Lazy Summer Protocol: Yield Source Update

The Lazy Summer protocol promise

Finding the best yields in DeFi shouldn't feel like a full-time job. Between monitoring multiple protocols, assessing risks, and rebalancing positions, yield farming can be exhausting. That's where Lazy Summer comes in.

Lazy Summer protocol provides automatic exposure to DeFi's highest quality yield sources, all through a single, simple interface. No constant monitoring. No manual rebalancing. Just set it and forget it while your capital works across the most promising opportunities in DeFi.

Staying up to date on new yield sources

As the protocol continues to expand, raising caps on proven yield sources and adding new ones, it's important to share these critical updates with the community.

This post breaks down:

- Current risk posture

- Recent risk cap changes

- A preview of what yield sources are coming next

- Most importantly, how YOU can shape Lazy Summer's future by requesting the yield sources you want to see

Current risk posture

Safety is the foundation of Lazy Summer Protocol. The protocol's design approaches risk management actively through calibrated caps for each yield source, set by our risk manager Block Analitica.

The current risk posture is: Still conservative, but gradually becoming more risk-on, with more risk caps being raised. These specific risk cap raises are shared below.

Why risk caps matter

Think of caps as training wheels that are gradually removed and added as yield sources gain and lose credibility. Specifically, risk caps seek to:

- Mitigate Risk: If something goes wrong with a yield source, limited exposure means limited damage

- Testing Ground: Lower caps let the protocol observe how yield sources perform under different market conditions

- Gradual Scaling: As yield sources prove themselves based on performance, the protocol can confidently increase allocation

- Market Adaptation: As market conditions and risk/reward balances change, risk caps can be increased or decreased across the board

Recent cap increases: yield sources approved for more capital and why

Several yield sources have recently had their caps raised. This is a big deal for a few reasons.

When Block Analitica raises a cap, it's a vote of confidence. It means:

- Proven Track Record: The yield source has demonstrated stability and reliability

- Risk Assessment Complete: Block Analitica has thoroughly evaluated the protocol's security and sustainability

- More Opportunity: More of your capital can flow to these high-performing yield sources

- Higher Potential Returns: Greater allocation to proven strategies means better overall yields

Yield Sources with Raised Caps

Let's explore some of the strategies that have earned increased allocations. Given Block Analitica's recent conservative stance, raising caps on these yield sources speaks volumes.

