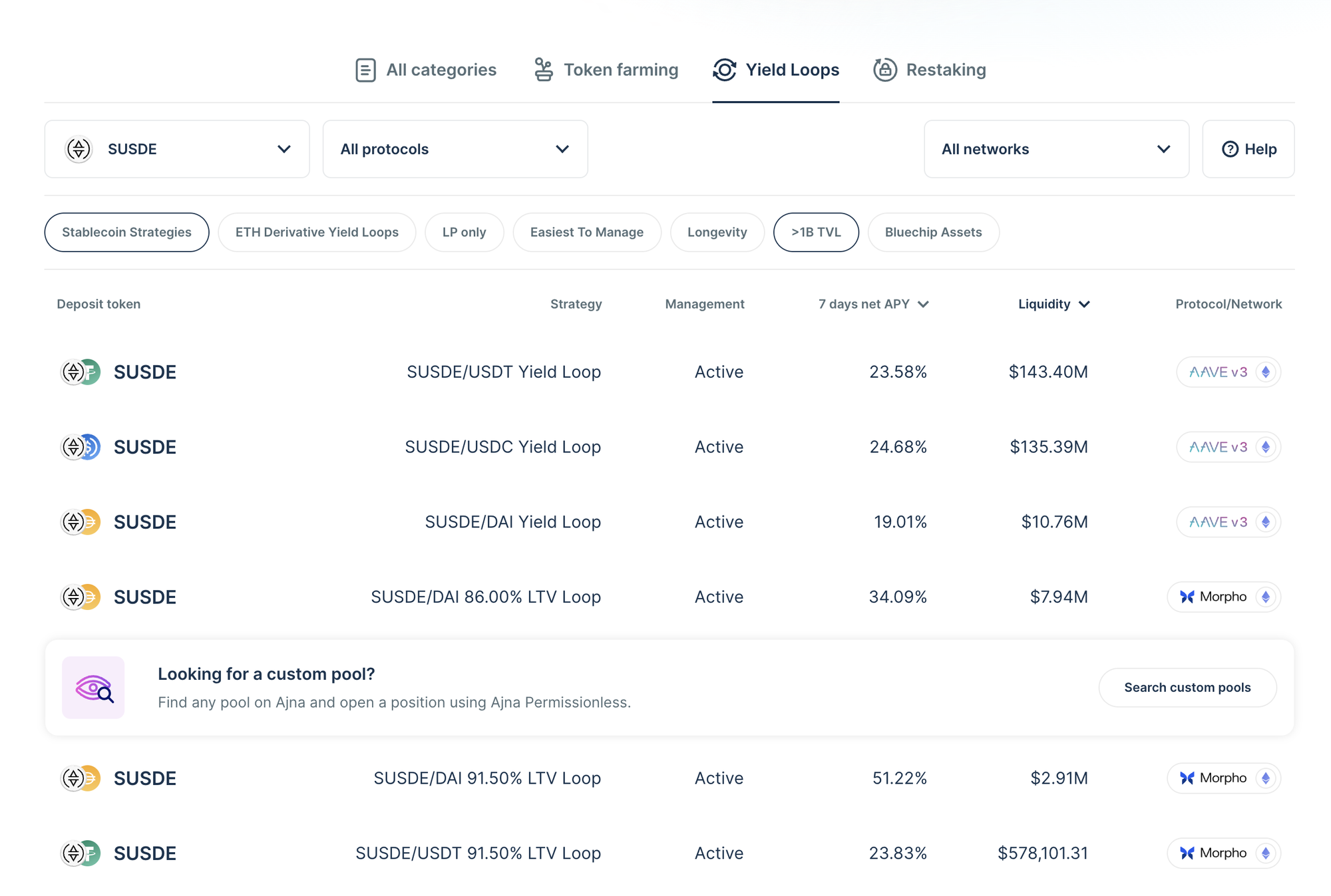

- SUSDE Yield Loops are outperforming the DeFi benchmark yields of 6.25% by up to 9xRight now on Summer.fi, you can earn yields from 20-50% by doing SUSDE yield loops utilizing Morpho or AAVE.

As a reminder, yield loops are a simple strategy that allow you to deposit your SUSDE as collateral and Mulitply your exposure to the SUSDE yield in a single transaction.

