Meet Maple Finance: Automated exposure to institutional quality yield

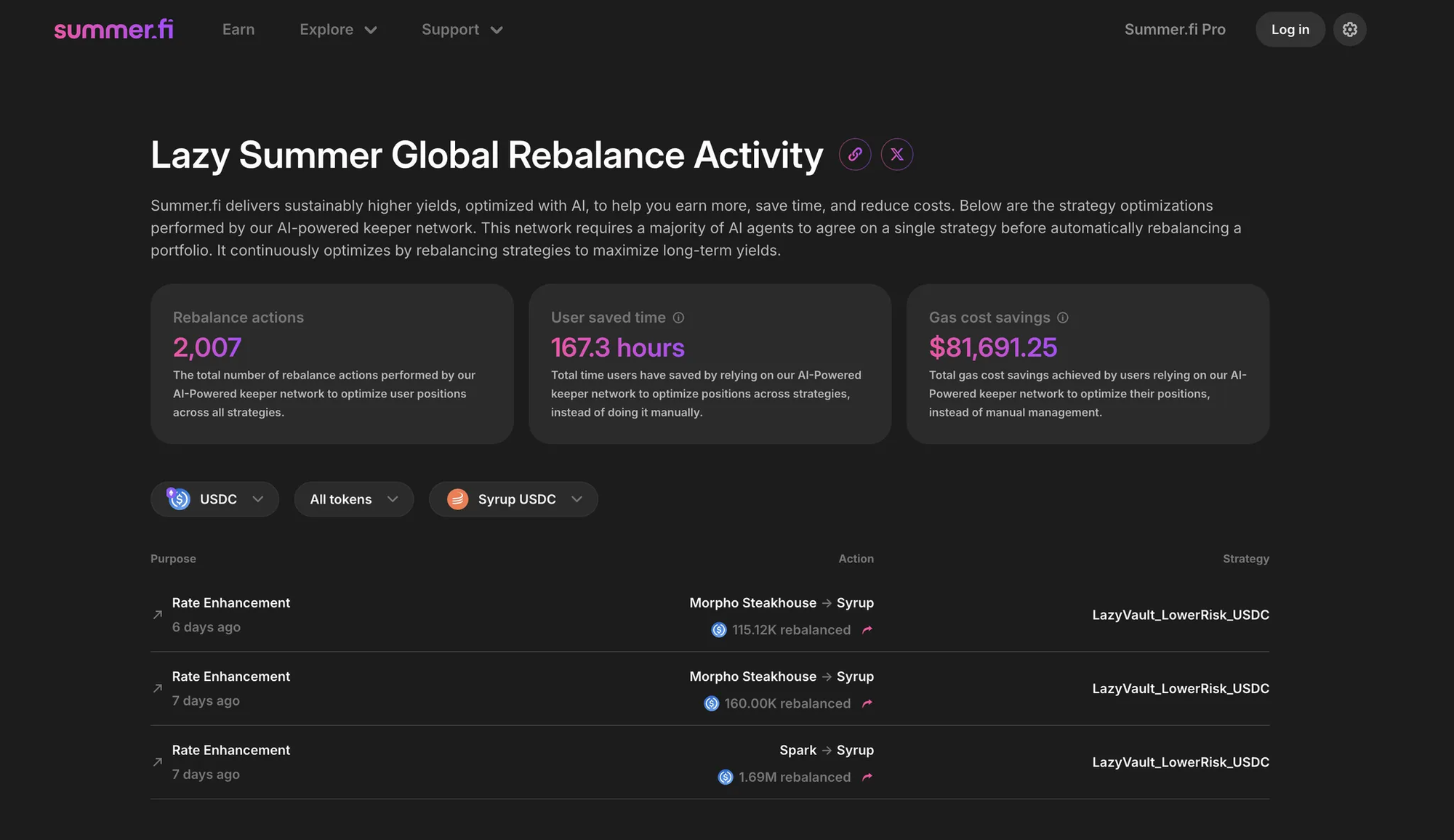

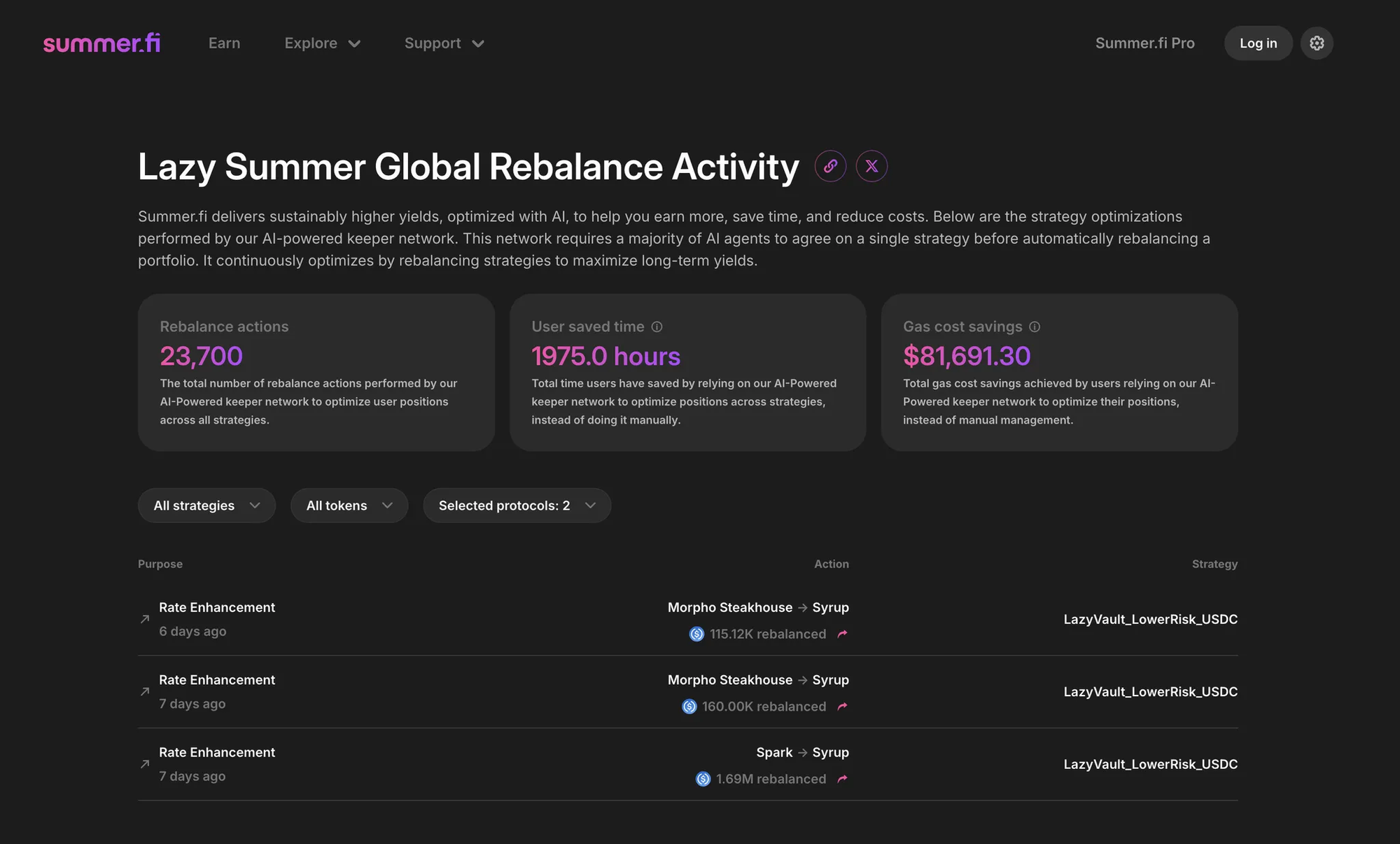

Starting today, users on Lazy Summer can tap into one of DeFi’s most trusted institutional yield engines—Maple Finance—without any manual effort.

Backed by AI-powered rebalancers, Lazy Summer now offers automated access to Maple’s Syrup Lend product, giving users a seamless path to high-quality, professionally managed yield.

Three Ways to Access Maple Finance’s Syrup Lend via Lazy Summer

Maple’s Syrup strategies are now live across three Lazy Summer vaults. Each vault is rebalanced continuously by our AI Keeper Network to optimize your risk-reward profile.

