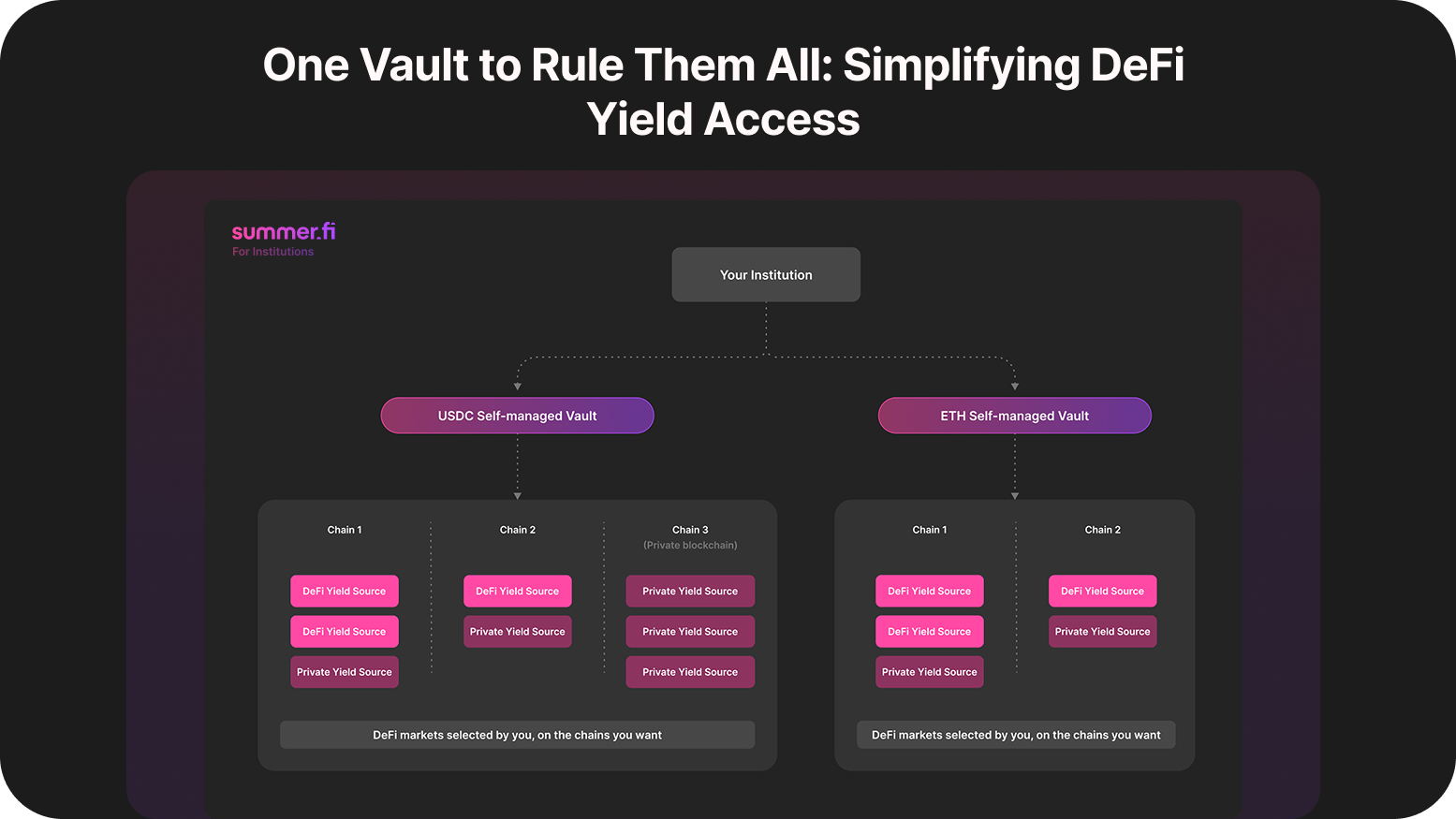

One Vault to Rule Them All: Simplifying DeFi Yield Access

DeFi today is scattered and high-maintenance. Tracking multiple markets on several protocols, migrating capital across markets on Aave, Morpho, Compound and more, whilst monitoring risk exposure 24/7 is not sustainable.

The Lazy Summer Protocol was designed to simplify this. It consolidates access to diversified yield strategies into a single vault structure with automated rebalancing, AI-powered allocation, and community-curated risk frameworks.

The result: streamlined access to potential yield opportunities, without the constant manual overhead.

