SUMR Tokenomics: Everything you need to know about SUMR

The rise of onchain yield

DeFi has reached an inflection point. Onchain yield is now one of crypto’s most enduring and scalable use cases, commanding the majority of all DeFi TVL and proving itself as one of crypto’s strongest product-market fit use cases.

Stablecoins sit at the core of this ecosystem. As Visa recently highlighted, onchain lending remains the foundational yield primitive powering stablecoin utility - transforming passive liquidity into productive capital through overcollateralized lending.

ETH, crypto’s premier productive asset, has also evolved beyond staking into a multi-layered yield ecosystem driven by lending, liquid re-staking, and structured looping strategies. Together, these forces have created a rich but increasingly complex landscape of yield generation.

Fragmentation: The hidden cost of opportunity

The explosion of yield sources has introduced an equally large problem…fragmentation.

Protocols compete across differing risk frameworks, reward designs, and liquidity incentives. The result: under-optimized capital and missed opportunities.

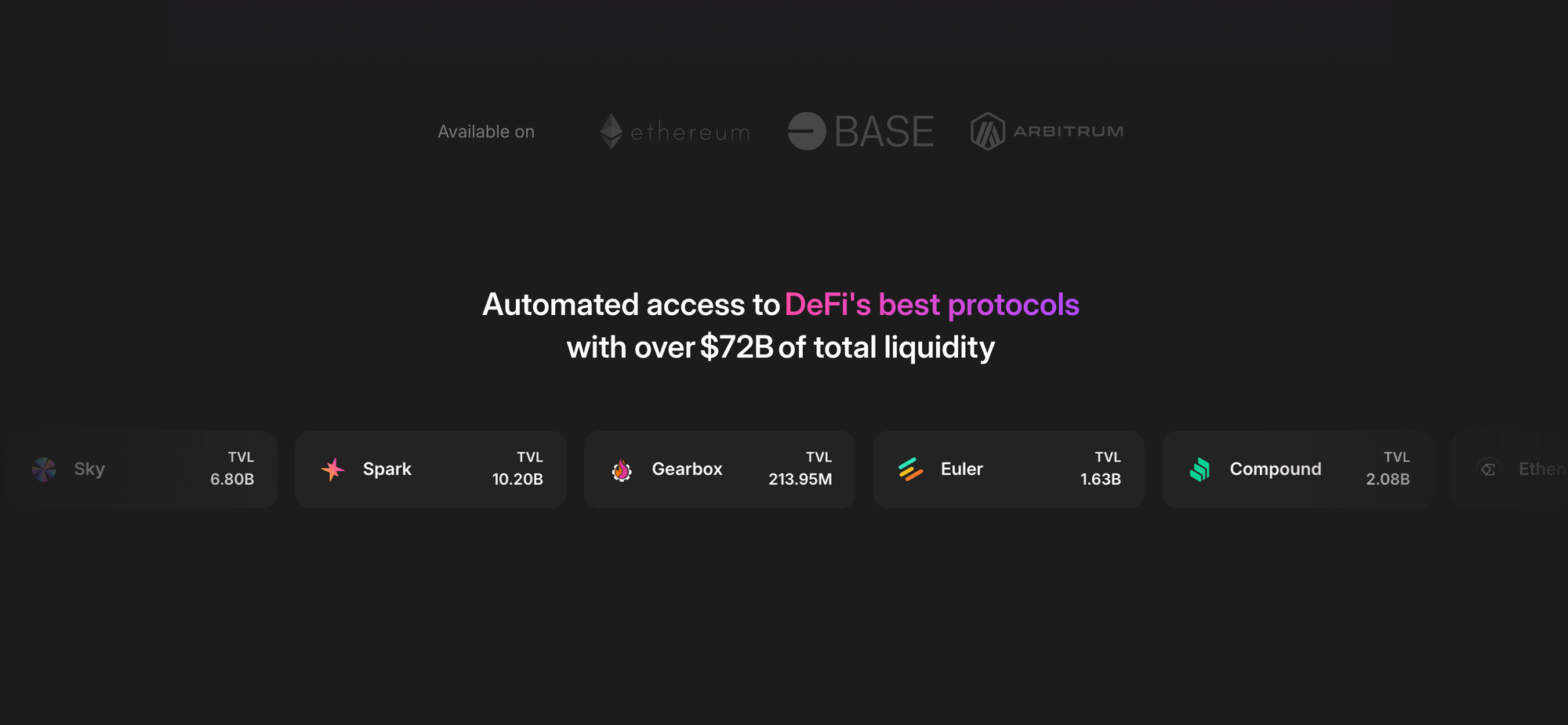

Lazy Summer exists to eliminate that fragmentation - delivering automated, high-quality yield access across the most trusted protocols onchain. With Lazy Summer, users don’t chase yield; yield finds them.

The SUMR Opportunity

As both stablecoin market cap and onchain AUM grow, the yield landscape does not simplify. It fragments: more protocols, more vault structures, more incentive programs, and more variance in risk/reward construction. For allocators, the bottleneck becomes operational: staying current and safe without becoming full-time yield traders.

By eliminating the friction of fragmentation, Lazy Summer isn't just participating in the yield economy; it is building the infrastructure to power its next phase of exponential growth, and the SUMR token will capture all of that created value, heres how:

Understanding SUMR tokenomic’s: the productive DeFi asset

Lazy Summer: A product that delivers on its promise

Lazy Summer is not a yield aggregator, it’s a fully automated yield optimization protocol built on transparency, trust, and risk conscious governance. SUMR token holders own the core economic engine of this system.

The model is simple: Lazy Summer generates real revenue. SUMR holders capture it.

