Say Hello to Hyperliquid

The HyperEVM ecosystem is now live on Lazy Summer Protocol. Starting today, you can access high-quality yield from the industry's fastest growing L1 through curated vaults, which aggregate exposure across multiple premium yield sources including:

- Felix Protocol: CDP stablecoin minting and Morpho-powered lending markets

- HyperLend: Next-generation money market protocol with HyperCore integration

- Hypurrfi: Debt infrastructure and overcollateralized lending

- Hyperbeat/ Morphobeat - Automated meta-yield vaults and liquid staking infrastructure

All accessible in USDC and USDT markets, combining the best of HyperEVM's ecosystem points with SUMR rewards, all in one place.

Above benchmark yields. Built in cross protocol risk curation. No yield chasing. Now on HyperEVM.

Hyperliquid, DeFi’s next big ecosystem?

What is Hyperliquid?

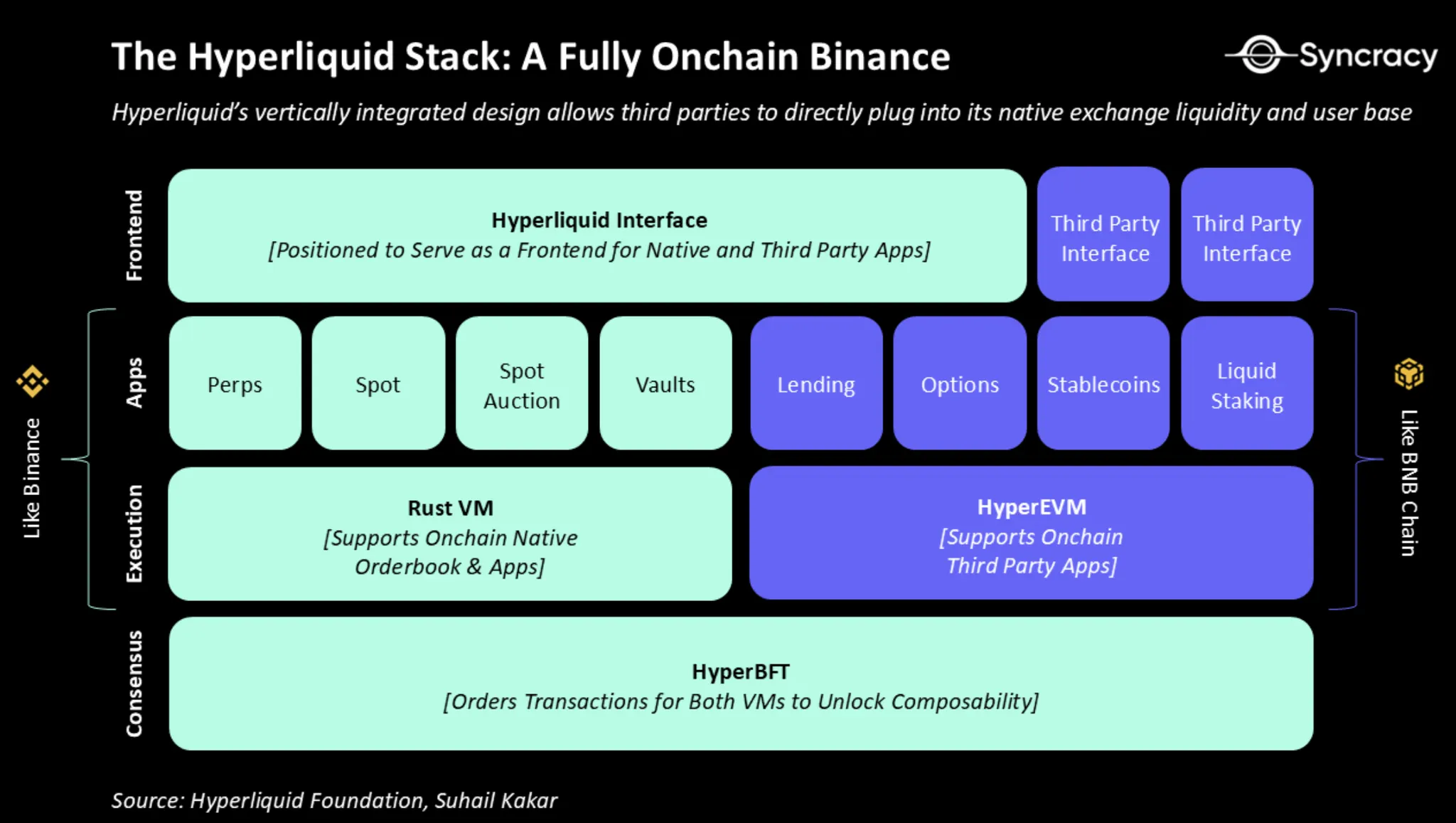

At a high level, Hyperliquid has two connected layers:

- HyperCore: the flagship perpetuals platform with onchain order books, margining, and a matching engine.

- HyperEVM: an EVM-compatible, general-purpose L1 designed to unlock DeFi composability for HyperCore.

This architecture creates something unprecedented: applications can read prices directly from HyperCore's order books, execute liquidations through native order flow, and build financial primitives that seamlessly bridge traditional DeFi and CEX-like trading infrastructure.