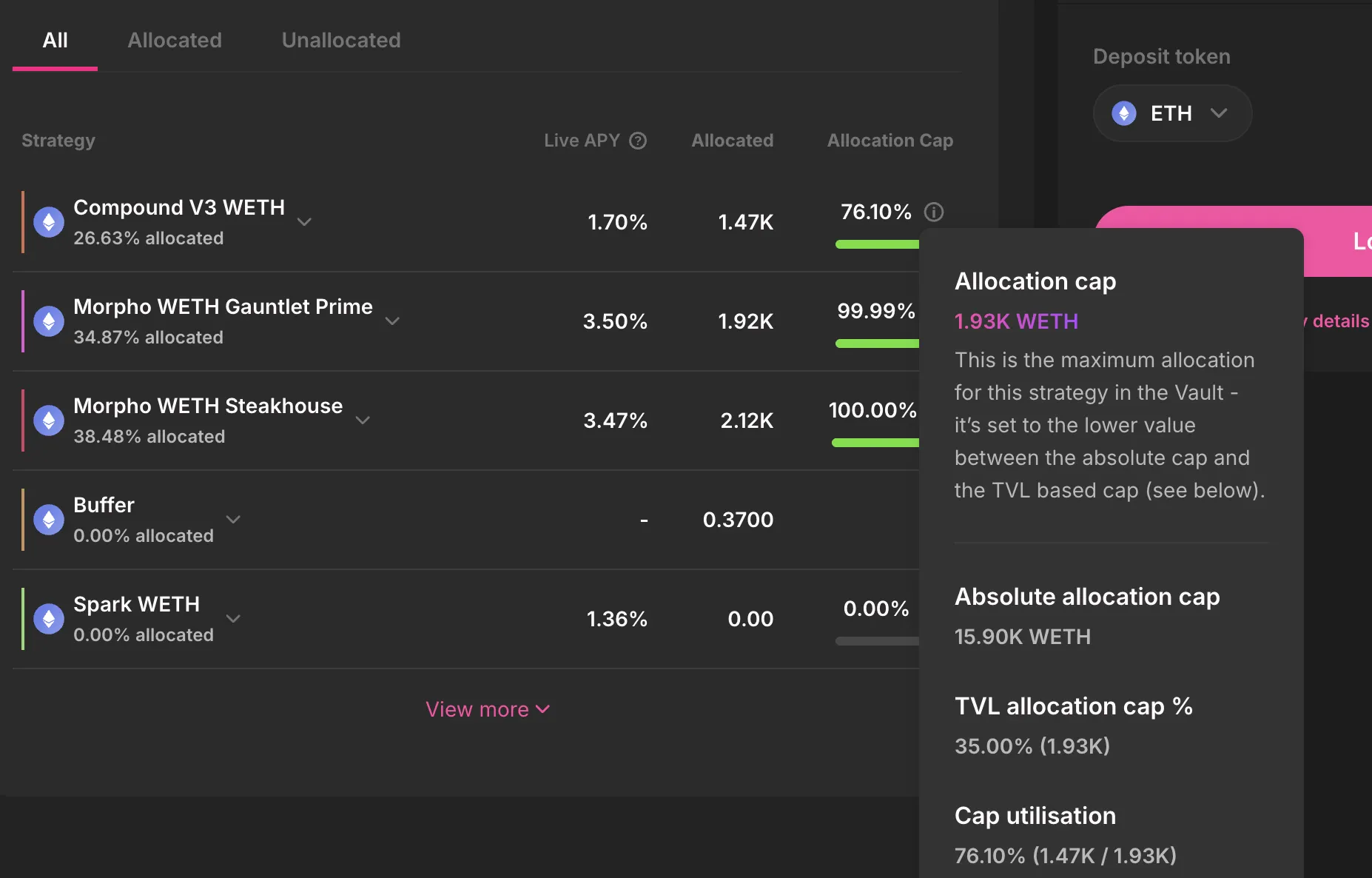

Mainnet ETH - Lower Risk

Morpho Steakhouse WETH

- Previous Cap: 0

- New Cap: 1.93K WETH

Morpho Gauntlet WETH Prime

- Previous Cap: 0

- New Cap: 5.30K WETH

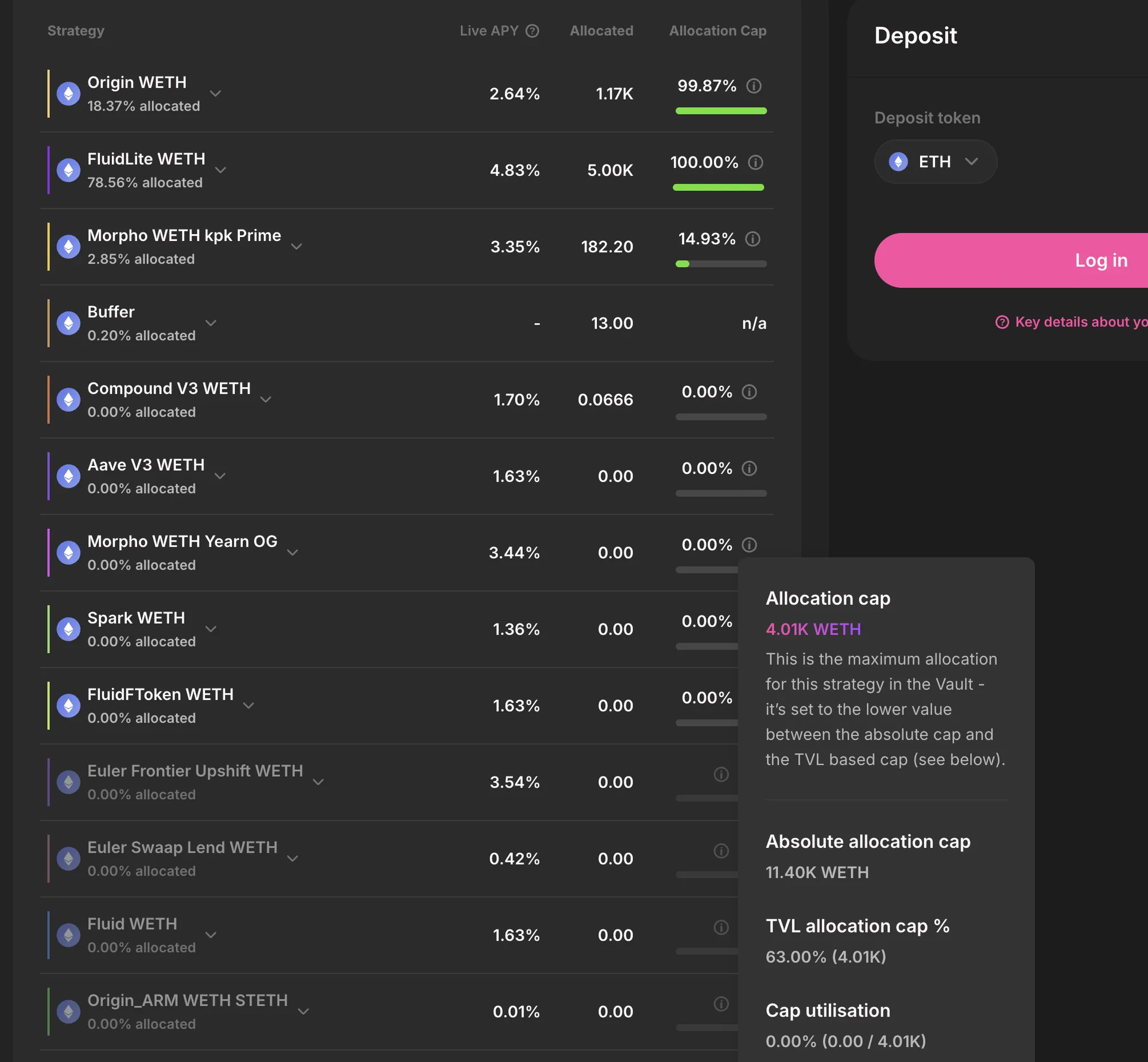

Mainnet ETH - Higher Risk

morpho Yearn OG WETH

- Previous Cap: 0

- New Cap: 11.40K WETH

morph KPK WETH Prime

- Previous Cap: 0

- New Cap: 1.22K WETH

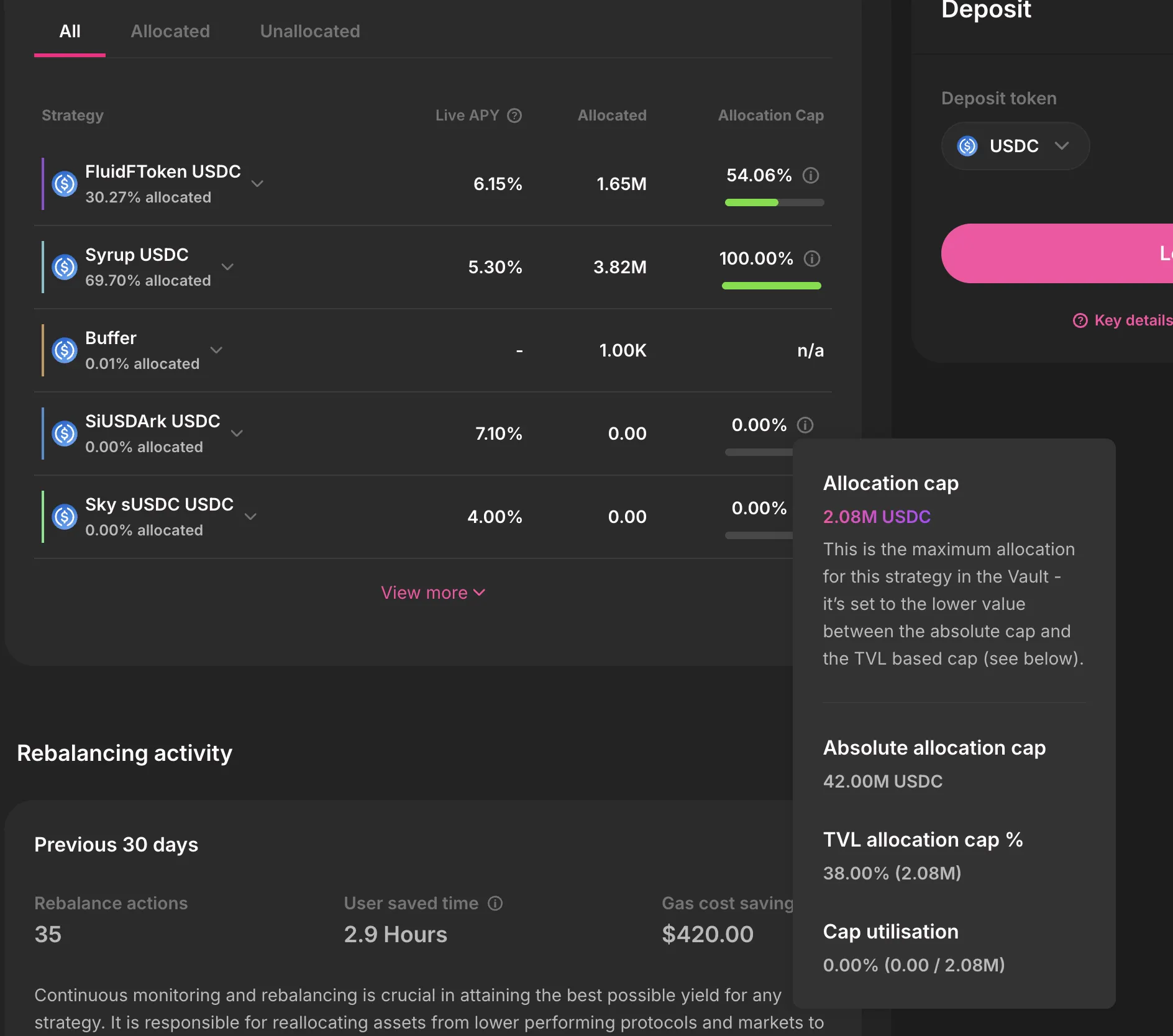

Mainnet USDC - Higher Risk

siUSD

- Previous Cap: 0

- New Cap: 42.00M USDC

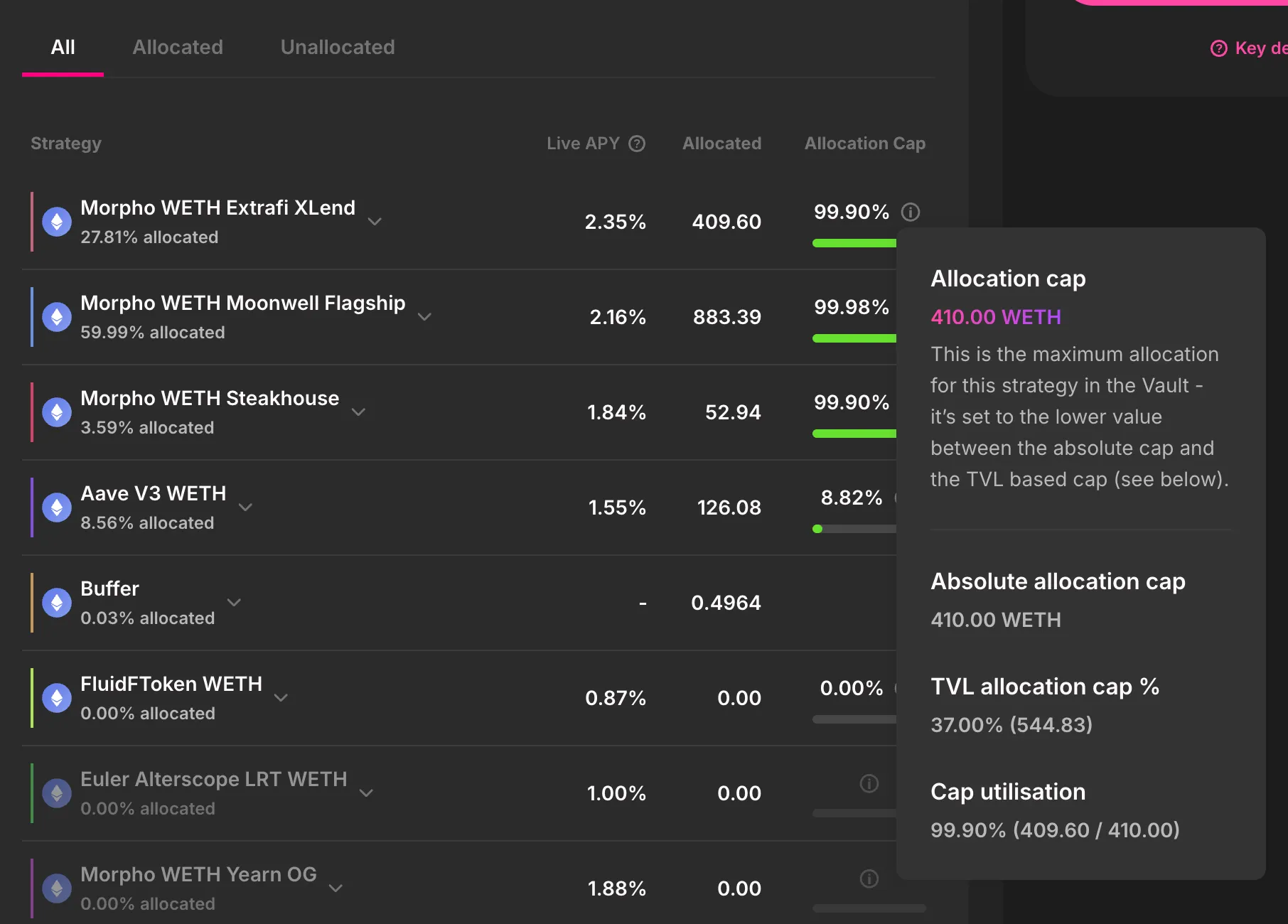

