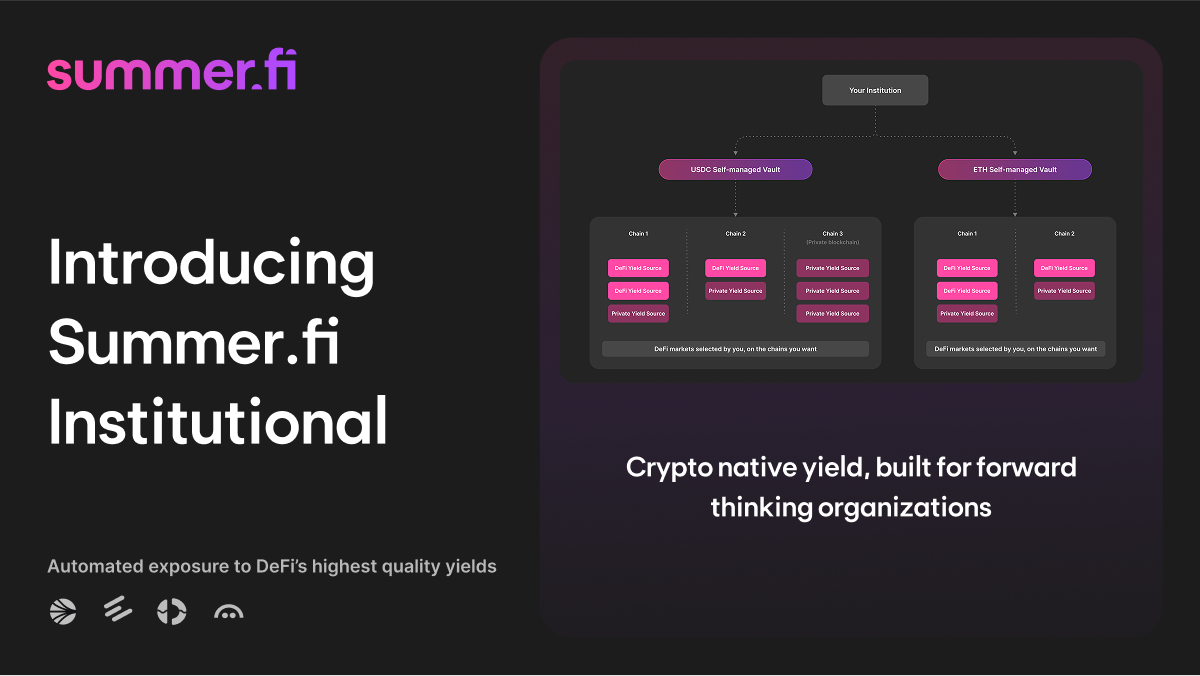

Introducing Summer.fi Institutional: Crypto-native yield, purpose-built for professional allocators and asset managers

Accessing on-chain yield is often complex and costly, with liquidity and yields fragmented across many protocols and chains. With Summer.fi Institutional, those concerns are no more. With the new institutional-grade vaults, accessing on-chain yield just became as simple as accessing your bank account. Whether you want to access staking solutions, lending markets, private markets, or RWA markets, the customizable vaults are built with your mandate.