1. Syrup USDC in the USDC Lower Risk Vault

A go-to option for conservative stablecoin holders. This strategy blends Maple’s Syrup USDC with other low-volatility opportunities, offering stable yield with minimized exposure.

- Target audience: Yield-seeking users prioritizing safety and diversification

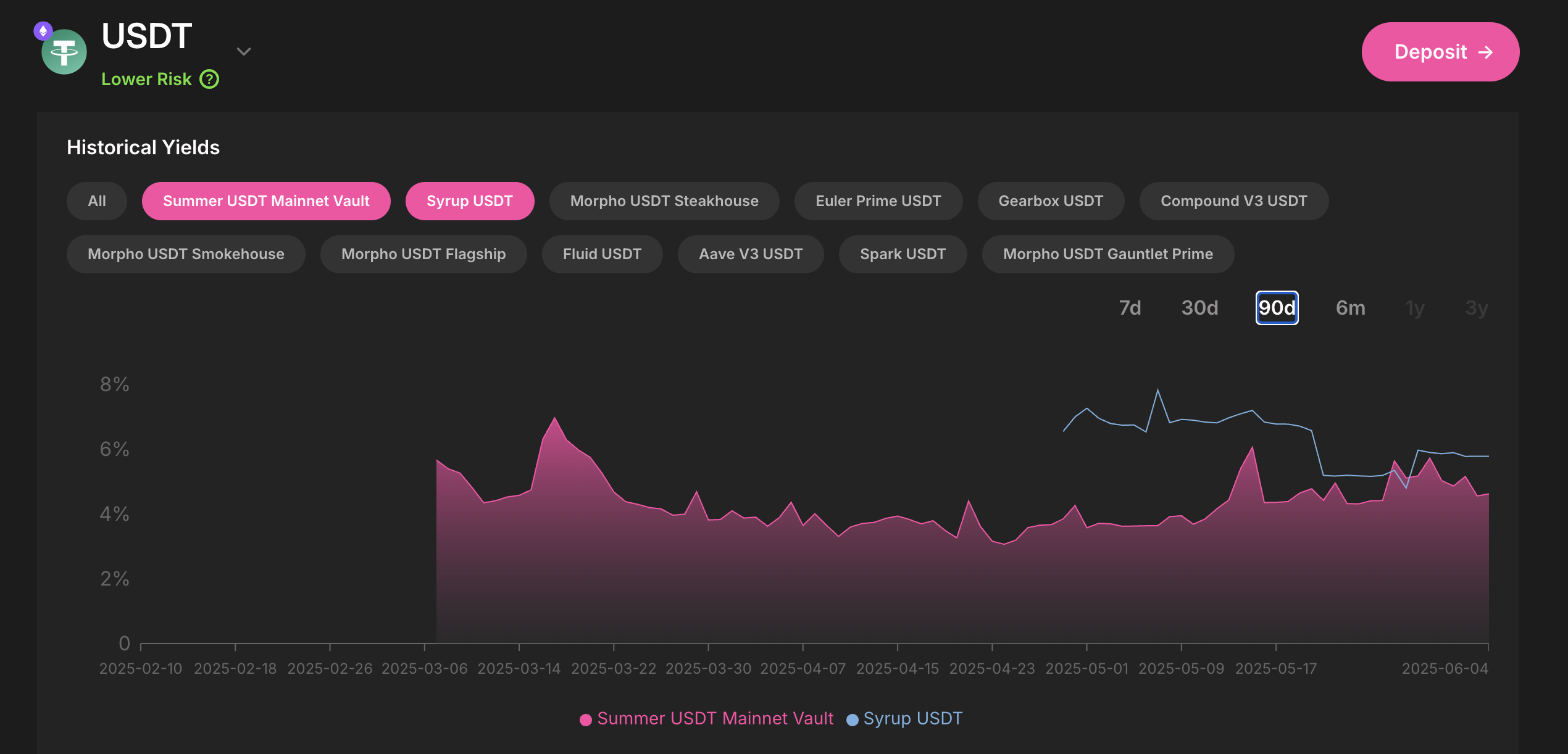

2.Syrup USDT in the USDT Lower Risk Vault

For users who prefer USDT exposure while accessing institutional-grade yield. This vault combines Syrup USDT with other secure lending protocols.

