Lazy Summer Protocol: Yield Source Update

The Lazy Summer Protocol Promise

Finding the best yields in DeFi shouldn't feel like a full-time job. Between monitoring multiple protocols, assessing risks, and rebalancing positions, yield farming can be exhausting. That's where Lazy Summer comes in.

Lazy Summer provides automatic exposure to DeFi's highest quality yield sources, all through a single, simple interface. No constant monitoring. No manual rebalancing. Just set it and forget it while your capital works across the most promising opportunities in DeFi.

Staying up to date on new yield sources

As the protocol continues to expand, raising caps on proven yield sources and adding new ones, it's important to share these critical updates with the community.

This post breaks down:

- current risk posture

- highlights recent risk cap changes

- and gives you a preview of what yield sources are coming next

- Most importantly, we'll show you how YOU can shape Lazy Summer's future by requesting the yield sources you want to see.

Current risk posture

Safety is the foundation of Lazy Summer Protocol, the protocols design is to approach to risk management actively. This is done through calibrated caps for each yield source by our risk manager Block Analitica.

The current risk posture is: Conservative, given broader DeFi market conditions.

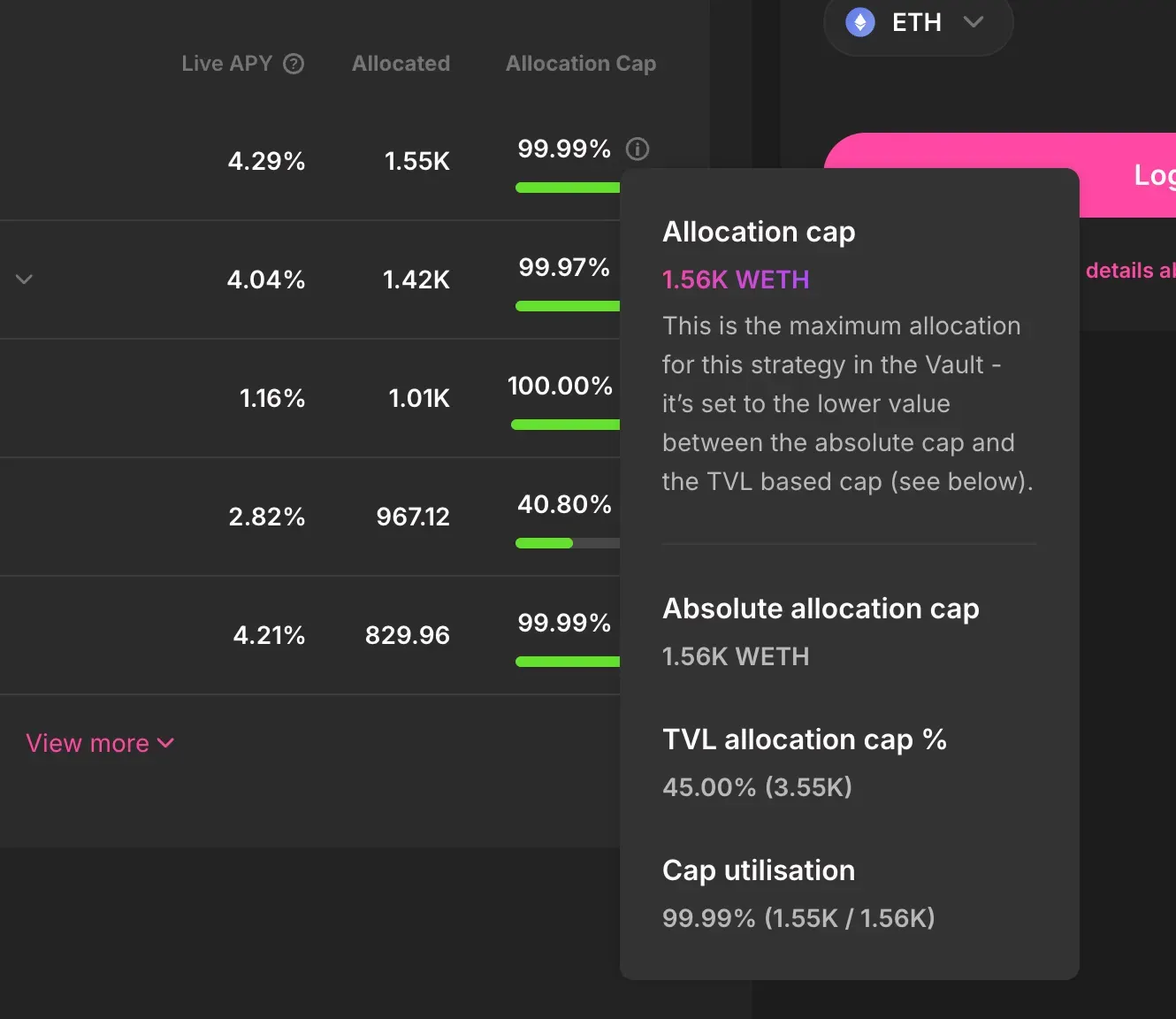

Why risk caps matter

Think of caps as training wheels that are gradually removed and added as yield sources gain and lose credibility. Specifically, risk caps seek to:

- Mitigate Risk: If something goes wrong with a yield source, limited exposure means limited damage

- Testing Ground: Lower caps let the protocol observe how yield sources perform under different market conditions.