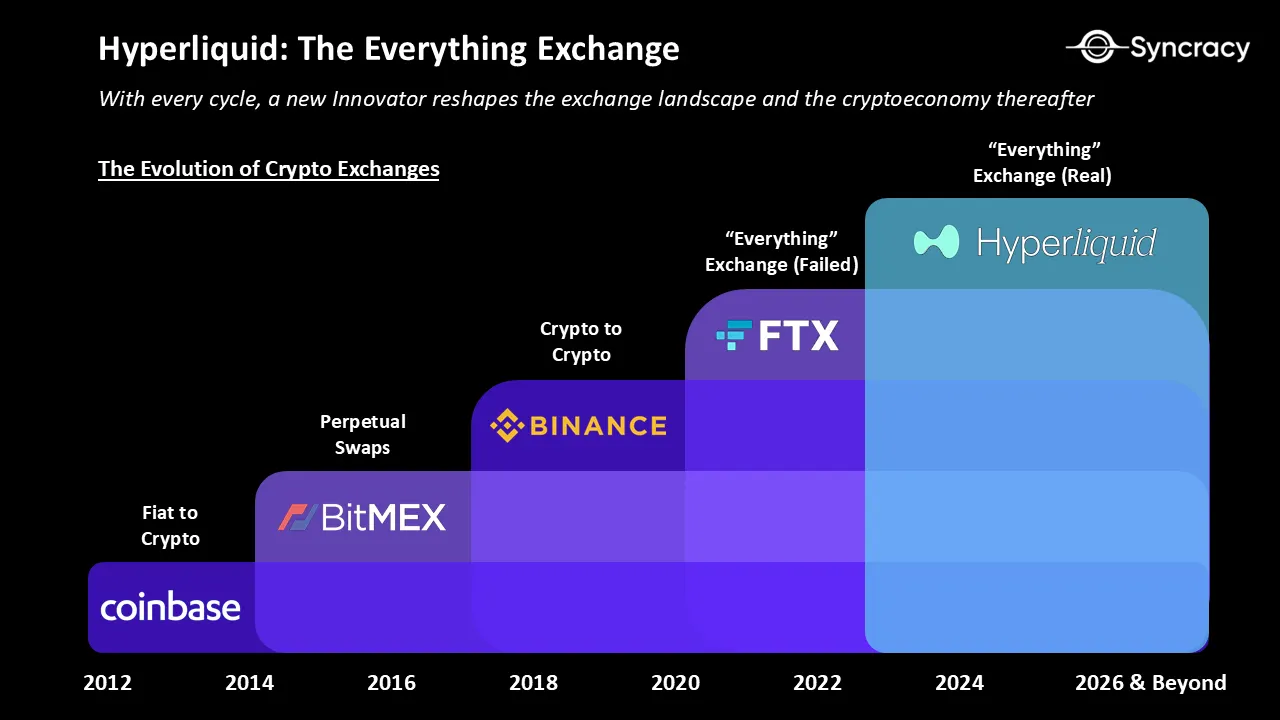

Why this matters: The "Everything Exchange" thesis

As outlined in Syncracy Capital's comprehensive Hyperliquid thesis, Hyperliquid is uniquely positioned to become what they call a "Financial Aggregator", combining two of crypto's most profitable business models: exchanges and smart contract platforms.

Hyperliquid's vertically integrated design, consolidating spot and derivatives markets while operating on its own high-performance blockchain positions it to become the "Everything Exchange."

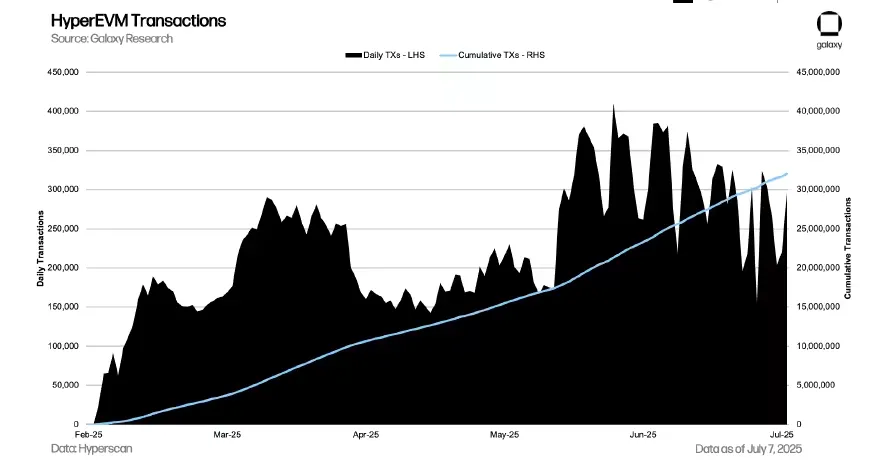

Growth: Hyperliquid as an L1 (the numbers)

Galaxy’s research captures it well, HyperEVM is being rolled out carefully so it doesn’t impact HyperCore, but it’s already showing traction in TVL, transactions, and app development.

