Lazy Summer Protocol Monthly Rebalance Trends – July 2025

How Did Capital Flow Within Lazy Summer Protocol During July?

Lazy Summer Protocol gives you automated exposure to DeFi’s highest-quality yields. Deposit once, and the protocol’s network of AI keepers keeps rotating your funds into the best risk-adjusted strategies, so you earn more while doing nothing.

https://summer.fi/earn/rebalance-activity

Below, we analyzed how capital moved during July: which vaults attracted the most inflows, which lost out, and what the net protocol growth looked like.

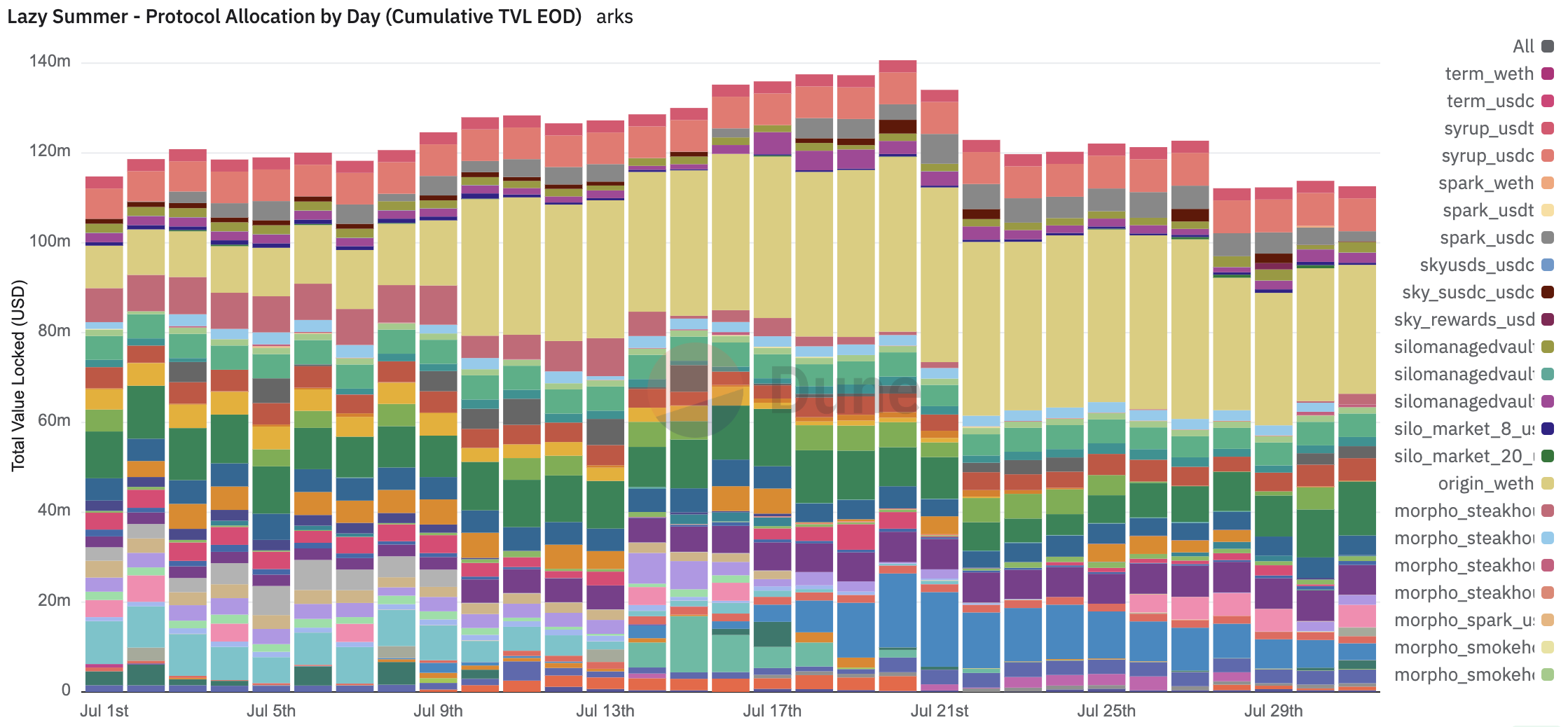

July featured a strong mid-month surge and a sharp late-month normalization.