Protocol revenues flow to two destinations:

- The Lazy Summer Treasury - governed by SUMR holders, compounding protocol value.

- SUMR Stakers - who earn direct USDC revenue share from protocol fees.

This is not speculative value. SUMR represents direct exposure to one of DeFi’s few sustainable business models, one that grows with deposits, TVL, and institutional adoption.

How Lazy Summer Protocol creates value for depositors and asset allocators

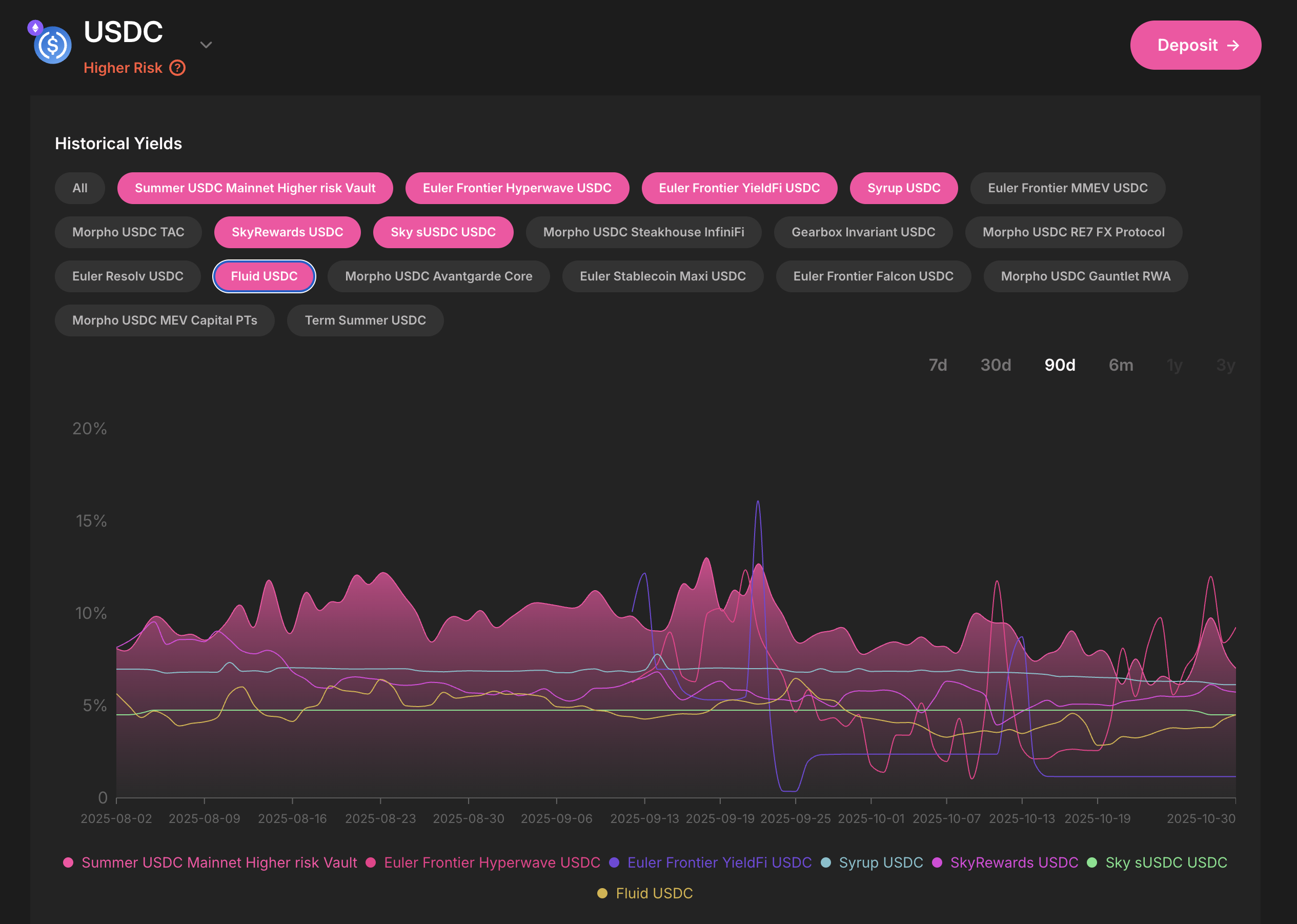

Above benchmark yield

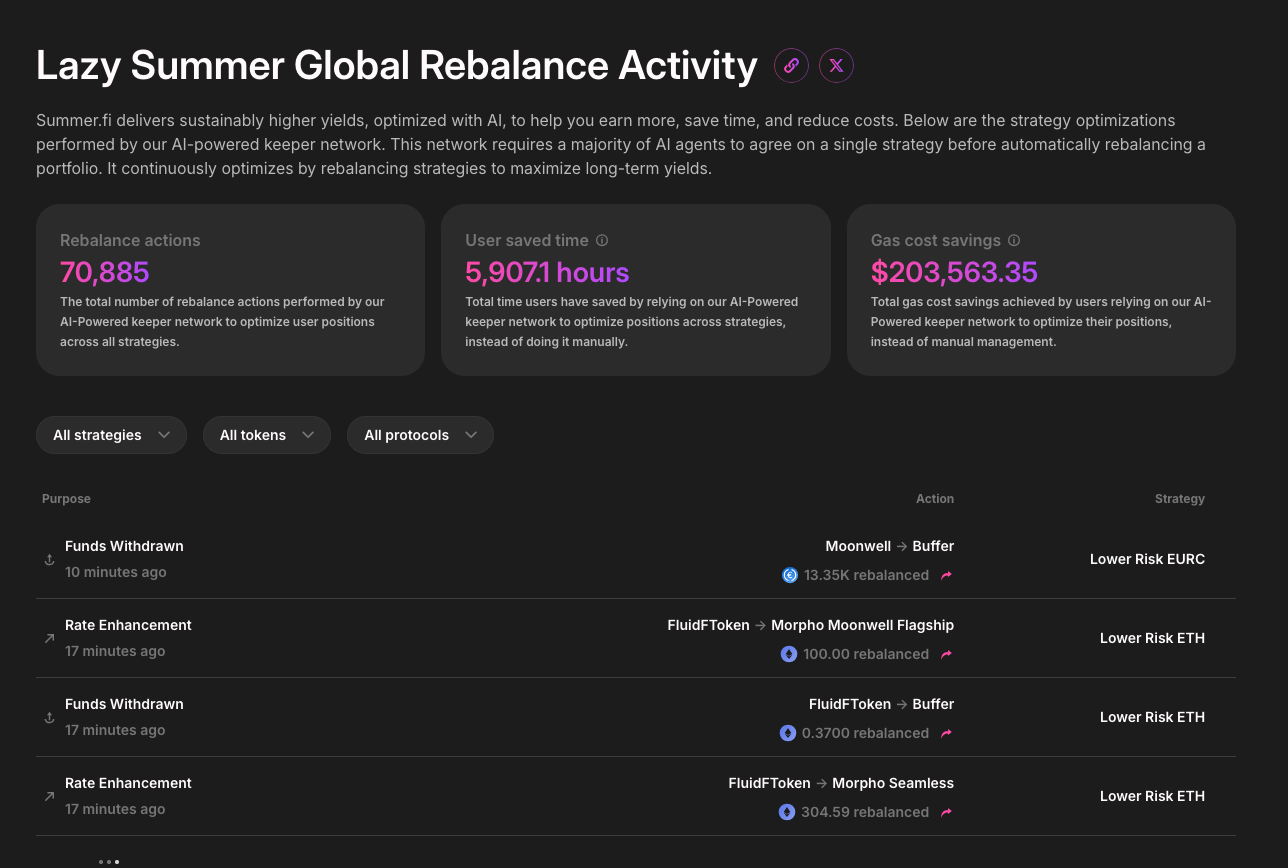

Access diversified yield across DeFi’s top protocols without manual management or risk analysis. Lazy Summer protocol automatically reallocates capital to the best-performing sources, consistently providing access to above-benchmark returns.

Time saved

Given that Lazy Summer Protocol users don’t have to spend time researching yields, analyzing risks, and managing positions, the protocol saves them ample time.

No yield chasing

New strategies are proposed via the Lazy Summer governance process, and risk is assessed independently by a third party (Block Analitica). That means, as new yield sources and yield ecosystem pop up, governance and risk curation decide whether they have what it takes to be added to Lazy Summer. Depositors don’t have to do a thing.

