Meet Morpho: The universal lending network

Morpho revolutionized DeFi lending with peer-matched markets. Lazy Summer Protocol makes it effortless, automatically optimizing access to Morpho’s top-performing, risk-curated strategies.

Morpho introduced a new model for efficiency in DeFi lending: instead of passively accepting pooled rates on Aave or Compound, it matches lenders and borrowers directly, improving outcomes for both parties.

That initial success helped Morpho gain traction, but the real innovation came with Morpho v1.

This innovation introduced isolated markets, a core innovation of the Morpho protocol, designed to maximize customizability, security, and risk management for decentralized lending and borrowing.

What makes isolated lending better for borrowers and lenders?

- Risk Containment: Each market’s risk parameters are isolated, meaning issues like bad debt in one market cannot spill over to others. This prevents systemic contagion and enables higher LTV ratios for safer asset pairs.

- Customizability: Creators can tailor markets for specific asset pairs, risk tolerances, and community needs, with immutable rules that foster transparency and predictability.

- Permissionless Expansion: Any DeFi user or integrator can launch new markets without governance approval, accelerating innovation and diversity of offerings

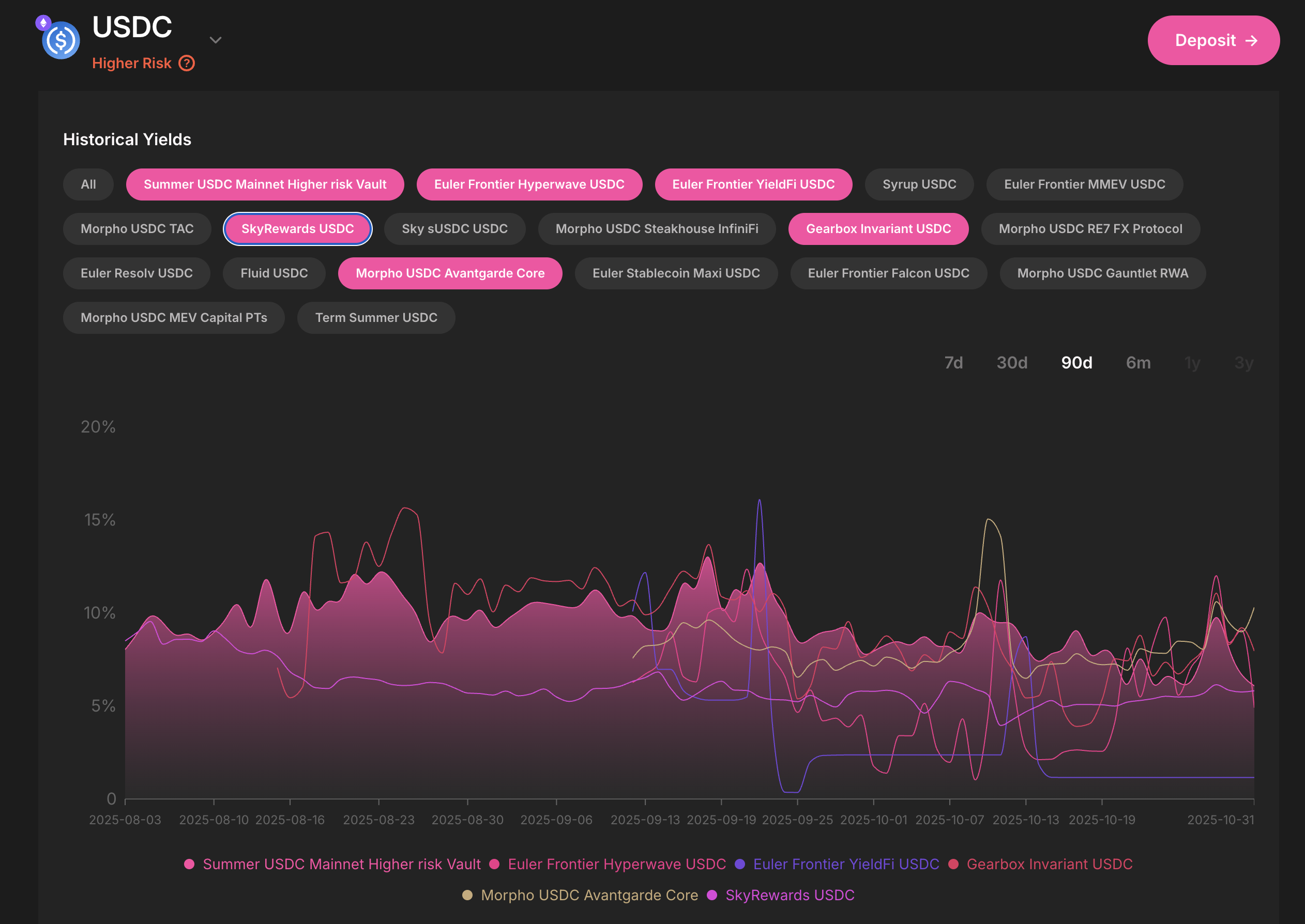

Though, while isolated markets increase the diversity and selection for borrowers and lenders, it also increases the complexity.