- Target audience: USDT holders looking for premium stablecoin returns.

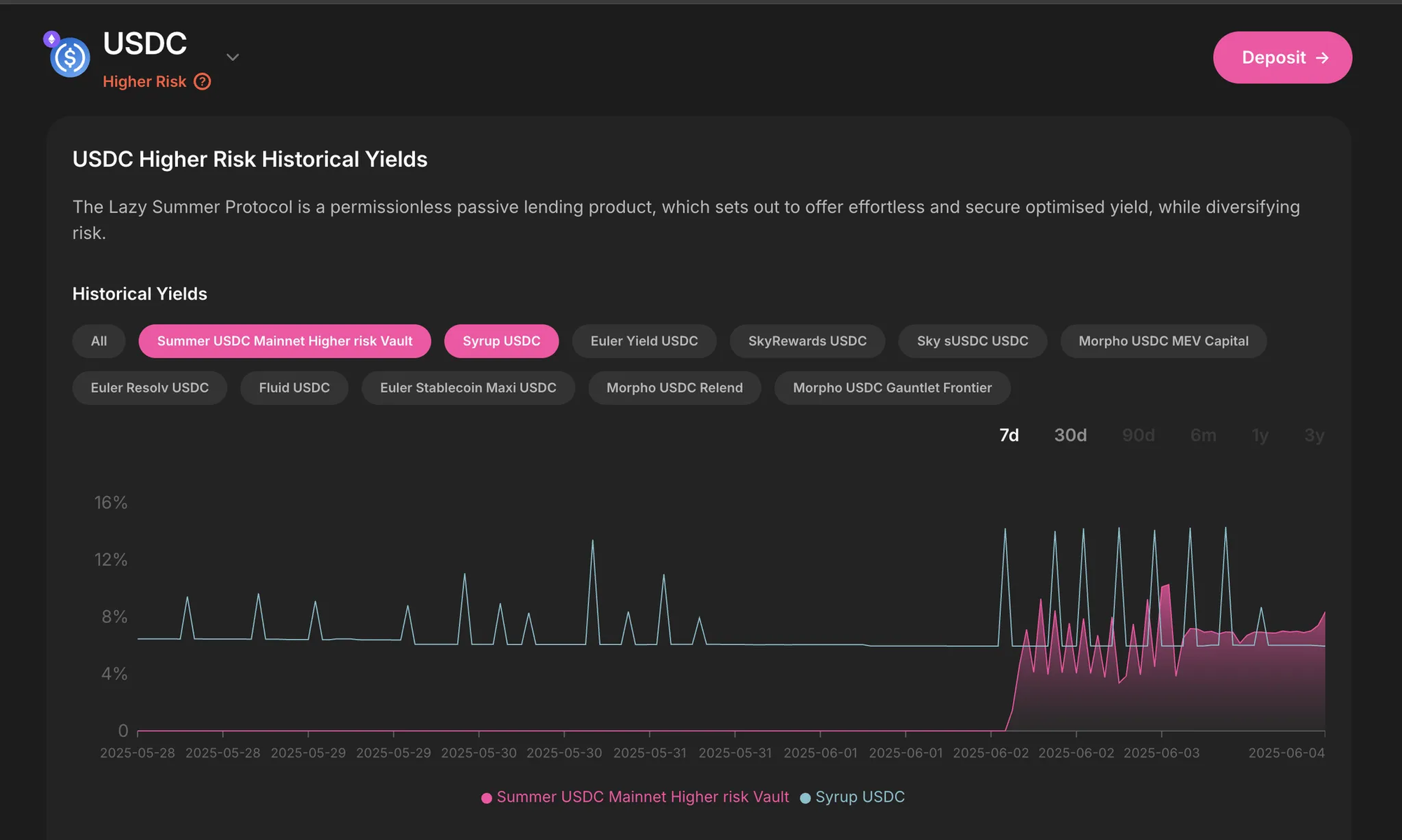

3. Syrup USDC in the USDC Higher Risk Vault

Designed for users willing to take on a bit more exposure in exchange for a higher yield. This vault uses a blend of Syrup and higher-yield strategies curated by the AI Rebalancer.