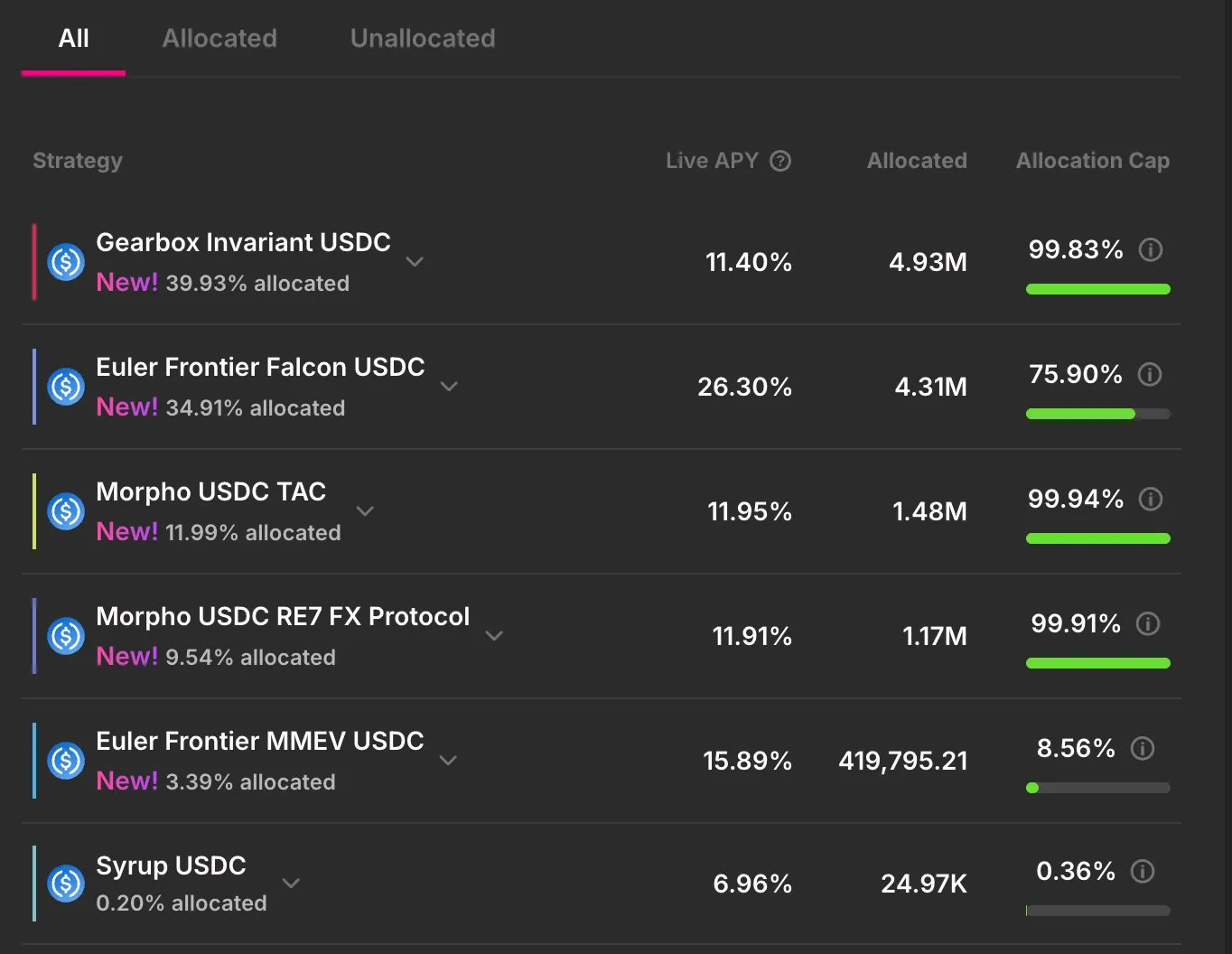

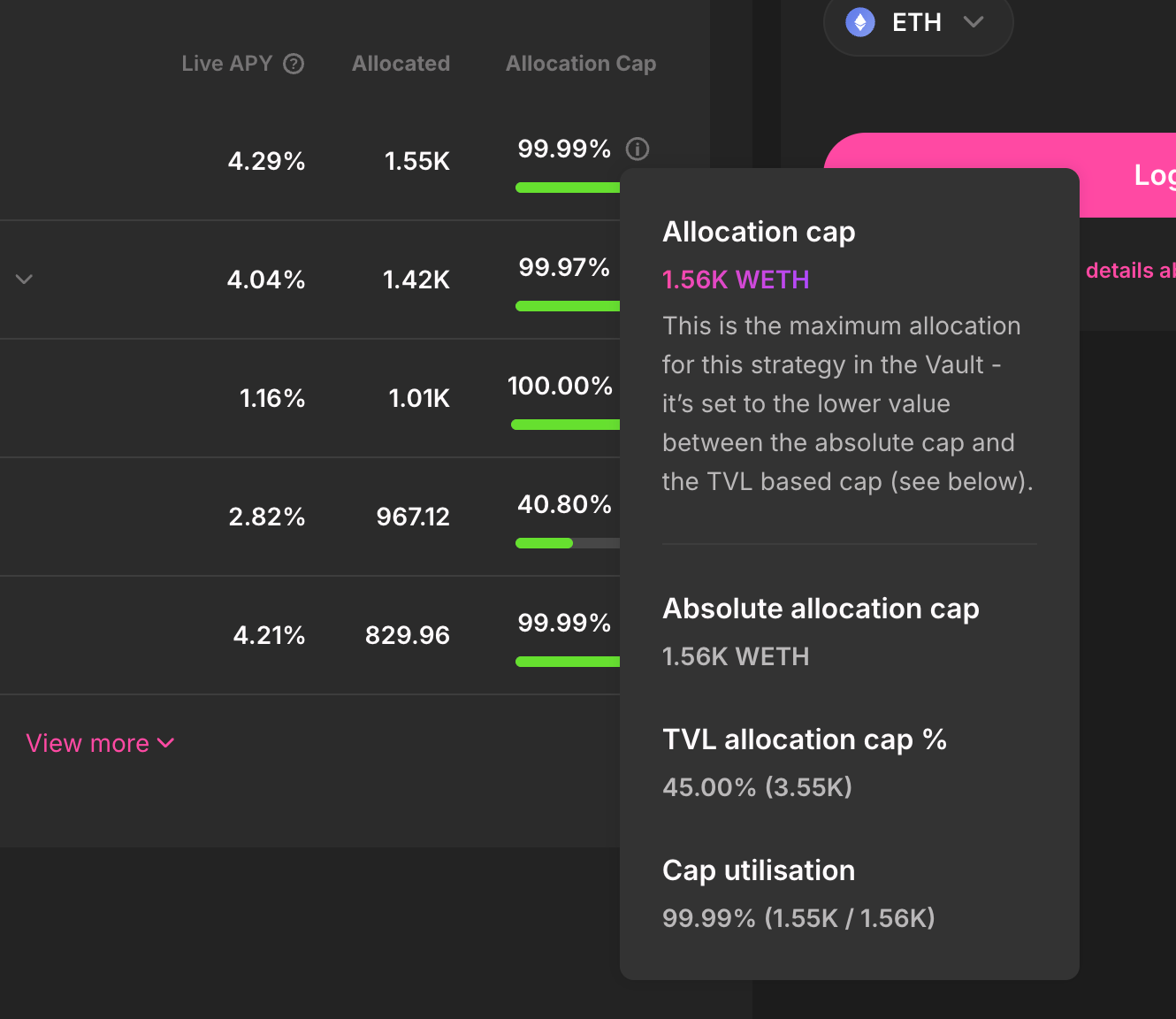

Example of new yield sources added to existing vaults

Risk curated and managed

One through line in DeFi is that not all yield is created equal. Most all DeFi users are acutely aware of this, and thus default to the most lindy protocols and yields. With Lazy Summer protocol, users can access novel yield sources, whilst still operating under best in class risk frameworks.

Yield source depth

Users get access to high quality yields, automatically. New DeFi yield sources come to market all the time. So much so that is impossible for any one person to keep up.

Diverse exposure across yield source ecosystems

Unlike being beholden to a single protocol, Lazy Summer users get access to all DeFi’s best yield ecosystems. If a new yield ecosystem pops up, it can be added to Lazy Summer Protocol.

