Institutional Risk Frameworks Meet DeFi: What They Demand and What’s Missing

Institutional allocators don’t “ape in.” Every deployment of capital runs through a risk framework: security, governance, liquidity, operations, and audit controls. These frameworks serve them well in traditional finance but they clash with the speed and fragmentation of DeFi.

The result? Lengthy analysis cycles, concentration risk, and manual processes that simply don’t scale. Off-the-shelf DeFi solutions rarely solve these issues.

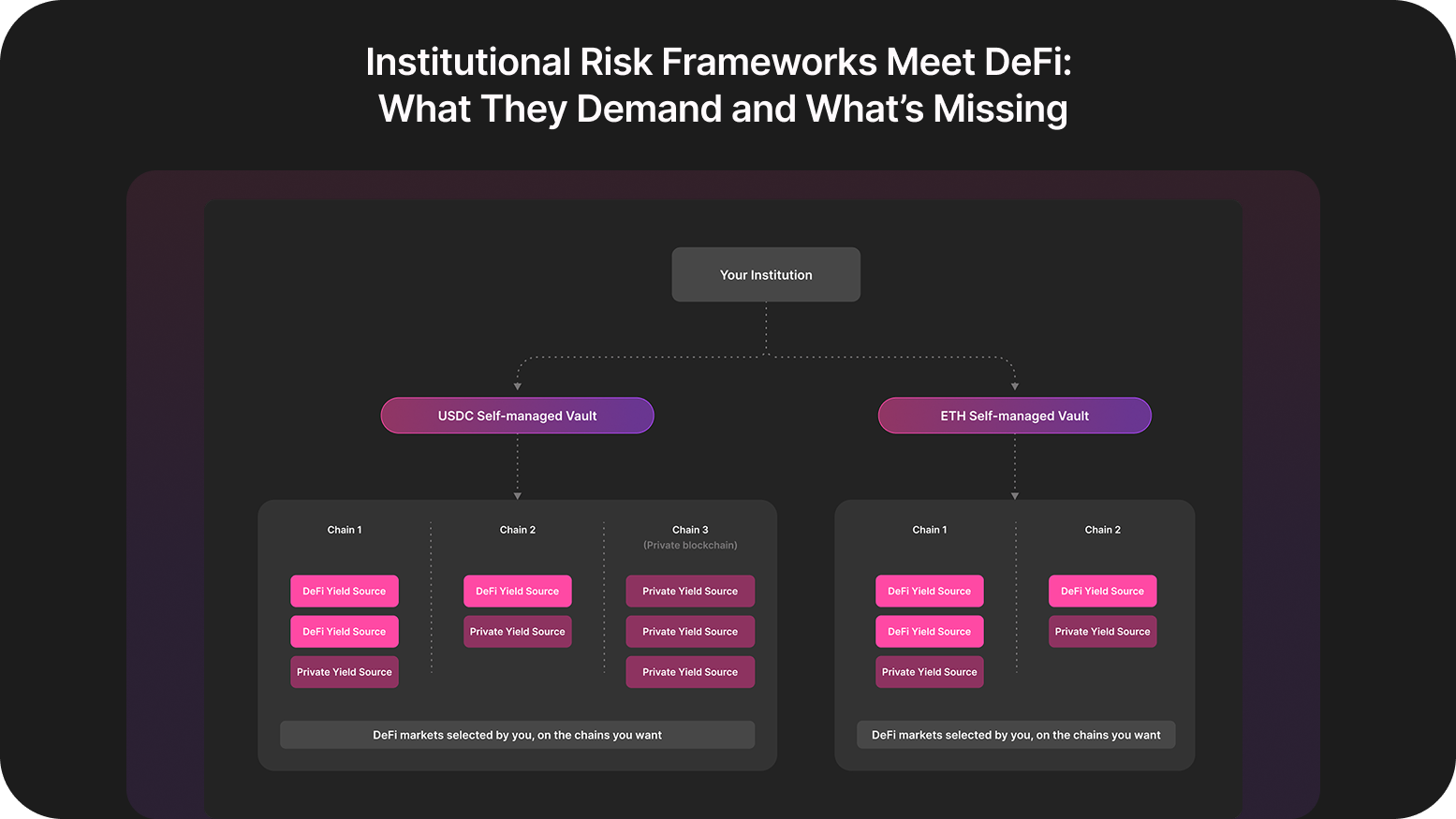

Summer.fi Institutional introduces self-managed closed vaults, designed to map onto institutional mandates, not retail shortcuts.

