Selecting the appropriate Borrow Pair

So, you know why you are borrowing on Summer.fi, but you might be wondering which position is the best for me? This guide will help you determine just that.

What you need to consider

There are 6 key factors that you should consider

- Asset Selection: Which Collateral do you have or which do you deem as fungible and which Debt tokens do you want to have exposure to?

- Protocol: Which protocols do you trust?

- Liquidity: Is there enough available on offer for you to borrow?

- Borrow Rate, cost vs LTV / Max Available to borrow: How much do you want to be able to borrow against your collateral? and what at cost are you willing to pay to borrow?

- Borrow Rate, variability: How comfortable are you with rates changing rapidly?

- Protection, automation availability: Do you want access to Automated Position management tools?

How to choose collateral and debt tokens

Asset Selection: Which Collateral do you have or which do you deem as fungible and which Debt tokens do you want to have exposure to?

“What asset should I borrow against?”

The first thing you need to do is determine which asset you want to borrow against. This might be as simple as the asset in your wallet. For example, if you have 50 ETH in your wallet, you might only want to borrow against ETH. If you only want to borrow against a specific asset, simply select You might have multiple assets that you want to borrow against, or you might not care about slight variations in a similar asset (e.g., ETH vs.that collateral.

You might have multiple assets that you want to borrow against, or you might not care about slight variations in a similar asset (e.g., ETH vs. stETH or cbETH). In this case, select all the collateral types that you want to borrow against.

Next, you’ll need to ask yourself an important question

“What asset would I like to borrow?”

For most people, the answer to this question will be some kind of stablecoin. But, there are many different stablecoins.

If you have a specific one you want to borrow, you can simply select it, such as DAI only.

If you are comfortable with all of them, you can do that in one click.

If you only want the highest quality and most trusted, our “bluechip asset” tag makes that easy.

Or, if you like a specific set, you can only select that set, such as USDC and USDT.

How to choose a protocol?

- Protocol: Which protocols do you trust?

The decision you’ll have to make concerns the protocol you want to use in the backend. The great thing about Summer.fi is that we provide a layer of curation, so any choice is a good choice, but you can further refine your options to personalize and optimize your experience Summer.fi.

What do I care about most when it comes to protocols?

When it comes to protocols, most users care about two things: Safety and/or Flexibility.

To aid in this, we provide a few tags you can select.

Safety

All projects have audits, and most users are not technical enough to understand them. As such, a few other proxies that most use for safety are time or [Lindyness] ,https://en.wikipedia.org/wiki/Lindy_effect#:~:text=The Lindy effect, also known, proportional to their current age, as well as TVL, which can be thought as a proxy for the markets implicit trust.

On Summer.fi you can select for these two variables with our Longevity (projects that have been around >3 years) and >1B TVL tags.

Flexibility

Generally, Flexibility means a diversity of assets supported and types of pair types supported. The tag of Isolated Pairs allows you to select for this, as it selects for protocols that contain risks to single pairs only, allowing them to be more expressive.

Liquidity: Is there enough available on offer for you to borrow?

You know what you are going to deposit, you know what you are going to borrow, and you are confident in the protocol that you are going to use. What’s next?

Can I borrow the amount that I need?

This question concerns sufficient liquidity. To answer this question, the protocol you selected must have at least the amount of liquidity you need for a specific pair. For example, if you want to borrow 100,000 USDC, the minimum liquidity you require is 100,000 USDC.

Summer.fi makes this with a selector that allows you to choose just that!

How to consider borrow rates

- Borrow Rate Cost vs LTV / Max Available to borrow: How much do you want to be able to borrow against your collateral? and what at cost are you willing to pay to borrow?

You now know that it's possible to get precisely what you want. With sufficient liquidity, you can deposit the collateral you want and borrow the asset you want.

