Lazy Summer and SUMR, a protocol with a business model, not just a token

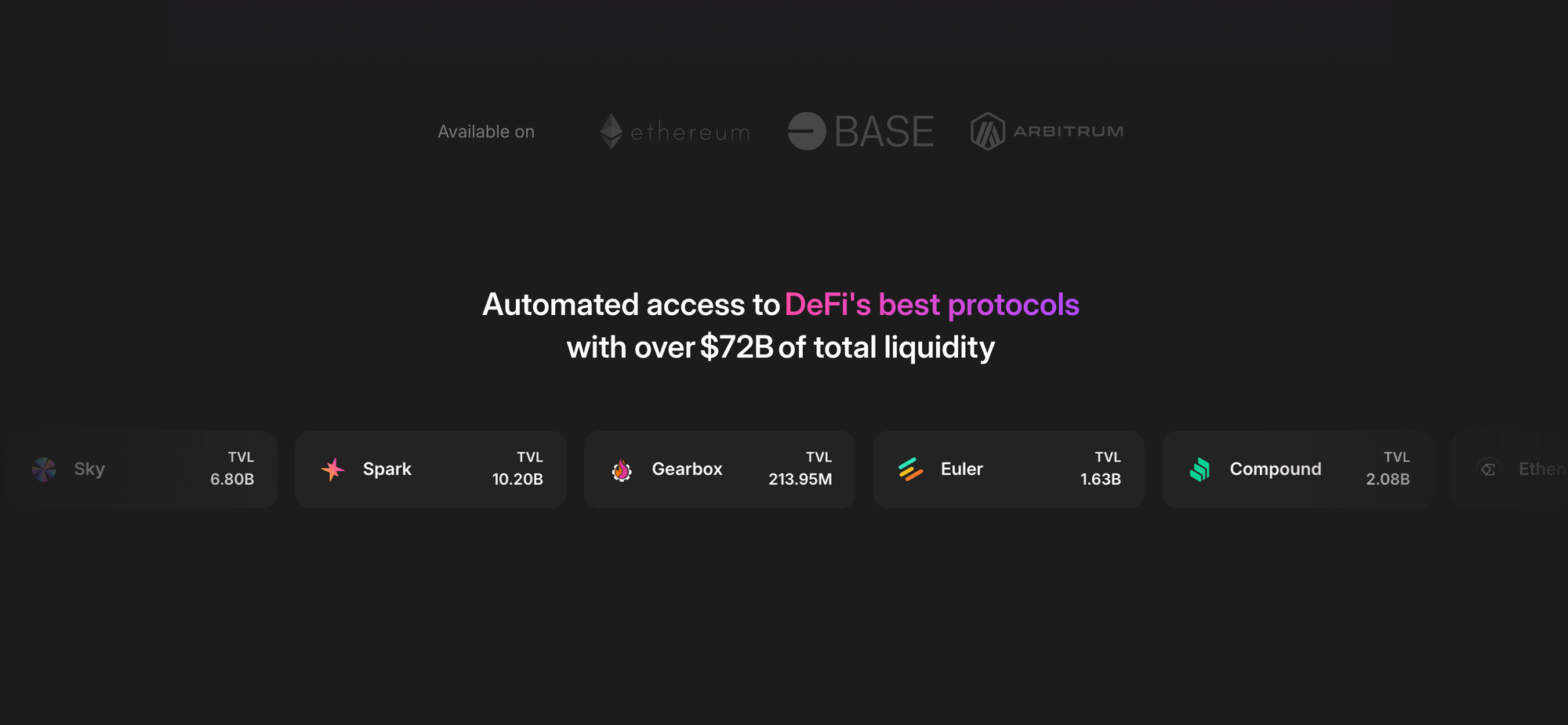

Lazy Summer Protocol makes DeFi’s best yield sources accessible through automation and risk curation. SUMR aligns users with the protocol’s growth, turning transparent yield access into a sustainable, governance-driven business model.