How institutions assess protocol risk

Before onboarding a protocol, institutions test it against multiple categories:

- Technical security → audits, code quality, oracle dependencies, upgrade rights.

- Market resilience → liquidity depth, slippage, collateral quality, liquidation logic.

- Governance analysis → decentralization, upgrade risks, reliance on multisigs.

- Operational factors → data availability, historical performance, incentives.

This isn’t a one-time exercise. Each new venue requires fresh evaluation often weeks of review and committee approval. Scaling this across every major protocol is practically impossible.

The time and complexity problem

Every DeFi market ships its own contracts, APIs, and cadence of upgrades. Integration can take weeks to months, followed by continuous maintenance as code changes.

That’s why many desks onboard just one or two markets they trust, even if their framework calls for broader diversification. The overhead forces concentration.

Overexposure to single markets

Ironically, frameworks meant to spread risk often lead to the opposite. Limited bandwidth means allocators funnel capital into the few venues that “pass.” The hidden cost: portfolios become dependent on the governance, incentives, and idiosyncrasies of a single market.

Manual offboarding: the weakest link

Even when risks emerge, such as an exploit, governance dispute, or liquidity drain, very few institutions have automated exits. Instead, ops teams rely on dashboards and manual playbooks: withdraw, bridge, and redeploy. In stressed conditions, that lag matters.

Why off-the-shelf DeFi doesn’t fit

Retail-facing solutions were never designed for institutional frameworks. Typical gaps include:

- No customization of exposure caps, asset mix, or diversification rules.

- Shared liquidity pools instead of ring-fenced structures.

- Lack of reporting — no daily NAV files, no audit-ready logs.

- No risk governance hooks — meaning no way to delegate oversight to independent risk managers.

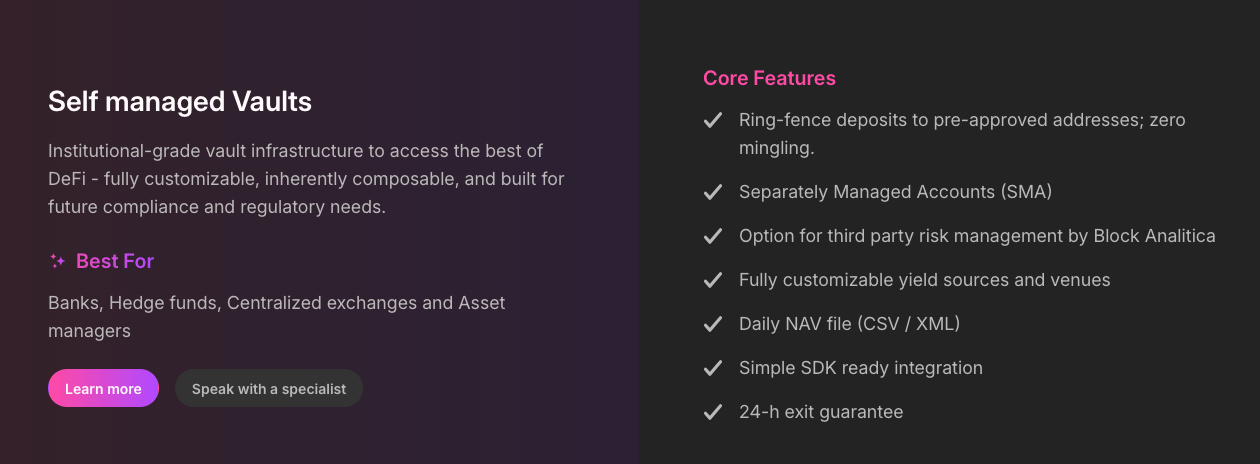

Introducing Summer.fi’s self-managed closed vaults

Summer.fi Institutional was designed to close these gaps. Its self-managed vaults bring policy-first structure to onchain yield:

- Closed access → vaults are ring-fenced, with deposits/withdrawals restricted to approved entities. No co-mingling.