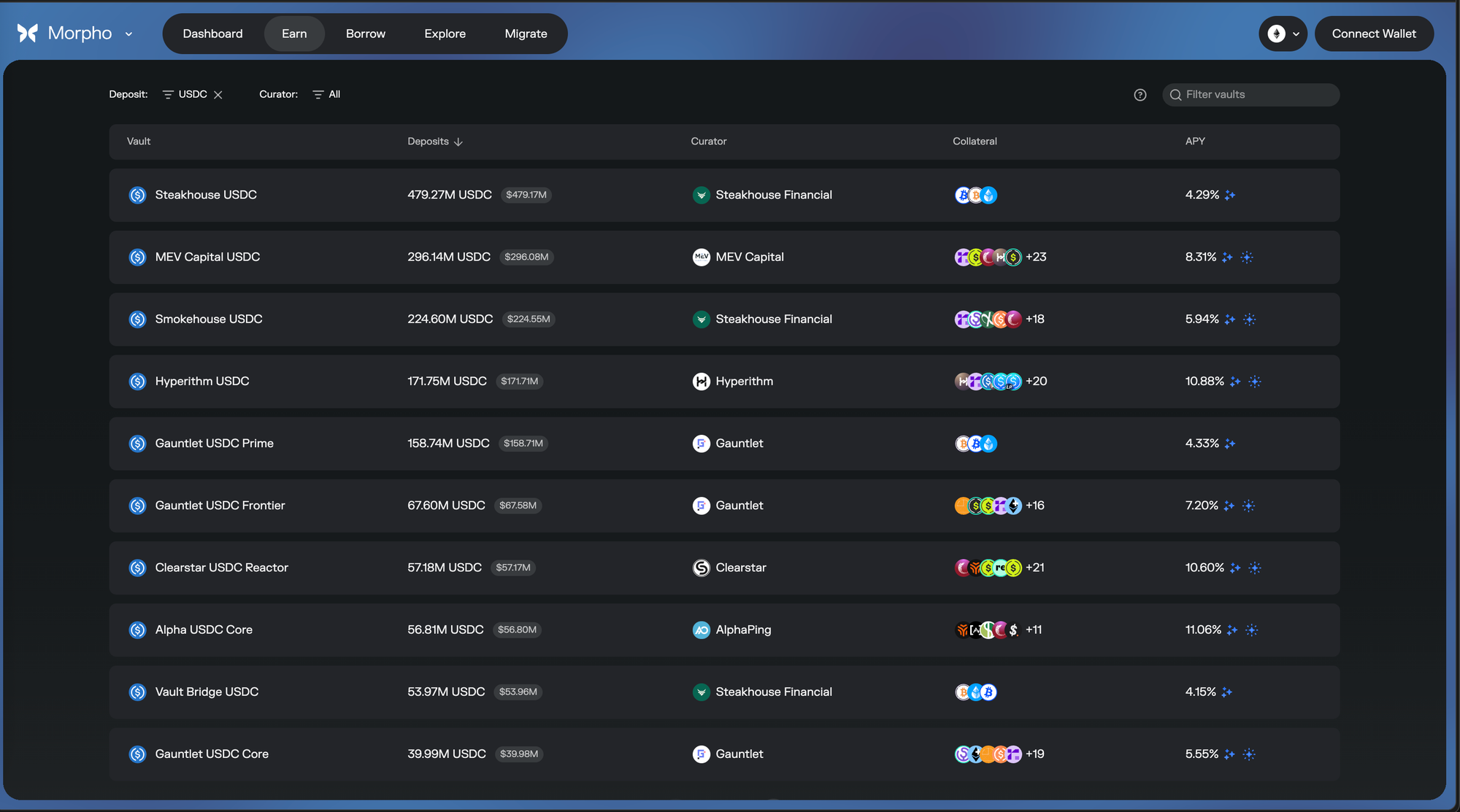

Today, a depositor of USDC on Mainnet has to choose between 60 different markets.

Morpho gives anyone the ability to create markets, Lazy Summer Protocol gives anyone the ability to access the best ones, automatically.

Through its AI-powered rebalancer Lazy Summer protocol continuously monitors Morpho’s performance across integrated vaults and reallocates capital based on real-time, risk-adjusted data. Giving users the best risk adjusted yields. More earnings, less work.

How does Lazy Summer Protocol enhance your Morpho lending experience?

- Automated yield optimization: The protocol uses AI-powered agent keepers to continuously monitor and rebalance user assets across top-performing morpho markets, ensuring users earn the best risk-adjusted yields without manual effort.

- 100% passive: Designed for "set and forget" use, users don't need to actively track yields or manage multiple positions, making sophisticated DeFi strategies accessible to anyone.

