Summer.fi goes all in on Lazy Summer Protocol as Summer.fi Pro transitions to DeFi Saver

Summer.fi Pro is transitioning to DeFi Saver and Lazy Summer is coming to DeFi Saver Smart Savings.

Today (January 14, 2026), we’re announcing an important step in the evolution of Summer.fi:

Summer.fi will now be 100% focused on the Lazy Summer Protocol, the onchain vault protocol built to deliver automated exposure to DeFi’s highest quality yields.

Specifically, we’re partnering with DeFi Saver, one of DeFi’s most trusted position management platforms, to ensure Summer.fi Pro users continue to have a best-in-class home for managing their positions and to bring Lazy Summer vaults to DeFi Saver’s Smart Savings product.

From February 12, 2026, all users with Borrow, Multiply, or Yield Loop positions on Summer.fi Pro will need to manage these positions through DeFi Saver.

This is a win for users, a win for Lazy Summer adoption, and a major milestone for SUMR as the protocol enters its next phase.

Why Sunset Summer.fi pro?

Summer.fi Pro helped define Summer.fi (formerly Oasis.app) and DeFi since it originally launched in November 2019 for the introduction of Multi Collateral Dai from MakerDAO.

It enabled the team to:

- Learn what “power users” truly need when managing positions across DeFi.

- Become a trusted destination across DeFi, first for the Sky ecosystem (formerly MakerDAO), and later for the broader bluechip DeFi protocol ecosystem (including Aave, Morpho, Spark, and more).

- Build the product taste, risk sensitivity, and engineering execution muscles that ultimately led to Lazy Summer.

But the reality is simple:

A best-in-class sophisticated DeFi position management product requires the full focus of a dedicated team, and so does building the best onchain vault protocol in the world.

To fully deliver on the Lazy Summer promise, summer.fi is dedicating all resources to the development of the Lazy Summer Protocol.

For Summer.fi users, that means:

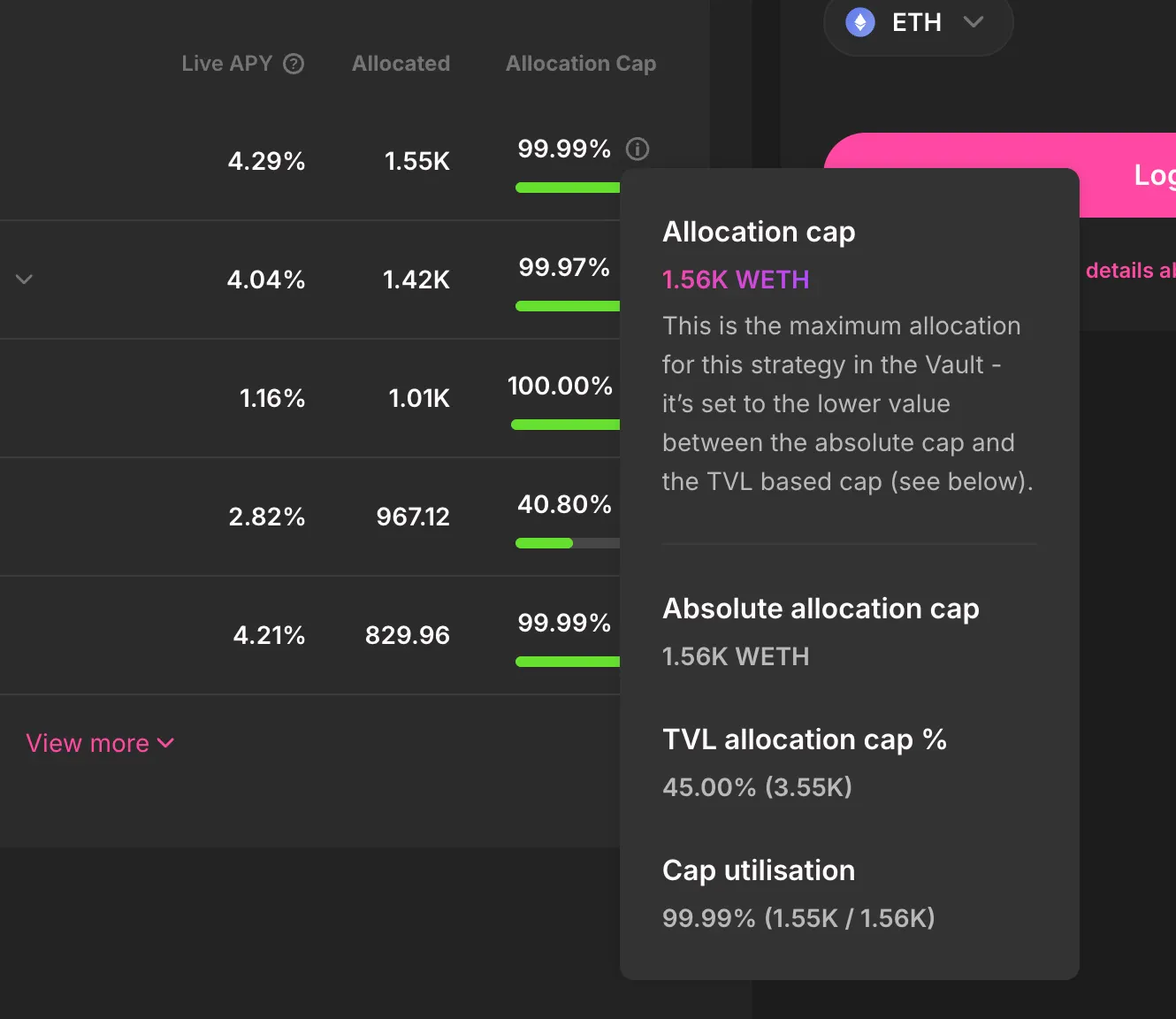

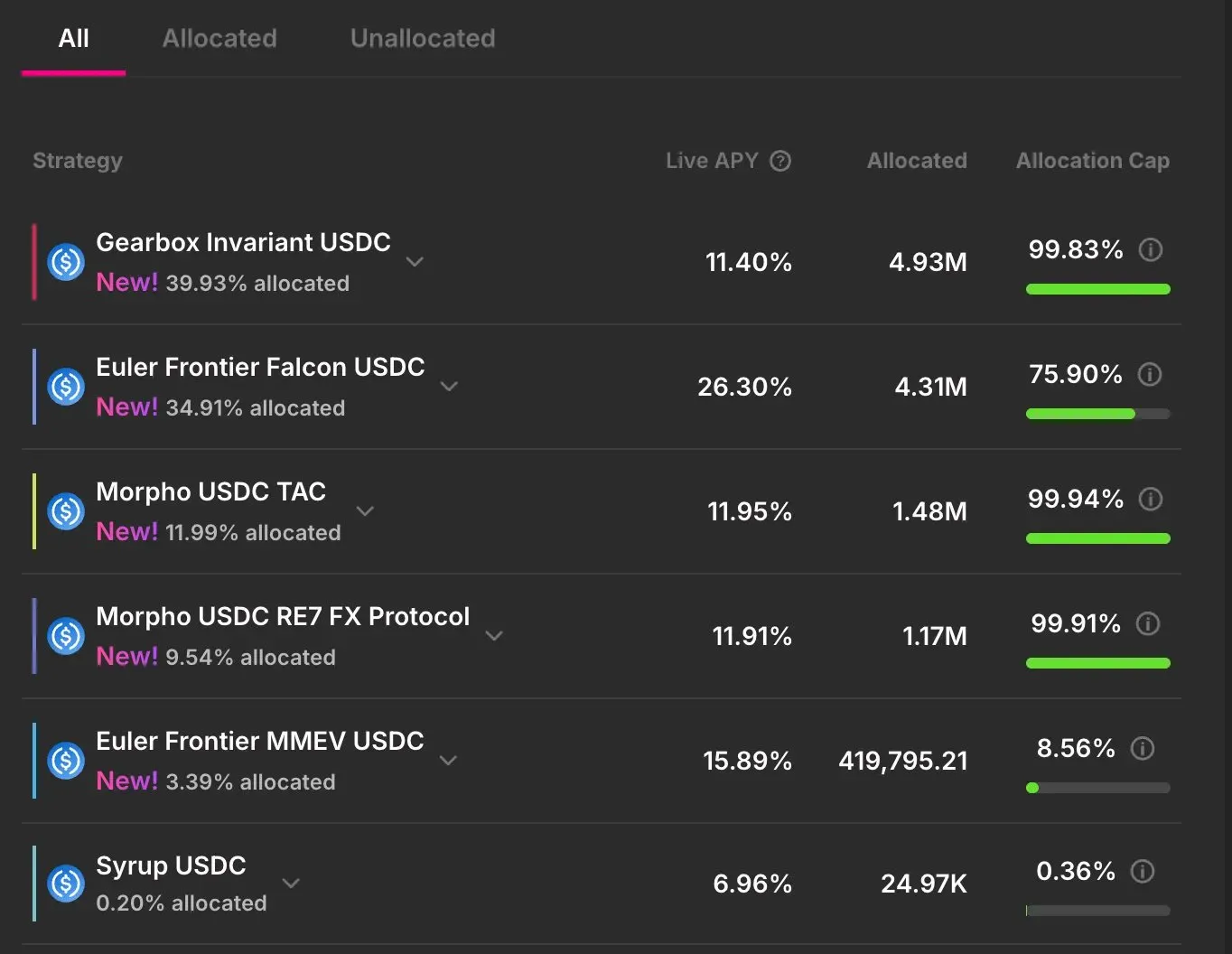

Above-Benchmark Yield: diversified exposure that consistently beats static deposits

Risk Curation: access to new yield sources inside a strict, governed framework

No Yield Chasing: Governance and risk experts handle rotation discipline so users don’t have t

What’s happening to Summer.fi and existing Summer.fi Pro positions

1. Summer.fi Pro is transitioning to DeFi Saver

Over the next 30 days, Summer.fi Pro users will have the option to continue managing their positions using Summer.fi Pro or DeFi Saver. Positions will be visible on the DeFi Saver platform. (app.defisaver.com)

DeFi Saver will support native management of positions that were previously managed through Summer.fi Pro, so users can keep doing what they already do, but on a platform that is fully focused on position management.

All else will remain the same for Summer.fi Pro users, except for automations, which will no longer work and must be reset on DeFi Saver.

2. Lazy Summer is coming to DeFi Saver Smart Savings.

DeFi Saver is also integrating the Lazy Summer Protocol into their Smart Savings product across:

- Ethereum

- Arbitrum

- Base

This means DeFi Saver users will gain access to automated, risk-curated yield vaults, powered by Lazy Summer, directly within DeFi Saver.

The evolution of Summer.fi (and what it unlocks)

Today marks a clear milestone for Summer.fi, as it becomes a dedicated onchain vault protocol.

That focus matters because the onchain vault market is fragmented and complex.

- yields change quickly

- risk varies widely

- users are forced to constantly monitor, rebalance, and assess tradeoffs

Lazy Summer exists to solve that, now has 100% focus on solving the problem.

Going forward, Summer.fi will be fully focused on:

- contributing to solving fragmentation in onchain yields

- support the Protocol in delivering best-in-class vault products for DeFi natives

- expanding into institutional-grade vault offerings, including expanding the self-managed vault infrastructure offering

