Lazy Summer - Weekly, where is the yield?

Where Is the Yield?

Weekly Rebalance Report — April 27, 2025

Lazy Summer is an automated DeFi yield optimizer. Deposit once, and our AI keepers continuously reallocate your assets into a curated basket of high-performing, risk-managed strategies—so you earn more while doing less.

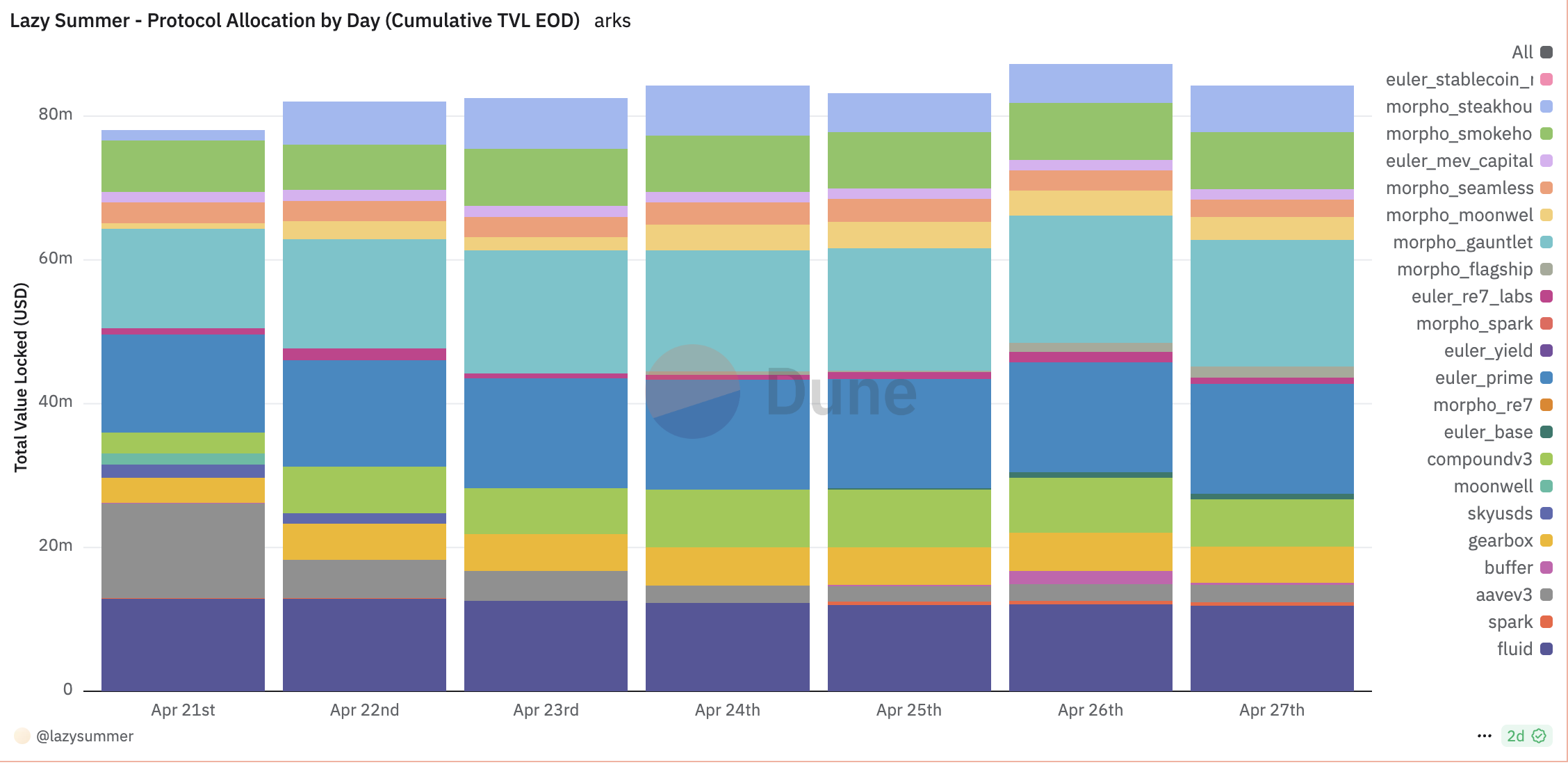

Top Rebalanced Protocols (Week Ending April 27, 2025)