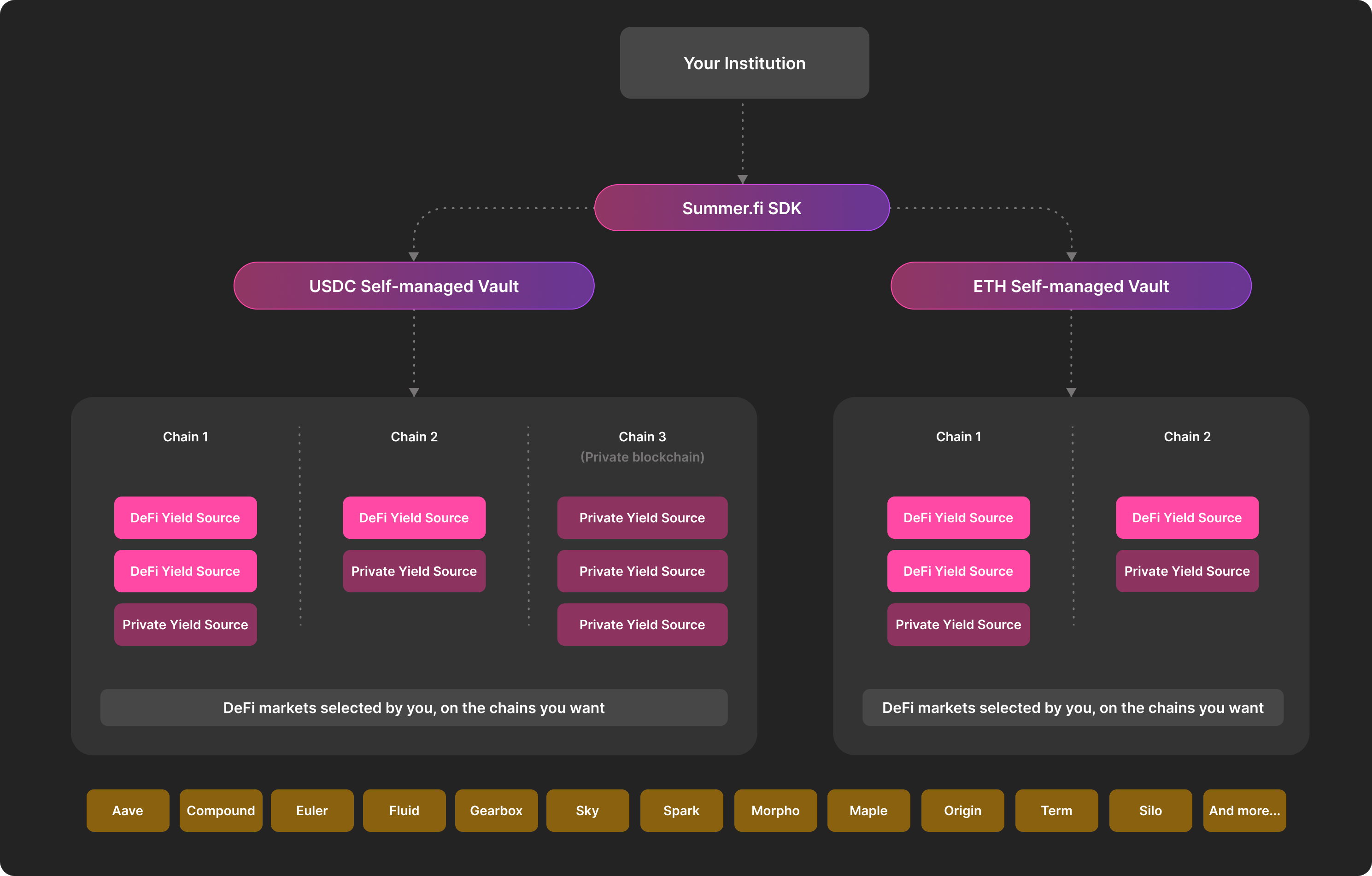

With a single integration, institutions can now access the entire on-chain yield market, with full control over risk, market exposure, and the ability to restrict user access to approved addresses only.

What is Summer.fi Institutional?

Summer.fi Institutional provides a set of customizable and composable institutional-grade vaults, which provide access to any on-chain (and off-chain) yield market with optional automation tools to support yield optimisation and diversification. Additionally, Summer.fi provides hands-on technical support to carefully select and build a vault portfolio based on your risk framework.

The key features and benefits of the institutional vaults include

The entire on-chain yield market with a single integration

- Support for all major stablecoins, ETH, and BTC.

- Access to both public (DeFi) and private (whitelisted) markets, spanning both on-chain and off-chain yield sources for maximum exposure.

- Optional automated rebalancing to either optimize for yield via the yield-seeking model or to optimize for risk and diversification.

- Custom fee structure to enable an additional revenue source.

- Quickly integrate with the safe and secure SDK, which abstracts away much of the complexity and associated infrastructure required when integrating Web3 and blockchain projects.

