Lazy Summer Governance Recap [August 2025]

![Lazy Summer Governance Recap [August 2025]](/content/images/size/w2000/2025/09/Gz1kYHXWAAATgoX.webp)

August was packed for Lazy Summer DAO: new ARKs, @fluidkey integration, treasury ATH, and big $SUMR TR-WG updates.

Grab your shades; here’s the August recap.

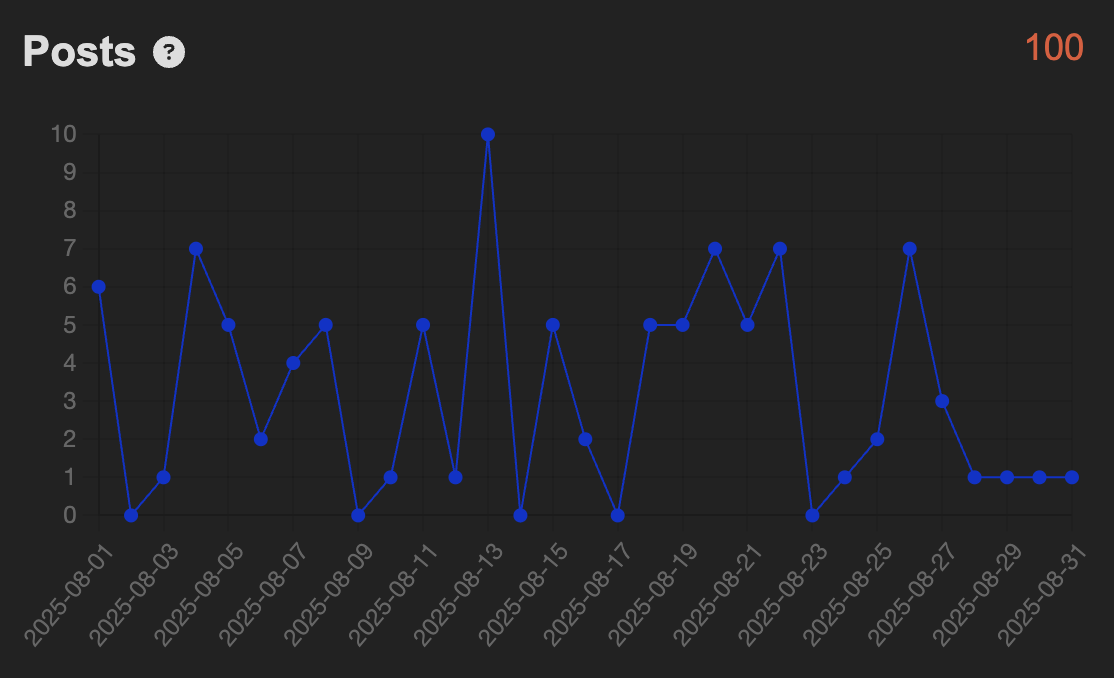

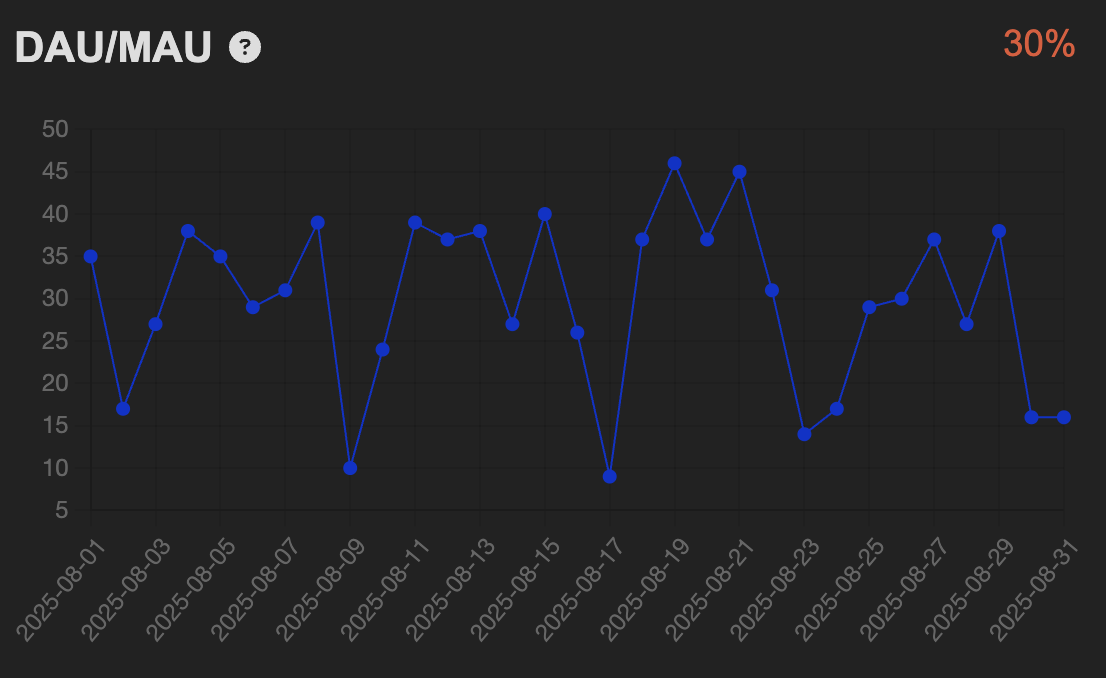

Governance stayed steady:

- 100 forum posts (down from July)

- DAU/MAU at 30% vs 38% in July

Slight dip in daily activity, but discussions remain consistent.

DAO metrics (July → Aug):

- Delegates: 510 → 514 (↑)

- $SUMR delegated: 348.9M → 353.6M (↑)

- Treasury: $129K → $160K (↑)

- Holders: 4,927 → 5,046 (↑)

Steady growth and the treasury crossed $150K ⬆️

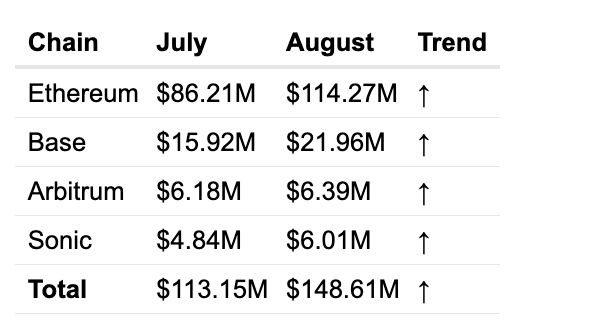

Protocol TVL (July → Aug):

Total TVL surged by $35M in August, driven primarily by Ethereum (+$28M) and Base (+$6M). Every chain saw growth.

Asset growth in August:

ETH-pegged assets soared (+$28M), USD-pegged climbed +$9M, and EUR-pegged continued its steady growth with +$0.3M. This mix shows a broad expansion across all asset types, which is great to see.

Notable RFCs:

- siUSD onboarding (@infiniFi_)

- Optimism mainnet fleets ($USDC + $ETH)

- $SUMR TR-WG readiness checklist

Forum: https://forum.summer.fi

Key SIPs executed:

- Merkl rewards enabled across vaults

- Multiple new ARKs on Ethereum, Base, Arbitrum

- Governance staking rewards extended

- Fleet token transferability enabled

Onchain votes in August:

- 10+ SIPs passed & executed