- Gradual Scaling: As yield sources prove themselves based on performance, the protocol can confidently increase allocation.

- Market Adaptation: As market conditions and risk/reward balances change risk caps can be increased or decreased across the board.

Recent cap increases: yield sources approved for more capital and why

Several yield sources have recently had their caps raised. This is a big deal for a few reasons.

When Block Analitica raises a cap, it's a vote of confidence, it means:

- Proven Track Record: The yield source has demonstrated stability and reliability

- Risk Assessment Complete: Block Analitica has thoroughly evaluated the protocol's security and sustainability

- More Opportunity: More of your capital can flow to these high-performing yield sources

- Higher Potential Returns: Greater allocation to proven strategies means better overall yields

Yield Sources with Raised Caps

Let's explore some of the strategies that have earned increased allocations, given Block Analtic’s recent risk off stance, raising caps on these yield sources speaks volumes.

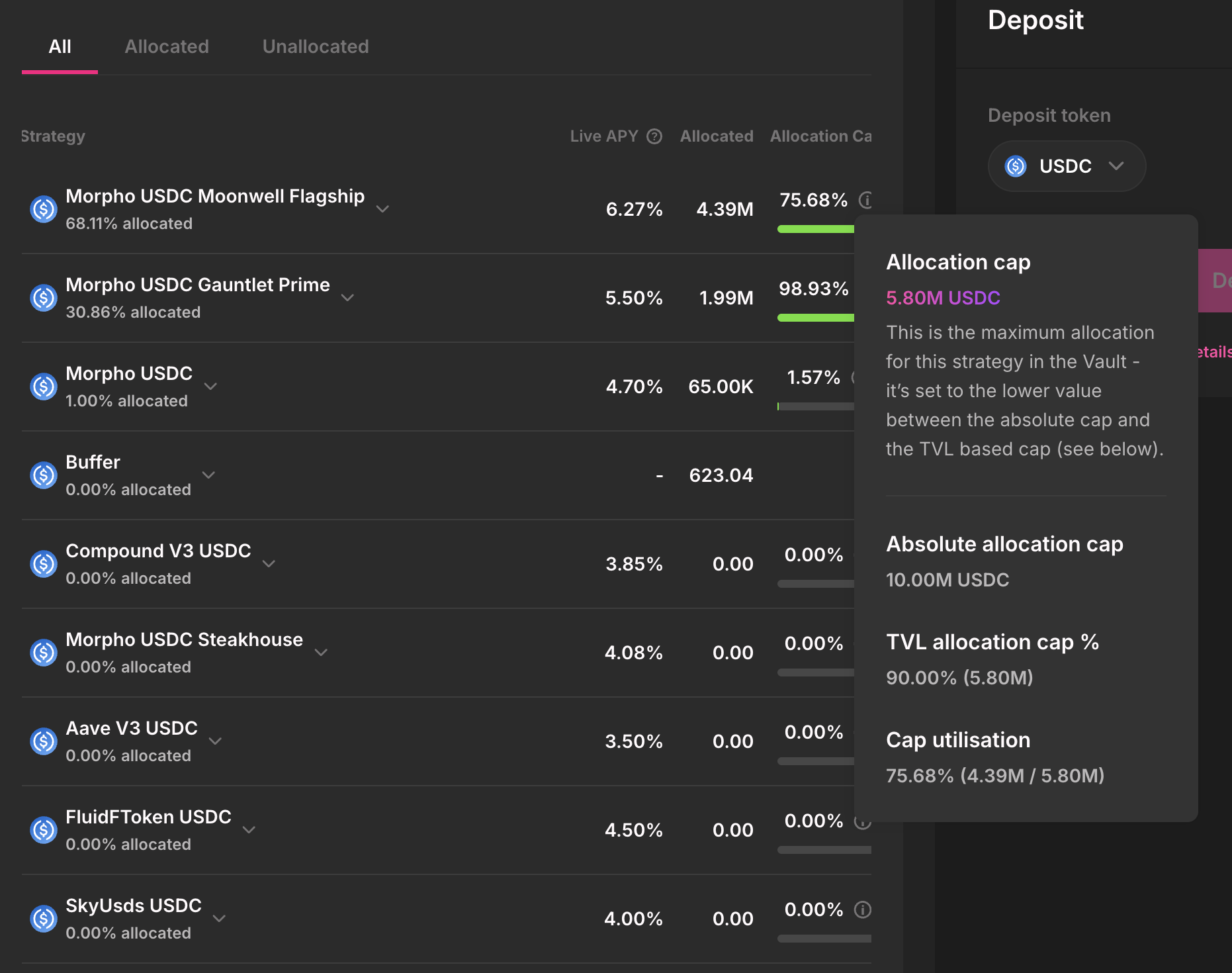

Base USDC Raised Caps

Morpho USDC Moonwell Flagship

- Previous Cap: 0

- New Cap: 5.80M USDC

- Currently Allocated: 4.46M (76.80% utilization)

