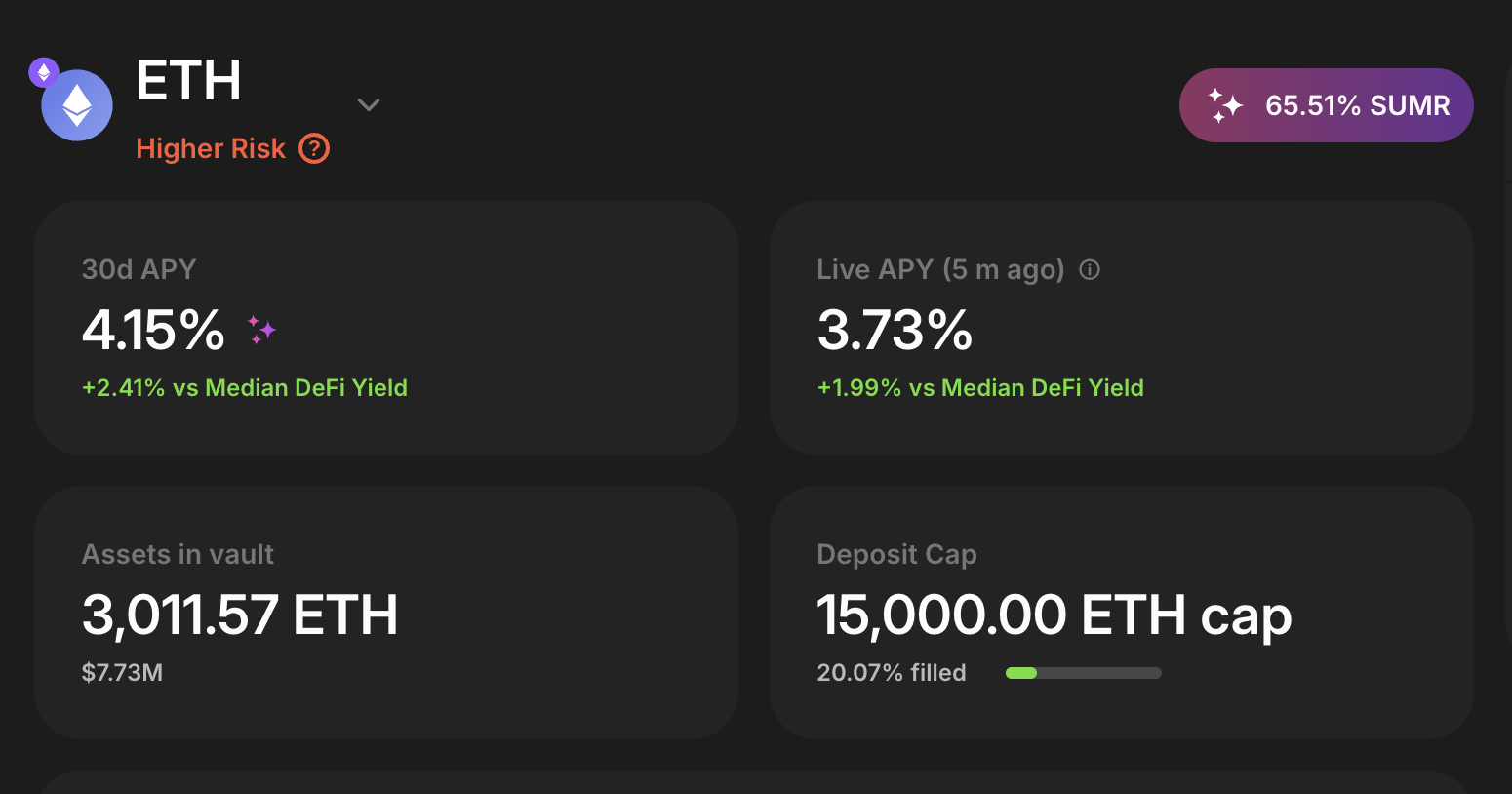

Introducing two new strategies for ETH Higher Risk

Unlock higher ETH Yield with Fluid Lite & Morpho Smokehouse

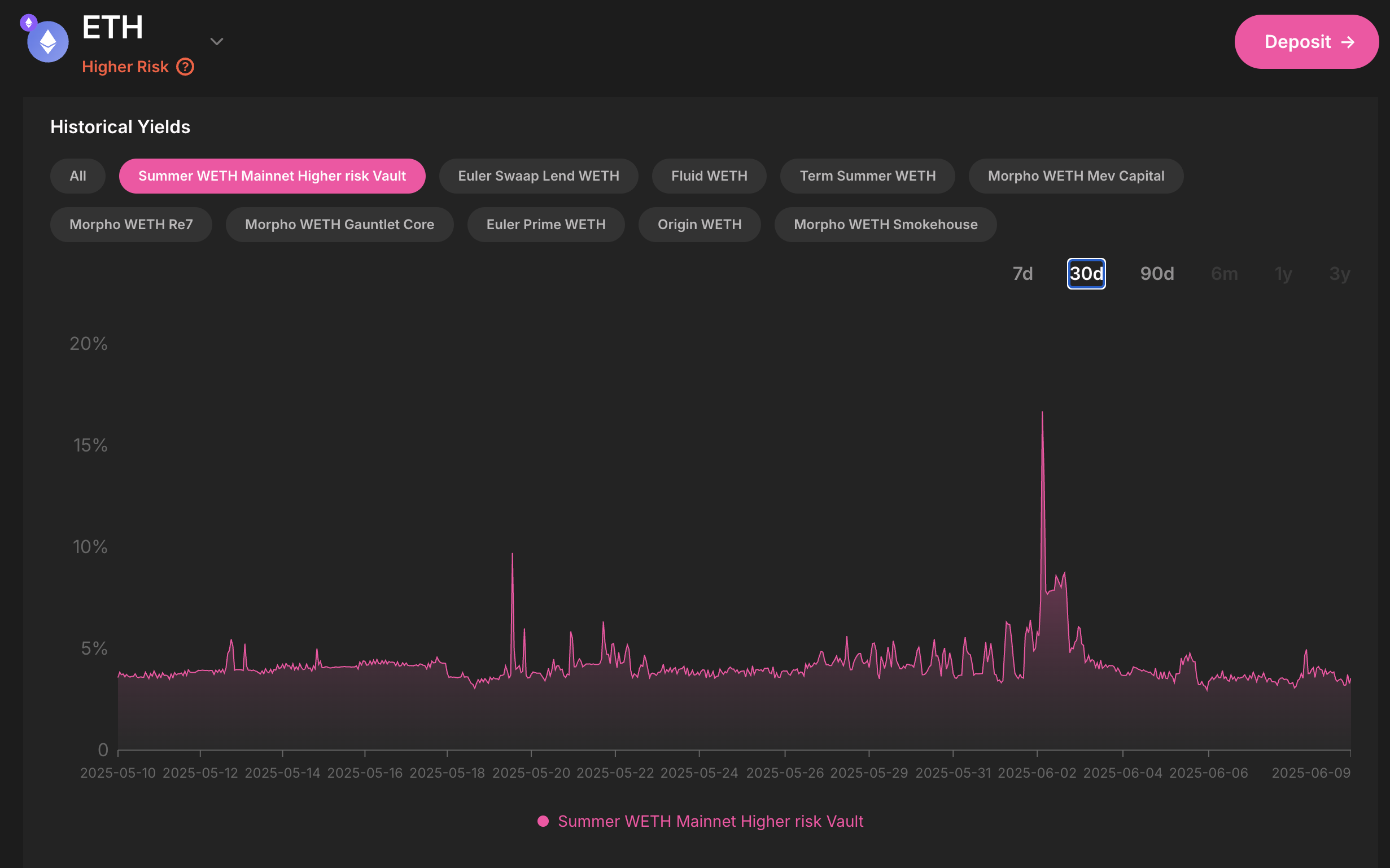

Recently, Lazy Summer launched the ETH Higher Risk vault, designed for users who want to go beyond staking and tap into DeFi’s most aggressive, high-yielding ETH strategies, without the hassle of managing them.

Today, that vault gets even more powerful. Lazy Summer has added two new strategies that deepen its exposure to sustainable, high-performance ETH opportunities:

Automated Exposure to Fluid Lite and Morpho Smokehouse

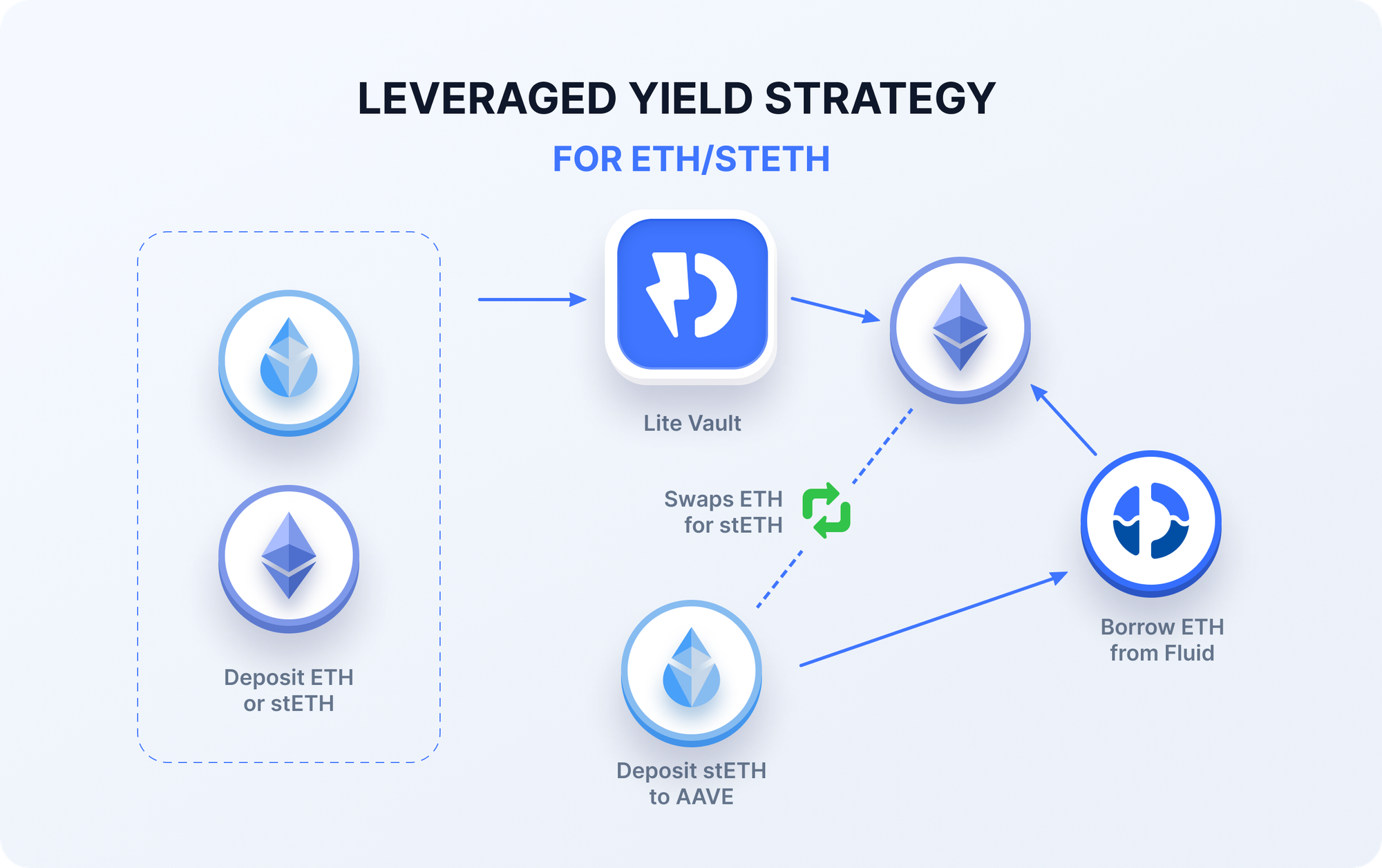

Fluid Lite ETH: Amplified Native ETH Yield

Fluid Lite is a leveraged ETH staking strategy that boosts your ETH yield by looping stETH positions through top-tier DeFi protocols like Aave, Morpho, and Compound.