SUMR is a productive DeFi asset that generates revenues from Lazy Summer’s best in class yield optimization service for both DeFi native and Institutional customers.

This makes business model of Lazy Summer, and SUMR value accrual very simple. Lazy Summer produces cash flows from providing a best in class yield optimization service, and those cash flows are directed back to two critical places for SUMR token holders.

- The Lazy Summer Protocol Treasury, owned by SUMR holders.

- Directly to the wallets of SUMR Staker’s, who earn a portion of Lazy Summer revenue for owning the token.

Lazy Summer Vault Revenue: The economic engine of SUMR

The protocol’s primary economic engine is vault generated revenue. Each vault charges a fee on the total assets under management, roughly 0.66% annually for public vaults.

Below are Lazy Summer Protocol revenue projections based on different TVL/AUM thresholds:

| Lazy Summer TVL / AUM | Calculation (TVL×0.0066) | Projected Annualized Revenue |

|---|---|---|

| $100M | $100,000,000 \times 0.0066$ | $660,000 |

| $250M | $250,000,000 \times 0.0066$ | $1,650,000 |

| $500M | $500,000,000 \times 0.0066$ | $3,300,000 |

| $1B | $1,000,000,000 \times 0.0066$ | $6,600,000 |

| $2B | $2,000,000,000 \times 0.0066$ | $13,200,000 |

| $5B | $5,000,000,000 \times 0.0066$ | $33,000,000 |

| $10B | $10,000,000,000 \times 0.0066$ | $66,000,000 |

Where does the revenue go?

Protocol revenue flows are directed to two critical sinks for SUMR holders:

- The Treasury: Controlled by SUMR holders for growth and sustainability.

- SUMR Stakers: Direct distribution of protocol revenue to stakers in USDC.

The Flywheel: SUMR staking as supply shock mechanics

SUMR tokenomics are designed to create a powerful feedback loop between protocol growth and token scarcity.

The Mechanism:

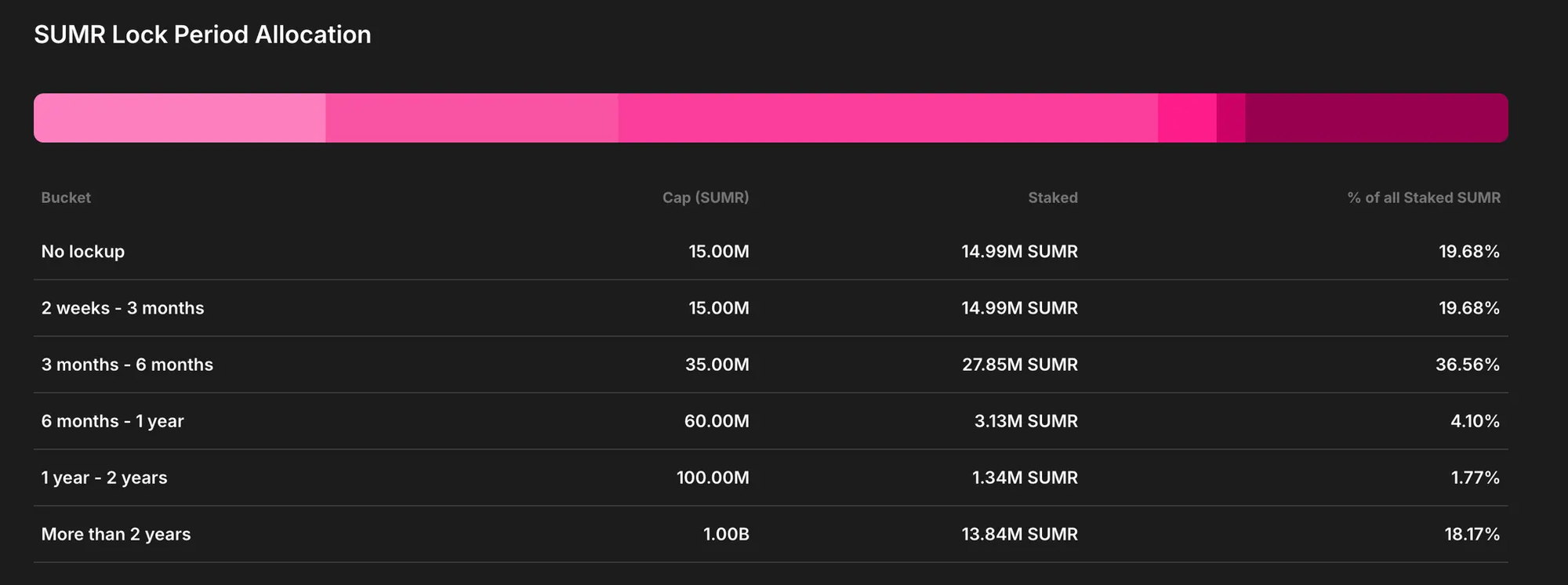

Investors who stake SUMR earn a portion of protocol revenue. However, they can amplify their rewards by "locking" their stake for up to 3 years. This conviction-based locking effectively removes supply from the market.

The SUMR flywheel effect:

- Emissions drive TVL: Incentives attract deposits into Lazy Summer vaults.

- TVL drives Revenue: Higher TVL generates more fees.

- Revenue drives Demand: Fees are shared with stakers in USDC, increasing the yield for holding SUMR.

- Locking reduces Float: To maximize that yield, holders lock tokens. Today, nearly 20% of staked SUMR is already locked for >2 years.

As the protocol grows, the circulating supply tightens, creating a potential supply shock just as institutional demand accelerates.

