Lazy Summer Monthly Rebalance Trends – June 2025

Big rebalancing moves in June

Where did the capital flow in Lazy Summer in June?

Lazy Summer gives you automated exposure to DeFi’s highest-quality yields. Deposit once and our the Protocols network of AI keepers keeps rotating your funds into the best risk-adjusted strategies—so you earn more while doing nothing.

Below we unpack exactly how capital moved during June: which vaults attracted the most inflows, which lost out, and what the net protocol growth looked like. To say the least, June saw some big winners and losers.

🧬 How Capital Was Rebalanced (Past 30 Days)

Top rebalanced protocols - June 2025

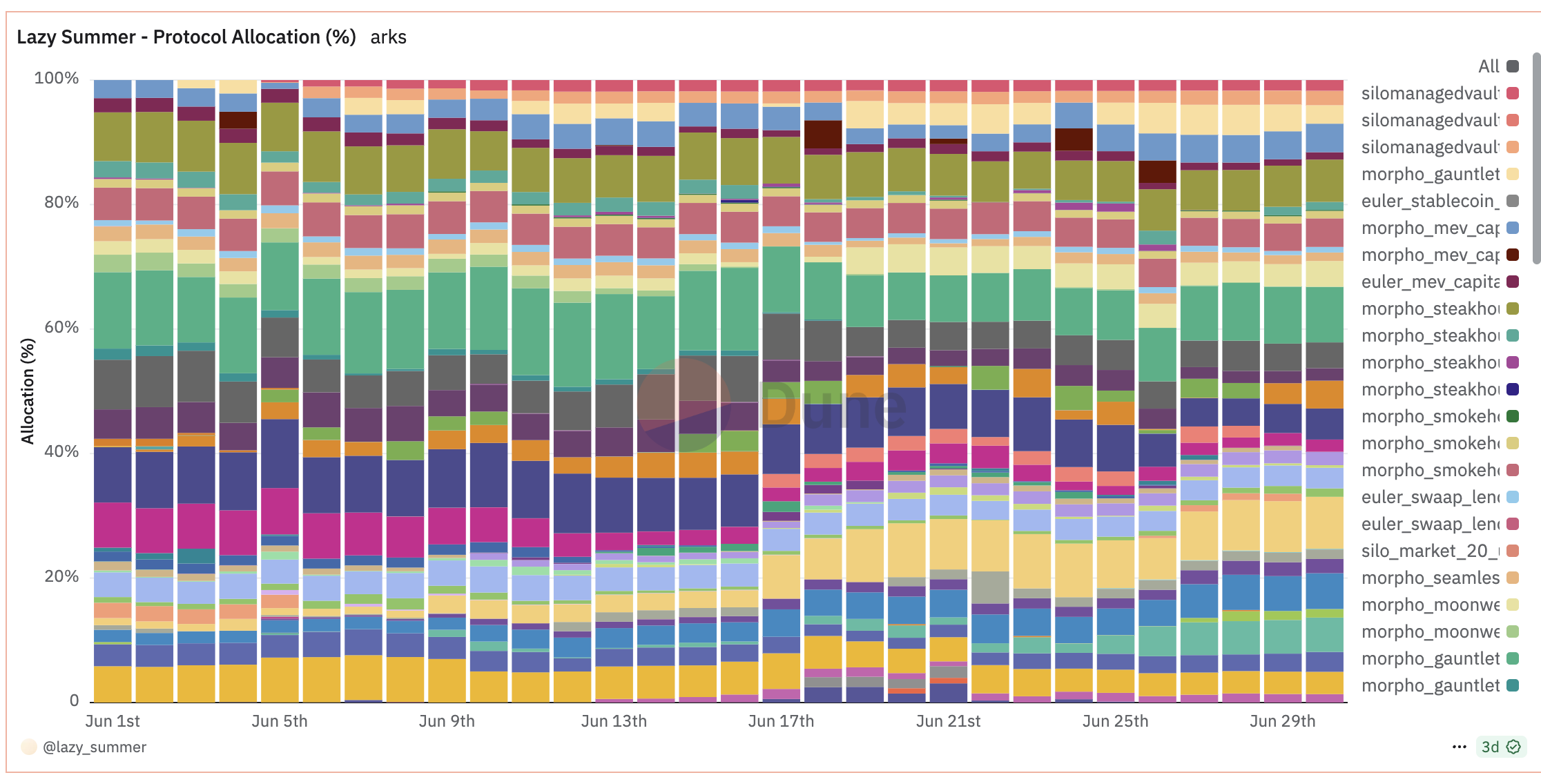

June was characterised by a two pronged rotation:

- Return of ETH benchmark yield – rebalances piled into Origin WETH and Fluid WETH, chasing fresh ETH yield.

- Rise of Maple FInance’s Syrup – Syrup USDC became a dark horse, grabbing serious share of capital.

Meanwhile, large blue-chip stablecoin vaults such as Euler Prime USDC continued to bleed TVL as users sought higher real yields.