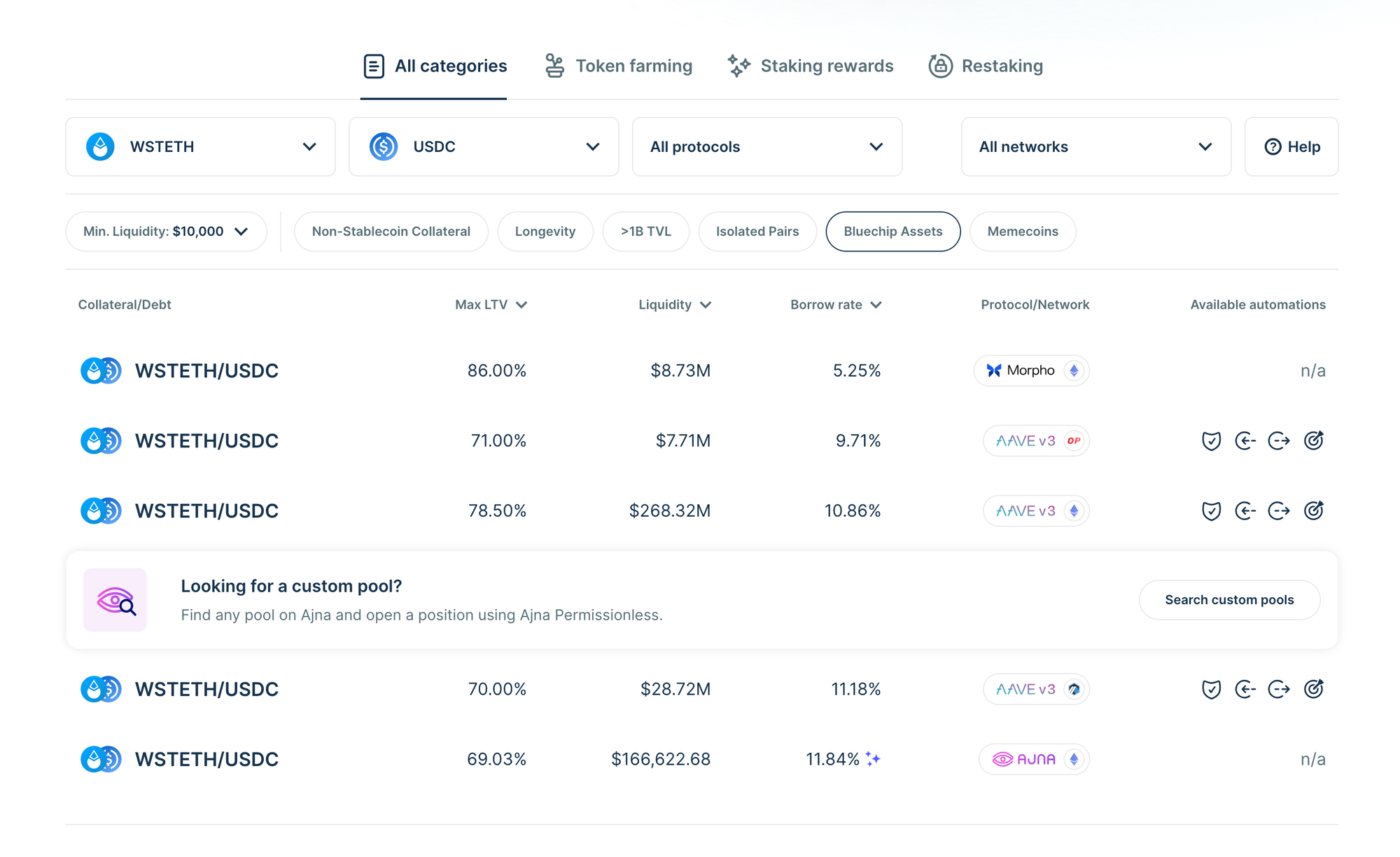

For some, you will notice that even for the same pair, you can have multiple options. Why?

For example, in the list below, I am presented with five options for the same pair.