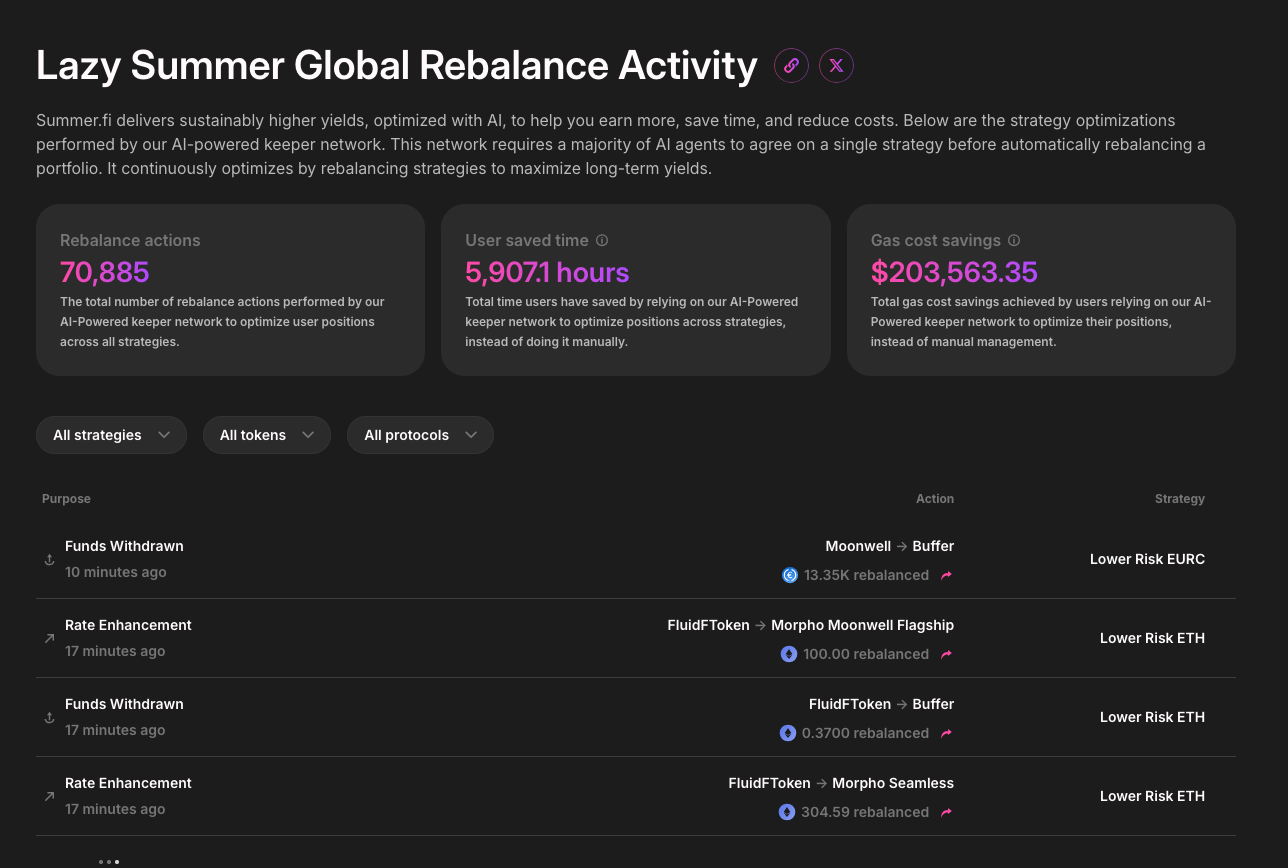

Lazy Summer protocol exists to make DeFi’s best yield opportunities available to everyone. It automates yield generation, enables third-party risk management, and optimizes potential returns, giving users the opportunity to earn more while doing less.

At the center of this mission is SUMR, the token that aligns with the economic value created by the protocol’s growth.

Delivering on the promise of earning more while doing less

Like all successful businesses and business models, the first and most important step is providing users with uncompromising value from using your product, only after which, in the context of crypto, should a token further amplify the underlying utility that users derive from the product.

Lazy Summer’s core focus is to deliver uncompromising value to its users through its core product, access to DeFi’s best yield sources. Upon this solid foundation, SUMR amplifies the utility and success of Lazy Summer Protocol, not as speculation, but as ownership in a revenue producing protocol that scales with adoption and usage.

Through automation, transparency, and governance, Lazy Summer has built one of DeFi’s rarest commodities: trust.