- Merkl rewards, ARKs, referral payouts, staking rewards

- Some proposals were cancelled or failed execution. 🐞

Full record: https://gov.summer.fi

$SUMR Transfer Readiness WG:

- Gov v2 ~90% done (no vote decay, new staking) (@halaprix)

- Liquidity plan v0.1: aiming $1M TVL in SUMR//ETH/USDC pools (TokenBrice)

- Partnerships explored: $OETH, $BOLD, $Aerodrome

Timeline: late Sep–early Oct.

Don’t forget: Fluidkey x Lazy Summer integration is live!

Funds earn yield instantly on deposit.

August showed strong growth:

- TVL: +$35M

- Treasury: +$30K

- $SUMR transfer prep advancing

Shout out to all delegates & the community!

Get Involved:

Catch full details and join ongoing discussions on the forum and governance dashboard:

- Discord: Summer.fi

- Forum: https://forum.summer.fi

- Onchain Governance: https://gov.summer.fi

Join us

Discord | Telegram | X/Twitter | Linktree

Disclaimer: Oazo Apps Limited functions solely as a front-end interface (Summer.fi) provider and it does not act on behalf of any user. Oazo Apps Limited did not launch nor does it operate or control the Lazy Summer Protocol. The Lazy Summer Protocol is accessed through Summer.fi. The information provided herein is provided on behalf of the Lazy Summer Foundation which launched the Protocol for informational purposes only and it does not constitute investment advice. Oazo Apps Limited and the Lazy Summer Foundation are not soliciting or recommending any transaction or guaranteeing any specific returns. Users interact with the Protocol at their own risk. T&C for the use of Summer.fi apply.