☀️ June 2025 Governance Recap ☀️

June flew by, but the Lazy Summer DAO didn’t sit still, the community kept shipping from vault expansions to new strategy integrations, but mainly having transformative strategy discussions.

Summer’s heating up, and the protocol is growing right along with it.

☀️ Don't forget to use sunscreen and referrals!!!

Below you will find your monthly dose of governance goodness; starting with some metrics:

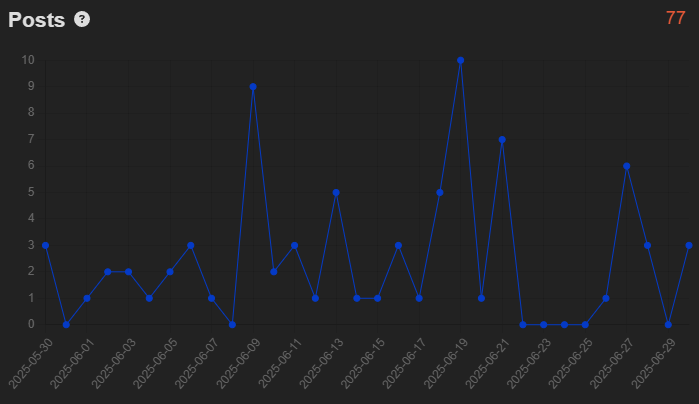

A total of 77 posts were recorded, with couple of noticeable spikes. Despite occasional dips, the overall trend suggests sporadic but responsive community participation.

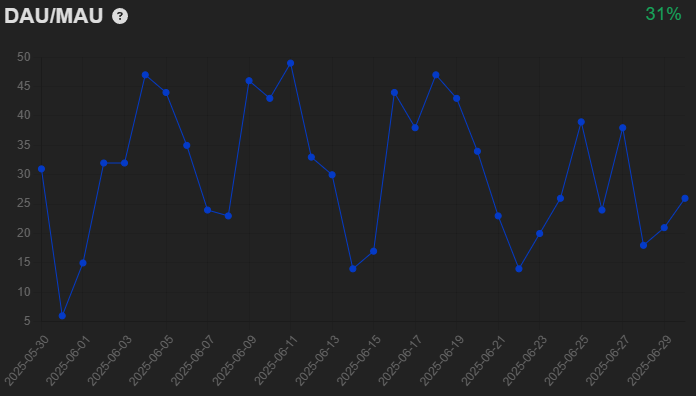

💡 DAU/MAU: Number of members that logged in in the last day divided by number of members that logged in the last month – returns a % which indicates community 'stickiness' (aim for >20%).

The Daily Active Users to Monthly Active Users ratio averaged 31%, indicating that roughly one-third of monthly users engaged on any given day.

DAO Metrics:

| Parameter | May | June | Trend |

|---|---|---|---|

| Delegates | 493 | 507 | ↑ |

| SUMR Delegated | 332.05M | 343.25M | ↑ |

| DAO Treasury | - | $102,200 | - |

| SUMR Holders | 4,313 | 4,614 | ↑ |

June saw steady growth in community engagement with an increase in delegates (+14) and SUMR delegated (+11M), while the DAO treasury reached $100K+ for the first time, and the number of SUMR holders rose by over 300.

Protocol Metrics:

| Chain TVL | May | June | Trend |

|---|---|---|---|

| Ethereum | $67.17M | $84.53M | ↑ |

| Base | $17.6M | $19.4M | ↑ |

| Arbitrum | $10.1M | $9.17M | ↓ |

| Sonic | $5.98M | $7.41M | ↑ |

| Total | $101.29M | $120.51M | ↑ |

Total TVL grew significantly in June, driven mainly by Ethereum (+$17.4M) and Base (+$1.8M), while Arbitrum saw a slight decline; overall, TVL climbed from $101M to $120M.

| Assets | May | June | Trend |

|---|---|---|---|

| ETH Pegged | $45.5M | $56.4M | ↑ |

| USD Pegged | $52.9M | $61.9M | ↑ |

| EUR Pegged | $2.8M | $2.1M | ↓ |

ETH-pegged assets continued to gain traction with a solid $11M increase, USD-pegged assets also grew by nearly $9M, whereas EUR-pegged assets dipped slightly, reflecting shifting user preferences.