Today, nearly 20% of all staked SUMR is already locked for over two years. Showcasing investor conviction and setting up a structural supply-side squeeze as adoption grows.

https://summer.fi/earn/staking

The onchain vault supercycle

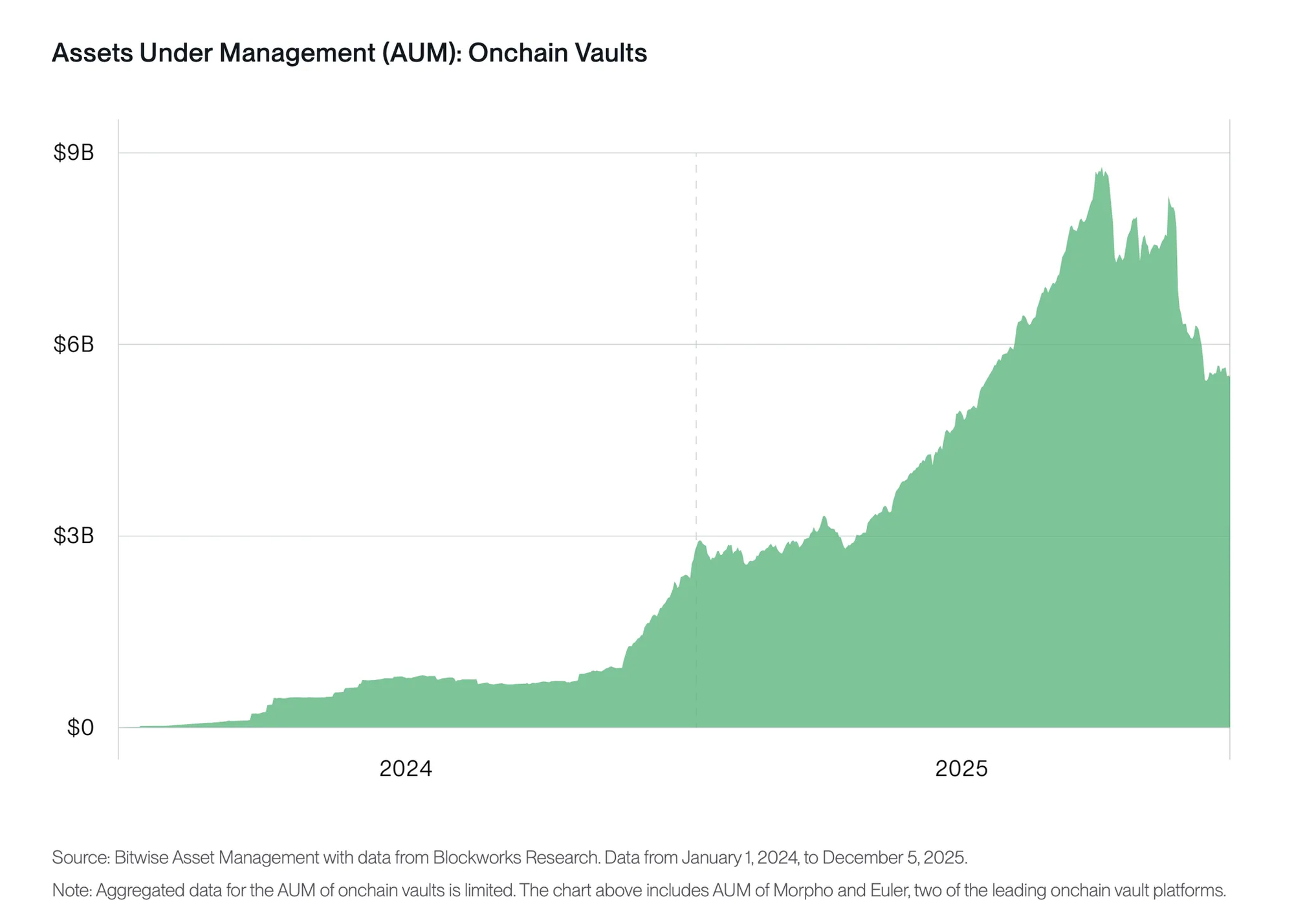

The addressable market for Lazy Summer is expanding rapidly. Bitwise predicts that onchain vault AUM will double by 2026, labeling these vaults "ETFs 2.0."

“We believe a wave of high-quality curators will enter the market in 2026, drawing billions of dollars of capital into the vaults they manage. The space will grow so fast it’ll catch the attention of major financial publications. One of them—Bloomberg, The Wall Street Journal, or the Financial Times—will label vaults “ETFs 2.0.”

