Inside Summer.fi’s USDC Lower-Risk Vault on Arbitrum

More Than “Another Yield Vault”

The Summer.fi “Lower‑Risk” USDC Vault on Arbitrum is your DeFi autopilot deposit USDC, set it and forget it. Kept lean by AI-powered keepers and curated by risk pros, it delivers steady yield without demanding your attention.

The USDC Lower-Risk Vault on Arbitrum takes a more adaptive approach. Rather than sitting idle, it:

- Rebalances automatically as market conditions change

- Enforces exposure caps per protocol to help manage downside

- Records every rebalance on-chain, available for review

- Operates with independent oversight from Block Analitica, a specialist risk team

What Is the USDC Lower-Risk Vault on Arbitrum?

The USDC Lower-Risk Vault is in Lazy Summer Protocol. It’s designed for users who want predictable, risk-adjusted yield on stablecoins without exposure to volatile assets.

- Built for conservative allocation into audited lending markets

- Designed to preserve capital first, then optimize for returns

- Ideal for users who want to park USDC safely while still earning

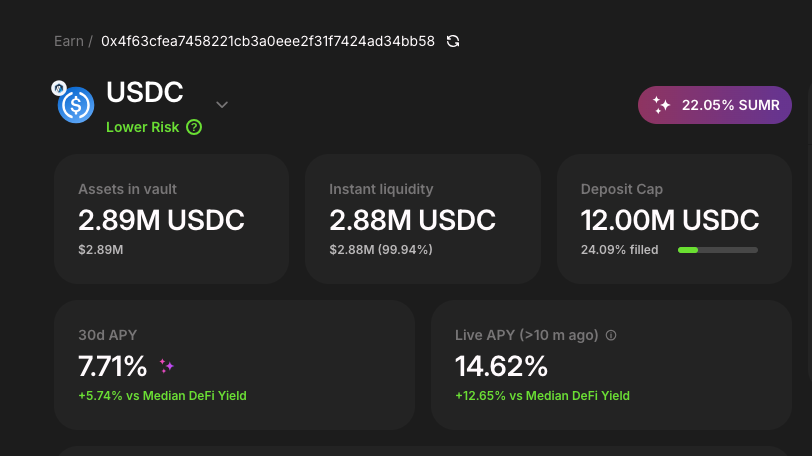

The State of the Vault (Right Now)

- 2.89M USDC held in the vault

- 2.72M USDC (94.34%) instantly liquid

- 12M USDC deposit cap, currently only 24% filled

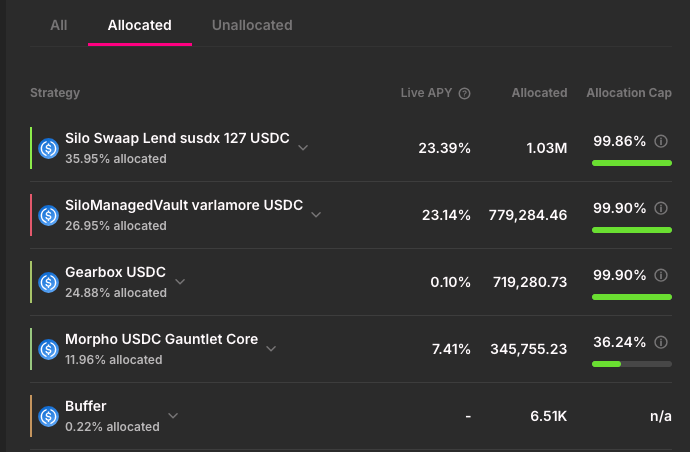

Vault exposure

This vault is composed of various DeFi protocols and markets on the Arbitrum Network. These are selected and maintained through a rigorous selection process with risk exposure managed by BlockAnalitica, an independent risk team. All protocols are vetted for security, performance, and trustworthy teams.

Why This Vault Matters

The Arbitrum USDC Lower-Risk Vault in the Lazy Summer Protocol distinguishes itself by combining scale with discipline:

- Security-First Allocation – Exposure is limited to stable, liquid, and heavily-audited protocols.

- Professional Risk Management – With oversight from independent risk managers like Block Analitica, vault limits and thresholds aren’t arbitrary. They’re calibrated to withstand stress.

- Automated Efficiency – No need to chase yields manually or pay gas fees for constant reallocations. Keepers handle this in the background.

- Institutional Readiness – Designed for allocators managing larger pools of capital, but just as accessible to individual users.

