Introducing SUMR Staking V2: All you need to know about DeFi’s most productive asset

SUMR Staking V2 is now live. This upgrade brings SUMR utility beyond a governance token and into what has the potential to be one of the DeFi ecosystem's most productive assets.

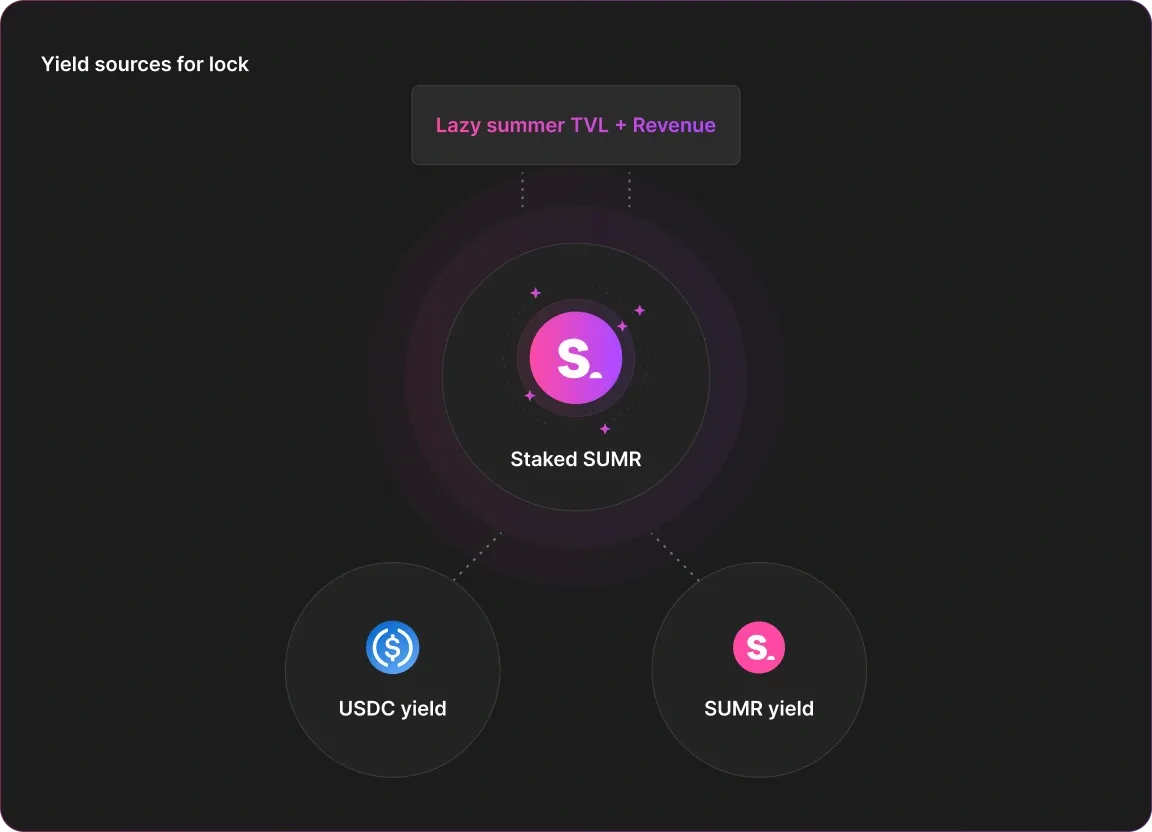

How? When you stake SUMR, you now get access to dual rewards: SUMR and USDC. Additional SUMR earned comes from tokens earmarked for community distribution, while the USDC rewards come directly from protocol revenues earned from fees on deposits.

In this post, we’ll cover:

- What’s new in Staking V2 vs V1 and why staking matters now more than ever (hint: TGE announcement)

- How to stake your SUMR

- How rewards (SUMR + USDC) work, including how locking, multipliers, and penalties work

What is new with SUMR Staking V2?

Staking V2 is the upgraded SUMR staking module that powers Governance V2 and aligns long-term SUMR holders with the growth of the Lazy Summer Protocol, and it has a few new additions that boost SUMR tokenomics and make it a productive asset ready for prime time.

What’s new in staking v2?

- Governance power without decay: vote directly or delegate to stewards who curate the best ARKs (yield sources), set parameters, and hold contributors accountable. Now, without voting decay, your rewards are not punished even if you miss a couple of votes.

- Access to MORE SUMR rewards: Additional SUMR can be earned by staking, but unlike v1, the longer you commit to staking, the higher your potential rewards.

