Lazy Summer Protocol - Dev Update

💫 What we’ve been shipping — More growth & transparency

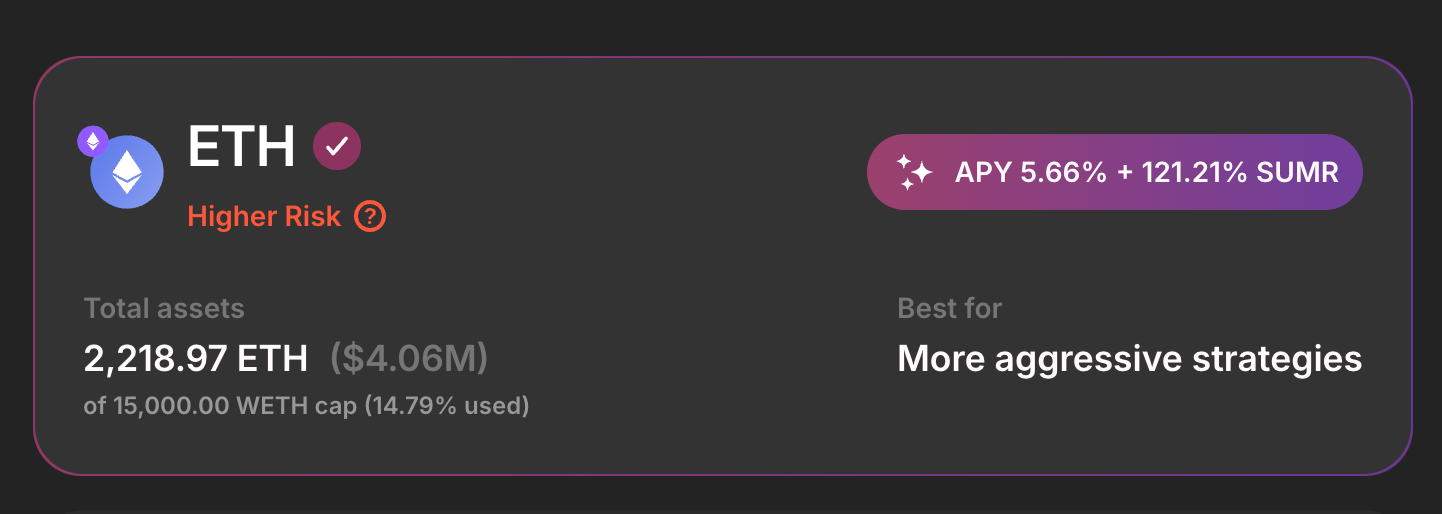

Higher‑Risk ETH Vaults

A new ETH vault tier that targets more aggressive strategies (morpho lending, leveraged stETH loops, etc.) with tighter guard‑rails from Block Analitica so that risk is still kept in check. Right now, this vault also has the highest SUMR Rewards!