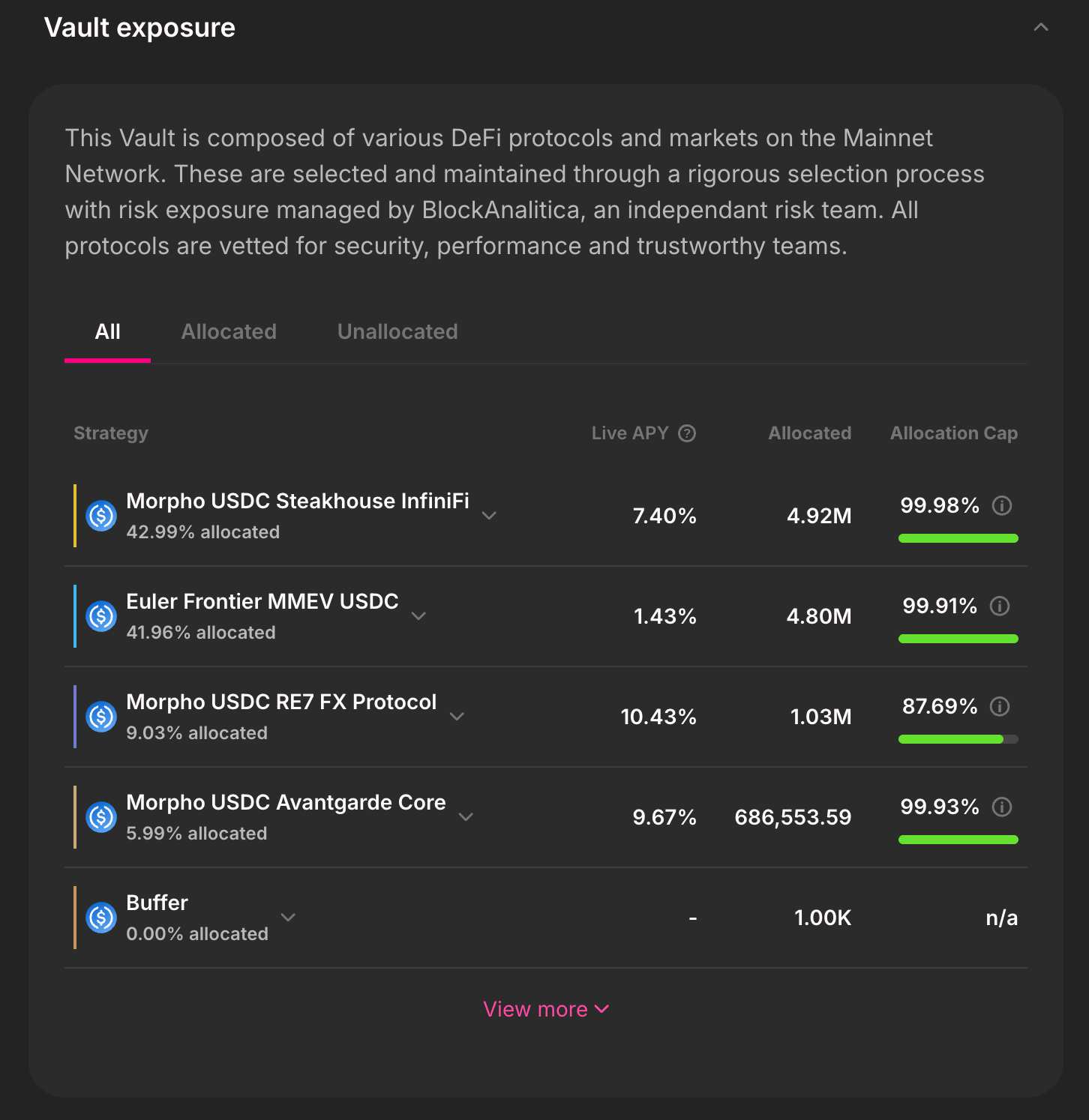

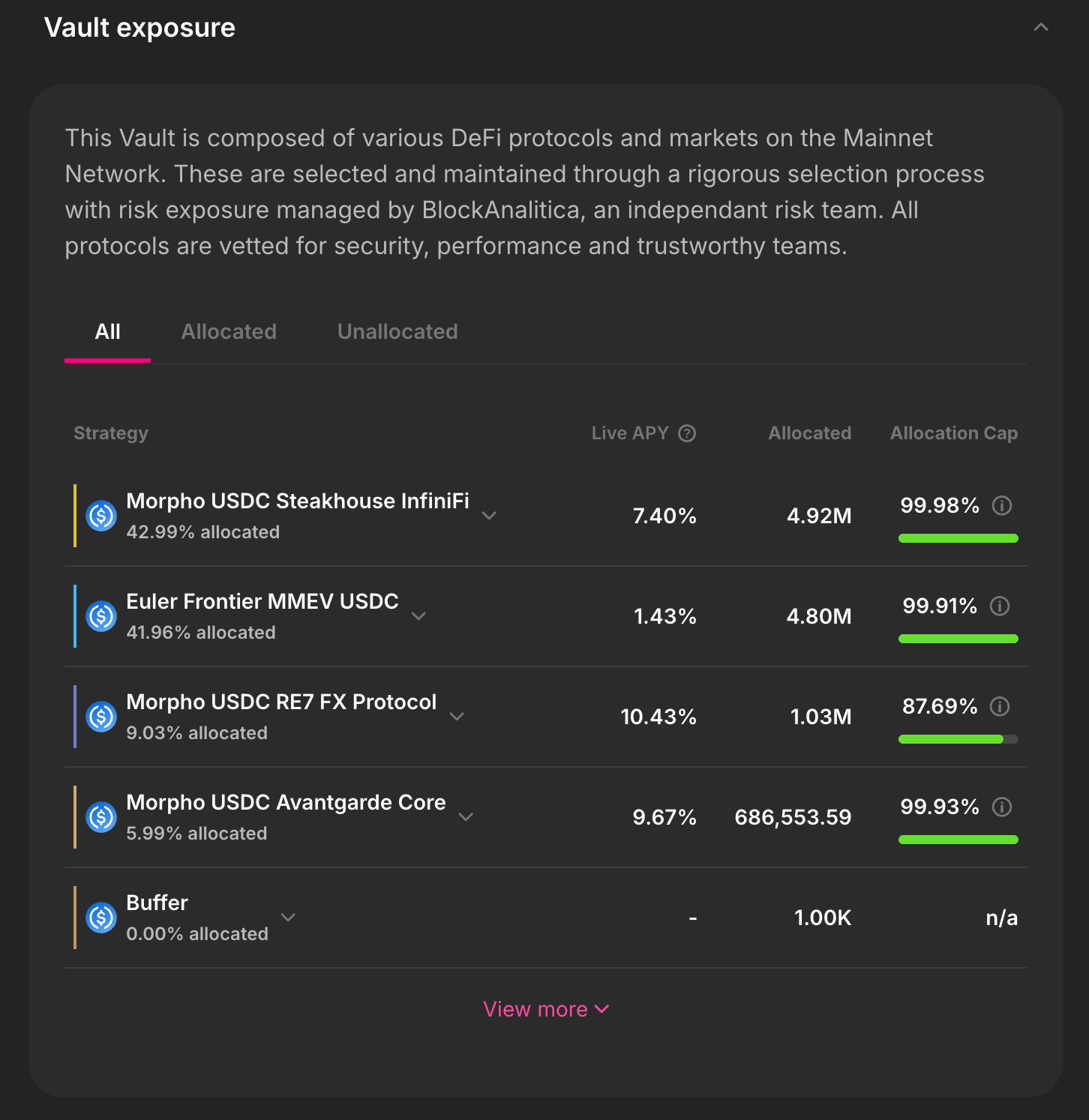

- Diversified, third party risk-managed portfolios: Lazy Vaults curate diversified portfolios that automatically rebalance to reduce exposure to any single protocol, mitigating risks and enhancing overall stability of returns.

- Sustainably Higher Yields: The AI and risk management teams, such as Block Analitica, optimize for sustainable and defensible yields rather than chasing short-term high but risky returns.

- Multi-Protocol Aggregation: The protocol integrates multiple tier-1 lending platforms like Aave V3 and Compound V3 into one. So you can the best of DeFi, not just Morpho.

- $SUMR Rewards: On top of all the protocol benefits, users also earn $SUMR rewards, the native token of the Lazy Summer Protocol.

Adapting to the ever changing DeFi landscape, Morpho v2

Soon, Morpho will introduce Morpho v2 , which introduces another step function innovation for DeFi borrowing and lending, fixed rates.

