Market Watch: How Lazy Summer’s USDC Vault Is Leading Arbitrum’s Yield Race

As Arbitrum’s yield markets expand, Lazy Summer’s USDC Lower-Risk Vault leads with automated rebalancing, risk-weighted optimization, and transparent on-chain performance. Backed by Block Analitica, it shows how automation defines the next era of efficient, stable DeFi yield.

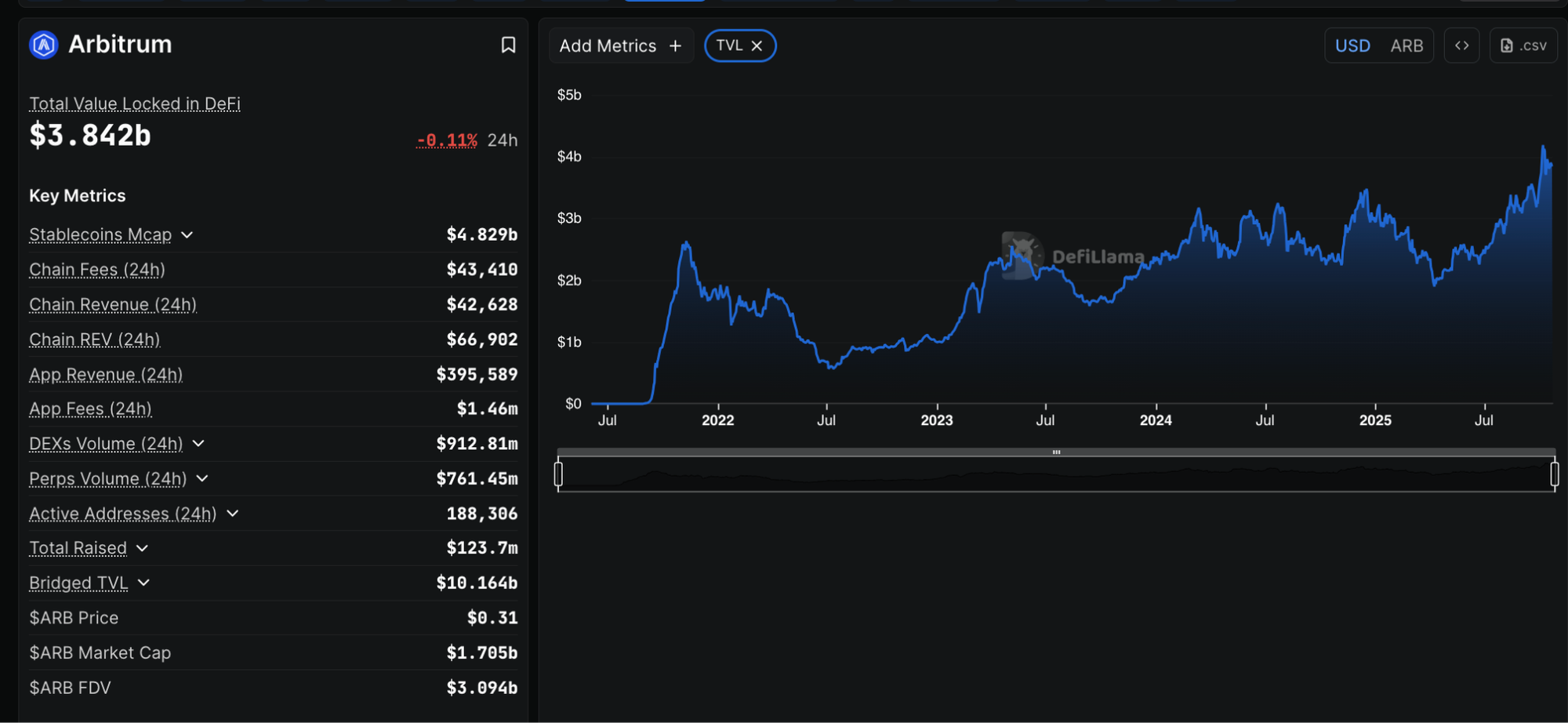

October 2025 has been a breakout month for Arbitrum, now hosting over $3.85 billion in TVL, processing millions of transactions daily, and maintaining gas fees under a tenth of a cent.

That combination of deep liquidity and ultra-low transaction cost creates the perfect environment for automation to thrive. Lazy Summer’s onchain keepers rebalance more frequently, reallocating capital between markets the moment yields shift, without eroding returns.

In short: Arbitrum gives automation room to breathe, and that’s why Lazy Summer’s engine is performing at its peak.