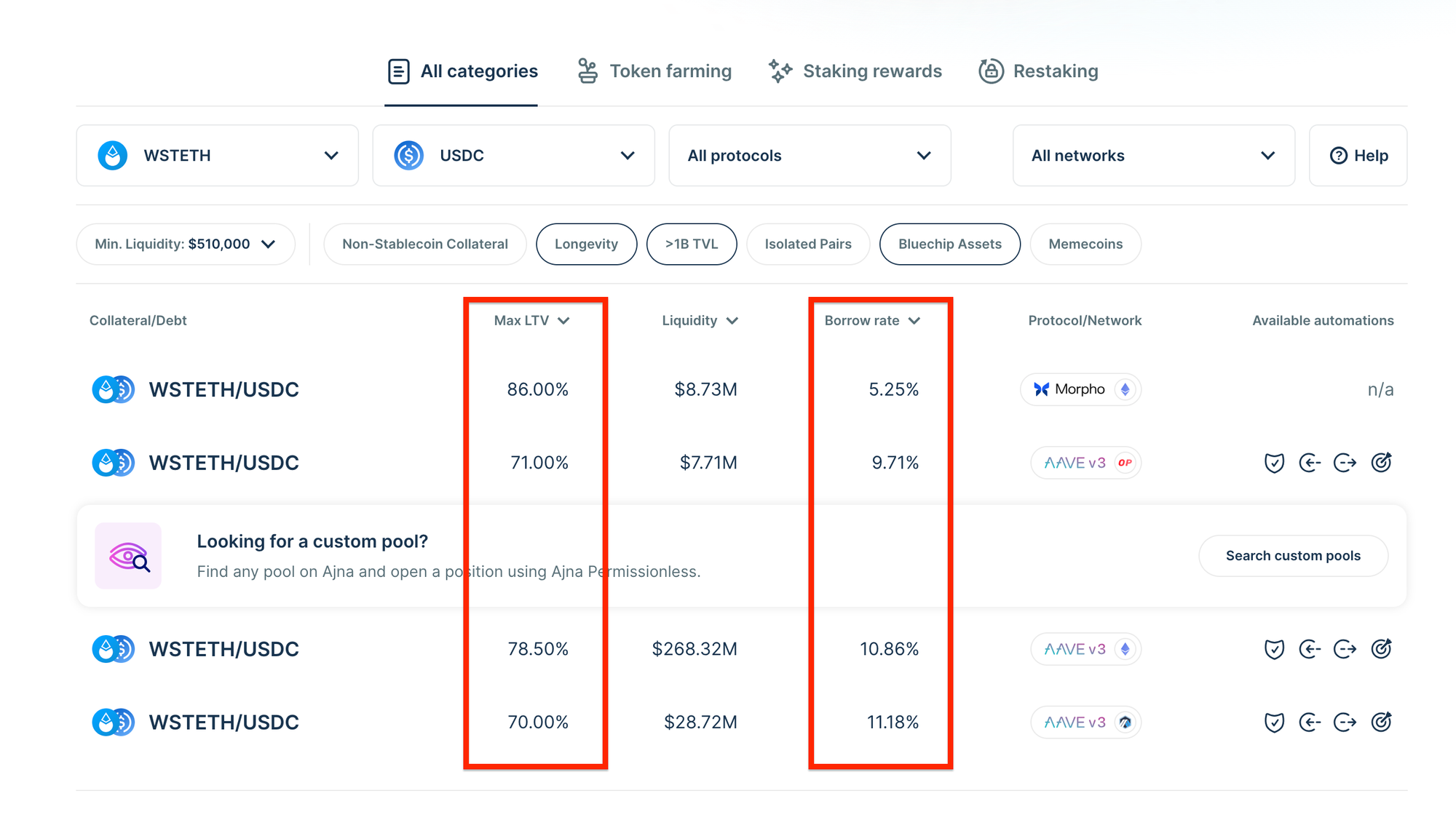

Given that we have already selected our protocol and specified the amount of liquidity we need, your options differ on two dimensions, Borrow Rate and Max LTV.

Start with Max LTV.

Max LTV is the highest loan-to-value ratio you are allowed. Practically speaking, it is the maximum you can borrow at any given time.

Whether loan-to-value you plan to borrow more or not, one advantage of choosing the higher LTV option, is that it will always give you a lower liquidation price. But this lower risk profile usually comes at a higher cost!

Determine how much you want to pay with the Borrow Rate.

Different pairs have different borrow rates, that is simply the difference in cost that you will on our outstanding debt.

Generally speaking, the higher the max LTV, the higher the borrow rate. However, a lower Max LTV generally also comes with a higher liquidation price.