Rebalance by % of TVL

| 🔼 Top 3 gainers by % of protocol TVL | TVL % Share |

|---|---|

| 🥇 Origin WETH | +8.2 % |

| 🥈 Syrup USDC | +5.6 % |

| 🥉 Fluid WETH | +5.4 % |

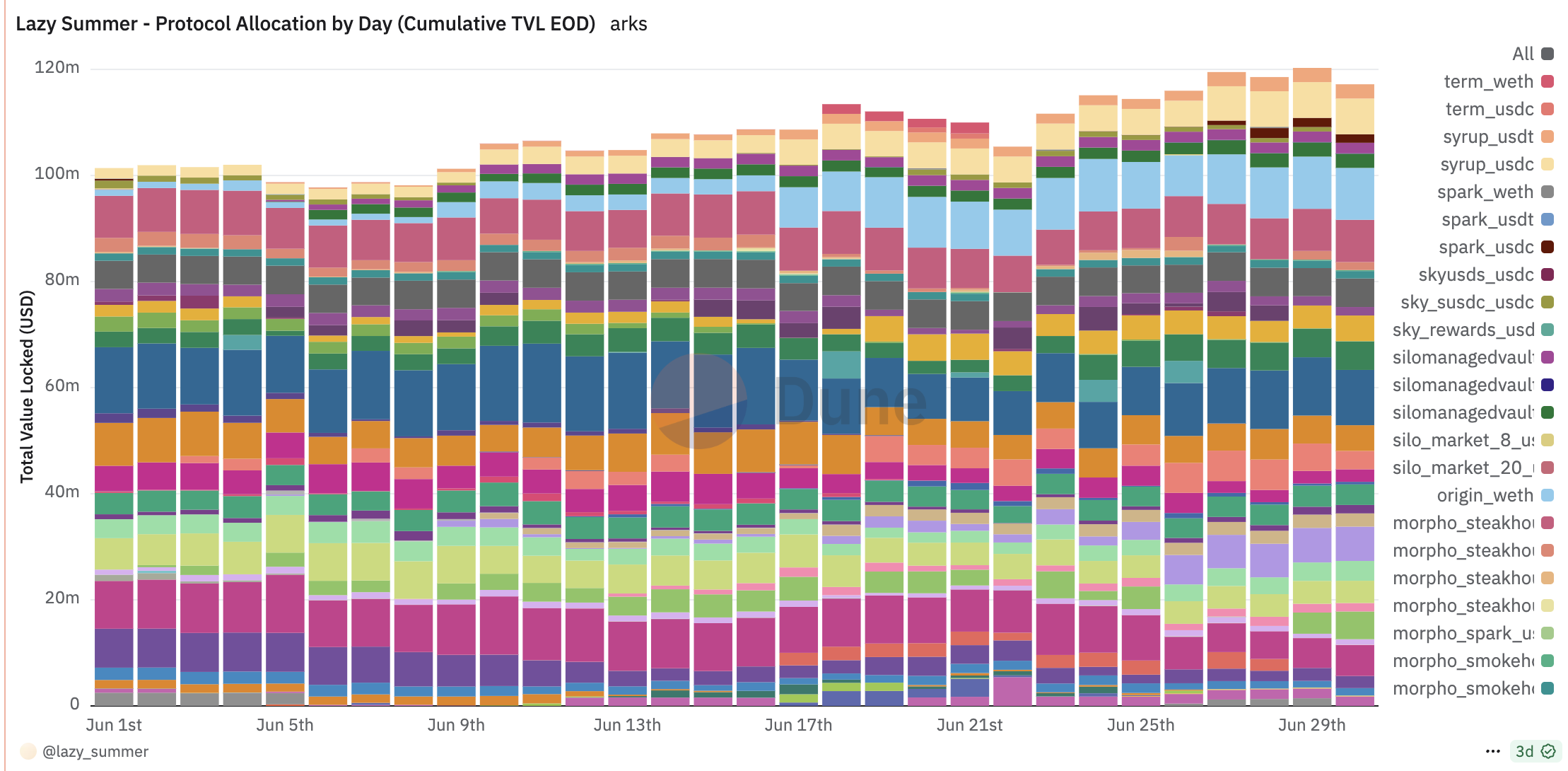

Rebalance by Total Capital Shift (USD)

| 💵 Top 3 gainers by absolute TVL | TVL ($) |

|---|---|

| 🥇 Origin WETH | +$9.59 M |

| 🥈 Syrup USDC | +$6.70 M |

| 🥉 Fluid WETH | +$6.33 M |

Total protocol TVL grew +$5.2 M month-over-month (1 Jun → 28 Jun).

Biggest outflows

| 🔻 Top 3 losers by TVL ($) | TVL ($) |

|---|---|

| 🥇 Euler Prime USDC | –$7.35 M |

| 🥈 Morpho Smokehouse USDC | –$5.30 M |

| 🥉 Morpho Flagship WETH | –$4.80 M |

Why the outflows? vaults with flat or declining APYs were systematically clipped by the keepers in favour of higher yield sources.

🧠 Key takeaways

- Origin WETH stole the show – +$9.6 M and +8 pp share in four weeks.

- Stablecoin yield is fragmenting – Syrup USDC & Frontier USDC ate into Gauntlet / Euler dominance.

- AI keepers remain ruthless – under performing yielding vaults (e.g. Euler Prime USDC) lost >$7 M despite historical winner status.

- Net protocol inflow was modest (+$5.2 M) but rotated far more than it grew, underscoring the power of automated re-allocation vs. manual yield chasing strategies.

🤖 How AI keeps you ahead

Lazy Summer’s architecture uses intelligent agents to optimize for net yield in real time.

- 📡 Continuous Scanning: Live APRs, incentives, TVL, and protocol risks are ingested 24/7.

- 🧠 Multi-Agent Consensus: Independent AI agents agree on reallocations within risk boundaries set by Block Analitica.

- ⛽ Gas-Efficient Execution: All rebalances are batched into a single keeper transaction, saving users gas and time.

✅ Start Earning DeFi’s Best Yields. Automatically.

Join us

Discord | Telegram | X/Twitter | Linktree

Disclaimer: Oazo Apps Limited functions solely as a front-end interface (Summer.fi) provider and it does not act on behalf of any user. Oazo Apps Limited did not launch nor does it operate or control the Lazy Summer Protocol. The Lazy Summer Protocol is accessed through Summer.fi. The information provided herein is provided on behalf of the Lazy Summer Foundation which launched the Protocol for informational purposes only and it does not constitute investment advice. Oazo Apps Limited and the Lazy Summer Foundation are not soliciting or recommending any transaction or guaranteeing any specific returns. Users interact with the Protocol at their own risk. T&C for the use of Summer.fi apply.