Morpho USDC Gauntlet Prime

- Previous Cap: 0

- New Cap: 2.01M USDC

- Currently Allocated: 1.99M (98.93% utilization)

Morpho USDC Steakhouse

- Previous Cap: 0

- New Cap: 2.90M USDC

- Currently Allocated: 0.00 (ready for deployment)

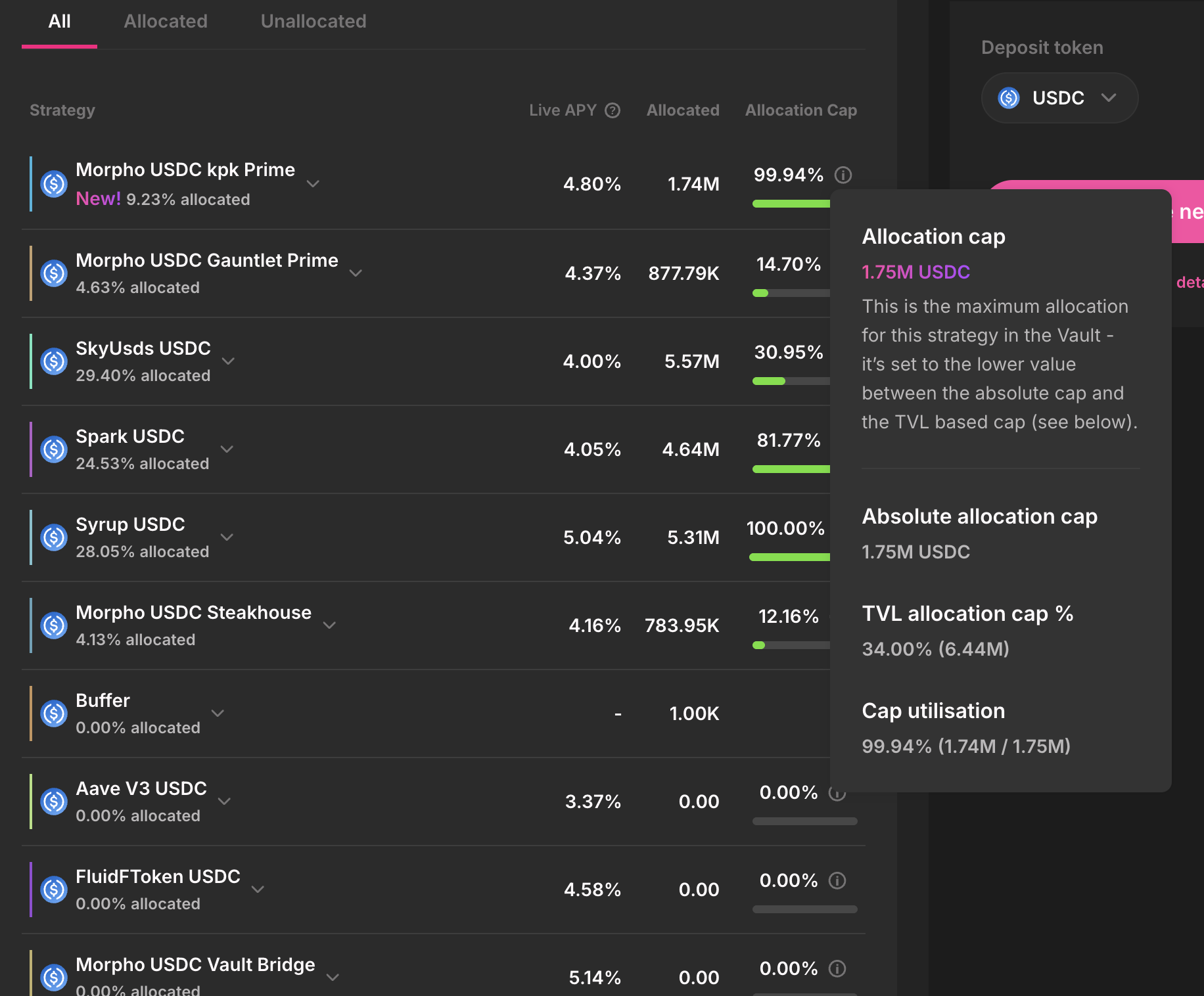

Mainnet USDC Raised Caps

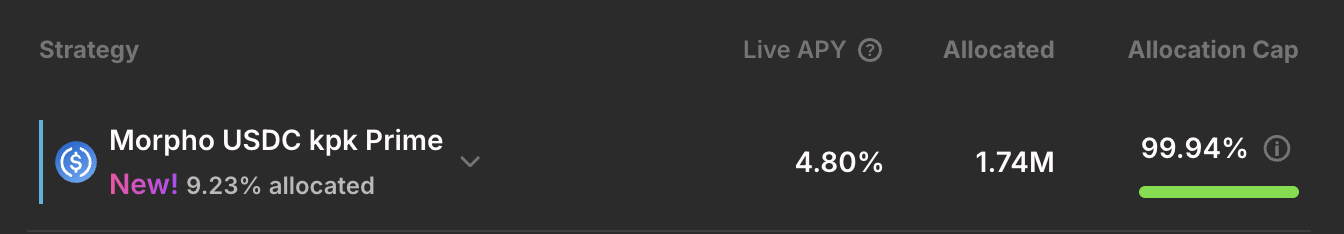

Morpho USDC kpk Prime

- Previous Cap: 0

- New Cap: 1.75M USDC

- Currently Allocated: 1.74M (99.94% utilization)