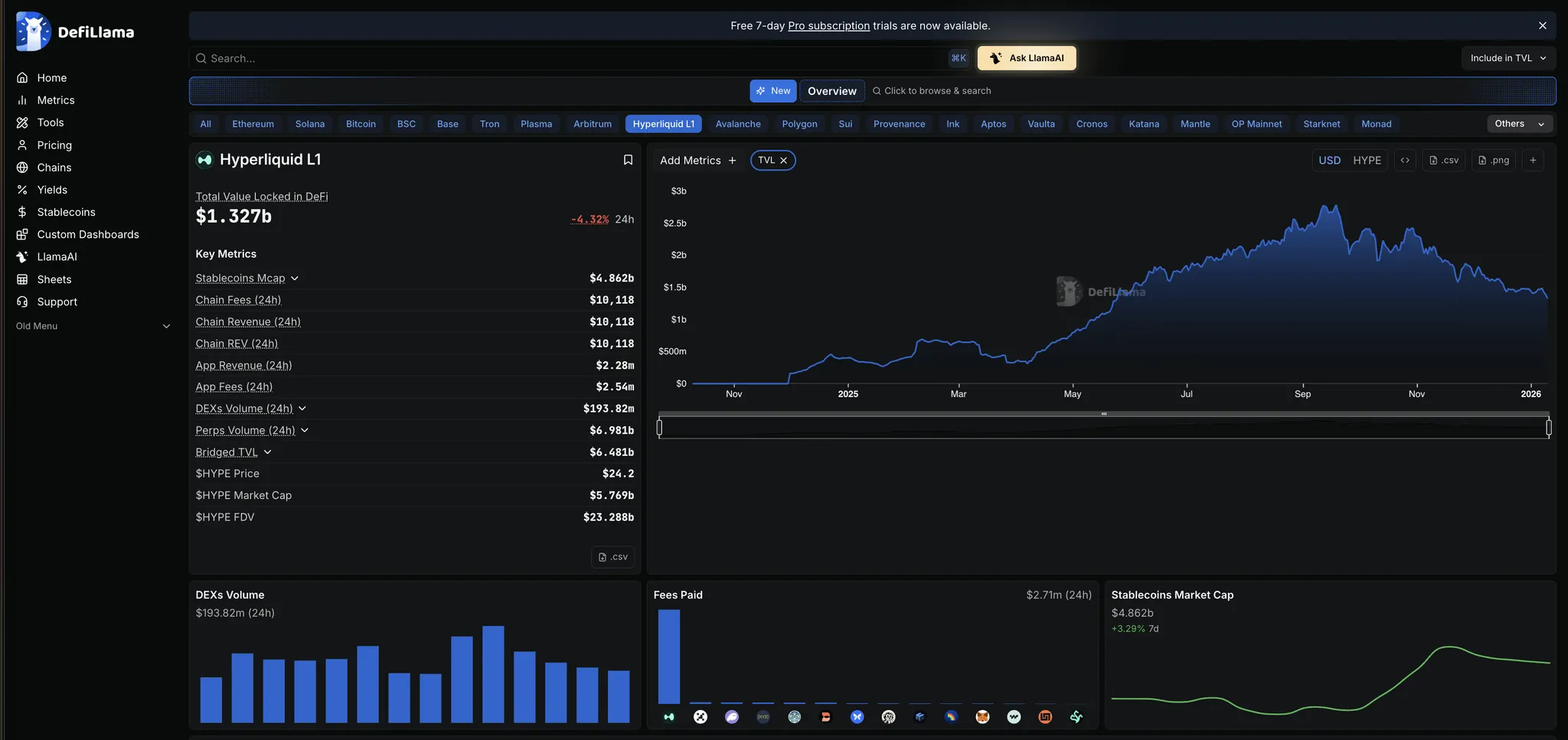

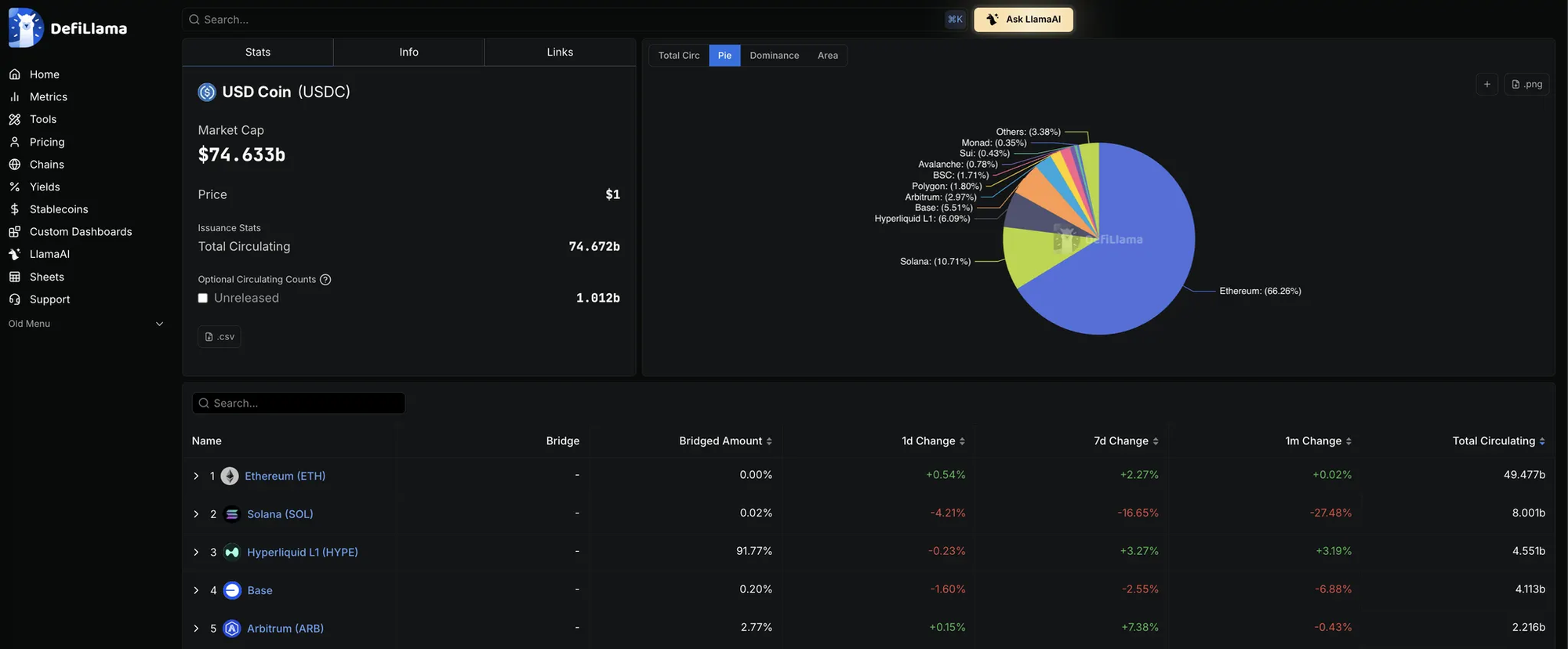

The numbers tell a remarkable growth story. According to DeFiLlama data, Hyperliquid has already become:

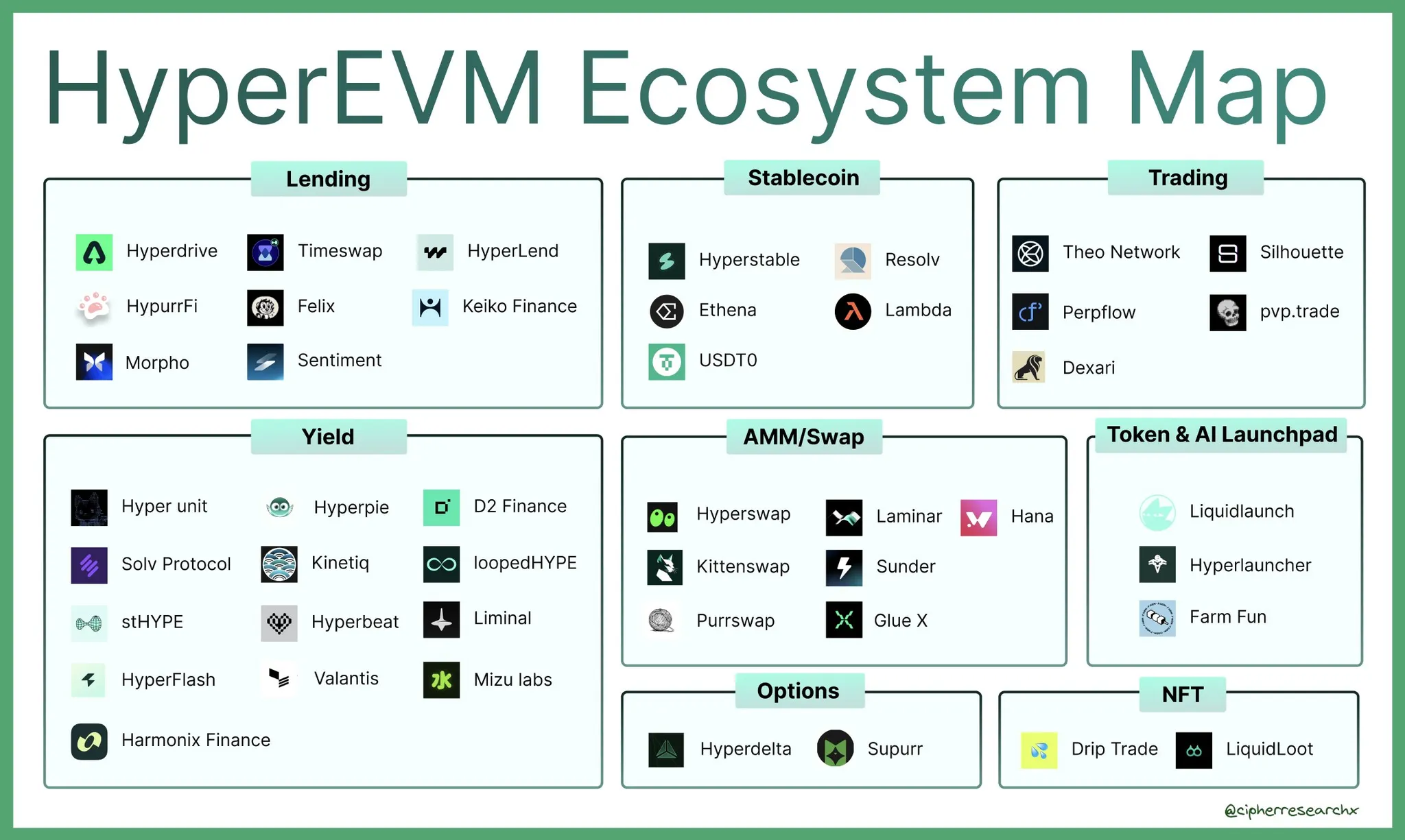

A quick map of the ecosystem: How HyperEVM has evolved

The DeFi landscape on HyperEVM is also rapidly maturing, with leading protocols establishing clear product-market fit:

https://x.com/CipherResearchx/status/1927438185648234589

To highlight a few:

Felix Protocol: provides two core primitives: a Liquity V2-style CDP market that mints feUSD stablecoin, and Morpho-powered vanilla lending markets. Felix enables users to borrow against HYPE, UBTC, and LSTs while earning protocol yield.

HyperLend: is the largest lending protocol on HyperEVM, offering core pools for multi-token lending, efficiency mode for correlated assets, and isolated pools for exotic collateral.

Hypurrfi: positions itself as Hyperliquid's debt infrastructure provider with lending/borrowing facilities, an overcollateralized stablecoin (USXL), built-in DEX functionality, and automated yield vaults.

Hyperbeat: is the ecosystem's native yield layer, offering liquid staking (beHYPE), automated meta-yield vaults, and Morpho-powered lending markets. With backing from Ether.fi ventures and Electric capital.