Open a SUSDE Yield Loop Position →

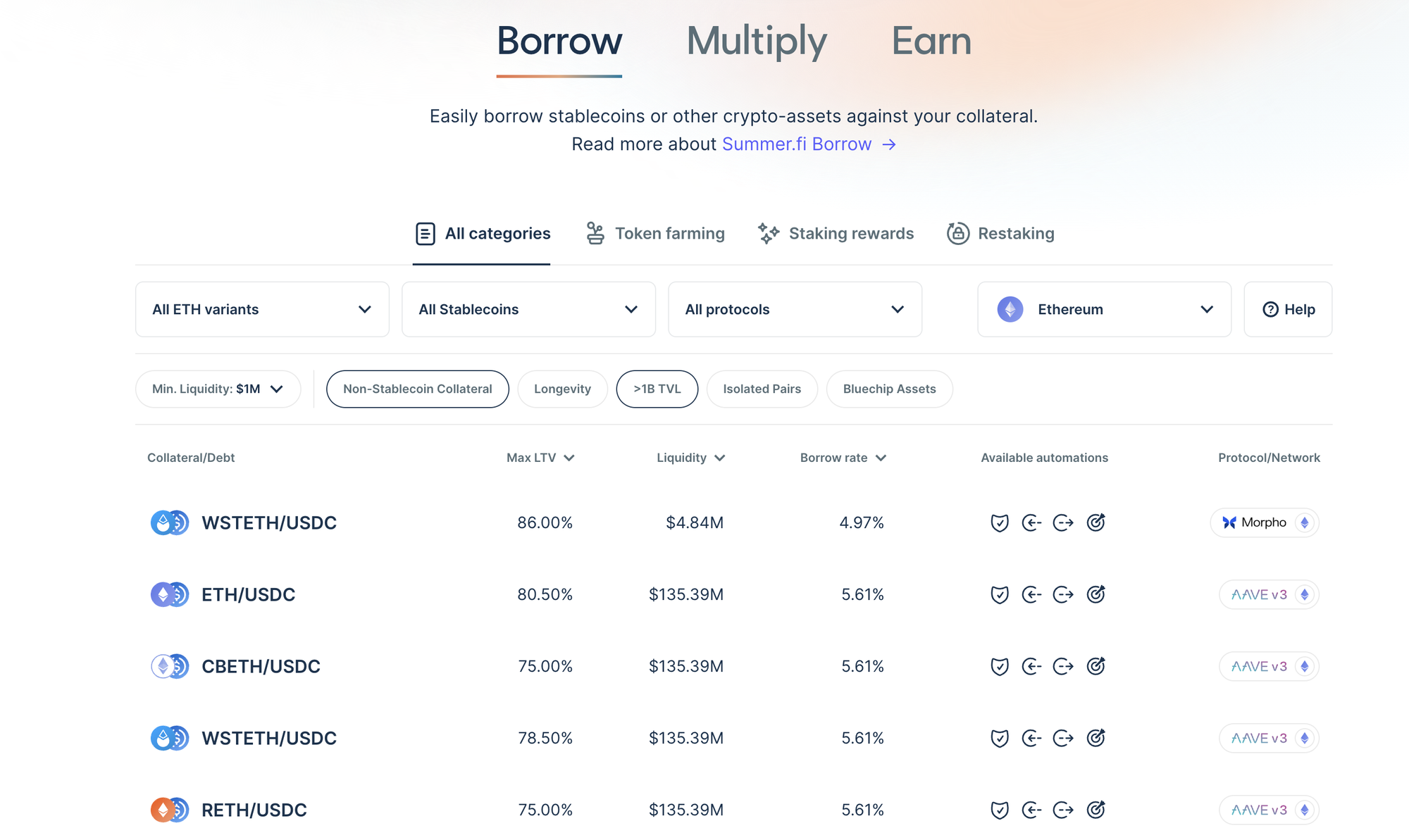

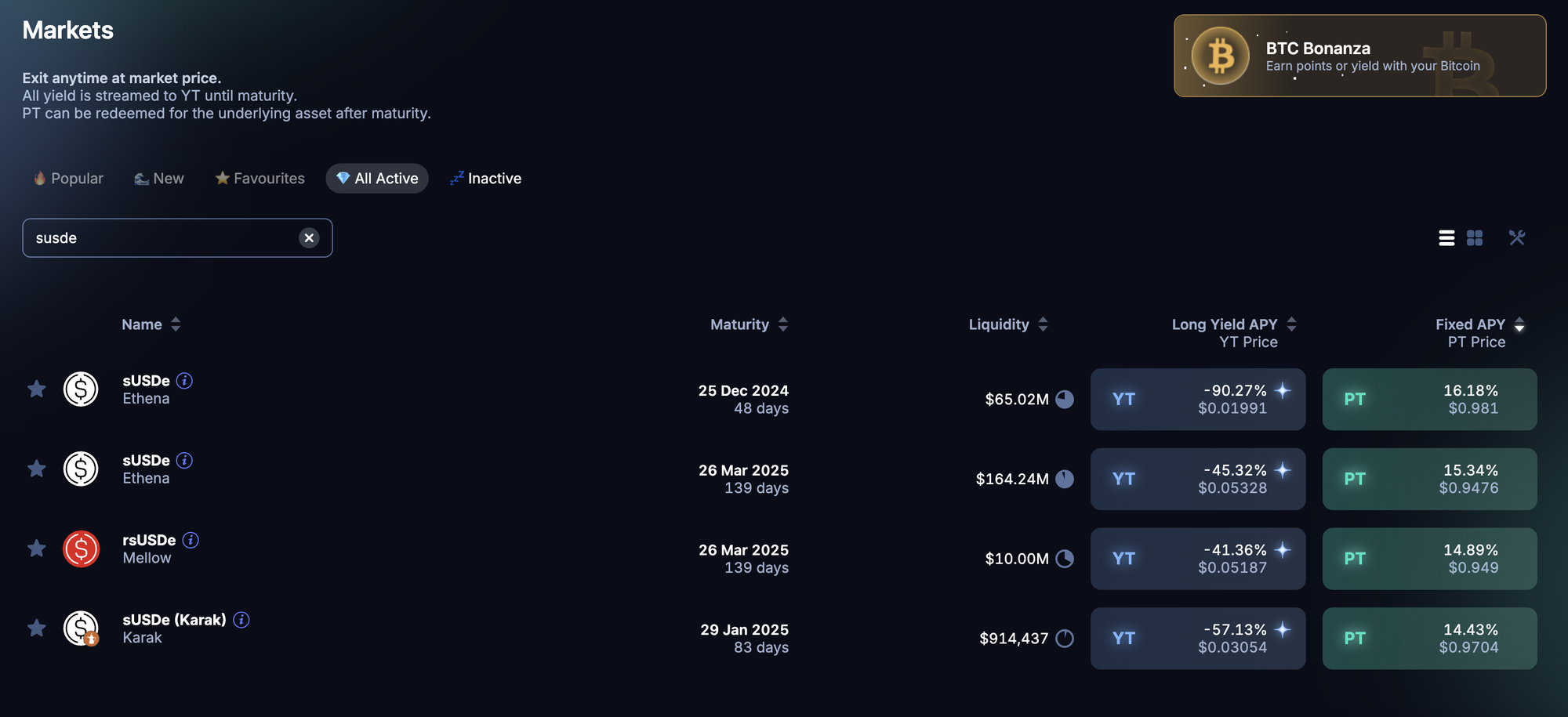

- Borrow Vault arbs keep you exposed to great price action, while allowing you to earn some yield on topOn Summer.fi you can borrow against your Bitcoin or ETH for rates lower than the SUSDE native yield as well as SUSDE yield loop yield.Specifically, you can: Borrow against the crypto assets you love and get exposure to fixed rate sUSDe yield on Pendle.How to do it: Use summer.fi to borrow againt any asset that you own, then deposit the borrowed assets into Pendle sUSDe for a higher rate of return over the same duration.Right now for example you can lock in 17% while borrowing against your ETH at around 5.5%, a spread of ~11.5% on your ETH!

Get started by borrowing against SUSDE on Summer.fi via Morpho or AAVE

- Earn ENA via Sats Campaign season 3 WHILE earning yield

If you decide to do one of the two above strategies on Summer.fi, you will also earn Sats within Season 3 which enables you to get distributed ENA.

These are the reasons why we believe Ethena strategies are slept on.

Getting in touch

If you have any questions regarding Summer.fi, contact us at support@summer.fi or our social media.