Lazy Summer Protocol Dev Update - Introducing Cross-Chain Vaults

What we've been building

Introducing Cross-Chain Vaults: Summer.fi just got… lazier 🤭.

By the end, you’ll know about Lazy Summer’s vision for optimized cross-chain yield, the architecture, and risk controls.

Why cross chain matters

Yield crops up and dies back in a matter of hours in some cases. It’s scattered and transient. I’ve seen large allocators withdraw eight figure sums, bridge and redeploy on a neighbouring chains all to capture a better rate for periods spanning less than 24 hrs. It’s easy to see the behaviour on chain — it’s happening all-the-time. These micro-optimisations only capture a few bps of upside but with the magic of compounding this can be meaningful over the course of 12 months or more.

These micro-optimisations are only practical for whales right now. Every cross-chain action costs gas, bridge fees and a persons time. To make it worth it, you need to command enough capital to make the fees immaterial, you need to keep a constant eye on yields and be ready to move throughout the day.

Cross-Chain Vaults solve this by treating every supported network as a single liquidity surface:

- Deposit once on whichever chain you already hold assets.

- Keepers handle cross chain rebalancing (and bridging)—keepers bridge your liquidity to fleet’s that are printing the best net APY.

- No more manual exits. You don’t even need to know where the assets end up; you just hold Fleet shares on the cross-chain vault’s hub chain.

Less clicking, less bridging, higher realised yield. Moon baby, moon.

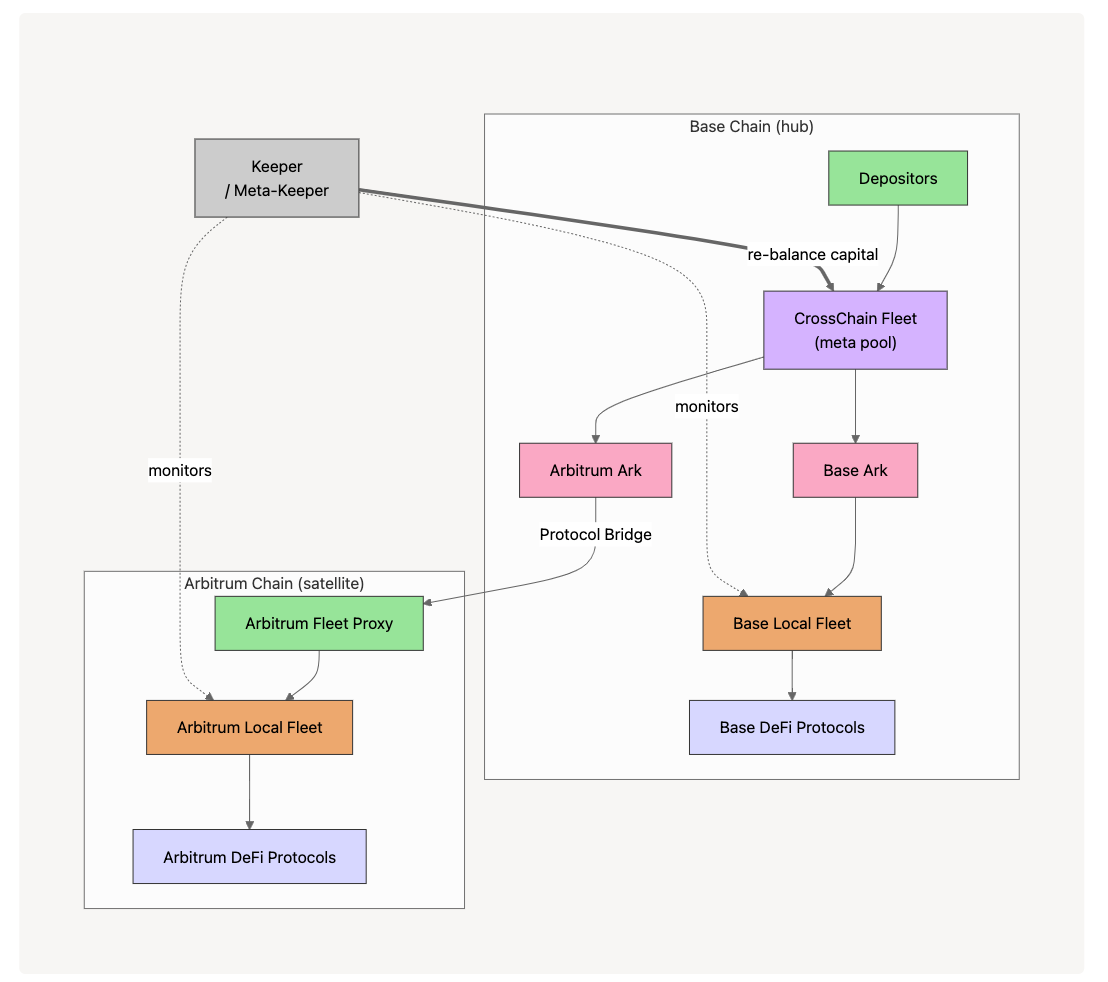

Architecture

Three layers

User-facing entry

Users execute one transaction on Chain A—USDC, ETH, for example. Assets are bridged along with a cross-chain message that says, “Mint Fleet X shares for this wallet.”

