Lazy Summer Governance Recap [May 2025]

![Lazy Summer Governance Recap [May 2025]](/content/images/size/w2000/2025/06/Template-1.png)

May was a month focused on bringing RFCs into improvement proposals and on-chain votes for the Lazy Summer DAO, with strategic integrations and community discussions shaping our path forward.

Let’s dive into the highlights:

Governance News and Builds in Focus:

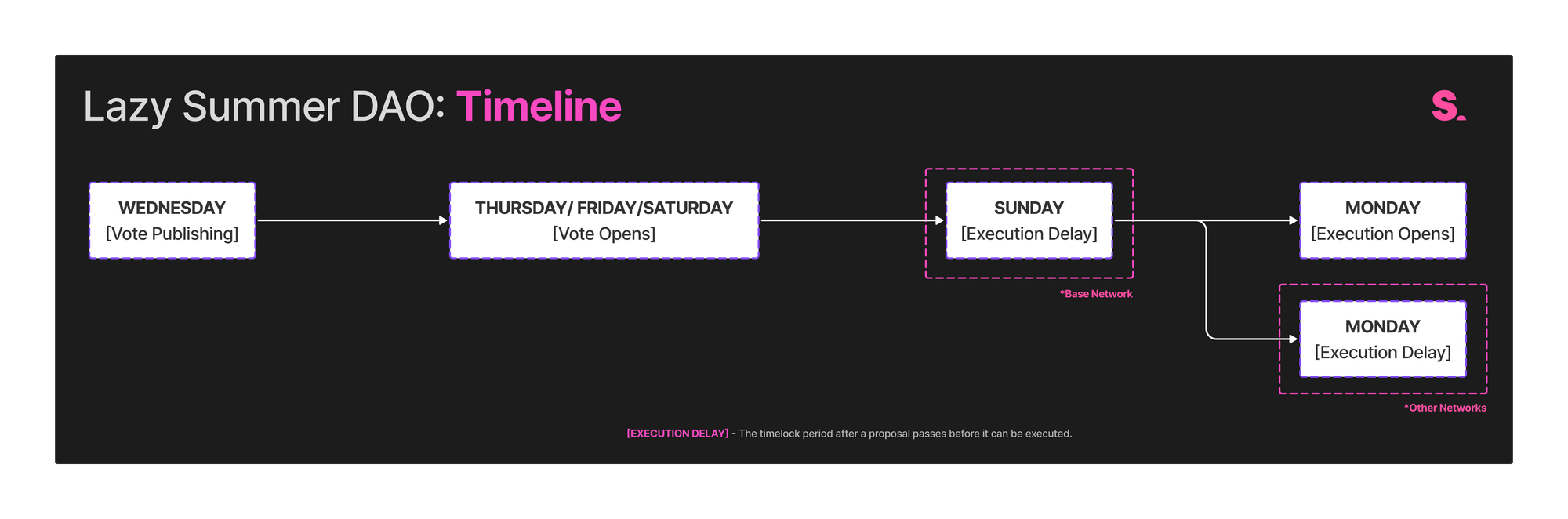

- Spawned from the discussions on the forum, the following flowchart/DAO governance process was suggested:

Lazy Summer DAO_ Governance Flow (4)7296×2416 229 KB

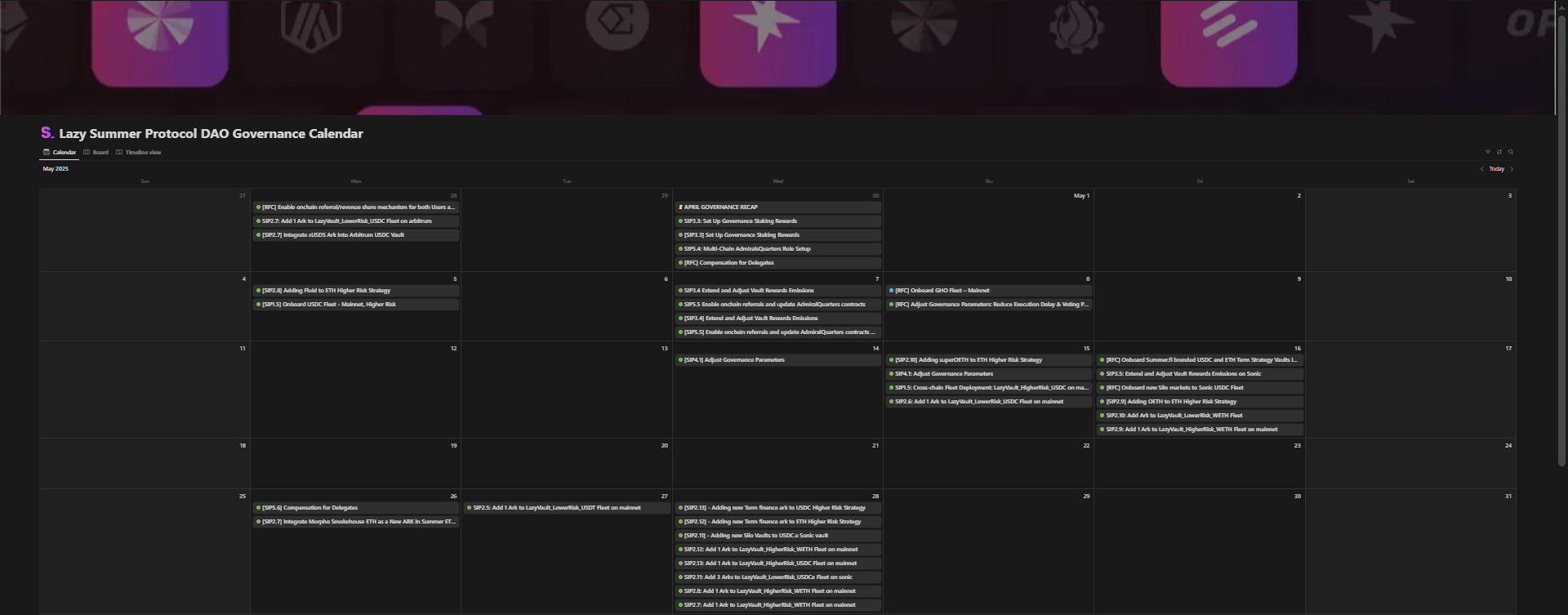

- Another community build was announced to help transparency and information seeking about the proposals and discussions live:

📅 dao-calendar

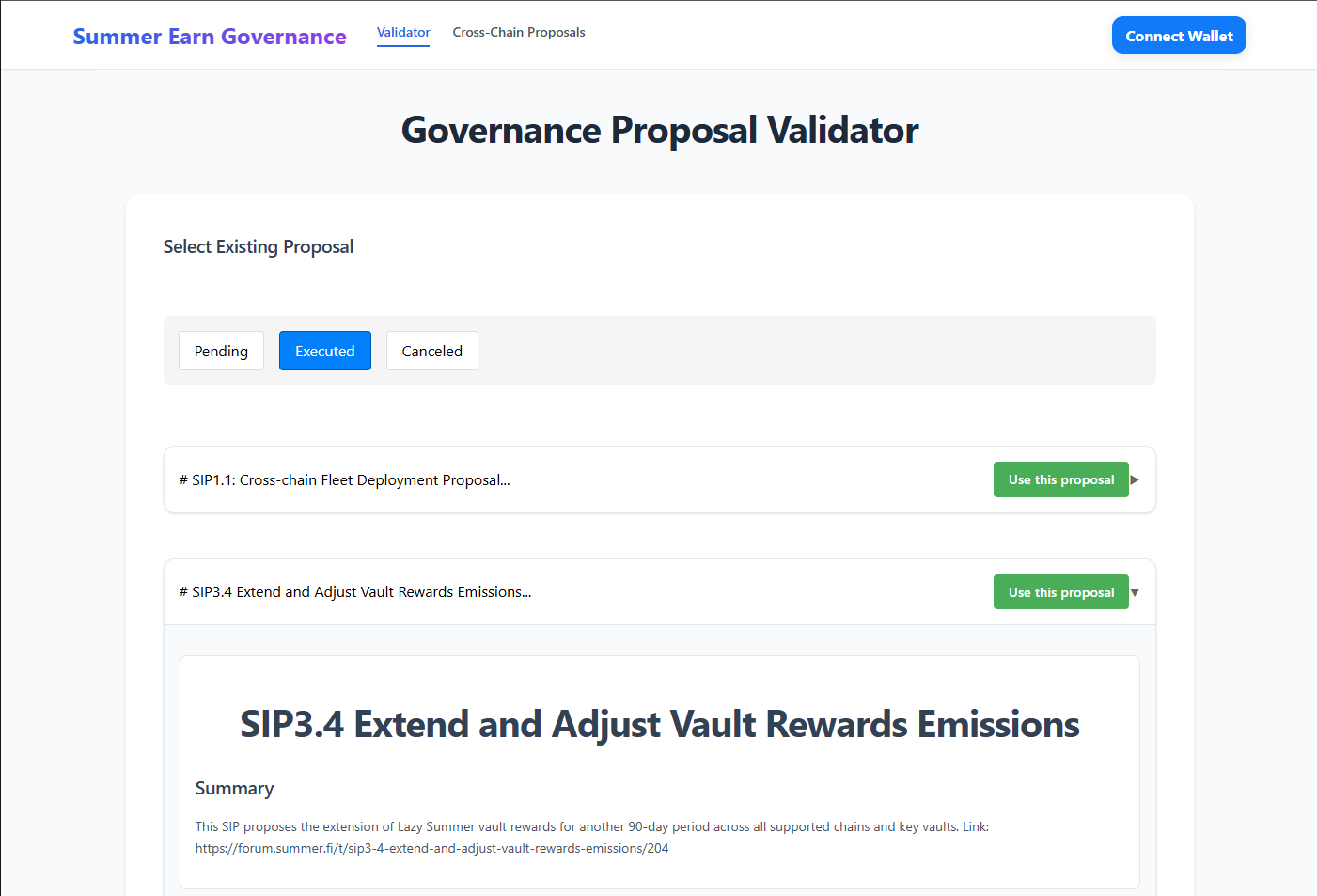

- Ever wondered wether the onchain proposal executive code aligns with what has been proposed on the forum? The proposal validator app has been built by @halaprix bringing verification of raw data closer to the non-technical delegates:

Notable RFCs:

[RFC] Onboard Summer.fi branded USDC and ETH Term Strategy Vaults into Lazy Summer’s high risk strategy (May 16th)

published by @billywelch

Proposes incorporating Summer.fi branded USDC and ETH Term Strategy Vaults into the high-risk strategy to leverage fixed-rate lending and idle liquidity for enhanced yields.

[RFC] Onboard new Silo markets to Sonic USDC Fleet (May 16th)

published by @halaprix

Recommends integrating three Silo Finance USDC vaults on the Sonic network to provide users with approximately 9.5% APR through combined native interest and token rewards.

[RFC] Onboard GHO Fleet – Mainnet (May 8th)

published by @jensei

Suggests launching a new GHO stablecoin vault on Ethereum Mainnet to diversify stablecoin offerings and capitalize on emerging yield opportunities.

[RFC] Adjust Governance Parameters: Reduce Execution Delay & Voting Period (May 8th)

published by @jensei

Proposes reducing the voting period from 5 to 3 days and the execution delay from 2 to 1 day on Base Network to enhance governance efficiency.

SIPs in Focus:

Governance brought up 12 Summer Improvement Proposals (SIPs) formalizing forum discussions:

[SIP2.13] - Adding new Term finance ark to USDC Higher Risk Strategy (May 28th)

published by @halaprix

Recommends adding a new Term Finance ARK to the USDC Higher Risk strategy to expand and diversify yield-generating avenues.

[SIP2.12] - Adding new Term finance ark to ETH Higher Risk Strategy (May 28th)

published by @halaprix

Proposes incorporating a new Term Finance ARK into the ETH Higher Risk strategy to enhance yield diversification.

[SIP2.11] - Adding new Silo Vaults to USDC.e Sonic vault (May 28th)

published by @halaprix

Suggests adding new Silo vaults to the USDC.e Sonic vault to diversify strategies and improve yield performance.

[SIP5.6] Compensation for Delegates (May 26th)

published by @jensei

Introduces a compensation framework for delegates to acknowledge their contributions and encourage active participation in governance.

[SIP2.7] Integrate Morpho Smokehouse ETH as a New ARK in Summer ETH Vault (May 26th)

published by @samehueasyou

Proposes integrating Morpho Smokehouse ETH as a new ARK to enhance the ETH vault’s strategy mix and yield potential.

[SIP2.9] Adding OETH to ETH Higher Risk Strategy (May 16th)

published by @pete

Recommends adding OETH to the ETH Higher Risk vault to expand exposure to different ETH-based yield opportunities.