- Customizable mandates → institutions define eligible assets, chains, markets, exposure caps, and reallocation logic.

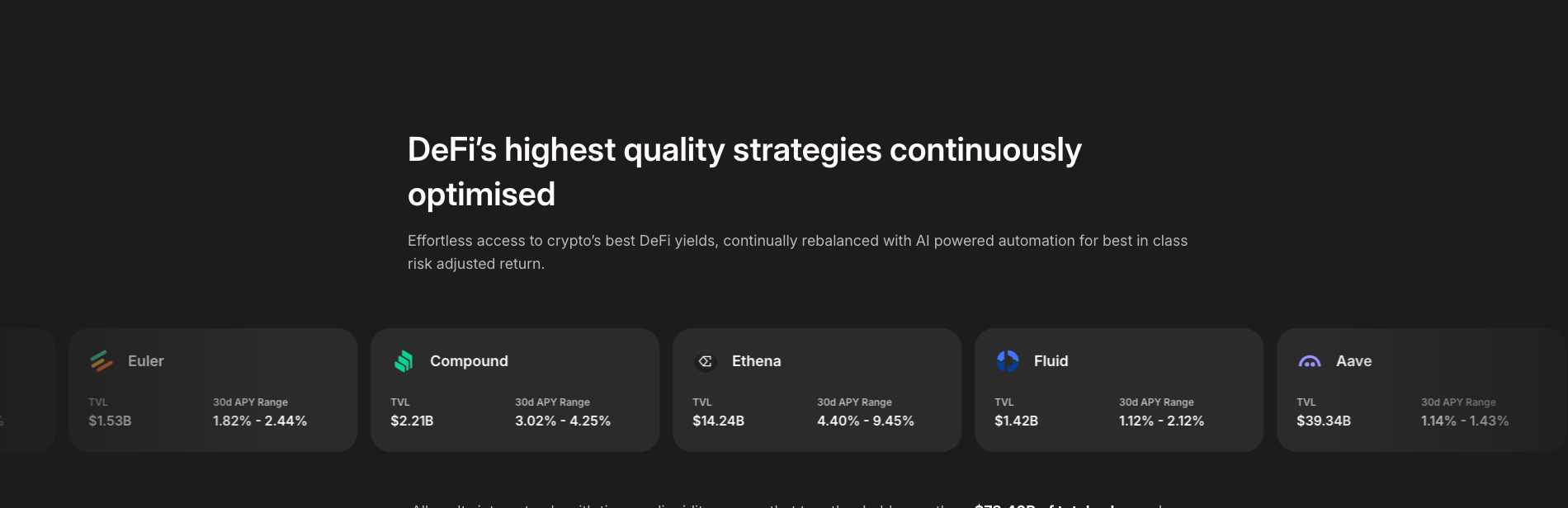

- Automated enforcement → AI-powered keepers monitor conditions and rebalance within pre-set parameters, continuously enforcing policy.

