If you don't know how the yield is generated, you are the yield

There's a saying in DeFi: if you don't know where the yield comes from, you are the yield.

People keep forgetting this, and while some things have certainly changed since the days of full blown scams, some things have not.

Some of the best risk-adjusted returns in all of finance are happening onchain. The problem isn't that everything is fake, it's that there's so much yield, from so many sources, that telling the exceptional from the dangerous takes real work, and that work is getting harder.

Its becoming important to know the source of your yield again

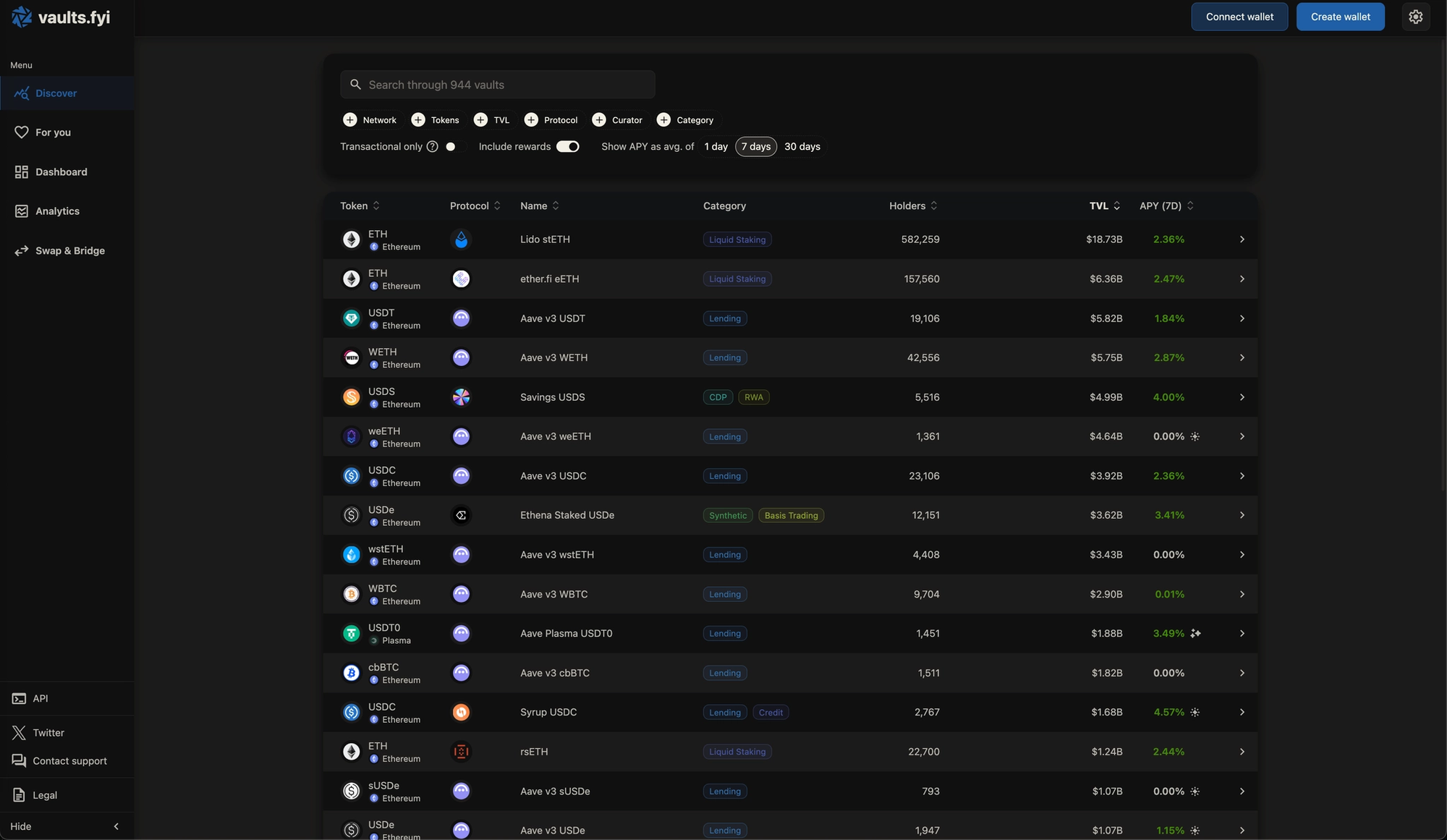

Yield is fragmenting. Morpho, Euler, Sky, Maple, Aave, Pendle, Ethena, RWA vaults.

All have different mechanics, different risks and critically different assumptions. The question is no longer "where can I find yield?" It's "how do I compare dozens of sources without becoming a full-time risk analyst?"

..and the growth is not stopping, 2026 looks like the year onchain yield goes from a ATH of $10B to $100B, driven by stablecoin regulation, the yield gap on zero-interest holdings (USDC, USDT) , and the broader maturation of the DeFi ecosystem. That means more options, more capital and more ways to unknowingly become the yield.

A brief history of users becoming the yield

BitConnect (2018): Promised ~1% daily from a "trading bot." …There was no bot. New deposits paid old investors, a classic Ponzi.

Iron Finance (2021): Five-figure APYs paid in TITAN tokens minted from nothing. Selling pressure triggered reflexive printing. TITAN went from $65 to zero in hours.

Wonderland/TIME (2022): ~80,000% APY via (3,3) staking. Supply expanded at the same rate as the "yield.", the token crashed because the emissions were the yield.

Terra/Anchor (2022): "Fixed" 19.5% on UST. Borrower revenue never covered it. VC money from Terraform Labs plugged the gap/, but when the reserve ran dry, $40B evaporated. Subsidized yields end.

Celsius & Voyager (2022): 5–18% APY from "trusted" platforms that lent your stablecoins to Three Arrows Capital, who gambled on leverage and lost. You were an unsecured creditor and didn't know it.