Base ETH - Lower Risk

Morpho Extrafi xlend WETH

- Previous Cap: 0

- New Cap: 410.00 WETH

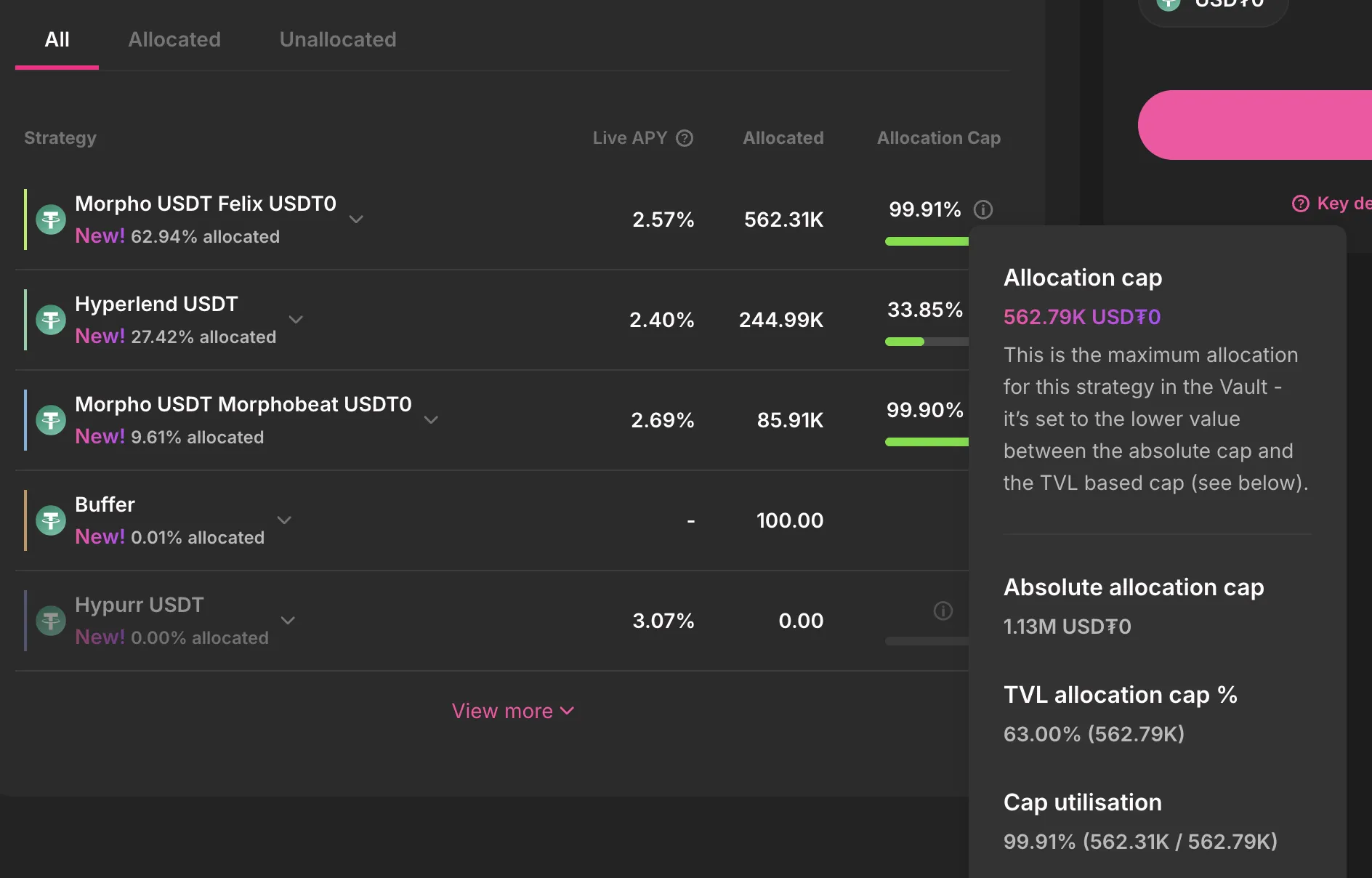

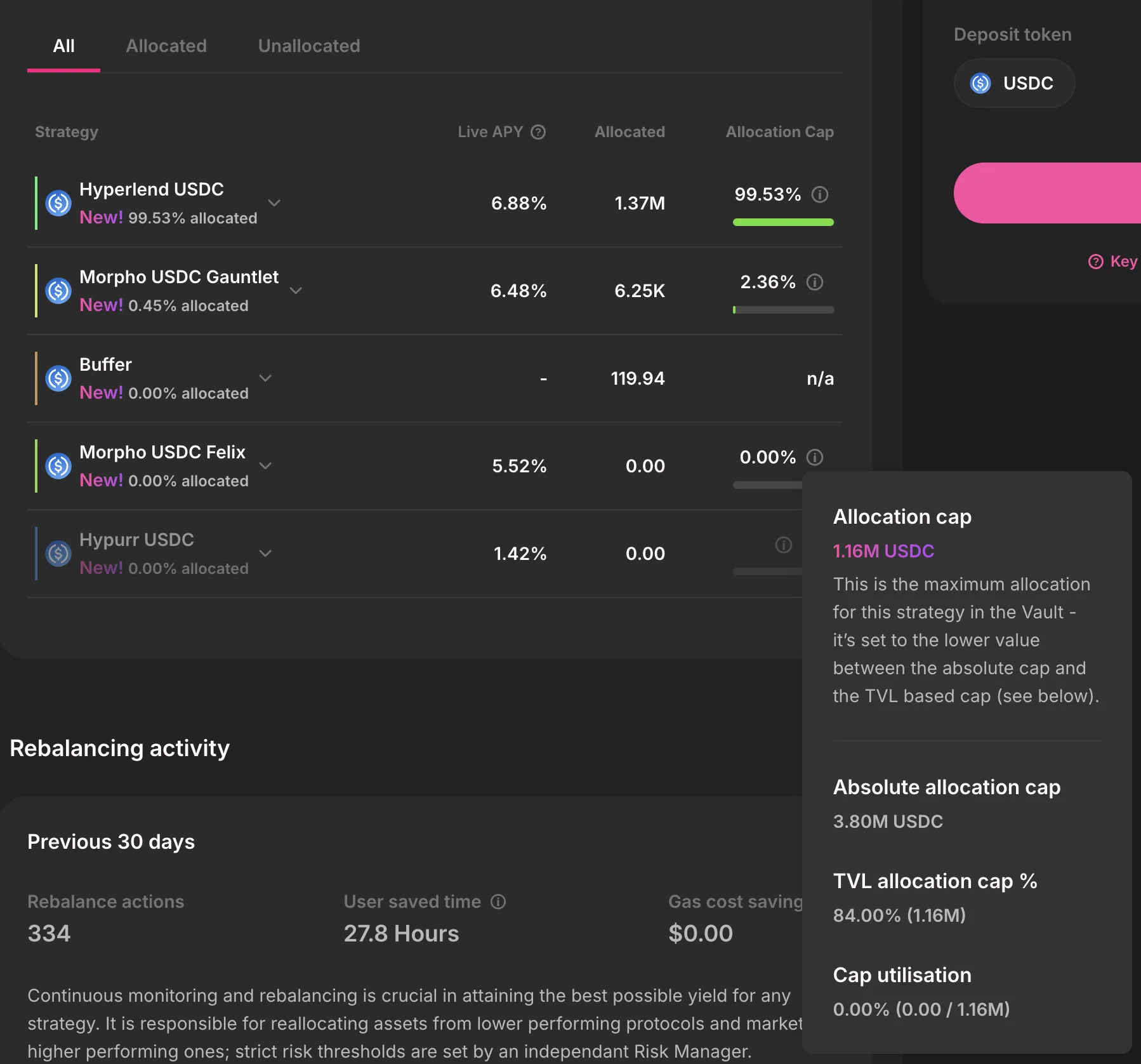

HyperEVM USDC & USDT - Lower Risk

Felix USDC & USDT

- Previous Cap: 0

- New Cap: 3.80M USDC

New Yield Sources Coming to Lazy Summer Protocol

Lazy Summer Protocol is not beholden to a single protocol or yield source type, and new yield sources are added at least every week. Here's what's being added to vaults in the coming weeks:

🟢 Already Live

