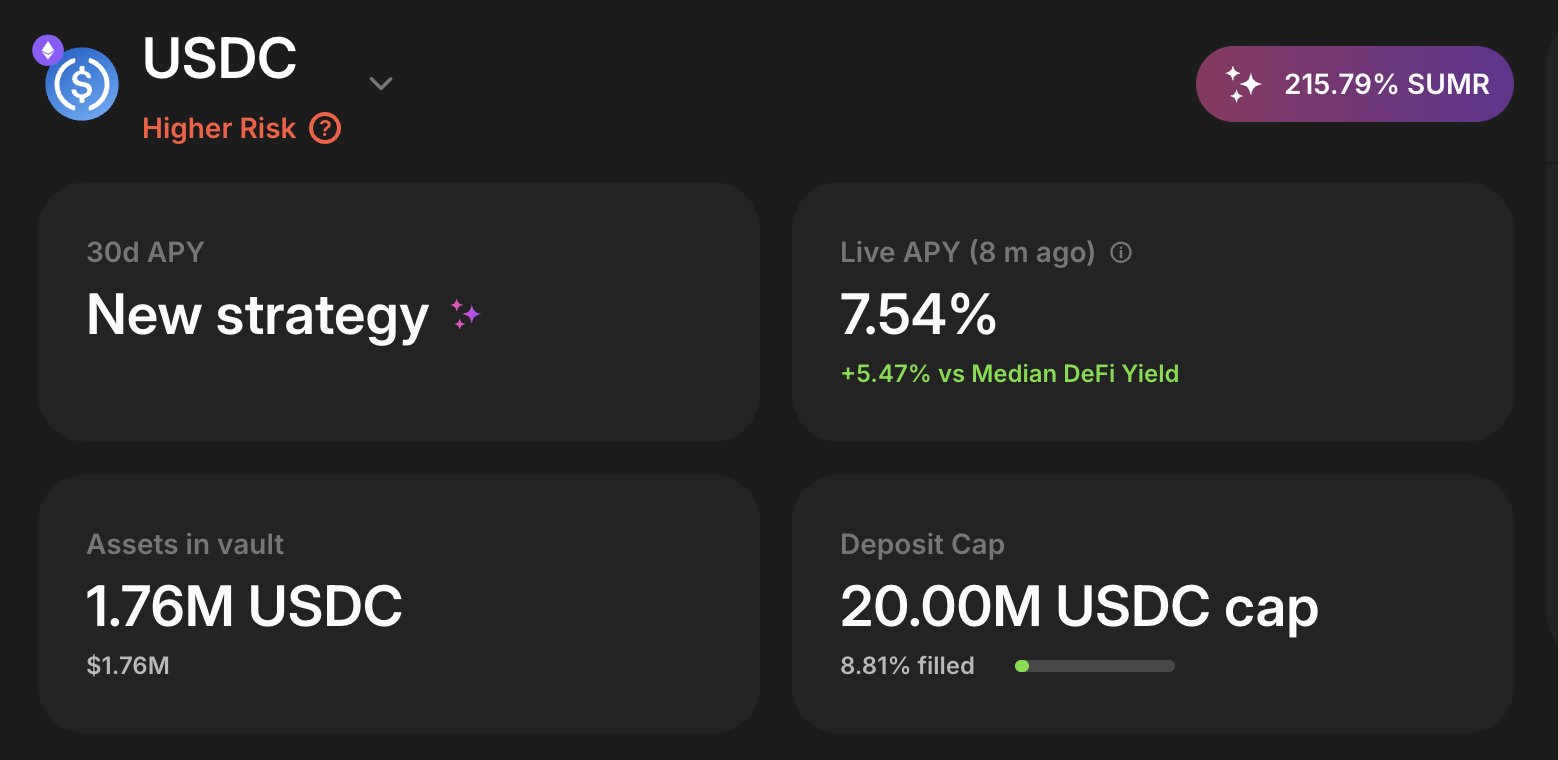

Say hello to USDC Higher Risk: DeFi’s more aggressive yields, made accessible

USDC Higher Risk on Lazy Summer gives you automated exposure to DeFi’s higher-yielding, more aggressive strategies—curated from the best protocols by expert risk curators.

This vault showcases the true power of Lazy Summer Protocol: diverse, barbelled yield strategies, AI-driven rebalancing, and professional-grade risk management, all in one.

The yield barbell: the new way to access DeFi’s higher yielding strategies

“Make sure you are barbelled, whatever that means in your business.” — Nassim Taleb, Antifragile

A barbell strategy avoids the mediocre middle: on one end, low-risk benchmark yields; on the other, high-risk, high-reward opportunities. USDC Higher Risk automates this approach, giving users access to both ends of the risk spectrum—without needing to lift a finger.