Morpho USDC Gauntlet Prime

- Previous Cap: 0

- New Cap: 5.96M USDC

- Currently Allocated: 877.78K (14.70% utilization)

Morpho USDC Steakhouse

- Previous Cap: 0

- New Cap: 6.44M USDC

- Currently Allocated: 783.95K (12.16% utilization)

Morpho USDC Vault Bridge

- Previous Cap: 0

- New Cap: 6.25M USDC

- Currently Allocated: 0.00 (ready for deployment)

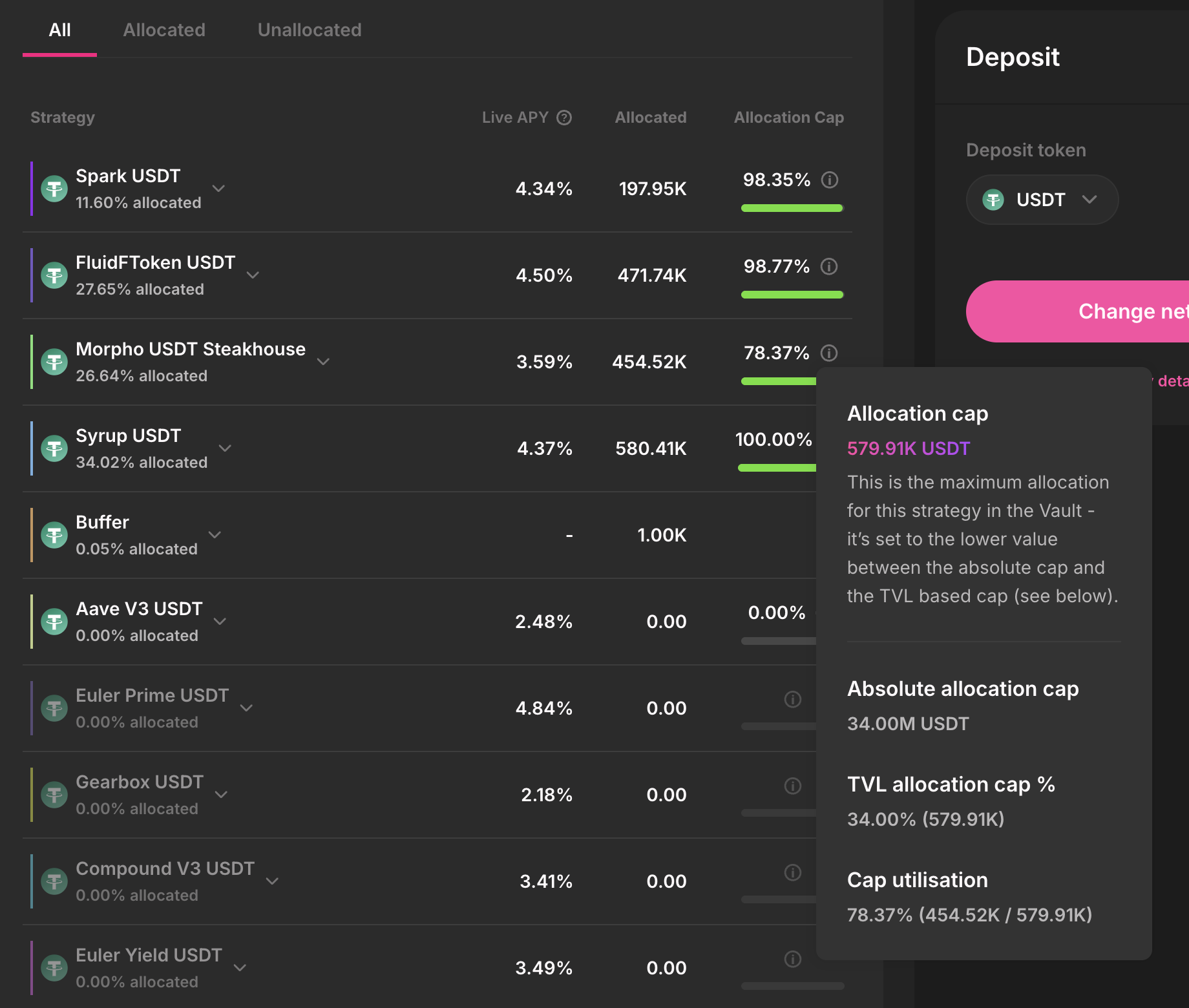

USDT Mainnet Caps

Morpho USDT Steakhouse

- Previous Cap: 0

- New Cap: 579.91K USDT

- Currently Allocated: 454.51K (78.37% utilization)