None this cycle

🟡 Coming Soon

ETH+

Vault: ETH Mainnet - Lower Risk

Why It's Here: ETH+ from Reserve Protocol acts as an LST aggregator token, offering diversification by holding a basket of wstETH, rETH, sfrxETH, and ETHx. Block Analitica's assessment confirms it meets baseline criteria for Lower Risk fleets, with conservative caps due to potential withdrawal periods. The collateral composition includes assets already onboarded to Lower Risk ETH Fleets, while the RSR staking mechanism provides first-loss capital protection.

Link to forum: RFC: Proposal to Onboard ETH+ to the Lower-Risk ETH Fleet

Morpho v2 Vaults

Vault: USDC/USDT/WETH Mainnet - Lower Risk

Why It's Here: Onboarding high-priority Morpho v2 vaults represents a like-for-like expansion within an existing risk set. These vaults allocate liquidity into Morpho V1 markets with positions verifiable onchain. This does not introduce new collateral exposure, the risk drivers remain unchanged. Morpho v2 vaults are among the most audited code in the industry.

Vaults being onboarded: Steakhouse Prime Instant (USDT & WETH), Gauntlet USDC Prime, KPK USDC Prime v2, KPK ETH Prime v2, API3 Core USDC, Avantgarde USDC Conservative

Link to forum: RFC: Onboarding High Priority Morpho v2 Vaults

🔵 Proposed and Pending Review

OUSD

Vault: USDC Mainnet - Lower Risk

Why It's Here: Origin Dollar (OUSD) is a yield-bearing stablecoin that automatically earns yield from DeFi strategies while sitting in your wallet. Adding OUSD to the Lower Risk USDC fleet provides passive yield generation backed by a battle-tested protocol with years of track record.