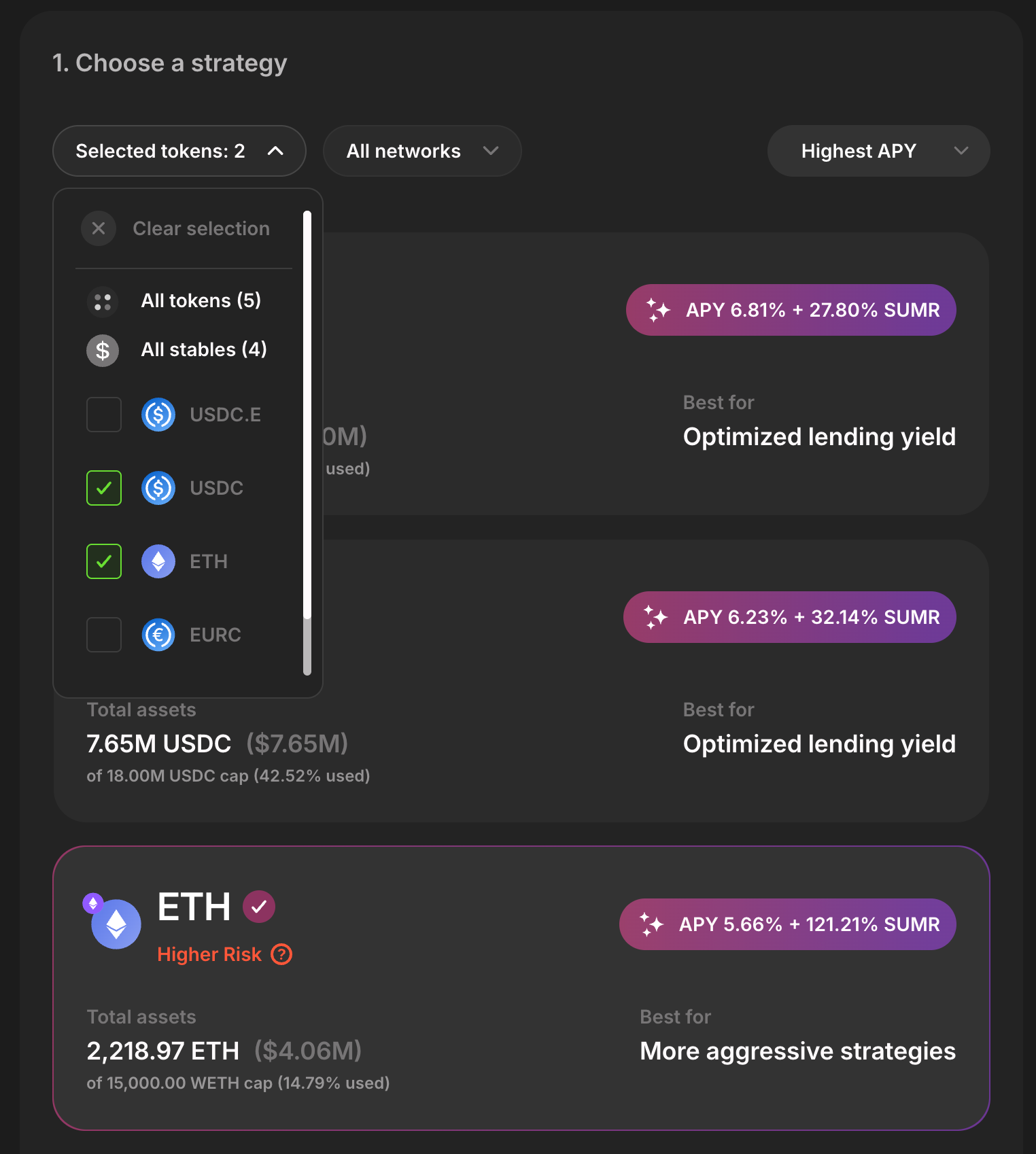

Smarter Filtering

Vault list now supports multi‑select asset, network, and APY and other range filters—for instant way finding.