Stay compliant with ease.

- Ring-fence deposits to pre-approved addresses; zero mingling with unknown funds.

- Full control over market exposure and yield sources, with the ability to set custom limits on a per-market basis by a segregated risk team (either internally or externally)

- Manage risk yourself or appoint a third-party risk curator (e.g., Block Analitica).

- Separately Managed Accounts (SMA).

- Flexible management dashboard, which provides the tools and data to manage your users and all deposited funds. This includes daily NAV files and full reporting as required.

- Support from a UK-based company, with dedicated account management and 24/7 help when it’s needed.

Why is Summer.fi Institutional needed?

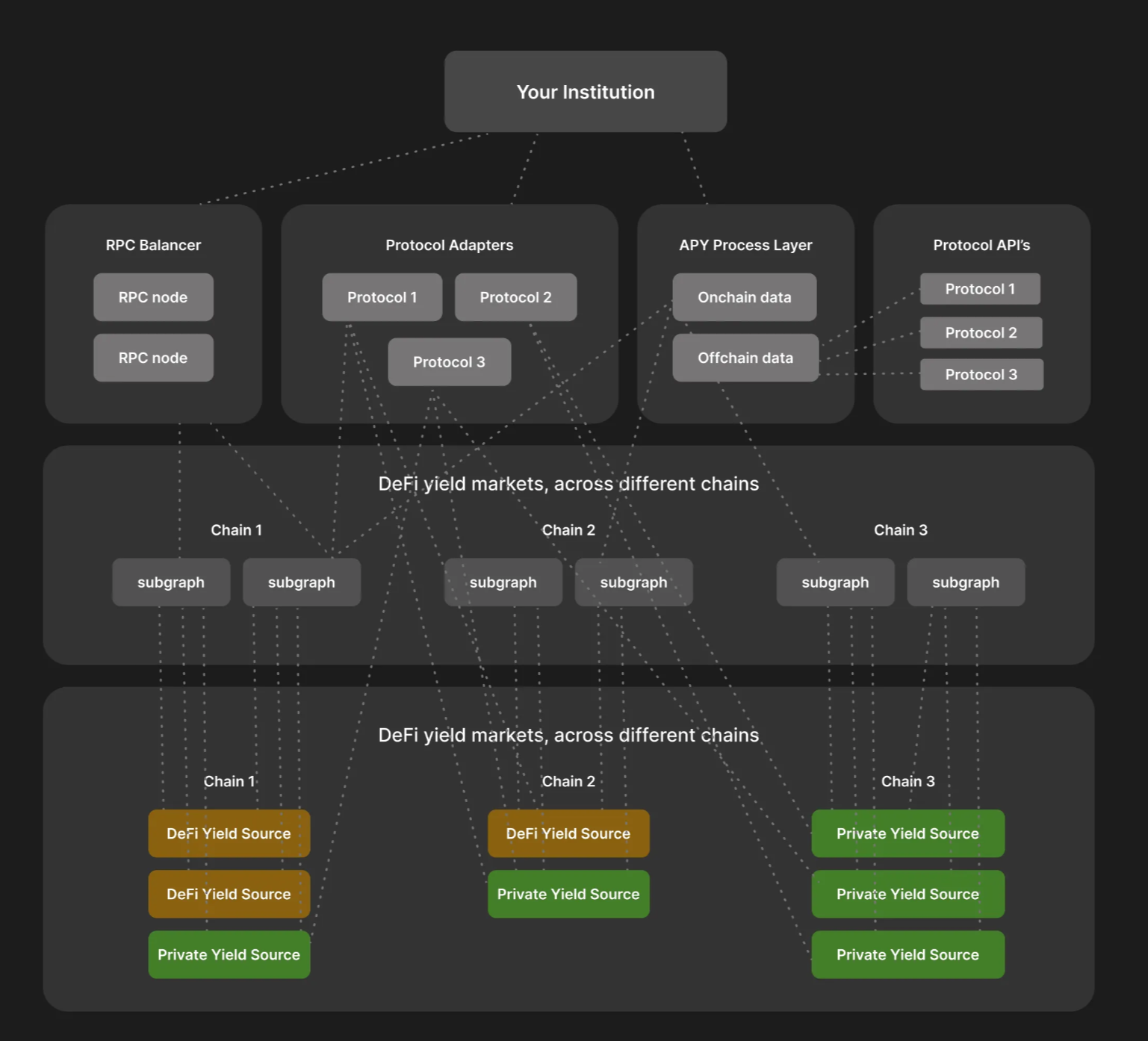

Like all good innovations, Summer.fi Institutional was born of observing painful necessity. Today, if institutions want to deploy capital into on-chain markets and earn a competitive, sustainable yield, they need to integrate many of the top-tier protocols that are available.

Each integration takes time, has its own complexity, and requires several other services, such as subgraphs and off-chain API integrations, just to get the information needed to make informed decisions.

What’s more, these protocols are constantly changing and evolving. Adding new markets, upgrading their protocols, and in many cases, releasing brand new versions every couple of years. Making integration a constant source of development and maintenance, which is both costly and inefficient for getting the best returns.

The hard reality is, many institutions have chosen not to adopt offering their clients an on-chain yield product because the costs of providing these services and the additional risk that comes with managing multiple integrations far outweigh any potential return.

With Summer.fi, costs are dramatically reduced, and ongoing maintenance of yield market access is completely eliminated. All with a single upfront integration, providing institutions, custodians, asset managers, and more with all the tools they need to access the yield markets they want exposure to.

"After speaking with institutional custodians, asset managers, and fund managers, a common theme quickly emerged: the DeFi market is fragmented and difficult to navigate. Too many protocols, even more individual markets, and constantly shifting yields create operational and strategic friction. Which protocol should they trust? How do they avoid concentration risk? And how can they consistently optimise yield?