How Lazy Summer Protocol creates value for depositors and asset allocator

Above benchmark yield

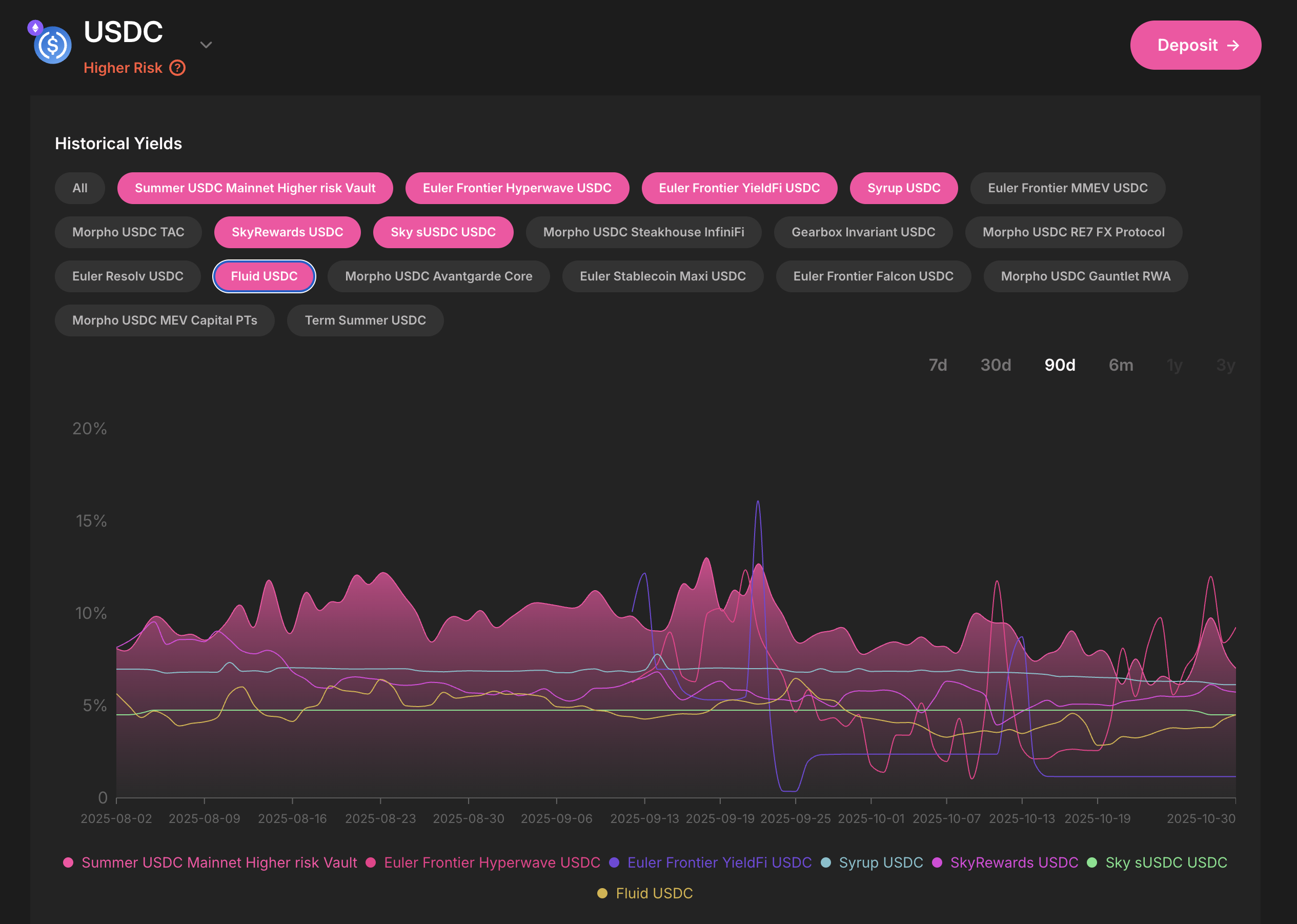

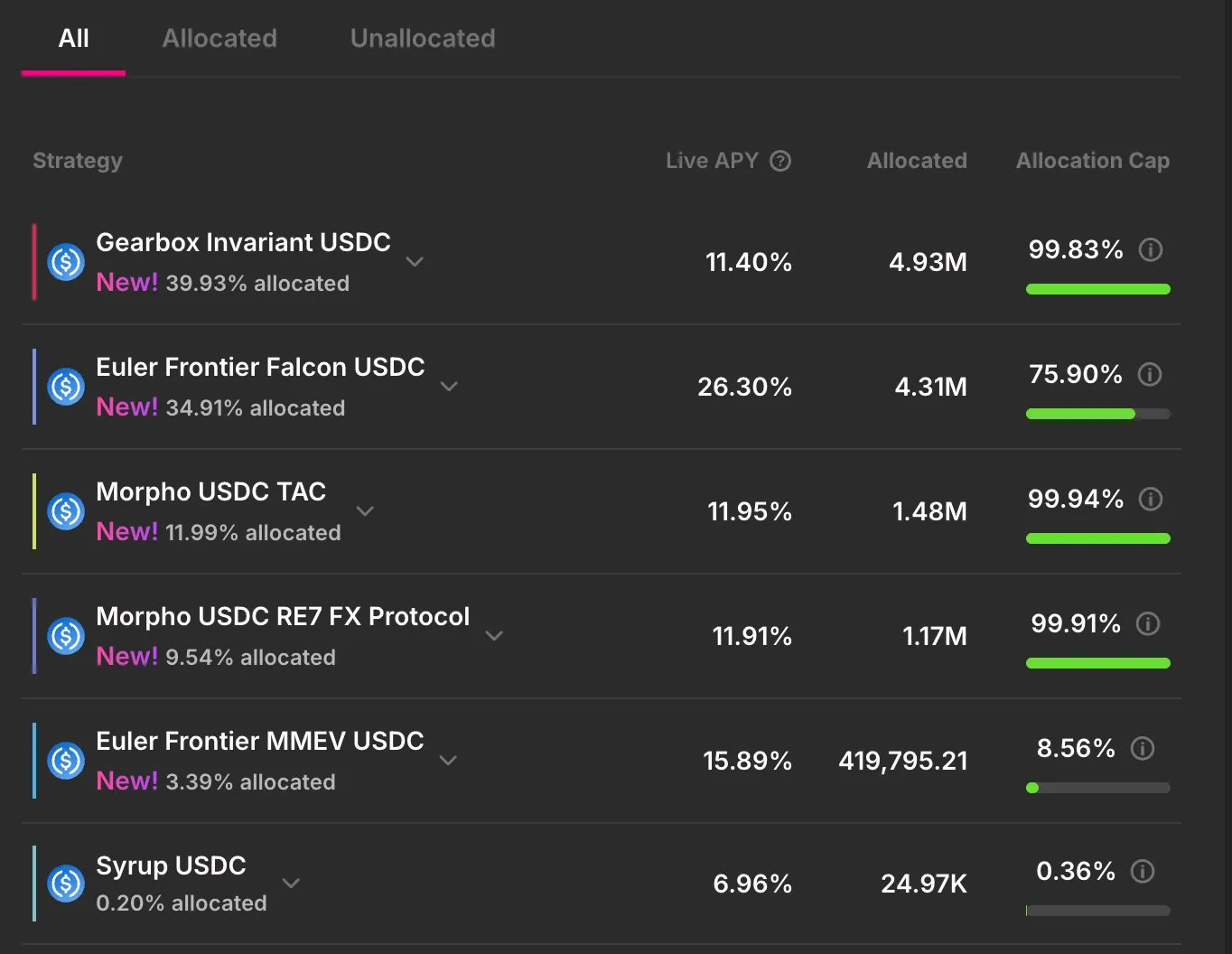

Access diversified yield across DeFi’s top protocols without manual management or risk analysis. Lazy Summer protocol automatically reallocates capital to the best-performing sources, consistently providing access to above-benchmark returns.

Time saved

Given that Lazy Summer Protocol users don’t have to spend time researching yields, analyzing risks, and managing positions, the protocol saves them ample time.