- USDC rewards from protocol revenue: Get the opportunity to participate in protocol revenue for staking your SUMR by being allocated LV (vault) tokens that keep compounding automatically.

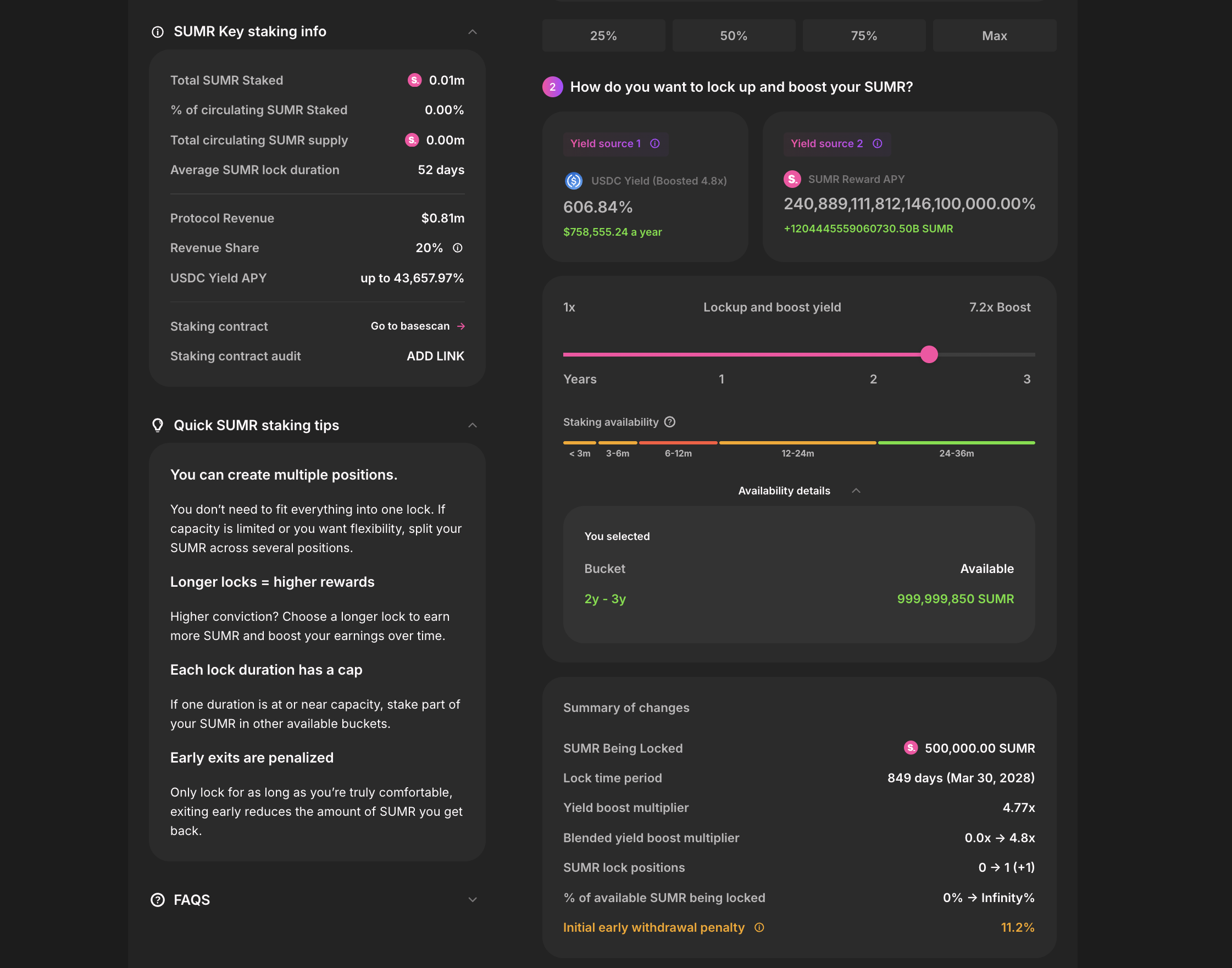

- Conviction based time based lock buckets: New in staking v2 is also the option to lock your staked SUMR for specific amounts of time, which in turn boosts your potentiality to earn both SUMR and USDC rewards.

How does staking v2 differ from staking v1?

Staking V1 was simple. Stake your SUMR and earn more SUMR. But in some ways, it was also more complex with “vote and reward power” based on your voting activity.