Link to forum: SIP2.47: Onboard OUSD to the Lower-Risk USDC Mainnet Fleet

USDC 40 Acres

Vault: USDC Base

Why It's Here: 40 Acres brings institutional-grade yield strategies to Base, offering curated exposure to the growing DeFi ecosystem on Coinbase's L2. This vault targets higher yields through actively managed positions across Base's most promising protocols.

Link to forum: RFC: Add 40Acres USDC Vault to Create a High Risk USDC Vault on Base

CAP Protocol (stcUSD)

Vault: USDC Mainnet - Higher Risk

Why It's Here: CAP Protocol offers operator-managed yield with verifiable downside protection built on EigenLayer's shared security model. Users get Aave base yield as a minimum guarantee while autonomous operators deploy capital into arbitrage, MEV, and RWA opportunities.

Link to forum: RFC: Onboard New Yield Sources and Raise Caps for USDC Higher Risk

Neutrl Protocol (sNUSD)

Vault: USDC Mainnet - Higher Risk

Why It's Here: Neutrl acquires discounted locked tokens from early investors via OTC deals and hedges exposure with perpetuals—a unique delta-neutral strategy. Their first epoch delivered 16.58% APY compared to 5.12% on sUSDe, demonstrating strong execution. Backed by STIX with $125M TVL.

Link to forum: RFC: Onboard New Yield Sources and Raise Caps for USDC Higher Risk

Lagoon Finance USDC Vault

Vault: USDC Mainnet - Higher Risk

Why It's Here: Lagoon's curated vaults deploy capital across DEX LP positions, money markets, and yield-bearing assets. With $300M platform TVL and 7 security audits, Lagoon brings institutional-grade curation to Higher Risk USDC strategies.

Link to forum: RFC: Onboard New Yield Sources and Raise Caps for USDC Higher Risk

Upshift Finance USDC Vaults

Vault: USDC Mainnet - Higher Risk

Why It's Here: Upshift brings institutional DeFi yield through KYC'd curators including MEV Capital, Tulipa Capital, and UltraYield. These vaults lend against blue-chip and RWA collateral, offering professional risk management with competitive returns.

Link to forum: RFC: Onboard New Yield Sources and Raise Caps for USDC Higher Risk

Morpho Resolv USDC Vault

Vault: USDC Mainnet - Higher Risk

Why It's Here: This curated Morpho vault focuses on lending against Resolv's ETH-collateralized stablecoin (USR/wstUSR). High borrowing demand combined with MORPHO rewards creates attractive yields for USDC depositors seeking exposure to the growing Resolv ecosystem.

Link to forum: RFC: Onboard New Yield Sources and Raise Caps for USDC Higher Risk

Morpho MEV Capital USDC Vault

Vault: USDC Mainnet - Higher Risk

Why It's Here: MEV Capital is one of Morpho's top curators with a proven track record of active rebalancing across lending markets. Their USDC vault benefits from professional management, battle-tested strategies, and MORPHO incentives.

Link to forum: RFC: Onboard New Yield Sources and Raise Caps for USDC Higher Risk

Midas mHYPER

Vault: USDC Mainnet - Higher Risk

Why It's Here: Midas brings institutional asset management onchain through mHYPER, a Liquid Yield Token managed by Hyperithm. The strategy combines leveraged USDe positions, basis trading, and Morpho LP across multiple chains. German-regulated with $1.2B+ platform TVL.

Link to forum: RFC: Onboard New Yield Sources and Raise Caps for USDC Higher Risk

Shift Protocol ext-USD

Vault: USDC Base - Lower Risk

Why It's Here: Shift Protocol tokenizes yield on Base, offering a straightforward path to competitive stablecoin returns on Coinbase's L2. This Lower Risk integration expands our Base presence with a proven yield source.

Link to forum: RFC: Raise Base Risk Caps and Add New Yield Sources

Revert Lend USDC

Vault: USDC Base - Lower Risk

Why It's Here: Revert Lend offers lending markets on Base with attractive utilization rates. Adding this to our Lower Risk Base fleet diversifies yield sources and captures growing demand for USDC borrowing on the network.

Link to forum: RFC: Raise Base Risk Caps and Add New Yield Sources

Harvest 40 Acres USDC

Vault: USDC Base - Lower Risk

Why It's Here: Harvest's 40 Acres vault on Base auto-compounds yields across the best opportunities on the network. This integration brings Harvest's yield optimization expertise to our Base USDC fleet.

Link to forum: RFC: Raise Base Risk Caps and Add New Yield Sources

Lagoon Finance ETH Vault

Vault: ETH Mainnet - Higher Risk

Why It's Here: Expanding on Lagoon's USDC presence, this ETH vault brings the same curated approach to ETH yield strategies. Professional curators deploy across DEX LP, lending, and yield-bearing positions to maximize ETH returns.