No yield chasing

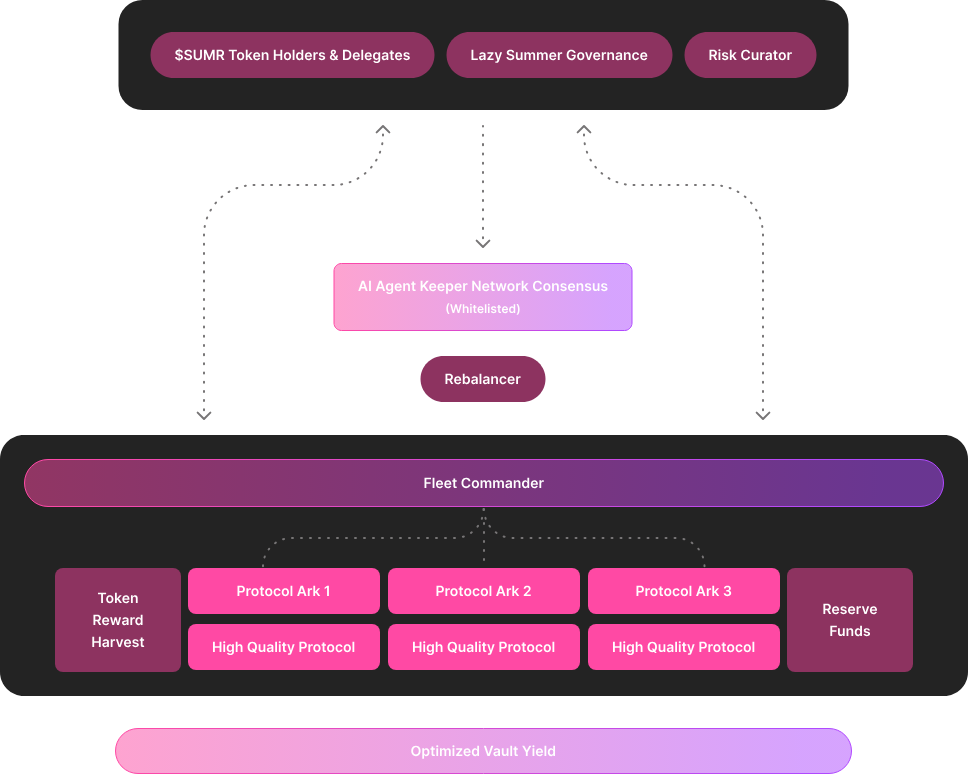

New strategies are proposed via the Lazy Summer governance process, and risk is assessed independently by a third party (Block Analitica). That means, as new yield sources and yield ecosystem pop up, governance and risk curation decide whether they have what it takes to be added to Lazy Summer. Depositors don’t have to do a thing.

Risk curated and managed

One through line in DeFi is that not all yield is created equal. Most all DeFi users are acutely aware of this, and thus default to the most lindy protocols and yields. With Lazy Summer protocol, users can access novel yield sources, whilst still operating under best in class risk frameworks.

Yield source depth

Users get access to high quality yields, automatically. New DeFi yield sources come to market all the time. So much so that is impossible for any one person to keep up.

Diverse exposure across yield source ecosystems

Unlike being beholden to a single protocol, Lazy Summer users get access to all DeFi’s best yield ecosystems. If a new yield ecosystem pops up, it can be added to Lazy Summer Protocol.