Staking V2 upgrades the ownership experience of SUMR in several key ways and differs from Staking V1 in the following ways:

- Dual rewards instead of single reflexive, same token rewards. Staking V1 only gave access to SUMR , meaning you only had the opportunity to earn more of the same token you staked, a reflexive exercise. Staking v2 introduces dual rewards for staking. That means you can potentially earn SUMR emissions and USDC for staking SUMR.

- Conviction weighted locking instead of passive staking with vote decay

Staking v1 incentivized governance participation by weighting vote power based on governance activity. Staking V2 presents the ability for users to lock their SUMR stake instead to create long term alignment. When you select a lock duration, you then receive a multiplier on any SUMR and USDC rewards. Your SUMR stake lock expresses how strongly you believe in the protocol.

Why stake SUMR?

There are three core reasons to stake SUMR in v2. Govern the Lazy Summer Protocol, earn more SUMR, and share in Lazy Summer Protocol revenue.

1. Govern the Lazy Summer Protocol

Staking SUMR gives you, or your delegate, the power to:

- Curate the best of DeFi

- Approve new ARKs (yield sources) to be onboarded.

- Offboard yield sources that no longer meet quality, risk, or performance standards.

- Keep contributors accountable

- Evaluate whether work done for the DAO is valuable.

- Align compensation, grants, and budgets with performance.

- Allocate protocol capital

- Decide how much protocol revenue flows to lockers, growth incentives, or the treasury over time.

SUMR is how the community steers the protocol.

2. Earn more SUMR than anyone before January 21 TGE.

Staking V2 keeps the core benefit from V1, staking your SUMR to earn additional SUMR. As mentioned above, staking v2 enables you to earn even more SUMR by locking your stake but staking v2 also launches at a critical time for another reason… SUMR TGE - Transferability Generation Event (TGE).

On January 21, 2025, SUMR will become tradable. Staking your SUMR in v2 is the perfect opportunity to increase your SUMR holdings and signal to the market confidence by locking, thus increasing the perception of SUMR value.

3. Participate in the revenue upside of the Lazy Summer Protocol

Staking SUMR in v2 enables you to be assigned a share of protocol revenue in accordance with a DAO-defined distribution model. This is staking v2’s big unlock.

A portion of protocol revenue (currently 20% of protocol yield) is routed to lockers as USDC-denominated LV vault tokens. These tokens keep compounding automatically in Lazy Summer’s strategies. As TVL, usage, and institutional adoption grow, protocol revenues can grow, and so does the potential USDC you earn for locking SUMR.

How to stake your SUMR in V2

If you have locked SUMR stake tokens in V1, you will first need to remove your stake from V1. This can be done in Summer.fi app by navigating to your portfolio and clicking the “SUMR Rewards” tab.

Additionally, if you have unclaimed SUMR tokens, you will first need to claim them before staking in v2.

Once you have SUMR tokens in your wallet, you will be ready to stake your SUMR tokens and step on the opportunity to earn dual rewards in SUMR and USDC in five simple steps:

Step 1: Navigate to the SUMR main page

- Go to http://summer.fi/earn/staking

- Click “Stake your SUMR”

Step 2: Choose how much SUMR to lock

- You can create multiple positions with different durations.

- Example:

- 5,000 SUMR → 3-year lock (max multiplier)

- 5,000 SUMR → 6-month lock (short-term flexibility)

Step 2: Pick your lock duration

- Each duration comes with:

- A time period (e.g. no lock, 3 months, 6 months, 1 year, up to ~3 years)

- A boost multiplier on SUMR and USDC rewards

- The longer you lock, the higher your multiplier.

You’ll see on-screen:

- Projected SUMR earnings

- Projected USDC earnings (in LV tokens)

- Both in percentage and estimated dollar/asset terms over a year.

