September 2025 Governance Recap

The Lazy Summer DAO kept pushing forward on SUMR transferability readiness, with Governance v2, and upgraded staking hitting Sherlock audit. We also saw steady growth across chains, new RFCs on stables and new network integrations, and lots of strategy discussions around risk, fleets, and future expansion.

☀️ It's always summer somewhere, so stack your referrals and let Lazy Summer Protocol do the rest!!!

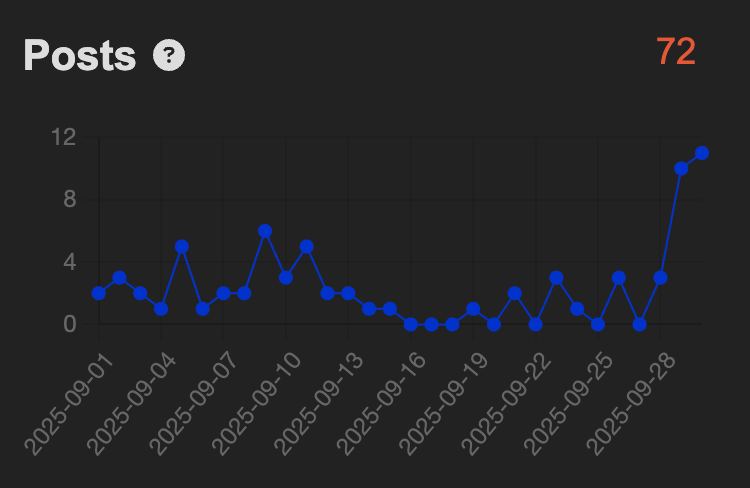

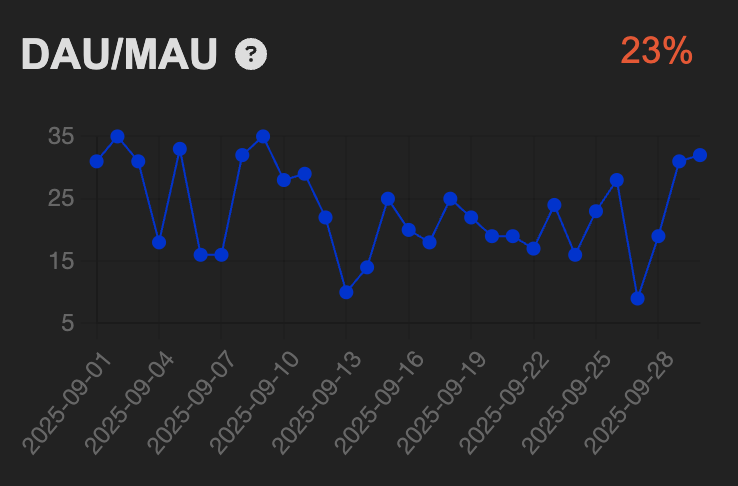

Here is the September overview of the forum metrics:

A total of 72 posts were recorded in September showing consistent governance discussions.

The DAU/MAU ratio averaged 23%, suggesting daily activity dipped, potentially concentrating around governance weekly cycles.

DAO Metrics:

| Parameter | August | September | Trend |

|---|---|---|---|

| Delegates | 514 | 521 | ↑ |

| SUMR Delegated | 353.62M | 360.5M | ↑ |

| DAO Treasury | $159,825 | $186,033 | ↑ |

| SUMR Holders | 5,046 | 5,536 | ↑ |

Delegate count climbed +7 and delegated SUMR grew by another 5M, showing continued confidence in Lazy Summer governance. The Lazy Summer Protocol added +$26K into the DAO treasury. SUMR holders rose by almost 500, growing the community of users.

Protocol Metrics:

| Chain | August | September | Trend |

|---|---|---|---|

| Ethereum | $114.27M | $143.19M | ↑ |

| Base | $21.96M | $25.12M | ↑ |

| Arbitrum | $6.39M | $9.81M | ↑ |

| Sonic | $6.01M | $4.61M | ↓ |

| TOTAL | $148.63M | $182.73M | ↑ |

Total TVL surged by $34M in September, driven primarily by Ethereum (+$31M). Sonic saw a decline of $1.5M.

| Asset Type | August (USD) | September (USD) | Trend |

|---|---|---|---|

| USD-pegged | $65.92M | $72.70M | ↑ |

| EUR-pegged | $3.54M | $3.27M | ↓ |

| Asset Type | August (USD) | September (USD) | Trend | August (ETH) | September (ETH) | Trend |

|---|---|---|---|---|---|---|

| ETH-pegged | $82.85M | $107.89M | ↑ | 18,858 | 26,035 | ↑ |

ETH-pegged assets soared (+$25M / +8K ETH), USD-pegged climbed +$7M, and EUR-pegged decreased by about -$200K. This mix shows an expansion across ETH and USD-pegged assets.