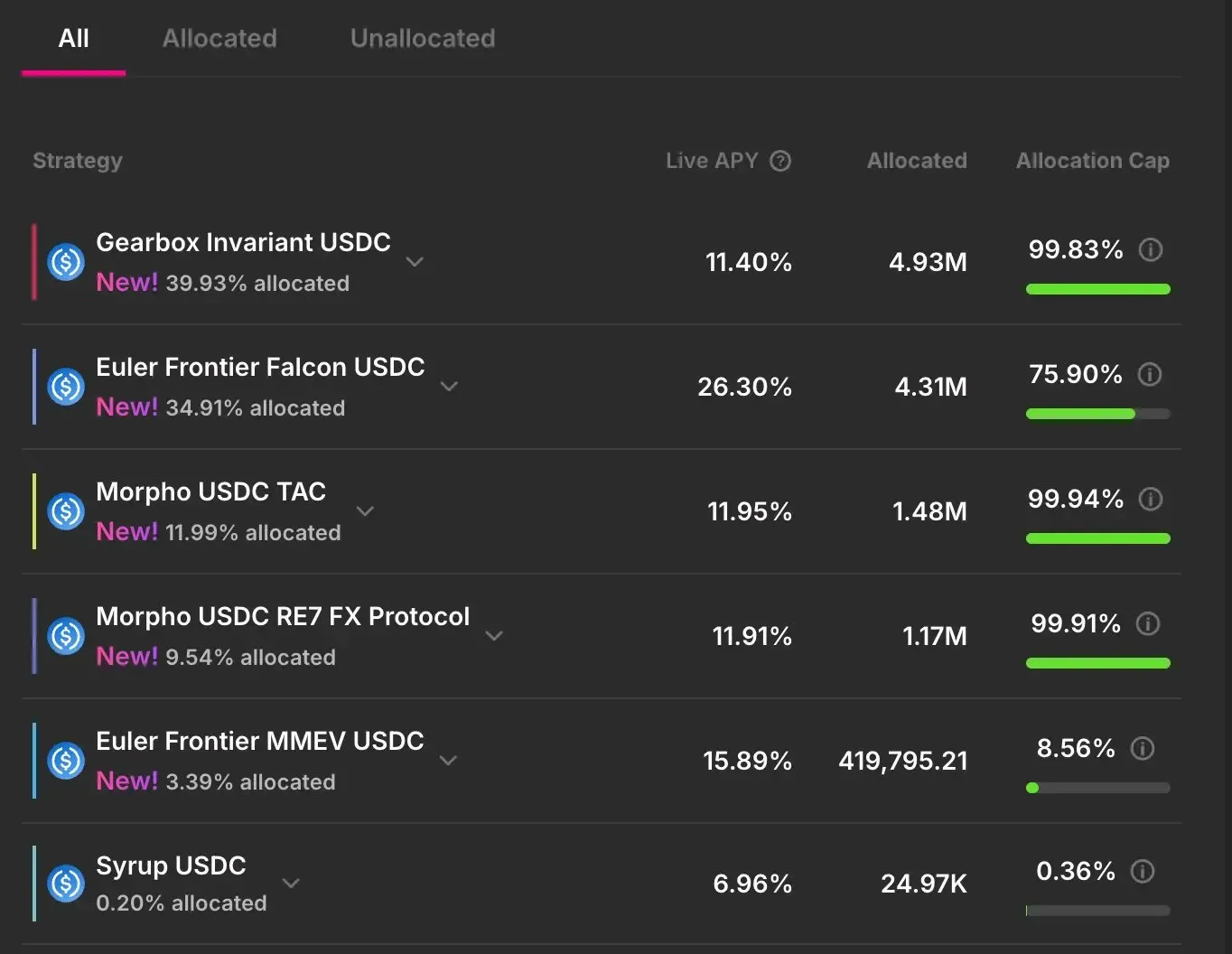

New Yield Sources coming to Lazy Summer Protocol

Lazy Summer protocol is not beholden to a single protocol or yield source type, and new yield sources are added usually at least every week. Here's what's being added to vaults in the coming week:

🟢 Already Live

Morpho USDC kpk Prime (Mainnet USDC)

Why It's Here: This connects our Lower Risk USDC vault to Morpho’s institutional-grade "Prime" instance. It offers higher capital efficiency than standard lending markets by utilizing curated risk parameters managed by kpk, ensuring our users get "whale-tier" lending rates with professional risk monitoring.

🟡 Coming Soon (in the next week)

kpkWETH Prime (Morpho)

Vualt: ETH Mainnet – Higher Risk Vault

Why It's Here: Similar to the USDC integration, this brings the Morpho Prime efficiency to our ETH fleet. It allows the vault to lend WETH against high-quality collateral with tighter spreads and better utilization rates than public P2P markets, directly boosting APY for ETH depositors.

Link to forum: SIP2.41: Onboard kpkWETH Prime

kpkUSDC Prime (Morpho)

Vault: USDC Mainnet – Higher Risk Vault

Why It's Here: This expands our Morpho Prime exposure into the Higher Risk fleet. By accepting slightly wider collateral parameters (curated by kpk), this source captures significantly higher lending APYs while maintaining the robust liquidation logic of the Morpho Blue architecture.