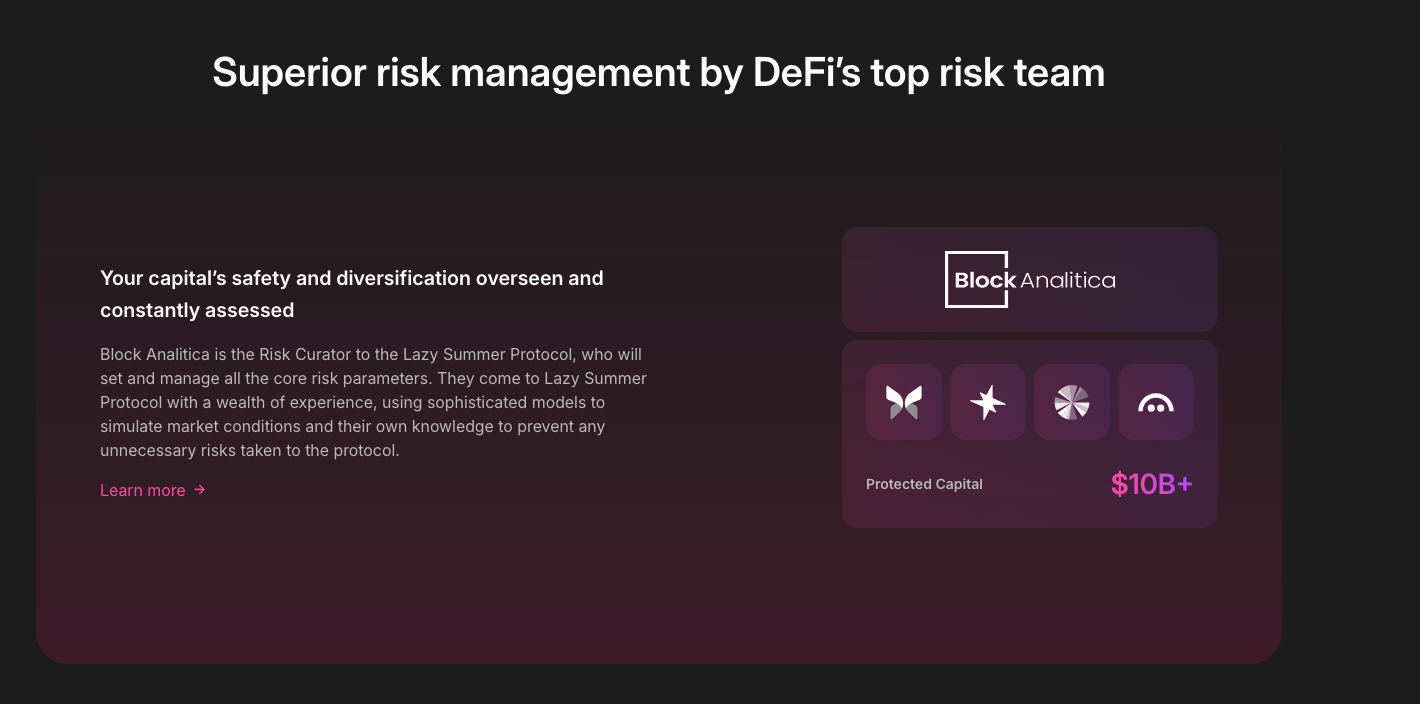

- Independent risk oversight → delegate monitoring to third parties like Block Analitica.

- Audit-ready reporting → daily NAV files, immutable transaction logs, and SDKs for custody/back-office integration.

One integration → instead of building connectors to multiple protocols, plug into a single infrastructure that spans DeFi and private markets across EVM chains.

In other words: institutional frameworks, translated into vault logic.

Interested in integrating?

Getting access to on-chain yield no longer needs to be complicated. If you’re interested to discover how Summer.fi Institutional would work for you and your clients, get in touch with a member of the team.

Website: https://summer.fi/institutions

Book a call: https://calendly.com/summer-fi/summer-institutional

Join us.

Discord | Telegram | X/Twitter | Linktree

Disclaimer: Oazo Apps Limited functions solely as a front-end interface (Summer.fi) provider and it does not act on behalf of any user. Oazo Apps Limited did not launch nor does it operate or control the Lazy Summer Protocol. The Lazy Summer Protocol is accessed through Summer.fi. The information provided herein is provided on behalf of the Lazy Summer Foundation which launched the Protocol for informational purposes only and it does not constitute investment advice. Oazo Apps Limited and the Lazy Summer Foundation are not soliciting or recommending any transaction or guaranteeing any specific returns. Users interact with the Protocol at their own risk. T&C for the use of Summer.fi apply.