The DeFi yield landscape: a map of fragmentation

DeFi yield has undeniable product market fit. The yields are real, the infrastructure is maturing, and the institutional appetite is here.

Onchain lending has grown nearly 10x in the last few years, just a few months ago DeFi TVL recently breached its 2021 high of ~$150 billion. Stablecoins have crossed the $300 billion supply threshold and processed $46 trillion in transaction volume.

But there's a paradox at the heart of all this growth - the very diversity that makes DeFi yield so powerful is also what makes it nearly impossible to manage well. We've been writing about this at Summer.fi for months:

- 2025 was the year of yield fragmentation

- 2026 is the year of onchain vaults. Lazy Summer exists so you can Do Less.

This post is about something we haven't done before: mapping the entire DeFi yield landscape in one place, so you can see just how fragmented it's become, and why that fragmentation is the defining challenge for every yield-seeking user in crypto today.

How we got here: smart contracts, stablecoins, onchain yield

A clear pattern of how crypto grows has emerged. A new onchain primitive is born, only power users understand it, the experience gets abstracted and packaged, and then broader adoption happens.

- 2014, Smart contracts: The world was introduced to programmable rules and programmable ownership. Smart contracts permanently changed the physics of finance, replacing layers of intermediaries, business hours, and siloed databases with 24/7 execution, shared settlement, and enforceable rules.

- 2017-2025, Stablecoins: The most successful smart contract use case to date, stablecoins answered the question: what happens when dollars become programmable and global?

- 2025-2026, Onchain yield: This is the cycle we're in right now, stablecoins proved onchain money, onchain yield proves onchain asset management. What started as simple "deposit and earn" mechanics have evolved into a full yield stack: peer-to-pool lending, isolated lending markets, curator-managed vaults, liquid staking, restaking, perp DEX LP vaults, fixed-rate primitives, institutional onchain credit, basis trading, and risk tranching.

Each cycle follows the same adoption curve, and each one created the foundation for the next.