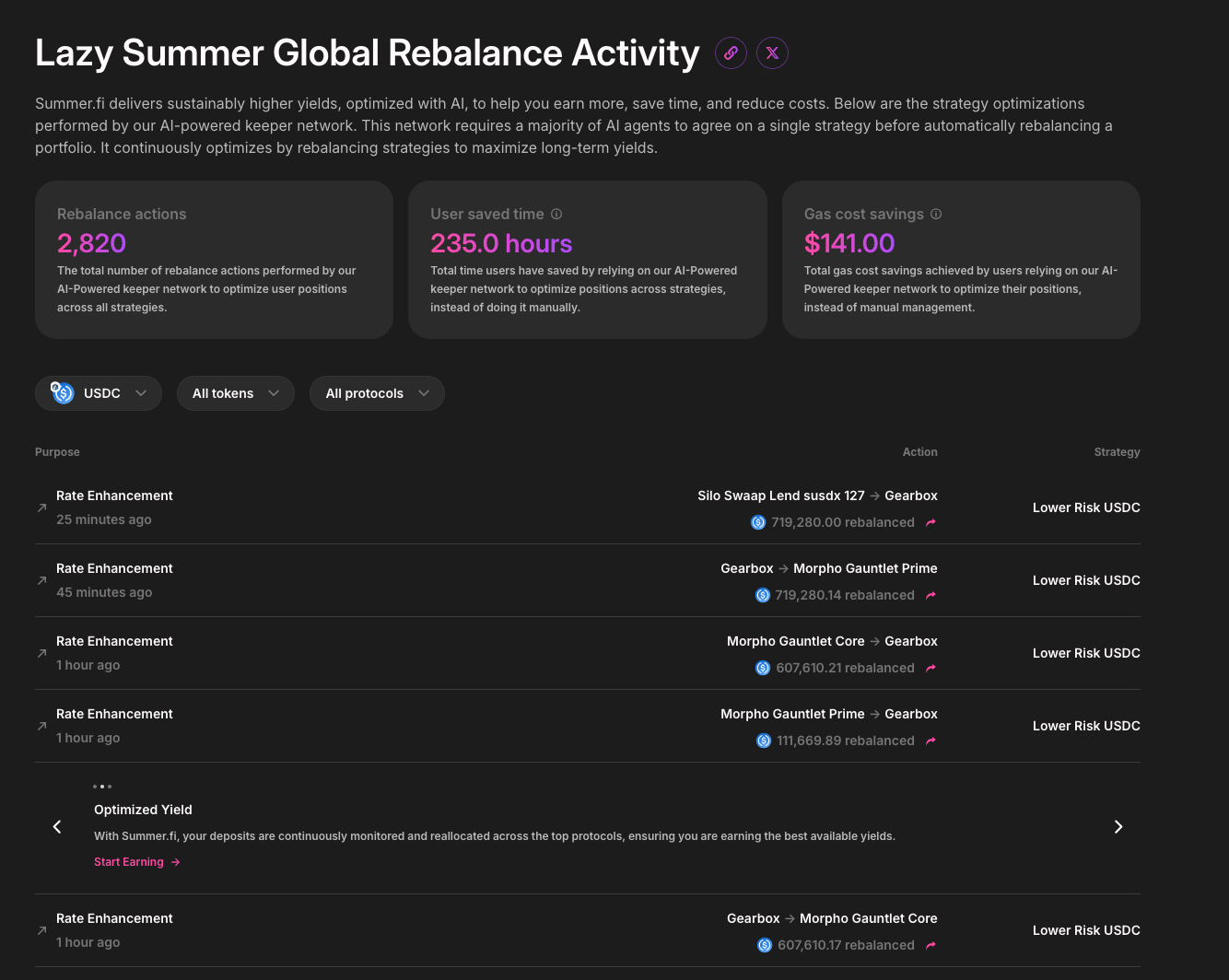

Where Rebalancing Comes Into Play

The real engine here is continuous optimization:

- AI Keeper Network – Strategy optimizations are executed by an AI-powered keeper network. This isn’t a single bot it’s a system of AI agents that continuously scan lending markets, evaluating yield, liquidity, and risk

- Adaptive Allocation – If a lending rate compresses or risk flags increase, the vault rebalances into safer or higher-efficiency venues.

- User Benefits Without Costs – Users don’t have to trigger or pay for these actions—the system batches and executes them autonomously.

- Full Transparency – Each rebalance is recorded and viewable on-chain in the rebalance log.

This ensures your capital is always in motion, but never recklessly so.

Why use Lazy Summer?

Trying to earn the best DeFi yields solo means:

- Constantly monitoring multiple platforms

- Rebalancing manually across vaults

- Juggling to analyze collateral types and borrower risks

With Lazy Summer:

- ✅ All strategies curated by experts

- ✅ AI keepers rebalance based on risk and performance

- ✅ SUMR governance ensures transparency and control

💸 Earn SUMR rewards while earning passive USDC yield

Depositors in Lazy Summer’s USDC lower risk vault on Mainnet earn:

- $SUMR based on deposit size

- Rewards can be claimed

- $SUMR provides governance rights + staking utility

How to Deposit and Get Started

It’s simple to put your USDC to work:

- Head to 🔗 Summer.fi

- Select the USDC Lower-Risk Vault on Arbitrum

- Deposit your USDC with a few clicks

- Sit back—the AI keepers take it from there

In Conclusion

The USDC Lower-Risk Vault on Arbitrum shows that DeFi vaults don’t need to be opaque or underperforming.

It demonstrates that yield strategies can be:

- Adaptive to market shifts

- Transparent and verifiable

- Built with independent risk oversight

If you’re looking for an example of how vault infrastructure can combine automation with accountability, this is it.

Join us

Discord | Telegram | X/Twitter | Linktree | Summer.fi Institutional

Disclaimer: Oazo Apps Limited functions solely as a front-end interface (Summer.fi) provider and it does not act on behalf of any user. Oazo Apps Limited did not launch nor does it operate or control the Lazy Summer Protocol. The Lazy Summer Protocol is accessed through Summer.fi. The information provided herein is provided on behalf of the Lazy Summer Foundation which launched the Protocol for informational purposes only and it does not constitute investment advice. Oazo Apps Limited and the Lazy Summer Foundation are not soliciting or recommending any transaction or guaranteeing any specific returns. Users interact with the Protocol at their own risk. T&C for the use of Summer.fi apply.