Most people want to earn more while doing less. And while we can’t make guarantees about your yield, here’s what the vault currently gives you exposure to:

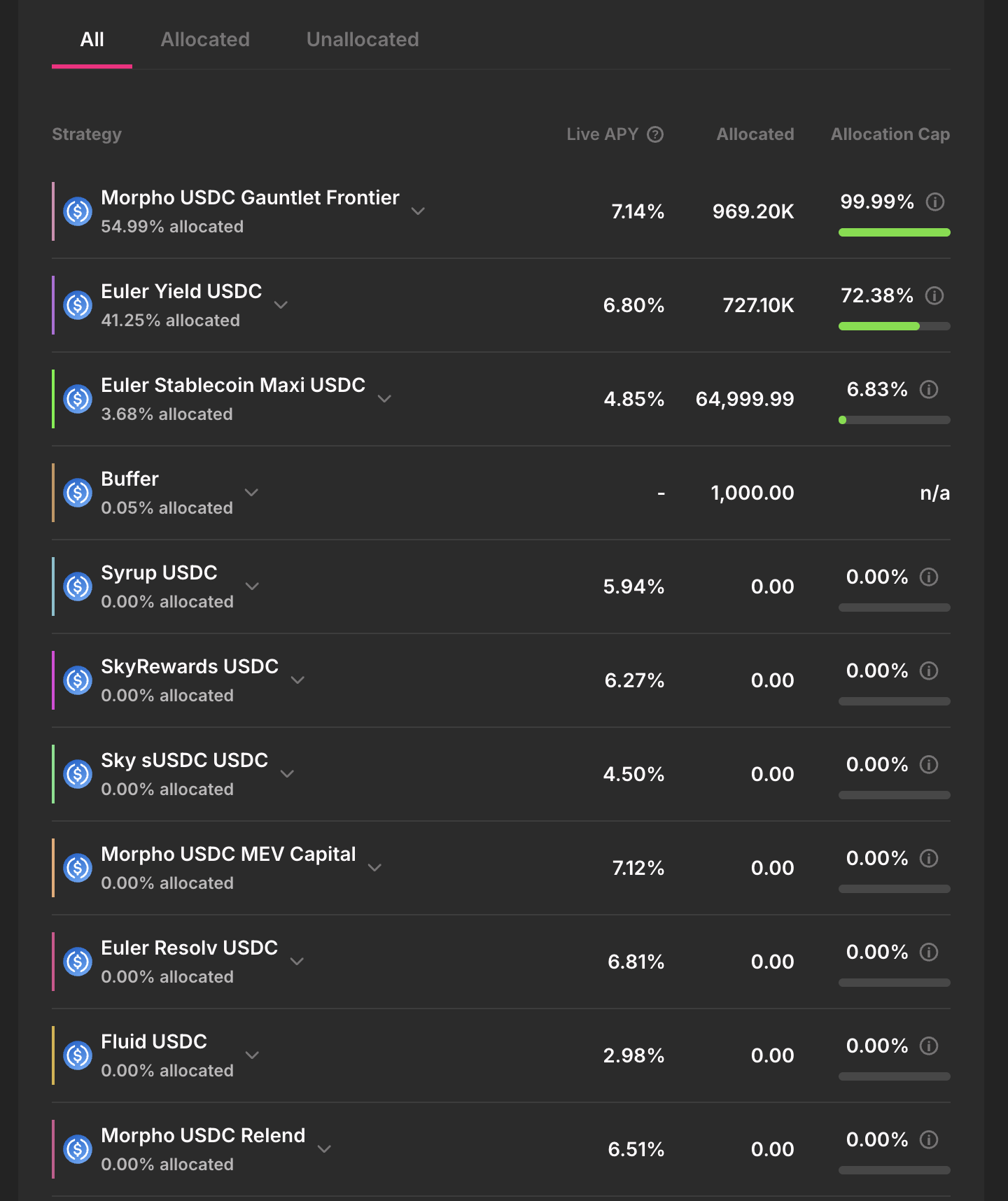

The barbell - benchmark Yield Strategies: DeFi’s tried and true yield

Low-risk, battle-tested yield strategies able to provide consistent returns and act as the foundation for a resilient portfolio. These are stablecoin lending protocols with strong risk parameters and long track records.

Sky sUSDs

A stablecoin lending strategy using sUSDs, where users earn yield by lending to overcollateralized borrowers via Sky's borrowers.

Yield Source: Stablecoin lending

Fluid USDC

A strategy that lends USDC into Fluid’s automated vaults, which route liquidity into on-chain lending protocols and funding rate capture strategies. Designed to offer stable yields with dynamic risk management across DeFi-native opportunities.

Yield Source: On-chain lending + funding rate arbitrage via automated vault allocation.