Link to forum: SIP2.42: Onboard kpkUSDC Prime

Extrafi XLend’s ETH Pool

Vault: Base ETH – Lower Risk Vault

Why It's Here: Extrafi is a dominant lending player on the Base L2. Integrating their XLend ETH pool allows our Base vaults to capture the high demand for ETH borrowing in that ecosystem, diversifying our yield sources beyond Aave and Compound on Layer 2.

Link to forum: SIP2.43: Add Extrafi XLend ETH Pool

Midas Apollo Crypto (mAPOLLO)

Vault: USDC Mainnet – Higher Risk Vault

Why It's Here: Midas is bridging the gap between institutional asset management and on-chain vaults. The mAPOLLO token represents an actively managed strategy of high-liquidity crypto assets. Onboarding this gives our USDC vault exposure to "total market" upside strategies without users needing to manage a portfolio themselves.

Link to forum: SIP2.45: Onboard Midas Apollo Crypto

Which yield sources are next?

The beauty of Lazy Summer is that it's a community-driven protocol. You, as a SUMR holder decide what yield sources go in the protocol next, with the risk assessment help of Block Analitica.

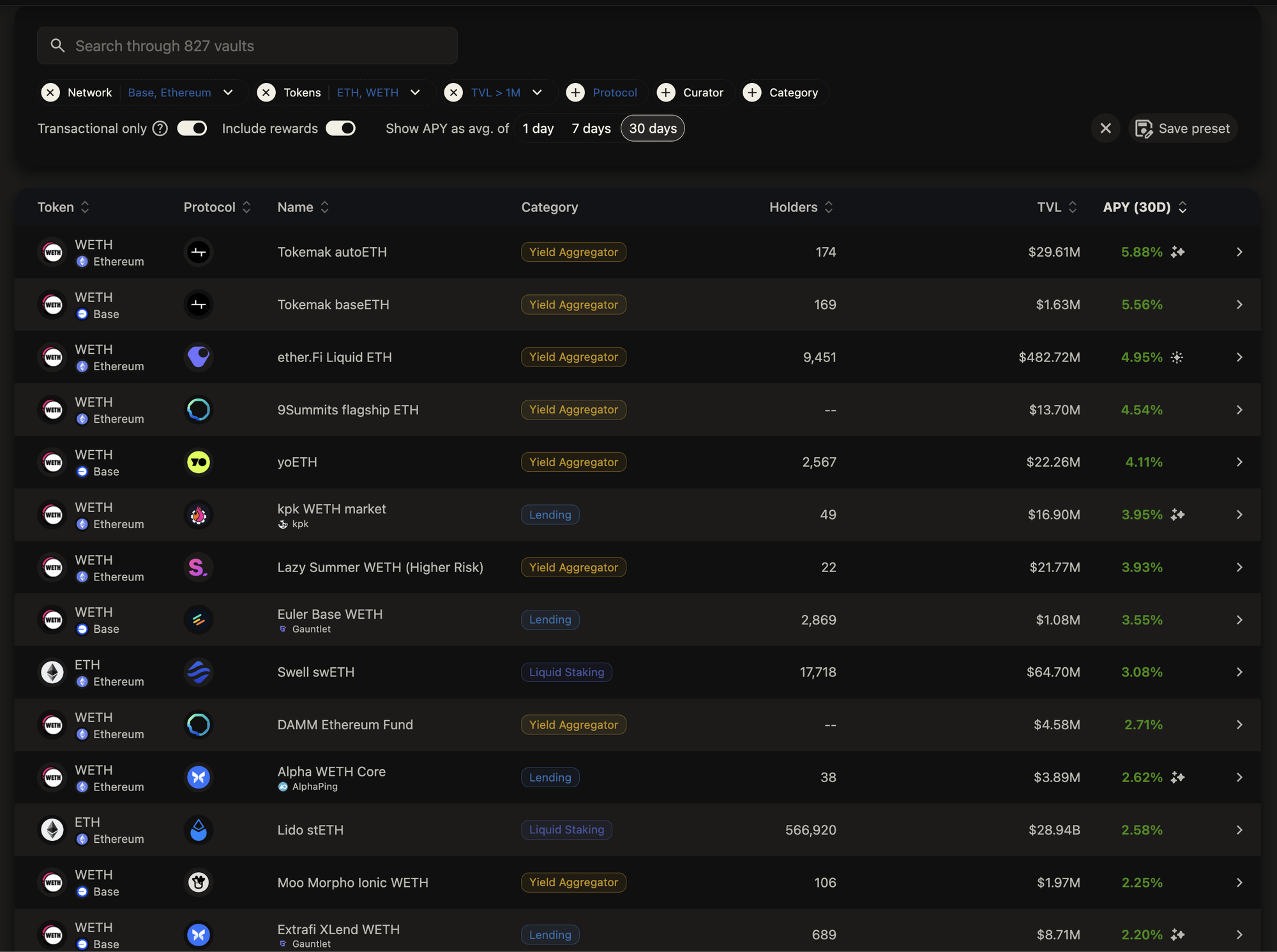

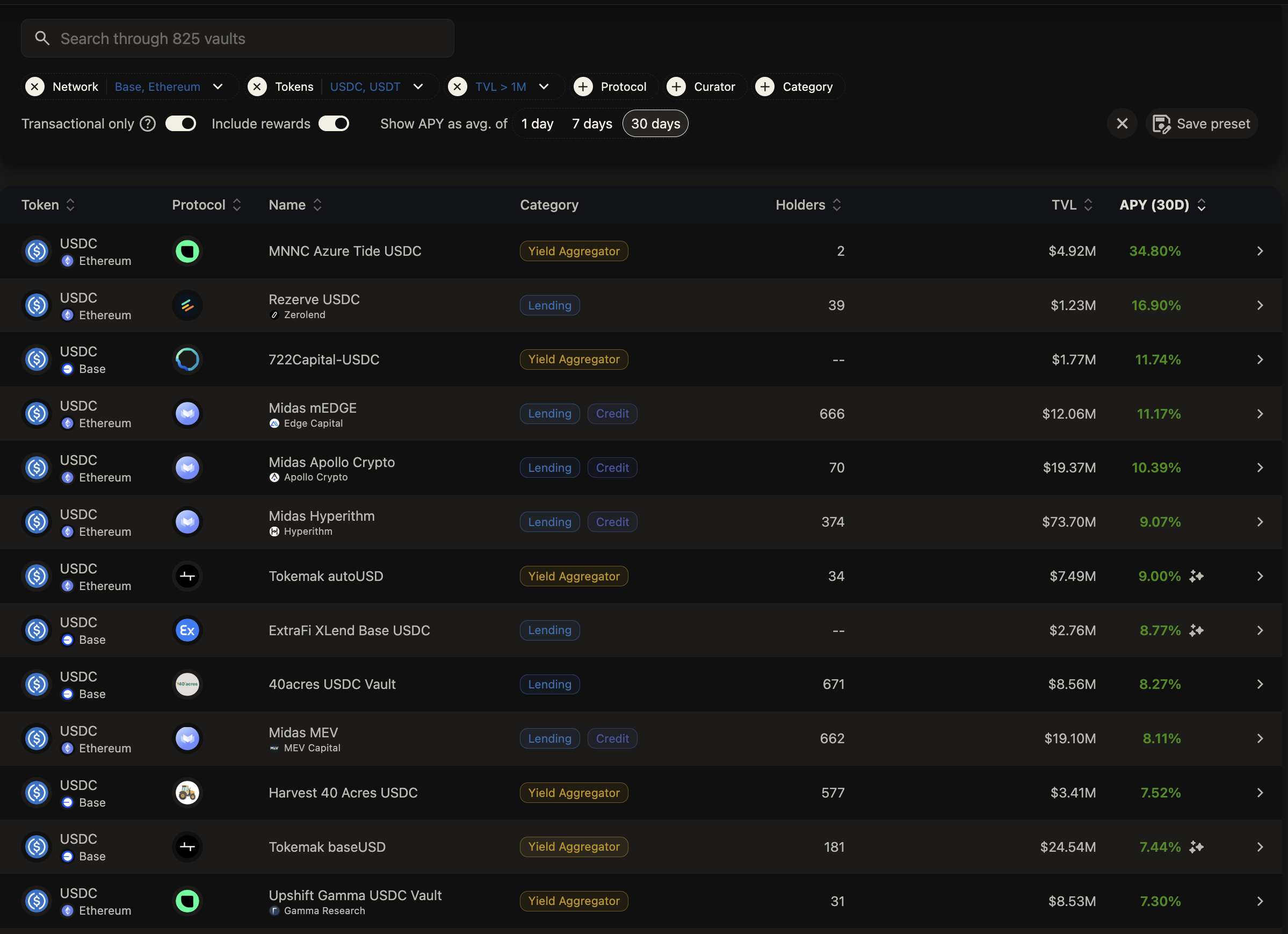

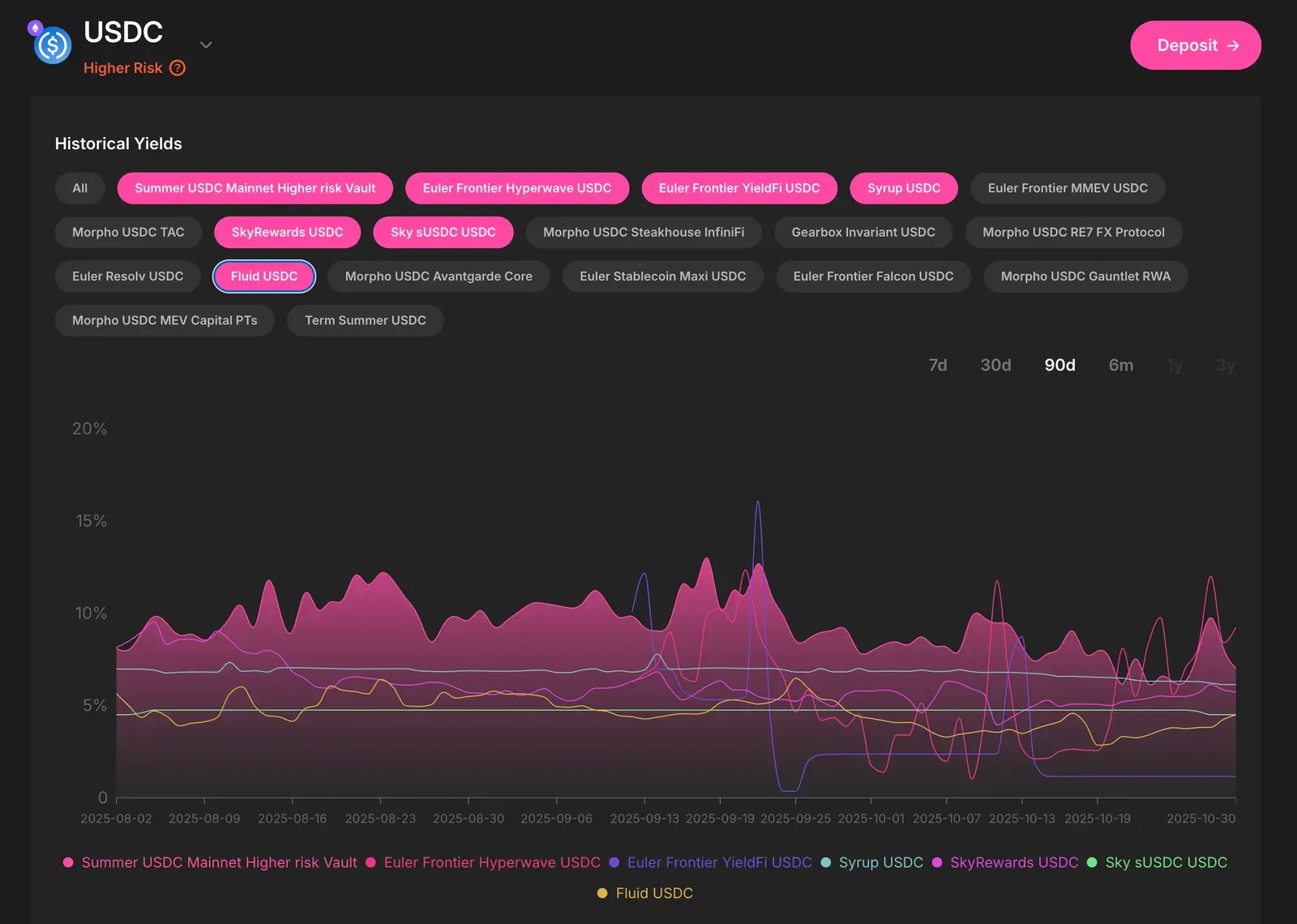

The "Vaults.fyi" yield scan

When you sort by highest APY, the results generally fall into three distinct buckets:

The "Too Risky" Bucket (Block Analitica Rejections):

