[RECAP] SUMR Transferability Community Call #3

![[RECAP] SUMR Transferability Community Call #3](/content/images/size/w2000/2025/11/Group-427321492.png)

Thanks to everyone who joined the third SUMR Transferability Community Call.

This session focused on final readiness for SUMR transferability, the rollout of Governance V2 and the new Staking & Lock Module (Staking V2), and a walkthrough of the updated staking interface. For the first time, participants got a preview of how users will migrate, stake, lock, and start earning dual rewards (SUMR + USDC) distributed from protocol revenue.

Below is a full recap of the call.

Context & Timeline

The process for SUMR transferability remains on track, with a small procedural update.

- The Sherlock audit contest for Governance V2 & the Lock Module is nearly finished; no critical issues, and final parameter reviews are in progress.

- To avoid delaying deployment by another week, contributors proposed a combined governance vote that will:

- Add the Lazy Summer Foundation multisig as a temporary governor (to perform whitelisting).

- Allow the Foundation to whitelist the staking contracts immediately upon deployment, without waiting for a second vote.

[SIP]: [SIP5.13] Multi-chain Foundation Roles Setup

[TALLY]: Lazy Summer DAO (Official) | SIP5.13: Multi-Chain Foundation Roles Setup

The target for SUMR transferability remains: November 18th (pending DAO approval), with initial transferability launching on Base, with expansions to mainnet and other chains later.

As shared during the call:

“We are living up to the same timeline; governance stays in control, and we avoid unnecessary slippage.”

Staking V2 & How Locking & Rewards Will Work

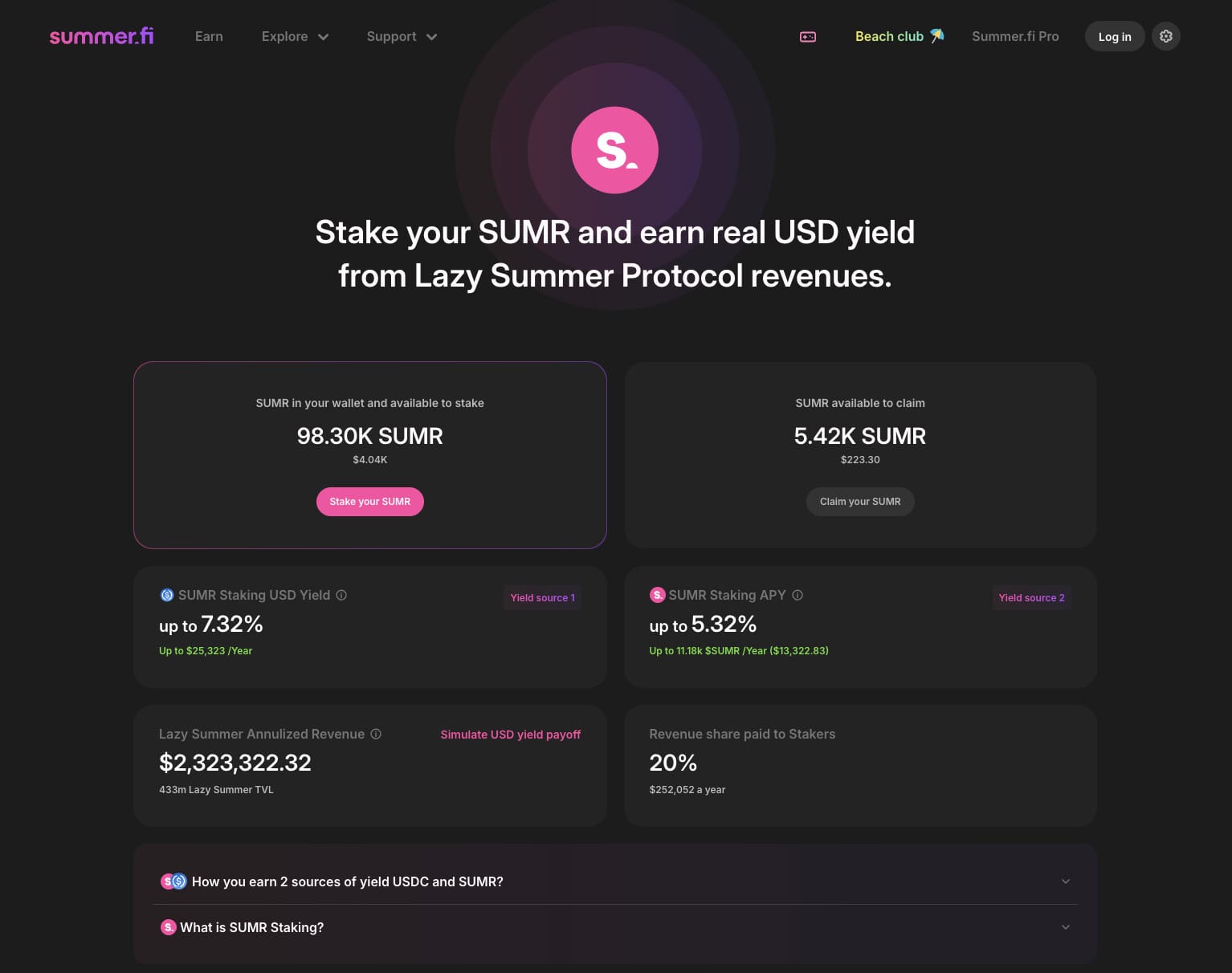

On this call, Summer.fi product manager Jordan demoed the new Staking & Lock module UI, where SUMR becomes productive governance.