- Morpho Gauntlet — $17.57M TVL, 5.20% APY

- Euler Prime — $15.29M TVL, 7.97% APY

- Fluid — $11.85M TVL, 2.46% APY

These three strategies drew the most capital this week, with Gauntlet and Euler continuing to lead. Fluid re-entered the top 3 despite declining yield, signalling inertia in allocation or rotation from other underperformers.

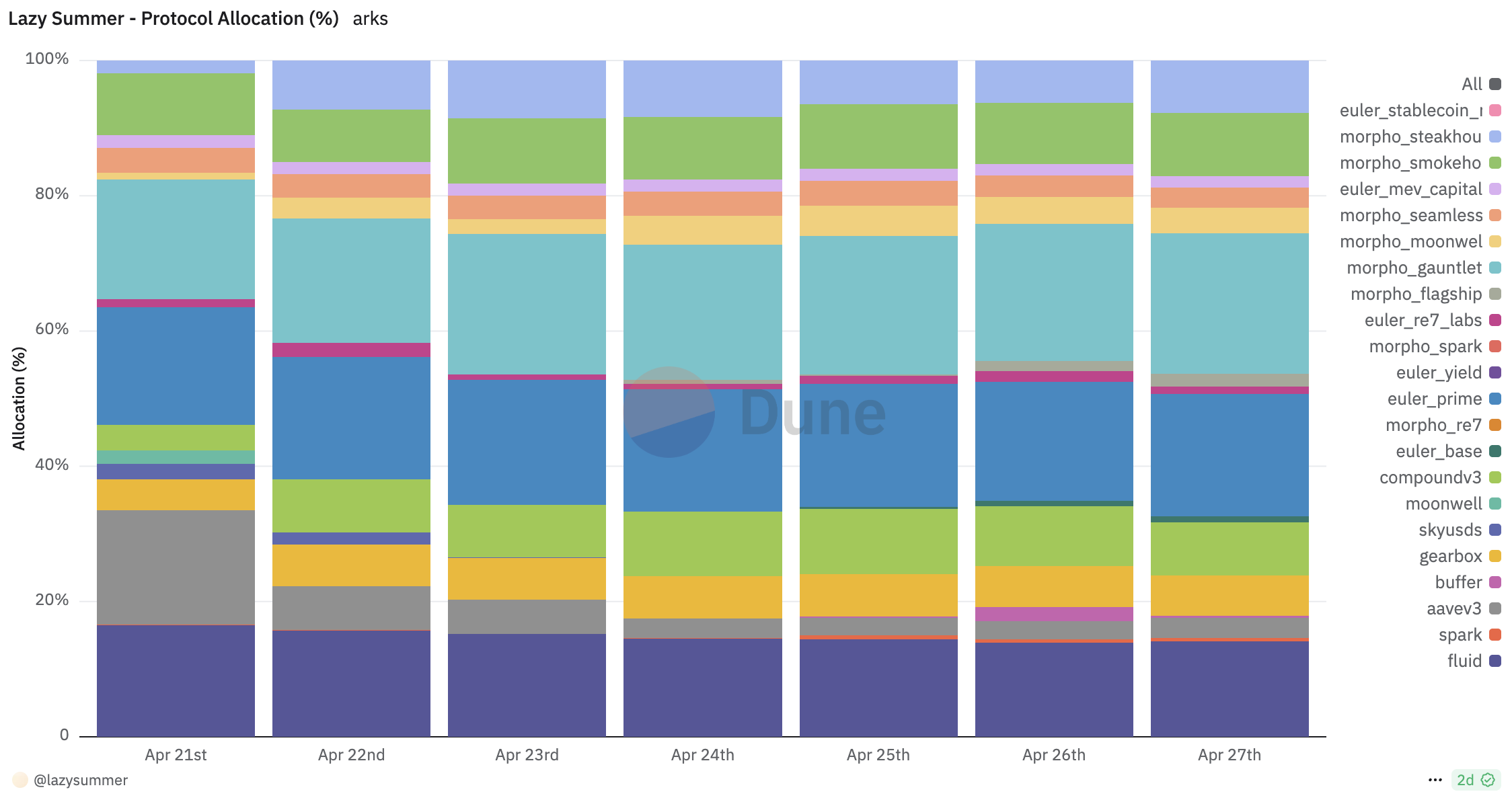

📈 How Capital Moved This Week

Lazy Summer’s AI-driven rebalancing continuously reallocates user funds toward better-performing opportunities. Each week, we snapshot these capital flows to uncover which protocols gained traction—and which lost favor.

(The visualization is changes in % of TVL in Lazy Summer Protocol, last 7 days)

🧠 Key Takeaways

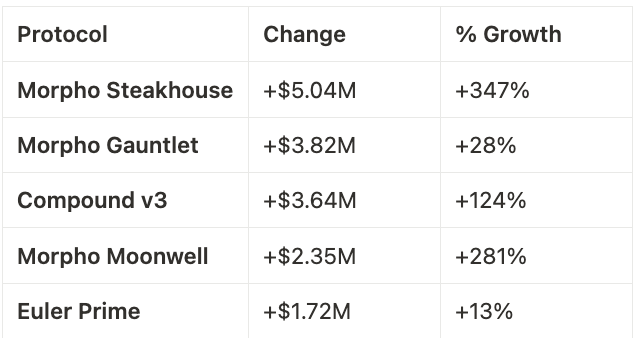

- Morpho Gauntlet held the top spot, gaining $3.8M in TVL.

- Euler Prime remained solid at #2, adding $1.7M.

- Fluid entered the top 3 as AAVE v3 plummeted from #3 to #9.

- Morpho Steakhouse surged nearly 5x, signaling strong confidence from the rebalancing agents.

