Institutional Adoption in Motion and Why Retail Should Pay Attention

Institutional adoption isn’t a prediction anymore, it’s happening in real time.

Glaxyresearch allocation survey shows a major shift: 74% of asset managers now have some level of digital asset exposure, up from 45% in 2023. The drivers are consistent across the board: stronger custody infrastructure, clearer regulatory frameworks, and the rise of transparent, on-chain yield markets.

Source: Galaxy Research Institutional Adoption in Motion

But the important shift isn’t just that institutions are entering it’s how their participation is transforming the environment for everyone else.

Institutions aren’t replacing retail they’re reinforcing the rails

Institutional capital doesn’t push retail out. It professionalizes the ecosystem. When institutional players scale in, several things happen at once:

- Liquidity deepens

- Funding rates stop swinging violently

- Risk management becomes more standardized

- Infrastructure expectations rise

All of this creates a more predictable environment, one where automated systems can do their best work. But there’s a second-order effect: yield opportunities start to compress as markets become more efficient. That’s why the Lazy Summer Protocol focuses on yield optimization within strict risk parameters. The system constantly reallocates across supported strategies so users can access potential yield opportunities that emerge even as competition increases. This isn’t about “beating institutions.” It’s about using infrastructure originally designed for institutions to operate smarter as an individual.

Retail’s opportunity in the institutional era

Retail often misinterprets institutional adoption as a threat: “If the big players are here, the alpha is gone.”

Not quite.

Institutional integration is actually an infrastructure upgrade.

Galaxy puts it simply: institutional inflows “expand liquidity depth and standardize risk practices.”

That translates to:

- More stable yield environments

- Lower volatility around core collateral markets

- Safer conditions for automated allocators

Lazy Summer Vaults take advantage of this environment by reallocating capital within risk-managed parameters, allowing users to access opportunities typically designed for larger allocators without requiring scale, tools, or constant monitoring.

The yield compression paradox and why it benefits automation

Yes, yields compress as deeper liquidity arrives.

But volatility compresses faster.

The net effect?

Higher risk-adjusted yield.

In that world, the edge comes from intelligence and speed, not brute capital. The Lazy Summer Protocol is designed for exactly this: reallocating toward emerging opportunities and stepping away from segments that are cooling off, all within predefined constraints set through governance.

When markets become more efficient, automation doesn’t lose power, it becomes essential.

The takeaway

Institutional adoption doesn’t mark the end of DeFi’s opportunity. It signals the transition from chaotic early markets to structured, scalable, interoperable financial rails.

The winners in this phase won’t be the loudest. They’ll be the builders and users who:

- abstract away complexity

- automate intelligently

- and tap into on-chain opportunities without institutional overhead

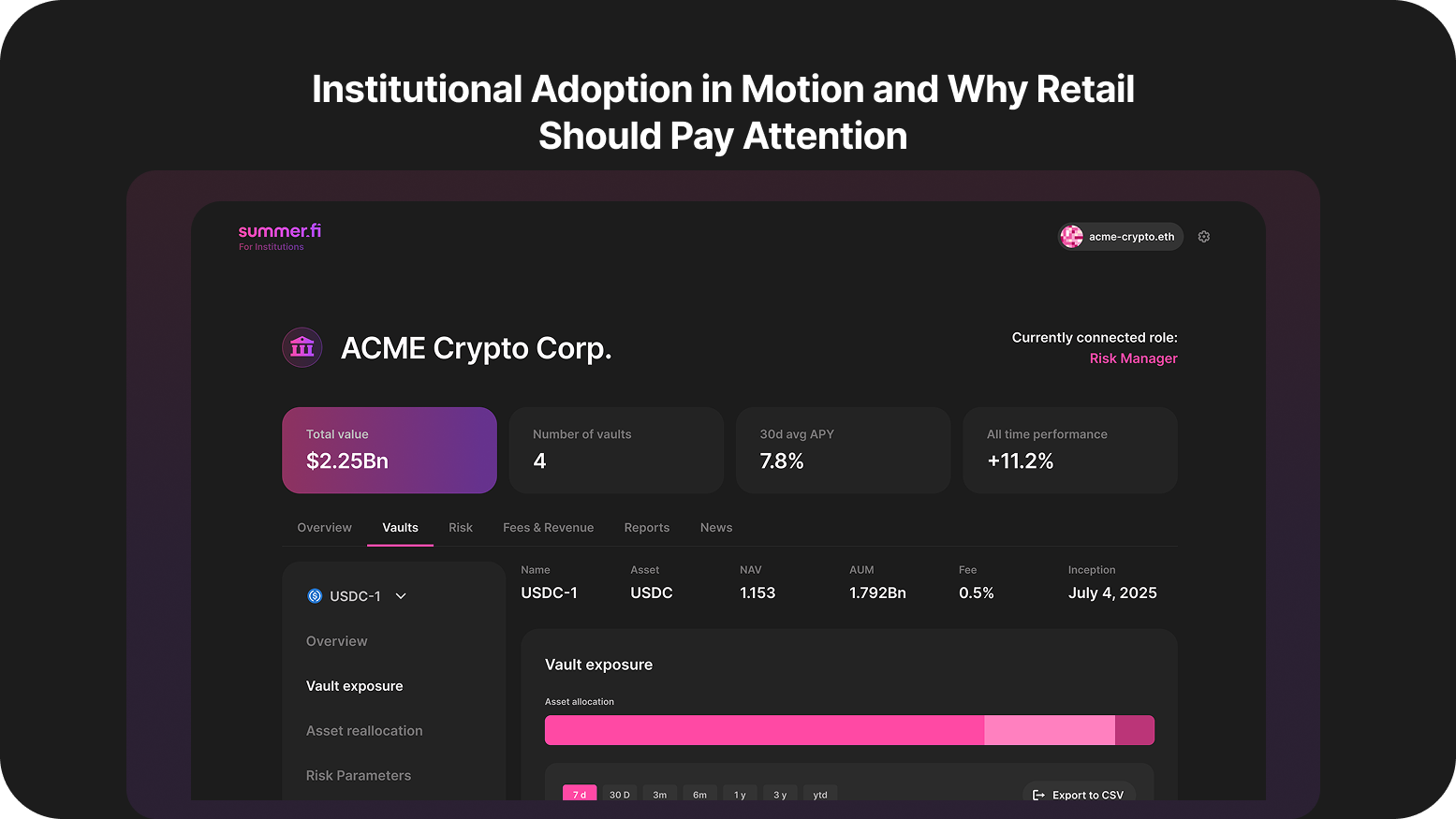

That’s where Summer.fi Institutional offering fits, and that’s why retail should care. Institutional infrastructure always expands the opportunity set for everyone who knows how to use it.

In conclusion,

If you’re exploring institutional-grade access to onchain yield markets: Summer.fi Institutional offers customizable, self-managed vaults designed for professional allocators who need control, transparency, and efficient access to curated DeFi strategies.

🌐 Explore Summer.fi Institutional: summer.fi/institutions

📅 Book a call: calendly.com/summer-fi/summer-institutional

Join us

Discord | Telegram | X/Twitter | Linktree

Disclaimer: Oazo Apps Limited functions solely as a front-end interface (Summer.fi) provider and it does not act on behalf of any user. Oazo Apps Limited did not launch nor does it operate or control the Lazy Summer Protocol. The Lazy Summer Protocol is accessed through Summer.fi. The information provided herein is provided on behalf of the Lazy Summer Foundation which launched the Protocol for informational purposes only and it does not constitute investment advice. Oazo Apps Limited and the Lazy Summer Foundation are not soliciting or recommending any transaction or guaranteeing any specific returns. Users interact with the Protocol at their own risk. T&C for the use of Summer.fi apply.