Lazy Summer Protocol x Hyperliquid: Doing Less

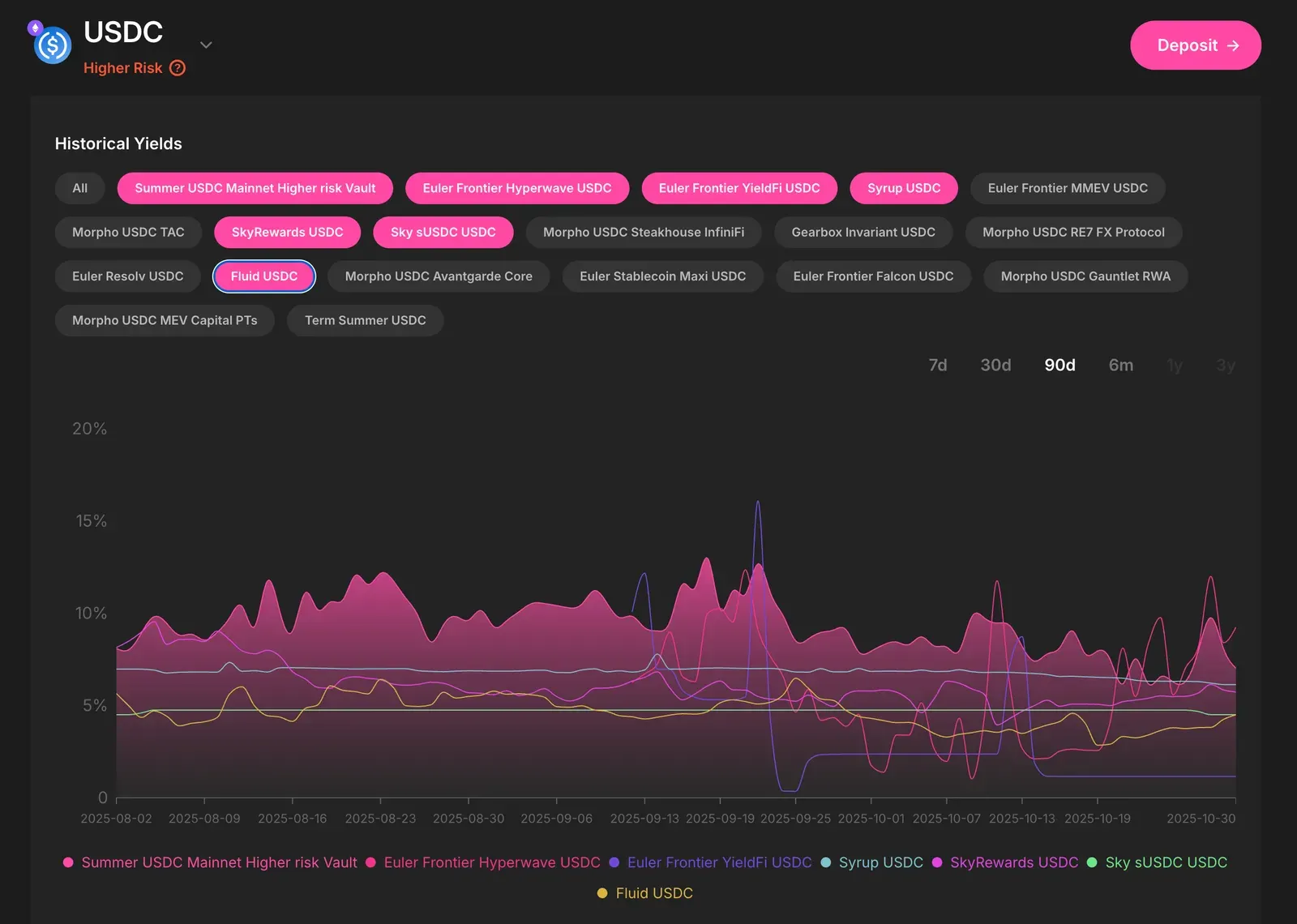

The Lazy Summer Protocol Promise → Now on HyperEVM, as outlined in our piece "The Lazy Summer Promise: Do Less," the DeFi yield stack has matured dramatically. What started as simple "deposit and earn" mechanics has evolved into a full onchain yield ecosystem: curated vaults, fixed-rate primitives, institutional onchain credit, and sophisticated money markets.

But growth brings growing pains. Earning the best risk-adjusted yield now requires:

- Tracking which markets are leading each month

- Monitoring risk limits and liquidity conditions

- Rotating deposits without compromising on safety

- Doing it again... and again

For DeFi natives, that's time and attention. For institutions, it's operational burden, governance overhead, and constant risk assessment.

The rapid growth and sophistication of the HyperEVM ecosystem creates is phenomenal, but it also means that as the yield landscape becomes even richer, it will also become more fragmented and complex to navigate. This is exactly where Lazy Summer Protocol excels.