Dual Rewards for Lockers:

- SUMR emissions (~5,000/day—proposal live on forum)

- USDC from protocol revenue (20% of protocol yield), distributed as LV (vault) tokens, which continue compounding automatically!

WIP for the Staking UI:

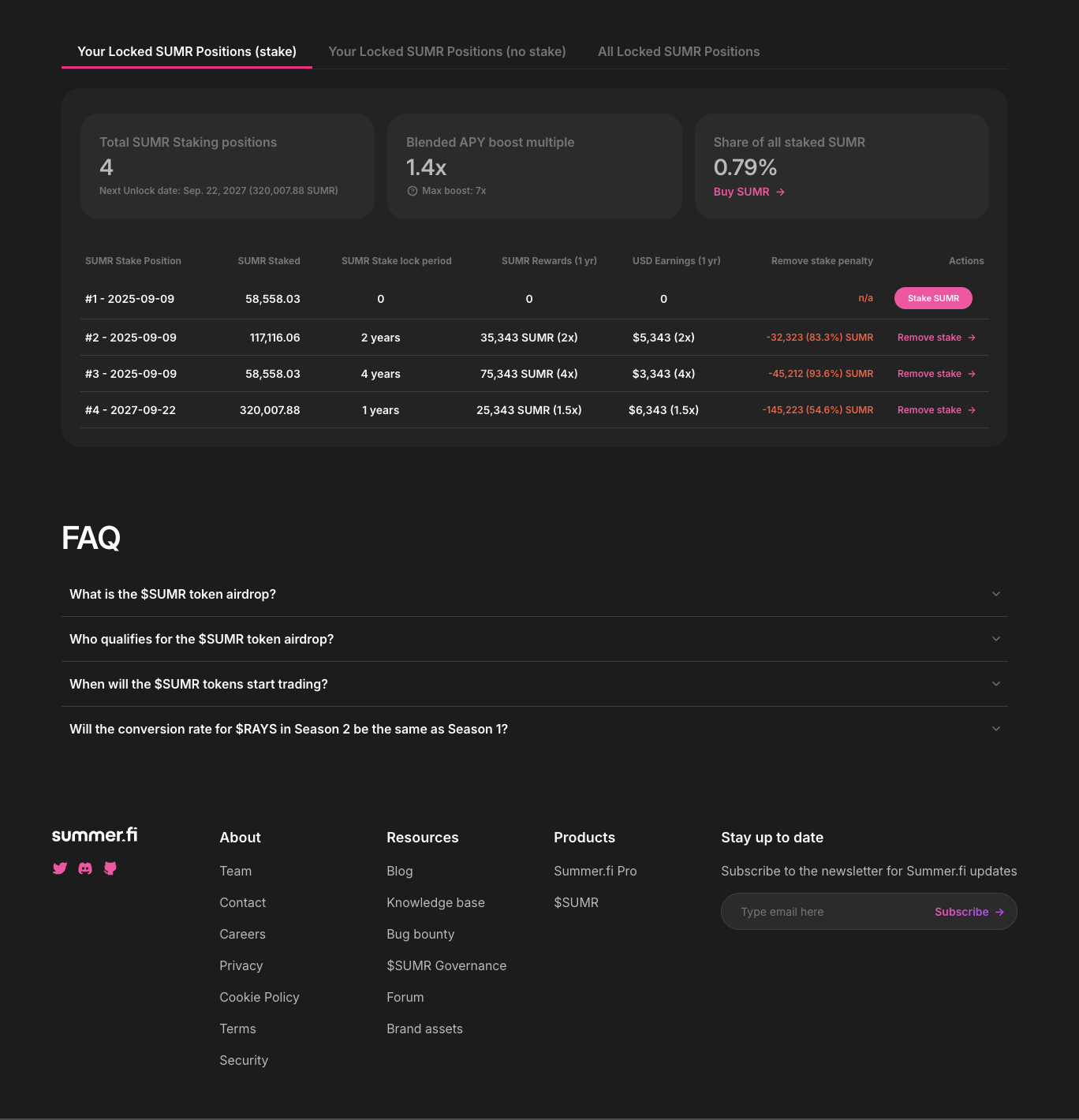

Locking Mechanics:

- Choose lock duration → receive a multiplier on voting power + yield

- Range: no lock (1x) → 3 years (~7.26x)

- Locks are non-extendable → plan ahead or use multiple lock positions (e.g. 3-year + 6-month split).