Source: **The Year Ahead: 10 Crypto Predictions for 2026 report**

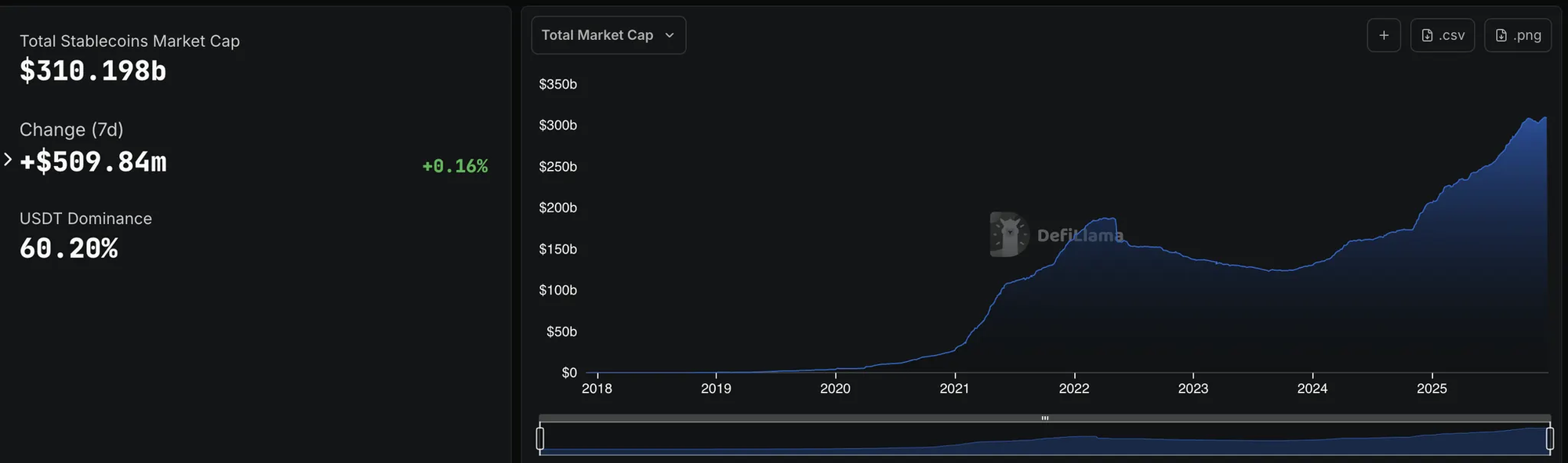

Simultaneously, the stablecoin market cap is approaching $300B. As billions of dollars in stablecoins seek yield, they will require an aggregation layer to manage risk and complexity. Lazy Summer is that layer.

Source: https://defillama.com/stablecoins

Every dollar entering DeFi yield ecosystems faces the same challenge - fragmentation and inefficiency. Lazy Summer fixes that, positioning itself as the default yield optimizer for both retail and institutional allocators.

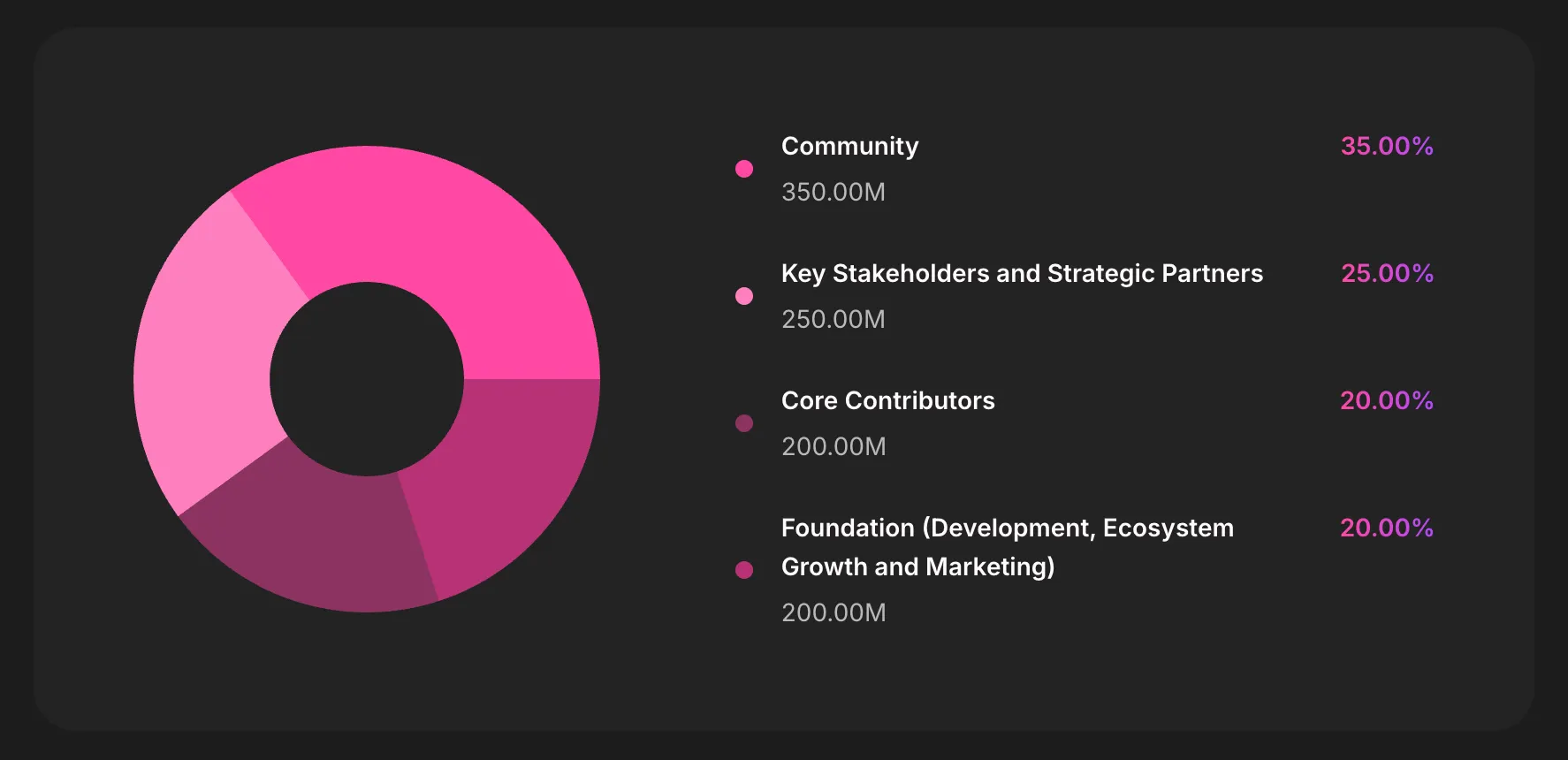

SUMR token supply & distribution

Max Supply: 1,000,000,000 SUMR. Initial Float: ~450,000,000 SUMR (upon transferability)

The distribution is heavily weighted toward community incentives and long-term alignment:

- 35% Community: Rewards for usage, governance, and active participation.