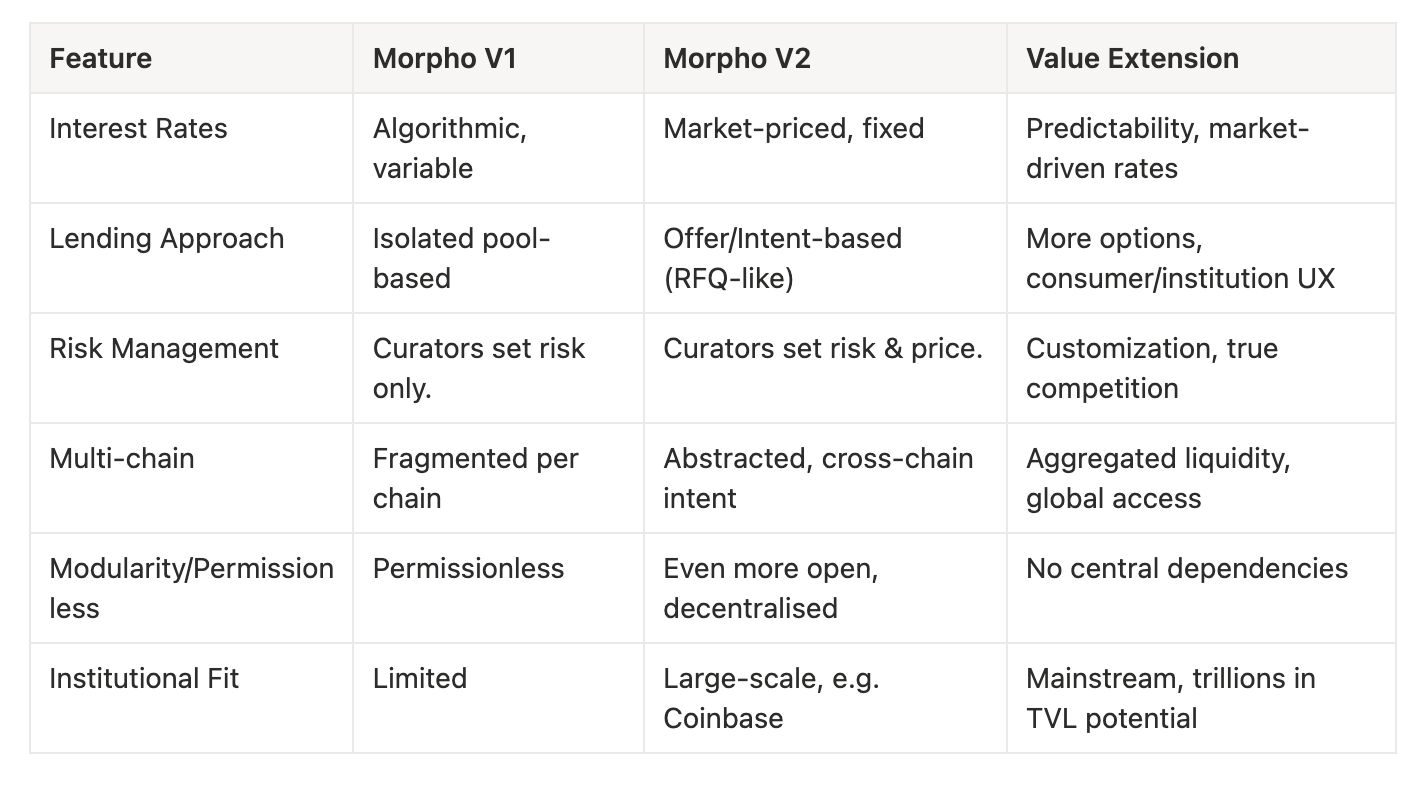

How will Morpho v2 extend the value of Morpho even further?

Fixed Rate Lending as a Core Primitive

- Morpho V1: Supported only variable rate lending, where interest rates were set by an on-chain algorithm or formula, typical of lending markets like Aave and Compound.

- Morpho V2: Removes the dependency on algorithmic interest rate models and introduces fixed rate lending as a core protocol primitive. This means risk and interest rates are now actively priced by market participants (curators), not dictated by a formula.

- Value: Enables predictability and tailored financial products for institutions and retail users, supporting significant use cases outside of crypto native users (e.g., loans for buying a house, consumer credit).

- Technical Leap: Morpho V2 functions as a zero coupon bond issuance/settlement protocol, letting borrowers mint fixed-term, fixed-rate bonds, which curators can buy and hold in vaults.

Intent-Based, Offer Model for Loans

- Morpho V1: Pool-based model, where liquidity is allocated to specific collateral/risk pools and borrowers tap into these pools.

- Morpho V2: Moves to an intent-based system, similar to traditional finance RFQ (Request For Quote) markets.

- Curators can promise liquidity at multiple terms, risk profiles, compliance options, and even multiple chains simultaneously.

- Borrowers interact with an order book of curated fixed-rate offers (rather than searching for pool liquidity).

- The protocol allows hundreds of offers using the same vault liquidity, unlocking flexibility for differentiated lending experiences.