The barbell - risk seeking, higher Yield, higher Risk Strategies

These are DeFi-native opportunities with elevated return potential. Riskier borrowers, more volatile strategies, and more aggressive postures — but monitored and managed by risk curators to minimize downside exposure.

Morpho Gauntlet USDC Frontier A lending strategy on Morpho Blue featuring higher-risk assets and elevated LLTVs. Managed by Gauntlet, it targets borrowers that would otherwise be excluded from mainstream pools.

Yield Source: Lending interest from long-tail collateral.

Morpho Re-Lend USDC Strategy that recursively lends and borrows USDC across Morpho Blue to amplify returns. Designed to maximize the supply side yield while tightly managing liquidation risks.

Yield Source: Internal leverage from recursive lending loops

Euler Yield USDC Isolated USDC lending markets on Euler. This strategy provides access to higher interest rates from markets that support smaller and more volatile assets as collateral.

Yield Source: Lending to risk-adjusted collateralized borrowers.

Euler Resolve USDC Structured risk vault that targets asymmetric yield strategies across Euler’s lending ecosystem. Includes dynamic collateral targeting based on real-time oracle data.

Yield Source: Lending premiums from volatile market participants.

Euler Stablecoin Maxi A yield-maximizing approach across stablecoin lending pools on Euler. Designed to move across underutilized pools for excess returns. Yield Source: Lending stablecoins with lower utilization thresholds.

Sky Rewards USDS Lending USDS while also farming protocol rewards from Sky. Strategy balances core yield with emissions-based bonus yield.

Yield Source: Lending + SKY token rewards.

Maple Syrup USDC This strategy earns yield through Maple’s syrup vaults, which lend USDC into pools for institutional borrowers. Vault capital is diversified across high-quality, large borrowers.

Yield Source: Core yield comes from institutional lending, not from speculative trading or algorithmic sources.

Ethena sUSDe (coming soon) Synthetic dollar yield via delta-neutral ETH derivatives. The sUSDe position is hedged with perpetuals to maintain peg while generating yield from basis spreads.

Yield Source: Funding rate arbitrage and staking derivatives.