Link to forum: RFC: Onboard Lagoon Finance ETH Vault to ETH Mainnet Higher Risk

Yield Basis ETH Vault

Vault: ETH Mainnet - Higher Risk

Why It's Here: Yield Basis offers a differentiated approach to ETH yield through basis trading and delta-neutral strategies. This adds another tool to our Higher Risk ETH arsenal for capturing yield across market conditions.

Link to forum: RFC: Onboard Yield Basis ETH Vault to ETH Mainnet Higher Risk

USD.ai (sUSDai)

Vault: USDC Arbitrum - Lower Risk

Why It's Here: USD.ai brings AI-optimized yield strategies to Arbitrum, automatically allocating across the best opportunities on the network. This expands our Arbitrum Lower Risk presence with an innovative approach to yield optimization.

Link to forum: RFC: Onboard USD.ai to USDC Arbitrum Lower Risk

🔴 Rejected

Kelp's hgETH

Vault: ETH Mainnet – Higher Risk

Why It Was Rejected: Block Analitica found that hgETH runs leverage positions across multiple chains and can take OTC positions, placing it outside our risk appetite. Multi-day drawdowns combined with 3-4 day redemption periods can crystallize losses during exit windows, and withdrawals are paid only in rsETH regardless of deposit asset. While Nexus Mutual insurance provides some protection, it doesn't eliminate path risk. May be reconsidered as collateral with limited caps in the future.

Link to forum: RFC: Proposal to Onboard Kelp's hgETH

⏸️ Paused

Midas Apollo

Vault: USDC Mainnet/Base – Higher Risk

Why It's Paused: Security analysis revealed scenarios where admin actions could manipulate fees, change oracle settings, or remove tokens, potentially locking users out of pending redemption requests. Users cannot rely on withdrawing USDC with the same terms as at deposit. The proposal remains paused pending resolution of these concerns.

Link to forum: RFC: Onboard Midas as a USDC Yield Source

Which yield sources are next?

The beauty of Lazy Summer is that it's a community-driven protocol. You, as a SUMR holder, decide what yield sources go in the protocol next, with risk assessment support from Block Analitica.

To illustrate this, let's look at a live market scan using Vaults.fyi, filtering for Stablecoins and ETH on Mainnet/Base with a minimum TVL of $1M.

The "Vaults.fyi" yield scan

When you sort by highest APY, the results generally fall into three distinct buckets:

The "Too Risky" Bucket (Block Analitica Rejections):

You will often see outliers with headline-grabbing APYs, like MNNC Azure Tide (~34%) or Rezerve (~16%). While attractive on paper, many of these sources have been reviewed and rejected by our risk curators at Block Analitica. Whether due to thin liquidity, centralization vectors, or unverified oracle dependencies, they currently sit outside our risk appetite—regardless of the APY.

The "Incoming" Bucket (In the process of being onboarded):

The next tier of high yields is dominated by protocols we are already in the process of onboarding. A perfect example is the Midas ecosystem (Midas Apollo, mEDGE), which appears prominently in the top 10 USDC yields. As noted in the "New Yield Sources" section above, governance is already moving to capture this. Similarly, ExtraFi and kpk/Morpho markets are already being integrated to capture the best ETH yields.

The "Capped" Bucket:

Other visible sources are often protocols Lazy Summer Protocol has already integrated but has assigned 0 caps or strict limits due to specific market risks. These yield sources are already integrated technically—just waiting for market conditions (liquidity depth, volatility) to improve so they can safely be allocated to once again.

How to request a new yield source

Have a protocol you love? A yield source you think we should integrate? Here's how to make it happen:

Submit an RFC (Request for Comments)

- Visit: Forum.summer.fi

- Use the Template: Fill out the standardized RFC format

- Engage with the Community: Respond to questions and feedback

- Wait for Review: With enough community feedback, Block Analitica will provide a GO or NO-GO from a risk perspective

It's all about the Lazy Summer promise... Do Less

Above Benchmark Yield: Diversified exposure that consistently beats static deposits

Risk Curation: Access to new yield sources inside a strict, governed framework

No Yield Chasing: Governance + risk experts handle rotation discipline so users don't have to

Do Less.

Join us

Discord | Telegram | X/Twitter | Linktree

Disclaimer: Oazo Apps Limited functions solely as a front-end interface (Summer.fi) provider and it does not act on behalf of any user. Oazo Apps Limited did not launch nor does it operate or control the Lazy Summer Protocol. The Lazy Summer Protocol is accessed through Summer.fi. The information provided herein is provided on behalf of the Lazy Summer Foundation which launched the Protocol for informational purposes only and it does not constitute investment advice. Oazo Apps Limited and the Lazy Summer Foundation are not soliciting or recommending any transaction or guaranteeing any specific returns. Users interact with the Protocol at their own risk. T&C for the use of Summer.fi apply.