Why Auto-Rebalancing Matters

Lazy Vaults are built on modular infrastructure. Behind the scenes:

- AI keeper agents continuously rotate capital within pre-set parameters: The vaults are powered by an AI Keeper Network on-chain agents that monitor markets 24/7. They continuously scan lending protocols for shifts in yield and risk, and automatically rotate capital within governance-set parameters, ensuring strategies stay adaptive and aligned without manual intervention.

- RAFTs harvest and auto-compound potential earnings.

- Buffers maintain liquidity so users can enter and exit smoothly.

Instead of chasing APYs across tabs and wasting gas, users interact with one vault that adjusts automatically based on governance parameters and third-party risk scoring.

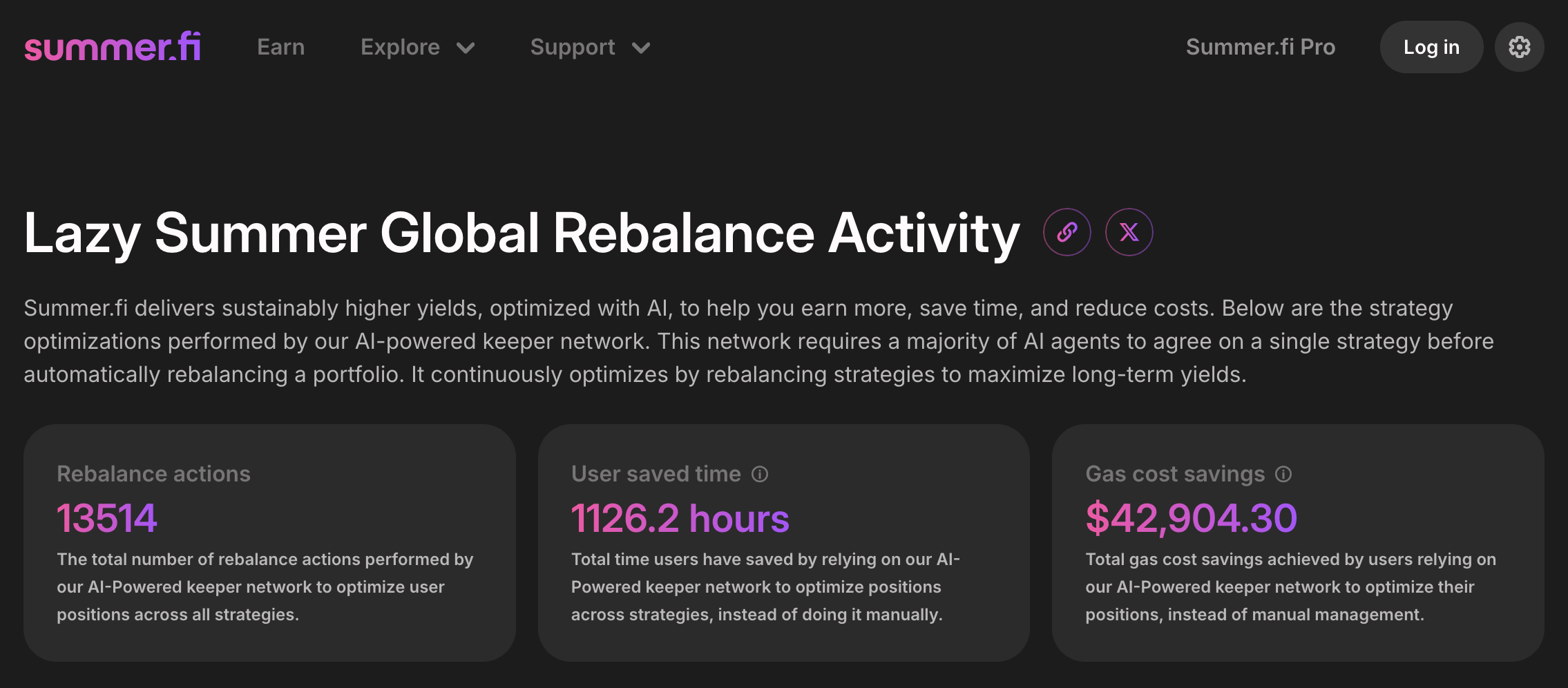

In April alone, automation saved participants over 1126.2 hours of management time and ~$42,904 in gas costs a clear demonstration of efficiency at scale.

For a firm to manually rebalance 13,514 times over the past few months would be virtually impossible. The AI-powered Keeper Network continuously monitors protocol activity and executes these moves automatically, making vaults significantly more efficient than manual strategies.