- 25% Strategic Partners: Investors and backers (subject to 24-month vesting).

- 20% Core Contributors: The team building the protocol (subject to performance milestones).

- 20% Foundation: Reserves for ecosystem growth, audits, and liquidity.

Note: A significant portion of the Core Contributor allocation is tied to ambitious performance milestones (e.g., TVL >$300M, non-DeFi integrations), ensuring the team only wins when the protocol scales.

SUMR token supply details

The emission rate for SUMR is dynamic and controlled by governance. It fluctuates based on active growth initiatives, with the long-term strategic intention for the emission rate to decrease over time as the protocol matures.

The details of SUMR token supply mentioned above are as follows:

Community Allocation - 350M SUMR

Purpose: To be distributed to the community over time via incentives and other mechanisms, ensuring decentralized control and fostering a user-driven protocol. Controlled by the Lazy Summer DAO.

Status as of December 2025: Approximately 151M tokens have been emitted, claimed, or made available for claim. The following table outlines the incentive initiatives run to date:

| Initiative | Description |

| Vault rewards | Incentives earned by users depositing into the LS Protocol. |

| Referral rewards | Incentives earned by users who have referred others to the protocol via a referral link. |

| Governance/staking rewards | Incentives earned by token holders staking via the v1 mechanism and participating in governance. |

| RAYS | Tokens made available for claim by those eligible for the initial airdrop. |

| Delegate rewards | Compensation for recognized Delegates for active participation in DAO governance. |

| Staking v2 rewards | Incentives earned by users staking via the new v2 mechanism. |

Staking v2 — Lockups and Penalties The Staking v2 mechanism incentivizes users to lock up tokens in exchange for protocol revenue sharing and $SUMR native rewards. This design encourages longer duration lockups, effectively removing these tokens from the circulating supply.

- Penalty Mechanism: Users who unstake before their lockup period concludes forfeit a portion of their tokens. These forfeited tokens are retained by the DAO and accrue back to the Community Allocation balance.

Key Stakeholders and Strategic Partners - 250M SUMR

Purpose: Granted to investors and backers to align incentives with those who provided early financial support.

Status as of December 2025: All tokens are subject to standard time-based vesting: 24 months linear vesting from the TGE date, following a 6-month cliff.

- Vested: 115M tokens.

- Unvested: 135M tokens remaining.

- Outlook: These will vest linearly over the remaining 13-month period ending January 2027

Core Contributors - 200M SUMR

Purpose: Granted to team members and core contributors with conditions designed to ensure long-term protocol success.

Status as of December 2025: This allocation is divided into three subcategories:

A) Time-based + Milestone-based Vesting (155M)

- Status: 81M tokens vested by end of 2025.

- Time-based (50%): Vesting month-to-month over 24 months from TGE (January 28, 2025), with a 6-month cliff.

- Milestone-based (50%): Vesting is triggered by the following achievements:

| Milestone | % Associated | Status |

| Protocol release | 20% | Achieved |

| TVL >$100M | 10% | Achieved |

| TVL >$300M | 10% | Not yet achieved |

| First non-DeFi integration live | 10% | Not yet achieved |

Note: There is no certainty regarding if or when the remaining milestones will be met. Current emissions modeling assumes these milestones are not achieved.

B) Time-based Vesting Only (14M)

- Status: 6.4M tokens vested by end of 2025.

- Conditions: Standard 24-month linear vesting from TGE (January 28, 2025) with a 6-month cliff.

C) Unallocated (31M)

- Status: Reserved to incentivize future contributors.

- Expectation: If allocated, these will likely carry both time-based and milestone-based vesting conditions.

Foundation - 200M SUMR

Purpose: Set aside for development, ecosystem growth, and marketing (e.g., technical audits, protocol services, risk curation, market making, and CEX listing fees).

Status as of December 2025: These tokens are not subject to programmatic vesting and are available for deployment as needed.

- Distributed/Allocated: 22M tokens.

- Planned Usage: A further 30.5M tokens are earmarked for the token launch in January 2026.

- Reserve: 147M tokens remain in the Foundation reserve.

The SUMR thesis

As institutions move onchain and stablecoin velocity accelerates, the infrastructure layer that efficiently allocates that capital - the yield optimizer - becomes one of the most valuable positions in DeFi’s value chain.

SUMR is the governance and value-accrual asset of Lazy Summer Protocol, a yield-optimization platform designed to automate exposure to DeFi’s highest-quality yield sources. The core investment thesis is straightforward:

- Onchain yield is a structural market (stablecoins + ETH yield ecosystems) that continues to expand as adoption grows.

- Yield markets are becoming more fragmented and operationally complex, even for sophisticated allocators.

- Lazy Summer positions as the allocator layer: curation + automation + risk management across yield sources.

- SUMR accrues value via a clean mechanism: TVL → fees → protocol revenue → (treasury + USDC to stakers).

- Staking introduces a second lever: dual rewards (USDC + SUMR) and conviction-based locking that can compress float as adoption expands.

The beginning of this new era: On January 21st SUMR starts trading

On January 21st, SUMR will start trading and become a liquid asset. You can prepare for that event by:

- Accessing SUMR via depositing in public vault

- Staking SUMR

- Joining the Lazy Summer Discord and Forum.