SUMR, the benefactor of a simple but powerful business model

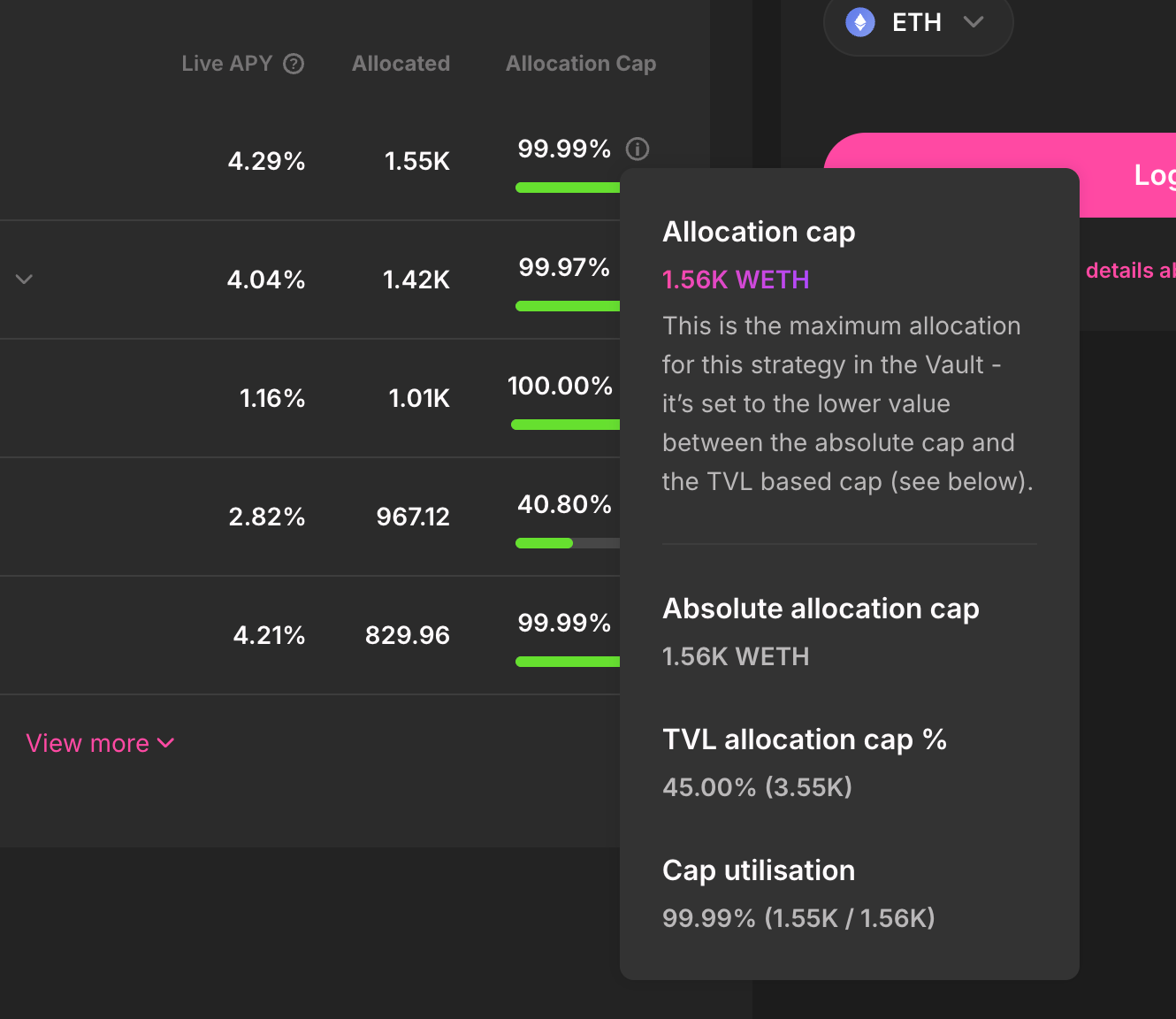

At its core, Lazy Summer Protocol operates a straightforward, scalable business model: it automates access to DeFi’s highest quality yield, captures a small share of that value through protocol fees, and directs those earnings into a treasury governed by SUMR holders.

As the protocol makes it easier for users to access DeFi’s best yields, the flow of value naturally moves back into the SUMR ecosystem, creating a governance-driven, self-reinforcing flywheel.

Vault Revenue: The Economic Engine

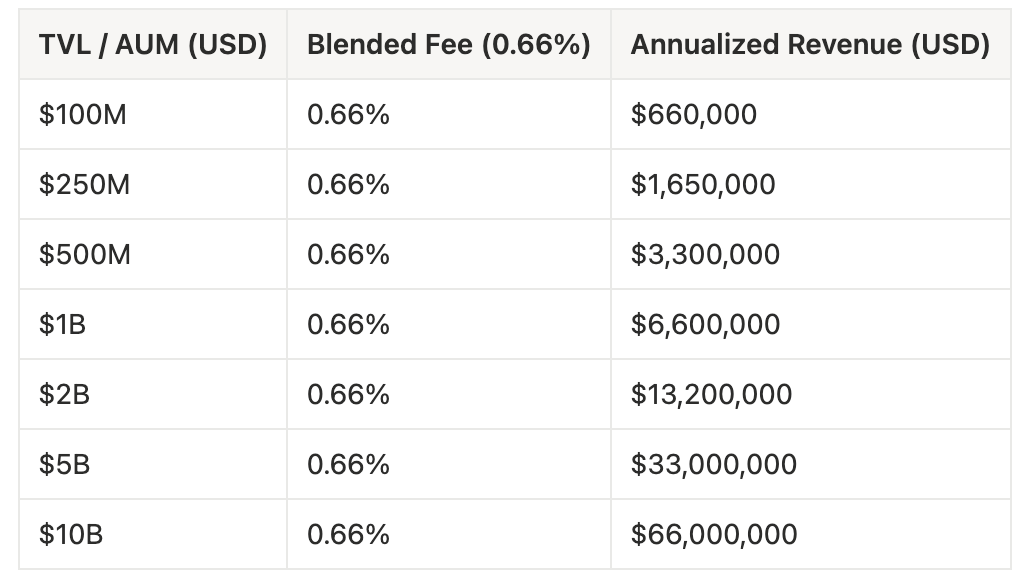

The protocol’s primary engine is vault generated revenue. Each vault charges a fee on the total assets under management, roughly 0.66% annually for DAO managed vaults. .