Notable RFCs:

- [RFC] Fluidkey Distribution of SUMR Tokens (September 5th) published by @jensei

Proposes a pilot SUMR distribution campaign via Fluidkey, leveraging their privacy-preserving accounts, auto-earn integration, and active user base.

- [RFC] ETH Strategy Perpetual Note (ESPN) Vault - High Risk Stables Vault (September 10th) published by @MasterMojo

Proposes adding the ESPN Vault as a new high-risk stablecoin strategy on Lazy Summer Protocol.

- [RFC] Onboarding Mainstreet Greenhouse USDC to the Sonic USDC.e vault (September 23rd) published by @Log

Proposes adding the Mainstreet Greenhouse USDC Silo Vault to the Sonic USDC.e vault.

- [RFC] Plasma Network Integration (September 30th) published by @MasterMojo

Proposes exploring integration with the newly launched Plasma Network, an EVM-compatible L1 optimized for stablecoin payments and DeFi.

SIPs in Focus:

- [SIP3.9] Delegate Rewards Distribution (August) (September 3rd) published by @jensei

Extends the delegate compensation program (first introduced in SIP5.6) to cover August 2025, rewarding active governance contributors for their participation.

- [SIP5.5.2] August Payouts for Referral Campaign (SIP5.5) (September 9th) published by @chrisb

Executes payouts for the August 2025 referral campaign previously approved in [SIP5.5].

- [SIP2.30] Add siUSD to Lower Risk USDC Vault (September 26th) published by @samehueasyou

Integrates InfiniFi’s siUSD into the USDC Mainnet Lower-Risk vault.

- [SIP3.10] Governance Staking Rewards Extension (September 29th) published by @jensei

Seeks to extend the current SUMR governance staking rewards for 25 days, bridging the period until the new Governance Module (Gov v2) launches at the end of October.

Tally Votes:

Published (September 3rd) / :white_check_mark: Passed & Executed

Published (September 4th) / :white_check_mark: Passed & Executed

Published (September 4th) / :white_check_mark: Passed & Executed

Published (September 4th) / :white_check_mark: Passed & Executed

Published (September 4th) / :white_check_mark: Passed & Executed

Published (September 9th) / :white_check_mark: Passed & Executed

Published (September 17th) / :white_check_mark: Passed & Executed

SUMR Transfer Readiness Working Group:

The @TR-WG contributors shared a major milestone this month.

- Governance V2, the new governance token, and the upgraded staking module are all now in Sherlock audit with 40,500 USDC prize pool. The 7-day contest ends October 7th, after which any findings will be applied before moving forward.

Considering the working group aligned, the next steps (according to @halaprix) will be:

- Grant governance & timelock roles to the Foundation multisig on all chains (Transitional Safety Net)

- Assign required roles to the new contracts

- Enable SUMR transferability

- Transition to new governance and (potentially) disable the old module

Timeline: The expectation is to recommend moving to Gov V2 & staking and enable SUMR transferability by the end of October.

Regarding the Liquidity:

Weekly updates are promised going forward as we enter the crucial final stretch toward transferability.

I would like to ask the community to keep in mind that the previously listed timeline was tentative, and a delay can always be expected - at the same time, there is a strong progress towards the SUMR transferability, now on the front of the development - which is amazing to see!

Get Involved:

Catch full details and join ongoing discussions on the forum and governance dashboard:

- Discord: Summer.fi

- Forum: https://forum.summer.fi

- Onchain Governance: https://gov.summer.fi

- Calendar: Notion

- DAO Dashboard: https://dune.com/lazysummer/lazy-summer-dao-governance

- Protocol Dashboard: https://dune.com/lazysummer/lazy-summer-protocol

- Token Dashboard: https://dune.com/lazysummer/sumr-claims

Shout out all the @Recognized_Delegates for doing the work!

See you on the Discord or Forum

Join us

Discord | Telegram | X/Twitter | Linktree

Disclaimer: Oazo Apps Limited functions solely as a front-end interface (Summer.fi) provider and it does not act on behalf of any user. Oazo Apps Limited did not launch nor does it operate or control the Lazy Summer Protocol. The Lazy Summer Protocol is accessed through Summer.fi. The information provided herein is provided on behalf of the Lazy Summer Foundation which launched the Protocol for informational purposes only and it does not constitute investment advice. Oazo Apps Limited and the Lazy Summer Foundation are not soliciting or recommending any transaction or guaranteeing any specific returns. Users interact with the Protocol at their own risk. T&C for the use of Summer.fi apply.