🧬 How Capital Was Rebalanced (Past 30 Days)

Protocol TVL movement

- Start: $114.8M (Jul 1)

- Peak: $140.7M (Jul 20)

- End: $113.8M (Jul 30)

Top rebalanced protocols, July 2025

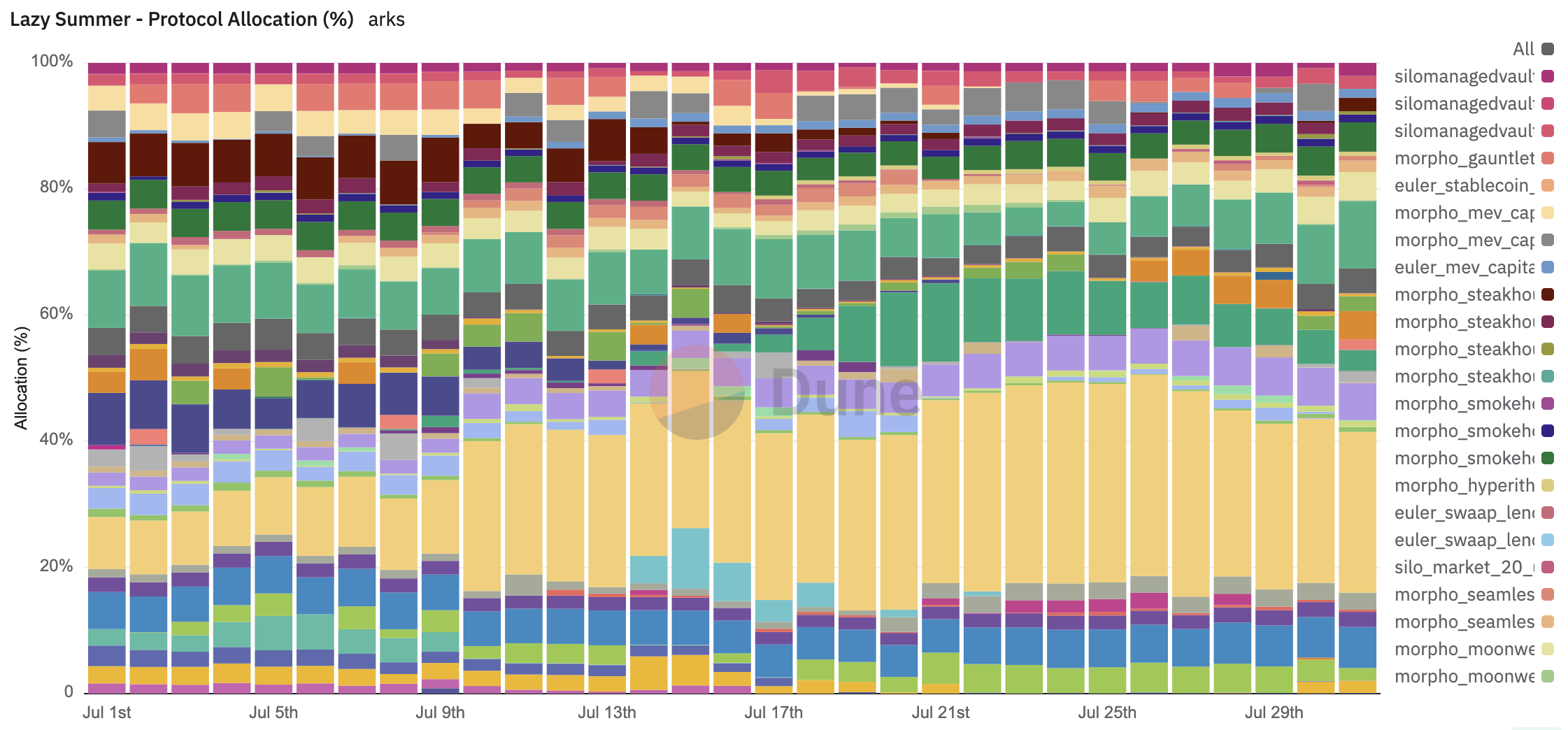

July was characterized by a two-pronged rotation:

- ETH benchmark yield regained momentum: Rebalances increasingly favoured Origin WETH and Compound v3 WETH as ETH yields outpaced stablecoin alternatives.

