Lazy Summer Protocol Community Call - SUMR transferability, DeFi risk, and getting to best in class yields

Overview - what’s going on

Over the last week, a few important things have happened both across DeFi and within the Lazy Summer Protocol.

In DeFi, we’ve seen ecosystem fragilities in risk management and protocol security exposed through the Stream collapse and the Balancer exploit. Lazy Summer Protocol was affected indirectly via one of the yield sources in the USDC Arbitrum vault – specifically the Silo Swaap Lend susdx 127 USDC position.

At the same time, Lazy Summer Protocol was approached by Aerodrome and offered a slot in its Aerodrome Ignition program. Ignition allows projects on Base to pre-inject a portion of their token supply (typically 10–20%) into a liquidity pool at launch, with AERO incentives to bootstrap deep, sticky liquidity.

Both of these developments impact Lazy Summer and the timing and structure of the SUMR transferability event, so the community has decided to host a call to form rough consensus and align on next steps.

Lazy Summer Protocol Community call #4:

Addressing the Lazy Summer Community

Date: Thursday, November 13th

Time: 14:30 CET • 08:30 EST • 13:30 UTC • 05:30 PST

Given the recent events in DeFi and the implications for SUMR and Lazy Summer, this community call will:

- Review how the protocol performed during the recent DeFi vulnerabilities.

- Outline what’s happening with the USDC Arbitrum vault.

- Explain the Aerodrome Ignition opportunity, and

- Align on the path forward for SUMR transferability.

Lazy Summer Protocol Performance during a DeFi wide vulnerability: USDC Arbitrum Vault - Silo Swaap Lend susdx 127 USDC

The call will start by addressing the recent DeFi vulnerabilities and how Lazy Summer Protocol responded, with a specific focus on the USDC Arbitrum vault and the Silo Swaap Lend susdx 127 USDC yield source.

Points to be covered:

- What happened in DeFi last week, and how Lazy Summer performed in that environment.

- What exactly is going on with the USDC Arbitrum vault and the Silo Swaap Lend susdx 127 USDC strategy.

- What actions Lazy Summer Protocol has already taken in response.

- What improvements are being implemented to strengthen risk management and protocol design going forward.

The goal is to be fully transparent about what happened, what was learned, and how to improve moving forward.

SUMR transferability and Aerodrome Ignition

Summer.fi CEO Chris Bradbury recently posted a SUMR Transferability update to the forum

In that post he shared that:

- The Sherlock audit report for the new staking and governance module has been received.

- The team plans to deploy Governance v2 and staking on 17 November and request whitelisting the same day.

As a result:

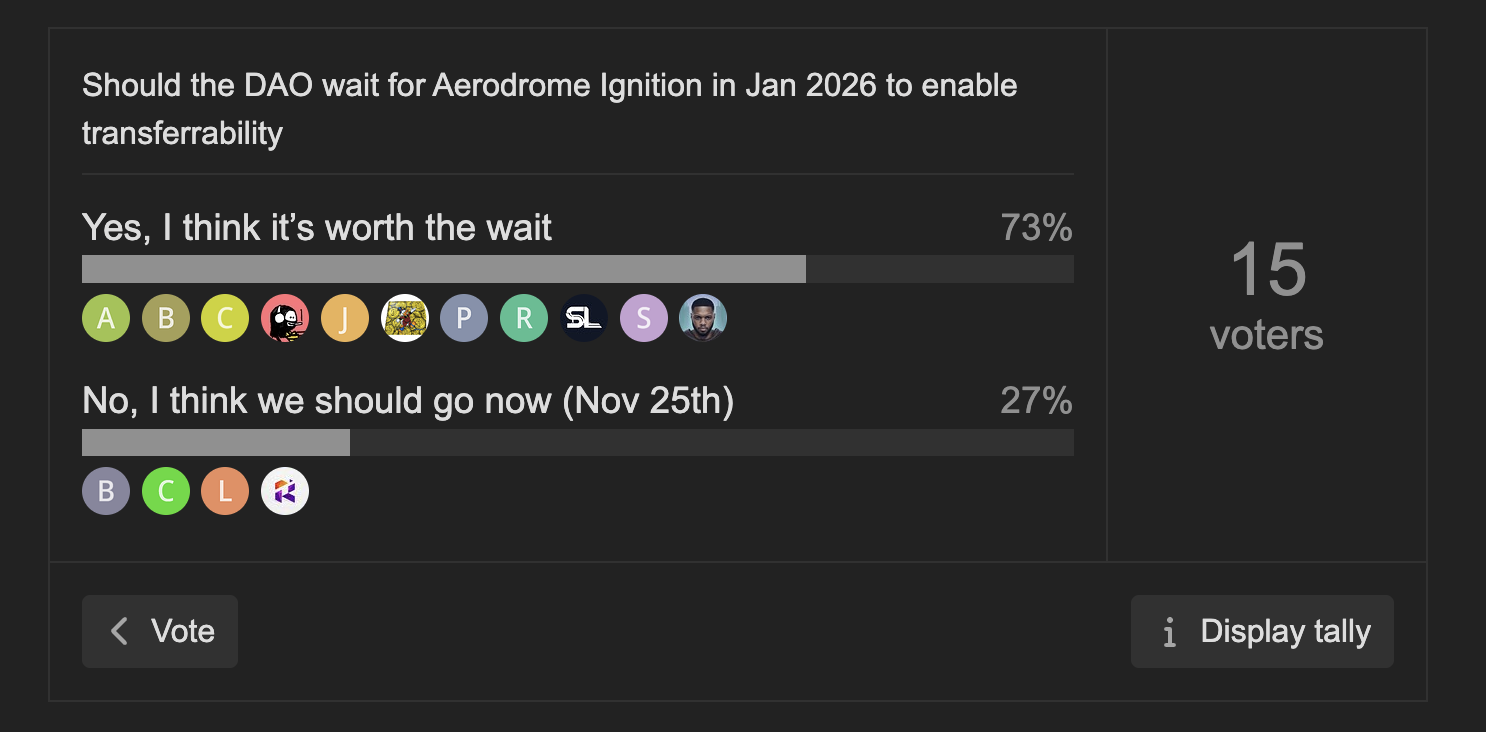

- SUMR transferability could be enabled as soon as November 25th if the DAO chooses not to wait.

However, Aerodrome has also invited SUMR to join its Ignition launch program in the second half of January 2026. Launching via Ignition would likely mean:

- A later token trading date, but

- Stronger initial liquidity, boosted by AERO incentives

- More marketing and distribution support through the Aerodrome/Base ecosystem

Should we (the community) enable SUMR transferability as soon as possible (late November), or wait until January to launch via Aerodrome Ignition and benefit from additional support?

Community questions to be addressed in the call:

- What exactly does Aerodrome Ignition provide (marketing, incentives, liquidity, technical support), and what are the concrete commitments vs “best efforts”?

- Are there other CEXs that Summer.fi is already in discussions with or has relationships with that could list SUMR, regardless of Ignition?

- What is the risk that Ignition deprioritises SUMR or changes timing (e.g., gives the end-of-January slot to another project)?

- If we choose to wait, under what conditions or new information would the DAO consider overriding that decision and enabling transferability earlier?

- How much additional TVL, treasury growth, and integrations (especially institutional/integrator deals) can realistically be achieved between now and late January?

- How will the team address the concern that Summer.Fi vaults are currently not consistently “best in class” on yield rankings (e.g., vaults.fyi ETH #14, USD #47), and what is the roadmap for:

- Updating/expanding fleets and arks,

- Supporting higher-risk options for users who want them,

- Ensuring the “best DeFi yields” narrative is factually defensible at launch?

- What are the liquidity seeding plans in each scenario (Ignition vs independent launch): size of pools, expected depth, and use of DAO funds/treasury?

- What are the communications and marketing plans around:

- A November launch (if we go now), versus

- A January Ignition launch (if we wait)?

When and how to join the community call

Date: Thursday, November 13th

Time: 14:30 CET • 08:30 EST • 13:30 UTC • 05:30 PST

Join link: https://meet.google.com/kzz-ygiw-oxp

For further details and ongoing discussion, you can:

- Join the Summer.fi forum

- Join the Summer.fi Discord

- Follow Summer.fi on X (Twitter)

We encourage all community members, delegators, and interested users to join the call, ask questions, and help shape the path forward for Lazy Summer Protocol and SUMR.

Disclaimer: Oazo Apps Limited functions solely as a front-end interface (Summer.fi) provider and it does not act on behalf of any user. Oazo Apps Limited did not launch nor does it operate or control the Lazy Summer Protocol. The Lazy Summer Protocol is accessed through Summer.fi. The information provided herein is provided on behalf of the Lazy Summer Foundation which launched the Protocol for informational purposes only and it does not constitute investment advice. Oazo Apps Limited and the Lazy Summer Foundation are not soliciting or recommending any transaction or guaranteeing any specific returns. Users interact with the Protocol at their own risk. T&C for the use of Summer.fi apply.