WIP for the Locking UI:

WIP for the All Locked SUMR UI:

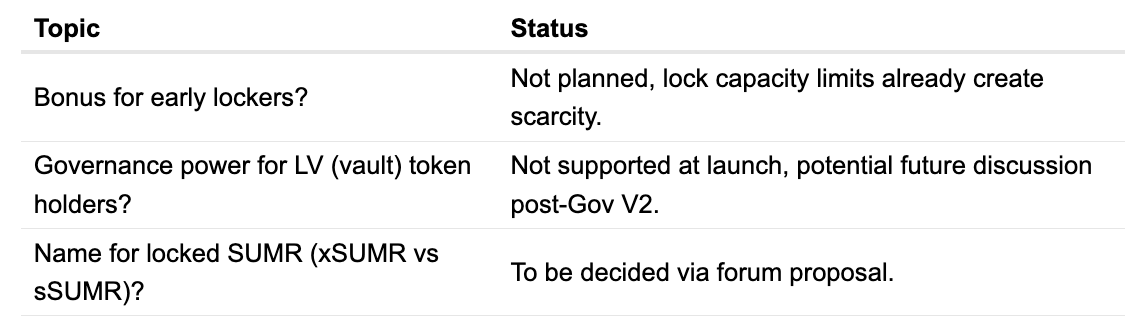

Capacity Limits (NEW):

Each lock duration has a maximum SUMR capacity.

- If a lock “bucket” is full → UI shows it as unavailable.

- Users can choose a shorter duration or lower the amount.

- Governance can vote to increase caps in the future.

As shared during the call:

“It’s conviction-weighted staking but with built-in scarcity.”

Rewards, Yield Loops & Transparency

The UI now helps users see how their lock contributes to long-term value.

Revenue → USDC to Lockers Flow:

More SUMR locked → stronger price → higher vault APY → higher TVL → more protocol revenue → more USDC rewards to lockers.

The UI shows:

- Expected USDC earnings.

- % of total SUMR supply locked.

- Average lock duration to gauge community conviction.

- Real-time available capacity per lock term.

This should add both transparency and social proof to governance participation.

Migration to Governance V2

Migration is manual (opt-in) as no one is forced. Users will be able to migrate on their own, directly via the new UI.

Migrating to V2 gives access to:

- SUMR daily emissions

- 20% USDC revenue sharing (as LV tokens)

- Full voting and delegation in the new governance system (xSUMR / sSUMR; naming to be finalized on the forum)

Important:

- You cannot extend a lock duration after creating it

- Early withdrawals are possible anytime, but with a penalty (up to 20%, linearly decreasing over time), depending on the lock period.

Liquidity & Launch Strategy

- The Lazy Summer DAO treasury will bootstrap initial liquidity, likely SUMR paired with stable assets on Aerodrome (Base).

- Community LPs will be encouraged to join, expected to be incentivized with SUMR rewards & USDC via governance proposal.

- Full liquidity parameters (fees, gauges, emissions) will be posted to the forum before deployment.

- Transferability won’t be a “free-for-all”; it will be intentional, aligned with incentives, and clear onboarding education.

How to Prepare

For existing SUMR holders:

Decide your lock strategy, multiple durations if needed.Review Governance V2 migration process.Confirm your delegate, or plan to vote yourself.Be ready for the whitelisting + transferability vote.

For new users or Base newcomers:

Bridge funds to Base.Keep some ETH for gas.Follow upcoming staking tutorials.

For LPs:

Watch for the Aerodrome liquidity proposal on the forum.Review incentives and parameters before contributing.

Open Questions / Future Possibilities

Next Milestones

- Publish staking & locking tutorials.

- Treasury plan for Aerodrome liquidity

- Governance vote to enable transferability

Expected SUMR transferability: around Nov 18th

Closing Thought

Every week brings us closer, so if you haven’t joined this time, keep an eye out for the next community call soon.

Stay strong in these turbulent times, and get ready for the Summer to SUMR transition with us!

Join us

Discord | Telegram | X/Twitter | Linktree

Disclaimer: Oazo Apps Limited functions solely as a front-end interface (Summer.fi) provider and it does not act on behalf of any user. Oazo Apps Limited did not launch nor does it operate or control the Lazy Summer Protocol. The Lazy Summer Protocol is accessed through Summer.fi. The information provided herein is provided on behalf of the Lazy Summer Foundation which launched the Protocol for informational purposes only and it does not constitute investment advice. Oazo Apps Limited and the Lazy Summer Foundation are not soliciting or recommending any transaction or guaranteeing any specific returns. Users interact with the Protocol at their own risk. T&C for the use of Summer.fi apply.