- Stablecoin yields consolidated to Morpho and Maple Syrup: The long tail (“Other”) shrank as capital concentrated into higher-confidence USDC venues, with some short-lived spikes (e.g., Frontier USDC) that reversed quickly as keepers exited once APYs normalized.

One protocol, Morpho (via multiple USDC strategies), effectively became significant on the stablecoin side by month's end.

Specifically, Morpho’s USDC strategies captured ~19.4% of total protocol TVL by Jul 30 (Smokehouse 4.6%, MEV Capital 4.3%, Moonwell 4.3%, Gauntlet 4.0%, ReLend 2.2%), highlighting both the flexibility of Morpho and Lazy Summer Protocol’s ability to unify fragmented yields into accessible exposure.

Maple’s Syrup ranked second at ~8.8% (USDC 6.4%, USDT 2.4%), ahead of Spark USDC (3.4%) and Aave v3 (2.7%).

Rebalance by % of TVL

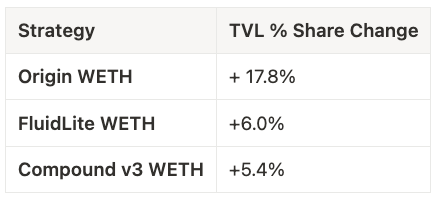

🔼 Top 3 gainers by % of protocol TVL

Why? ETH venues offered superior real yield through mid-month; the rebalancing favoured battle-tested pools as ETH price rallied, despite unusual ETH staking queue activity.

Rebalance by Total Capital Shift (USD)

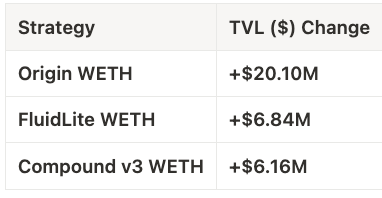

💵 Top 3 gainers by absolute TVL ($)

Note: Absolute $ shifts reflect both share changes and the TVL base rising into July 20 before normalizing late in the month.

Total protocol TVL peaked at +$25.9M over the first 20 days, then retraced into month end.

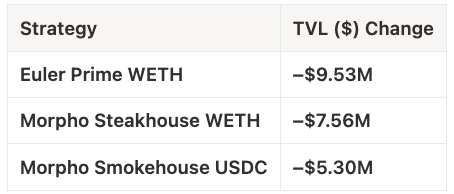

Biggest outflows

Why the outflows? As relative APYs flattened or declined, AI keepers clipped positions and rotated into higher-yielding venues.

🧠 Key takeaways

- Origin WETH led July: +17.8% share and +$20.1M in four weeks.

- ETH concentration rose.

- USDC consolidated under Morpho’s flexible protocol, which enables many strategies by different curators (~19.4% combined), outpacing Syrup and other venues by month end.

- Automation > manual chasing: despite a modest month-end net TVL change, internal rotation materially improved users’ blended yield versus manually depositing into any one strategy.

🤖 How AI keeps you ahead

Lazy Summer Protocol’s architecture uses intelligent agents to optimize for net yield in real time.

- 📡 Continuous Scanning: Live APRs, incentives, TVL, and protocol risks monitored 24/7.

- 🧠 Multi-Agent Consensus: Independent AI agents agree on reallocations within Block Analitica-set risk boundaries.

- ⛽ Gas-Efficient Execution: Rebalances are batched into single keeper transactions, saving users gas and time.

✅ Access DeFi’s Best Yields. Automatically.