- Target audience: Sophisticated stablecoin users aiming to earn more

Get Rewarded in $SUMR for Syrup Exposure

All Lazy Summer vaults with Syrup USDC exposure also reward users with $SUMR—the native governance and rewards token of the protocol.

- Earn SUMR passively by holding positions in vaults with Syrup exposure

- Participate in protocol governance or stake to compound your rewards

What’s the story of Maple Finance?

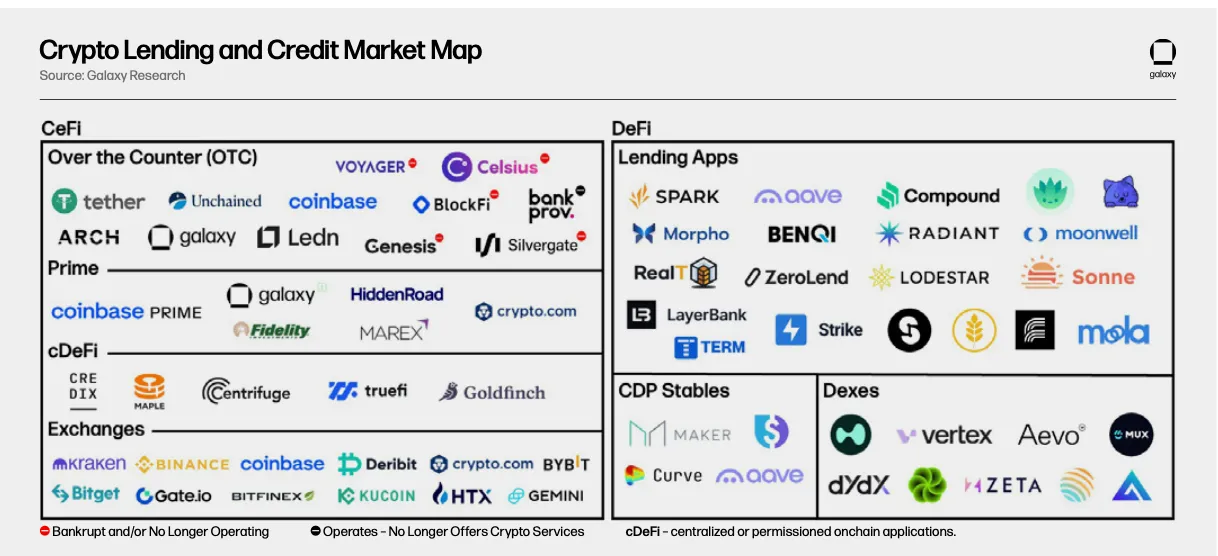

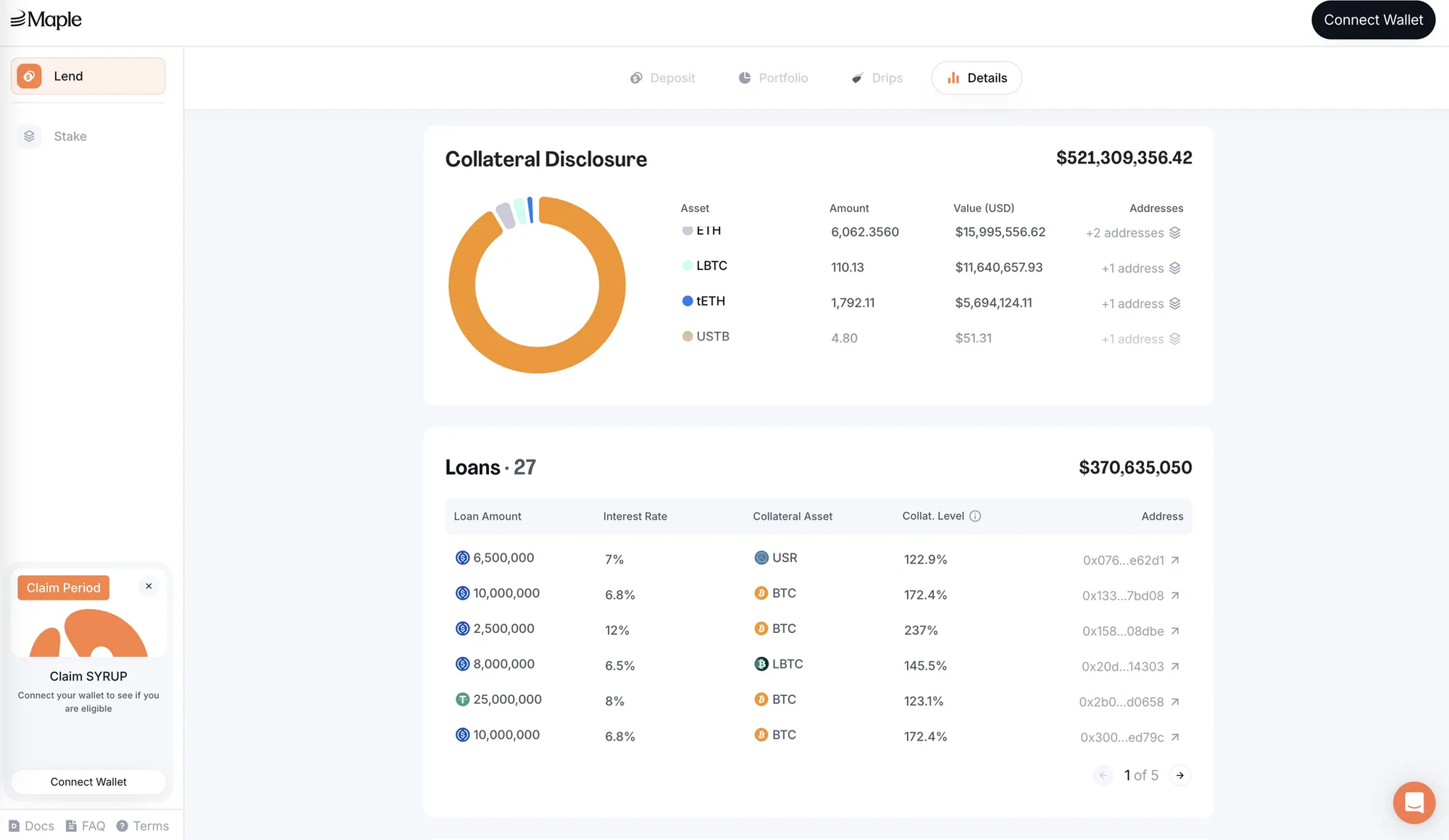

Maple is a leading institutional credit protocol that brings the sophistication of traditional finance to DeFi. Its platform connects professional borrowers and lenders through onchain, high-touch lending markets.