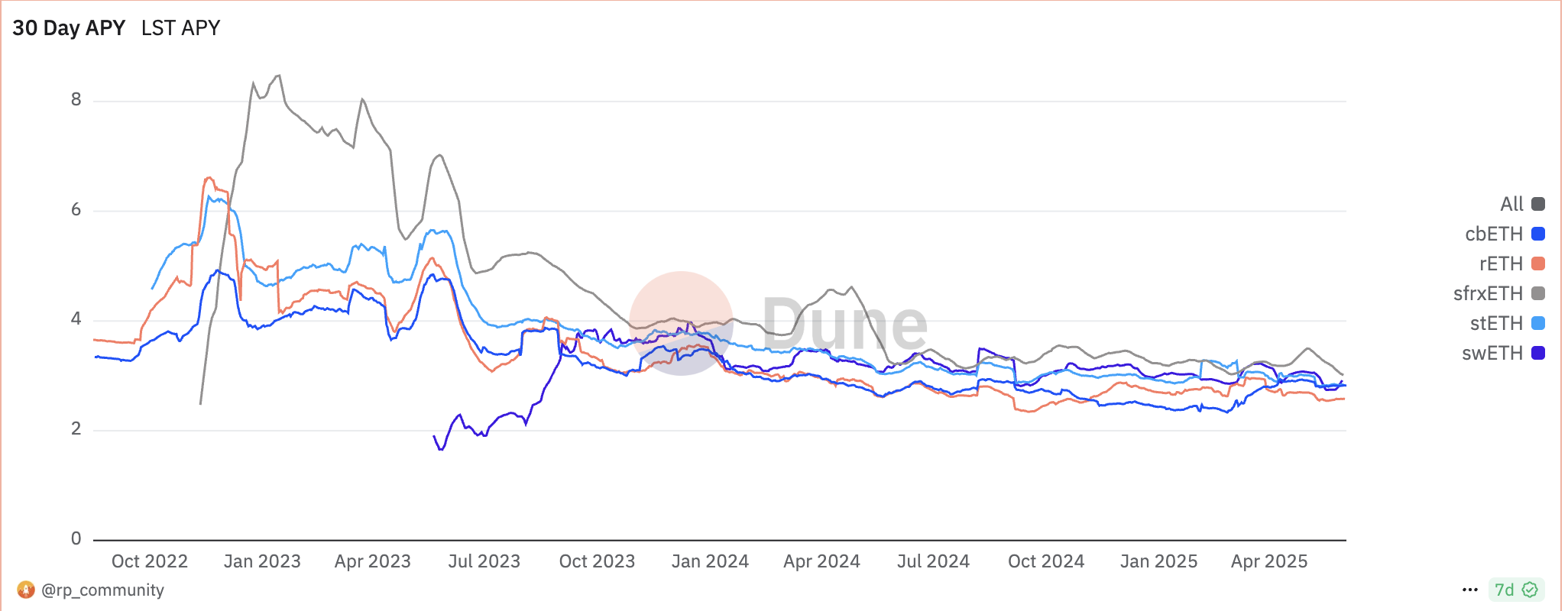

Unlike other high-yield products that rely on unsustainable token emissions, Fluid Lite taps into Ethereum’s native staking rewards—amplified through smart, looped leverage.