- Value: Drastically increases the diversity and specificity of loan/collateral types; drives competitive pricing and customizability for all users

Decentralized and Externalized Risk and Rate Setting

- Morpho V1: Risk curators managed risk but did not control pricing (interest rates); the protocol was more centralized in rate setting.

- Morpho V2: Gives risk curators full freedom and responsibility to set both the risk parameters and the pricing of loans (interest rates).

- Risk curators become complex DeFi entities with strong incentives to build businesses, drive adoption, and innovate.

- Institutions like Coinbase can tailor risk profiles, compliance, and fees as needed—without reliance on Morpho governance or centralized control.

- Value: Empowers large-scale integrations (e.g., Coinbase’s BTC-backed loans), unleashes market-driven rate dynamics, and dramatically expands ecosystem utility.

Multi-Chain Support & Liquidity Abstraction

- Morpho V1: Liquidity was fragmented across multiple chain instances, with the user experience tied to specific networks.

- Morpho V2: Designed for seamless multi-chain lending, abstracts the network away from the user experience.

- Users or curators express lending intent without caring which chain the transaction takes place on; bridging and cross-chain execution is handled “just-in-time”.

- Value: Aggregates fragmented liquidity, expands utility across many Layer 2s/L3s, simplifies integrations for platforms like Coinbase and future partners.

Modular, Permissionless Infrastructure

- Both V1 and V2 are built as open, permissionless, immutable infrastructure—but V2 further externalizes all power:

- No dependence on Morpho’s token, team, or governance (code is immutable) for integrations and risk management.

- Anybody can create lending/borrowing experiences on top, tailored for their audience with specific risk profiles, fees, compliance needs.

- Value: Drives composability, permissionless innovation, and scalability to “trillions” in on-chain lending/borrowing.

Improved UX and Institutional Adoption

- V2’s architecture is optimized for integrations with consumer platforms (Coinbase), institutions, and creators building complex yield products.

- Offers retail and institutional users improved predictability, UX parity with fintech, and access to global, competitive DeFi rates.

- Facilitates growth into “tens of billions in liquidity,” with the ambition to collapse the cost of trust and make on-chain loans mainstream.

- The vault model abstracts complexity away for end users, allowing rolling of loans and easy management of multiple bond offers

Lazy Summer Protocol x Morpho v2: unparalleled accessibility for DeFi’s best innovations

As Morpho evolves with v2, how might Lazy Summer Protocol increase its accessibility, making Morpho v2 accessible to all, as it relates to complexity?

Here are some ways that Lazy Summer Protocol might make Morpho v2 even better:

Auto-Rolling & Laddering: Never think about maturity

Lazy Summer protocol could build features where a user’s loan or deposit is automatically rolled into a new offer upon maturity or split strategically (“laddering”) over different timeframes. This would ensure that users maintain continuous exposure without manually managing expirations.

Aggregated Best Rates:

Lazy Summer protocol can aggregate offers across all Morpho V2 markets and route user funds toward the most attractive options, whether for lending or borrowing. Users would always receive the optimum available rate (after fees) without manual comparison.

Get the best of Morpho automatically—use Lazy Summer Protocol

Access Morpho’s strategies through the Lazy Summer Protocol today via Summer.fi/earn

Join us

Discord | Telegram | X/Twitter | Linktree

Disclaimer: Oazo Apps Limited functions solely as a front-end interface (Summer.fi) provider and it does not act on behalf of any user. Oazo Apps Limited did not launch nor does it operate or control the Lazy Summer Protocol. The Lazy Summer Protocol is accessed through Summer.fi. The information provided herein is provided on behalf of the Lazy Summer Foundation which launched the Protocol for informational purposes only and it does not constitute investment advice. Oazo Apps Limited and the Lazy Summer Foundation are not soliciting or recommending any transaction or guaranteeing any specific returns. Users interact with the Protocol at their own risk. T&C for the use of Summer.fi apply.