This is the path to making onchain yield products truly scalable, not just for DeFi natives, but for institutional adoption too.

Full incentive alignment for the SUMR token

This partnership announcement comes at a critical time. At 00:00 UTC on January 22, 2026, SUMR begins trading.

From here, the SUMR story gets simpler and stronger:

- SUMR success is now directly tied to Lazy Summer’s growth

- SUMR becomes the focal point of ecosystem alignment of Lazy Summer growth and revenue.

And because DeFi Saver will integrate and promote Lazy Summer within Smart Savings, including SUMR rewards, further drive distribution of SUMR and revenue to SUMR token holders.

More users using Lazy Summer → more protocol momentum → stronger long-term alignment with SUMR.

Everything Summer.fi Pro users need to know

Here are the specifics and what to expect.

Key dates

- January 14, 2026: Announcement + transition begins

- January 14 → February 11, 2026: Notice Period (30 days)

- February 12, 2026: Summer.fi Pro becomes read-only from the Portfolio Page(view-only)

- Read-only remains available for at least 12 months

During the Notice Period (Jan 14 → Feb 12)

- You can keep viewing and using Summer.fi Pro as usual.

- You’ll see clear messaging across Summer.fi Pro and our channels about the transition.

- You’ll have the option to begin viewing and managing your positions through DeFi Saver.

On February 12, 2026 (read-only mode)

- Summer.fi Pro will switch to view-only.

- You’ll only be able to view your positions from the Portfolio Page on Summer.fi Pro.

- All actions and management of positions will be handled through DeFi Saver (via direct linking).

A note on automation

Summer.fi Pro’s existing automation service will be discontinued at the end of the notice period (February 12,2026). If you currently rely on automation from Summer.fi Pro, please plan accordingly and review your positions during the notice period and enable DeFi Saver Automations if you wish to continue have downside protection and/or upside oppotunity.