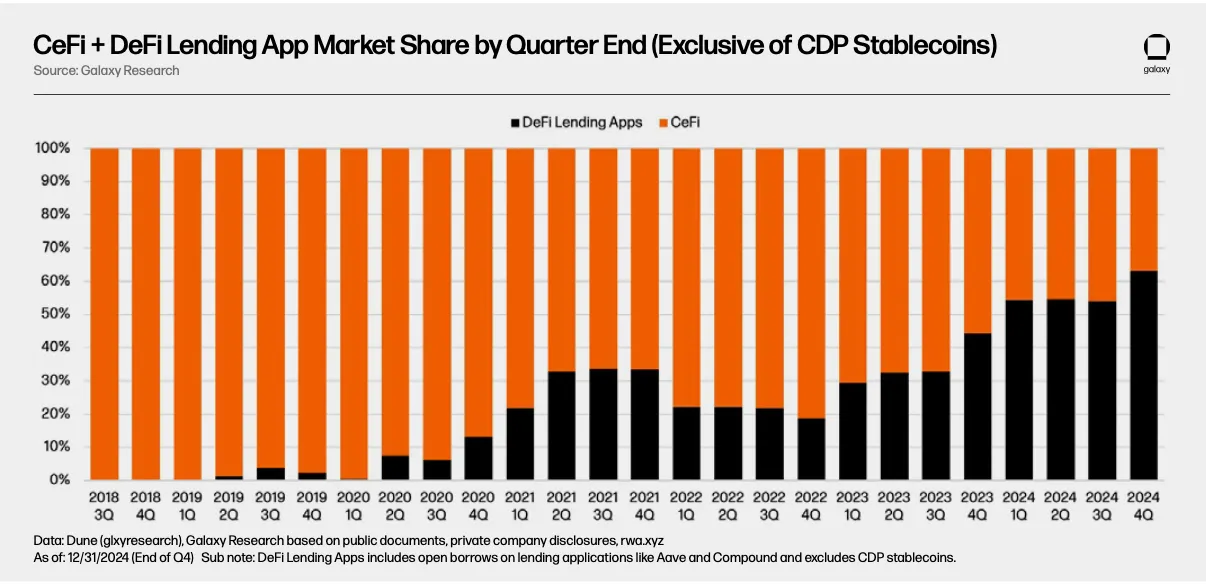

From undercollateralized loans to Maple 2.0

Maple launched with undercollateralized loans managed by trusted delegates. After the 2022 credit unwind, the protocol evolved to better meet institutional standards with:

- In-house credit underwriting

- Overcollateralized lending and borrowing

- Enhanced onchain transparency and reporting

This pivot to Maple 2.0 attracted a broader set of institutions—from family offices to funds—and helped push Maple’s total value locked (TVL) past $1 billion.

Maple’s evolving product suite

Maple now operates across two fronts:

1. Maple Borrowing: where your yield comes from

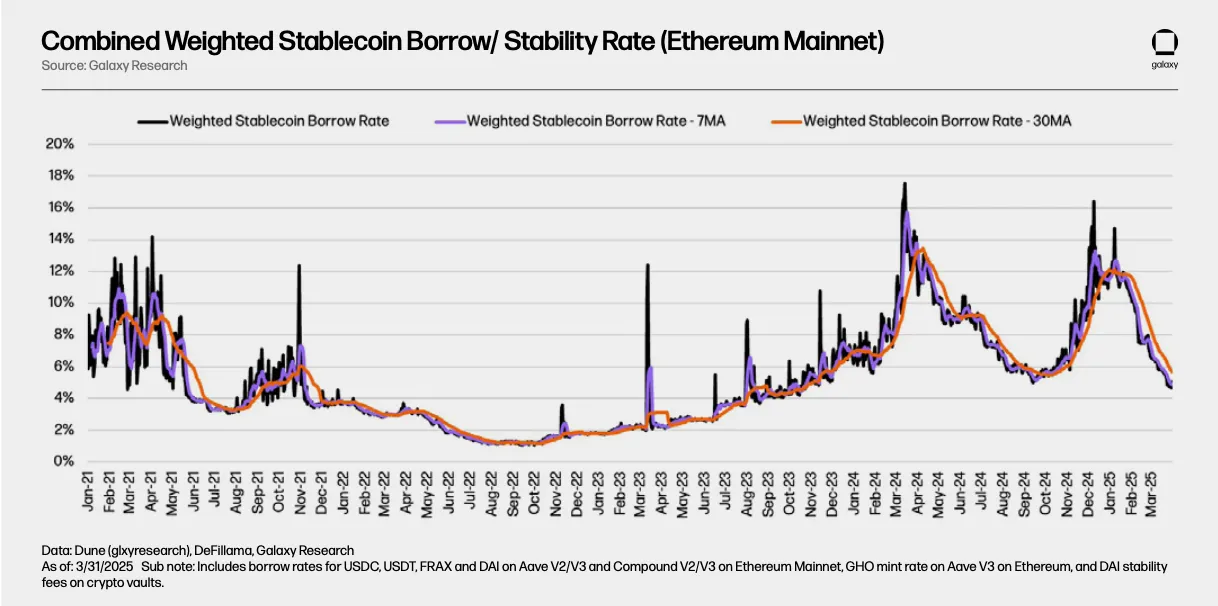

At the heart of Maple’s model is a simple principle: your yield is paid by institutional borrowers who are willing to pay a premium for a better borrowing experience.

Unlike traditional DeFi lending platforms that rely on volatile interest rates and collateral-based liquidations, Maple attracts sophisticated borrowers—such as market makers, crypto funds, and institutional traders—who value:

- Rate certaintyFixed, predictable borrowing costs so they can manage capital efficiently.

- No forced liquidation riskLoans aren’t subject to automatic liquidations due to price volatility—removing a major operational risk for institutional borrowers.

- Tailored termsLending arrangements are customized to match institutional strategy timelines, asset mixes, and risk tolerances.

These differentiated features mean Maple borrowers are willing to pay a premium—a higher interest rate than they would on mass-market DeFi protocols.