Below are Lazy Summer Protocol revenue projections based on different TVL/AUM thresholds

Lazy Summer Protocol Treasury: Value accumulation under the discretion of SUMR holders

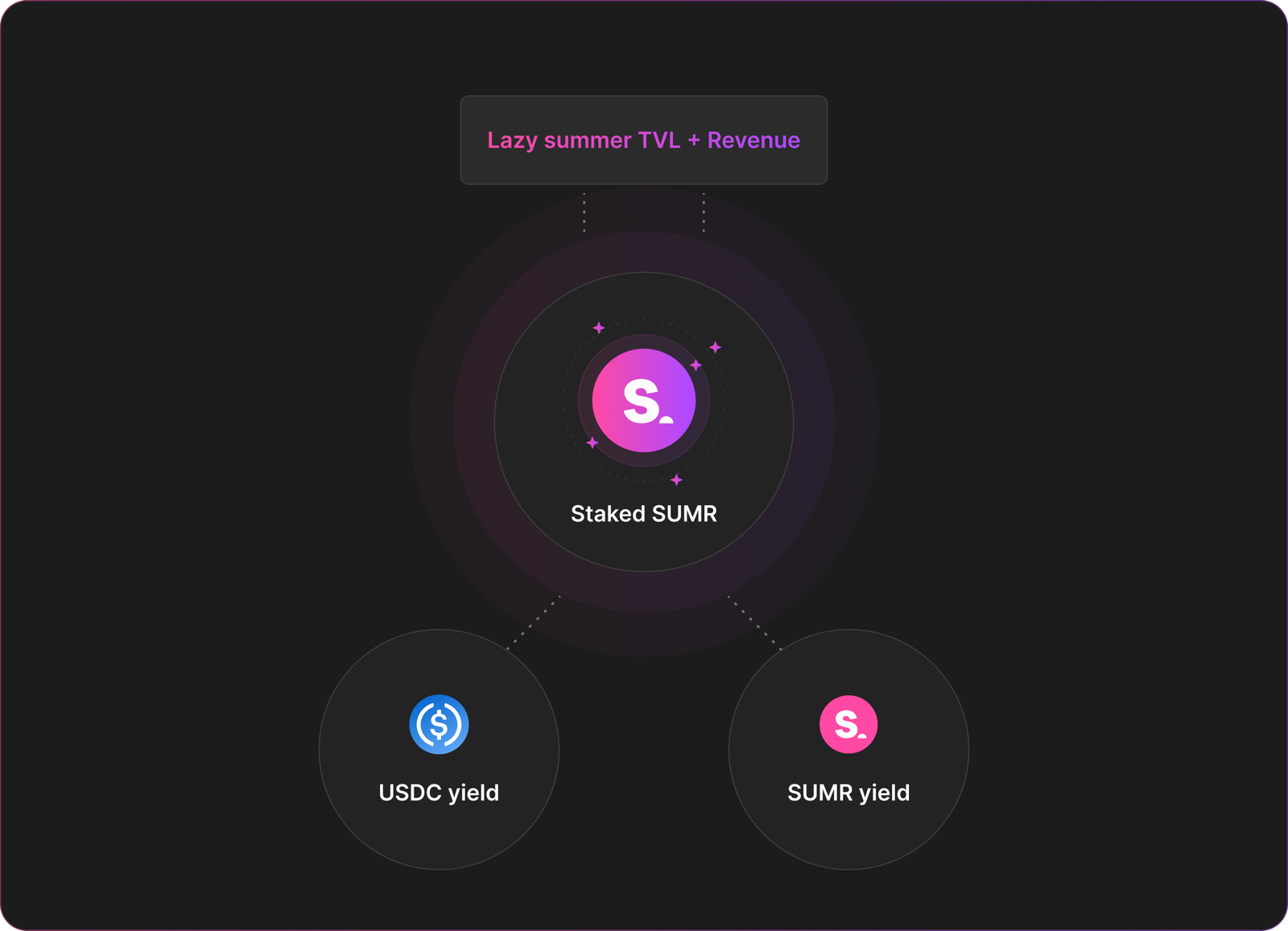

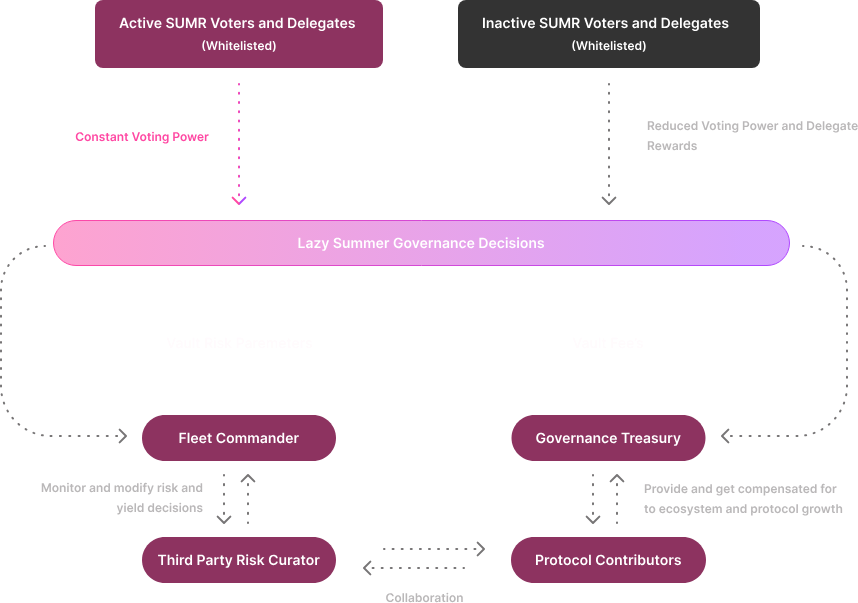

All vault fees flow directly into the Lazy Summer Protocol Treasury, governed by SUMR lockers. Through governance, SUMR holders decide how capital is deployed, funding contributors, growing the product, or rewarding (e.g., through USDC) long-term stakers.

Each uptick in TVL expands treasury inflows, tightening the link between protocol performance and SUMR value.

$SUMR Staking

Staking SUMR grants holders the opportunity to benefit from protocol growth and participate in governance. Stakers may receive USDC from the treasury, derived from protocol revenues. Stakers may also receive additional SUMR allocated from the community supply, aligning rewards with contribution and stewardship.

This mechanism turns SUMR from a static governance token into an active claim on the protocol’s long-term growth.

Aligning incentives for core service providers: Summer.fi as a technology services provider

Summer.fi provides technology services to the Lazy Summer Foundation in relation to the Lazy Summer Protocol, including user-facing features such as a streamlined UX.

As compensation for the services, Summer.fi earns 30% of the DAO-managed vault's revenue (subject to continued approval by governance). Summer.fi holds ~13% of SUMR supply. This structure aligns long-term incentives between Summer.fi as a core contributor and governance.

$SUMR Rewards

To align incentives and foster an engaged community, 35% of SUMR’s total supply is reserved for distribution via airdrops, farming, rewards, and grants. These rewards provide an additional yield layer over the core vault returns. Acting as a way to attract new depositors who may come for the SUMR token rewards, but stay for the protocols fundamental utility.

Governance