A note on Ajna positions

DeFi Saver will not support Ajna positions. If you have an Ajna position, you should review it during the notice period and decide what you want to do.

What this means for Lazy Summer users

Nothing changes about your Lazy Summer experience on Summer.fi, except that it gets better from here.

This transition is designed so that:

- Summer.fi can fully focus on vault execution and protocol growth

- Lazy Summer gets expanded distribution through DeFi Saver, with the introduction of Smart Savings soon on major L2s such as Base, Optimism and Arbitrum

- and the ecosystem has a clearer narrative: Lazy Summer is the vault protocol. DeFi Saver is the DeFi position manager.

Each product gets to be world-class at what it does.

FAQs

1) I haven’t paid attention in months. Am I at risk right now?

No. Nothing “breaks” today.

- Your Lazy Summer deposits stay where they are (on Summer.fi).

- Your Summer.fi Pro positions don’t suddenly close or change.What is changing is where you’ll manage your Summer.fi Pro positions going forward after February 12th. These will now need to be managed on → app.defisaver.com

2) What exactly is happening to Summer.fi Pro?

Summer.fi Pro is being sunset and transitioned into a view-only (read-only) interface. After the transition, Summer.fi Pro will remain as:

- a landing page explaining the change

- a portfolio page so you can still view your positions…but position management actions will happen on DeFi Saver.

3) Do I need to do anything right now?

If you want the smoothest experience: yes, during the next 30 days.

During the Notice Period (Jan 13 → Feb 11, 2026), you should:

- open your Summer.fi Pro portfolio

- start managing positions via DeFi Saver (so you’re comfortable before read-only mode)

- review any automations (see below)

If you do nothing, you’ll still be able to view positions on Summer.fi Pro after Feb 11, you’ll just be able to use DeFi Saver to manage them.

4) Where do I manage my existing Summer.fi Pro positions?

Until February 12, 2026 you can continue to manage your positions at pro.summer.fi. After this date, you will manage all existing and any new positions on DeFi Saver (app.defisaver.com).

DeFi Saver will support native management of positions you previously managed through Summer.fi Pro (Except for any Ajna positions)

6) How long will Summer.fi Pro stay online?

The read-only version stays live for at least 12 months after Feb 12, 2026.

After that, Summer may keep it up or sunset it depending on resources.

7) What about my Summer.fi Pro automations?

Summer.fi Pro automations will stop working at the end of the Notice Period (Feb 12, 2026).

If you rely on automation today, you should:

- review what’s currently enabled

- plan to recreate/reset automation in DeFi Saver (if you want automation going forward)

8) What about my Lazy Summer deposits? Do I need to move anything?

No action required. Your Lazy Summer deposits remain on Summer.fi.

The whole point of this transition is that Summer.fi is now fully focused on improving Lazy Summer.

9) Is Lazy Summer changing because of this?

Your existing Lazy Summer vault positions continue as normal.

What changes is the company focus and distribution:

- more engineering focus on Lazy Summer improvements

- Lazy Summer will also become available via DeFi Saver Smart Savings (new distribution)

10) Will I still earn SUMR?

If you’re earning SUMR today through Lazy Summer or other SUMR-related programs, your ability to earn depends on the specific program rules (vault incentives, staking, etc.). This transition itself doesn’t “turn off” SUMR.

Also: DeFi Saver plans to support Lazy Summer inside Smart Savings and may run SUMR incentive moments there too, which helps grow adoption and SUMR utility.

11) What’s the “one sentence” summary for me?

- Lazy Summer: keep earning on Summer.fi as usual.

- Summer.fi Pro positions: start using DeFi Saver within the next 30 days so you’re set before Feb 11.

Join us

Discord | Telegram | X/Twitter | Linktree

Disclaimer: Oazo Apps Limited functions solely as a front-end interface (Summer.fi) provider and it does not act on behalf of any user. Oazo Apps Limited did not launch nor does it operate or control the Lazy Summer Protocol. The Lazy Summer Protocol is accessed through Summer.fi. The information provided herein is provided on behalf of the Lazy Summer Foundation which launched the Protocol for informational purposes only and it does not constitute investment advice. Oazo Apps Limited and the Lazy Summer Foundation are not soliciting or recommending any transaction or guaranteeing any specific returns. Users interact with the Protocol at their own risk. T&C for the use of Summer.fi apply.