- Sustainable: Built on ETH staking, not mercenary emissions

- High-performing: Recycles ETH via lending to boost APRs

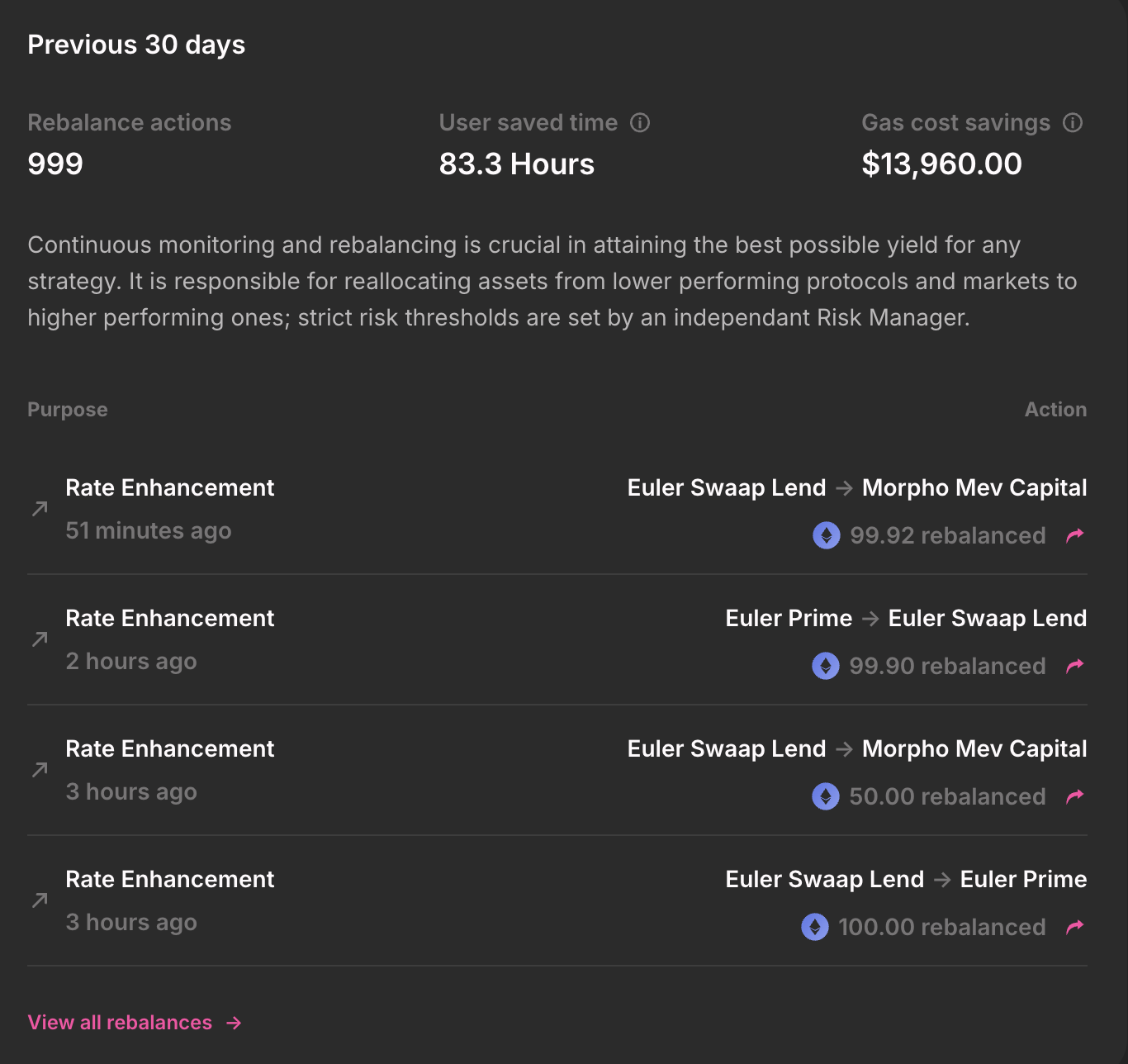

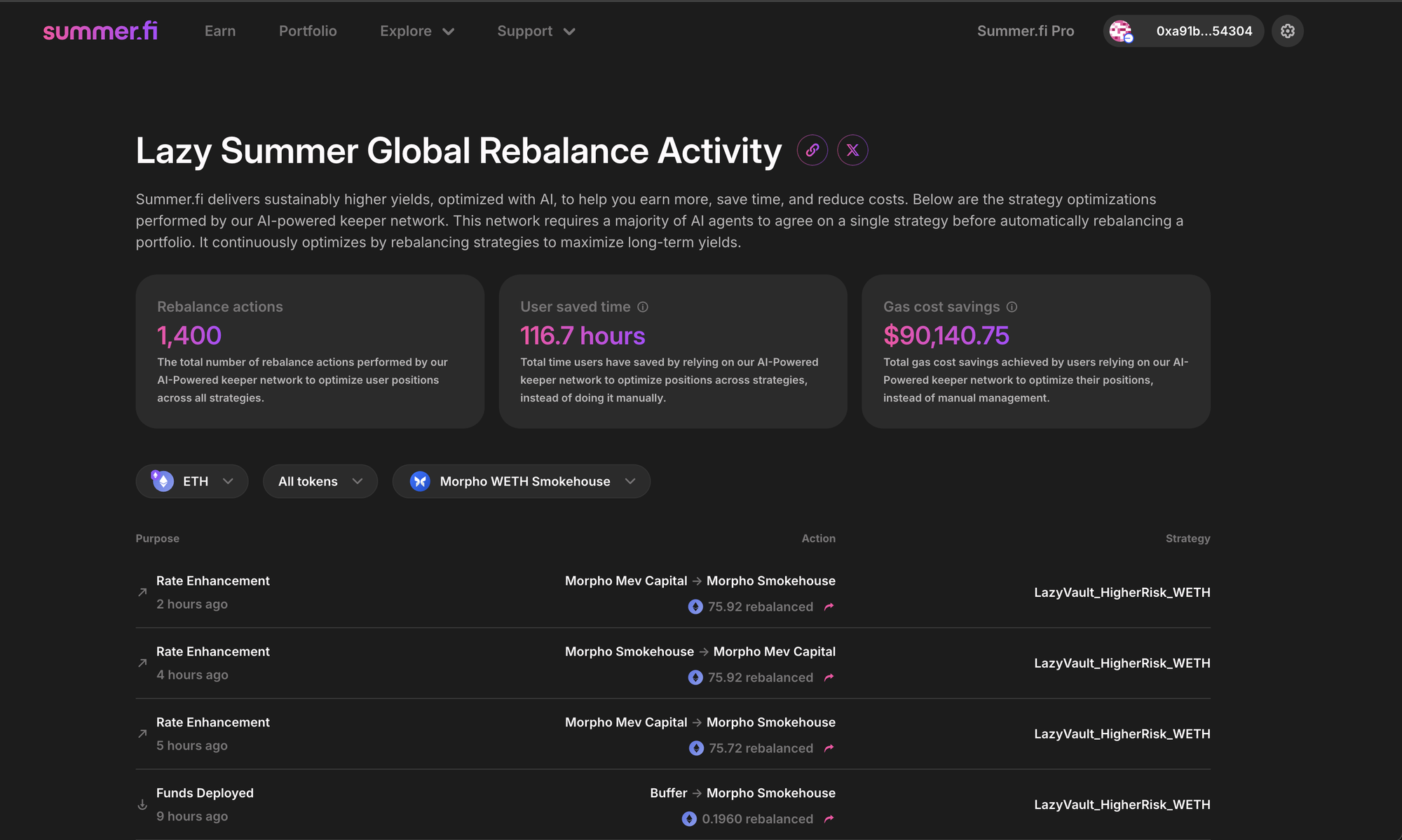

The Lazy Summer Advantage:

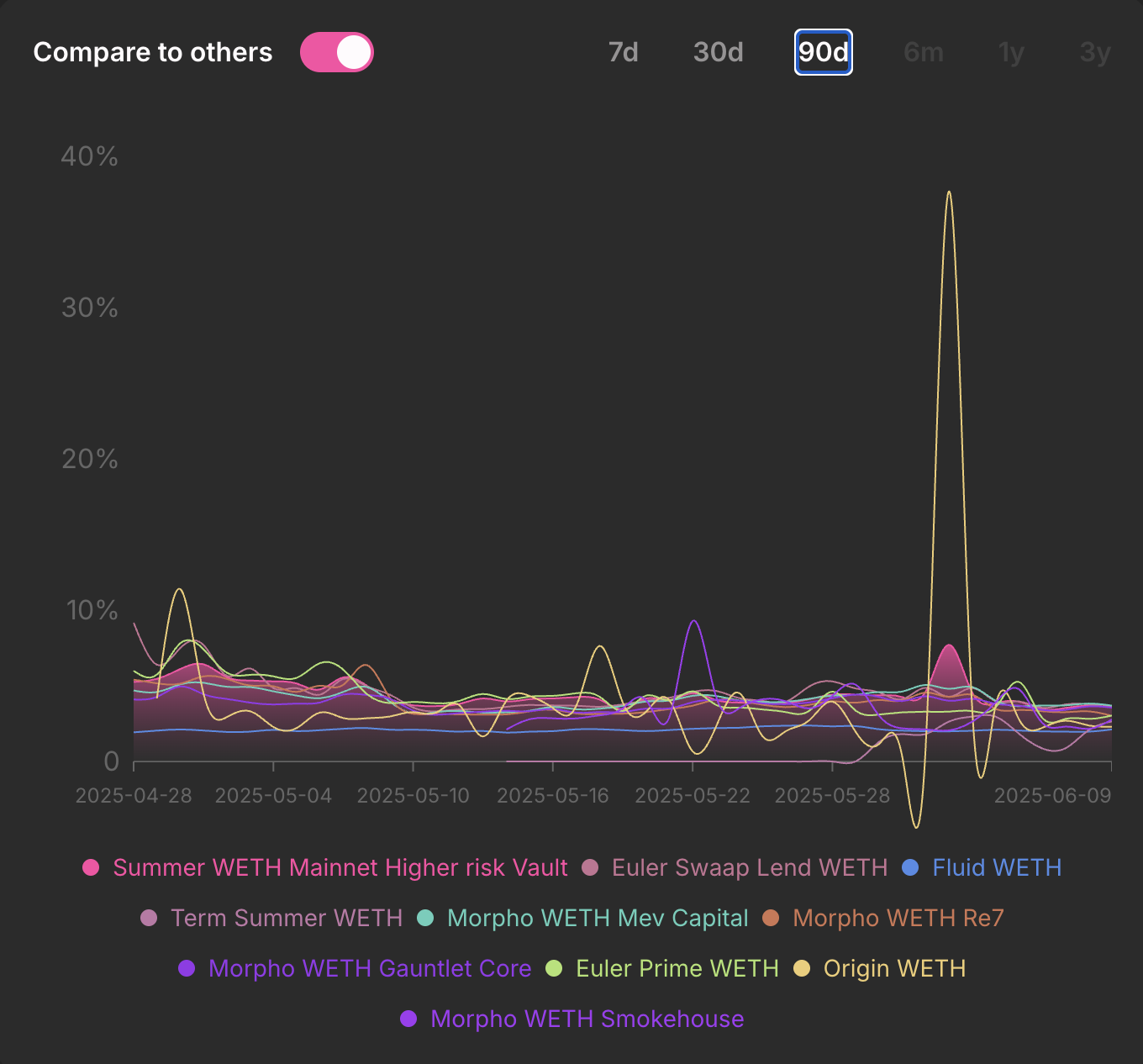

You get automated exposure to Fluid Lite, plus dynamic rebalancing across other top-performing ETH strategies—no management required. If the ETH looping strategy is under performing, the protocol will automatically route your capital to better risk adjusted strategies.

Morpho ETH Smokehouse: Diversified, Aggressive ETH Lending

The Smokehouse ETH Vault is curated by Steakhouse and built on Morpho Blue. It seeks yield from a wide range of ETH-backed collateral types, allocating capital across the most competitive markets like ynETHx, rsETH, bbqWSTETH, and more.

By capturing both staking rewards and lending spreads from diverse ETH derivatives, Smokehouse targets a higher APR than vanilla ETH staking.

- Diversified exposure: Earn across multiple staked ETH collateral types

- Actively managed: Morpho Blue + Steakhouse curation ensures top markets

- High-yield focused: Targets aggressive lending spreads with staking upside

The Lazy Summer Advantage:

You get seamless access to multiple Morpho markets—all rebalanced automatically for risk and yield performance, with exposure growing as new markets are added.

Never chase yield manually again: Save time, earn more and get lazy with Summer

With Fluid Lite and Morpho Smokehouse now live, the ETH Higher Risk vault offers:

- Higher yields than solo staking or lending

- Diversified exposure across ETH strategies and collateral types

- Hands-off performance, rebalanced by AI and curated by experts

You no longer have to pick winners or manage loops. Lazy Summer bundles the best strategies for you—and adapts as the market evolves.