Gemini Earn (2022): Gemini → Genesis → Alameda → FTX. Three counterparties deep, each adding opacity. When FTX collapsed, the yield chain snapped.

Same pattern every time: yield disconnected from real activity, opaque sources, users who surrendered control to systems they didn't understand.

Onchain yield is different, but can be similar

Today's onchain vaults aren't black boxes, smart contracts are auditable and capital flows are traceable.

But transparency isn't understanding, and complexity has replaced opacity as the hard problem for users to really understand and assess. You can see what's happening, the question is whether you can make sense of it.

A framework for knowing if you are the yield

We know that it is going to get increasingly difficult to assess the validity of yield, and that's why we partnered with Block Analitica to build a risk framework around two questions:

- Are you the yield? and

- How is the yield generated?

Hard filters: a binary pass/fail screener for yield sources determined by

- 180+ days on mainnet

- Recent audit

- Sufficient TVL and liquidity

- 60%+ of collateral backing unlocked

- Verifiable onchain or via independent attestation

Risk tiering: Yield sources that pass get categorized.

- Category A: no leverage, no cross-chain backing, 365+ days live, no exploits = up to 100% allocation.

- Category B: leverage or delta-neutral (not both), 180+ days = max 70%.

- Category C: cross-chain backing, multiple risk factors = max 30%, strict inflow limits.

To read and understand about the entire framework, you can read about it here.

Framework in action: DAO risk-managed vaults

Frameworks are great, but most people won't apply them manually.

So we’ve created DAO risk-managed vaults on the Lazy Summer Protocol. Every yield source passes the hard filters, gets categorized, gets exposure limits, and keepers rebalance automatically.

Soon, on Summer.fi you will be able to exposure to all of the best DeFi yields automatically.

Unlike Lazy Summer vaults actively risk managed by Block Analitica, DAO risk-managed vaults follow the automated risk framework, giving you automatic access to the newest, highest quality yields, and highest earning yields.