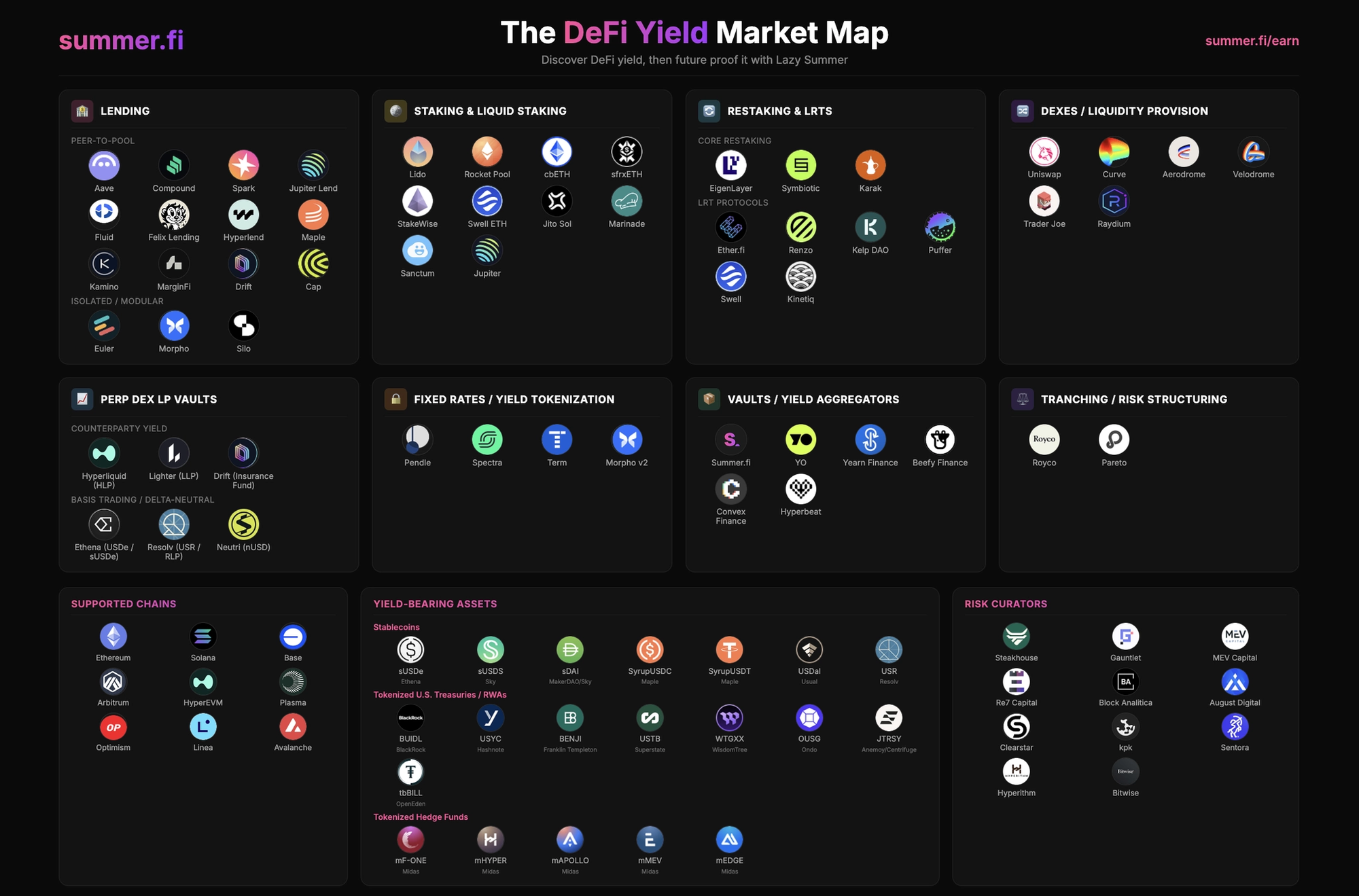

The DeFi Yield Market Map

To illustrate the scale and fragmentation of onchain yield in 2026, we built an interactive market map that catalogs every major yield source, protocol, chain, yield-bearing asset, and risk curator in DeFi today.

Here's what we found: 58 protocols, across 8 distinct categories, deployed on 9 chains, producing yield on 20+ yield-bearing assets, governed by 11+ independent risk curators.

That's the state of DeFi yield. A sprawling, interconnected, constantly shifting ecosystem that no individual participant can reasonably monitor in full.

The eight pillars of DeFi yield

1. Lending: Peer-to-Pool The OGs. Aave, Compound, Spark, Fluid, Moonwell. These are the deep, conservative benchmarks for stablecoin and ETH yield.

2. Lending: Isolated & Modular This is where the market split in 2025, Morpho and Euler pioneered modular lending, where capital efficiency comes from curator-managed parameters rather than monolithic governance. The result: more yield, but more choice. A simple search on DefiLlama returns 255+ individual Morpho vaults.

3. Staking & Liquid Staking ETH staking remains the "risk-free rate" of DeFi, but how users access that rate has diversified dramatically. Lido's stETH dominates, but Rocket Pool, Coinbase's cbETH, Swell, and Jito (on Solana) each offer different tradeoffs in decentralization, liquidity, and additional yield. Origin's OETH and FluidLite have pushed into more advanced passive strategies.

4. Restaking & LRTs EigenLayer introduced the concept of restaking: securing additional networks with already-staked ETH. Liquid restaking tokens (LRTs) from Ether.fi, Renzo, Kelp, and Puffer then made restaked positions composable.

5. DEXes & Liquidity Provision Uniswap, Curve, Balancer, Aerodrome, Raydium. Providing liquidity to decentralized exchanges has always been a yield source, but concentrated liquidity, ve-tokenomics, and chain-specific incentive structures have made LP strategy dramatically more complex.

6. Perp DEX LP Vaults One of the newer and fastest-growing categories. Hyperliquid's HLP let users provide liquidity to perpetual futures markets and earn from trading fees, funding rates, and trader losses. These vaults represent a fundamentally different risk profile: you're effectively the counterparty to leveraged traders.

7. Vaults & Yield Aggregators These are the abstraction layers that route capital across multiple underlying yield sources. Summer.fi is the best one… but we might biassed.

8. Fixed Rates, Yield Tokenization & Tranching Pendle allows users to split yield-bearing assets into principal and yield components, creating fixed-rate exposure. Spectra and other protocols bring similar mechanics to different chains. Meanwhile, tranching protocols let users choose their position on the risk curve: senior tranches for lower-risk, junior tranches for leveraged yield.

The infrastructure layer

The map doesn't stop at protocols, underneath the eight yield categories sits a complex infrastructure layer:

- 9 chains: Ethereum Mainnet, Base, Arbitrum, Optimism, Solana, Sonic, Polygon, HyperEVM, and BNB Chain.

- 20+ yield-bearing assets across three categories: yield-bearing stablecoins (sUSDe, sUSDS, sDAI, Syrup USDC/USDT, OUSD), tokenized US Treasuries and RWAs (BUIDL, USYC, USTB, BENJI, OUSG), and tokenized hedge funds and structured products (USDF, USDtb). Each of these represents a different risk/reward profile, a different regulatory posture, and a different counterparty structure.

- 11+ risk curators: Block Analitica, Gauntlet, Steakhouse, RE7, MEV Capital, Smokehouse, kpk, Yearn, Clearstar, and others. In the curator model, these are the teams that set parameters, manage risk limits, and determine which collateral is accepted. Choosing a vault increasingly means choosing a curator, and most users have no framework for evaluating them.