Summer.fi Institutional is a natural complement to the Lazy Summer Protocol. With the advanced vault infrastructure, institutions can now access DeFi yields in a way that fits their specific risk, asset, and chain preferences, all through a single integration. The automated rebalancing logic ensures capital is always optimised for risk and return."

Anthony Fernandez, August 2025

Who is it for?

Summer.fi Institutional is ultimately for anyone with a large amount of capital, either their own or their customers', who want to access sustainable on-chain yield in a safe and compliant way. This can range from asset managers to custodians to financial apps with a large user base.

- Asset Managers—Build bespoke yield products for clients using self-managed vaults, restricted access, and segregated risk controls.

- Crypto Custodians—Manage closed-access vaults restricted to their custody clients with the option to connect to both public and private markets and segregated risk control.

- Family Offices—Oversee and automate all positions from a single dashboard, with private and public markets in one place.

- Crypto native funds—Deposit into the public DAO-managed Vaults, relying on the expertise of BlockAnalitica to manage the risk while you earn the best available risk-adjusted yields.

- Fintech/Financial Apps—Offer a new self-branded yield-bearing product to your customers with a custom self-managed vault, restricted to only your uses with easy integration with the SDK.

Interested in integrating?

Getting access to on-chain yield no longer needs to be complicated. If you’re interested to discover how Summer.fi Institutional would work for you and your clients, get in touch with a member of the team.

Website: https://summer.fi/institutions

Book a call: https://calendly.com/summer-fi/summer-institutional

Join us

Discord | Telegram | X/Twitter | Linktree

Disclaimer: Oazo Apps Limited functions solely as a front-end interface (Summer.fi) provider and it does not act on behalf of any user. Oazo Apps Limited did not launch nor does it operate or control the Lazy Summer Protocol. The Lazy Summer Protocol is accessed through Summer.fi. The information provided herein is provided on behalf of the Lazy Summer Foundation which launched the Protocol for informational purposes only and it does not constitute investment advice. Oazo Apps Limited and the Lazy Summer Foundation are not soliciting or recommending any transaction or guaranteeing any specific returns. Users interact with the Protocol at their own risk. T&C for the use of Summer.fi apply.