Inside the Lazy Summer Protocol

The Lazy Summer Protocol continuously monitors yield markets across protocols like Morpho Gauntlet Core and Prime, Silo Finance, and Euler, dynamically reallocating user capital through a decentralized network of on-chain keepers.

All vault parameters, from exposure limits to yield targets, are curated by Block Analitica, providing governance-level oversight and ensuring capital only flows through audited, approved strategies.

When market conditions change, Lazy Summer’s AI-powered keeper network automatically reallocates capital according to predefined risk parameters, eliminating manual switching and reducing human lag.

How the USDC Lower-Risk Vault Pulled Ahead

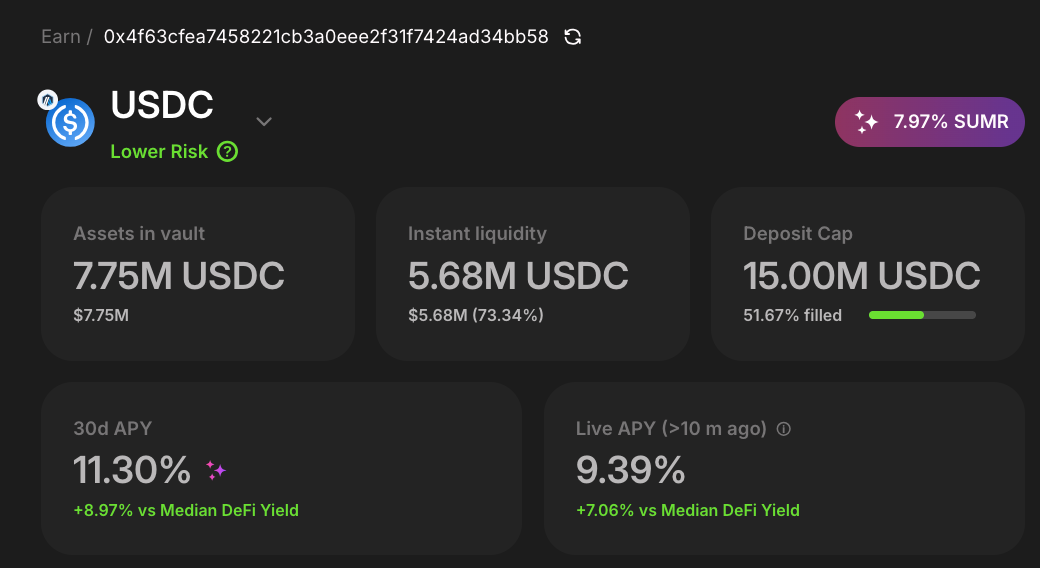

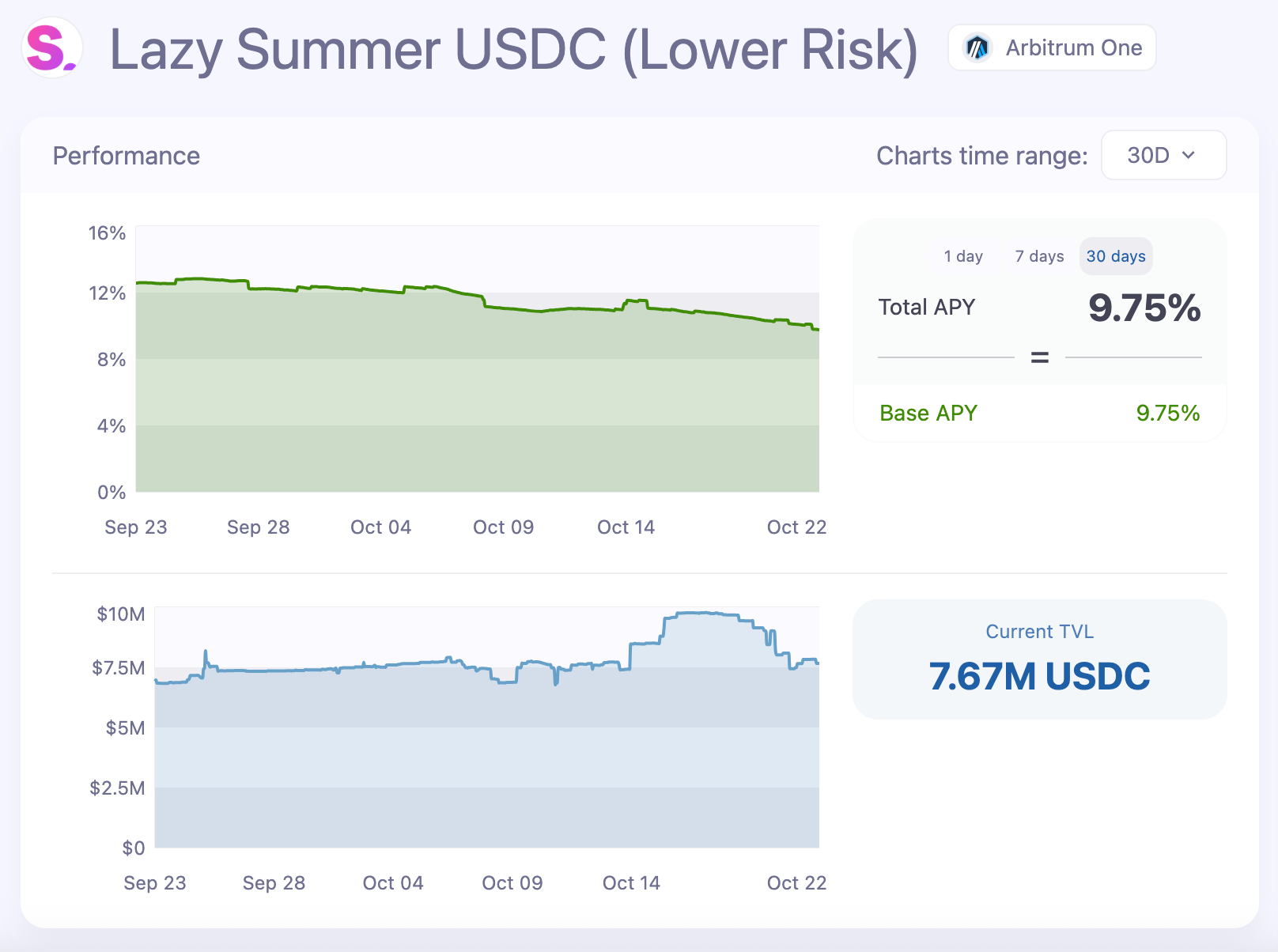

The USDC Lower-Risk Vault has quietly outperformed its peers across Arbitrum’s stablecoin ecosystem, sustaining an average 30-day APY of around 11%, with roughly $7.7 million assets in vault.

What’s driving the performance:

- Diversified exposure across multiple vetted and audited markets, reducing idle capital

- Risk-weighted optimisation that prioritises steady, efficient strategies rather than chasing volatile spikes

With automatic, round-the-clock adjustment built into the protocol logic, the vault demonstrates how automation can maintain yield efficiency in practice.

You can find full details here: https://app.vaults.fyi/opportunity/arbitrum/0x4F63cfEa7458221CB3a0EEE2F31F7424Ad34bb58

What It Means for Users

For most DeFi investors, yield optimization has meant juggling dashboards, monitoring APYs, and constantly reallocating capital. Lazy Summer ends that cycle.