The fragmentation problem

If you're holding USDC on Ethereum and you want to earn yield, you currently have to choose between: Aave V3, Compound V3, Spark, Fluid, Morpho (with 25+ different curators), Euler (with multiple risk curators), Sky Savings Rate, Syrup, and dozens of vault strategies built on top of these. That's before considering whether you should be on Base, Arbitrum, or Solana instead.

If you're holding ETH, multiply that complexity by the staking/restaking layer on top of the lending layer.

If you want to be diversified, good luck. You need to:

- Evaluate dozens of protocols across technical risk, smart contract audits, oracle dependencies, and governance structures

- Compare yields that change daily (sometimes hourly) across multiple chains

- Assess curator quality on platforms like Morpho and Euler, where there are 25+ curators with different strategies, different risk tolerances, and different track records

- Monitor your positions constantly, because the optimal allocation today may be suboptimal tomorrow

- Rebalance across protocols and chains, paying gas fees and managing bridge risk every time you rotate

- Stay current as new yield sources, new protocols, and new chains come online every month

As Galaxy's research on onchain yield frames it: the DeFi market is diverse, fragmented, dynamic, and only getting more so. The complexity is growing faster than the yields themselves.

This is the paradox we identified in our 2025 fragmentation analysis: onchain yield got so much better that it actually got worse for the manual allocator. The sheer volume of choice created a "paradox of choice" that penalizes those without the time or tools to monitor it.

The yield chasing trap

What most people actually do in the face of this complexity is one of two things: nothing, or yield chasing.

- The do nothing approach means you park in a single protocol, usually Aave or a single Morpho vault, and forget about it. It's rational, in the sense that it minimizes time spent. But it's also expensive. You're accepting single-protocol risk, single-curator risk, and the opportunity cost of not being allocated to wherever the best risk-adjusted yield is at any given moment.

- The yield chasing approach means you actively rotate capital to wherever APYs are highest. This sounds sophisticated, but in practice it usually means: chasing incentive programs that are temporary, paying gas fees that eat into your profits, arriving late to yield spikes that sophisticated automated systems already captured, and taking on risks you didn't fully evaluate because you were moving too fast.

Neither approach is a real strategy, one leaves money on the table and the other conflates activity with sophistication.

What both approaches have in common is that they're manual responses to a problem that requires automation.

DAO Managed Vaults

This is why we built DAO Managed Vaults: Lazy Summer's answer to the fragmentation problem.

From a single deposit, your capital flows automatically across the best yield opportunities in DeFi. Not one protocol, one curator or one yield source, the full breadth of the market map, filtered through a transparent risk framework developed in partnership with Block Analitica.

USDC on Ethereum Mainnet: 14 yield sources across 6 protocols, including Sky Rewards, Syrup USDC, Fluid, Morpho (multiple curators: kpk, Yearn, Gauntlet, Smokehouse, Steakhouse), Euler, Upshift, and Origin. From a single deposit.

ETH on Ethereum Mainnet: 12 yield sources across Fluid, Origin, Morpho, and Lagoon Finance. One deposit. Zero maintenance.

USDC on Base: 13 yield sources across Fluid, Gauntlet, Moonwell, Morpho, and 40 Acres.

Every yield source passes through a four-step risk process:

- Yield source proposal

- Risk filtering (protocol age, audit status, TVL/APY screen, backing liquidity, verifiable backing, swap liquidity, critical dependency analysis)

- Risk categorization (high/moderate/lower confidence tiers with corresponding allocation limits)

- SUMR holder governance vote.

Get automated access to DeFi’s best yield sources

We built the DeFi Yield Market Map because we believe seeing the full landscape in one place tells you something that no individual protocol page or yield aggregator can.

It tells you that DeFi yield is no longer a single market, it's an ecosystem of ecosystems and its only going to get worse.

Let the fragmentation and immense growth work to your benefit with DAO managed vaults and future proof your DeFi yield with Lazy Summer.

Join us

Discord | Telegram | X/Twitter | Linktree

Disclaimer: Oazo Apps Limited functions solely as a front-end interface (Summer.fi) provider and it does not act on behalf of any user. Oazo Apps Limited did not launch nor does it operate or control the Lazy Summer Protocol. The Lazy Summer Protocol is accessed through Summer.fi. The information provided herein is provided on behalf of the Lazy Summer Foundation which launched the Protocol for informational purposes only and it does not constitute investment advice. Oazo Apps Limited and the Lazy Summer Foundation are not soliciting or recommending any transaction or guaranteeing any specific returns. Users interact with the Protocol at their own risk. T&C for the use of Summer.fi apply.