That premium is exactly what funds the yield you earn when depositing into Maple strategies.

2. Maple Lend: Where Institutions Access Yield

Maple Lend is built for institutions like accredited investors, family offices, and funds.

Unlike Syrup (which is permissionless), Maple Lend requires KYC and offers tailored, compliant pools with stricter custody and collateral controls.

Why Permissioned?

Institutional capital has legal, operational, and regulatory constraints. Maple Lend meets these with:

- KYC/AML processes

- Audited, transparent pools

- Qualified custody with no rehypothecation

Maple Lend provides the infrastructure and underwriting that powers the yield in Syrup. These pools fund institutional borrowers and generate yield from borrower premiums.

- Blue Chip Pool: Conservative lending backed by BTC/ETH in custody

- HYSL: Higher-yield pool with staked, overcollateralized altcoins

Maple Syrup: DeFi native institutional grade yield

Syrup is Maple’s permissionless product suite that brings institutional-grade yield to DeFi users.

While Maple Lend is restricted to accredited institutions, Syrup is open to anyone onchain. It offers access to the same borrower base and credit underwriting, but through DeFi-native infrastructure.

- Syrup USDC & USDT pools lend to institutional borrowers vetted by Maple’s credit team

- Yields are generated from the borrower premiums paid for tailored loan terms and predictability

- Lazy Summer integrates Syrup into vaults that rebalance automatically for optimal risk-adjusted yield

The future of onchain private credit: Bridging DeFi and traditional markets

As more financial assets move onchain—from stablecoins to private credit to tokenized treasuries—protocols like Maple will serve as the connective tissue between DeFi-native capital and traditional institutions.

What’s Next for Maple? Solving institutional pain points onchain

Maple Finance is rapidly evolving to address institutional pain points onchain by focusing on several strategic initiatives.

- First, it is expanding its digital asset offerings, notably with the introduction of a BTC lending product, designed to provide institutional and qualified investors with structured yield opportunities and controlled risk exposure.

- Second, Maple is primed for the expansion of private credit onchain. It is well positioned tto integrate real-world assets (RWAs) and stablecoins into its lending infrastructure, thereby broadening the scope and utility of its credit markets for large capital allocators.

- Third, Maple is meeting institutional demand where it is by forging partnerships with leading industry players, such as serving as a launch partner with Ethena Converge, to deliver compliant, transparent, and scalable lending solutions.

These efforts are unified by the SYRUP token, which aligns stakeholders and incentivizes participation across both institutional and DeFi-native products, positioning Maple as a leading digital asset credit manager for the next era of onchain finance.

Why Lazy Summer + Maple Is a Perfect Match

Maple brings the borrowers—institutions paying a premium for predictability. Lazy Summer brings the infrastructure—automated, intelligent, objective and accessible.

Together, they unlock institutional-grade yield for everyday users—without the spreadsheets or tedious journey of chasing yields.

How Lazy Summer makes Maple stronger:

- Rebalances in real time when Maple’s risk-adjusted yield outperforms

- Allocates intelligently, never going all-in—always balancing Maple with other high-quality options

- Expands access by surfacing Maple’s best opportunities to users who don’t want to manage positions manually

How Maple makes Lazy Summer better:

- Introduces steady, premium-grade yield from borrowers with real credit needs

- Diversifies the vaults beyond typical DeFi yield farms

- Bridges onchain finance and traditional capital flows in a way few protocols can

Start earning

Automated exposure to institutional credit yield is now just one click away.

Get started with Maple Syrup inside Lazy Summer today.

👉 Start Earning Now

Join us

Discord | Telegram | X/Twitter | Linktree

Disclaimer: Oazo Apps Limited functions solely as a front-end interface (Summer.fi) provider and it does not act on behalf of any user. Oazo Apps Limited did not launch nor does it operate or control the Lazy Summer Protocol. The Lazy Summer Protocol is accessed through Summer.fi. The information provided herein is provided on behalf of the Lazy Summer Foundation which launched the Protocol for informational purposes only and it does not constitute investment advice. Oazo Apps Limited and the Lazy Summer Foundation are not soliciting or recommending any transaction or guaranteeing any specific returns. Users interact with the Protocol at their own risk. T&C for the use of Summer.fi apply.