Instead of forcing users to withdraw assets back to their wallets and redeploy into another market, vaults move capital directly from one lending protocol to another. This streamlined approach reduces transaction steps, lowers costs, and minimizes the chance of user error—delivering a more efficient way to maintain exposure across DeFi markets.

https://summer.fi/earn/rebalance-activity

Diversification by Design

Lazy Vaults don’t rely on one market. They diversify across multiple ARKs (Automated Revenue Kernels) plugged into leading protocols such as:

- Aave

- Morpho

- Compound

- Curated third-party pools

All underlying markets are independently assessed for security, risk exposure, and performance by external risk teams such as Block Analitica. This means participants access a broader range of potential yield sources while distributing risk across strategies.

Yield-Seeking Mode: Optimizing Opportunities

Lazy Vaults can enter a yield-seeking mode, where AI agents shift exposure toward the highest-yielding lending opportunities that still meet strict risk criteria.

The mechanism prioritizes markets with healthy loan ratios, liquidity depth, and credible teams. This mode is about maximizing potential returns, always within the risk boundaries defined by governance.

Risk-Maintaining Mode: Protecting Capital

Equally important, vaults can operate in risk-maintaining mode. This is activated when conditions such as rising bad debt ratios or liquidity stresses are identified in an underlying market.

In this scenario, the vault reduces exposure, shifting capital to safer strategies. It’s a risk-first framework designed to preserve capital and stabilize performance across cycles.

One Integration, Broad Market Access

Instead of integrating separately with Aave, Morpho, Compound, and other protocols, Lazy Summer vaults package this into one interface. For institutions, that means one integration rather than dozens. For individuals, it’s one deposit rather than constant manual juggling.

This consolidation increases efficiency, reduces transaction costs, and removes the complexity of balancing protocol-by-protocol exposure.

Case Study: Manual Management vs. Lazy Vault Efficiency

Manual DeFi Management

- Monitor 5–10 lending markets daily.

- Pay gas for every move.

- React slowly to changes in APYs or loan health.

Lazy Vault Management

- Deposit once via Summer.fi

- Automated agents rebalance and compound in real time 24/7.

- Independent risk curators enforce safety parameters.

- Withdraw anytime through vault liquidity buffers.

This case study highlights the capital efficiency gains from automation: less time, fewer costs, and better portfolio balance across protocols.

The Institutional Angle

Professional allocators face additional complexity: compliance, reporting, and segregation of capital. That’s where Summer.fi Institutional comes in.

What It Provides

- Customizable and composable vaults that can tap into both on-chain and off-chain yield markets.

- Single API/SDK integration — one connection to access the entire DeFi yield landscape.

- Vaults with flexible modes — optional automated rebalancing between yield-seeking and risk-maintaining.

- Custom fee structures that institutions can configure for clients.

- Secure SDK to embed vault infrastructure into fintech apps or custodial platforms.

Institutional-Grade Controls

- Ring-fenced deposits — only whitelisted addresses gain access.

- Segregated accounts (SMAs) — client assets remain strictly separate.

- Independent audits and risk assessments from firms like Block Analitica.

- Daily NAV reporting and exports in standard formats (CSV, XML).

- 24/7 UK-based support and a 24-hour exit guarantee for withdrawals.

Who It’s For

- Asset managers — build bespoke yield portfolios for clients.

- Custodians — closed-access vaults for custody clients.

- Family offices — oversee both private and public yield strategies in one dashboard.

- Crypto-native funds & DAOs — operate curated vaults with governance-aligned exposures.

- Fintech apps — embed branded yield products directly through the SDK.

In short: the same principles that simplify yield for individuals also scale seamlessly to institutions but with compliance, reporting, and segregation features they require.

Final Word

Lazy Summer vaults are built to simplify, diversify, and automate. By combining:

- Auto-rebalancing

- Diversification across Aave, Morpho, Compound, and more

- Yield-seeking when opportunities arise

- Risk-maintaining when conditions turn volatile

- Institutional-grade controls and reporting for professional allocators.

They deliver streamlined, risk-aware access to DeFi’s potential yield opportunities, all through a single vault.

→ Explore Vaults on Summer.fi

→ Learn about Summer.fi Institutional

→ Schedule a 15-minute call with a specialist https://calendly.com/summer-fi/summer-institutional

Join us

Discord | Telegram | X/Twitter | Linktree

Disclaimer: Oazo Apps Limited functions solely as a front-end interface (Summer.fi) provider and it does not act on behalf of any user. Oazo Apps Limited did not launch nor does it operate or control the Lazy Summer Protocol. The Lazy Summer Protocol is accessed through Summer.fi. The information provided herein is provided on behalf of the Lazy Summer Foundation which launched the Protocol for informational purposes only and it does not constitute investment advice. Oazo Apps Limited and the Lazy Summer Foundation are not soliciting or recommending any transaction or guaranteeing any specific returns. Users interact with the Protocol at their own risk. T&C for the use of Summer.fi apply.