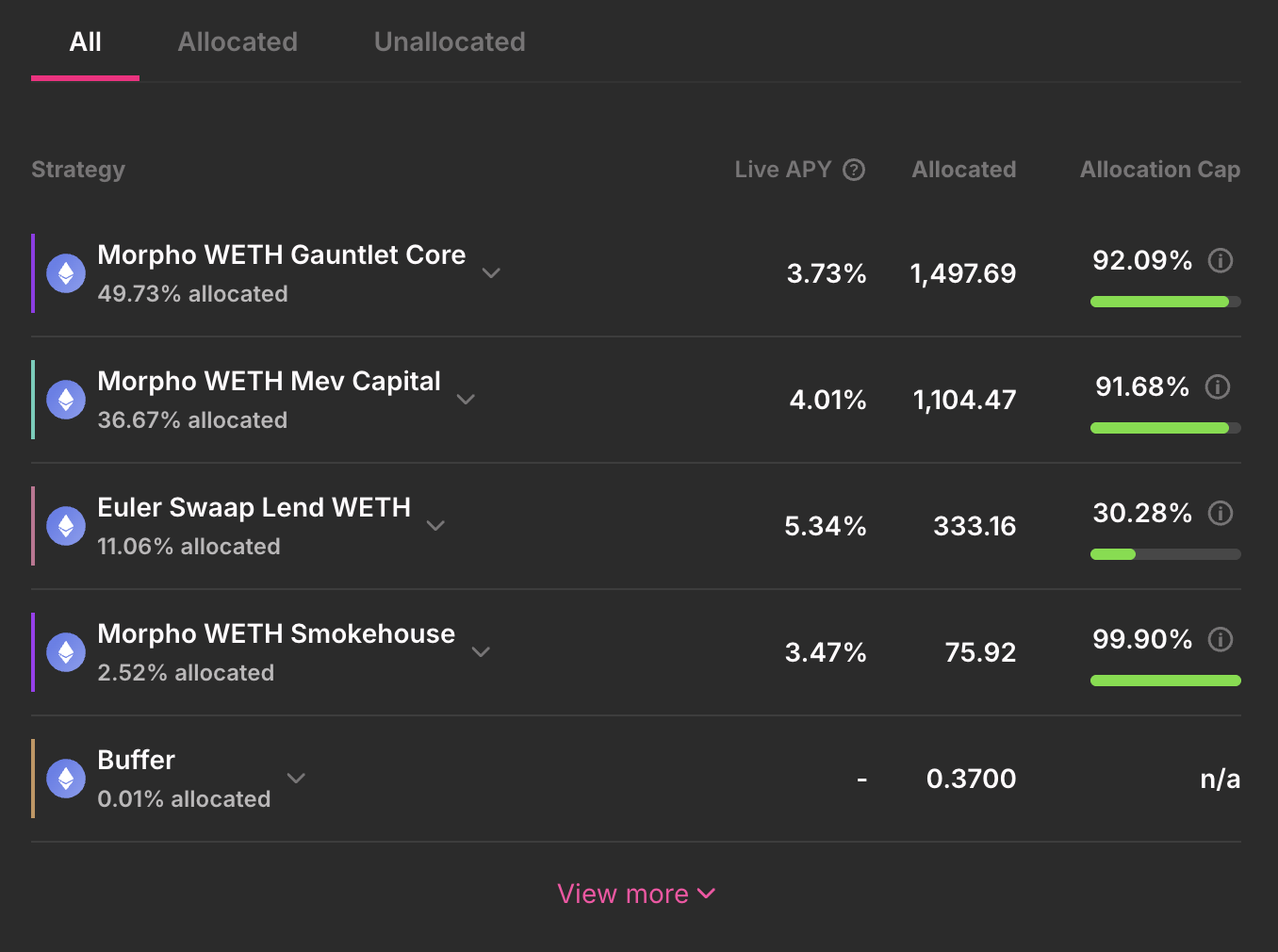

| Strategy | 30d APY | Description |

|---|---|---|

| 🪙 Hold ETH | 0.00% | No yield—ETH sitting idle does not earn anything. |

| 🌱 Hold stETH | 2.71% | Earns native staking yield, but no yield optimization. |

| 💼 stETH Vault | 3.84% | Combines staking rewards with additional lending yield. |

| 🔥 ETH Higher Risk | 4.15% | Exposure to leveraged staking (Fluid Lite) + multi-market ETH lending (Smokehouse), auto-optimized for high performance. |

Chasing high ETH yields on your own means juggling:

- Multiple protocols to monitor

- Manual leverage and health factor management

- Constant reallocation to chase better APRs

It’s complex, time-consuming, and easy to get wrong. Instead of building and managing your own high-yield strategy, you can deposit into one vault… ETH Higher Risk and get automated exposure to:

- Fluid Lite – Sustainable leverage on native ETH staking rewards

- Morpho Smokehouse – Diversified, high-yield ETH lending across multiple collaterals

- + More strategies added dynamically as new opportunities arise

Earn $SUMR Rewards While You Earn ETH Yield

- Earn SUMR based on your ETH vault deposit size

- Rewards are distributed regularly and can be compounded or claimed

- SUMR gives you governance power, staking yield, and a say in the future of the protocol

How Lazy Summer Works

- Deposit into a vault (like ETH Higher Risk)

- Your ETH is deployed across multiple curated strategies

- AI Keepers rebalance to maximize yield and minimize risk

- Strategies are curated and overseen by experts like Block Analitica

- All activity is visible on-chain and governed by SUMR holders

How to Deposit & Get Exposure to Fluid Lite + Smokehouse

- Connect your wallet on Summer.fi

- Deposit ETH or any asset into the ETH Higher Risk vault

- Earn yield instantly with automated rebalancing

- Migrate in one click from Morpho, Aave, or Compound

- Already deposited? Switch any time with Vault Switch

Why Users Trust Lazy Summer

- Audited: Contracts audited by firms like ChainSecurity

- Risk-Managed: Vaults curated by Block Analitica

- Proven: Over $2.3B managed via Summer.fi with zero protocol-level losses

- Transparent: On-chain rebalances, yield flows, and open governance

Start higher ETH yields now

- SUMR rewards are live

- Fluid Lite and Smokehouse now active in ETH Higher Risk

- Deposit with any asset and migrate seamlessly

👉 Deposit into ETH Higher Risk now

Join us

Discord | Telegram | X/Twitter | Linktree

Disclaimer: Oazo Apps Limited functions solely as a front-end interface (Summer.fi) provider and it does not act on behalf of any user. Oazo Apps Limited did not launch nor does it operate or control the Lazy Summer Protocol. The Lazy Summer Protocol is accessed through Summer.fi. The information provided herein is provided on behalf of the Lazy Summer Foundation which launched the Protocol for informational purposes only and it does not constitute investment advice. Oazo Apps Limited and the Lazy Summer Foundation are not soliciting or recommending any transaction or guaranteeing any specific returns. Users interact with the Protocol at their own risk. T&C for the use of Summer.fi apply.