- Net Deposits: $19.8M

- Net Inflow: $22M (from users having first deposits)

⚠️ Data snapshot taken: 30/06/2025 - 15:00

Notable RFCs:

- [RFC] When, and under what circumstances, should SUMR transfers be enabled (June 7th) published by @chrisb

Invites the community to align on key conditions like TVL targets, treasury strategy, staking upgrades, and liquidity incentives; before enabling SUMR token transferability.

- [RFC] The only way out, is up: The path to 1B TVL is 10x from here (June 12th) published by @samehueasyou

Proposes a roadmap to grow Lazy Summer to $1B+ TVL by aligning product, marketing, and tokenomics around automated yield and $SUMR incentives.

- [RFC] Onboarding Seamless WETH Vault on Base (June 17th) published by @yellowknife

Onboarding a Seamless WETH Vault on Base to enhance ETH Earn strategies with optimized yield and risk-managed exposure.

SIPs in Focus:

- [SIP2.10.1] Increase superOETH Ark allocation cap (June 9th) published by @pete

Raising the allocation cap for the superOETH Ark in the ETH Lower Risk vault on Base, allowing more capital to flow into this top-performing strategy to boost overall vault APY.

- [SIP2.14] Onboard Hyperithm Morpho USDC to the USDC Mainnet - Lower Risk Vault (June 11th) published by @Hyperithm

Adding Hyperithm’s institutional-grade Morpho USDC strategy to the USDC Mainnet Lower Risk vault, enhancing yield diversification with a secure, algorithm-driven lending approach.

- [SIP2.15] Adding OETH to ETH Lower Risk Strategy (June 18th) published by @pete

Adding Origin Ether (OETH) as a new ARK in the ETH Mainnet Lower Risk vault, aiming to diversify ETH yield strategies, grow TVL, and engage OETH holders.

- [SIP2.16] Onboard Morpho Seamless WETH market to BASE WETH Lower Risk Vault (June 30th) published by @chrisb

Onboarding the Morpho Seamless WETH market into the WETH Lower Risk vault on Base to expand Base vaults by tapping into one of the top ETH APR markets.

- [SIP3.5] Delegate Rewards Distribution (June) (June 30th)

Distributing 151,999.99 SUMR from the Lazy Summer DAO treasury to active and verified delegates for their contributions in June 2025.

Tally Votes:

Published (June 4th) / ✅ Passed

Get Involved:

Catch full details and join ongoing discussions on the forum and governance dashboard:

- Discord: https://discord.com/invite/summerfi

- Forum: https://forum.summer.fi

- Onchain Governance: https://gov.summer.fi

- Calendar: https://summerfi.notion.site/dao-calendar

- DAO Dashboard: https://dune.com/lazysummer/lazy-summer-dao-governance

- Protocol Dashboard: https://dune.com/lazysummer/lazy-summer-protocol

- Token Dashboard: https://dune.com/lazysummer/sumr-claims

See you on the Discord or Forum;

Join us

Discord | Telegram | X/Twitter | Linktree

Disclaimer: Oazo Apps Limited functions solely as a front-end interface (Summer.fi) provider and it does not act on behalf of any user. Oazo Apps Limited did not launch nor does it operate or control the Lazy Summer Protocol. The Lazy Summer Protocol is accessed through Summer.fi. The information provided herein is provided on behalf of the Lazy Summer Foundation which launched the Protocol for informational purposes only and it does not constitute investment advice. Oazo Apps Limited and the Lazy Summer Foundation are not soliciting or recommending any transaction or guaranteeing any specific returns. Users interact with the Protocol at their own risk. T&C for the use of Summer.fi apply.