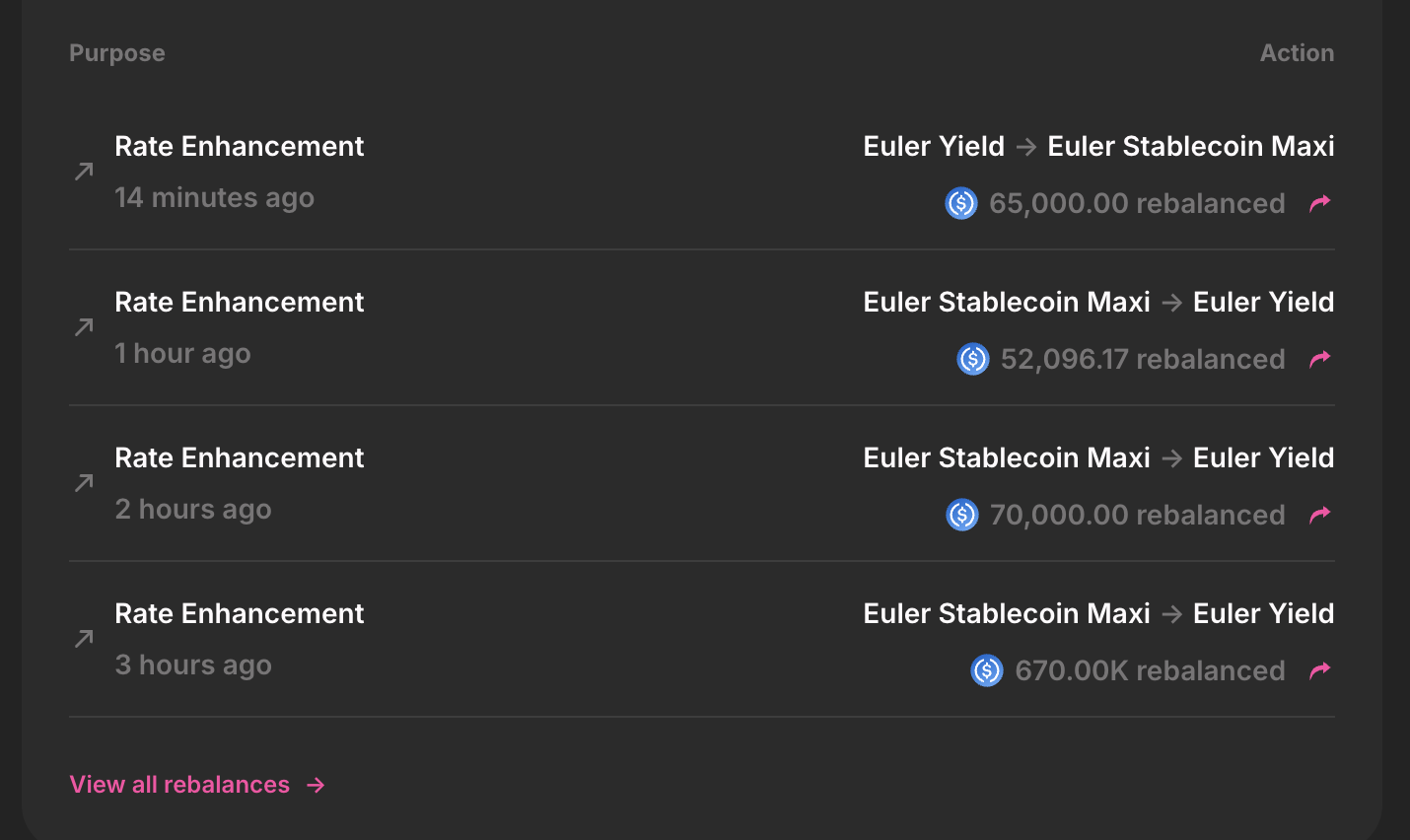

Yield that hyper adapts to the market, zero management

AI-Powered Rebalancing

Lazy Summer automatically monitors the yield and risk across every strategy. If the yield on a high-risk strategy drops below the benchmark, funds are pulled out. If a high-yield opportunity spikes, capital flows in. You never have to rebalance, monitor rates, or worry about missing out.

For example, if high-risk strategies drop below benchmark returns, capital is automatically weighted toward safer options.

Rapid Strategy Onboarding

New strategies can be added in as little as one week. This means you stay on the edge of innovation, with exposure to early alpha while still having professional oversight. For example, If a new Pendle opportunity offers 12%+ yield, it can be added within days.

What’s possible in the future?

Pendle LP positions, Uniswap v3 stablecoin pairs, Rumpel point-based rewards farming, Contango stablecoin loops, and much more.

Have an idea? Post it on the forum →

Why deposit in USDC Higher Risk on Lazy Summer?

Earn more

- Automated exposure to DeFi’s most rewarding strategies

- Continuous optimization to seek top yields across DeFi

Save time

- Set-and-forget. No more chasing APYs or rebalancing manually

- AI-powered reallocation means your yield is always working for you

Keep it simple, low cost

- One vault. All the best opportunities.

- No gas fees, no spreadsheets, no switching.Just a 1% annual AUM fee.

Offload risk management

- Strategies are risk-curated by Block Analitica, DeFi’s top risk team

- Protocol risk, collateral quality, and yield sustainability all monitored and managed for you

- Diversified allocations reduce exposure to single-strategy failure

$SUMR Rewards

- Earn SUMR tokens proportional to your deposit volume

- Rewards are distributed regularly and can be compounded or claimed

- SUMR offers governance power and additional earning via staking

How Lazy Summer works

Lazy Summer is a DeFi vault system that makes earning yield easy and smart:

- You deposit into a vault (like USDC Higher Risk), and your capital is spread across multiple strategies.

- A network of AI agents constantly checks what’s working best, then shifts your funds accordingly.

- Behind the scenes, risk experts (Block Analitica) decide which strategies are safe to include, and when to cap or remove exposure.

- As new opportunities arise, they’re quickly added—so your vault stays fresh and competitive.

Everything is visible on-chain, open-source, and governed by SUMR holders.

How to deposit into USDC Higher Risk

- Connect your wallet on Summer.fi

- Deposit USDC or any asset into the Higher Risk vault

- Earn yield instantly with auto-rebalancing enabled

- Migrate positions from Morpho, Aave and Compound in one transaction

- Already have a Lazy Summer Vault? Switch anytime with Vault Switch

Why trust Lazy Summer?

- Security: Smart contracts audited by leading firms like ChainSecurity

- Risk Management: Block Analitica oversees all vault parameters

- Track Record: Summer.fi has managed over $2.3B in assets with zero protocol-level losses

- Transparency: All strategies, yields, and rebalances are visible on-chain

Get started today – space is limited

- Capped at $20M max vault size initially – early deposits have priority

- SUMR rewards live now

- Deposit from any asset with built-in swap and migration tools

Join us

Discord | Telegram | X/Twitter | Linktree

Disclaimer: Oazo Apps Limited functions solely as a front-end interface (Summer.fi) provider and it does not act on behalf of any user. Oazo Apps Limited did not launch nor does it operate or control the Lazy Summer Protocol. The Lazy Summer Protocol is accessed through Summer.fi. The information provided herein is provided on behalf of the Lazy Summer Foundation which launched the Protocol for informational purposes only and it does not constitute investment advice. Oazo Apps Limited and the Lazy Summer Foundation are not soliciting or recommending any transaction or guaranteeing any specific returns. Users interact with the Protocol at their own risk. T&C for the use of Summer.fi apply.