👉 Go find the highest yield and SUMR rewards for you →

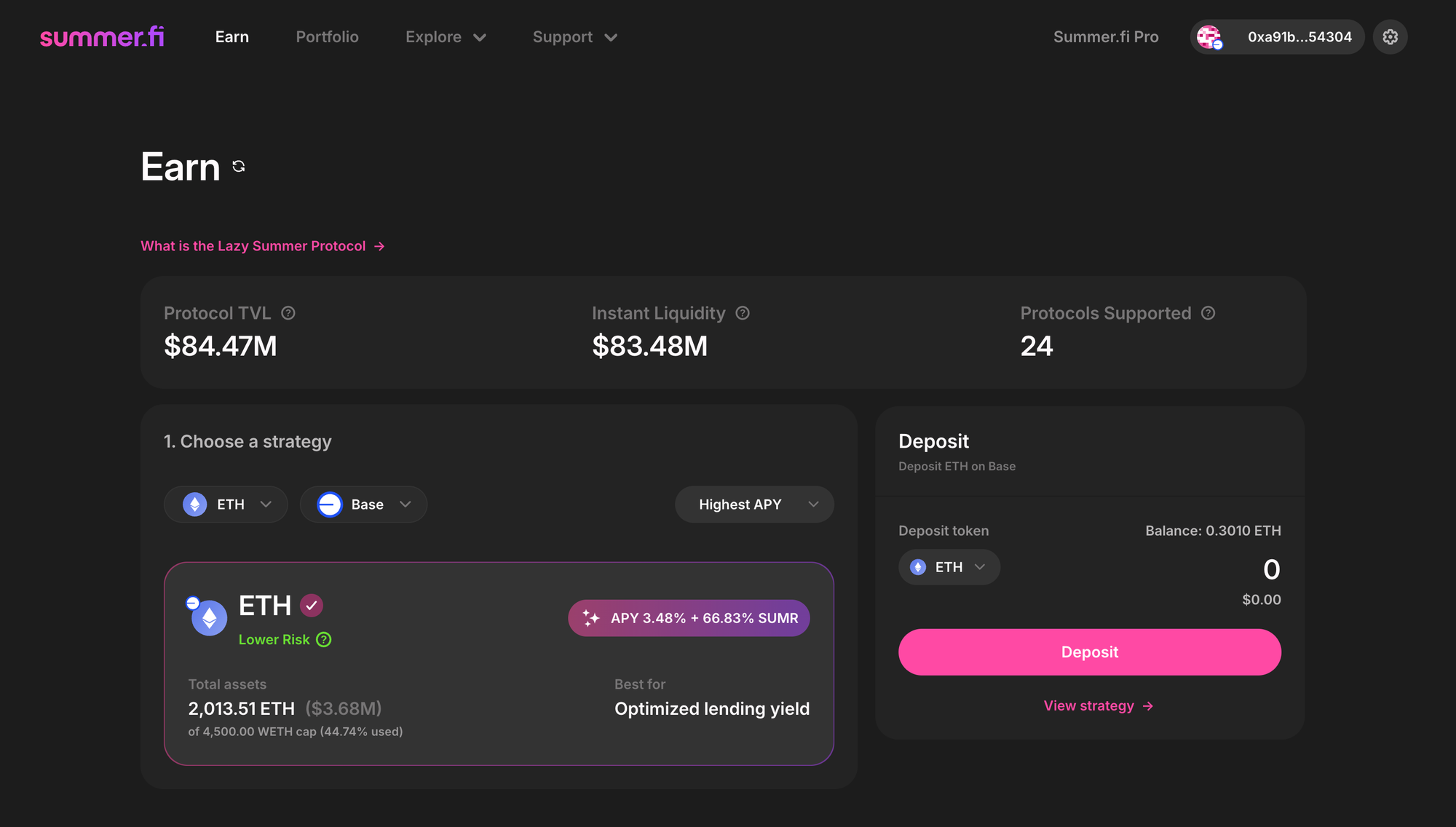

New ETH Vault on Base

ETH vault now live on Base L2. All the same great rebalancing, same great yield - but now just cheaper and on Base, on of the fastest growing networks.

🔭 Coming Soon

What’s Cooking:

USDC Higher‑Risk Vaults

Similar to our ETH higher risk vaults, we will now have USDC higher risk vaults. Giving users to new yield sources, more aggressive parameters and increased APY.

New straetgies in higher risk:

- Sky Rewards

-Ethena sUSDe

-More aggressive lending strategies from Morpho, Euler and others.

What’s Cooking:

Maple USDC & USDT Vaults

Institutional real‑world‑credit yields—risk‑curated and wrapped in Lazy Summer automation. As mentioned last time Maple’s SyrupUSDC will also be launched soon, giving users even more diverse high yield sources for their assets.