Governance is the heartbeat of Lazy Summer’s business model. SUMR holders do not simply vote, they direct capital and shape the evolution of the protocol.

Every major decision, from allocating the accumulated treasury to onboarding new yield sources and networks is done by SUMR token holders.

This model ensures that value generated by the protocol remains in the hands who are most incentive aligned for the long term.

New sources of demand for Lazy Summer, for SUMR.

As SUMR becomes a liquid, tradable asset, its value will be driven by protocol expansion and treasury growth.

Key catalysts include:

- Crosschain Vaults: Deposit once, gain access to strategies of multiple chains.

- Network Expansion: Plasma, Hyperliquid, and more newer opportunities, greater reach.

- Yield Loops via Morpho Markets: Optimised performance of the Lazy Summer Vaults (with automation coming soon thereafter).

- Institutional demand for Lazy Summer Protocol: First deployments of institutional vaults powered by Lazy Summer Protocol.

- Crosschain Vault Switching: Flexibility to switch between vaults and chains.

- New Asset Vaults: BTC, new stablecoins (USDH, USDE…), and beyond.

- Consistent strategy onboarding: Fresh strategies from top protocols.

Join us

Discord | Telegram | X/Twitter | Linktree

Disclaimer: Oazo Apps Limited functions solely as a front-end interface (Summer.fi) provider and it does not act on behalf of any user. Oazo Apps Limited did not launch nor does it operate or control the Lazy Summer Protocol. The Lazy Summer Protocol is accessed through Summer.fi. The information provided herein is provided on behalf of the Lazy Summer Foundation which launched the Protocol for informational purposes only and it does not constitute investment advice. Oazo Apps Limited and the Lazy Summer Foundation are not soliciting or recommending any transaction or guaranteeing any specific returns. Users interact with the Protocol at their own risk. T&C for the use of Summer.fi apply.