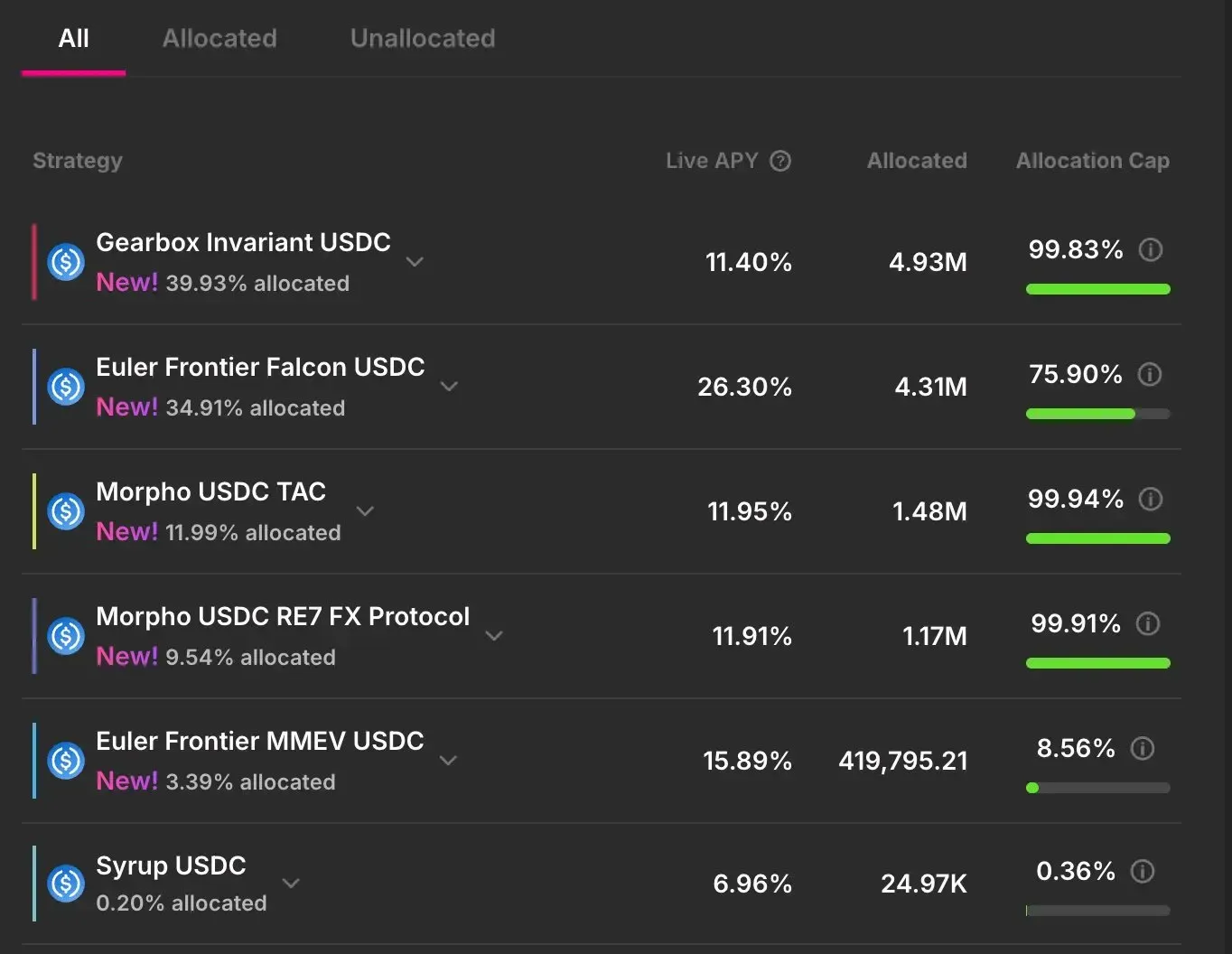

Lazy Summer Protocol aggregates diversified exposure to high-quality onchain yields with embedded, protocol-agnostic risk curation from top risk manager Block Analitica and automated rebalancing.

Now HyperEVM users get the same promise from Lazy Summer Protocol:

✅ Above-Benchmark Yield - Diversified exposure that consistently beats static deposits

✅ Risk Curation - Access to new yield sources inside a strict, governed framework

✅ No Yield Chasing - Governance and risk experts handle rotation discipline

Meet the Yield Sources

Specifcally, Doing Less on HyperEVM with Lazy Summer Protocol's vaults means curated exposure to the ecosystem's highest yield sources:

Hypurrfi

HypurrFi offers lending markets, yield vaults, and built-in DEX functionality, positioning itself as Hyperliquid's debt infrastructure provider.

Hyperbeat / Morpho

Hyperbeat is the ecosystem's native yield layer, backed by leading investors including ether.fi Ventures and Electric Capital. Through Morpho-powered vaults, Hyperbeat offers:

- Meta-yield vaults that optimize across HyperEVM and HyperCore

- Delta-neutral strategies utilizing funding rate arbitrage

- Liquid staking through beHYPE

- Credit layers enabling borrowing against vault positions

Hyperbeat's vaults typically generate the highest APYs in the ecosystem by combining multiple yield streams: lending yields, funding rate capture, liquidation profits, and strategy fees.

HyperLend

As the largest lending protocol, HyperLend provides institutional-grade money markets with HyperCore integration for liquidations. Key features include:

- Core pools for diversified lending

- Efficiency mode for higher LTV on correlated assets

- Isolated pools for exotic collateral

- Cross-chain liquidation execution

Felix Protocol

Felix combines CDP stablecoin minting (feUSD) with Morpho-powered lending markets, offering users flexibility across both primitives. Felix enables:

- Minting feUSD against HYPE, UBTC, and LST collateral

- Vanilla lending markets for major assets

- Stability pools for passive yield

- Integration with ecosystem stablecoins

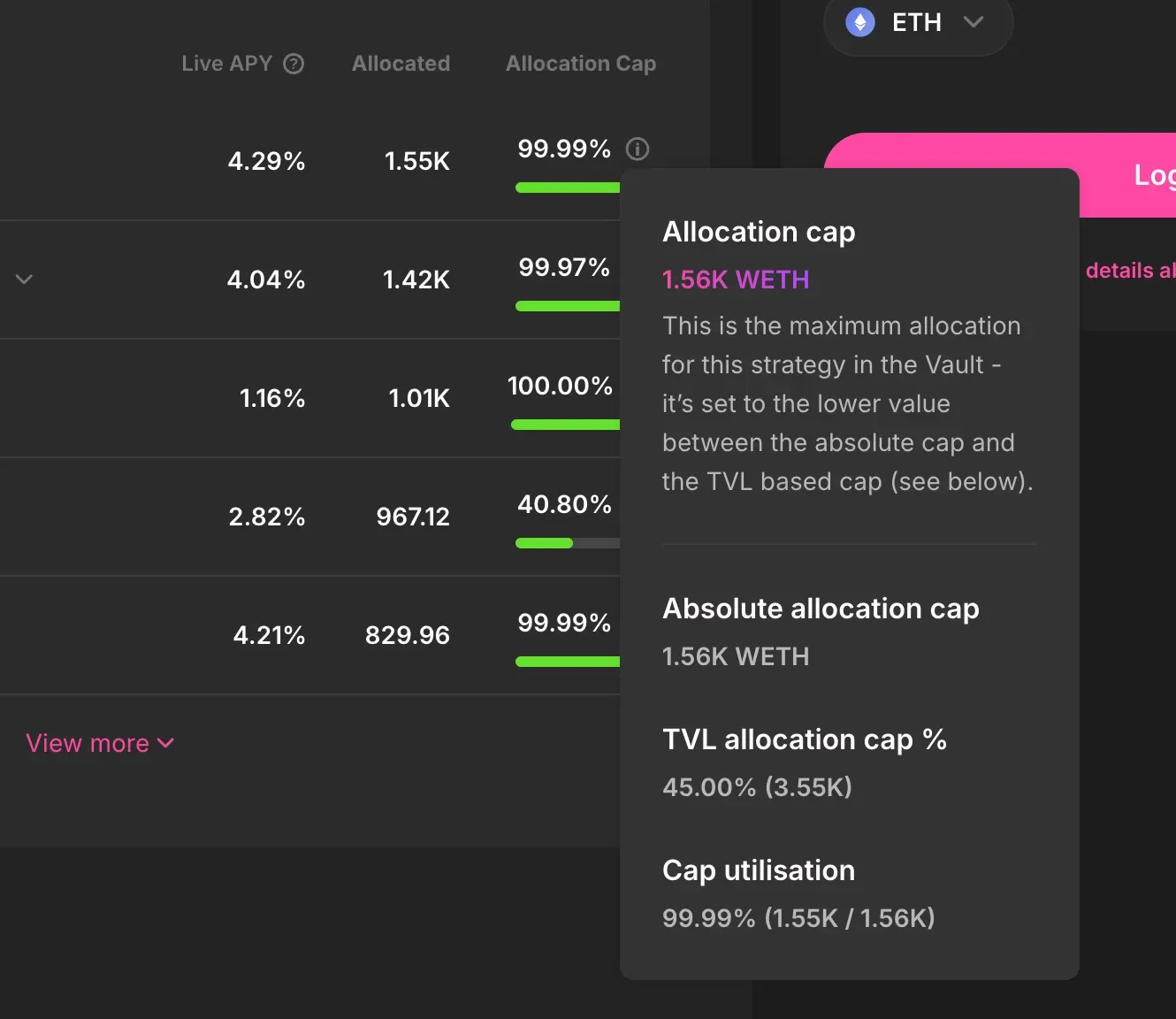

By aggregating across these protocols, Lazy Summer Protocol provides diversified exposure that reduces single-protocol risk while maximizing risk adjusted yield across the HyperEVM ecosystem.

Vault aggregation meets the everything exchange

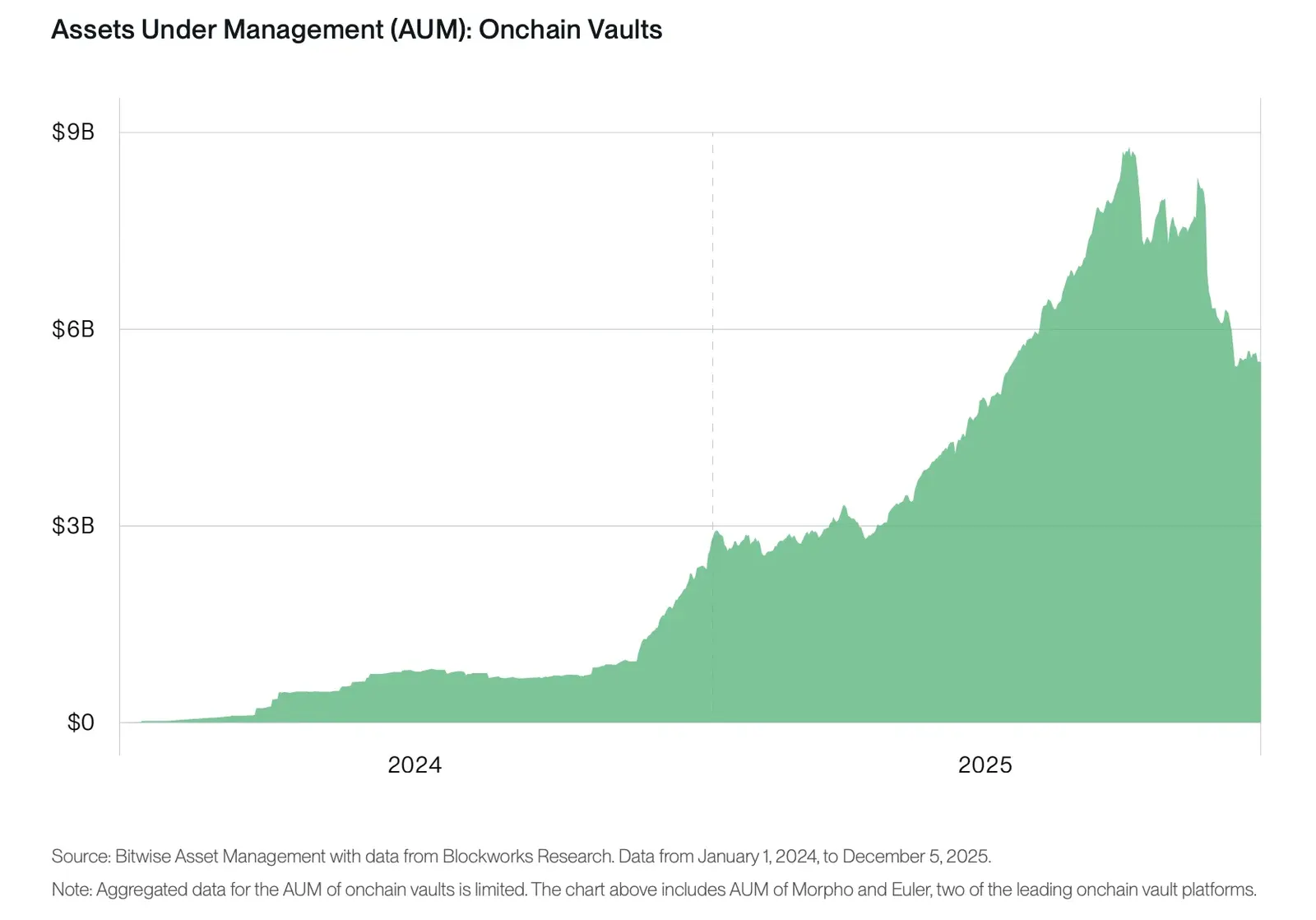

Our essay "2026 Will Be the Year of Onchain Vaults" makes a clear prediction: just as stablecoins proved the viability of onchain money, onchain vaults will prove the viability of onchain asset management.