This layer is fairly straightforward. We’re leaning heavily towards using Enso’s bridging + swap solution for this. They’ve already solved the problem really well.

We have our own in-house capability that we’ll use when a specific chain is not supported by Enso.

Inter-chain rebalancing

This is where 90% of the effort has been put in. Keepers (meta-keepers if you like) track each single-chain fleet (USDC Base, USDC Arbitrum, etc.). When the spread between fleets justifies it, the keeper bridges capital and re-weights positions so the global fleet composition always sits in the highest-yielding venues. This will work out the box with capital being allocated across our existing single-chain fleets.

There’s more. Block Analytica are helping explore the idea of having dedicated single-chain fleets for cross-chain fleets to use. Dedicated fleets would not have the Ark level restrictions - specifically around max % of TVL that can be deployed per Ark. Why is this important? In the extreme, it means we could allocate 100% of capital on a given chain to a single Ark (the highest performing Ark on that chain). For now, this remains in the R&D phase as we’ll need to get comfortable we can manage risk effectively between chains — with fewer single chain capital controls in place.

Bridging

All cross-chain transactions (+ messages) are routed through BridgeRouter.sol. BridgeRouter is responsible for routing calls to the desired adapter.

Adapters make the functionality of any cross-chain messaging layer available to our bridging system. Adapters can support one or more of the desired functions we require:

- asset transfers with message

- standalone cross-chain messaging

- cross-chain state reads or queries

For now, we have two adapters nearly ready for Audit: LayerZeroAdapter.sol and StargateAdapter.sol

But the architecture is modular — the intention is to add new adapters over time and remove our reliance on any single messaging protocol — and point of failure.

Example flow

- You bridge 100k USDC from Arbitrum to a cross-chain fleet deployed on Base.

- You receive fleet shares on Base and your 100k sits in the cross-chain fleets buffer Ark for < 5mins.

- A keeper picks submits a rebalancing action that moves 50k USDC into an underlying single-chain fleet on Base, the other 50k USDC is board to a mainnet cross-chain ark ready for bridging.

- Keeper submits a follow up transaction with messaging fee that bridges the 50k USDC from the mainnet cross-chain ark on Base to it’s counterpart fleet-proxy contract on mainnet.

- In turn, the proxy immediately (within the same t/x) deposits to the USDC fleet on mainnet.

- Minutes later the meta-keeper decides Arbitrum is only marginally better than a new opportunity on mainnet. It bridges part of the pool over—you do nothing, but your capital is now earning more.

Risk controls

- Governance allow-list. SUMR holders vote new chains in (or out). Identical to how governance votes to add new Arks to a single-chain fleet right now.

- Per-chain caps. New networks start tiny; limits ratchet up once they prove uptime and Lindy.

- External risk curators keep eyes on oracles, bridge invariants, and chain-specific economic vectors.

- Full audit booked for Q3 2025; nothing ships main-net until the report is green.

The Cross chain vision

Think of it as a fluid liquidity layer floating above every L2 and new L1.

When a roll-up launches a programme—higher yields, lower fees—Lazy Summer fleets can supply just enough capital to juice returns, but not so much that we blow utilisation limits.

Once the promo ends or perceived risk jumps, keepers withdraw funds. Users stay ignorant of chain churn; they just see a stable, market-beating APY.

That fluid layer also helps new chains get off the ground. Instead of running costly liquidity-mining campaigns, they can tap Summer as a liquidity-as-a-service endpoint. Good for protocols, good for our depositors, good for ETH security in the long haul.

Liquidity-as-a-service angle means in the future we can net depositors wholesale yields (superior to anything they could get as an individual). All made practical and possible with cross-chain vaults.

Why it matters: user benefits of cross chain to look forward to

- Higher net yields – Capture cross-chain differentials the second they exceed fees and slippage.

- Lower friction – one deposit, no bridge UI, no chain toggle, no “did the tx clear?” anxiety.

- Cheaper– fewer signatures and fewer on-chain hops mean materially lower gas and bridge costs.

- Transparent safety net – exposure caps, live monitoring, and a governance kill-switch if any chain misbehaves.

Cross chain Fleets collapse the complexity of a dozen roll-ups into a single “deposit and chill” product.

You’ll see the audit in Q3 and the first production fleets shortly after. We’re building it so you can do less and earn more.