How to know if you need position management automation

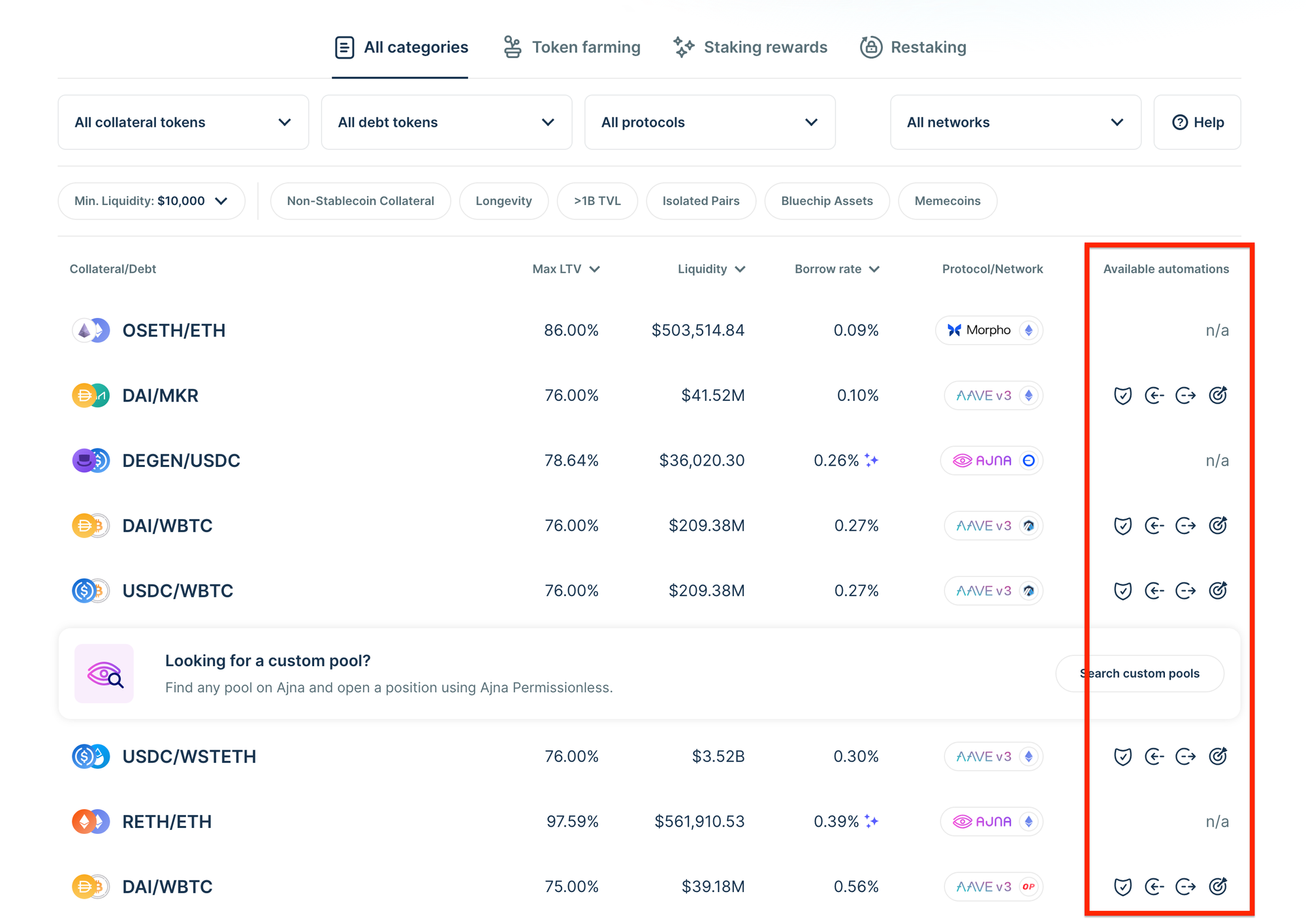

- Protection, automation availability: Do you want access to Automated Position management tools?

Do I want to worry about liquidation?

Unequivocally, the answer to the above question for most is…NO! As such, at Summer.fi, we make it really easy to view what automations are supported for any given pair.

Getting in touch

If you have any questions regarding Summer.fi, contact us at support@summer.fi or our social media.