The thesis is straightforward: vaults combine three properties that are hard to combine in traditional finance:

- Noncustodial infrastructure: Users don't hand assets to managers; assets live in verifiable contracts

- Programmability: Rules are enforced onchain through code, not policy

- Composable integration: Any wallet or app can integrate vault exposure through standard interfaces

This creates a hybrid transparency model where custody and balances are public and verifiable, while strategy logic can remain partially private to prevent front-running.

As Matt Hougan of Bitwise argues, vaults may eventually replace large parts of traditional asset management because their structure is simply superior, much like how ETFs replaced mutual funds. Bitwise's 2026 predictions put it bluntly: major financial publications will label vaults "ETFs 2.0."

Hyperliquid accelerates this thesis. The combination of deep native liquidity, sophisticated yield sources, and a captive audience of engaged users creates ideal conditions for vault adoption. But as the ecosystem proliferates, with 175+ projects building and new strategies launching weekly, navigating this landscape becomes increasingly complex. When onchain vaults meet the everything exchange, it resulted in supercharged aggregation and superior end user experience.

https://www.syncracy.io/writing/hyperliquid-thesis

Just the beginning

Hyperliquid represents far more than just another yield opportunity. It's an entry point into the broader Hyperliquid ecosystem. In the future, Lazy Summer Protocol looks forward to providing curated access to even more of the ecosystem, such as:

- USDH: The native stablecoin of Hyperliquid.

- HYPE as a deposit asset: Yield on hyperliquid’s native asset and HyperEVM gas token.

- Other yield sources: Expand into additional HyperEVM ecosystem protocols

How to Get Started

Getting started with HyperEVM on Lazy Summer Protocol is designed to be simple, but those new to the HyperEVM ecosystem might need some assistance. Watch the tutorial or read below.

1a. Get Your Deposit Token + HYPE for Gas

Ensure you have:

- USDC or USDT for depositing into vaults

- HYPE for gas fees on HyperEVM transactions

You can swap other assets to USDC/USDT on HyperSwap or other HyperEVM DEXs. HYPE can be purchased on Hyperliquid's spot exchange and transferred to EVM.

1b. Bridge to HyperEVM

You'll need to bridge assets (HYPE and Deposit assets USDC or USDT) to the HyperEVM network. You can bridge from multiple chains including:

- Ethereum Mainnet

- Arbitrum

- Base

- Other major L1s and L2s.

HyperEVM bridge options:

3. Deposit and Do Less

Once you have your assets ready:

- Visit summer.fi/earn

- Connect your wallet to HyperEVM

- Deposit your USDC or USDT

- That's it - your assets are now earning across multiple HyperEVM yield sources automatically

The vaults handle everything else: monitoring markets, rebalancing positions, managing risk, and maximizing your risk-adjusted returns.

Do Less.

Rewards, Rewards, Rewards

One of the most compelling aspects of participating in the HyperEVM ecosystem through Lazy Summer Protocol is the layered rewards structure.

Access the HyperEVM points ecosystem in one place

By depositing into Lazy Summer Protocol's HyperEVM vaults, you gain exposure to ecosystem points from:

- Felix - Accumulate points toward the Felix protocol airdrop.

- Hypurrfi - Earn Hypurrfi points (HP) which use a multiplier system to reward long-term participants and larger positions.

- HyperLend - Accumulate lending activity points from the largest lending protocol on HyperEVM.

- Hyperbeat Hearts - Hyperbeat's points program allocates 51 million "Hearts" to participants based on engagement with their products.

Instead of manually managing positions across 4+ protocols to maximize points, Lazy Summer Protocol automatically distributes your capital across these yield sources, ensuring you capture ecosystem points while our risk framework keeps your deposits safe.

SUMR Rewards

On top of HyperEVM ecosystem points, all Lazy Summer Protocol depositors earn SUMR rewards.

What is SUMR?

SUMR is Lazy Summer Protocol's native protocol token, designed to align long-term users with long-term protocol growth.

SUMR TGE: January 21, 2026

The SUMR Token Generation Event (TGE) is happening on January 21, 2026.

The TGE will launch via Aerodrome Ignition on Base, making SUMR fully liquid and tradeable. After TGE, the "Do Less" promise stays the same, but with more upside embedded via SUMR rewards and SUMR Staking.

You'll not only earn yield through curated strategies and ecosystem points from HyperEVM protocols, but you'll also have real economic ownership in the protocol that powers them.

Key TGE Details:

- Launch date: January 21, 2026

- Platform: Aerodrome Ignition on Base

- All previously earned SUMR rewards become liquid

Ready to get started?

👉 Visit summer.fi/earn to access HyperEVM vaults

👉 Mark your calendar: January 21, 2026 for SUMR TGE

👉 Join the conversation: Follow updates on Summer.fi's social channels

Join us

Discord | Telegram | X/Twitter | Linktree

Disclaimer: Oazo Apps Limited functions solely as a front-end interface (Summer.fi) provider and it does not act on behalf of any user. Oazo Apps Limited did not launch nor does it operate or control the Lazy Summer Protocol. The Lazy Summer Protocol is accessed through Summer.fi. The information provided herein is provided on behalf of the Lazy Summer Foundation which launched the Protocol for informational purposes only and it does not constitute investment advice. Oazo Apps Limited and the Lazy Summer Foundation are not soliciting or recommending any transaction or guaranteeing any specific returns. Users interact with the Protocol at their own risk. T&C for the use of Summer.fi apply.