Step 3: Check capacity & finalize

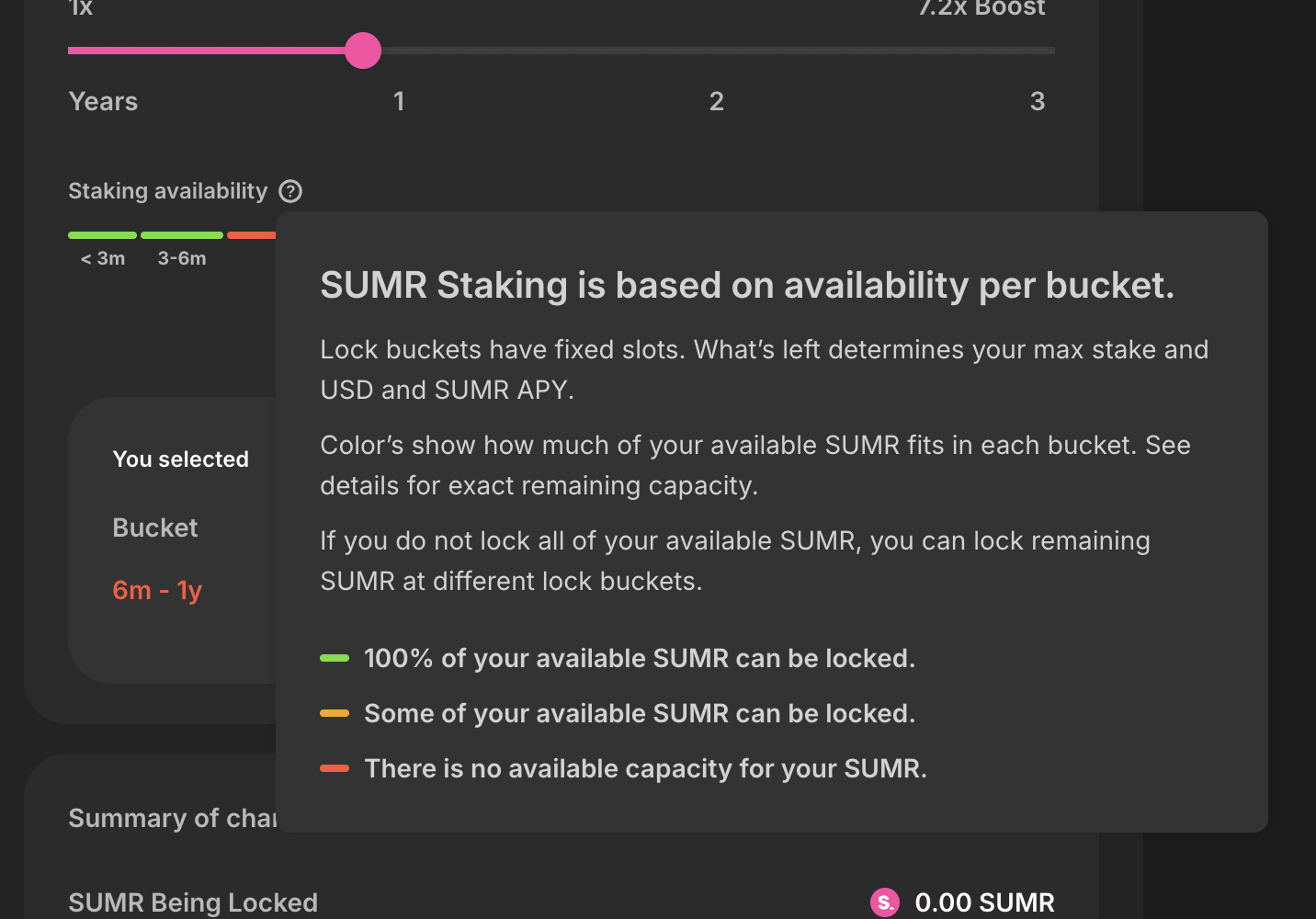

- Each lock duration has a capacity limit (how much SUMR can be locked in that bucket).

- If the bucket is near or at capacity: Once you confirm, you create your lock position.

- You might need to lower the amount you lock in that bucket, or

- Split across multiple buckets with separate positions

Step 4: Consider the early withdrawal penalty

- You can withdraw your SUMR before the end of your lock.

- But you’ll pay a penalty on the SUMR returned to you, with the penalty decreasing as you get closer to the end of your lock.

- This is designed to:

- Reward people who commit to their chosen lock, and

- Still give you an escape hatch if your circumstances change.

Step 5: Re-delegate your SUMR to the delegate of your choice

- As a result of the staking v2 upgrade, you will need to re-delegate your SUMR.

- To do this, simply navigate to your portfolio page and click on Change Delegate.

Stake SUMR, participate in the Lazy Summer Protocol. Get ready for TGE on January 21, 2026.

Staking V2 expands what SUMR can do inside the Lazy Summer Protocol. With dual rewards, lock based multiplier, and a more robust business model for long-term growth, at the perfect time, just before TGE.

Get ready for SUMR TGE on January 21 2026 by:

- Staking SUMR and getting access to potential dual rewards.

- Depositing in the Lazy Summer Protocol and earning access to SUMR rewards for depositing.

Start staking: summer.fi/earn/staking