You will often see outliers with headline grabbing APYs, like MNNC Azure Tide (~34%) or Rezerve (~16%). While attractive on paper, many of these sources have been reviewed and rejected by our risk curators at Block Analitica.

Whether due to thin liquidity, centralization vectors, or unverified oracle dependencies, they currently sit outside our risk appetite. Regardles of the APY.

The "Incoming" Bucket (In the process of being onboarded):

The next tier of high yields is dominated by protocols we are already in the process of onboarding. A perfect example is the Midas ecosystem (Midas Apollo, mEDGE), which appears prominently in the top 10 USDC yields.

As noted in the “New Yield sources” above, governance is already moving to capture this. Similarly, ExtraFi and kpk/Morpho markets are already being integrated to capture the best ETH yields.

The "Capped" Bucket:

Other visible sources are often protocols The Lazy Summer Protocol have already integrated but have assigned 0 caps or strict limits due to specific market risks. These yield sources are already integrated technically; ust waiting for the market conditions (liquidity depth, volatility) to improve so they can safely be allocated to once again.

How to request a new yield source

Have a protocol you love? A yield source you think we should integrate? Here's how to make it happen:

Submit an RFC (Request for Comments)

- Visit: Forum.summer.fi

- Use the Template: Fill out our standardized RFC format

- Engage with the Community: Respond to questions and feedback