- Morpho Flagship and Euler ETH Base joined the leaderboard, showing increased diversification into niche strategies.

👉 Lazy Summer’s AI agents kept users exposed to the best opportunities while steering them away from laggards like AAVE—all automatically.

🧬 How Capital Was Rebalanced (Past 7 Days)

Rebalance by Total Capital Shift (USD)

Rebalance by % of TVL

📊 Weekly Winners & Losers

🟢 Top 5 TVL Gainers (Absolute)

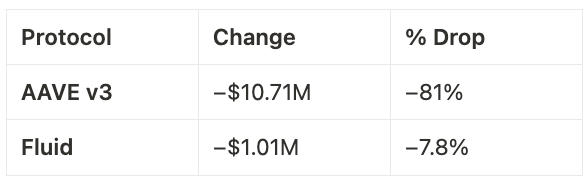

🔻 Top 2 TVL Losers

🤖 How AI Keeps You Ahead

Lazy Summer’s architecture uses intelligent agents to optimize for net yield in real time.

- 📡 Continuous Scanning: Live APRs, incentives, TVL, and protocol risks are ingested 24/7.

- 📈 Predictive Forecasting: Machine learning anticipates yield shifts before they happen.

- 🧠 Multi-Agent Consensus: Independent AI agents agree on reallocations within risk boundaries set by Block Analitica.

- ⛽ Gas-Efficient Execution: All rebalances are batched into a single keeper transaction, saving users gas and time.

✅ Start Earning DeFi’s Best Yields. Automatically.