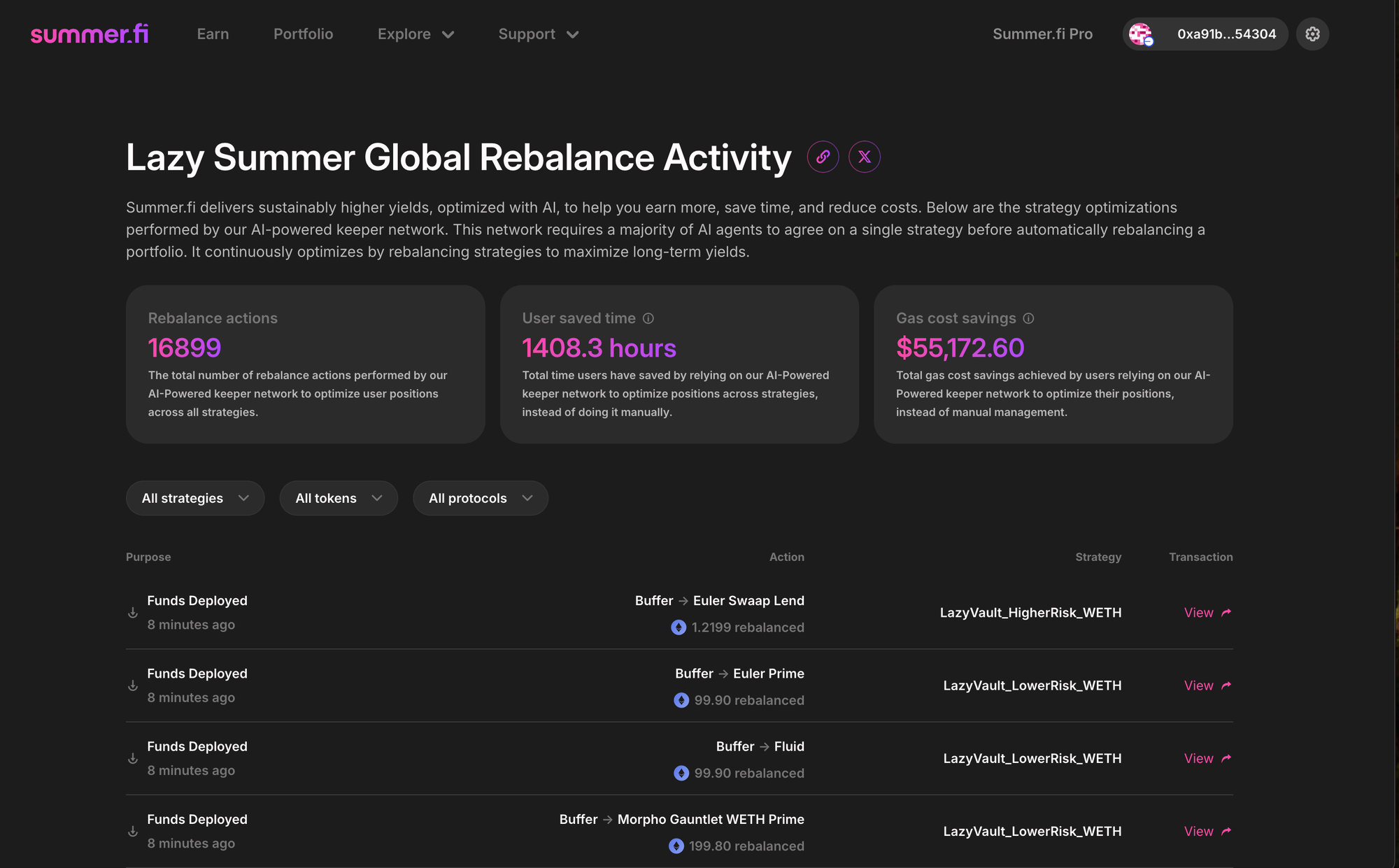

✨ Feature Spotlight: Global Rebalance Activity

What is the Rebalance Activity page?

Lazy Summer’s core promise is hands‑free optimisation. The Rebalance Activity page is the public ledger of that promise in action. Every time our AI‑powered keeper network moves capital—whether it’s harvesting a higher rate, managing buffer liquidity, or derisking an over‑exposed market—the event is stamped here with a purpose tag, timestamp, and on‑chain transaction link.

Why it matters

- Proof‑of‑Work — tangible evidence that the rebalancer inside Lazy Summer is awake 24/7.

- Transparency — removes the black‑box stigma from DeFi automation.