- Wait for Review: With enough community feedback, Block Analytica will give a GO or NOGO from a risk perspective.

It's all about the Lazy Summer promise... Do Less

Above Benchmark Yield: diversified exposure that consistently beats static deposits

Risk Curation: access to new yield sources inside a strict, governed framework

No Yield Chasing: governance + risk experts handle rotation discipline so users don’t have to

Save the date: January 21, 2026

Today, SUMR rewards are not liquid. That changes on January 21, 2026, with the SUMR TGE.

After TGE, the “Do Less” promise stays the same, but with more upside embedded. You’re not only earning yield through curated strategies, but you can also have real economic ownership in the protocol that powers them.

Do Less.

Disclaimer: Oazo Apps Limited functions solely as a front-end interface (Summer.fi) provider and it does not act on behalf of any user. Oazo Apps Limited did not launch nor does it operate or control the Lazy Summer Protocol. The Lazy Summer Protocol is accessed through Summer.fi. The information provided herein is provided on behalf of the Lazy Summer Foundation which launched the Protocol for informational purposes only and it does not constitute investment advice. Oazo Apps Limited and the Lazy Summer Foundation are not soliciting or recommending any transaction or guaranteeing any specific returns. Users interact with the Protocol at their own risk. T&C for the use of Summer.fi apply.