The USDC Lower-Risk Vault delivers:

• Automated yield management with parameters defined by Block Analitica.

• Transparent, on-chain performance data visible in real time.

• SUMR rewards that align user participation with protocol growth.

In a sector defined by noise, this vault demonstrates the precision and transparency shaping the next era of DeFi yield.

👉 Explore the vault → Summer.fi/earn/arbitrum/position/0x4f63cfea7458221cb3a0eee2f31f7424ad34bb58

In conclusion

As yield markets evolve and Arbitrum cements its position as the leading Layer 2 for capital efficiency, automation will define the next frontier of performance. Lazy Summer protocol USDC lower risk vault isn’t chasing short-term gains it’s setting a new benchmark for risk-adjusted, automated yield.

If your stablecoins aren’t working this intelligently, they’re sitting idle.

Join us

Discord | Telegram | X/Twitter | Linktree

Disclaimer: Oazo Apps Limited functions solely as a front-end interface (Summer.fi) provider and it does not act on behalf of any user. Oazo Apps Limited did not launch nor does it operate or control the Lazy Summer Protocol. The Lazy Summer Protocol is accessed through Summer.fi. The information provided herein is provided on behalf of the Lazy Summer Foundation which launched the Protocol for informational purposes only and it does not constitute investment advice. Oazo Apps Limited and the Lazy Summer Foundation are not soliciting or recommending any transaction or guaranteeing any specific returns. Users interact with the Protocol at their own risk. T&C for the use of Summer.fi apply.