[SIP2.10] Adding superOETH to ETH Higher Risk Strategy (May 15th)

published by @pete

Suggests incorporating superOETH into the ETH Lower Risk vault to diversify assets and optimize yield strategies.

[SIP4.1] Adjust Governance Parameters (May 14th)

published by @0xtucks

Proposes reducing the voting period and execution delay to streamline governance processes and enhance protocol agility.

[SIP3.4] Extend and Adjust Vault Rewards Emissions (May 7th)

published by @jensei

Extends vault rewards for another 90 days across all supported chains, adjusting emission rates to maintain momentum and attract capital ahead of token transferability.

[SIP5.5] Enable onchain referrals and update AdmiralQuarters contracts on all chains to support Referral Codes (May 7th)

published by @chrisb

Introduces an onchain referral program by updating AdmiralQuarters contracts across all chains, incentivizing both users and integrators with SUMR rewards.

[SIP2.8] Adding Fluid to ETH Higher Risk Strategy (May 5th)

published by @samehueasyou

Suggests integrating Fluid Lite ETH into the ETH Higher Risk vault to diversify yield sources and tap into Fluid’s unique liquid staking model.

[SIP1.5] Onboard USDC Fleet - Mainnet, Higher Risk (May 5th)

published by @samehueasyou

Proposes launching a higher-risk USDC vault on Ethereum Mainnet, aggregating diverse strategies like lending, farming, and real-world credit to attract yield-seeking users.

Tally Votes:

In May we saw 15 governance votes completed on Tally:

SIP5.5 Enable onchain referrals and update AdmiralQuarters contracts

Published (May 7th) / ✅ Passed

SIP3.4 Extend and Adjust Vault Rewards Emissions

Published (May 7th) / ✅ Passed

SIP2.6: Add 1 Ark to LazyVault_LowerRisk_USDC Fleet on mainnet

Published (May 15th) / ✅ Passed

SIP1.5: Cross-chain Fleet Deployment: LazyVault_HigherRisk_USDC on mainnet

Published (May 15th) / ✅ Passed

SIP4.1: Adjust Governance Parameters

Published (May 15th) / ✅ Passed

SIP2.9: Add 1 Ark to LazyVault_HigherRisk_WETH Fleet on mainnet

Published (May 16th) / ✅ Passed

SIP2.12: Add 1 Ark to LazyVault_HigherRisk_WETH Fleet on mainnet

Published (May 28th) / ✅ Passed

SIP2.13: Add 1 Ark to LazyVault_HigherRisk_USDC Fleet on mainnet

Published (May 28th) / ✅ Passed

SIP2.11: Add 3 Arks to LazyVault_LowerRisk_USDCe Fleet on sonic

Published (May 28th) / ✅ Passed

SIP2.8: Add 1 Ark to LazyVault_HigherRisk_WETH Fleet on mainnet

Published (May 28th) / ✅ Passed

SIP2.7: Add 1 Ark to LazyVault_HigherRisk_WETH Fleet on mainnet

Published (May 28th) / ✅ Passed

SIP2.5: Add 1 Ark to LazyVault_LowerRisk_USDT Fleet on mainnet

Published (May 28th) / ✅ Passed

SIP3.5: Extend and Adjust Vault Rewards Emissions on Sonic

Published (May 16th) / ✅ Passed

SIP2.10: Add Ark to LazyVault_LowerRisk_WETH Fleet

Published (May 16th) / ✅ Passed

As we transition into June, our aim shifts again to exploring innovative strategies on our way to $1B TVL and new possible integrations, so we can bring the lazy summer closer to end users. Your continued engagement and feedback are invaluable as we navigate the evolving DeFi landscape together. Shout out all the @Recognized_Delegates for doing the work!

See you on the forum; your friendly green blob.

Join us

Discord | Telegram | X/Twitter | Linktree

Disclaimer: Oazo Apps Limited functions solely as a front-end interface (Summer.fi) provider and it does not act on behalf of any user. Oazo Apps Limited did not launch nor does it operate or control the Lazy Summer Protocol. The Lazy Summer Protocol is accessed through Summer.fi. The information provided herein is provided on behalf of the Lazy Summer Foundation which launched the Protocol for informational purposes only and it does not constitute investment advice. Oazo Apps Limited and the Lazy Summer Foundation are not soliciting or recommending any transaction or guaranteeing any specific returns. Users interact with the Protocol at their own risk. T&C for the use of Summer.fi apply.