Meet Euler: Precision-Engineered Yield, Automated by Lazy Summer Protocol

Euler brings precision; Lazy Summer protocol provides the intelligence.

A new chapter for active lending: automated Euler exposure inside Lazy Summer Protocol

Euler is known for bringing modular, isolated risk markets to DeFi, giving users fine-grained control over what assets they lend and how they’re exposed. But that precision comes with friction: dozens of pools, varying yields, and complex borrower dynamics that shift daily.

The Lazy Summer Protocol integrates over 15 Euler markets across USDC, USDT and ETH on Mainnet and Base. These include Euler’s Prime, Stablecoin Maxi, and Swaap Lend strategies, providing users with automated, data-driven exposure to Euler’s opportunities without manually tracking utilization, collateral health, or migrations.

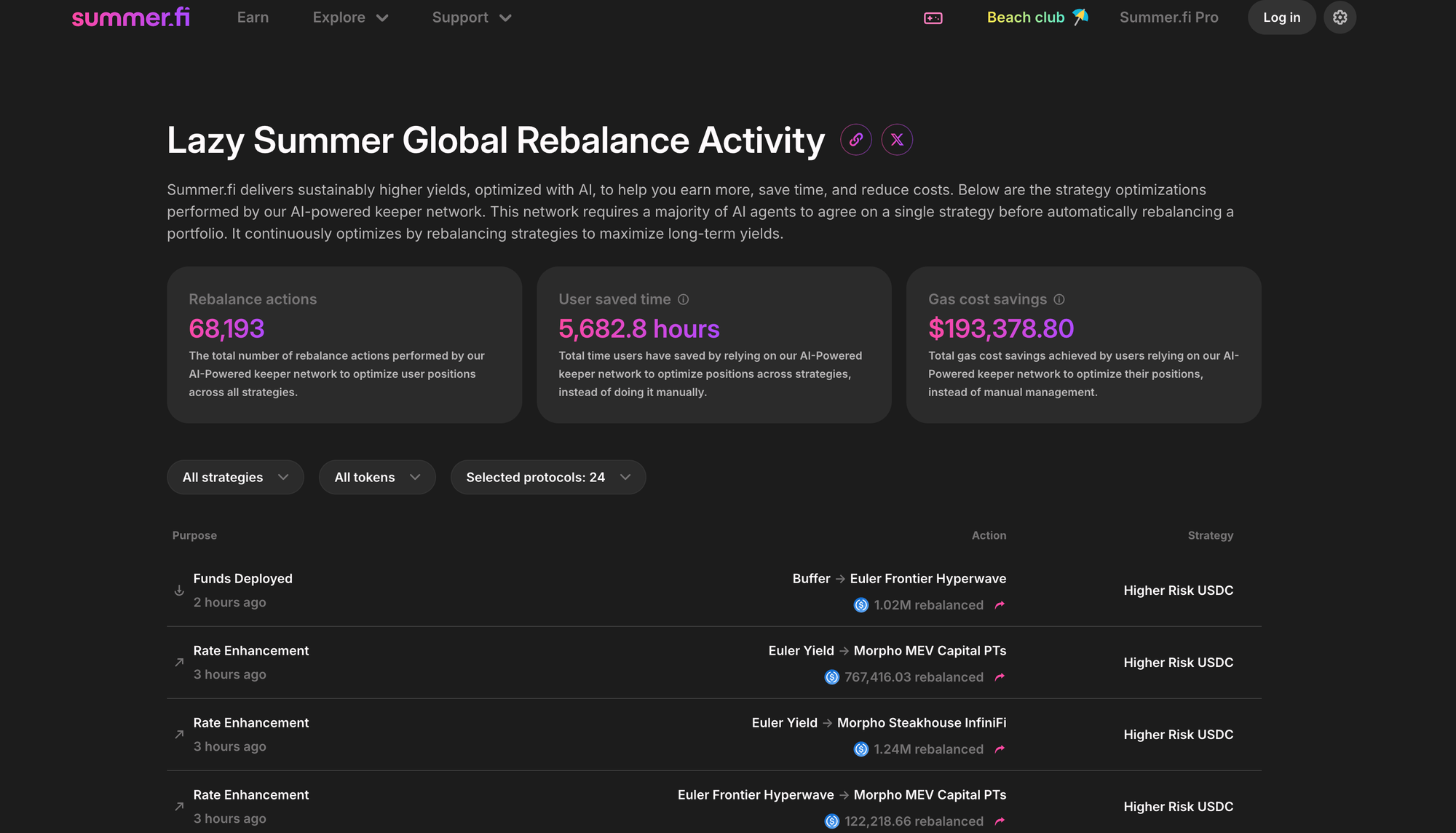

See all Euler rebalance actions on Lazy Summer Protocol

How Euler changed DeFi lending

When Euler launched, it redefined risk management. Instead of pooling all collateral together (like Compound v2 or Aave v2), it isolated markets by asset pair, giving lenders and borrowers surgical control.

That modularity unlocked new yield possibilities but also made tracking those yields across assets and epochs a full-time job. Yields on WETH and USDC markets could diverge rapidly depending on borrower composition and volatility.

How Lazy Summer makes Euler even better

The Lazy Summer’s AI Rebalancer continuously monitors Euler’s utilization rates, borrow spreads, and reserve factors across dozens of vaults. It identifies where Euler’s risk-adjusted yield (after accounting for liquidity depth and volatility) exceeds other protocols and allocates accordingly.

- Dynamic market selection: If Euler’s Prime vault yield rises above Fluid’s or Morpho’s equivalent, the Lazy Summer protocol reallocates automatically.

- Cross-protocol diversification: Positions remain distributed across multiple strategies to maintain balanced exposure.

- Objective, data-driven allocation: Decisions are determined by on real-time data , not sentiment.

This integration transforms Euler from a high-maintenance power tool into an optimized yield source while retaining its core advantage: transparent, isolated credit risk.

Participation Incentives

Users accessing vaults on Summer.fi with Euler may be eligible to receive $SUMR token rewards in addition to the protocol's performance.

This reward structure is designed to align participation with the protocol's goals: by supplying liquidity into productive, risk-managed markets, you help secure and decentralize DeFi’s lending infrastructure and get rewarded for it.

Why Lazy Summer + Euler is a perfect match

Euler brings precision; Lazy Summer protocol provides the intelligence.

Together, they create sophisticated users access to a dynamic, diversified yield layer without spreadsheets, gas costs, or reaction delays.

Access Euler's performance through the Lazy Summer Protocol today via Summer.fi/earn and let the AI Keeper Network rebalance, optimize, and protect your position in real time.

Join us

Discord | Telegram | X/Twitter | Linktree

Disclaimer: Oazo Apps Limited functions solely as a front-end interface (Summer.fi) provider and it does not act on behalf of any user. Oazo Apps Limited did not launch nor does it operate or control the Lazy Summer Protocol. The Lazy Summer Protocol is accessed through Summer.fi. The information provided herein is provided on behalf of the Lazy Summer Foundation which launched the Protocol for informational purposes only and it does not constitute investment advice. Oazo Apps Limited and the Lazy Summer Foundation are not soliciting or recommending any transaction or guaranteeing any specific returns. Users interact with the Protocol at their own risk. T&C for the use of Summer.fi apply.